Deck 13: Imperfect Competition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/21

Play

Full screen (f)

Deck 13: Imperfect Competition

1

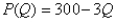

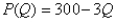

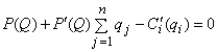

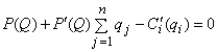

The Nash equilibrium of the Cournot game in which two identical firms face market demand  And have costs

And have costs  is given by

is given by  :

:

A)50.0.

B)41.7.

C)31.5.

D)27.8.

And have costs

And have costs  is given by

is given by  :

:A)50.0.

B)41.7.

C)31.5.

D)27.8.

27.8.

2

It is important to understand oligopoly markets because:

A)although few real world markets are oligopolies,their existence raises interesting theoretical questions.

B)oligopolies typically generate more deadweight loss than monopolies.

C)oligopolies can generate a whole range of possible outcomes between monopoly and perfect competition.

D)one can predict the market outcome exactly just by knowing the number of firms in the market.

A)although few real world markets are oligopolies,their existence raises interesting theoretical questions.

B)oligopolies typically generate more deadweight loss than monopolies.

C)oligopolies can generate a whole range of possible outcomes between monopoly and perfect competition.

D)one can predict the market outcome exactly just by knowing the number of firms in the market.

oligopolies can generate a whole range of possible outcomes between monopoly and perfect competition.

3

A profit-maximizing firm should spend an additional dollar on advertising so long as this expenditure results in more than one dollar of:

A)additional sales.

B)reduced costs.

C)increased profits.

D)demand.

A)additional sales.

B)reduced costs.

C)increased profits.

D)demand.

increased profits.

4

All of the following are problems associated with maintaining a cartel except that:

A)cartels are illegal.

B)a large amount of information is needed to coordinate a cartel.

C)profits are not maximized by a cartel so it will evolve into a monopoly.

D)each member of the cartel has an incentive to "chisel" by expanding output.

A)cartels are illegal.

B)a large amount of information is needed to coordinate a cartel.

C)profits are not maximized by a cartel so it will evolve into a monopoly.

D)each member of the cartel has an incentive to "chisel" by expanding output.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

5

In the Hotelling model,what effect would an increase in the transportation cost t have on,in the first instance,a monopoly firm and,in the second instance,two firms located at the extremes of the line segment who compete over the marginal consumer?

A)The monopolist's profit would decrease but the duopolists' would increase.

B)Both monopolist's and duopolists' profits would increase.

C)Both monopolist's and duopolists' profits would decrease.

D)The monopolist's profit would increase but the duopolists' would decrease.

A)The monopolist's profit would decrease but the duopolists' would increase.

B)Both monopolist's and duopolists' profits would increase.

C)Both monopolist's and duopolists' profits would decrease.

D)The monopolist's profit would increase but the duopolists' would decrease.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

6

What factor would not help resolve the Bertrand paradox (that a perfectly competitive outcome can emerge with as few as two firms in the market)if the basic Bertrand model were extended to include it?

A)Repeated interaction

B)Search costs

C)Sequential moves

D)Product differentiation

A)Repeated interaction

B)Search costs

C)Sequential moves

D)Product differentiation

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

7

Which feature of a market would contribute most to overall social welfare?

A)Low prices and high outputs

B)Reduction in costs due to technological improvements

C)The invention of new products

D)Difficult to weigh a,b,and c without further information about society's preferences

A)Low prices and high outputs

B)Reduction in costs due to technological improvements

C)The invention of new products

D)Difficult to weigh a,b,and c without further information about society's preferences

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

8

The more a firm invests in a new production technology,the lower its marginal costs.Which of the following scenarios involving this incumbent firm and a potential entrant makes the least economic sense?

A)The incumbent overinvests to deter entry when this investment is observable to the entrant.

B)The incumbent overinvests to deter entry when this investment is unobservable to the entrant.

C)The incumbent underinvests to accommodate entry when this investment is observable and they compete in prices.

D)The incumbent overinvests to accommodate entry when this investment is observable and they compete in quantities.

A)The incumbent overinvests to deter entry when this investment is observable to the entrant.

B)The incumbent overinvests to deter entry when this investment is unobservable to the entrant.

C)The incumbent underinvests to accommodate entry when this investment is observable and they compete in prices.

D)The incumbent overinvests to accommodate entry when this investment is observable and they compete in quantities.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

9

Each firm in a cartel has an incentive to chisel because market price exceeds:

A)marginal cost.

B)average cost.

C)average variable cost.

D)average fixed cost.

A)marginal cost.

B)average cost.

C)average variable cost.

D)average fixed cost.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

10

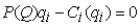

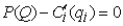

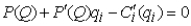

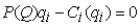

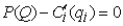

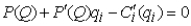

A firm's first-order condition from the Cournot game with general demands and costs is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

11

How does the leader's behavior in the quantity-leadership (Stackelberg)game compare to that in the analogous price-leadership game?

A)It behaves as a "puppy dog" in both.

B)It behaves as a "top dog" in the quantity leadership game but a "puppy dog" in the price leadership game.

C)It behaves as a "top dog" in the quantity leadership game but a "puppy dog" in the price leadership game

D)It behaves as a "top dog" in both.

A)It behaves as a "puppy dog" in both.

B)It behaves as a "top dog" in the quantity leadership game but a "puppy dog" in the price leadership game.

C)It behaves as a "top dog" in the quantity leadership game but a "puppy dog" in the price leadership game

D)It behaves as a "top dog" in both.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

12

The subgame-perfect equilibrium of a two-stage game in which firms first choose capacities and then engage in a Bertrand price setting game resembles the equilibrium in:

A)the competitive model.

B)the Cournot model.

C)the cartel model.

D)the price leadership model.

A)the competitive model.

B)the Cournot model.

C)the cartel model.

D)the price leadership model.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

13

The Nash equilibrium in a Bertrand game of price setting where all firms have different marginal cost is:

A)efficient because all mutually beneficial transactions will occur.

B)efficient because of the free entry assumption.

C)inefficient because some mutually beneficial transactions will be foregone.

D)inefficient because of the uncertainties inherent in the game.

A)efficient because all mutually beneficial transactions will occur.

B)efficient because of the free entry assumption.

C)inefficient because some mutually beneficial transactions will be foregone.

D)inefficient because of the uncertainties inherent in the game.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

14

Product differentiation complicates the study of oligopolies because such markets may not:

A)be efficient.

B)have prices equal to marginal cost.

C)have free entry and exit.

D)obey the law of one price.

A)be efficient.

B)have prices equal to marginal cost.

C)have free entry and exit.

D)obey the law of one price.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

15

The Nash equilibrium in a Bertrand game in which firms produce perfect substitutes and have equal marginal costs is:

A)efficient because all mutually beneficial transactions will occur.

B)efficient because of the free entry assumption.

C)inefficient because some mutually beneficial transactions will be foregone.

D)inefficient because of the uncertainties inherent in the game.

A)efficient because all mutually beneficial transactions will occur.

B)efficient because of the free entry assumption.

C)inefficient because some mutually beneficial transactions will be foregone.

D)inefficient because of the uncertainties inherent in the game.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

16

A cartel-like collusive solution can be a Nash equilibrium only in price-setting games with:

A)infinite replications.

B)finite replications.

C)dominant strategies.

D)more than two players.

A)infinite replications.

B)finite replications.

C)dominant strategies.

D)more than two players.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

17

In the Hotelling model of spatial competition,profits arise from:

A)monopoly power.

B)rents based on locational advantage.

C)the ability to price discriminate.

D)increasing returns to scale.

A)monopoly power.

B)rents based on locational advantage.

C)the ability to price discriminate.

D)increasing returns to scale.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

18

In a Cournot equilibrium,each firm chooses an output level which:

A)maximizes joint profits.

B)maximizes the price received.

C)maximizes profits given what the other firms produce.

D)maximizes revenue given what the other firms produce.

A)maximizes joint profits.

B)maximizes the price received.

C)maximizes profits given what the other firms produce.

D)maximizes revenue given what the other firms produce.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

19

The Stackelberg outcome differs from the Cournot equilibrium because:

A)the games involve different strategic variables.

B)the first mover can commit to an output off its best-response function.

C)quantity supplied is not equal to quantity demanded at the prevailing price.

D)it's not a perfectly competitive outcome.

A)the games involve different strategic variables.

B)the first mover can commit to an output off its best-response function.

C)quantity supplied is not equal to quantity demanded at the prevailing price.

D)it's not a perfectly competitive outcome.

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose n identical firms engage in Bertrand competition in a stage game repeated infinitely often.What condition on the discount factor

Is required for firms to be able to tacitly collude on the monopoly industry output?

A)

B)

C)

D)

Is required for firms to be able to tacitly collude on the monopoly industry output?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following factors might explain why the long-run equilibrium number of firms can in some instances exceed the socially optimal number?

A)The appropriability effect (the increase in consumers surplus following entry is not "appropriated" by entrants).

B)The feedback effect (an increase in the number of firms increases the competitiveness of the market).

C)The business-stealing effect (entry reduces rival firms' profits,a social loss that entrants do not account for).

D)The ratchet effect (the more profits the entrants earn,the more the stockholders expect them to earn in the future).

A)The appropriability effect (the increase in consumers surplus following entry is not "appropriated" by entrants).

B)The feedback effect (an increase in the number of firms increases the competitiveness of the market).

C)The business-stealing effect (entry reduces rival firms' profits,a social loss that entrants do not account for).

D)The ratchet effect (the more profits the entrants earn,the more the stockholders expect them to earn in the future).

Unlock Deck

Unlock for access to all 21 flashcards in this deck.

Unlock Deck

k this deck