Deck 14: Economic and Social Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 14: Economic and Social Policy

1

President Ronald Reagan embraced Keynesian economics in the 1980s.

False

2

The Federal Reserve Board is in charge of fiscal policy in the United States.

False

3

Entitlements are government-sponsored programs, such as Medicare and Medicaid, which provide benefits to qualifying individuals.

True

4

The presidency as an institution gained more budgetary power in the United States starting in 1921.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Payroll taxes are regressive.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

Under the Constitution, the president has the power of the purse.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

Democrats have traditionally sought to change the Social Security system to partial privatization so that the trust fund does not decrease and go bankrupt.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

The assassination of President John F.Kennedy led to the passage of gun control legislation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

Monetary policy is a shared exercise between the national government and the states.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

Although many argue that employment is important for a healthy economy, the U.S.government has never made full employment an explicit goal of its economic policy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

The Federal-State Unemployment Compensation Program was established in 1965 as part of the creation of Medicare.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Budgetary spending that is required by law is called mandatory spending.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

The U.S.Department of Education was created in 1856.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Members of the baby-boom generation-a term used to describe individuals born between 1946 and 1964-will put a great deal of stress on the Social Security system when they retire.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Defining a problem as an issue that requires the federal government's attention is the second stage of the policy-making process.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Social Security is the least popular social program in the United States.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

Each woman, man, and child in the United States in effect currently carries more than $55,000 of the national debt.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

Fiscal policy has redistributive implications.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

Government regulation has a limited impact on the economy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

None of the social policies passed under the New Deal remain today.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

What did the Employment Act of 1946 do?

A)provided higher education assistance to 7.8 million World War II veterans

B)created new regulations and safeguards to protect against inflation

C)guaranteed all Americans the right to unemployment insurance

D)created the Council of Economic Advisers and made full employment a goal of economic policy

A)provided higher education assistance to 7.8 million World War II veterans

B)created new regulations and safeguards to protect against inflation

C)guaranteed all Americans the right to unemployment insurance

D)created the Council of Economic Advisers and made full employment a goal of economic policy

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

During the Reagan presidency, taxes and spending fell as a share of the overall economy. What was the result?

A)budget surpluses that gradually helped pay off the federal debt

B)a balanced federal budget by the end of Reagan's presidency

C)no major changes in the nation's annual deficits or overall debt

D)continued budget deficits and a significant increase in the nation's federal debt

A)budget surpluses that gradually helped pay off the federal debt

B)a balanced federal budget by the end of Reagan's presidency

C)no major changes in the nation's annual deficits or overall debt

D)continued budget deficits and a significant increase in the nation's federal debt

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following constitutes the highest portion of expenditures in the national budget?

Which one of the following constitutes the highest portion of expenditures in the national budget?A)discretionary defense spending

B)Social Security and Medicare combined

C)transportation

D)net interest paid on the national debt

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

Keynesian economics was developed in the

A)1780s.

B)1840s.

C)1930s.

D)1970s.

A)1780s.

B)1840s.

C)1930s.

D)1970s.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

Which one of the following statements is accurate?

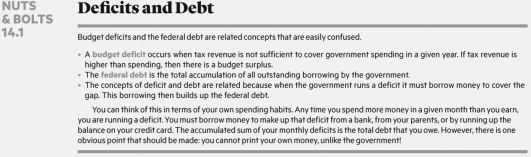

Which one of the following statements is accurate?A)Budget deficits are cumulative figures over time.

B)Budget deficits are figures in a given fiscal year.

C)The national debt is a figure in a given fiscal year.

D)Borrowing money over time reduces the national debt.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

What does the Government Performance and Results Act (GPRA) of 1993 require?

A)that Congress address federal funding of education every two years

B)that agencies report strategic plans and performance evaluations

C)that the percentage of the U.S.population on welfare decreases every year

D)that all senior citizens be eligible for Medicare

A)that Congress address federal funding of education every two years

B)that agencies report strategic plans and performance evaluations

C)that the percentage of the U.S.population on welfare decreases every year

D)that all senior citizens be eligible for Medicare

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following is an example of mandatory spending in the federal budget?

A)funding for the national parks and forest systems

B)national security expenditures for the Department of Homeland Security

C)an entitlement program such as Social Security

D)funding for the National Aeronautics and Space Administration (NASA)

A)funding for the national parks and forest systems

B)national security expenditures for the Department of Homeland Security

C)an entitlement program such as Social Security

D)funding for the National Aeronautics and Space Administration (NASA)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

Taxing and spending decisions are known as ________ policy.

A)punitive

B)mandatory

C)monetary

D)fiscal

A)punitive

B)mandatory

C)monetary

D)fiscal

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following describes the top policy priorities among a political party, politicians, or a coalition of politicians?

A)social policy efforts

B)legislative leviathan

C)key-issue agenda

D)a policy agenda

A)social policy efforts

B)legislative leviathan

C)key-issue agenda

D)a policy agenda

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following is an example of a progressive tax?

A)the income tax

B)the payroll tax

C)the gas tax

D)the cigarette tax

A)the income tax

B)the payroll tax

C)the gas tax

D)the cigarette tax

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

________ was a staunch advocate of supply-side economics.

A)Ronald Reagan

B)Tip O'Neill

C)Ted Kennedy

D)Jimmy Carter

A)Ronald Reagan

B)Tip O'Neill

C)Ted Kennedy

D)Jimmy Carter

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

During the nation's recent economic crisis, what would a proponent of Keynesian economics have done?

A)supported the government's entire $787 billion stimulus plan of tax cuts and government spending

B)supported the stimulus plan's tax cuts but not the increases in government spending

C)opposed the stimulus plan's tax cuts but supported the increases in government spending

D)opposed the government's entire stimulus plan because it added to the federal debt

A)supported the government's entire $787 billion stimulus plan of tax cuts and government spending

B)supported the stimulus plan's tax cuts but not the increases in government spending

C)opposed the stimulus plan's tax cuts but supported the increases in government spending

D)opposed the government's entire stimulus plan because it added to the federal debt

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

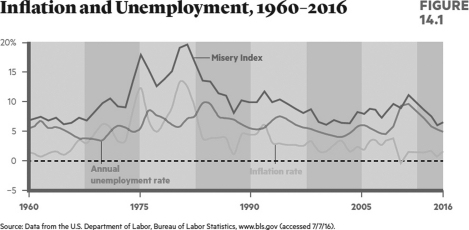

The Misery Index is based on

The Misery Index is based onA)a stagnant economy with inflation.

B)the sum of the inflation rate and the unemployment rate.

C)increases in the cost of living combined with slow growth in the nation's gross domestic product (GDP).

D)the nation's income inequality rate combined with various quality-of-life indicators.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following statements is accurate?

A)The U.S.Treasury Department distributes money to banks in the Federal Reserve System.

B)The U.S.Treasury Department produces currency and coins.

C)The U.S.Treasury Department is in charge of monetary policy.

D)The Fed is in charge of fiscal policy.

A)The U.S.Treasury Department distributes money to banks in the Federal Reserve System.

B)The U.S.Treasury Department produces currency and coins.

C)The U.S.Treasury Department is in charge of monetary policy.

D)The Fed is in charge of fiscal policy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

The theory that lowering taxes will stimulate the economy because of increased investment and spending among the public is called

A)Keynesian economics.

B)fiscal federalism.

C)supply-side economics.

D)central economic planning.

A)Keynesian economics.

B)fiscal federalism.

C)supply-side economics.

D)central economic planning.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

State governments

A)have a central role in education and welfare.

B)have a central role in monetary policy.

C)do not administer federal programs.

D)have no role in education since the passage of the No Child Left Behind law.

A)have a central role in education and welfare.

B)have a central role in monetary policy.

C)do not administer federal programs.

D)have no role in education since the passage of the No Child Left Behind law.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

Countercyclical taxing and spending policy is known as

A)Keynesian economics.

B)fiscal federalism.

C)supply-side economics.

D)central economic planning.

A)Keynesian economics.

B)fiscal federalism.

C)supply-side economics.

D)central economic planning.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

When there is too much money flowing and too few goods, it is likely to lead to

A)tax cuts.

B)a rise in taxes.

C)an interest rate cut.

D)inflation.

A)tax cuts.

B)a rise in taxes.

C)an interest rate cut.

D)inflation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

The ________ is the total accumulation of money borrowed by the government.

A)budget deficit

B)federal debt

C)budget surplus

D)federal balance sheet

A)budget deficit

B)federal debt

C)budget surplus

D)federal balance sheet

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

What does the gross domestic product (GDP) measure?

A)the annual difference between a country's imported goods and exported goods

B)a country's economic output and activity

C)the country's total annual sales of manufactured goods

D)the goods consumed in the nation over a year

A)the annual difference between a country's imported goods and exported goods

B)a country's economic output and activity

C)the country's total annual sales of manufactured goods

D)the goods consumed in the nation over a year

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

________ was NOT a social program created during the New Deal.

A)Medicare

B)Social Security

C)Welfare for families with dependent children

D)Labor rights to organize a union

A)Medicare

B)Social Security

C)Welfare for families with dependent children

D)Labor rights to organize a union

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Which one of the following was a component of President George W.Bush's plan to scale back social programs?

A)end the War on Poverty

B)add a prescription drug plan to Medicare

C)eliminate Medicaid

D)privatize portions of Social Security

A)end the War on Poverty

B)add a prescription drug plan to Medicare

C)eliminate Medicaid

D)privatize portions of Social Security

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

The Sherman Antitrust Act led to the dissolution of the ________ monopoly?

A)coal

B)oil

C)railroad

D)telegraph

A)coal

B)oil

C)railroad

D)telegraph

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

What can be concluded from reading this passage?

A)The controversy over grazing rights and environmental policy in the Western United States has been resolved.

B)Ranchers tend to forge alliances with the activist environmental groups in the United States.

C)Free market environmentalism may be a way to forge a working compromise between those espousing grazing rights versus those who advocate for environmental protection.

D)It is likely that federal officials will give back millions of acres to the states to sell to their citizens.

A)The controversy over grazing rights and environmental policy in the Western United States has been resolved.

B)Ranchers tend to forge alliances with the activist environmental groups in the United States.

C)Free market environmentalism may be a way to forge a working compromise between those espousing grazing rights versus those who advocate for environmental protection.

D)It is likely that federal officials will give back millions of acres to the states to sell to their citizens.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

Government assistance, usually in the form of financial assistance, to individuals in need is called

A)block grants.

B)welfare.

C)Medicare.

D)Social Security.

A)block grants.

B)welfare.

C)Medicare.

D)Social Security.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

How did the chair of the Fed, Ben Bernanke, respond to the economic crisis in 2008?

A)He did not advocate any policy changes.

B)He responded by "flooding the street with money."

C)He responded by increasing interest rates significantly.

D)He encouraged members of Congress to return to the gold standard.

A)He did not advocate any policy changes.

B)He responded by "flooding the street with money."

C)He responded by increasing interest rates significantly.

D)He encouraged members of Congress to return to the gold standard.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

Medicare was one of the most significant social policies passed during the presidency of

A)John F.Kennedy.

B)Harry Truman.

C)Lyndon Johnson.

D)Bill Clinton.

A)John F.Kennedy.

B)Harry Truman.

C)Lyndon Johnson.

D)Bill Clinton.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

The logic behind lowering interest rates is to

A)decrease the amount of money being borrowed.

B)lower inflation.

C)increase the amount of money being borrowed.

D)encourage people to buy government bonds.

A)decrease the amount of money being borrowed.

B)lower inflation.

C)increase the amount of money being borrowed.

D)encourage people to buy government bonds.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

The specific interest rate that banks pay to the Federal Reserve Bank for short-term loans is called

A)a short-term rate.

B)a discount rate.

C)an emergency loan rate.

D)a federal reserve rate.

A)a short-term rate.

B)a discount rate.

C)an emergency loan rate.

D)a federal reserve rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

Funding for the Great Society was quickly threatened by

A)income tax cuts passed by Congress.

B)World War II.

C)the Korean War.

D)the Vietnam War.

A)income tax cuts passed by Congress.

B)World War II.

C)the Korean War.

D)the Vietnam War.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

The specific interest rate that banks pay each other for emergency overnight loans is called

A)an emergency loan rate.

B)an overnight loan rate.

C)a federal reserve rate.

D)a federal funds rate.

A)an emergency loan rate.

B)an overnight loan rate.

C)a federal reserve rate.

D)a federal funds rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

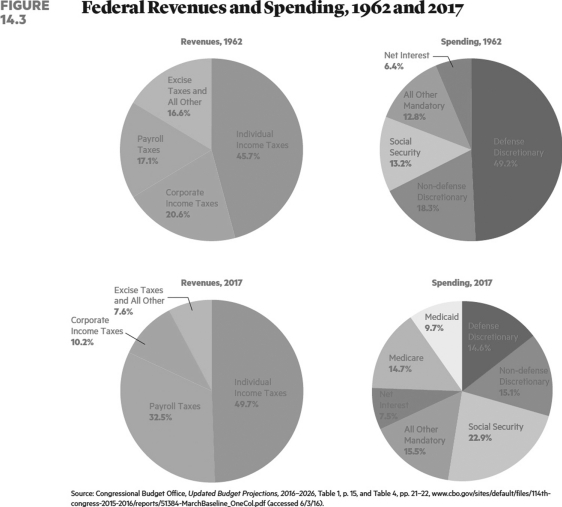

Which one of the following statements is accurate?

Which one of the following statements is accurate?A)The proportion of revenue received from payroll taxes is much lower today than in the early 1960s.

B)The proportion of revenue received from corporate income taxes is much less today than in the early 1960s.

C)The proportion of spending on the net interest on the debt is much higher today than it was in the early 1960s.

D)The proportion of spending on Social Security is lower today than in the early 1960s.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

The reserve requirement requires

A)the federal government to insure all bank deposits of up to $250,000.

B)the Federal Reserve to hold a minimum amount of gold and precious metals.

C)the Treasury Department to reserve a portion of U.S.currency in the event of a national emergency.

D)banks to have a certain amount of money on hand to back up their assets.

A)the federal government to insure all bank deposits of up to $250,000.

B)the Federal Reserve to hold a minimum amount of gold and precious metals.

C)the Treasury Department to reserve a portion of U.S.currency in the event of a national emergency.

D)banks to have a certain amount of money on hand to back up their assets.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

A natural monopoly occurs because

A)one company offers a product that is clearly superior to its competitors.

B)mergers occur between rival companies until only one remains.

C)one company corners the market by buying up companies in other industries that control the means of production.

D)the costs are so high to enter a specific business that only one company in the market can be profitable.

A)one company offers a product that is clearly superior to its competitors.

B)mergers occur between rival companies until only one remains.

C)one company corners the market by buying up companies in other industries that control the means of production.

D)the costs are so high to enter a specific business that only one company in the market can be profitable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

If the Fed governors wanted to put downward pressure on the FFR, it would likely

A)sell government bonds to banks.

B)purchase government bonds from banks.

C)increase the reserve requirement.

D)increase the discount rate.

A)sell government bonds to banks.

B)purchase government bonds from banks.

C)increase the reserve requirement.

D)increase the discount rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

One of the first social welfare programs enacted by the federal government was financial assistance to veterans of

A)the Civil War.

B)World War I.

C)the Spanish American War.

D)World War II.

A)the Civil War.

B)World War I.

C)the Spanish American War.

D)World War II.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

A ________ tax takes a larger share of poor people's income than the income of wealthy people.

A)progressive

B)mandatory

C)discretionary

D)regressive

A)progressive

B)mandatory

C)discretionary

D)regressive

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

The ________ was the name given to a group of government-sponsored social and economic programs developed by Franklin Roosevelt to combat the Great Depression.

A)New Deal

B)Great Society

C)1934 Stimulus Package

D)War on Poverty

A)New Deal

B)Great Society

C)1934 Stimulus Package

D)War on Poverty

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

The Great Society was a social plan developed by President

A)Franklin Roosevelt.

B)Lyndon Johnson.

C)Harry Truman.

D)John Kennedy.

A)Franklin Roosevelt.

B)Lyndon Johnson.

C)Harry Truman.

D)John Kennedy.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Because of severe economic conditions, the federal government began enacting policies to ensure the well-being of the American public starting in the

A)1880s.

B)1910s.

C)1930s.

D)1960s.

A)1880s.

B)1910s.

C)1930s.

D)1960s.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

Overall, Americans spend ________ on health care compared to the rest of the world.

A)much more

B)a little more

C)a little less

D)much less

A)much more

B)a little more

C)a little less

D)much less

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

What was one of the consequences of No Child Left Behind?

A)increased federal funding for education

B)expanded Head Start to every school district

C)placed national accountability and testing requirements in every school district

D)decreased federal funding for education

A)increased federal funding for education

B)expanded Head Start to every school district

C)placed national accountability and testing requirements in every school district

D)decreased federal funding for education

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

Every president since ________ who attempted comprehensive health care reform failed until Barack Obama.

A)Ulysses S.Grant

B)Theodore Roosevelt

C)Harry Truman

D)Lyndon Johnson

A)Ulysses S.Grant

B)Theodore Roosevelt

C)Harry Truman

D)Lyndon Johnson

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

Over 70 million Americans receive health care coverage through

A)food stamps.

B)Aid to Families with Dependent Children/Temporary Assistance for Needy Families.

C)Medicare.

D)Medicaid.

A)food stamps.

B)Aid to Families with Dependent Children/Temporary Assistance for Needy Families.

C)Medicare.

D)Medicaid.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

________ percent of the American population is living in poverty.

A)Two percent

B)Fifteen percent

C)Twenty-five percent

D)Forty percent

A)Two percent

B)Fifteen percent

C)Twenty-five percent

D)Forty percent

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

Which one of the following is NOT a recommendation made by public policy experts to keep the Social Security system working effectively?

A)eliminate Social Security benefits for those over 90 years old

B)raise the age requirement to qualify for Social Security

C)lower benefits for nonworking spouses and wealthier individuals

D)raise payroll taxes

A)eliminate Social Security benefits for those over 90 years old

B)raise the age requirement to qualify for Social Security

C)lower benefits for nonworking spouses and wealthier individuals

D)raise payroll taxes

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

Which president proposed the Race to the Top program to provide competitive grants to schools, encouraging them to adopt better methods of teaching and assessment?

A)Lyndon Johnson

B)Ronald Reagan

C)George W.Bush

D)Barack Obama

A)Lyndon Johnson

B)Ronald Reagan

C)George W.Bush

D)Barack Obama

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

Generally speaking, Medicare provides insurance for ________, while Medicaid provides insurance for ________.

A)government employees; senior citizens

B)senior citizens; the poor

C)the poor; senior citizens

D)senior citizens; government employees

A)government employees; senior citizens

B)senior citizens; the poor

C)the poor; senior citizens

D)senior citizens; government employees

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Why is the retirement of the baby-boom generation considered a problem for the future of Social Security?

A)More retirees mean more people on Medicare, which shares a funding pool with Social Security.

B)Retirees tend to cluster in certain states, which means that the states they are moving from will lose the benefits of their Social Security payments.

C)Social Security functions best when there are fewer workers and more retirees, thus increasing support for the program.

D)Retiring baby boomers will reduce the number of workers per retiree and strain the financial resources of the program.

A)More retirees mean more people on Medicare, which shares a funding pool with Social Security.

B)Retirees tend to cluster in certain states, which means that the states they are moving from will lose the benefits of their Social Security payments.

C)Social Security functions best when there are fewer workers and more retirees, thus increasing support for the program.

D)Retiring baby boomers will reduce the number of workers per retiree and strain the financial resources of the program.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

What do most policy experts say about the future of the Social Security system?

A)The system's collection and allocation of funds will be the same.

B)The amount of funds coming into the system will increase, because the number of people working is increasing dramatically.

C)The amount of money coming into the system will decrease, because the number of people retiring is increasing dramatically.

D)It will cease to exist, because the Social Security Act of 1935 is scheduled to expire in 2050.

A)The system's collection and allocation of funds will be the same.

B)The amount of funds coming into the system will increase, because the number of people working is increasing dramatically.

C)The amount of money coming into the system will decrease, because the number of people retiring is increasing dramatically.

D)It will cease to exist, because the Social Security Act of 1935 is scheduled to expire in 2050.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

Which one of the following is NOT an example of a welfare, or income support, program?

A)food stamps

B)Medicare

C)unemployment benefits

D)Temporary Assistance for Needy Families

A)food stamps

B)Medicare

C)unemployment benefits

D)Temporary Assistance for Needy Families

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

An individual making less than approximately ________ is considered below the federal poverty line as a single person.

A)$12,000

B)$22,000

C)$30,000

D)$44,000

A)$12,000

B)$22,000

C)$30,000

D)$44,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

A social policy vision such as George W.Bush's, in which citizens take responsibility for their own social well-being, is called

A)the Second Great Society.

B)the New Deal society.

C)the ownership society.

D)the safety net society.

A)the Second Great Society.

B)the New Deal society.

C)the ownership society.

D)the safety net society.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

What is a major critique of partial and full privatization of Social Security?

A)Recipients will receive less money.

B)The federal government gets to decide which private investments are made.

C)State governments would tax profits made from private investments.

D)Transition to privatization would be expensive.

A)Recipients will receive less money.

B)The federal government gets to decide which private investments are made.

C)State governments would tax profits made from private investments.

D)Transition to privatization would be expensive.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

Although there is some variation, Medicare is a government-sponsored health care program for

A)people living below the poverty line.

B)citizens 65 and older.

C)all children under the age of 18.

D)citizens 55 and older.

A)people living below the poverty line.

B)citizens 65 and older.

C)all children under the age of 18.

D)citizens 55 and older.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

No Child Left Behind is an example of education policy

A)becoming more controlled by state and local governments.

B)becoming more controlled by the federal government.

C)increasingly being funded by the federal government.

D)passed during the Great Society.

A)becoming more controlled by state and local governments.

B)becoming more controlled by the federal government.

C)increasingly being funded by the federal government.

D)passed during the Great Society.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

Which one of the following describes the group of Americans born between 1946 and 1964 who will be retiring in large numbers over the next 20 years?

A)the baby-boom generation

B)Generation X

C)the World War II generation

D)the Social Security generation

A)the baby-boom generation

B)Generation X

C)the World War II generation

D)the Social Security generation

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

The Social Security Administration trust fund will not be able to keep up with demand.Projections suggest the program will only be able to pay about ________ of its obligated expenditures in 2037.

A)95 percent

B)77 percent

C)50 percent

D)25 percent

A)95 percent

B)77 percent

C)50 percent

D)25 percent

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Which one of the following statements is accurate?

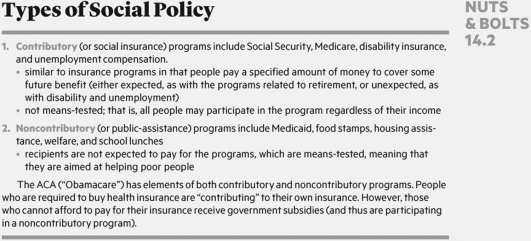

Which one of the following statements is accurate?A)Social Security is a noncontributory program.

B)Medicare is a contributory program.

C)The Affordable Care Act is a noncontributory program.

D)Disability insurance is a noncontributory program.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

The purpose of the Land Grant College Act was to

A)build more colleges and universities during the nineteenth century.

B)build more colleges after World War II.

C)establish colleges that would promote education in areas such as business and finance.

D)establish colleges that would promote education in areas such as agriculture and mechanical arts.

A)build more colleges and universities during the nineteenth century.

B)build more colleges after World War II.

C)establish colleges that would promote education in areas such as business and finance.

D)establish colleges that would promote education in areas such as agriculture and mechanical arts.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck