Deck 13: A Macroeconomic Theory of the Open Economy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/184

Play

Full screen (f)

Deck 13: A Macroeconomic Theory of the Open Economy

1

In the open-economy macroeconomic model, how can the market for loanable funds identity be written?

A)S = I

B)S = NCO

C)S = I + NCO

D)S + I = NCO

A)S = I

B)S = NCO

C)S = I + NCO

D)S + I = NCO

C

2

If a country's imports are greater than its exports, what is the country said to have?

A)a trade surplus

B)a trade deficit

C)a comparative advantage

D)an absolute advantage

A)a trade surplus

B)a trade deficit

C)a comparative advantage

D)an absolute advantage

B

3

Jack and Jill are co-owners of the Canadian firm Wells Grey Petroleum. Jack borrows money to build an oil well in Alberta. Jill borrows money to build an oil well in Venezuela. Which of the following purchases of capital counts as demand for loanable funds in the Canadian market?

A)both Jack's and Jill's purchase of capital

B)neither Jack's nor Jill's purchase of capital

C)Jack's purchase of capital, but not Jill's

D)Jill's purchase of capital, but not Jack's

A)both Jack's and Jill's purchase of capital

B)neither Jack's nor Jill's purchase of capital

C)Jack's purchase of capital, but not Jill's

D)Jill's purchase of capital, but not Jack's

A

4

When does the purchase of a capital asset add to the demand for loanable funds?

A)only if the asset is located at home

B)only if the asset is located abroad

C)whether the asset is located at home or abroad

D)never

A)only if the asset is located at home

B)only if the asset is located abroad

C)whether the asset is located at home or abroad

D)never

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

5

In an open economy, which of the following does the market for loanable funds take as given?

A)saving

B)investment

C)exchange rate

D)real interest rate

A)saving

B)investment

C)exchange rate

D)real interest rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

6

In the open-economy macroeconomic model, where does the supply of loanable funds come from?

A)national saving

B)private saving

C)domestic investment

D)the sum of domestic investment and net capital outflow

A)national saving

B)private saving

C)domestic investment

D)the sum of domestic investment and net capital outflow

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is the effect of an increase in the Canadian real interest rate?

A)Canadians buy more foreign assets, which increases Canadian net capital outflow.

B)Canadians buy more foreign assets, which reduces Canadian net capital outflow.

C)Foreigners buy more Canadian assets, which reduces Canadian net capital outflow.

D)Foreigners buy more Canadian assets, which increases Canadian net capital outflow.

A)Canadians buy more foreign assets, which increases Canadian net capital outflow.

B)Canadians buy more foreign assets, which reduces Canadian net capital outflow.

C)Foreigners buy more Canadian assets, which reduces Canadian net capital outflow.

D)Foreigners buy more Canadian assets, which increases Canadian net capital outflow.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

8

In the open-economy macroeconomic model, where does the demand for loanable funds come from?

A)domestic investment

B)net exports

C)net capital outflow

D)the sum of net capital outflow and domestic investment

A)domestic investment

B)net exports

C)net capital outflow

D)the sum of net capital outflow and domestic investment

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following does the open-economy macroeconomic model take as given?

A)GDP, but not the price level

B)the price level, but not GDP

C)both the price level and GDP

D)the exchange rate

A)GDP, but not the price level

B)the price level, but not GDP

C)both the price level and GDP

D)the exchange rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

10

In an open economy, what does the market for loanable funds equate national saving with?

A)domestic investment

B)net capital outflow

C)the sum of national consumption and government spending

D)the sum of domestic investment and net capital outflow

A)domestic investment

B)net capital outflow

C)the sum of national consumption and government spending

D)the sum of domestic investment and net capital outflow

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

11

What effect does a fall in the real interest rate have on the quantity of loanable funds?

A)It increases the quantity of loanable funds demanded.

B)It decreases the quantity of loanable funds demanded.

C)It increases the quantity of loanable funds supplied.

D)It does not affect the quantity of loanable funds supplied.

A)It increases the quantity of loanable funds demanded.

B)It decreases the quantity of loanable funds demanded.

C)It increases the quantity of loanable funds supplied.

D)It does not affect the quantity of loanable funds supplied.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following does the open-economy macroeconomic model examine?

A)the determination of output growth rate and the real interest rate

B)the determination of unemployment and the exchange rate

C)the determination of output growth rate and the inflation rate

D)the determination of the trade balance and the exchange rate

A)the determination of output growth rate and the real interest rate

B)the determination of unemployment and the exchange rate

C)the determination of output growth rate and the inflation rate

D)the determination of the trade balance and the exchange rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following best describes the effects of an increase in real interest rates in Canada?

A)It discourages both Canadian and foreign residents from buying Canadian assets.

B)It encourages both Canadian and foreign residents to buy Canadian assets.

C)It encourages Canadian residents to buy Canadian assets, but discourages foreign residents from buying Canadian assets.

D)It encourages foreign residents to buy Canadian assets, but discourages Canadian residents from buying Canadian assets.

A)It discourages both Canadian and foreign residents from buying Canadian assets.

B)It encourages both Canadian and foreign residents to buy Canadian assets.

C)It encourages Canadian residents to buy Canadian assets, but discourages foreign residents from buying Canadian assets.

D)It encourages foreign residents to buy Canadian assets, but discourages Canadian residents from buying Canadian assets.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following does the open-economy macroeconomic model include?

A)only the market for loanable funds

B)only the market for foreign-currency exchange

C)both the market for loanable funds and the market for foreign-currency exchange

D)neither the market for loanable funds or the market for foreign-currency exchange

A)only the market for loanable funds

B)only the market for foreign-currency exchange

C)both the market for loanable funds and the market for foreign-currency exchange

D)neither the market for loanable funds or the market for foreign-currency exchange

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following would be consistent with an increase in the Canadian real interest rate?

A)A Swiss bank purchases a Canadian bond instead of the German bond it had considered purchasing.

B)Canadian firms decide, since interest rates are higher, to do more investment spending.

C)Brad, a Canadian resident, decides to put less money in his savings account than he had planned to.

D)Canadian net exports increase.

A)A Swiss bank purchases a Canadian bond instead of the German bond it had considered purchasing.

B)Canadian firms decide, since interest rates are higher, to do more investment spending.

C)Brad, a Canadian resident, decides to put less money in his savings account than he had planned to.

D)Canadian net exports increase.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

16

What does the market for loanable funds coordinate?

A)supply and demand for dollars in the foreign exchange market

B)people who want to import or export goods

C)sellers and buyers

D)lenders and borrowers

A)supply and demand for dollars in the foreign exchange market

B)people who want to import or export goods

C)sellers and buyers

D)lenders and borrowers

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

17

What does a lower real interest rate decrease the quantity of?

A)loanable funds demanded

B)loanable funds supplied

C)domestic investment

D)net capital outflow

A)loanable funds demanded

B)loanable funds supplied

C)domestic investment

D)net capital outflow

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

18

What does the market for foreign-currency exchange coordinate?

A)foreign investment

B)foreign trade

C)people exchanging domestic currency for the currency of other countries

D)investment and saving

A)foreign investment

B)foreign trade

C)people exchanging domestic currency for the currency of other countries

D)investment and saving

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following best describes the effects of an increase in the real interest rate?

A)It discourages people from saving and so increases the quantity of loanable funds demanded.

B)It discourages people from saving and so decreases the quantity of loanable funds demanded.

C)It encourages people to save and so increases the quantity of loanable funds supplied.

D)It encourages people to save and so decreases the quantity of loanable funds supplied.

A)It discourages people from saving and so increases the quantity of loanable funds demanded.

B)It discourages people from saving and so decreases the quantity of loanable funds demanded.

C)It encourages people to save and so increases the quantity of loanable funds supplied.

D)It encourages people to save and so decreases the quantity of loanable funds supplied.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

20

What does a higher real interest rate lowers the quantity of?

A)national saving

B)net capital outflow

C)loanable funds demanded

D)loanable funds supplied

A)national saving

B)net capital outflow

C)loanable funds demanded

D)loanable funds supplied

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

21

If there is a surplus of loanable funds, which of the following best describes the consequences?

A)The quantity demanded is greater than the quantity supplied, and the interest rate will rise.

B)The quantity demanded is greater than the quantity supplied, and the interest rate will fall

C)The quantity demanded is less than the quantity supplied, and the interest rate will rise.

D)The quantity demanded is less than the quantity supplied, and the interest rate will fall.

A)The quantity demanded is greater than the quantity supplied, and the interest rate will rise.

B)The quantity demanded is greater than the quantity supplied, and the interest rate will fall

C)The quantity demanded is less than the quantity supplied, and the interest rate will rise.

D)The quantity demanded is less than the quantity supplied, and the interest rate will fall.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

22

At the equilibrium interest rate in the open economy macroeconomic model, which of the following is the amount that people want to save?

A)the desired quantity of net capital outflow

B)the desired quantity of domestic investment

C)the desired quantity of net capital outflow plus domestic investment

D)the desired quantity of net capital outflow minus domestic investment

A)the desired quantity of net capital outflow

B)the desired quantity of domestic investment

C)the desired quantity of net capital outflow plus domestic investment

D)the desired quantity of net capital outflow minus domestic investment

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

23

If the world real interest rate exceeds the interest rate that would occur if the Canadian economy were closed, then the Canadian net capital outflow will be which of the following?

A)positive

B)negative

C)decreasing

D)increasing

A)positive

B)negative

C)decreasing

D)increasing

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

24

If the quantity of loanable funds supplied is greater than the quantity demanded, which of the following best describes the consequences?

A)There is a shortage of loanable funds, and the interest rate will fall.

B)There is a shortage of loanable funds, and the interest rate will rise.

C)There is a surplus of loanable funds, and the interest rate will fall.

D)There is a surplus of loanable funds, and the interest rate will rise.

A)There is a shortage of loanable funds, and the interest rate will fall.

B)There is a shortage of loanable funds, and the interest rate will rise.

C)There is a surplus of loanable funds, and the interest rate will fall.

D)There is a surplus of loanable funds, and the interest rate will rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

25

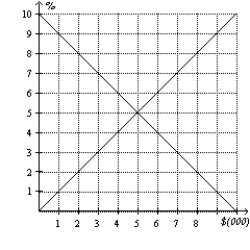

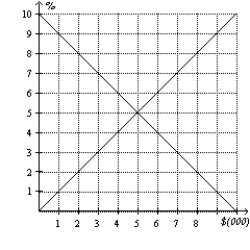

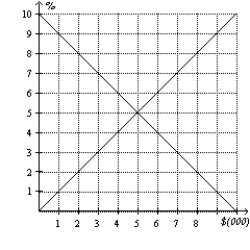

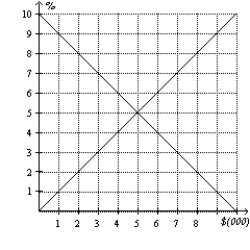

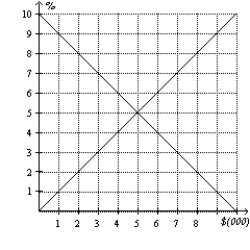

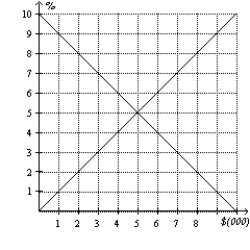

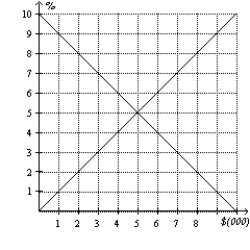

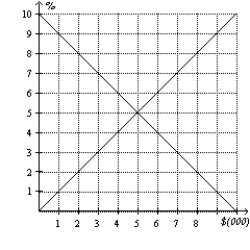

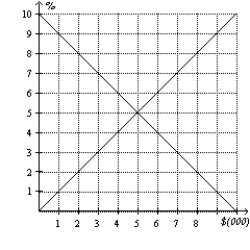

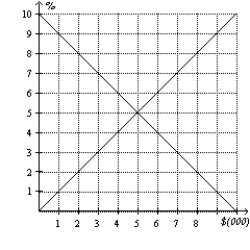

Figure 32-1

Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, what is the quantity of loanable funds demanded?

A)$7000

B)$6000

C)$5000

D)$4000

Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, what is the quantity of loanable funds demanded?

A)$7000

B)$6000

C)$5000

D)$4000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

26

In an open economy, which of the following best identifies the sources of loanable funds?

A)Canadians who consume less than their income and government budget deficit

B)Canadians who consume less than their income and government budget surplus

C)foreigners who buy Canadian bonds and stock and Canadian government surplus

D)foreigners who invest in Canada and Canadian government surplus

A)Canadians who consume less than their income and government budget deficit

B)Canadians who consume less than their income and government budget surplus

C)foreigners who buy Canadian bonds and stock and Canadian government surplus

D)foreigners who invest in Canada and Canadian government surplus

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

27

In an open economy, where does the demand for loanable funds come from?

A)only from those who want to borrow funds to buy domestic capital goods

B)only from those who want to borrow funds to buy foreign assets

C)from those who want to borrow funds to buy either domestic capital goods or foreign assets

D)from those who want to borrow funds to buy Canadian bonds or stock in Canadian companies

A)only from those who want to borrow funds to buy domestic capital goods

B)only from those who want to borrow funds to buy foreign assets

C)from those who want to borrow funds to buy either domestic capital goods or foreign assets

D)from those who want to borrow funds to buy Canadian bonds or stock in Canadian companies

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

28

Figure 32-1

Refer to Figure 32-1. If the world interest rate equals 4 percent, what is the net capital outflow?

A)$4000

B)$2000

C)-$2000

D)-$4000

Refer to Figure 32-1. If the world interest rate equals 4 percent, what is the net capital outflow?

A)$4000

B)$2000

C)-$2000

D)-$4000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

29

Figure 32-1

Refer to Figure 32-1. In the figure shown, if the real interest rate is 6 percent, what is the result?

A)a surplus of $4000

B)surplus of $2000

C)shortage of $4000

D)shortage of $2000

Refer to Figure 32-1. In the figure shown, if the real interest rate is 6 percent, what is the result?

A)a surplus of $4000

B)surplus of $2000

C)shortage of $4000

D)shortage of $2000

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

30

Figure 32-1

Refer to Figure 32-1. If the world interest rate equals 6 percent, what is the net capital outflow?

A)positive

B)negative

C)either positive or negative

D)Net capital outflow is not determined by the world interest rate.

Refer to Figure 32-1. If the world interest rate equals 6 percent, what is the net capital outflow?

A)positive

B)negative

C)either positive or negative

D)Net capital outflow is not determined by the world interest rate.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

31

What changes will a shortage of loanable funds induce in a Savings-Investment diagram in a closed economy?

A)The demand for loanable funds curve will shift right, so the interest rate will rise.

B)The supply of loanable funds curve will shift left, so the interest rate will fall.

C)There will be no shifts of the curves, but the interest rate will rise.

D)There will be no shifts of the curves, but the interest rate will rise.

A)The demand for loanable funds curve will shift right, so the interest rate will rise.

B)The supply of loanable funds curve will shift left, so the interest rate will fall.

C)There will be no shifts of the curves, but the interest rate will rise.

D)There will be no shifts of the curves, but the interest rate will rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

32

If the world real interest rate is less than the real interest rate that would occur in Canada if there was no trade, then how does Canadian net capital outflow change?

A)It decreases.

B)It increases.

C)It does not change.

D)There is not sufficient information to determine the change in capital outflow.

A)It decreases.

B)It increases.

C)It does not change.

D)There is not sufficient information to determine the change in capital outflow.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is consistent with negative net exports?

A)Net capital outflow is positive, so foreign assets bought by Canadians are greater than Canadian assets bought by foreigners.

B)Net capital outflow is positive, so Canadian assets bought by foreigners are greater than foreign assets bought by Canadians.

C)Net capital outflow is negative, so foreign assets bought by Canadians are greater than Canadian assets bought by foreigners.

D)Net capital outflow is negative, so Canadian assets bought by foreigners are greater than foreign assets bought by Canadians.

A)Net capital outflow is positive, so foreign assets bought by Canadians are greater than Canadian assets bought by foreigners.

B)Net capital outflow is positive, so Canadian assets bought by foreigners are greater than foreign assets bought by Canadians.

C)Net capital outflow is negative, so foreign assets bought by Canadians are greater than Canadian assets bought by foreigners.

D)Net capital outflow is negative, so Canadian assets bought by foreigners are greater than foreign assets bought by Canadians.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

34

Figure 32-1

Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, there will be pressure for which of the following changes?

A)for the real interest rate to rise

B)for the demand for loanable funds curve to shift right

C)for the supply for loanable funds curve to shift left

D)for the real interest rate to fall

Refer to Figure 32-1. In the figure shown, if the real interest rate is 4 percent, there will be pressure for which of the following changes?

A)for the real interest rate to rise

B)for the demand for loanable funds curve to shift right

C)for the supply for loanable funds curve to shift left

D)for the real interest rate to fall

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

35

In an open economy, what does net capital outflow equal?

A)imports

B)net exports

C)exports

D)net imports

A)imports

B)net exports

C)exports

D)net imports

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following would make both the equilibrium interest rate and the equilibrium quantity of loanable funds increase?

A)The demand for loanable funds shifts right.

B)The demand for loanable funds shifts left.

C)The supply of loanable funds shifts right.

D)The supply of loanable funds shifts left.

A)The demand for loanable funds shifts right.

B)The demand for loanable funds shifts left.

C)The supply of loanable funds shifts right.

D)The supply of loanable funds shifts left.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

37

In the market for foreign currency exchange in the open economy macroeconomic model, which of the following does the amount of net capital outflow represent?

A)the quantity of dollars supplied for the purpose of selling assets domestically

B)the quantity of dollars supplied for the purpose of buying assets abroad

C)the quantity of dollars demanded for the purpose of buying Canadian net exports of goods and services

D)the quantity of dollars demanded for the purpose of importing foreign goods and services

A)the quantity of dollars supplied for the purpose of selling assets domestically

B)the quantity of dollars supplied for the purpose of buying assets abroad

C)the quantity of dollars demanded for the purpose of buying Canadian net exports of goods and services

D)the quantity of dollars demanded for the purpose of importing foreign goods and services

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following would make the equilibrium interest rate increase and the equilibrium quantity of funds decrease?

A)The supply of loanable funds shifts right.

B)The supply of loanable funds shifts left.

C)The demand for loanable funds shifts right.

D)The demand for loanable funds shifts left.

A)The supply of loanable funds shifts right.

B)The supply of loanable funds shifts left.

C)The demand for loanable funds shifts right.

D)The demand for loanable funds shifts left.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is consistent with positive net exports?

A)Exports are greater than imports.

B)Net capital outflow is negative.

C)Exports are less than imports.

D)Net capital outflow is zero.

A)Exports are greater than imports.

B)Net capital outflow is negative.

C)Exports are less than imports.

D)Net capital outflow is zero.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

40

In the open economy macroeconomic model, what is net capital outflow equal to?

A)the quantity of dollars supplied in the foreign exchange market

B)the quantity of dollars demand in the foreign exchange market

C)the quantity of funds supplied in the loanable funds market

D)the quantity of funds demanded in the loanable funds market

A)the quantity of dollars supplied in the foreign exchange market

B)the quantity of dollars demand in the foreign exchange market

C)the quantity of funds supplied in the loanable funds market

D)the quantity of funds demanded in the loanable funds market

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

41

What is the real exchange rate equal to?

A)the relative price of domestic and foreign currency

B)the relative price of domestic and foreign goods

C)the ratio between the domestic and foreign interest rates

D)the nominal exchange rate minus the inflation rate

A)the relative price of domestic and foreign currency

B)the relative price of domestic and foreign goods

C)the ratio between the domestic and foreign interest rates

D)the nominal exchange rate minus the inflation rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

42

In the open-economy macroeconomic model, which of the following is the key determinant of net capital outflow?

A)the nominal exchange rate

B)the nominal interest rate

C)the real exchange rate

D)the real interest rate

A)the nominal exchange rate

B)the nominal interest rate

C)the real exchange rate

D)the real interest rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is included in the supply of dollars in the market for foreign-currency exchange in the open-economy macroeconomic model?

A)A retail outlet in Afghanistan wants to buy watches from a Canadian manufacturer.

B)A Canadian bank loans dollars to Blair, a Canadian resident, who wants to purchase a new car made in Canada.

C)A Canadian-based mutual fund wants to purchase stock issued by a Polish company.

D)A Canadian resident imports a car made in Japan.

A)A retail outlet in Afghanistan wants to buy watches from a Canadian manufacturer.

B)A Canadian bank loans dollars to Blair, a Canadian resident, who wants to purchase a new car made in Canada.

C)A Canadian-based mutual fund wants to purchase stock issued by a Polish company.

D)A Canadian resident imports a car made in Japan.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

44

In the market for foreign-currency exchange in the open-economy macroeconomic model, which of the following results from a higher real exchange rate?

A)It makes Canadian goods more expensive relative to foreign goods and reduces the quantity of dollars supplied.

B)It makes Canadian goods more expensive relative to foreign goods and reduces the quantity of dollars demanded.

C)It makes foreign goods more expensive relative to Canadian goods and reduces the quantity of dollars supplied.

D)It makes foreign goods more expensive relative to Canadian goods and reduces the quantity of dollars demanded.

A)It makes Canadian goods more expensive relative to foreign goods and reduces the quantity of dollars supplied.

B)It makes Canadian goods more expensive relative to foreign goods and reduces the quantity of dollars demanded.

C)It makes foreign goods more expensive relative to Canadian goods and reduces the quantity of dollars supplied.

D)It makes foreign goods more expensive relative to Canadian goods and reduces the quantity of dollars demanded.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

45

What does the value of net exports equal?

A)the value of national saving

B)the value of public saving

C)the value of national saving minus imports

D)the value of national saving minus domestic investment

A)the value of national saving

B)the value of public saving

C)the value of national saving minus imports

D)the value of national saving minus domestic investment

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

46

According to the theory of purchasing-power parity, what is the shape of the demand curve for foreign-currency exchange?

A)downward sloping

B)upward sloping

C)horizontal

D)vertical

A)downward sloping

B)upward sloping

C)horizontal

D)vertical

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is consistent with an above-the-equilibrium exchange rate of the dollar?

A)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will appreciate.

B)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will depreciate.

C)The quantity of dollars supplied is less than the quantity demanded, and the dollar will appreciate.

D)The quantity of dollars supplied is less than the quantity demanded, and the dollar will depreciate.

A)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will appreciate.

B)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will depreciate.

C)The quantity of dollars supplied is less than the quantity demanded, and the dollar will appreciate.

D)The quantity of dollars supplied is less than the quantity demanded, and the dollar will depreciate.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is the supply and demand for loanable funds equation in an open economy?

A)S = I

B)S = NX + NCO

C)S = NCO

D)S = I + NCO

A)S = I

B)S = NX + NCO

C)S = NCO

D)S = I + NCO

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following would tend to shift the supply of dollars in the foreign-currency exchange market model to the right?

A)The exchange rate rises.

B)The exchange rate falls.

C)The expected rate of return on Canadian assets rises.

D)The expected rate of return on Canadian assets falls.

A)The exchange rate rises.

B)The exchange rate falls.

C)The expected rate of return on Canadian assets rises.

D)The expected rate of return on Canadian assets falls.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would tend to shift the supply of dollars in the foreign-currency exchange market model to the left?

A)The exchange rate rises.

B)The exchange rate falls.

C)The expected rate of return on Canadian assets rises.

D)The expected rate of return on Canadian assets falls.

A)The exchange rate rises.

B)The exchange rate falls.

C)The expected rate of return on Canadian assets rises.

D)The expected rate of return on Canadian assets falls.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is consistent with a depreciation of the dollar?

A)Canadian goods become less expensive relative to foreign goods, which makes exports rise and imports fall.

B)Canadian goods become less expensive relative to foreign goods, which makes exports fall and imports rise.

C)Canadian goods become more expensive relative to foreign goods, which makes exports rise and imports fall.

D)Canadian goods become more expensive relative to foreign goods, which makes exports fall and imports rise.

A)Canadian goods become less expensive relative to foreign goods, which makes exports rise and imports fall.

B)Canadian goods become less expensive relative to foreign goods, which makes exports fall and imports rise.

C)Canadian goods become more expensive relative to foreign goods, which makes exports rise and imports fall.

D)Canadian goods become more expensive relative to foreign goods, which makes exports fall and imports rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is consistent with a below-the-equilibrium exchange rate of the dollar?

A)The quantity of dollars supplied is less than the quantity demanded, and the dollar will appreciate.

B)The quantity of dollars supplied is less than the quantity demanded, and the dollar will depreciate.

C)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will appreciate.

D)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will depreciate.

A)The quantity of dollars supplied is less than the quantity demanded, and the dollar will appreciate.

B)The quantity of dollars supplied is less than the quantity demanded, and the dollar will depreciate.

C)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will appreciate.

D)The quantity of dollars supplied is greater than the quantity demanded, and the dollar will depreciate.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

53

What is net capital outflow equal to?

A)national saving minus the trade balance

B)domestic investment plus national saving

C)national saving minus domestic investment

D)domestic investment minus national saving

A)national saving minus the trade balance

B)domestic investment plus national saving

C)national saving minus domestic investment

D)domestic investment minus national saving

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

54

What is the variable that links the market for loanable funds and the foreign-currency exchange market?

A)net capital outflow

B)national saving

C)exports

D)imports

A)net capital outflow

B)national saving

C)exports

D)imports

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

55

What does the identity "net capital outflow = net exports" imply?

A)The supply of dollars equals the demand for dollars in the foreign-currency exchange market.

B)National saving equals domestic investment.

C)The volume of exports equals the volume of imports.

D)National saving is greater than domestic investment.

A)The supply of dollars equals the demand for dollars in the foreign-currency exchange market.

B)National saving equals domestic investment.

C)The volume of exports equals the volume of imports.

D)National saving is greater than domestic investment.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is consistent with an appreciation of the dollar?

A)Canadian goods become less expensive relative to foreign goods, which makes exports rise and imports fall.

B)Canadian goods become less expensive relative to foreign goods, which makes exports fall and imports rise.

C)Canadian goods become more expensive relative to foreign goods, which makes exports rise and imports fall.

D)Canadian goods become more expensive relative to foreign goods, which makes exports fall and imports rise.

A)Canadian goods become less expensive relative to foreign goods, which makes exports rise and imports fall.

B)Canadian goods become less expensive relative to foreign goods, which makes exports fall and imports rise.

C)Canadian goods become more expensive relative to foreign goods, which makes exports rise and imports fall.

D)Canadian goods become more expensive relative to foreign goods, which makes exports fall and imports rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is included in the demand for dollars in the market for foreign-currency exchange in the open-market macroeconomic model?

A)A firm in Kenya wants to buy wheat from a Canadian firm.

B)A Japanese bank desires to purchase Canadian government securities.

C)A Canadian citizen wants to buy a bond issued by a Mexican corporation.

D)A Canadian citizen exchanges dollars for Euros.

A)A firm in Kenya wants to buy wheat from a Canadian firm.

B)A Japanese bank desires to purchase Canadian government securities.

C)A Canadian citizen wants to buy a bond issued by a Mexican corporation.

D)A Canadian citizen exchanges dollars for Euros.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

58

What is the price that balances supply and demand in the market for foreign-currency exchange in the open-economy macroeconomic model?

A)the nominal exchange rate

B)the nominal interest rate

C)the real exchange rate

D)the real interest rate

A)the nominal exchange rate

B)the nominal interest rate

C)the real exchange rate

D)the real interest rate

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

59

In the open-economy macroeconomic model, what does the quantity of dollars demanded in the foreign-currency exchange market depend on?

A)the real exchange rate and import quotas

B)the real exchange rate and government deficit

C)the real interest rate and import quotas

D)import quotas and government deficit

A)the real exchange rate and import quotas

B)the real exchange rate and government deficit

C)the real interest rate and import quotas

D)import quotas and government deficit

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

60

Where does the supply of dollars in the foreign currency exchange market come from?

A)from Canadian national saving

B)from Canadian net capital outflow

C)from domestic investment

D)from foreign demand for Canadian goods

A)from Canadian national saving

B)from Canadian net capital outflow

C)from domestic investment

D)from foreign demand for Canadian goods

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

61

If Canadian citizens decide to save a larger fraction of their incomes, which of the following best identifies the effects?

A)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

B)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

C)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

D)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

A)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

B)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

C)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

D)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

62

If Canadian citizens decide to purchase more foreign assets at each interest rate, which of the following best describes the effects?

A)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

B)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

C)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow decreases.

D)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow increases.

A)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

B)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

C)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow decreases.

D)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

63

Suppose that the government of Jordan raises its budget deficit. Which of the following best predicts the effects of this action?

A)The real exchange rate of the Jordanian dinar would depreciate, and Jordanian net exports would rise.

B)The real exchange rate of the Jordanian dinar would depreciate, and Jordanian net exports would fall.

C)The real exchange rate of the Jordanian dinar would appreciate, and Jordanian net exports rise.

D)The real exchange rate of the Jordanian dinar would appreciate, and Jordanian net exports fall.

A)The real exchange rate of the Jordanian dinar would depreciate, and Jordanian net exports would rise.

B)The real exchange rate of the Jordanian dinar would depreciate, and Jordanian net exports would fall.

C)The real exchange rate of the Jordanian dinar would appreciate, and Jordanian net exports rise.

D)The real exchange rate of the Jordanian dinar would appreciate, and Jordanian net exports fall.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following best predicts the effects of an increase in a country's real interest rate?

A)Its net capital outflow and the real exchange rate increase.

B)Its net capital outflow and the real exchange rate decrease.

C)Its net capital outflow increases and the real exchange rate decreases.

D)Its net capital outflow decreases and the real exchange rate increases.

A)Its net capital outflow and the real exchange rate increase.

B)Its net capital outflow and the real exchange rate decrease.

C)Its net capital outflow increases and the real exchange rate decreases.

D)Its net capital outflow decreases and the real exchange rate increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

65

If the government of India made policy changes that increased national saving, which of the following best predicts the consequences?

A)The real exchange rate of the rupee would depreciate, and Indian net exports would rise.

B)The real exchange rate of the rupee would depreciate, and Indian net exports would fall.

C)The real exchange rate of the rupee would appreciate, and Indian net exports would rise.

D)The real exchange rate of the rupee would appreciate, and Indian net exports would fall.

A)The real exchange rate of the rupee would depreciate, and Indian net exports would rise.

B)The real exchange rate of the rupee would depreciate, and Indian net exports would fall.

C)The real exchange rate of the rupee would appreciate, and Indian net exports would rise.

D)The real exchange rate of the rupee would appreciate, and Indian net exports would fall.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following best predicts the effects of a fall in the Canadian real interest rate?

A)Owning Canadian assets becomes less attractive, and net capital outflow rises.

B)Owning Canadian assets becomes less attractive, and net capital outflow falls.

C)Owning Canadian assets becomes more attractive, and net capital outflow rises.

D)Owning Canadian assets becomes more attractive, and net capital outflow falls.

A)Owning Canadian assets becomes less attractive, and net capital outflow rises.

B)Owning Canadian assets becomes less attractive, and net capital outflow falls.

C)Owning Canadian assets becomes more attractive, and net capital outflow rises.

D)Owning Canadian assets becomes more attractive, and net capital outflow falls.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

67

Suppose that Chile has a budget surplus, and then goes into deficit. Which of the following best predicts the consequences?

A)National saving would increase, and Chile's supply of loanable funds would shift to the left.

B)National saving would increase, and Chile's demand for loanable funds would shift to the right.

C)National saving would decrease, and Chile's supply of loanable funds would shift to the left.

D)National saving would decrease, and Chile's demand for loanable funds would shift to the right.

A)National saving would increase, and Chile's supply of loanable funds would shift to the left.

B)National saving would increase, and Chile's demand for loanable funds would shift to the right.

C)National saving would decrease, and Chile's supply of loanable funds would shift to the left.

D)National saving would decrease, and Chile's demand for loanable funds would shift to the right.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

68

If a government increases its budget deficit, which of the following best describes the consequences?

A)Interest rates and domestic investment rise.

B)Interest rates and domestic investment fall.

C)Interest rates rise and domestic investment fall.

D)Interest rates fall and domestic investment rise.

A)Interest rates and domestic investment rise.

B)Interest rates and domestic investment fall.

C)Interest rates rise and domestic investment fall.

D)Interest rates fall and domestic investment rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

69

If a country went from a government budget deficit to a surplus, which of the following best predicts the consequences?

A)National savings would increase, shifting the supply of loanable funds right.

B)National savings would increase, shifting the supply of loanable funds left.

C)National savings would decrease, shifting the demand for loanable funds right.

D)National savings would decrease, shifting the demand for loanable funds left.

A)National savings would increase, shifting the supply of loanable funds right.

B)National savings would increase, shifting the supply of loanable funds left.

C)National savings would decrease, shifting the demand for loanable funds right.

D)National savings would decrease, shifting the demand for loanable funds left.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

70

If Canadian citizens decide to save a smaller fraction of their incomes, which of the following best describes the effects?

A)Canadian domestic investment increases, and Canadian net capital outflow increases.

B)Canadian domestic investment increases, and Canadian net capital outflow decreases.

C)Canadian domestic investment decreases, and Canadian net capital outflow increases.

D)Canadian domestic investment decreases, and Canadian net capital outflow decreases.

A)Canadian domestic investment increases, and Canadian net capital outflow increases.

B)Canadian domestic investment increases, and Canadian net capital outflow decreases.

C)Canadian domestic investment decreases, and Canadian net capital outflow increases.

D)Canadian domestic investment decreases, and Canadian net capital outflow decreases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

71

If Canadian firms decide to invest more domestically at each interest rate, which of the following best describes the results?

A)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow decreases.

B)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow increases.

C)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

D)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

A)The real interest rate decreases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow decreases.

B)The real interest rate decreases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow increases.

C)The real interest rate increases, the real exchange rate of the dollar appreciates, and Canadian net capital outflow decreases.

D)The real interest rate increases, the real exchange rate of the dollar depreciates, and Canadian net capital outflow increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

72

What are the effects of an increase in the supply of loanable funds?

A)Net capital outflow and the real exchange rate both increase.

B)Net capital outflow and the real exchange rate both decrease.

C)Net capital outflow increases, and the real exchange rate decreases.

D)Net capital outflow decreases, and the real exchange rate increases.

A)Net capital outflow and the real exchange rate both increase.

B)Net capital outflow and the real exchange rate both decrease.

C)Net capital outflow increases, and the real exchange rate decreases.

D)Net capital outflow decreases, and the real exchange rate increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following best predicts the effects of an increase in the supply of loanable funds?

A)The interest rate and the real exchange rate both increase.

B)The interest rate and the real exchange rate both decrease.

C)The interest rate increases, and the real exchange rate decreases.

D)The interest rate decreases, and the real exchange rate increases.

A)The interest rate and the real exchange rate both increase.

B)The interest rate and the real exchange rate both decrease.

C)The interest rate increases, and the real exchange rate decreases.

D)The interest rate decreases, and the real exchange rate increases.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

74

The People's Republic of China has had a large trade surplus in recent years. Which of the following is the most likely explanation of this surplus?

A)China has a high rate of inflation, which reduces the value of its currency.

B)China has a large supply of labour, so low wages give it a competitive edge.

C)China has many trade barriers, which restrict the ability of other countries to sell their products in China.

D)China has a large amount of saving relative to domestic investment.

A)China has a high rate of inflation, which reduces the value of its currency.

B)China has a large supply of labour, so low wages give it a competitive edge.

C)China has many trade barriers, which restrict the ability of other countries to sell their products in China.

D)China has a large amount of saving relative to domestic investment.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

75

How does the supply or demand for loanable funds shift when a country increases its budget deficit?

A)The supply of loanable funds shifts right.

B)The supply of loanable funds shifts left.

C)The demand for loanable funds shifts right.

D)The demand for loanable funds shifts left.

A)The supply of loanable funds shifts right.

B)The supply of loanable funds shifts left.

C)The demand for loanable funds shifts right.

D)The demand for loanable funds shifts left.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following best predicts the effects of an increase in the Canadian real interest rate?

A)Canadian net capital outflow and net capital outflow of other countries would rise.

B)Canadian net capital outflow and net capital outflow of other countries would fall.

C)Canadian net capital outflow would rise, while net capital outflow of other countries would fall.

D)Canadian net capital outflow would fall, while net capital outflow of other countries would rise.

A)Canadian net capital outflow and net capital outflow of other countries would rise.

B)Canadian net capital outflow and net capital outflow of other countries would fall.

C)Canadian net capital outflow would rise, while net capital outflow of other countries would fall.

D)Canadian net capital outflow would fall, while net capital outflow of other countries would rise.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

77

If a government increases its budget deficit, which of the following best predicts the effects?

A)Interest rates rise and the real exchange rate appreciates.

B)Interest rates fall and the real exchange rate depreciates.

C)Interest rates rise and the real exchange rate depreciates.

D)Interest rates fall and the real exchange rate appreciates.

A)Interest rates rise and the real exchange rate appreciates.

B)Interest rates fall and the real exchange rate depreciates.

C)Interest rates rise and the real exchange rate depreciates.

D)Interest rates fall and the real exchange rate appreciates.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

78

If the government of Colombia implemented a policy that reduced national saving, which of the following best predicts the consequences?

A)Its real exchange rate would depreciate, and Colombian net exports would rise.

B)Its real exchange rate would depreciate, and Colombian net exports would fall.

C)Its real exchange rate would appreciate, and Colombian net exports would rise.

D)Its real exchange rate would appreciate, and Colombian net exports would fall.

A)Its real exchange rate would depreciate, and Colombian net exports would rise.

B)Its real exchange rate would depreciate, and Colombian net exports would fall.

C)Its real exchange rate would appreciate, and Colombian net exports would rise.

D)Its real exchange rate would appreciate, and Colombian net exports would fall.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

79

How does a change in government budget affect national saving?

A)An increase in budget deficit increases national saving.

B)An increase in budget surplus increases national saving.

C)A decrease in budget surplus increases national saving.

D)A decrease in budget deficit does not affect national saving.

A)An increase in budget deficit increases national saving.

B)An increase in budget surplus increases national saving.

C)A decrease in budget surplus increases national saving.

D)A decrease in budget deficit does not affect national saving.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

80

In the open-economy macroeconomic model, which of the following would make Mexico's net capital outflow decrease?

A)a decrease in Canadian interest rates

B)a decrease in Mexican interest rates

C)an appreciation of the Mexican peso

D)an increase in Mexico's net exports

A)a decrease in Canadian interest rates

B)a decrease in Mexican interest rates

C)an appreciation of the Mexican peso

D)an increase in Mexico's net exports

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck