Deck 15: Capital and Time

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 15: Capital and Time

1

The "rate of return" refers to:

A)the increase in future output made possible by investing one unit of current output in capital accumulation.

B)the dividend payments made on corporate issued stock.

C)the increase in current output made possible by investing in units of future output in capital accumulation.

D)the rate at which capital depreciates.

A)the increase in future output made possible by investing one unit of current output in capital accumulation.

B)the dividend payments made on corporate issued stock.

C)the increase in current output made possible by investing in units of future output in capital accumulation.

D)the rate at which capital depreciates.

the increase in future output made possible by investing one unit of current output in capital accumulation.

2

A rise in interest rates leads to:

A)an increase in the PDV of profits from owning a machine.

B)a decrease in the PDV of profits from owning a machine.

C)offsetting the effects on the costs and benefits of owning a machine.

D)no effect on either the costs or benefits of owning a machine.

A)an increase in the PDV of profits from owning a machine.

B)a decrease in the PDV of profits from owning a machine.

C)offsetting the effects on the costs and benefits of owning a machine.

D)no effect on either the costs or benefits of owning a machine.

a decrease in the PDV of profits from owning a machine.

3

Adding uncertainty to future consumption will tend to increase savings providing:

A)

B)

C)

D)

A)

B)

C)

D)

4

A firm that is maximizing its profits will keep renting machines up to the point where:

A)the marginal productivity of a capital is maximized.

B)the marginal value product of machines is maximized.

C)the marginal value product of machines is equal to the market rental rate for machines.

D)the machine's market rental rate is minimized.

A)the marginal productivity of a capital is maximized.

B)the marginal value product of machines is maximized.

C)the marginal value product of machines is equal to the market rental rate for machines.

D)the machine's market rental rate is minimized.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

A consumption-based theory of the determination of the real interest rate is based on the assumption that:

A)a rise in the real interest rate will increase current consumption.

B)the real interest rate must adjust to make people willing to experience changing consumption levels over time.

C)the real interest rate is determined by the supply and demand for investment and is therefore unaffected by consumption decisions.

D)the real interest rate must be positive.

A)a rise in the real interest rate will increase current consumption.

B)the real interest rate must adjust to make people willing to experience changing consumption levels over time.

C)the real interest rate is determined by the supply and demand for investment and is therefore unaffected by consumption decisions.

D)the real interest rate must be positive.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose an individual has a fixed amount of wealth to allocate between consumption in two periods (c1 and c2).Any funds not spent in period 1 will earn interest (at the rate r)which will increase purchasing power in period 2.Consider four possible reactions to an increase in r:

I.c1 increases.

II.c1 decreases.

III.c2 increases.

IV.c2 decreases.

Which of these is consistent with the hypothesis that both c1 and c2 are normal goods?

A)I,II,III,and IV

B)I,II,and IV,but not III

C)I,III,and IV,but not II

D)I,II and III,but not IV

I.c1 increases.

II.c1 decreases.

III.c2 increases.

IV.c2 decreases.

Which of these is consistent with the hypothesis that both c1 and c2 are normal goods?

A)I,II,III,and IV

B)I,II,and IV,but not III

C)I,III,and IV,but not II

D)I,II and III,but not IV

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

The present value of $1 payable in two years is:

A)$1.

B)$1/(1 + 2r).

C)$1/(1 - 2r).

D)$1/(1 + r)2.

A)$1.

B)$1/(1 + 2r).

C)$1/(1 - 2r).

D)$1/(1 + r)2.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

In a perfectly competitive market,a firm's rental rate for a machine (v)will be given by:

Where r is the prevailing rate of interest and d is the depreciation rate.In this formula,p represents:

A)the present market price of the machine.

B)the initial purchase price of the machine (assuming this differs from its present market price).

C)the price of the firm's product.

D)the depreciated value of the machine.

Where r is the prevailing rate of interest and d is the depreciation rate.In this formula,p represents:

A)the present market price of the machine.

B)the initial purchase price of the machine (assuming this differs from its present market price).

C)the price of the firm's product.

D)the depreciated value of the machine.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Under a consumption-based theory of the pricing of risky assets,uncertain returns on such an asset should be discounted by a "stochastic discount factor" that takes into account:

A)the mean and standard deviation of the uncertain return.

B)whether the uncertain return has a normal distribution.

C)both the nominal and real interest rates.

D)the rate of time preference and present and future marginal utility of wealth.

A)the mean and standard deviation of the uncertain return.

B)whether the uncertain return has a normal distribution.

C)both the nominal and real interest rates.

D)the rate of time preference and present and future marginal utility of wealth.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

A fall in interest rates leads to:

A)an increase in the rental rate on a machine.

B)a decrease in the rental rate on a machine.

C)no change in the rental rate on a machine.

D)a fall in the marginal productivity of capital.

A)an increase in the rental rate on a machine.

B)a decrease in the rental rate on a machine.

C)no change in the rental rate on a machine.

D)a fall in the marginal productivity of capital.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

The present value of $1 payable in the future decreases:

A)the higher r is and the sooner it is to be paid.

B)the lower r is and the sooner it is to be paid.

C)the higher r is and the longer time until it is paid.

D)the lower r is and the longer time until it is paid.

A)the higher r is and the sooner it is to be paid.

B)the lower r is and the sooner it is to be paid.

C)the higher r is and the longer time until it is paid.

D)the lower r is and the longer time until it is paid.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Accelerated depreciation laws may increase firms' investment in equipment because:

A)machines will wear out more rapidly.

B)profits will be increased.

C)the rental rate on capital will be reduced.

D)the price of machines will fall.

A)machines will wear out more rapidly.

B)profits will be increased.

C)the rental rate on capital will be reduced.

D)the price of machines will fall.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Under competitive conditions,the relative price of a finite resource would be expected to:

A)rise at an increasing rate.

B)rise at a rate equal to the real interest rate.

C)rise at a rate equal to the nominal interest rate.

D)rise at a rate determined by demand conditions.

A)rise at an increasing rate.

B)rise at a rate equal to the real interest rate.

C)rise at a rate equal to the nominal interest rate.

D)rise at a rate determined by demand conditions.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

An increase in the corporate profits tax will most likely lead to:

A)a decrease in the rental rate of capital in the corporate sector.

B)no change in the rental rate of capital in the corporate sector.

C)no change in the rental rate of capital in the non-corporate sector.

D)an increase in the rental rate of capital in the corporate sector.

A)a decrease in the rental rate of capital in the corporate sector.

B)no change in the rental rate of capital in the corporate sector.

C)no change in the rental rate of capital in the non-corporate sector.

D)an increase in the rental rate of capital in the corporate sector.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

If the interest rate rises,the present discounted value of a stream of payments owed in the future:

A)rises.

B)stays constant.

C)falls.

D)may rise or fall depending on the shape of the stream.

A)rises.

B)stays constant.

C)falls.

D)may rise or fall depending on the shape of the stream.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

In Fisher's model of the determination of the rate of return,the price of a "future good" is:

A)less than the price of a current good if the interest rate is negative.

B)equal to the price of a current good if the interest rate is positive.

C)greater than the price of a current good if the interest rate is positive.

D)less than the price of a current good if the interest rate is positive.

A)less than the price of a current good if the interest rate is negative.

B)equal to the price of a current good if the interest rate is positive.

C)greater than the price of a current good if the interest rate is positive.

D)less than the price of a current good if the interest rate is positive.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

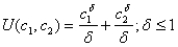

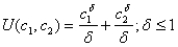

If a person's inter-temporal utility function is given by  ,lower values for

,lower values for  Will:

Will:

A)make this person more averse to consumption fluctuations.

B)make this person less averse to consumption fluctuations.

C)reduce overall consumption levels.

D)reduce savings.

,lower values for

,lower values for  Will:

Will:A)make this person more averse to consumption fluctuations.

B)make this person less averse to consumption fluctuations.

C)reduce overall consumption levels.

D)reduce savings.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

The annual rental rate for a machine is:

A)the yearly depreciation and maintenance costs for the machine.

B)the yearly interest costs associated with owning the machine.

C)the initial purchase price of the machine divided by the number of years the machine is expected to last.

D)the sum of the yearly depreciation,maintenance,and interest costs associated with owning the machine.

A)the yearly depreciation and maintenance costs for the machine.

B)the yearly interest costs associated with owning the machine.

C)the initial purchase price of the machine divided by the number of years the machine is expected to last.

D)the sum of the yearly depreciation,maintenance,and interest costs associated with owning the machine.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

If individuals make intertemporal choices using "hyperbolic discounting",this may create inefficient choices because individuals will:

A)not take account of their time preferences.

B)make choices that are inconsistent over time.

C)have a preference for only consuming in the future.

D)confuse nominal and real interest rates.

A)not take account of their time preferences.

B)make choices that are inconsistent over time.

C)have a preference for only consuming in the future.

D)confuse nominal and real interest rates.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

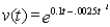

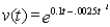

If a tree's value (v)is growing according to the equation

With an annual interest rate of 5 percent,the tree should be harvested when t =:

A)5 years.

B)10 years.

C)25 years.

D)100 years.

With an annual interest rate of 5 percent,the tree should be harvested when t =:

A)5 years.

B)10 years.

C)25 years.

D)100 years.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck