Deck 7: Profit Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/117

Play

Full screen (f)

Deck 7: Profit Planning

1

In preparing a master budget for a commercial entity,the last schedule prepared is usually the cash budget which summarizes all the previously prepared schedules and provides all information required for control purposes.

False

2

The beginning cash balance is not included on the cash budget since the cash budget deals exclusively with cash flows rather than with balance sheet amounts.

False

3

The production budget includes detailed information as to the number of units of direct materials and the number of direct labour hours required for each budget period for a manufacturing business.

False

4

The direct materials to be purchased for a period can be obtained by subtracting the desired ending inventory of direct materials from the total direct materials needed for the period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

5

In zero-based budgeting,the preparers are required to justify all expenditures,not just changes in the budget from the previous year.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

6

Budgets are used for planning rather than for control of operations.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

7

Sales forecasts are drawn up after the cash budget has been completed since only then are the funds available for marketing known.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

8

On a budgeted balance sheet,the cash number is the ending cash balance as projected by the cash budget.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

9

In companies that have "no lay-off" policies,the total direct labour cost for a budget period is computed by multiplying the total direct labour hours needed to make the budgeted output of completed units by the direct labour wage rate.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

10

As the sales forecast is the usual starting point for budgeting,not-for-profit entities do not prepare budgets as they have no sales.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

11

A multi-tiered business's standing budget committee prepares all the detailed budgets for all components of the organization.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

12

Budgets describe in financial terms the plans to achieve an entity's strategic objectives.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

13

A self-imposed budget can be a very effective device to control and evaluate a manager's performance in an organization.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

14

In a traditional incremental approach to budgeting,there is usually the assumption that the previous year's budget is used as a starting point.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

15

The usual starting point in budgeting for a for-profit organization is to make a forecast of cash receipts and cash disbursements.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

16

When using the self-imposed budget approach,it is generally best for top management to accept all budget estimates without question in order to minimize adverse behavioural responses from employees.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

17

A production budget is to a manufacturing firm as a merchandise purchases budget is to a merchandising firm.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

18

In the merchandise purchases budget,the required purchases (in units)for a period can be determined by subtracting the beginning merchandise inventory (in units)from the budgeted sales (in units).

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

19

Control involves developing objectives and preparing the various budgets to achieve those objectives.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

20

One of the distinct advantages of a budget is that it can help to uncover potential bottlenecks before they occur.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

21

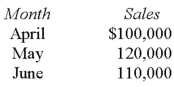

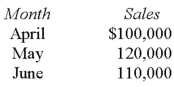

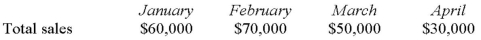

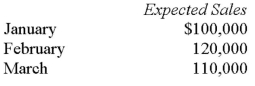

The PDQ Company makes collections on credit sales according to the following schedule: 25% in month of sale

70% in month following sale

4% in second month following sale

1% uncollectible

The following sales have been budgeted: The budget for cash collections in June will be:

The budget for cash collections in June will be:

A) $110,000.

B) $111,000.

C) $113,400.

D) $115,500.

70% in month following sale

4% in second month following sale

1% uncollectible

The following sales have been budgeted:

The budget for cash collections in June will be:

The budget for cash collections in June will be:A) $110,000.

B) $111,000.

C) $113,400.

D) $115,500.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

22

On a budgeted balance sheet,the retained earnings number is the net income number as projected by the budgeted income statement.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

23

The direct materials budget:

A) is the beginning point in the budget process.

B) must provide for desired ending inventory as well as for production.

C) is accompanied by a schedule of cash collections.

D) is completed after the cash budget.

A) is the beginning point in the budget process.

B) must provide for desired ending inventory as well as for production.

C) is accompanied by a schedule of cash collections.

D) is completed after the cash budget.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

24

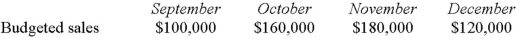

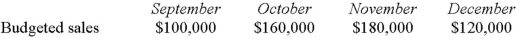

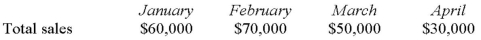

Budgeted sales in Allen Company over the next four months are given below:  Twenty-five percent of the company's sales are for cash and 75% are on credit.Collections for sales on credit follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder are uncollectible.Given these data,cash collections in December should be?

Twenty-five percent of the company's sales are for cash and 75% are on credit.Collections for sales on credit follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder are uncollectible.Given these data,cash collections in December should be?

A) $103,500.

B) $120,000.

C) $133,500.

D) $153,000.

Twenty-five percent of the company's sales are for cash and 75% are on credit.Collections for sales on credit follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder are uncollectible.Given these data,cash collections in December should be?

Twenty-five percent of the company's sales are for cash and 75% are on credit.Collections for sales on credit follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder are uncollectible.Given these data,cash collections in December should be?A) $103,500.

B) $120,000.

C) $133,500.

D) $153,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a benefit of budgeting?

A) It uncovers potential bottlenecks before they occur.

B) It coordinates the activities of the entire organization by integrating the plans and objectives of the various parts.

C) It ensures that accounting records comply with generally accepted accounting principles.

D) It provides benchmarks for evaluating subsequent performance.

A) It uncovers potential bottlenecks before they occur.

B) It coordinates the activities of the entire organization by integrating the plans and objectives of the various parts.

C) It ensures that accounting records comply with generally accepted accounting principles.

D) It provides benchmarks for evaluating subsequent performance.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

26

The cash budget must be prepared before you can complete the:

A) production budget.

B) budgeted balance sheet.

C) raw materials purchases budget.

D) schedule of cash disbursements.

A) production budget.

B) budgeted balance sheet.

C) raw materials purchases budget.

D) schedule of cash disbursements.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

27

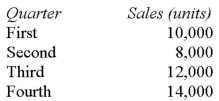

The Tobler Company has budgeted production for next year as follows:  Four kilograms of raw materials are required for each unit produced.Raw materials on hand at the start of the year total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.Budgeted purchases of raw materials in kilograms in the third quarter will be?

Four kilograms of raw materials are required for each unit produced.Raw materials on hand at the start of the year total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.Budgeted purchases of raw materials in kilograms in the third quarter will be?

A) 50,400.

B) 56,800.

C) 62,400.

D) 63,200.

Four kilograms of raw materials are required for each unit produced.Raw materials on hand at the start of the year total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.Budgeted purchases of raw materials in kilograms in the third quarter will be?

Four kilograms of raw materials are required for each unit produced.Raw materials on hand at the start of the year total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.Budgeted purchases of raw materials in kilograms in the third quarter will be?A) 50,400.

B) 56,800.

C) 62,400.

D) 63,200.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

28

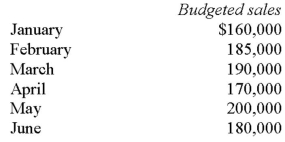

Parlee Company's sales are 30% in cash and 70% on credit.Sixty percent of the credit sales are collected in the month of sale,25% in the month following sale,and 12% in the second month following sale.The remainder are uncollectible.The following are budgeted sales data:  Total cash receipts in April would be budgeted to be:

Total cash receipts in April would be budgeted to be:

A) $27,230.

B) $36,230.

C) $38,900.

D) $47,900.

Total cash receipts in April would be budgeted to be:

Total cash receipts in April would be budgeted to be:A) $27,230.

B) $36,230.

C) $38,900.

D) $47,900.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

29

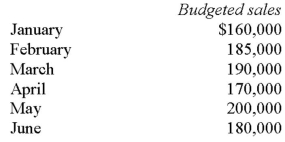

Orion Corporation is preparing a cash budget for the six months beginning January 1.Shown below are the company's expected collection pattern and the budgeted sales for the period. Expected collection pattern:

65% collected in the month of sale

20% collected in the month after sale

10% collected in the second month after sale

4% collected in the third month after sale

1% uncollectible The estimated total cash collections during April from sales and accounts receivables will be:

The estimated total cash collections during April from sales and accounts receivables will be:

A) $155,900.

B) $167,000.

C) $171,666.

D) $173,400.

65% collected in the month of sale

20% collected in the month after sale

10% collected in the second month after sale

4% collected in the third month after sale

1% uncollectible

The estimated total cash collections during April from sales and accounts receivables will be:

The estimated total cash collections during April from sales and accounts receivables will be:A) $155,900.

B) $167,000.

C) $171,666.

D) $173,400.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

30

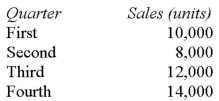

The Waverly Company has budgeted sales for next year as follows:  The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.Scheduled production in units for the third quarter should be:

The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.Scheduled production in units for the third quarter should be:

A) 13,500.

B) 17,500.

C) 18,500.

D) 22,000.

The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.Scheduled production in units for the third quarter should be:

The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.Scheduled production in units for the third quarter should be:A) 13,500.

B) 17,500.

C) 18,500.

D) 22,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

31

Walsh Company expects sales of Product W to be 60,000 units in April,75,000 units in May and 70,000 units in June.The company desires that the inventory on hand at the end of each month be equal to 40% of the next month's expected unit sales.Due to excessive production during March,on March 31 there were 25,000 units of Product W in the ending inventory.Given this information,Walsh Company's production of Product W for the month of April should be how many units:

A) 60,000.

B) 65,000.

C) 66,000.

D) 75,000.

A) 60,000.

B) 65,000.

C) 66,000.

D) 75,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

32

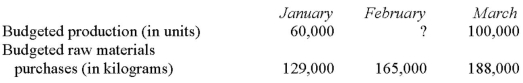

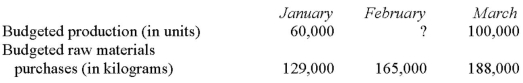

Marple Company's budgeted production in units and budgeted raw materials purchases over the next three months are given below:  Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.Budgeted production in units for February will be?

Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.Budgeted production in units for February will be?

A) 75,000.

B) 82,500.

C) 105,000.

D) 150,000.

Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.Budgeted production in units for February will be?

Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.Budgeted production in units for February will be?A) 75,000.

B) 82,500.

C) 105,000.

D) 150,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

33

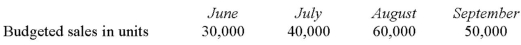

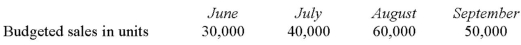

Modesto Company produces and sells Product AlphaB.To guard against stockouts,the company requires that 20% of the next month's sales be on hand at the end of each month.Budgeted sales of Product AlphaB over the next four months are:  Budgeted production units for August will be:

Budgeted production units for August will be:

A) 50,000.

B) 58,000.

C) 62,000.

D) 70,000.

Budgeted production units for August will be:

Budgeted production units for August will be:A) 50,000.

B) 58,000.

C) 62,000.

D) 70,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

34

The budget or schedule that provides necessary input data for the direct labour budget is the:

A) raw materials purchases budget.

B) production budget.

C) schedule of cash collections.

D) cash budget.

A) raw materials purchases budget.

B) production budget.

C) schedule of cash collections.

D) cash budget.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

35

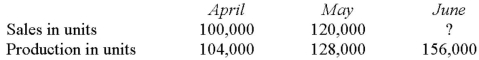

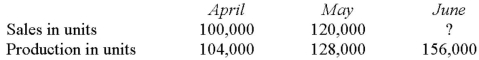

Friden Company has budgeted sales and production over the next quarter as follows:  The company has 20,000 units of product on hand at April 1.20% of the next month's sales needs in units must be on hand at the end of each month.July sales are expected to be 140,000 units.Budgeted sales for June will be (in units):

The company has 20,000 units of product on hand at April 1.20% of the next month's sales needs in units must be on hand at the end of each month.July sales are expected to be 140,000 units.Budgeted sales for June will be (in units):

A) 128,000.

B) 160,000.

C) 184,000.

D) 188,000.

The company has 20,000 units of product on hand at April 1.20% of the next month's sales needs in units must be on hand at the end of each month.July sales are expected to be 140,000 units.Budgeted sales for June will be (in units):

The company has 20,000 units of product on hand at April 1.20% of the next month's sales needs in units must be on hand at the end of each month.July sales are expected to be 140,000 units.Budgeted sales for June will be (in units):A) 128,000.

B) 160,000.

C) 184,000.

D) 188,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

36

The master budget process usually begins with the:

A) production budget.

B) operating budget.

C) sales budget.

D) cash budget.

A) production budget.

B) operating budget.

C) sales budget.

D) cash budget.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

37

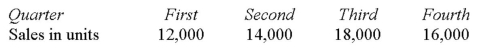

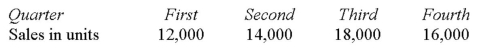

Superior Industries' sales budget shows quarterly sales for the next year as follows:  Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.Budgeted production in units for the second quarter should be:

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.Budgeted production in units for the second quarter should be:

A) 7,200.

B) 8,000.

C) 8,400.

D) 8,800.

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.Budgeted production in units for the second quarter should be:

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.Budgeted production in units for the second quarter should be:A) 7,200.

B) 8,000.

C) 8,400.

D) 8,800.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

38

Pardee Company plans to sell 12,000 units during the month of August.If the company has 2,500 units on hand at the start of the month,and plans to have 2,000 units on hand at the end of the month,how many units must be produced during the month?

A) 11,500 units.

B) 12,000 units.

C) 12,500 units.

D) 14,000 units.

A) 11,500 units.

B) 12,000 units.

C) 12,500 units.

D) 14,000 units.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

39

There are various budgets within the master budget.One of these budgets is the production budget.Which of the following BEST describes the production budget?

A) It details the required direct labour hours.

B) It details the required raw materials purchases.

C) It is calculated based on the sales budget,the desired beginning inventory and the desired ending inventory.

D) It summarizes the costs of producing required units for the budget period.

A) It details the required direct labour hours.

B) It details the required raw materials purchases.

C) It is calculated based on the sales budget,the desired beginning inventory and the desired ending inventory.

D) It summarizes the costs of producing required units for the budget period.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

40

Fairmont Inc.uses an accounting system that charges costs to the manager who has been delegated the authority to make decisions concerning the costs.For example,if the sales manager accepts a rush order that will result in higher than normal manufacturing costs,these additional costs are charged to the sales manager because the authority to accept or decline the rush order was given to the sales manager.This type of accounting system is known as:

A) responsibility accounting.

B) contribution accounting.

C) absorption accounting.

D) operational budgeting.

A) responsibility accounting.

B) contribution accounting.

C) absorption accounting.

D) operational budgeting.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

41

ABC Company has a cash balance of $9,000 on April 1.The company must maintain a minimum cash balance of $6,000.During April expected cash receipts are $45,000.Expected cash disbursements during the month total $52,000.During April the company will need to borrow:

A) $2,000.

B) $4,000.

C) $6,000.

D) $8,000.

A) $2,000.

B) $4,000.

C) $6,000.

D) $8,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

42

The budgeted cash receipts for October are:

A) $188,000.

B) $226,000.

C) $248,000.

D) $278,000.

A) $188,000.

B) $226,000.

C) $248,000.

D) $278,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

43

In a budget of cash receipts for March,the total cash receipts would be:

A) $8,200.

B) $16,000.

C) $17,800.

D) $20,200.

A) $8,200.

B) $16,000.

C) $17,800.

D) $20,200.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

44

The amount of cash collected during the month of June should be:

A) $32,000.

B) $40,000.

C) $40,400.

D) $41,000.

A) $32,000.

B) $40,000.

C) $40,400.

D) $41,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

45

In a budgeted balance sheet,the merchandise inventory on February 28 would be:

A) $3,200.

B) $4,800.

C) $7,500.

D) $9,600.

A) $3,200.

B) $4,800.

C) $7,500.

D) $9,600.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

46

In a budgeted income statement for the month of February,net income would be:

A) $0.

B) $1,800.

C) $4,200.

D) $9,000.

A) $0.

B) $1,800.

C) $4,200.

D) $9,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

47

The expected cash collections from customers during April would be:

A) $117,600.

B) $137,000.

C) $139,000.

D) $150,000.

A) $117,600.

B) $137,000.

C) $139,000.

D) $150,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

48

The expected cash disbursements during April for inventory purchases would be:

A) $87,300.

B) $90,000.

C) $97,000.

D) $100,000.

A) $87,300.

B) $90,000.

C) $97,000.

D) $100,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

49

The cash disbursements during the month of June for goods purchased for resale and for operating expenses should be:

A) $40,000.

B) $41,000.

C) $42,500.

D) $43,500.

A) $40,000.

B) $41,000.

C) $42,500.

D) $43,500.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

50

The total cash collected by LaGrange Company during January would be:

A) $254,000.

B) $331,500.

C) $344,000.

D) $410,000.

A) $254,000.

B) $331,500.

C) $344,000.

D) $410,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

51

The expected cash balance on April 30 would be:

A) $19,700.

B) $28,700.

C) $54,700.

D) $62,700.

A) $19,700.

B) $28,700.

C) $54,700.

D) $62,700.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

52

The accounts receivable balance that would appear in the March 31 budgeted balance sheet would be:

A) $8,800.

B) $12,400.

C) $15,000.

D) $16,000.

A) $8,800.

B) $12,400.

C) $15,000.

D) $16,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

53

In a budget of cash disbursements for March,the total cash disbursements would be:

A) $11,200.

B) $13,900.

C) $16,900.

D) $22,300.

A) $11,200.

B) $13,900.

C) $16,900.

D) $22,300.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

54

The Willsey Merchandise Company has budgeted $40,000 in sales for the month of December.The company's cost of goods sold is 30% of sales.If the company has budgeted to purchase $18,000 in merchandise during December,then the budgeted change in inventory levels over the month of December is:

A) $6,000 increase.

B) $10,000 decrease.

C) $15,000 decrease.

D) $22,000 increase.

A) $6,000 increase.

B) $10,000 decrease.

C) $15,000 decrease.

D) $22,000 increase.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

55

The Stacy Company makes and sells a single product,Product R.Budgeted sales for April are $300,000.Gross margin is budgeted at 30% of sales dollars.If the net income for April is budgeted at $40,000,the budgeted selling and administrative expenses are:

A) $50,000.

B) $78,000.

C) $102,000.

D) $133,333.

A) $50,000.

B) $78,000.

C) $102,000.

D) $133,333.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

56

If Pardise Company plans to sell 480,000 units during July,the number of units it would have to manufacture during July would be:

A) 440,000.

B) 450,000.

C) 480,000.

D) 510,000.

A) 440,000.

B) 450,000.

C) 480,000.

D) 510,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

57

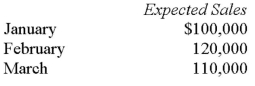

Avril Company makes collections on sales according to the following schedule: 30% collected in the month of sale

60% collected in the month following sale

8% collected in the second month following sale

2% uncollectible

The following sales are expected: Cash collections in March should be budgeted to be:

Cash collections in March should be budgeted to be:

A) $105,000.

B) $110,000.

C) $110,800.

D) $113,000.

60% collected in the month following sale

8% collected in the second month following sale

2% uncollectible

The following sales are expected:

Cash collections in March should be budgeted to be:

Cash collections in March should be budgeted to be:A) $105,000.

B) $110,000.

C) $110,800.

D) $113,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

58

The expected cash disbursements during April for operating expenses would be:

A) $15,000.

B) $23,000.

C) $30,000.

D) $38,000.

A) $15,000.

B) $23,000.

C) $30,000.

D) $38,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

59

What is the budgeted accounts receivable balance on June 1 of the current year:

A) $56,000.

B) $64,000.

C) $76,000.

D) $132,000.

A) $56,000.

B) $64,000.

C) $76,000.

D) $132,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

60

The budgeted accounts receivable balance on September 30 is:

A) $126,000.

B) $148,000.

C) $166,000.

D) $190,000.

A) $126,000.

B) $148,000.

C) $166,000.

D) $190,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

61

The total number of units to be produced in February is:

A) 5,220.

B) 5,400.

C) 5,580.

D) 6,120.

A) 5,220.

B) 5,400.

C) 5,580.

D) 6,120.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

62

The total of units to be produced in October is:

A) 4,530.

B) 5,070.

C) 5,670.

D) 5,890.

A) 4,530.

B) 5,070.

C) 5,670.

D) 5,890.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

63

The total number of units to be produced in July is:

A) 6,920.

B) 7,100.

C) 7,280.

D) 7,630.

A) 6,920.

B) 7,100.

C) 7,280.

D) 7,630.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

64

The opening inventory in units for April is:

A) 380.

B) 460.

C) 720.

D) 4,600.

A) 380.

B) 460.

C) 720.

D) 4,600.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

65

The opening inventory in units for September is:

A) 370.

B) 530.

C) 670.

D) 6,700.

A) 370.

B) 530.

C) 670.

D) 6,700.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

66

If the budgeted cash disbursements for selling and administrative expenses for November total $123,250,then how many units of Product SW does the company plan to sell in November (rounded to the nearest whole unit):

A) 20,111.

B) 22,952.

C) 25,000.

D) 33,444.

A) 20,111.

B) 22,952.

C) 25,000.

D) 33,444.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

67

The budgeted cash disbursements for December are:

A) $382,500.

B) $442,500.

C) $472,500.

D) $477,500.

A) $382,500.

B) $442,500.

C) $472,500.

D) $477,500.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

68

If the budgeted production for July is 6,000 units,then the total budgeted factory overhead for July is:

A) $77,000.

B) $82,000.

C) $85,000.

D) $93,000.

A) $77,000.

B) $82,000.

C) $85,000.

D) $93,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

69

If the company has budgeted to sell 24,000 units of Product SW in September,then the total budgeted fixed selling and administrative expenses for September would be?

A) $48,000.

B) $54,000.

C) $67,000.

D) $78,000.

A) $48,000.

B) $54,000.

C) $67,000.

D) $78,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

70

If the company has budgeted to sell 20,000 units of Product SW in October,then the total budgeted variable selling and administrative expenses for October will be:

A) $40,000.

B) $45,000.

C) $56,250.

D) $78,000.

A) $40,000.

B) $45,000.

C) $56,250.

D) $78,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

71

If the budgeted cash disbursements for factory overhead for September are $80,000,then the budgeted production in units for September must be?

A) 6,200.

B) 6,500.

C) 7,000.

D) 7,400.

A) 6,200.

B) 6,500.

C) 7,000.

D) 7,400.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

72

The desired ending inventory in units for December is:

A) 690.

B) 780.

C) 870.

D) 960.

A) 690.

B) 780.

C) 870.

D) 960.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

73

If 500,000 finished units were to be manufactured during July,the units of raw material needed to be purchased would be:

A) 990,000.

B) 1,000,000.

C) 1,010,000.

D) 1,020,000.

A) 990,000.

B) 1,000,000.

C) 1,010,000.

D) 1,020,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

74

The budgeted cash receipts for December are:

A) $137,500.

B) $412,500.

C) $550,000.

D) $585,000.

A) $137,500.

B) $412,500.

C) $550,000.

D) $585,000.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

75

The desired ending inventory in units for March is:

A) 380.

B) 460.

C) 540.

D) 720.

A) 380.

B) 460.

C) 540.

D) 720.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

76

The company has budgeted to produce 25,000 units of Product T in June.The finished goods inventories on June 1 and June 30 were budgeted at 500 and 700 units,respectively.Budgeted direct labour costs incurred in June would be:

A) $227,500.

B) $293,384.

C) $295,750.

D) $304,031.

A) $227,500.

B) $293,384.

C) $295,750.

D) $304,031.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

77

If the budgeted production for August is 5,000 units,then the total budgeted factory overhead per unit is:

A) $15.

B) $18.

C) $20.

D) $22.

A) $15.

B) $18.

C) $20.

D) $22.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

78

If the company has budgeted to sell 25,000 units of Product SW in July,then the total budgeted selling and administrative expenses for July will be:

A) $56,250.

B) $78,000.

C) $123,250.

D) $134,250.

A) $56,250.

B) $78,000.

C) $123,250.

D) $134,250.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

79

The budgeted direct labour cost per unit of Product T would be:

A) $7.00.

B) $9.10.

C) $10.40.

D) $11.83.

A) $7.00.

B) $9.10.

C) $10.40.

D) $11.83.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck

80

The desired ending inventory in units for August is:

A) 370.

B) 530.

C) 670.

D) 710.

A) 370.

B) 530.

C) 670.

D) 710.

Unlock Deck

Unlock for access to all 117 flashcards in this deck.

Unlock Deck

k this deck