Deck 3: Engagement Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 3: Engagement Planning

1

Which of the following provides the best method of obtaining an understanding of a continuing client's business for planning an audit?

A) Performing tests of details of transactions and balances

B) Reviewing prior year audit documentation and the permanent file for the client

C) Reading specialized industry journals

D) Reevaluating the client's internal control environment

A) Performing tests of details of transactions and balances

B) Reviewing prior year audit documentation and the permanent file for the client

C) Reading specialized industry journals

D) Reevaluating the client's internal control environment

B

2

Which of the following would a successor auditor ask the predecessor auditor to provide after accepting an audit engagement?

A) Disagreements between the predecessor auditor and management as to significant accounting policies and principles

B) The predecessor auditor's understanding of the reasons for the change of auditors

C) Facts known to the predecessor auditor that might bear on the integrity of management

D) Matters that may facilitate the evaluation of financial reporting consistency between the current and prior years

A) Disagreements between the predecessor auditor and management as to significant accounting policies and principles

B) The predecessor auditor's understanding of the reasons for the change of auditors

C) Facts known to the predecessor auditor that might bear on the integrity of management

D) Matters that may facilitate the evaluation of financial reporting consistency between the current and prior years

D

3

The pre-engagement activities of an audit engagement for a public accounting firm do not include

A) evaluating the public accounting firm's independence with regard to the audit engagement.

B) obtaining predecessor audit documentation.

C) obtaining an engagement letter.

D) ensuring that there are sufficient firm resources to complete the engagement on a timely basis.

A) evaluating the public accounting firm's independence with regard to the audit engagement.

B) obtaining predecessor audit documentation.

C) obtaining an engagement letter.

D) ensuring that there are sufficient firm resources to complete the engagement on a timely basis.

B

4

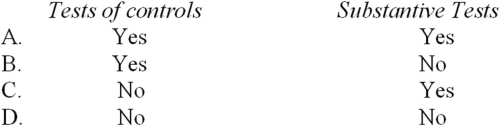

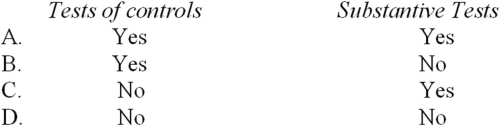

During a financial statement audit an internal auditor may provide direct assistance to the independent CPA in performing.

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following factors should an external auditor obtain updated information about then assessing an internal auditor's competence?

A) The reporting status of the internal auditor within the organization.

B) The educational level and professional experiences of the internal auditor.

C) Whether policies prohibit the internal auditor from auditing areas where relatives are employed.

D) Whether the board of directors, audit committee, or owner-manager oversees employment decisions related to the internal auditor.

A) The reporting status of the internal auditor within the organization.

B) The educational level and professional experiences of the internal auditor.

C) Whether policies prohibit the internal auditor from auditing areas where relatives are employed.

D) Whether the board of directors, audit committee, or owner-manager oversees employment decisions related to the internal auditor.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

C.Hill,CPA,has been retained to audit the financial statements of Monday Co.Monday's predecessor auditor was K.Post,CPA,whom Monday has notified by that its services have been terminated.Under these circumstances,which party should initiate the communications between Hill and Post?

A) Hill, the auditor

B) Post, the predecessor auditor

C) Monday's controller or CFO

D) The chair of Monday's board of directors

A) Hill, the auditor

B) Post, the predecessor auditor

C) Monday's controller or CFO

D) The chair of Monday's board of directors

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following factors most likely would cause an auditor not to accept a new audit engagement?

A) An inadequate understanding of the entity's internal controls

B) The close proximity to the end of the entity's fiscal year

C) Concluding that the entity's management probably lacks integrity

D) The inability to perform preliminary analytical procedures before assessing control risk

A) An inadequate understanding of the entity's internal controls

B) The close proximity to the end of the entity's fiscal year

C) Concluding that the entity's management probably lacks integrity

D) The inability to perform preliminary analytical procedures before assessing control risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

When applying analytical procedures during an audit,which of the following is the best approach for developing expectations?

A) Considering unaudited account balances and ratios to calculate what adjusted balances should be

B) Identifying reasonable explanations for unexpected differences before talking to client management

C) Considering the pattern of several unusual changes without trying to explain what caused them

D) Comparing client data with client-determined expected results to reduce detailed tests of account balances

A) Considering unaudited account balances and ratios to calculate what adjusted balances should be

B) Identifying reasonable explanations for unexpected differences before talking to client management

C) Considering the pattern of several unusual changes without trying to explain what caused them

D) Comparing client data with client-determined expected results to reduce detailed tests of account balances

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following procedures would a CPA most likely perform in the planning phase of a financial statement audit?

A) Make inquiries of the client's lawyer concerning pending litigation.

B) Perform cutoff tests of cash receipts and disbursements.

C) Compare financial information with nonfinancial operating data.

D) Recalculate the prior year's accruals and deferrals.

A) Make inquiries of the client's lawyer concerning pending litigation.

B) Perform cutoff tests of cash receipts and disbursements.

C) Compare financial information with nonfinancial operating data.

D) Recalculate the prior year's accruals and deferrals.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following auditor concerns most likely could be so serious that the auditor would conclude that a financial statement audit cannot be conducted?

A) The entity has no formal written code of conduct.

B) The integrity of entity's management is suspect.

C) Procedures requiring separation of duties are subject to management override.

D) Management fails to modify prescribed controls for changes in conditions.

A) The entity has no formal written code of conduct.

B) The integrity of entity's management is suspect.

C) Procedures requiring separation of duties are subject to management override.

D) Management fails to modify prescribed controls for changes in conditions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

Audit documentation does not normally include the

A) specific assertions under audit.

B) industry accounting guides.

C) record of the procedures performed.

D) decisions made in the course of the audit.

A) specific assertions under audit.

B) industry accounting guides.

C) record of the procedures performed.

D) decisions made in the course of the audit.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following explanations best describes why an auditor may decide to reduce tests of details for a particular audit objective?

A) The audit is being performed soon after the balance sheet date.

B) Audit staff are experienced in performing the planned procedures.

C) Analytical procedures have revealed no unusual or unexpected results.

D) There were many transactions posted to the account during the period.

A) The audit is being performed soon after the balance sheet date.

B) Audit staff are experienced in performing the planned procedures.

C) Analytical procedures have revealed no unusual or unexpected results.

D) There were many transactions posted to the account during the period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is most accurate regarding sufficient and appropriate documentation?

A) Accounting estimates are not considered sufficient and appropriate documentation.

B) Sufficient and appropriate documentation should include evidence that the audit working papers have been reviewed.

C) If additional evidence is required to document significant findings or issues, the original evidence is not considered sufficient and appropriate and therefore should be deleted from the working papers.

D) Audit documentation is the property of the client, and sufficient and appropriate copies should be retained by the auditor for at least five years.

A) Accounting estimates are not considered sufficient and appropriate documentation.

B) Sufficient and appropriate documentation should include evidence that the audit working papers have been reviewed.

C) If additional evidence is required to document significant findings or issues, the original evidence is not considered sufficient and appropriate and therefore should be deleted from the working papers.

D) Audit documentation is the property of the client, and sufficient and appropriate copies should be retained by the auditor for at least five years.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following matters does an auditor usually include in the engagement letter?

A) Arrangements regarding fees and billing

B) Analytical procedures that the auditor plans to perform

C) Indications of negative cash flows from operating activities

D) Identification of working capital deficiencies

A) Arrangements regarding fees and billing

B) Analytical procedures that the auditor plans to perform

C) Indications of negative cash flows from operating activities

D) Identification of working capital deficiencies

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

When assessing internal auditors' objectivity,an independent auditor should

A) consider the policies that prohibit the internal auditors from auditing areas where they were recently assigned.

B) review the internal auditors' reports to determine that their conclusions are consistent with the work performed.

C) verify that the internal auditors' assessment of control risk is comparable to the independent auditor's assessment.

D) evaluate the quality of the internal auditors' working paper documentation and their recent audit recommendations.

A) consider the policies that prohibit the internal auditors from auditing areas where they were recently assigned.

B) review the internal auditors' reports to determine that their conclusions are consistent with the work performed.

C) verify that the internal auditors' assessment of control risk is comparable to the independent auditor's assessment.

D) evaluate the quality of the internal auditors' working paper documentation and their recent audit recommendations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

The auditor is not required to ask the predecessor auditor about

A) facts that might bear on the integrity of management.

B) disagreements the predecessor may have had with management about accounting principles and audit procedures.

C) the fees charged for the previous audit.

D) the predecessor's understanding about the reasons for the change of auditors.

A) facts that might bear on the integrity of management.

B) disagreements the predecessor may have had with management about accounting principles and audit procedures.

C) the fees charged for the previous audit.

D) the predecessor's understanding about the reasons for the change of auditors.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is a correct statement regarding the nature and timing of communications between an accounting firm performing an initial audit of an issuer and the issuer's audit committee?

A) Prior to accepting the engagement, the firm must orally affirm its independence to the audit committee with all members present.

B) The firm must address all independence impairment issues on the date of the audit opinion.

C) Communications related to independence may occur in any form prior to issuance of the financial statements.

D) Prior to accepting the engagement, the firm should describe in writing all relationships that, as of the date of the communication, may reasonably be thought to bear on independence.

A) Prior to accepting the engagement, the firm must orally affirm its independence to the audit committee with all members present.

B) The firm must address all independence impairment issues on the date of the audit opinion.

C) Communications related to independence may occur in any form prior to issuance of the financial statements.

D) Prior to accepting the engagement, the firm should describe in writing all relationships that, as of the date of the communication, may reasonably be thought to bear on independence.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

Before accepting an engagement to audit a new client,a CPA is required to obtain

A) an assessment of fraud risk factors likely to cause material misstatements.

B) an understanding of the prospective client's industry and business.

C) the prospective client's signature to a written engagement letter.

D) the prospective client's consent to make inquiries of the predecessor, if any.

A) an assessment of fraud risk factors likely to cause material misstatements.

B) an understanding of the prospective client's industry and business.

C) the prospective client's signature to a written engagement letter.

D) the prospective client's consent to make inquiries of the predecessor, if any.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following steps should an auditor perform first to determine the existence of related parties?

A) Examine invoices, contracts, and purchasing orders.

B) Request a list of related parties from management.

C) Review the company's business structure.

D) Review proxy and other materials filed with the SEC.

A) Examine invoices, contracts, and purchasing orders.

B) Request a list of related parties from management.

C) Review the company's business structure.

D) Review proxy and other materials filed with the SEC.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

Before accepting an engagement to audit a new client,an auditor is required to

A) make inquiries of the predecessor auditor after obtaining the consent of the prospective client.

B) obtain the prospective client's signature to the engagement letter.

C) prepare a memorandum setting forth the staffing requirements and documenting the preliminary audit plan.

D) discuss the management representation letter with the prospective client's audit committee.

A) make inquiries of the predecessor auditor after obtaining the consent of the prospective client.

B) obtain the prospective client's signature to the engagement letter.

C) prepare a memorandum setting forth the staffing requirements and documenting the preliminary audit plan.

D) discuss the management representation letter with the prospective client's audit committee.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

An engagement letter is used primarily to

A) ensure a clear contractual understanding of the services to be provided by the CPA.

B) express an opinion on the financial statements.

C) provide management representations to be included in the audit evidence.

D) disclaim liability.

A) ensure a clear contractual understanding of the services to be provided by the CPA.

B) express an opinion on the financial statements.

C) provide management representations to be included in the audit evidence.

D) disclaim liability.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

Management's responsibility in a computer system would not include

A) ensuring that the documentation of the system is complete and up to date.

B) maintaining a system of transaction processing that includes an audit trail.

C) assessing the control risk.

D) making computer resources and knowledgeable personnel available for questions.

A) ensuring that the documentation of the system is complete and up to date.

B) maintaining a system of transaction processing that includes an audit trail.

C) assessing the control risk.

D) making computer resources and knowledgeable personnel available for questions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

The characteristics that distinguish computer processing from manual processing would not include

A) a decrease of management supervision of operations.

B) automatic initiation and execution of transactions.

C) the possible concentration of control activities.

D) a high potential for unauthorized access to data.

A) a decrease of management supervision of operations.

B) automatic initiation and execution of transactions.

C) the possible concentration of control activities.

D) a high potential for unauthorized access to data.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

Prior to beginning the fieldwork on a new audit engagement in which the audit team does not possess expertise in the industry in which the client operates,the audit team should

A) reduce audit risk by lowering the preliminary levels of materiality.

B) design special substantive tests to compensate for the lack of industry expertise.

C) engage financial experts familiar with the nature of the industry.

D) obtain knowledge of matters that relate to the nature of the entity's business.

A) reduce audit risk by lowering the preliminary levels of materiality.

B) design special substantive tests to compensate for the lack of industry expertise.

C) engage financial experts familiar with the nature of the industry.

D) obtain knowledge of matters that relate to the nature of the entity's business.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

The essential advantages of a computer-assisted audit techniques (CAATs)package would not include the fact that

A) the same software can be used on different types of clients' computer environments.

B) a large number of CAATs packages are currently available.

C) software packages are always inexpensive.

D) the ability to control and modify the program to meet an auditors' need.

A) the same software can be used on different types of clients' computer environments.

B) a large number of CAATs packages are currently available.

C) software packages are always inexpensive.

D) the ability to control and modify the program to meet an auditors' need.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following use of computer-assisted audit techniques (CAATs)would most likely be considered a search for fraudulent activities?

A) Selecting customers' accounts receivable for confirmation

B) Recalculating inventory extensions

C) Scanning accounts receivable balances for amounts over the credit limit

D) Comparing a list of vendor addresses to employee address files

A) Selecting customers' accounts receivable for confirmation

B) Recalculating inventory extensions

C) Scanning accounts receivable balances for amounts over the credit limit

D) Comparing a list of vendor addresses to employee address files

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

The basic auditing application of the personal computer as an audit tool would not include

A) spreadsheet analysis.

B) sample planning, selection, and evaluation.

C) continuous monitoring of a client's internal control system.

D) analytical review.

A) spreadsheet analysis.

B) sample planning, selection, and evaluation.

C) continuous monitoring of a client's internal control system.

D) analytical review.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

An auditor would most likely be use word processing software for what purpose?

A) Performing analytical procedures

B) Preparing a trial balance

C) Preparing an audit plan

D) Obtaining a sample selection

A) Performing analytical procedures

B) Preparing a trial balance

C) Preparing an audit plan

D) Obtaining a sample selection

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

Computer-assisted audit techniques (CAATs)could not be used for which of the following audit tasks?

A) Testing calculations and making computations

B) Evaluating control risk assessment

C) Summarizing, resequencing, and reformatting data

D) Comparing audit evidence from manual audit procedures to company needs

A) Testing calculations and making computations

B) Evaluating control risk assessment

C) Summarizing, resequencing, and reformatting data

D) Comparing audit evidence from manual audit procedures to company needs

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

This year,Blakeney Enterprises engaged a new auditor who must

A) attempt to communicate with the predecessor auditor before accepting the engagement.

B) review the predecessor's audit documentation if the audit is to be in accordance with GAAS.

C) seek the SEC's permission to accept the engagement if Blakeney is publicly owned.

D) reject the engagement if the change in auditors resulted from a dispute with the predecessor.

A) attempt to communicate with the predecessor auditor before accepting the engagement.

B) review the predecessor's audit documentation if the audit is to be in accordance with GAAS.

C) seek the SEC's permission to accept the engagement if Blakeney is publicly owned.

D) reject the engagement if the change in auditors resulted from a dispute with the predecessor.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following procedures would an auditor most likely perform in planning a financial statement audit?

A) Inquiring of the client's legal counsel concerning pending litigation

B) Comparing the financial statements to anticipated results

C) Examining computer-generated exception reports to verify the effectiveness of internal controls

D) Searching for unauthorized transactions that may aid in detecting unrecorded liabilities

A) Inquiring of the client's legal counsel concerning pending litigation

B) Comparing the financial statements to anticipated results

C) Examining computer-generated exception reports to verify the effectiveness of internal controls

D) Searching for unauthorized transactions that may aid in detecting unrecorded liabilities

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

A primary advantage of using computer-assisted audit techniques (CAATs)packages to audit the financial statements of a client that uses computerized information systems is that the auditor may

A) access information stored on computer files even with a limited understanding of the client's hardware and software features.

B) consider increasing the use of substantive tests of transactions in place of analytical procedures.

C) substantiate the accuracy of data by using self-checking digits and hash totals.

D) reduce the level of required tests of controls to a relatively small amount.

A) access information stored on computer files even with a limited understanding of the client's hardware and software features.

B) consider increasing the use of substantive tests of transactions in place of analytical procedures.

C) substantiate the accuracy of data by using self-checking digits and hash totals.

D) reduce the level of required tests of controls to a relatively small amount.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

During the initial planning phase of an audit,a CPA most likely would

A) test specific internal control activities that are likely to prevent fraud.

B) evaluate the reasonableness of the client's accounting estimates of inventory obsolescence.

C) discuss the timing of the audit procedures with the client's management.

D) inquire of the client's attorney as to whether any unrecorded claims are probable of assertion.

A) test specific internal control activities that are likely to prevent fraud.

B) evaluate the reasonableness of the client's accounting estimates of inventory obsolescence.

C) discuss the timing of the audit procedures with the client's management.

D) inquire of the client's attorney as to whether any unrecorded claims are probable of assertion.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

Errors in data processed in a batch computer system may not be detected immediately because

A) transaction trails in a batch system are available for only a limited period of time.

B) there are time delays in processing transactions in a batch system.

C) errors in some transactions cause rejection of other transactions in the batch.

D) random errors are more likely in a batch system than in an online system.

A) transaction trails in a batch system are available for only a limited period of time.

B) there are time delays in processing transactions in a batch system.

C) errors in some transactions cause rejection of other transactions in the batch.

D) random errors are more likely in a batch system than in an online system.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following types of transactions would be routine and computerized?

A) Capital stock sales and repurchases

B) Credit sales and billings

C) Income tax expense and liability

D) Bank loan transactions

A) Capital stock sales and repurchases

B) Credit sales and billings

C) Income tax expense and liability

D) Bank loan transactions

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

Comparing data on separate files can be accomplished by using computer-assisted audit techniques (CAATs)to determine whether comparable information is in agreement.Examples of such comparisons would not include

A) payroll details with personnel records.

B) current and prior inventory to details of purchases and sales.

C) paid vouchers to disbursements.

D) observation of inventory accounts.

A) payroll details with personnel records.

B) current and prior inventory to details of purchases and sales.

C) paid vouchers to disbursements.

D) observation of inventory accounts.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a category of audit documentation?

A) Temporary files

B) Permanent files

C) Audit administrative files

D) Current documentation files

A) Temporary files

B) Permanent files

C) Audit administrative files

D) Current documentation files

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

For which of the following judgments may an independent auditor share responsibility with an entity's internal auditor who is assessed to be both competent and objective?

A) Assessment of inherent risk, yes; assessment of control risk, yes

B) Assessment of inherent risk, yes; assessment of control risk, no

C) Assessment of inherent risk, no; assessment of control risk, yes

D) Assessment of inherent risk, no; assessment of control risk, no

A) Assessment of inherent risk, yes; assessment of control risk, yes

B) Assessment of inherent risk, yes; assessment of control risk, no

C) Assessment of inherent risk, no; assessment of control risk, yes

D) Assessment of inherent risk, no; assessment of control risk, no

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

The firm of Banta,Brown,and Burgess,CPAs,requires that audit documentation contain the initials of the preparer and the reviewer in the top right-hand corner.This procedure provides evidence of professional concern regarding which generally accepted auditing standard?

A) Independence

B) Adequate technical competence and capabilities

C) Adequate planning and supervision

D) Gathering sufficient competent evidence

A) Independence

B) Adequate technical competence and capabilities

C) Adequate planning and supervision

D) Gathering sufficient competent evidence

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

An auditor would least likely use computer software to

A) access client data files.

B) prepare spreadsheets.

C) assess information systems control risk.

D) construct parallel simulations to test the client's computing system.

A) access client data files.

B) prepare spreadsheets.

C) assess information systems control risk.

D) construct parallel simulations to test the client's computing system.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

The auditor looked at a bank statement received and held by the client.What kind of audit procedure would this be considered?

A) Recalculation

B) Physical observation

C) Confirmation

D) Examination of documents

A) Recalculation

B) Physical observation

C) Confirmation

D) Examination of documents

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a way in which auditors use the concept of overall materiality?

A) As a guide to planning the audit plan

B) As a guide to the evaluation of evidence

C) As a guide for making decisions about the audit report

D) As a guide for assessing control risk

A) As a guide to planning the audit plan

B) As a guide to the evaluation of evidence

C) As a guide for making decisions about the audit report

D) As a guide for assessing control risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

In considering overall materiality for planning purposes,an auditor believes that misstatements aggregating $10,000 would have a material effect on an entity's income statement but that misstatements would have to aggregate $20,000 to materially affect the balance sheet.Ordinarily,it would be appropriate to design audit procedures that would be expected to detect misstatements aggregating

A) $10,000.

B) $15,000.

C) $20,000.

D) $30,000.

A) $10,000.

B) $15,000.

C) $20,000.

D) $30,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

The idea of the cycle approach is to group accounts together by

A) specific function.

B) financial statement assertion.

C) audit objective.

D) transactions that affect all accounts in that particular group.

A) specific function.

B) financial statement assertion.

C) audit objective.

D) transactions that affect all accounts in that particular group.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

An auditor who uses 7 percent of income before taxes as a basis for overall materiality would be basing judgment on

A) absolute size.

B) relative size.

C) nature of the item.

D) cumulative effects.

A) absolute size.

B) relative size.

C) nature of the item.

D) cumulative effects.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

Cutoff tests designed to detect credit sales made before the end of the year that have been recorded in the subsequent year provide assurance about management's assertion of

A) presentation and disclosure.

B) completeness.

C) rights and obligations.

D) existence.

A) presentation and disclosure.

B) completeness.

C) rights and obligations.

D) existence.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

The independent auditors' audit design prepared prior to the start of fieldwork is appropriately considered documentation of

A) planning.

B) supervision.

C) information evaluation.

D) quality assurance.

A) planning.

B) supervision.

C) information evaluation.

D) quality assurance.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

In the preparation of an audit plan,which of the following items is not essential?

A) A review of material from prior audits

B) The preparation of a budget identifying the costs of resources needed

C) An understanding of controls established by management

D) Assessment of inherent risk

A) A review of material from prior audits

B) The preparation of a budget identifying the costs of resources needed

C) An understanding of controls established by management

D) Assessment of inherent risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is not one of the four major cycles?

A) Revenue and cash collection

B) Acquisition and expenditure

C) Cash receipts and disbursements

D) Financing and investing

A) Revenue and cash collection

B) Acquisition and expenditure

C) Cash receipts and disbursements

D) Financing and investing

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following audit procedures probably would provide the most reliable evidence concerning the entity's assertion of rights and obligations related to inventories?

A) Trace test counts noted during the physical count of inventory to the summarization of quantities.

B) Inspect agreements for evidence of inventory held on consignment.

C) Select the last few shipping advices used before the physical count and determine whether the shipments were recorded as sales.

D) Inspect the open purchase order file for significant commitments to consider for disclosure.

A) Trace test counts noted during the physical count of inventory to the summarization of quantities.

B) Inspect agreements for evidence of inventory held on consignment.

C) Select the last few shipping advices used before the physical count and determine whether the shipments were recorded as sales.

D) Inspect the open purchase order file for significant commitments to consider for disclosure.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

To satisfy the valuation assertion when auditing an investment in another company that is publicly and actively traded,an auditor most likely would seek to

A) inspect the stock certificates evidencing the investment.

B) examine the audited financial statements of the investee company.

C) review the broker's advice or canceled check for the investment's acquisition.

D) obtain market quotations from The Wall Street Journal or another independent source.

A) inspect the stock certificates evidencing the investment.

B) examine the audited financial statements of the investee company.

C) review the broker's advice or canceled check for the investment's acquisition.

D) obtain market quotations from The Wall Street Journal or another independent source.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

During an audit of an entity's stockholders' equity accounts,the auditor determines whether there are restrictions on retained earnings resulting from loans,agreements,or state law.This audit procedure most likely is intended to verify management's assertion

A) existence or occurrence.

B) completeness.

C) valuation or allocation.

D) presentation and disclosure.

A) existence or occurrence.

B) completeness.

C) valuation or allocation.

D) presentation and disclosure.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is not considered an accounting estimate?

A) Allowance for loan losses

B) Credit sales

C) Net realizable value of inventory

D) Percentage-of-completion revenue to be recorded

A) Allowance for loan losses

B) Credit sales

C) Net realizable value of inventory

D) Percentage-of-completion revenue to be recorded

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

Auditors should design the written audit plan so that

A) all material transactions will be selected for substantive testing.

B) substantive tests prior to the balance sheet date will be minimized.

C) the audit procedures selected will achieve specific audit objectives.

D) each account balance will be tested under either tests of controls or tests of transactions.

A) all material transactions will be selected for substantive testing.

B) substantive tests prior to the balance sheet date will be minimized.

C) the audit procedures selected will achieve specific audit objectives.

D) each account balance will be tested under either tests of controls or tests of transactions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

In determining whether transactions have been recorded,the direction of the audit testing should start from the

A) general ledger balances.

B) adjusted trial balance.

C) original source documents.

D) general journal entries.

A) general ledger balances.

B) adjusted trial balance.

C) original source documents.

D) general journal entries.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

In designing written audit plans,an auditor should establish specific audit objectives that relate primarily to the

A) timing of audit procedures.

B) cost-benefit of gathering techniques.

C) selected audit techniques.

D) financial statement assertions.

A) timing of audit procedures.

B) cost-benefit of gathering techniques.

C) selected audit techniques.

D) financial statement assertions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following most likely would give the most assurance concerning the valuation assertion of accounts receivable?

A) Tracing amounts in the subsidiary ledger to details on shipping documents

B) Comparing receivable turnover rates to industry statistics for reasonableness

C) Inquiring about receivables pledged under loan agreements

D) Assessing the allowance for uncollectible accounts for reasonableness

A) Tracing amounts in the subsidiary ledger to details on shipping documents

B) Comparing receivable turnover rates to industry statistics for reasonableness

C) Inquiring about receivables pledged under loan agreements

D) Assessing the allowance for uncollectible accounts for reasonableness

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

In testing the existence assertion for an asset,an auditor ordinarily works from the

A) financial statements to the potentially unrecorded items.

B) potentially unrecorded items to the financial statement.

C) accounting records to the supporting evidence.

D) supporting evidence to the accounting records.

A) financial statements to the potentially unrecorded items.

B) potentially unrecorded items to the financial statement.

C) accounting records to the supporting evidence.

D) supporting evidence to the accounting records.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

Looking at vendors' invoices for particular information is an example of

A) physical observation.

B) confirmation.

C) inspection of documents.

D) scanning.

A) physical observation.

B) confirmation.

C) inspection of documents.

D) scanning.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would be a step in an internal control program?

A) Obtain an aged trial balance of the accounts receivable.

B) Prepare and send confirmations on a sample of customers' accounts receivable.

C) Assess the control risk for sales and collections.

D) Read sales contracts for evidence of customers' rights of return or price allowance terms.

A) Obtain an aged trial balance of the accounts receivable.

B) Prepare and send confirmations on a sample of customers' accounts receivable.

C) Assess the control risk for sales and collections.

D) Read sales contracts for evidence of customers' rights of return or price allowance terms.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

An auditor most likely would review an entity's periodic accounting for the numerical sequence of shipping documents and invoices to support management's financial statement assertion of

A) rights and obligations.

B) completeness.

C) presentation and disclosure.

D) existence or occurrence.

A) rights and obligations.

B) completeness.

C) presentation and disclosure.

D) existence or occurrence.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

Do the following regarding auditors' concepts of overall "materiality" considered at the planning stage (i.e.,"planning materiality").

a.Define or describe independent auditors' concept of "planning materiality."

b.Name (but do not describe or explain)three common relationships or considerations used by auditors when assessing the dollar amount considered to be material.

a.Define or describe independent auditors' concept of "planning materiality."

b.Name (but do not describe or explain)three common relationships or considerations used by auditors when assessing the dollar amount considered to be material.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

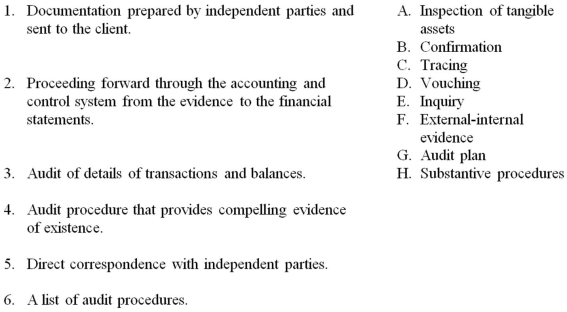

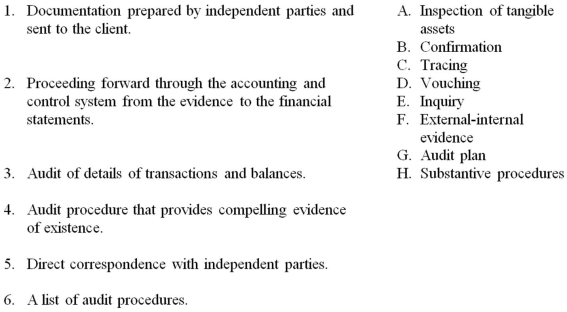

For each of the descriptions 1-6,match the correct word or phrase from A-H.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

The confirmation of a cash balance provides primary evidence regarding which management assertion?

A) Existence

B) Valuation

C) Allocation

D) Completeness

A) Existence

B) Valuation

C) Allocation

D) Completeness

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

The confirmation of an accounts receivable balance provides primary evidence regarding which management assertion?

A) Completeness

B) Valuation

C) Allocation

D) Existence

A) Completeness

B) Valuation

C) Allocation

D) Existence

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

What are the characteristics that distinguish computer processing from manual processing?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is a substantive test that an auditor most likely would perform to verify the existence and valuation of recorded accounts payable?

A) Investigating the open purchase order file to ascertain that prenumbered purchase orders are used and accounted for

B) Receiving the client's unopened mail for a reasonable period of time after year-end to search for unrecorded vendor's invoices

C) Vouching selected entries in the accounts payable subsidiary ledger to purchase orders and receiving reports

D) Confirming accounts payable balances with known vendors and suppliers who have zero balances at year-end

A) Investigating the open purchase order file to ascertain that prenumbered purchase orders are used and accounted for

B) Receiving the client's unopened mail for a reasonable period of time after year-end to search for unrecorded vendor's invoices

C) Vouching selected entries in the accounts payable subsidiary ledger to purchase orders and receiving reports

D) Confirming accounts payable balances with known vendors and suppliers who have zero balances at year-end

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

An auditor's purpose in auditing the information contained in the pension footnote most likely is to obtain evidence concerning management's assertion about

A) rights and obligations.

B) existence.

C) presentation and disclosure.

D) valuation.

A) rights and obligations.

B) existence.

C) presentation and disclosure.

D) valuation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

An auditor tests an entity's control that matches shipping documents to sales invoices before they are recorded in the financial statements as revenue in support of management's financial statement assertion of

A) valuation or allocation.

B) presentation and disclosure.

C) existence or occurrence.

D) rights and obligations.

A) valuation or allocation.

B) presentation and disclosure.

C) existence or occurrence.

D) rights and obligations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

Identify the two types of audit plans and indicate the purpose of each.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

What are the advantages and limitations derived from using computer-assisted audit techniques (CAATs)packages?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

Explain the bottom-up approach and the top-down approach to quantifying overall materiality.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

In auditing accrued liabilities,an auditor's procedures most likely would focus primarily on management's assertion of

A) existence or occurrence.

B) completeness.

C) presentation and disclosure.

D) valuation or allocation.

A) existence or occurrence.

B) completeness.

C) presentation and disclosure.

D) valuation or allocation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following audit procedures would an auditor most likely perform to test controls relating to management's valuation assertion for accounts receivable?

A) Verify that extensions and footings on the entity's sales invoices and monthly customer statements have been recomputed.

B) Inspect the entity's reports of prenumbered shipping documents that have not been recorded in the sales journal.

C) Compare the invoiced prices on prenumbered sales invoices to the entity's authorized price list.

D) Inquire about the entity's credit-granting policies and test whether credit checks have been consistently applied to new customers.

A) Verify that extensions and footings on the entity's sales invoices and monthly customer statements have been recomputed.

B) Inspect the entity's reports of prenumbered shipping documents that have not been recorded in the sales journal.

C) Compare the invoiced prices on prenumbered sales invoices to the entity's authorized price list.

D) Inquire about the entity's credit-granting policies and test whether credit checks have been consistently applied to new customers.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

An auditor most likely would inspect additions to the audit client's Property,Plant,and Equipment account to obtain evidence concerning management's assertions about

A) existence or occurrence.

B) rights and obligations.

C) presentation and disclosure.

D) valuation or allocation.

A) existence or occurrence.

B) rights and obligations.

C) presentation and disclosure.

D) valuation or allocation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

D.Jackson,CPA,audited Washington Company's financial statements for the year ended December 31,2007.On November 1,2008,Washington notified Jackson that it was changing auditors and that Jackson's services were being terminated.On November 5,2008,Washington invited Lincoln,CPA,to make a proposal for an engagement to audit its financial statements for the year ended December 31,2008.

Required:

What procedures concerning Jackson should Lincoln perform before accepting the engagement?

Required:

What procedures concerning Jackson should Lincoln perform before accepting the engagement?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

In testing the completeness assertion for a liability account,an auditor ordinarily works from the

A) financial statements to the potentially unrecorded items.

B) potentially unrecorded items to the financial statements.

C) accounting records to the supporting evidence.

D) trial balance to the subsidiary ledger.

A) financial statements to the potentially unrecorded items.

B) potentially unrecorded items to the financial statements.

C) accounting records to the supporting evidence.

D) trial balance to the subsidiary ledger.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

An auditor selected items for test counts from a client's inventory listing before observing the client's physical inventory at the warehouse.The auditor then found the items selected at the warehouse and counted them.This procedure most likely obtained evidence concerning management's assertion of

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) valuation.

A) rights and obligations.

B) completeness.

C) existence or occurrence.

D) valuation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck