Deck 14: Partnership Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

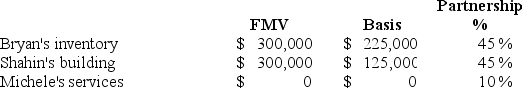

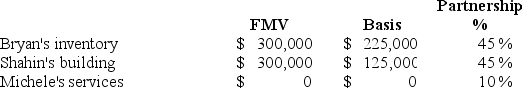

Question

Question

Question

Question

Question

Question

Question

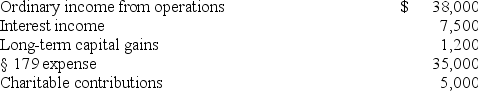

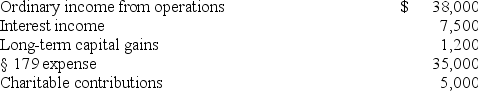

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 14: Partnership Taxation

1

Partnership income or loss and separately stated items are reported to the individual partners via Schedule K-1.

True

2

Partnership income and losses are divided into two components: ordinary items and separately stated items.

True

3

A partner's basis in his or her partnership interest (outside basis)is the sum of the money contributed plus the adjusted basis of property contributed.

True

4

A partner never recognizes a gain or loss on the formation of a partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

Guaranteed payments are the only items that are reported both as a deduction for ordinary income and as a separately stated item.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

A partner's share of recourse liabilities increases the partner's basis in his or her partnership interest.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

Ordinary income from a partnership is not considered self-employment income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

Nondeductible partnership items do not decrease a partner's basis in the partnership interest.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

If Jake contributes land to a partnership with a basis of $12,000 and a FMV of $18,000,the partnership will have a basis in the asset of $12,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

If Casey's partnership basis is only $100,000 and Cherie's basis is $200,000,there is no way both Casey and Cherie can be equal partners at 50% each in the partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

The term "step-into-the-shoes" means that the partnership starts a new depreciation period for any depreciable asset contributed to the partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

When a partner is released of a partnership liability,the partner is treated as receiving a money distribution,which reduces his or her partnership basis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

All income/gain and expense/loss items affect a partner's basis in his or her partnership interest.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

Ordinary income includes interest income and dividend income received by the partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

Typically,a partner does not recognize a gain when he or she receives a current distribution.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

If a personal-use asset is contributed to a partnership for business use,the partnership's basis in the asset is always the FMV of the asset.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

Guaranteed payments are always determined with regard to partnership income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

All income and expense items of a partnership that may be treated differently at the partner level must be "separately stated."

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

Generally,guaranteed payments do not have an impact on a partner's basis in the partnership interest.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

If only cash is contributed on the formation of a partnership,outside basis will equal inside basis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

If Josh's partnership basis was $5,000 and he received a distribution of land that had a basis of $10,000,Josh would be required to recognize a $5,000 gain.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

Section 179 expense is reported as a(an):

A)Ordinary deduction to a partnership.

B)Separately stated item.

C)Both as an ordinary deduction and as a separately stated item.

D)Capital loss to the partnership.

A)Ordinary deduction to a partnership.

B)Separately stated item.

C)Both as an ordinary deduction and as a separately stated item.

D)Capital loss to the partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

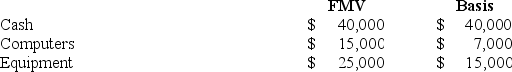

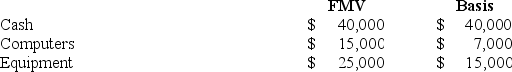

Raul contributes the following assets to a partnership for a 50% interest: What is Raul's basis in his partnership interest?

A)$0.

B)$50,000.

C)$100,000.

D)$155,000.

A)$0.

B)$50,000.

C)$100,000.

D)$155,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

The sale of a partnership interest is similar to the sale of any capital asset and is reported by the partner on Schedule D of his or her individual tax return.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

A guaranteed payment is treated as:

A)A separately stated item.

B)An ordinary expense.

C)Both a separately stated item and an ordinary expense.

D)None of these.

A)A separately stated item.

B)An ordinary expense.

C)Both a separately stated item and an ordinary expense.

D)None of these.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

Caroline,Jessica,and Samantha form a partnership.Caroline contributes a building,Jessica contributes cash and Samantha will operate the business. How much income must Samantha recognize?

A)$0.

B)$400,000.

C)$480,000.

D)$500,000.

A)$0.

B)$400,000.

C)$480,000.

D)$500,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

If Janelle's partnership basis was $5,000 and she received a distribution of land that had a basis of $10,000,the basis of the land in Janelle's hands would be $10,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

A partner can recognize a loss on a liquidating distribution.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

When a partner increases his or her share of the partnership's liabilities,the liability increase is treated as a:

A)Money distribution.

B)Money contribution.

C)Recognition of income.

D)Has no effect on the partner.

A)Money distribution.

B)Money contribution.

C)Recognition of income.

D)Has no effect on the partner.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

If a personal-use asset is contributed to a partnership for business use,the partnership's basis in the asset is always:

A)$0.

B)The FMV of the asset at the date of contribution.

C)The basis of the asset at the date of contribution.

D)The lesser of the asset's FMV or basis at the date of contribution.

A)$0.

B)The FMV of the asset at the date of contribution.

C)The basis of the asset at the date of contribution.

D)The lesser of the asset's FMV or basis at the date of contribution.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is reported as a separately stated item from a partnership?

A)Capital gain.

B)Depreciation expense.

C)Interest expense to buy business equipment.

D)Sales income.

A)Capital gain.

B)Depreciation expense.

C)Interest expense to buy business equipment.

D)Sales income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

Upon the sale of a partnership interest,a partner must recognize ordinary income if the partnership has substantially appreciated inventory or unrealized receivables.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

If a partner contributes services on the formation of a partnership,how much income does the service partner recognize,if any?

A)$0.

B)$0,unless the partner receives a cash distribution.

C)An amount equal to the FMV of the services rendered.

D)$0 if the partner's basis was $0 when the services were performed.

A)$0.

B)$0,unless the partner receives a cash distribution.

C)An amount equal to the FMV of the services rendered.

D)$0 if the partner's basis was $0 when the services were performed.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Lacy contributes the following assets to a partnership for a 25% interest: The land and the van have a basis to the partnership of:

A)Land $0;Van $0.

B)Land $15,000;Van $10,000.

C)Land $15,000;Van $15,000.

D)Land $50,000;Van $15,000.

A)Land $0;Van $0.

B)Land $15,000;Van $10,000.

C)Land $15,000;Van $15,000.

D)Land $50,000;Van $15,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is reported as ordinary income or expense from a partnership?

A)Depreciation expense.

B)Section 179 expense.

C)Gain on the sale of a Section 1231 asset.

D)Dividend income.

A)Depreciation expense.

B)Section 179 expense.

C)Gain on the sale of a Section 1231 asset.

D)Dividend income.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Liquidation occurs when a partner's entire interest is redeemed by the partnership.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

How does a partner treat premiums on health insurance provided by the partnership?

A)As a guaranteed payment.

B)As an ordinary income item reported on a W-2.

C)As a separately stated item.

D)As a capital gain item.

A)As a guaranteed payment.

B)As an ordinary income item reported on a W-2.

C)As a separately stated item.

D)As a capital gain item.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

A pre-contribution gain occurs when a partner contributes appreciated property to a partnership and,within seven years,the partnership distributes the same property to another partner.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

Bethany contributes a building to a partnership with a basis of $120,000 and a FMV of $200,000.Bethany's basis in her partnership interest would:

A)Not increase at all.

B)Increase by $80,000.

C)Increase by $120,000.

D)Increase by $200,000.

A)Not increase at all.

B)Increase by $80,000.

C)Increase by $120,000.

D)Increase by $200,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

Miguel contributes land to a partnership with a basis of $12,000 and a FMV of $18,000.How much gain will Miguel recognize?

A)$0.

B)$6,000.

C)$12,000.

D)$18,000.

A)$0.

B)$6,000.

C)$12,000.

D)$18,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Paris,a 60% partner in Omega Partnership,has a basis of $25,000 in her partnership interest.Paris receives a cash distribution of $24,000 at year-end.What is Paris's basis in her partnership interest at the end of the year?

A)$0.

B)$1,000.

C)$24,000.

D)$25,000.

A)$0.

B)$1,000.

C)$24,000.

D)$25,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

Sabrina has a $12,000 basis in her S&B partnership interest.Sabrina receives a current cash distribution of $10,000 and equipment with a $5,000 basis (FMV $6,000).What is Sabrina's basis in the equipment received?

A)$0.

B)$2,000.

C)$5,000.

D)$6,000.

A)$0.

B)$2,000.

C)$5,000.

D)$6,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

Rich is a partner in RKW partnership.Rich owned 50% through January 1,2017 through April 30,2017,when he bought Kevin's 25% interest.He owned 75% for the rest of the year (assume a 365-day year).The partnership had ordinary income of $150,000 and $25,000 in long-term capital gains.Barring any special allocations in a partnership agreement,Rich's share of the income items is (round the answers up to the nearest whole dollar):

A)$75,000 ordinary income;$12,500 capital gain.

B)$100,172 ordinary income;$16,696 capital gain.

C)$112,500 ordinary income;$18,750 capital gain.

D)$150,000 ordinary income;$25,000 capital gain.

A)$75,000 ordinary income;$12,500 capital gain.

B)$100,172 ordinary income;$16,696 capital gain.

C)$112,500 ordinary income;$18,750 capital gain.

D)$150,000 ordinary income;$25,000 capital gain.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

Partner Jamie has a basis of $10,000 in a partnership at the beginning of the year.She receives $5,000 in cash distributions,her distributive share of income is $3,000,and she receives an equipment distribution with a basis of $6,000 (FMV $12,000).Jamie's basis in her partnership interest at the end of the year is:

A)$0.

B)$2,000.

C)$8,000.

D)$13,000.

A)$0.

B)$2,000.

C)$8,000.

D)$13,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following items increases a partner's basis in his or her partnership interest?

A)The basis of property contributed.

B)Ordinary income that flows through from the partnership.

C)Tax-exempt income that flows through from the partnership.

D)All of these.

A)The basis of property contributed.

B)Ordinary income that flows through from the partnership.

C)Tax-exempt income that flows through from the partnership.

D)All of these.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

In 2016,Angel contributes land to a partnership with a basis of $12,000 and a FMV of $22,000.In 2017,when the FMV of the land is $28,000,the partnership distributes the land to Shelia,another partner.What is the basis of the land to Shelia assuming she has a $40,000 basis in her partnership interest?

A)$0.

B)$12,000.

C)$22,000.

D)$28,000.

A)$0.

B)$12,000.

C)$22,000.

D)$28,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

In 2016,Angel contributes land to a partnership with a basis of $12,000 and a FMV of $22,000.In 2017,when the FMV of the land is $28,000,the partnership distributes the land to Shelia,another partner.What is the gain or loss recognized by Angel on the distribution to Shelia?

A)$0.

B)$10,000.

C)$16,000.

D)$28,000.

A)$0.

B)$10,000.

C)$16,000.

D)$28,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

Sabrina has a $12,000 basis in her S&B partnership interest.Sabrina receives a current cash distribution of $10,000 and equipment with a $5,000 basis (FMV $6,000).What is Sabrina's basis in her partnership interest at the end of the year?

A)$0.

B)$2,000.

C)$7,000.

D)$12,000.

A)$0.

B)$2,000.

C)$7,000.

D)$12,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

Parker,a 25% partner in Delta Partnership,has a basis of $25,000 in his partnership interest.Parker receives a cash distribution of $24,000 at year-end.What is Parker's recognized gain or loss?

A)$0.

B)$1,000.

C)$24,000.

D)$25,000.

A)$0.

B)$1,000.

C)$24,000.

D)$25,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

A partner had the following items reported on a partnership Schedule K-1: The partner's self-employment income for the year is:

A)$26,000.

B)$32,500.

C)$48,500.

D)$64,500.

A)$26,000.

B)$32,500.

C)$48,500.

D)$64,500.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

The general rule regarding income and expense items of a partnership and their classification is:

A)All income and expense items of a partnership are treated as ordinary income/expense items.

B)All income and expense items of a partnership that may be treated differently at the partner level must be "separately stated."

C)All income and expense items of a partnership are treated as separately stated items.

D)All income and expense items of a partnership are treated as capital income or losses.

A)All income and expense items of a partnership are treated as ordinary income/expense items.

B)All income and expense items of a partnership that may be treated differently at the partner level must be "separately stated."

C)All income and expense items of a partnership are treated as separately stated items.

D)All income and expense items of a partnership are treated as capital income or losses.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

A partnership has $23,000 of depreciation expense and $25,000 of Section 179 expense.How are the depreciation and Section 179 expenses reported?

A)Both as separately stated items.

B)As a $48,000 ordinary expense item.

C)Depreciation is treated as a $23,000 ordinary expense and the $25,000 Section 179 expense is separately stated.

D)Section 179 is treated as a $25,000 ordinary expense and the $23,000 depreciation is separately stated.

A)Both as separately stated items.

B)As a $48,000 ordinary expense item.

C)Depreciation is treated as a $23,000 ordinary expense and the $25,000 Section 179 expense is separately stated.

D)Section 179 is treated as a $25,000 ordinary expense and the $23,000 depreciation is separately stated.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

As a general rule,a distribution to a partner from a partnership is treated as:

A)A guaranteed payment.

B)A reduction in basis,and no gain or loss is recognized.

C)Ordinary income.

D)A capital gain distribution.

A)A guaranteed payment.

B)A reduction in basis,and no gain or loss is recognized.

C)Ordinary income.

D)A capital gain distribution.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

A partner had the following items reported on a partnership Schedule K-1: The partner's self-employment income for the year equals:

A)$28,000.

B)$37,000.

C)$42,000.

D)$68,000.

A)$28,000.

B)$37,000.

C)$42,000.

D)$68,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following items decreases a partner's basis in his or her partnership interest?

A)A cash distribution from the partnership.

B)A nondeductible expense that flows through from the partnership.

C)A release from partnership liabilities.

D)All of these.

A)A cash distribution from the partnership.

B)A nondeductible expense that flows through from the partnership.

C)A release from partnership liabilities.

D)All of these.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Rental income and expenses are treated as:

A)Ordinary income for all partners.

B)Separately stated because individual partners may treat rental income or losses differently.

C)Capital gains or losses because the rental property is an investment.

D)None of these.

A)Ordinary income for all partners.

B)Separately stated because individual partners may treat rental income or losses differently.

C)Capital gains or losses because the rental property is an investment.

D)None of these.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

Sabrina has a $12,000 basis in her S&B partnership interest.Sabrina receives a current cash distribution of $10,000 and equipment with a $5,000 basis (FMV $6,000).What is Sabrina's recognized gain or loss?

A)$0.

B)$3,000.

C)$4,000.

D)$16,000.

A)$0.

B)$3,000.

C)$4,000.

D)$16,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

Partner Tami (a 20% partner)had the following items reported to her on a partnership Schedule K-1: Tami had a basis in her partnership interest of $14,000 at the beginning of the year.Additionally,the partnership has recourse liabilities of $100,000 outstanding at the end of the year.What is Tami's basis in her partnership interest at the end of the year?

A)$7,000.

B)$11,200.

C)$23,200.

D)$31,200.

A)$7,000.

B)$11,200.

C)$23,200.

D)$31,200.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following partnership items are not included in the self-employment income calculation?

A)Ordinary income.

B)Section 179 expense.

C)Guaranteed payments.

D)Gain on the sale of partnership property.

A)Ordinary income.

B)Section 179 expense.

C)Guaranteed payments.

D)Gain on the sale of partnership property.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

Partner Spence had the following items reported on a partnership Schedule K-1: Spence had a basis in his partnership interest of $23,000 at the beginning of the year.What is Spence's basis in his partnership interest at the end of the year?

A)$21,000.

B)$31,200.

C)$54,200.

D)$70,200.

A)$21,000.

B)$31,200.

C)$54,200.

D)$70,200.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

Molly has a $15,000 basis in her partnership interest when she receives a liquidating distribution from the partnership.Molly receives cash of $6,000.What is Molly's recognized gain or loss on the liquidating distribution?

A)$0.

B)($6,000).

C)($9,000).

D)($15,000).

A)$0.

B)($6,000).

C)($9,000).

D)($15,000).

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Anna has a $25,000 basis in her partnership interest when she receives liquidating distributions from the partnership.Anna receives cash of $18,000 and computer equipment with a basis to the partnership of $15,000.What are the tax consequences of the liquidating distributions to Anna?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

Bryan,Shahin,and Michele form a partnership.Bryan and Shahin contribute inventory and a building,respectively.Michele agrees to perform all of the accounting and office work in exchange for a 10% interest.

a.Do any of the partners recognize any gain? If so,how much and why?

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership of each asset?

a.Do any of the partners recognize any gain? If so,how much and why?

a.Do any of the partners recognize any gain? If so,how much and why?b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership of each asset?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

On April 30 of the current year,Ashley contributes a building with a $155,000 basis and a $235,000 FMV in exchange for a partnership interest.She purchased the building eight years ago.

a.What is Ashley's basis in her partnership interest?

b.What is Ashley's holding period of her partnership interest?

c.What is the basis of the building in the hands of the partnership?

d.What is the holding period of the building in the hands of the partnership?

e.How will the partnership depreciate the building in the year of contribution?

a.What is Ashley's basis in her partnership interest?

b.What is Ashley's holding period of her partnership interest?

c.What is the basis of the building in the hands of the partnership?

d.What is the holding period of the building in the hands of the partnership?

e.How will the partnership depreciate the building in the year of contribution?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Latesha contributes a building with a FMV of $125,000 and a basis of $115,000 to a partnership on January 4,2014.On December 15,2017,the partnership distributed the building to Katie,a partner in the same partnership.At distribution,the building had a FMV of $129,000.

a.What is the effect of the distribution on Latesha,if any?

b.What is the effect of the distribution to Katie?

a.What is the effect of the distribution on Latesha,if any?

b.What is the effect of the distribution to Katie?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

Charley is a partner in Charley,Austin,Liz & Bass Partnership.Charley owned 25% from January 1,2017 to April 1,2017 when he bought both Liz's 25% and Bass's 25% interests.He owned 75% for the rest of the year.The partnership had ordinary income of $358,000 and $12,000 in long-term capital gains.Barring any special allocations in a partnership agreement,what is Charley's share of income (assume a 365-day year)?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

Calvin purchased a 30% partnership interest for $53,000 in March 2015.Calvin's share of partnership income was $5,000 in 2015,$25,000 in 2016,and ($9,000)in 2017.Calvin made no additional contributions to,or withdrawals from,the partnership.On December 1,2017,Calvin sold his partnership interest for $83,000.What is Calvin's gain or loss on the disposal?

A)$0.

B)$9,000.

C)$30,000.

D)$83,000.

A)$0.

B)$9,000.

C)$30,000.

D)$83,000.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

Jeremy and Juan are equal partners in the JJ Partnership.Jeremy receives a guaranteed payment of $120,000.In addition to the guaranteed payment,Jeremy withdraws $30,000 from the partnership.The partnership has $78,000 in ordinary income during the year.

a.How much income must Jeremy report from JJ partnership?

b.What is the effect on Jeremy's partnership basis?

a.How much income must Jeremy report from JJ partnership?

b.What is the effect on Jeremy's partnership basis?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

When dealing with the liquidation of a partnership interest,a partner will:

A)Never recognize a loss.

B)Only recognize a loss when property,inventory,and/or receivables are distributed.

C)Only recognize a loss when money,inventory,and/or receivables are distributed.

D)None of these.

A)Never recognize a loss.

B)Only recognize a loss when property,inventory,and/or receivables are distributed.

C)Only recognize a loss when money,inventory,and/or receivables are distributed.

D)None of these.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

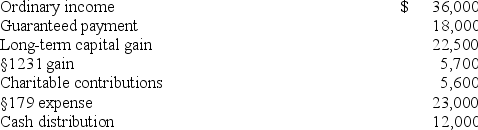

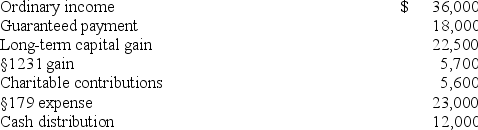

Marty and Blake are equal partners in MB Partnership.The partnership reports the following items of income and expense:

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

b.Where (on what forms)will these separatley stated items amounts be reported by the partners?

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?

a.Which items are considered separately stated items? How will these items be reported to the partners? What form will be used?b.Where (on what forms)will these separatley stated items amounts be reported by the partners?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

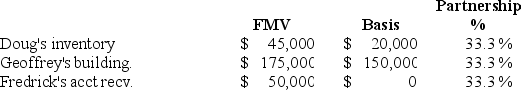

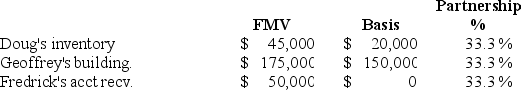

Doug,Geoffrey,and Fredrick form a partnership and contribute the following assets:

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership in each asset?

d.What are the holding periods to the partnership for each asset?

e.How would your answer change with respect to Geoffrey if his basis in the building was $85,000?

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership in each asset?

d.What are the holding periods to the partnership for each asset?

e.How would your answer change with respect to Geoffrey if his basis in the building was $85,000?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

Rita has a beginning basis in a partnership of $43,000.Rita's share of income and expense from the partnership consists of the following amounts:

a.What items are separately stated?

a.What items are separately stated?

b.What is Rita's self-employment income?

c.Calculate Rita's partnership basis at the end of the year.

a.What items are separately stated?

a.What items are separately stated?b.What is Rita's self-employment income?

c.Calculate Rita's partnership basis at the end of the year.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Callie contributes the following assets to a partnership in exchange for a 30% partnership interest:

What is Callie's beginning basis in her partnership interest?

What is Callie's beginning basis in her partnership interest?

What is Callie's beginning basis in her partnership interest?

What is Callie's beginning basis in her partnership interest?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Jose purchased a 30% partnership interest for $38,000 in June 2014.Jose's share of partnership income was $8,000 in 2014,$12,000 in 2015,$28,000 in 2016,and $6,000 in 2017.Jose made no additional contributions to,or withdrawals from,the partnership.On December 29,2017,Jose sold his partnership interest for $108,000.What is Jose's gain or loss on the sale of his partnership interest?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

Cameron has a basis in his partnership interest of $5,000.Cameron's share of partnership income is $5,000.He also receives a cash distribution from the partnership of $13,000.What is his gain or loss as a result of the distribution?

A)$13,000.

B)$5,000.

C)$3,000.

D)$0.

A)$13,000.

B)$5,000.

C)$3,000.

D)$0.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck