Deck 16: Financing Project Development

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 16: Financing Project Development

1

Permanent financing commitments usually allow the lender to approve major leases.

True

2

Construction loans provide the money to construct a building and are usually provided by life insurance companies or pensions funds.

False

3

Which one of the common contingencies is usually included with a permanent financing agreement?

A) Completion date for construction phase.

B) Minimum rent-up requirements

C) Materials used in construction phase

D) Cleanliness of work area

A) Completion date for construction phase.

B) Minimum rent-up requirements

C) Materials used in construction phase

D) Cleanliness of work area

Cleanliness of work area

4

Why would a developer be willing to manage a completed project even after it has been sold?

A) The developer knows the project better than other management companies and,therefore,could manage the property more efficiently

B) The developer could profit from the lucrative management fees being charges by management companies

C) Knowledge of the tenant's needs and the current leasing market might give the developer better insight with respect to future developments

D) All of the above

A) The developer knows the project better than other management companies and,therefore,could manage the property more efficiently

B) The developer could profit from the lucrative management fees being charges by management companies

C) Knowledge of the tenant's needs and the current leasing market might give the developer better insight with respect to future developments

D) All of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Commitments for construction financing are usually contingent on commitments for permanent financing.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

What term applies to the use of third-party financing that is used between funding advanced by the permanent lender and funds needed to repay the construction loan?

A) Interim Loan

B) Mini-perm financing

C) Gap financing

D) Partial financing

A) Interim Loan

B) Mini-perm financing

C) Gap financing

D) Partial financing

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Permanent loans provide the money for a single permanent mortgage loan and are usually provided by commercial banks or mortgage banking companies.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

Developers usually holdback about ___ percent of each progress payment.

A) 1

B) 10

C) 25

D) 75

A) 1

B) 10

C) 25

D) 75

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

Permanent funding commitments usually contain many funding contingencies.Which of the following would typically not be one of those contingencies?

A) Approval of all prospective leases

B) Approval of design changes or building material substitution

C) Provisions for gap financing

D) Minimum rent-up requirements

A) Approval of all prospective leases

B) Approval of design changes or building material substitution

C) Provisions for gap financing

D) Minimum rent-up requirements

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

Mini-perm loans usually refer to:

A) financing at local coffers.

B) financing for lease-up period.

C) financing for construction and all subsequent periods.

D) financing for construction,lease-up,and one or two subsequent years.

A) financing at local coffers.

B) financing for lease-up period.

C) financing for construction and all subsequent periods.

D) financing for construction,lease-up,and one or two subsequent years.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

In the context of a lease,percentage rents generally indicate that:

A) thetenant will pay a proportionate amount of rent for his space in comparison to the total net rentable area.

B) inaddition to a base rent,the lessor will receive a percentage of the tenant's cash flow above some break even point.

C) thetenant will pay a rent that is a certain percentage of the national average.

D) None of the above.

A) thetenant will pay a proportionate amount of rent for his space in comparison to the total net rentable area.

B) inaddition to a base rent,the lessor will receive a percentage of the tenant's cash flow above some break even point.

C) thetenant will pay a rent that is a certain percentage of the national average.

D) None of the above.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is the usual progression for a real estate development project?

A) Land acquisition,Completion,Management,Sale,Construction

B) Land acquisition,Construction,Completion,Management,Sale

C) Land acquisition,Construction,Completion,Sale ,Management

D) Land acquisition,Management,Construction,Completion,Sale

A) Land acquisition,Completion,Management,Sale,Construction

B) Land acquisition,Construction,Completion,Management,Sale

C) Land acquisition,Construction,Completion,Sale ,Management

D) Land acquisition,Management,Construction,Completion,Sale

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

Interest on a construction loan is usually paid:

A) upfront at the beginning of the loan.

B) periodically over the life of the loan.

C) inquarterly installments over the life of the loan.

D) atthe end of the loan.

A) upfront at the beginning of the loan.

B) periodically over the life of the loan.

C) inquarterly installments over the life of the loan.

D) atthe end of the loan.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

The demand for retail space should be examined in terms of the characteristics of the tenants demand in a given market.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a "soft cost" of construction?

A) The cost of the architectural drawings

B) The cost of pouring the foundation

C) The costs of erecting the building

D) The costs of finishing the interior space

A) The cost of the architectural drawings

B) The cost of pouring the foundation

C) The costs of erecting the building

D) The costs of finishing the interior space

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

Besides an estimate of costs,a construction loan submission package includes many other components.Which of the following would NOT be one of those components?

A) Pro Forma Statement of Cash Flows for an investor's portfolio

B) Pro Forma Statement of Cash Flows

C) Pro Forma Operating Statement

D) Ratio and Sensitivity Analysis

A) Pro Forma Statement of Cash Flows for an investor's portfolio

B) Pro Forma Statement of Cash Flows

C) Pro Forma Operating Statement

D) Ratio and Sensitivity Analysis

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

The most common method of distributing the funds provided by a construction loan is:

A) asingle lump sum of money at the closing of the loan.

B) asingle lump sum of money at the end of the construction project to reimburse the developer for the project's expenses and profit.

C) aseries of payments throughout the construction project to reimburse the developer for costs incurred since the previous payment.

D) aseries of payments throughout the construction project to reimburse the developer for anticipated expenses in the upcoming period.

A) asingle lump sum of money at the closing of the loan.

B) asingle lump sum of money at the end of the construction project to reimburse the developer for the project's expenses and profit.

C) aseries of payments throughout the construction project to reimburse the developer for costs incurred since the previous payment.

D) aseries of payments throughout the construction project to reimburse the developer for anticipated expenses in the upcoming period.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

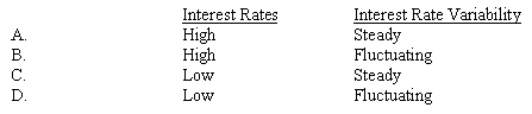

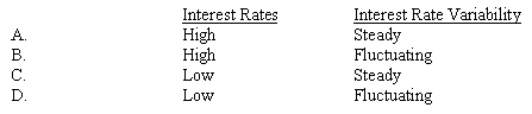

18

In comparison to permanent financing,the rates and rate variability for a construction loan would be:

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT true concerning a construction loan?

A) It usually has a lower rate than does permanent financing

B) It is also known as interim loan

C) Hard costs can usually be financed

D) The entire land cost can not usually be financed

A) It usually has a lower rate than does permanent financing

B) It is also known as interim loan

C) Hard costs can usually be financed

D) The entire land cost can not usually be financed

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is NOT one of the strategies of developers mentioned in this chapter.

A) To sell and lease back the land

B) Owning and managing after sale

C) Sell after lease-up phase

D) Develop for lease in master-planned development

A) To sell and lease back the land

B) Owning and managing after sale

C) Sell after lease-up phase

D) Develop for lease in master-planned development

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

Under a triparty buy-sell agreement,the construction lender will accept funding from the first party willing to repay the construction loan.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

Generally,as the cost of a site increases,so do the quality and the density of the improvements constructed on it.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Loans made under the assumption that markets will turn around are referred to as spec loans.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

Lenders typically finance the development of a project as a percentage of completed appraised value,including the price of the site.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Even after obtaining permanent financing,a developer still maintains the right to alter a project's design or the level of expenditures.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck