Deck 30: Financial Distress

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 30: Financial Distress

1

Whether bankruptcy is entered voluntarily or involuntarily the major difference between Chapter 7 and Chapter 11 is:

A) that liquidation occurs in Chapter 11 but reorganization is the objective under Chapter 7.

B) that there is no priority of claims under Chapter 11.

C) that liquidation occurs in Chapter 7 but reorganization is the objective under chapter 11.

D) no lawyers' fees are necessary under Chapter 7.

E) None of these.

A) that liquidation occurs in Chapter 11 but reorganization is the objective under Chapter 7.

B) that there is no priority of claims under Chapter 11.

C) that liquidation occurs in Chapter 7 but reorganization is the objective under chapter 11.

D) no lawyers' fees are necessary under Chapter 7.

E) None of these.

that liquidation occurs in Chapter 7 but reorganization is the objective under chapter 11.

2

Many corporations choose Chapter 11 bankruptcy proceedings voluntarily because the management can:

A) take up to 120 days to file a reorganization plan.

B) continue to run the business.

C) reorganize if the required fractions of creditors approve of the plan and it is confirmed when the reorganization takes place.

D) All of these.

E) None of these.

A) take up to 120 days to file a reorganization plan.

B) continue to run the business.

C) reorganize if the required fractions of creditors approve of the plan and it is confirmed when the reorganization takes place.

D) All of these.

E) None of these.

All of these.

3

A firm in financial distress that reorganizes:

A) continues to run the business as a going concern.

B) must have acceptance of the plan by the creditors.

C) may distribute new securities to creditors and shareholders.

D) All of these.

E) None of these.

A) continues to run the business as a going concern.

B) must have acceptance of the plan by the creditors.

C) may distribute new securities to creditors and shareholders.

D) All of these.

E) None of these.

All of these.

4

What is the absolute priority rule of the following claims once a corporation is determined to be bankrupt?

A) Administrative expenses, wages claims, government tax claims, debtholder and then equityholder claims

B) Administrative expenses, wages claims, government tax claims, equityholder and then debtholder claims

C) Wage claims, administrative expenses, debtholder claims, government tax claims and equityholder claims

D) Wage claims, administrative expenses, debtholder claims, equityholder claims and government tax claims

E) None of these.

A) Administrative expenses, wages claims, government tax claims, debtholder and then equityholder claims

B) Administrative expenses, wages claims, government tax claims, equityholder and then debtholder claims

C) Wage claims, administrative expenses, debtholder claims, government tax claims and equityholder claims

D) Wage claims, administrative expenses, debtholder claims, equityholder claims and government tax claims

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action?

A) Cash payments are delayed to creditors.

B) The market value of the stock declines by 10%.

C) The firm's operating cash flow is insufficient to pay current obligations.

D) Cash distributions are eliminated because the board of directors considers the surplus account to be low.

E) None of these.

A) Cash payments are delayed to creditors.

B) The market value of the stock declines by 10%.

C) The firm's operating cash flow is insufficient to pay current obligations.

D) Cash distributions are eliminated because the board of directors considers the surplus account to be low.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

A firm has several options available to it in times of financial distress. The firm may:

A) reduce capital and R & D spending.

B) raise new funds by selling securities or major assets.

C) file for bankruptcy.

D) negotiate with lenders.

E) All of these statements are truE.

A) reduce capital and R & D spending.

B) raise new funds by selling securities or major assets.

C) file for bankruptcy.

D) negotiate with lenders.

E) All of these statements are truE.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

Insolvency can be defined as:

A) not having cash.

B) being illiquid.

C) an inability to pay one's debts.

D) an inability to increase one's debts.

E) the present value of payments being less than assets.

A) not having cash.

B) being illiquid.

C) an inability to pay one's debts.

D) an inability to increase one's debts.

E) the present value of payments being less than assets.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

APR,as it relates to financial distress,means the rules of:

A) absolute profitability.

B) arbitration priority.

C) absolute priority.

D) arbitration profitability.

E) automatic profitability.

A) absolute profitability.

B) arbitration priority.

C) absolute priority.

D) arbitration profitability.

E) automatic profitability.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

Financial distress can involve which of the following:

A) asset restructuring.

B) financial restructuring.

C) liquidation.

D) All of these.

E) None of these.

A) asset restructuring.

B) financial restructuring.

C) liquidation.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

Financial restructuring can occur as:

A) a private workout.

B) an employee buy-out.

C) a bankruptcy reorganization.

D) Both a private workout and a bankruptcy reorganization.

E) Both an employee buy-out and a bankruptcy reorganization.

A) a private workout.

B) an employee buy-out.

C) a bankruptcy reorganization.

D) Both a private workout and a bankruptcy reorganization.

E) Both an employee buy-out and a bankruptcy reorganization.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

Most firms in financial distress do not fail and cease to exist. Many firms can actually benefit from distress by:

A) forcing a firm to reevaluate their core operations.

B) realigning their capital structure to reduce interest costs.

C) entering Chapter 11 and liquidating the firm.

D) Both forcing a firm to reevaluate their core operations; and realigning their capital structure to reduce interest costs.

E) Both forcing a firm to reevaluate their core operations; and entering Chapter 11 and liquidating the firm.

A) forcing a firm to reevaluate their core operations.

B) realigning their capital structure to reduce interest costs.

C) entering Chapter 11 and liquidating the firm.

D) Both forcing a firm to reevaluate their core operations; and realigning their capital structure to reduce interest costs.

E) Both forcing a firm to reevaluate their core operations; and entering Chapter 11 and liquidating the firm.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

The difference between liquidation and reorganization is:

A) reorganization terminates all operations of the firm and liquidation only terminates non-profitable operations.

B) liquidation terminates only profitable operations and reorganization terminates only non-profitable operations.

C) liquidation terminates all operations and reorganization maintains the option of the firm as a going concern.

D) liquidation only deals with current assets and reorganization only consolidates debt.

E) None of these.

A) reorganization terminates all operations of the firm and liquidation only terminates non-profitable operations.

B) liquidation terminates only profitable operations and reorganization terminates only non-profitable operations.

C) liquidation terminates all operations and reorganization maintains the option of the firm as a going concern.

D) liquidation only deals with current assets and reorganization only consolidates debt.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

The absolute priority rule:

A) is set to ensure senior claims are paid first.

B) is the priority rule in liquidations.

C) distributes proceeds of secured assets sales to the secured creditors first and the remainder to the unsecured.

D) All of these.

E) None of these.

A) is set to ensure senior claims are paid first.

B) is the priority rule in liquidations.

C) distributes proceeds of secured assets sales to the secured creditors first and the remainder to the unsecured.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

Flow-based insolvency is:

A) a balance sheet measurement.

B) a negative equity position.

C) when operating cash flow is insufficient to meet current obligations.

D) inability to pay one's debts.

E) Both when operating cash flow is insufficient to meet current obligations and inability to pay one's debts.

A) a balance sheet measurement.

B) a negative equity position.

C) when operating cash flow is insufficient to meet current obligations.

D) inability to pay one's debts.

E) Both when operating cash flow is insufficient to meet current obligations and inability to pay one's debts.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

Stock-based insolvency is a:

A) income statement measurement.

B) balance sheet measurement.

C) a book value measurement only.

D) Both income statement measurement and a book value measurement only.

E) Both balance sheet measurement and a book value measurement only.

A) income statement measurement.

B) balance sheet measurement.

C) a book value measurement only.

D) Both income statement measurement and a book value measurement only.

E) Both balance sheet measurement and a book value measurement only.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

Bankruptcy reorganizations are used by management to:

A) forestall the inevitable liquidation in all cases.

B) provide time to turn the business around.

C) allow the courts time to set up an administrative structure.

D) All of these.

E) None of these.

A) forestall the inevitable liquidation in all cases.

B) provide time to turn the business around.

C) allow the courts time to set up an administrative structure.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

A corporation is adjudged bankrupt under Chapter 7. When do the shareholders receive any payment?

A) After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.

B) After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and then the shareholders divide any remainder.

C) After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.

D) After the trustee liquidates the assets the shareholders are paid first because they are the owners of the firm and have the principal stake.

E) None of these.

A) After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.

B) After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and then the shareholders divide any remainder.

C) After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.

D) After the trustee liquidates the assets the shareholders are paid first because they are the owners of the firm and have the principal stake.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

A firm that has a series of negative earnings,sales declines and workforce reductions is likely headed to:

A) acquisition of another firm.

B) a merger.

C) financial distress.

D) new financing.

E) None of these.

A) acquisition of another firm.

B) a merger.

C) financial distress.

D) new financing.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

If a firm has a stock based insolvency in both book and market value terms and liquidates:

A) the payoff will not be 100% to all investors.

B) the unsecured creditors are likely to get less than full value.

C) the equityholders typically should receive nothing.

D) All of these.

E) None of these.

A) the payoff will not be 100% to all investors.

B) the unsecured creditors are likely to get less than full value.

C) the equityholders typically should receive nothing.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

Some of the various events which typically occur around the period of financial distress for a firm are:

A) continued increase in earnings.

B) steady growth.

C) dividend reductions.

D) Both continued increase in earnings and steady growth.

E) Both continued increase in earnings and dividend reductions.

A) continued increase in earnings.

B) steady growth.

C) dividend reductions.

D) Both continued increase in earnings and steady growth.

E) Both continued increase in earnings and dividend reductions.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

Perhaps equally,if not more damaging are the indirect costs of financial distress. Some examples of indirect costs are:

A) loss of current customers.

B) loss of business reputation.

C) management consumed in survival and not on a strategic direction.

D) All of these.

E) Both loss of current customers and loss of business reputation.

A) loss of current customers.

B) loss of business reputation.

C) management consumed in survival and not on a strategic direction.

D) All of these.

E) Both loss of current customers and loss of business reputation.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

Successful private workouts are better for firms than formal bankruptcy because:

A) direct costs are considerably lower in private workouts.

B) private workout firms can issue new debt senior to all prior debt.

C) stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.

D) Both direct costs are considerably lower in private workouts; and private workout firms can issue new debt senior to all prior debt.

E) Both direct costs are considerably lower in private workouts; and stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.

A) direct costs are considerably lower in private workouts.

B) private workout firms can issue new debt senior to all prior debt.

C) stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.

D) Both direct costs are considerably lower in private workouts; and private workout firms can issue new debt senior to all prior debt.

E) Both direct costs are considerably lower in private workouts; and stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2 million. The proposed financial structure is $750,000 in new mortgage debt,$250,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. How much should the unsecured creditors receive?

A) $500,000

B) $667,000

C) $750,000

D) $1,000,000

E) None of these.

A) $500,000

B) $667,000

C) $750,000

D) $1,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

Magic Mobile Homes is to be liquidated. All creditors,both secured and unsecured,are owed $2 million. Administrative costs of liquidation and wage payments are expected to be $500,000. A sale of assets is expected to bring $1.8 million after taxes. Secured creditors have a mortgage lien for $1,200,000 on the factory which will be liquidated for $900,000 out of the sale proceeds. The corporate tax rate is 34%. How much and what percentage of their claim will the unsecured creditors receive,in total?

A) $100,000; 12.50%

B) $290,909; 36.36%

C) $300,000; 37.50%

D) $600,000; 75.00%

E) Not enough information to answer

A) $100,000; 12.50%

B) $290,909; 36.36%

C) $300,000; 37.50%

D) $600,000; 75.00%

E) Not enough information to answer

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

Equityholders may prefer a formal bankruptcy filing because:

A) the firm can issue debtor in possession debt.

B) the firm can delay pre-bankruptcy interest payments.

C) the lack of information about the length and magnitude of the cash flow problem favors equityholders.

D) All of these.

E) None of these.

A) the firm can issue debtor in possession debt.

B) the firm can delay pre-bankruptcy interest payments.

C) the lack of information about the length and magnitude of the cash flow problem favors equityholders.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

Prepackaged bankruptcies are:

A) described as a combination of a private workout and a liquidation.

B) the easiest way to transfer wealth to the shareholders.

C) described as a combination of a completed private workout and the formal bankruptcy filing.

D) All of these.

E) None of these.

A) described as a combination of a private workout and a liquidation.

B) the easiest way to transfer wealth to the shareholders.

C) described as a combination of a completed private workout and the formal bankruptcy filing.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

Firms deal with financial distress by:

A) selling major assets.

B) merging with another firm.

C) issuing new securities.

D) exchanging debt for equity.

E) All of

A) selling major assets.

B) merging with another firm.

C) issuing new securities.

D) exchanging debt for equity.

E) All of

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

Credit scoring models are used by lenders to:

A) determine the borrowers capacity to pay.

B) aid in the prediction of default or bankruptcy.

C) determine the optimal debt equity ratio.

D) Both determine the borrowers capacity to pay and aid in the prediction of default or bankruptcy.

E) Both determine the borrowers capacity to pay and determine the optimal debt equity ratio.

A) determine the borrowers capacity to pay.

B) aid in the prediction of default or bankruptcy.

C) determine the optimal debt equity ratio.

D) Both determine the borrowers capacity to pay and aid in the prediction of default or bankruptcy.

E) Both determine the borrowers capacity to pay and determine the optimal debt equity ratio.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

The net payoff to creditors in formal bankruptcy may be low in present value terms because:

A) the financial structure may be complicated with several groups and types of creditors.

B) indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.

C) administrative costs are high and increase with the complexity and length of time in the formal bankruptcy process.

D) All of these.

E) None of these.

A) the financial structure may be complicated with several groups and types of creditors.

B) indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.

C) administrative costs are high and increase with the complexity and length of time in the formal bankruptcy process.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

A large negative equity position will lead a firm to be more likely to try to:

A) not file bankruptcy.

B) liquidate.

C) reorganize.

D) consolidate.

E) None of these.

A) not file bankruptcy.

B) liquidate.

C) reorganize.

D) consolidate.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

The key intuition of a Z-score model like Altman's is that:

A) only publicly traded firms can be evaluated.

B) one will be just as well off by guessing on default rates.

C) all corporations will default at least once.

D) financial profiles of bankrupt and non-bankrupt firms are very different one year before bankruptcy.

E) privately traded firms have better financial information which are disclosed to lenders and need not rely on any efficient market notions.

A) only publicly traded firms can be evaluated.

B) one will be just as well off by guessing on default rates.

C) all corporations will default at least once.

D) financial profiles of bankrupt and non-bankrupt firms are very different one year before bankruptcy.

E) privately traded firms have better financial information which are disclosed to lenders and need not rely on any efficient market notions.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

Altman's Z-score predicts the:

A) percentage of payout to equityholders in liquidations.

B) percentage of payout to equityholders in reorganization.

C) likelihood of a private workout.

D) likelihood of bankruptcy of a firm within one year.

E) None of these.

A) percentage of payout to equityholders in liquidations.

B) percentage of payout to equityholders in reorganization.

C) likelihood of a private workout.

D) likelihood of bankruptcy of a firm within one year.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

Very small firms are more likely to:

A) file for strategic bankruptcy.

B) file for bankruptcy protection earlier than large firms.

C) reorganize than liquidate compared to large firms.

D) liquidate than reorganize compared to large firms.

E) None of these.

A) file for strategic bankruptcy.

B) file for bankruptcy protection earlier than large firms.

C) reorganize than liquidate compared to large firms.

D) liquidate than reorganize compared to large firms.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements about private workouts of financial distress is NOT true?

A) Senior debt is usually replaced with junior debt.

B) Debt is usually replaced with equity.

C) Private workouts account for about three quarters of all reorganizations.

D) Top management is often dismissed or takes pay reductions.

E) None of these.

A) Senior debt is usually replaced with junior debt.

B) Debt is usually replaced with equity.

C) Private workouts account for about three quarters of all reorganizations.

D) Top management is often dismissed or takes pay reductions.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

Altman develop the Z-score model for publicly traded manufacturing firms. Using financial statement data and multiple discriminant analysis,he found that:

A) in actual use, a Z-score greater than 2.99 meant bankruptcy within one year.

B) in actual use, a Z-score greater than 1.81 implied a 90% chance of bankruptcy within one year.

C) in actual use, a Z-score of less than 1.81 would predict bankruptcy within one year.

D) in actual use, a Z-score less than 2.99 meant non-bankruptcy within one year.

E) None of these.

A) in actual use, a Z-score greater than 2.99 meant bankruptcy within one year.

B) in actual use, a Z-score greater than 1.81 implied a 90% chance of bankruptcy within one year.

C) in actual use, a Z-score of less than 1.81 would predict bankruptcy within one year.

D) in actual use, a Z-score less than 2.99 meant non-bankruptcy within one year.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

Magic Mobile Homes is to be liquidated. All creditors,both secured and unsecured,are owed $2 million. Administrative costs of liquidation and wage payments are expected to be $500,000. A sale of assets is expected to bring $1.8 million after taxes. Secured creditors have a mortgage lien for $1,200,000 on the factory which will be liquidated for $900,000 out of the sale proceeds. The corporate tax rate is 34%. How much and what percentage of their claim will the secured creditors receive,in total?

A) $900,000; 75%

B) $981,818; 81.82%

C) $1,009,091; 84.1%

D) $1,200,000; 100%

E) Not enough information to answer.

A) $900,000; 75%

B) $981,818; 81.82%

C) $1,009,091; 84.1%

D) $1,200,000; 100%

E) Not enough information to answer.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

In a prepackaged bankruptcy the firm:

A) and creditors agree to a private reorganization outside formal bankruptcy.

B) must reach agreement privately with most of the creditors.

C) will have difficulty when there are thousands of reluctant trade creditors.

D) All of these.

E) None of these.

A) and creditors agree to a private reorganization outside formal bankruptcy.

B) must reach agreement privately with most of the creditors.

C) will have difficulty when there are thousands of reluctant trade creditors.

D) All of these.

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

Approximately ____ of all firms going through a Chapter 11 bankruptcy successfully reorganize.

A) 0%

B) 15%

C) 25%

D) 50%

E) 85%

A) 0%

B) 15%

C) 25%

D) 50%

E) 85%

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

Financial distress may be more expensive if the:

A) information about the permanency of the shortfall is limited.

B) firm has many different types of creditors and other investors.

C) firm has never entered into bankruptcy before.

D) Both information about the permanency of the shortfall is limited; and firm has many different types of creditors and other investors.

E) Both firm has many different types of creditors and other investors; and firm has never entered into bankruptcy beforE.

A) information about the permanency of the shortfall is limited.

B) firm has many different types of creditors and other investors.

C) firm has never entered into bankruptcy before.

D) Both information about the permanency of the shortfall is limited; and firm has many different types of creditors and other investors.

E) Both firm has many different types of creditors and other investors; and firm has never entered into bankruptcy beforE.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2 million. The proposed financial structure is $750,000 in new mortgage debt,$250,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. How much should the secured creditors receive?

A) $1,000,000

B) $1,250,000

C) $1,333,333

D) $1,500,000

E) None of these.

A) $1,000,000

B) $1,250,000

C) $1,333,333

D) $1,500,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

The management of Patricia's Paddle Boats has proposed to reorganize the firm. The proposal is based on a going-concern value of $2,100,000. The proposed financial structure is $1,000,000 in new mortgage debt,$100,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2,500,000. Secured creditors have a mortgage lien for $1,300,000 on the factory. The corporate tax rate is 34%. How much should the unsecured creditors receive?

A) $600,000

B) $667,000

C) $900,000

D) $1,000,000

E) None of these.

A) $600,000

B) $667,000

C) $900,000

D) $1,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

Patricia's Paddle Boats is to be liquidated. All creditors,both secured and unsecured,are owed $2,100,000. Administrative costs of liquidation and wage payments are expected to be $750,000. A sale of assets is expected to bring $2,500,000 after taxes. Secured creditors have a mortgage lien for $1,900,000 on the factory which will be liquidated for $1,200,000 out of the sale proceeds. The corporate tax rate is 40%. How much and what percentage of their claim will the unsecured creditors receive,in total?

A) $100,000; 25.00%

B) $122,222; 61.11%

C) $166,666; 77.50%

D) $200,000; 100.00%

E) Not enough information to answer

A) $100,000; 25.00%

B) $122,222; 61.11%

C) $166,666; 77.50%

D) $200,000; 100.00%

E) Not enough information to answer

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2 million. The proposed financial structure is $750,000 in new mortgage debt,$250,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%. What will the equityholders receive if they had 5 million shares with a par value of $0.50 each?

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt,$300,000 in subordinated debt and $1,500,000 in new equity. All creditors,both secured and unsecured,are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. How much should the unsecured creditors receive?

A) $300,000

B) $500,000

C) $1,000,000

D) $2,300,000

E) None of these.

A) $300,000

B) $500,000

C) $1,000,000

D) $2,300,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

The management of Patricia's Paddle Boats has proposed to reorganize the firm. The proposal is based on a going-concern value of $2,100,000. The proposed financial structure is $1,000,000 in new mortgage debt,$100,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2,500,000. Secured creditors have a mortgage lien for $1,300,000 on the factory. The corporate tax rate is 34%. What will the equityholders receive if they had 5 million shares with a par value of $0.50 each?

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

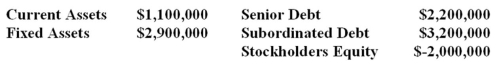

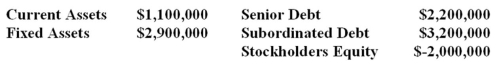

The Steel Pony Company,a maker of all-terrain recreational vehicles,is having financial difficulties due to high interest payments. The estimated "going concern" value of Steel Pony is $4.0 million. The senior debt claim is on all fixed assets. The balance sheet of the firm is as shown:

If Steel Pony decides to file for formal bankruptcy and expects to sell the firm for the "going concern" value and pay administrative fees which amount to 5% of the total going concern value,determine the distribution of the proceeds under the rules of absolute priority.

If Steel Pony decides to file for formal bankruptcy and expects to sell the firm for the "going concern" value and pay administrative fees which amount to 5% of the total going concern value,determine the distribution of the proceeds under the rules of absolute priority.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

Patricia's Paddle Boats is to be liquidated. All creditors,both secured and unsecured,are owed $2,100,000. Administrative costs of liquidation and wage payments are expected to be $750,000. A sale of assets is expected to bring $2,500,000 after taxes. Secured creditors have a mortgage lien for $1,900,000 on the factory which will be liquidated for $1,200,000 out of the sale proceeds. The corporate tax rate is 40%. How much and what percentage of their claim will the secured creditors receive,in total?

A) $900,000; 47.37%

B) $1,250,000; 65.79%

C) 1,627,777; 85.67%

D) $1,900,000; 100%

E) Not enough information to answer.

A) $900,000; 47.37%

B) $1,250,000; 65.79%

C) 1,627,777; 85.67%

D) $1,900,000; 100%

E) Not enough information to answer.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt,$300,000 in subordinated debt and $1,500,000 in new equity. All creditors,both secured and unsecured,are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. How much should the secured creditors receive?

A) $1,500,000

B) $2,000,000

C) $2,300,000

D) $3,000,000

E) None of these.

A) $1,500,000

B) $2,000,000

C) $2,300,000

D) $3,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt,$300,000 in subordinated debt and $1,500,000 in new equity. All creditors,both secured and unsecured,are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%. What will the equityholders receive if they had 5 million shares with a par value of $0.50 each?

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

A) $0

B) $35,714

C) $583,333

D) $1,000,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

The Here Today Corporation has applied to your bank for a loan. You have their financial statements and the revised Z-score model of:

Z = 6.56 (Net Working Capital/Total Assets) + 3.26 (Accumulated Retained Earnings/Total Assets) + 1.05 (EBIT/Total Assets) + 6.72 (Book Value of Equity/Total Liabilities) where:

Z < 1.23 predicts bankruptcy. A Z score between 1.23 and 2.90 indicates gray area. A Z score greater than 2.90 indicates no bankruptcy. From the financial statements you gathered net working capital of $237,500; accumulated retained earnings of $120,000; book value of equity of $950,000; total assets of $4,750,000; EBIT of $261,250; and total liabilities of $3,800,000. Should the bank lend to Here Today?

Z = 6.56 (Net Working Capital/Total Assets) + 3.26 (Accumulated Retained Earnings/Total Assets) + 1.05 (EBIT/Total Assets) + 6.72 (Book Value of Equity/Total Liabilities) where:

Z < 1.23 predicts bankruptcy. A Z score between 1.23 and 2.90 indicates gray area. A Z score greater than 2.90 indicates no bankruptcy. From the financial statements you gathered net working capital of $237,500; accumulated retained earnings of $120,000; book value of equity of $950,000; total assets of $4,750,000; EBIT of $261,250; and total liabilities of $3,800,000. Should the bank lend to Here Today?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

When choosing between liquidation and reorganization,what are some of the empirical factors that lead a firm toward one choice or the other?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

52

The management of Patricia's Paddle Boats has proposed to reorganize the firm. The proposal is based on a going-concern value of $2,100,000. The proposed financial structure is $1,000,000 in new mortgage debt,$100,000 in subordinated debt and $1,000,000 in new equity. All creditors,both secured and unsecured,are owed $2,500,000. Secured creditors have a mortgage lien for $1,300,000 on the factory. The corporate tax rate is 34%. How much should the secured creditors receive?

A) $100,000

B) $1,000,000

C) $1,100,000

D) $1,300,000

E) None of these.

A) $100,000

B) $1,000,000

C) $1,100,000

D) $1,300,000

E) None of these.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck