Deck 5: Adjustable and Floating Rate Mortgage Loans

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 5: Adjustable and Floating Rate Mortgage Loans

1

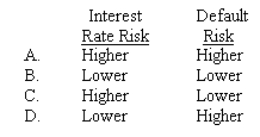

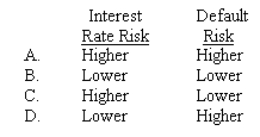

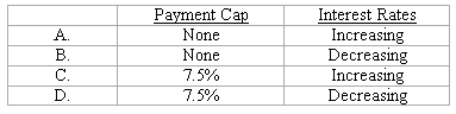

Which of the following descriptions most accurately reflects the risk position of an ARM lender in comparison to that of a FRM lender?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

D Above.

2

Which of the following clauses leads to higher risk for an ARMs lender?

A) Negative amortization is not allowed,when interest is not covered by the payment due to a payment cap.

B) There is floor for payments.

C) Adjustment interval is longer than one year.

D) All of the above.

A) Negative amortization is not allowed,when interest is not covered by the payment due to a payment cap.

B) There is floor for payments.

C) Adjustment interval is longer than one year.

D) All of the above.

Adjustment interval is longer than one year.

3

Which is NOT a component of an ARM?

A) A margin

B) An index

C) A chapter

D) Caps

A) A margin

B) An index

C) A chapter

D) Caps

A chapter

4

A major benefit of a PLAM is the mortgage payment increases closely following borrower salary increases.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

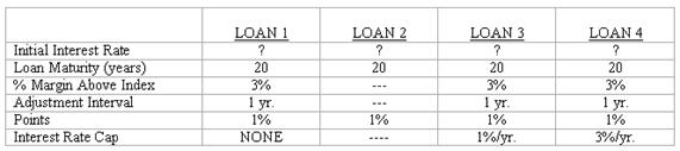

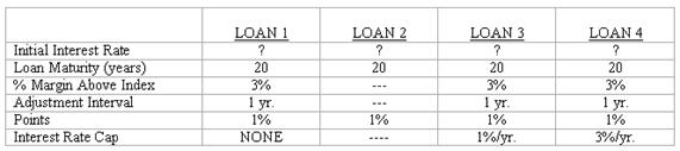

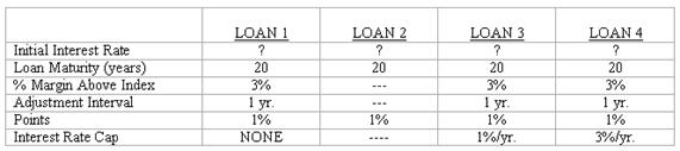

Which loan is a FRM?

A) Loan 1

B) Loan 2

C) Loan 3

D) Loan 4

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

In order to calculate the APR for an ARM,you must,

A) only use the first year's given interest rate.

B) estimate interest rates over the life of the loan.

C) assume the worst case scenario and use interest rates at their highest possible point over the life of the loan.

D) use only the first five year's interest rates because they can easily be estimated and most people only own a property for five years.

A) only use the first year's given interest rate.

B) estimate interest rates over the life of the loan.

C) assume the worst case scenario and use interest rates at their highest possible point over the life of the loan.

D) use only the first five year's interest rates because they can easily be estimated and most people only own a property for five years.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

Characteristics of a PLAM include an increasing mortgage payment and an adjusting loan balance tied to an index.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

If an ARM index increased 15%,the negative amortization on a loan with a 5% annual payment cap is calculated by:

A) using the same payment as last year and deducting 5% from the principal balance.

B) increasing the payment by 5%.

C) totaling the difference between the payment as if no cap existed and the 5% capped payment.

D) compounding the difference between the payment as if no cap existed and the 5% capped payments.

A) using the same payment as last year and deducting 5% from the principal balance.

B) increasing the payment by 5%.

C) totaling the difference between the payment as if no cap existed and the 5% capped payment.

D) compounding the difference between the payment as if no cap existed and the 5% capped payments.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

PLAMs have been very popular with lenders.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Negative amortization reduces the principal balance of a loan.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

With which loan does the lender have the lowest interest rate risk?

A) Loan 1

B) Loan 2

C) Loan 3

D) Loan 4

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

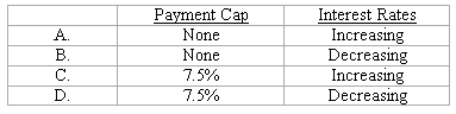

Under which scenario is negative amortization likely to occur?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

If one of the terms of an ARM read: Interest is capped at 2%/5%,what would that mean?

A) The borrower can choose the cap he wants by simply circling the appropriate choice.

B) The interest rate has a 2% annual cap rate and a 5% lifetime cap rate.

C) The interest rate has a 5% annual cap rate and a 2% lifetime cap rate.

D) The interest rate has a 2% annual cap rate and a 5% floor cap rate.

A) The borrower can choose the cap he wants by simply circling the appropriate choice.

B) The interest rate has a 2% annual cap rate and a 5% lifetime cap rate.

C) The interest rate has a 5% annual cap rate and a 2% lifetime cap rate.

D) The interest rate has a 2% annual cap rate and a 5% floor cap rate.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

The expected cost of borrowing does not depend on which of the following provisions?

A) The frequency of payment adjustments.

B) The inclusions of caps and floors on the interest rate,payment or loan balances.

C) The spread over the index chosen for a given ARM.

D) None of the above.

A) The frequency of payment adjustments.

B) The inclusions of caps and floors on the interest rate,payment or loan balances.

C) The spread over the index chosen for a given ARM.

D) None of the above.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

Given that every other factor is equal,which of the following ARM will have lowest expected cost?

A) ARM with payment caps and negative amortization.

B) ARM with interest rate caps.

C) ARM with longer Adjustment interval.

D) ARM with no caps or limitations.

A) ARM with payment caps and negative amortization.

B) ARM with interest rate caps.

C) ARM with longer Adjustment interval.

D) ARM with no caps or limitations.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

ARMs help lenders combat unanticipated inflation changes,interest rate changes,and a maturity gap.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following are disadvantages of PLAMs?

A) Lenders face high levels of interest rate risk under PLAMs.

B) Fewer homebuyers are likely to qualify for financing using PLAMs in comparison to CPMs.

C) The price level used to index PLAMs is measured on an ex post basis and historic prices may not be an accurate reflection of future price.

D) All of the above.

A) Lenders face high levels of interest rate risk under PLAMs.

B) Fewer homebuyers are likely to qualify for financing using PLAMs in comparison to CPMs.

C) The price level used to index PLAMs is measured on an ex post basis and historic prices may not be an accurate reflection of future price.

D) All of the above.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

ARMs were developed because lenders were tired of offering a limited selection of loan alternatives to borrowers.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

Lender's can partially avoid estimating interest rates by tying an ARM to an interest rate index.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

Which loan should have the lowest initial interest rate?

A) Loan 1

B) Loan 2

C) Loan 3

D) Loan 4

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

The floor of an ARM is the maximum reduction of payments or interest rates allowed.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

ARMs eliminate all the lender's interest rate risk.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

The default risk of a FRM is higher than the default risk of an ARM.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck