Deck 10: Estimating Risk and Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/106

Play

Full screen (f)

Deck 10: Estimating Risk and Return

1

Which of these is the line on a graph of return and risk (standard deviation) from the risk-free rate through the market portfolio?

A) Capital Asset Pricing Line

B) Capital Market Line

C) Efficient Market Line

D) Efficient Market Hypothesis

A) Capital Asset Pricing Line

B) Capital Market Line

C) Efficient Market Line

D) Efficient Market Hypothesis

Capital Market Line

2

Which of these is the measurement of risk for a collection of stocks for an investor?

A) beta

B) efficient market

C) expected return

D) portfolio beta

A) beta

B) efficient market

C) expected return

D) portfolio beta

portfolio beta

3

Similar to the Capital Market Line except risk is characterized by beta instead of standard deviation.

A) Market Risk Line

B) Probability Market Line

C) Security Market Line

D) Stock Market Line

A) Market Risk Line

B) Probability Market Line

C) Security Market Line

D) Stock Market Line

Security Market Line

4

The stocks of small companies that are priced below $1 per share.

A) bargain stocks

B) hedge fund stocks

C) penny stocks

D) stock market bubble stocks

A) bargain stocks

B) hedge fund stocks

C) penny stocks

D) stock market bubble stocks

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

5

A theory that describes the types of information that are reflected in current stock prices.

A) asset pricing

B) behavioral finance

C) efficient market hypothesis

D) public information

A) asset pricing

B) behavioral finance

C) efficient market hypothesis

D) public information

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

6

A measure of the sensitivity of a stock or portfolio to market risk.

A) behavioral finance

B) beta

C) efficient market

D) hedge

A) behavioral finance

B) beta

C) efficient market

D) hedge

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

7

This is the average of the possible returns weighted by the likelihood of those returns occurring.

A) efficient return

B) expected return

C) market return

D) required return

A) efficient return

B) expected return

C) market return

D) required return

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

8

Investor enthusiasm causes an inflated bull market that drives prices too high, ending in a dramatic collapse in prices.

A) behavior finance

B) efficient market

C) privately held information

D) stock market bubble

A) behavior finance

B) efficient market

C) privately held information

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is a true statement?

A) The risk and return that a firm experienced in the past is also the risk level for its future.

B) Firms can quite possibly change their stocks' risk level by substantially changing their business.

C) If a firm takes on riskier new projects over time, the firm itself will become less risky.

D) If a firm takes on less risky new projects over time, the firm itself will become more risky.

A) The risk and return that a firm experienced in the past is also the risk level for its future.

B) Firms can quite possibly change their stocks' risk level by substantially changing their business.

C) If a firm takes on riskier new projects over time, the firm itself will become less risky.

D) If a firm takes on less risky new projects over time, the firm itself will become more risky.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

10

The asset pricing theory based on a beta, a measure of market risk.

A) Behavioral Asset Pricing Model

B) Capital Asset Pricing Model

C) Efficient Markets Asset Pricing Model

D) Efficient Market Hypothesis

A) Behavioral Asset Pricing Model

B) Capital Asset Pricing Model

C) Efficient Markets Asset Pricing Model

D) Efficient Market Hypothesis

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is NOT a necessary condition for an efficient market?

A) Many buyers and sellers.

B) No prohibitively high barriers to entry.

C) Free and readily available information available to all participants.

D) No trading or transaction costs.

A) Many buyers and sellers.

B) No prohibitively high barriers to entry.

C) Free and readily available information available to all participants.

D) No trading or transaction costs.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

12

This is the reward investors require for taking risk.

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

13

This has not been released to the public, but is known by few individuals, likely company insiders.

A) audited financial statements

B) restricted stock

C) privately held information

D) insider trading

A) audited financial statements

B) restricted stock

C) privately held information

D) insider trading

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

14

The set of probabilities for all possible occurrences.

A) probability

B) probability distribution

C) stock market bubble

D) market probabilities

A) probability

B) probability distribution

C) stock market bubble

D) market probabilities

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

15

The use of debt to increase an investment position.

A) behavioral finance

B) financial leverage

C) probability

D) stock market bubble

A) behavioral finance

B) financial leverage

C) probability

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

16

This is data that includes past stock prices and volume, financial statements, corporate news, analyst opinions, etc.

A) audited financial statements

B) generally accepted accounting principles

C) privately held information

D) public information

A) audited financial statements

B) generally accepted accounting principles

C) privately held information

D) public information

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

17

This is typically considered the return on U.S. government bonds and bills and equals the real interest plus the expected inflation premium.

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

18

In theory, this is a combination of securities that places the portfolio on the efficient frontier and on a line tangent from the risk-free rate.

A) efficient market

B) market portfolio

C) probability distribution

D) stock market bubble

A) efficient market

B) market portfolio

C) probability distribution

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

19

This is the reward for taking systematic stock market risk.

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

A) required return

B) risk-free rate

C) risk premium

D) market risk premium

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

20

This model includes an equation that relates a stock's required return to an appropriate risk premium:

A) asset pricing

B) behavioral finance

C) beta

D) efficient markets

A) asset pricing

B) behavioral finance

C) beta

D) efficient markets

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

21

The study of the cognitive processes and biases associated with making financial and economic decisions.

A) asset pricing model

B) behavioral finance

C) efficient market hypothesis

D) stock market bubble

A) asset pricing model

B) behavioral finance

C) efficient market hypothesis

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

22

Portfolio Beta You have a portfolio with a beta of 0.9. What will be the new portfolio beta if you keep 40 percent of your money in the old portfolio and 60 percent in a stock with a beta of 1.5?

A) 1.00

B) 1.20

C) 1.26

D) 2.40

A) 1.00

B) 1.20

C) 1.26

D) 2.40

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

23

Risk Premium The annual return on the S&P 500 Index was 12.4 percent. The annual T-bill yield during the same period was 5.7 percent. What was the market risk premium during that year?

A) 5.7%

B) 6.7%

C) 12.4%

D) 18.1%

A) 5.7%

B) 6.7%

C) 12.4%

D) 18.1%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

24

Risk Premium The annual return on the S&P 500 Index was 18.1 percent. The annual T-bill yield during the same period was 6.2 percent. What was the market risk premium during that year?

A) 6.2%

B) 11.9%

C) 18.1%

D) 24.3%

A) 6.2%

B) 11.9%

C) 18.1%

D) 24.3%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

25

CAPM Required Return A company has a beta of 0.50. If the market return is expected to be 12 percent and the risk-free rate is 5 percent, what is the company's required return?

A) 6.0%

B) 8.5%

C) 11.0%

D) 13.5%

A) 6.0%

B) 8.5%

C) 11.0%

D) 13.5%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

26

Special rights given to some employees to buy a specific number of shares of the company stock at a fixed price during a specific period of time.

A) executive stock options

B) privately held information

C) restricted stock

D) stock market bubble

A) executive stock options

B) privately held information

C) restricted stock

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

27

Required Return If the risk-free rate is 10 percent and the market risk premium is 4 percent, what is the required return for the market?

A) 4%

B) 7%

C) 10%

D) 14%

A) 4%

B) 7%

C) 10%

D) 14%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

28

CAPM Required Return A company has a beta of 3.25. If the market return is expected to be 14 percent and the risk-free rate is 5.5 percent, what is the company's required return?

A) 22.750%

B) 33.125%

C) 45.500%

D) 51.000%

A) 22.750%

B) 33.125%

C) 45.500%

D) 51.000%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

29

Stock Market Bubble If the NASDAQ stock market bubble peaked at 3,750, and two and a half years later it had fallen to 2,200, what would be the percentage decline?

A) -15.87%

B) -17.05%

C) -41.33%

D) -58.67%

A) -15.87%

B) -17.05%

C) -41.33%

D) -58.67%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

30

Shares of stock issued to employees that have limitations on when they can be sold.

A) executive stock options

B) privately held information

C) restricted stock

D) stock market bubble

A) executive stock options

B) privately held information

C) restricted stock

D) stock market bubble

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

31

The constant growth model assumes which of the following?

A) That there is privately held information.

B) That the stock is efficiently priced.

C) That there are executive stock options available to managers.

D) That there is no restricted stock.

A) That there is privately held information.

B) That the stock is efficiently priced.

C) That there are executive stock options available to managers.

D) That there is no restricted stock.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

32

Stock Market Bubble If the Japanese stock market bubble peaked at 37,500, and two and a half years later it had fallen to 25,900, what was the percentage decline?

A) -10.31%

B) -27.63%

C) -30.93%

D) -69.07%

A) -10.31%

B) -27.63%

C) -30.93%

D) -69.07%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

33

Company Risk Premium A company has a beta of 4.5. If the market return is expected to be 14 percent and the risk-free rate is 7 percent, what is the company's risk premium?

A) 7.0%

B) 25.5%

C) 31.5%

D) 38.5%

A) 7.0%

B) 25.5%

C) 31.5%

D) 38.5%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

34

CAPM Required Return A company has a beta of 3.75. If the market return is expected to be 20 percent and the risk-free rate is 9.5 percent, what is the company's required return?

A) 33.250%

B) 39.375%

C) 48.875%

D) 55.625%

A) 33.250%

B) 39.375%

C) 48.875%

D) 55.625%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

35

Expected Return A company's current stock price is $84.50 and it is likely to pay a $3.50 dividend next year. Since analysts estimate the company will have a 10% growth rate, what is its expected return?

A) 4.14%

B) 4.26%

C) 10.00%

D) 14.14%

A) 4.14%

B) 4.26%

C) 10.00%

D) 14.14%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

36

Company Risk Premium A company has a beta of 2.91. If the market return is expected to be 16 percent and the risk-free rate is 4 percent, what is the company's risk premium?

A) 11.64%

B) 12.00%

C) 22.91%

D) 34.92%

A) 11.64%

B) 12.00%

C) 22.91%

D) 34.92%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

37

Portfolio Beta You have a portfolio with a beta of 1.25. What will be the new portfolio beta if you keep 80 percent of your money in the old portfolio and 20 percent in a stock with a beta of 1.75?

A) 1.00

B) 1.35

C) 1.50

D) 3.00

A) 1.00

B) 1.35

C) 1.50

D) 3.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

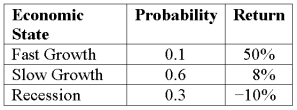

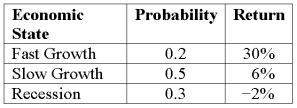

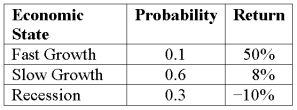

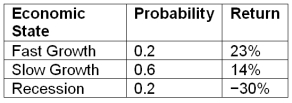

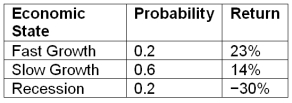

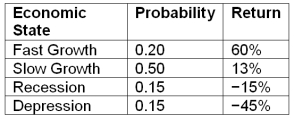

38

Expected Return Compute the expected return given these three economic states, their likelihoods, and the potential returns:

A) 6.8%

B) 12.8%

C) 16.0%

D) 22.7%

A) 6.8%

B) 12.8%

C) 16.0%

D) 22.7%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

39

Required Return If the risk-free rate is 8 percent and the market risk premium is 2 percent, what is the required return for the market?

A) 2%

B) 6%

C) 8%

D) 10%

A) 2%

B) 6%

C) 8%

D) 10%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

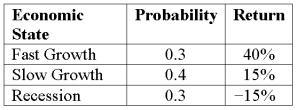

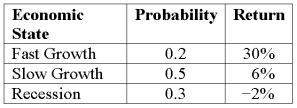

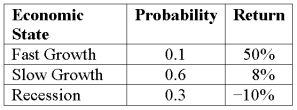

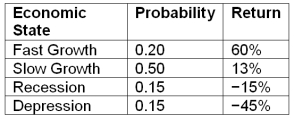

40

Expected Return Compute the expected return given these three economic states, their likelihoods, and the potential returns:

A) 13.5%

B) 22.5%

C) 18.3%

D) 40.0%

A) 13.5%

B) 22.5%

C) 18.3%

D) 40.0%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

41

Under/Over-Valued Stock A manager believes his firm will earn a 7.5 percent return next year. His firm has a beta of 2, the expected return on the market is 5 percent, and the risk-free rate is 2 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

A) 8%, under-valued

B) 8%, over-valued

C) 12%, under-valued

D) 12%, over-valued

A) 8%, under-valued

B) 8%, over-valued

C) 12%, under-valued

D) 12%, over-valued

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

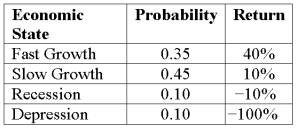

42

Expected Return Risk Compute the standard deviation of the expected return given these three economic states, their likelihoods, and the potential returns:

A) 8.4%

B) 10.87%

C) 11.34%

D) 24.09%

A) 8.4%

B) 10.87%

C) 11.34%

D) 24.09%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

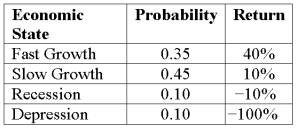

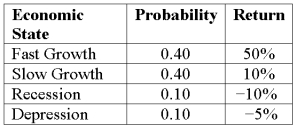

43

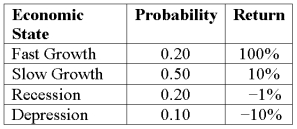

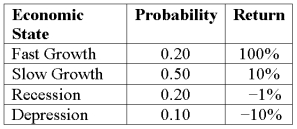

Expected Return and Risk Compute the standard deviation given these four economic states, their likelihoods, and the potential returns:

A) 7.5%

B) 12.65%

C) 39.48%

D) 113.69%

A) 7.5%

B) 12.65%

C) 39.48%

D) 113.69%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

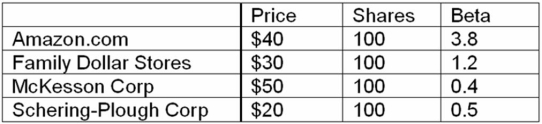

44

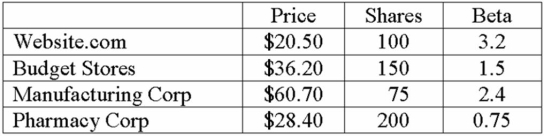

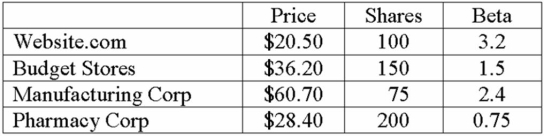

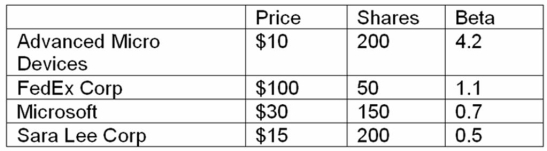

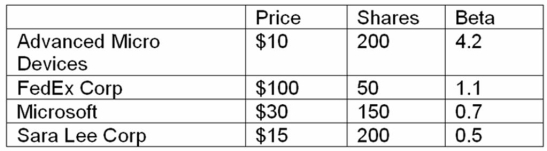

Portfolio Beta and Required Return You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 14 percent and the risk-free rate is 5 percent, what is the required return of the portfolio?

A) 20.21%

B) 22.66%

C) 28.66%

D) 32.48%

A) 20.21%

B) 22.66%

C) 28.66%

D) 32.48%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

45

Under/Over-Valued Stock A manager believes his firm will earn a 12 percent return next year. His firm has a beta of 1.2, the expected return on the market is 8 percent, and the risk-free rate is 3 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

A) 9%, under-valued

B) 9%, over-valued

C) 13.8%, under-valued

D) 13.8%, over-valued

A) 9%, under-valued

B) 9%, over-valued

C) 13.8%, under-valued

D) 13.8%, over-valued

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

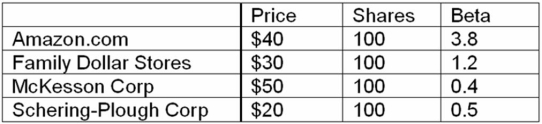

46

Portfolio Beta You hold the positions in the table below. What is the beta of your portfolio?

A) 1.4

B) 2.08

C) 2.13

D) 5.6

A) 1.4

B) 2.08

C) 2.13

D) 5.6

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

47

Portfolio Beta You own $1,000 of City Steel stock that has a beta of 1.5. You also own $5,000 of Rent-N-Co (beta = 1.8) and $4,000 of Lincoln Corporation (beta = 0.9). What is the beta of your portfolio?

A) 1.4

B) 1.5

C) 4.2

D) 4.65

A) 1.4

B) 1.5

C) 4.2

D) 4.65

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

48

Expected Return Risk Compute the standard deviation of the expected return given these three economic states, their likelihoods, and the potential returns:

A) 6.8%

B) 16.5%

C) 21.5%

D) 46.4%

A) 6.8%

B) 16.5%

C) 21.5%

D) 46.4%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

49

The average annual return on the S&P 500 Index from 1986 to 1995 was 17.6 percent. The average annual T-bill yield during the same period was 9.8 percent. What was the market risk premium during these ten years?

A) 8.2%

B) 7.8%

C) 8.8%

D) 9.8%

A) 8.2%

B) 7.8%

C) 8.8%

D) 9.8%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

50

You have a portfolio with a beta of 3.1. What will be the new portfolio beta if you keep 85 percent of your money in the old portfolio and 15 percent in a stock with a beta of 4.5?

A) 3.31

B) 3.51

C) 3.61

D) 3.71

A) 3.31

B) 3.51

C) 3.61

D) 3.71

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

51

Under/Over-Valued Stock A manager believes his firm will earn a 16 percent return next year. His firm has a beta of 1.5, the expected return on the market is 14 percent, and the risk-free rate is 4 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

A) 19%, under-valued

B) 19%, over-valued

C) 22%, under-valued

D) 22%, over-valued

A) 19%, under-valued

B) 19%, over-valued

C) 22%, under-valued

D) 22%, over-valued

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

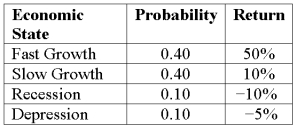

52

Expected Return and Risk Compute the standard deviation given these four economic states, their likelihoods, and the potential returns:

A) 6.71%

B) 22.5%

C) 23.37%

D) 52.20%

A) 6.71%

B) 22.5%

C) 23.37%

D) 52.20%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

53

Hastings Entertainment has a beta of 1.24. If the market return is expected to be 10 percent and the risk-free rate is 4 percent, what is Hastings' required return?

A) 11.44%

B) 12.44%

C) 14.96%

D) 16.40%

A) 11.44%

B) 12.44%

C) 14.96%

D) 16.40%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

54

Expected Return A company's current stock price is $65.40 and it is likely to pay a $2.25 dividend next year. Since analysts estimate the company will have a 11.25% growth rate, what is its expected return?

A) 3.44%

B) 3.61%

C) 11.25%

D) 14.69%

A) 3.44%

B) 3.61%

C) 11.25%

D) 14.69%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

55

Portfolio Beta You own $2,000 of City Steel stock that has a beta of 2.5. You also own $8,000 of Rent-N-Co (beta = 1.9) and $4,000 of Lincoln Corporation (beta = 0.25). What is the beta of your portfolio?

A) 1.51

B) 1.55

C) 4.65

D) 14.00

A) 1.51

B) 1.55

C) 4.65

D) 14.00

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

56

Expected Return and Risk Compute the standard deviation given these four economic states, their likelihoods, and the potential returns:

A) 12.19%

B) 23.8%

C) 38.65%

D) 88.06%

A) 12.19%

B) 23.8%

C) 38.65%

D) 88.06%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

57

Risk Premiums You own $5,000 of Software Corp's stock that has a beta of 3.75. You also own $10,000 of Home Improvement Corp (beta = 1.5) and $15,000 of Publishing Corp (beta = 0.35). Assume that the market return will be 13 percent and the risk-free rate is 4.5 percent. What is the risk premium of the portfolio?

A) 11.05%

B) 16.50%

C) 17.00%

D) 24.70%

A) 11.05%

B) 16.50%

C) 17.00%

D) 24.70%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

58

Netflicks, Inc. has a beta of 3.61. If the market return is expected to be 13.2 percent and the risk-free rate is 7 percent, what is Netflicks' risk premium?

A) 20.91%

B) 22.38%

C) 25.72%

D) 29.38%

A) 20.91%

B) 22.38%

C) 25.72%

D) 29.38%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

59

Compute the expected return given these three economic states, their likelihoods, and the potential returns:

A) 3.5%

B) 7.0%

C) 7.5%

D) 12.5%

A) 3.5%

B) 7.0%

C) 7.5%

D) 12.5%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

60

Risk Premiums You own $14,000 of Diner's Corp stock that has a beta of 2.1. You also own $14,000 of Comm Corp (beta = 1.3) and $12,000 of Airlines Corp (beta = 0.6). Assume that the market return will be 15 percent and the risk-free rate is 6.5 percent. What is the total risk premium of the portfolio?

A) 11.645%

B) 20.55%

C) 23.905%

D) 38.00%

A) 11.645%

B) 20.55%

C) 23.905%

D) 38.00%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

61

Universal Forest's current stock price is $154.00 and it is likely to pay a $5.23 dividend next year. Since analysts estimate Universal Forest will have a 13.0% growth rate, what is its required return?

A) 16.40%

B) 15.28%

C) 13.62%

D) 14.71%

A) 16.40%

B) 15.28%

C) 13.62%

D) 14.71%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

62

US Bancorp holds a press conference to announce a positive news event that was unexpected to the market. As soon as the announcement is made, the stock price increases $8 per share but then over the next hour the price falls resulting in a net increase of only $4. Given this information which of the following statements is correct?

A) This is an example of a market overreaction.

B) This is an example of a market underreaction.

C) This is an example of a semi-strong efficient market.

D) None of these statements are correct.

A) This is an example of a market overreaction.

B) This is an example of a market underreaction.

C) This is an example of a semi-strong efficient market.

D) None of these statements are correct.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

63

US Bancorp holds a press conference to announce a positive news event that was unexpected to the market. As soon as the announcement is made, the stock price increases $8 per share but then over the next hour the price continues to increase resulting in a total increase of $11. Given this information which of the following statements is correct?

A) This is an example of a market overreaction.

B) This is an example of a market underreaction.

C) This is an example of a semi-strong efficient market.

D) None of these statements are correct.

A) This is an example of a market overreaction.

B) This is an example of a market underreaction.

C) This is an example of a semi-strong efficient market.

D) None of these statements are correct.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

64

Compute the expected return and standard deviation given these four economic states, their likelihoods, and the potential returns:

A) 9.5%; 32.43%

B) 9.5%; 21.96%

C) 9.5%; 18.97%

D) 9.5%; 29.18%

A) 9.5%; 32.43%

B) 9.5%; 21.96%

C) 9.5%; 18.97%

D) 9.5%; 29.18%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

65

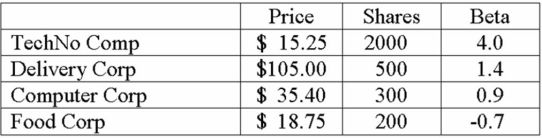

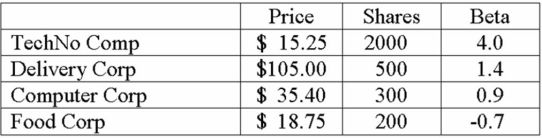

You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 12 percent and the risk-free rate is 3.5 percent, what is the required return of the portfolio?

A) 14.21%

B) 16.76%

C) 13.97%

D) 15.38%

A) 14.21%

B) 16.76%

C) 13.97%

D) 15.38%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

66

Estee Lauder's upcoming dividend is expected to be $0.65 and its stock is selling at $45. The firm has a beta of 1.1 and is expected to grow at 10% for the foreseeable future. Compute Estee Lauder's required return using both CAPM and the constant growth model. Assume that the market portfolio will earn 11 percent and the risk-free rate is 4 percent.

A) CAPM: 11.2%; Constant Growth Model: 10.97%

B) CAPM: 11.7%; Constant Growth Model: 11.44%

C) CAPM: 10.1%; Constant Growth Model: 11.46%

D) CAPM: 9.2%; Constant Growth Model: 9.56%

A) CAPM: 11.2%; Constant Growth Model: 10.97%

B) CAPM: 11.7%; Constant Growth Model: 11.44%

C) CAPM: 10.1%; Constant Growth Model: 11.46%

D) CAPM: 9.2%; Constant Growth Model: 9.56%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

67

A manager believes his firm will earn an 18 percent return next year. His firm has a beta of 1.75, the expected return on the market is 13 percent, and the risk-free rate is 5 percent. Compute the return the firm should earn given its level of risk and determine whether the manager is saying the firm is under-valued or over-valued.

A) 19%; over-valued

B) 19%; under-valued

C) 16.7%; over-valued

D) 16.7%; under-valued

A) 19%; over-valued

B) 19%; under-valued

C) 16.7%; over-valued

D) 16.7%; under-valued

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

68

Stock A has a required return of 12%. Stock B has a required return of 15%. Assume a risk-free rate of 4.75%. Which of the following is a correct statement about the two stocks?

A) Stock A is riskier.

B) Stock B is riskier.

C) The stocks have the same risk.

D) We would need to know if the markets are efficient to answer this question.

A) Stock A is riskier.

B) Stock B is riskier.

C) The stocks have the same risk.

D) We would need to know if the markets are efficient to answer this question.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

69

Stock A has a required return of 19%. Stock B has a required return of 11%. Assume a risk-free rate of 4.75%. Which of the following is a correct statement about the two stocks?

A) Stock A is riskier.

B) Stock B is riskier.

C) The stocks have the same risk.

D) We would need to know if the markets are efficient to answer this question.

A) Stock A is riskier.

B) Stock B is riskier.

C) The stocks have the same risk.

D) We would need to know if the markets are efficient to answer this question.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

70

Stock A has a required return of 19%. Stock B has a required return of 11%. Assume a risk-free rate of 4.75%. By how much does Stock A's risk premium exceed the risk premium of Stock B?

A) 3.25%

B) 6.25%

C) 8.00%

D) 7.00%

A) 3.25%

B) 6.25%

C) 8.00%

D) 7.00%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

71

You hold the positions in the table below. What is the beta of your portfolio? If you expect the market to earn 10 percent and the risk-free rate is 4 percent, what is the required return of the portfolio?

A) 12.37%

B) 9.73%

C) 10.17%

D) 11.68%

A) 12.37%

B) 9.73%

C) 10.17%

D) 11.68%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

72

The Nasdaq stock market bubble peaked at 10,816 in 2000. Two and a half years later it had fallen to 4,000. What was the percentage decline?

A) -63.02%

B) -69.47%

C) -57.13%

D) -49.18%

A) -63.02%

B) -69.47%

C) -57.13%

D) -49.18%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

73

You own $9,000 of Olympic Steel stock that has a beta of 2.5. You also own $7,000 of Rent-a-Center (beta = 1.2) and $8,000 of Lincoln Educational (beta = 0.4). What is the beta of your portfolio?

A) 1.18

B) 1.07

C) 1.42

D) 1.53

A) 1.18

B) 1.07

C) 1.42

D) 1.53

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

74

ABC Inc. has a dividend yield equal to 3% and is expected to grow at a 7% rate for the next 7 years. What is ABC's required return?

A) 10%

B) 11%

C) 4%

D) 5%

A) 10%

B) 11%

C) 4%

D) 5%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

75

Paccar's current stock price is $75.10 and it is likely to pay a $3.29 dividend next year. Since analysts estimate Paccar will have a 14.2% growth rate, what is its required return?

A) 15.39%

B) 17.94%

C) 18.58%

D) 19.62%

A) 15.39%

B) 17.94%

C) 18.58%

D) 19.62%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

76

Praxair's upcoming dividend is expected to be $2.25 and its stock is selling at $65. The firm has a beta of 0.8 and is expected to grow at 10% for the foreseeable future. Compute Praxair's required return using both CAPM and the constant growth model. Assume that the market portfolio will earn 10 percent and the risk-free rate is 3 percent.

A) CAPM: 8.6%; Constant Growth Model: 13.46%

B) CAPM: 9.7%; Constant Growth Model: 12.56%

C) CAPM: 10.1%; Constant Growth Model: 11.46%

D) CAPM: 8.2%; Constant Growth Model: 9.56%

A) CAPM: 8.6%; Constant Growth Model: 13.46%

B) CAPM: 9.7%; Constant Growth Model: 12.56%

C) CAPM: 10.1%; Constant Growth Model: 11.46%

D) CAPM: 8.2%; Constant Growth Model: 9.56%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is incorrect?

A) Technical analysis is expected to work if markets are weak-form efficient.

B) If markets are strong-form efficient then they must also be weak-form efficient.

C) It is not likely that the market is strong-form efficient.

D) None of these statements are incorrect.

A) Technical analysis is expected to work if markets are weak-form efficient.

B) If markets are strong-form efficient then they must also be weak-form efficient.

C) It is not likely that the market is strong-form efficient.

D) None of these statements are incorrect.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following statements is incorrect?

A) The capital market line shows the relationship between return and risk as measured by the standard deviation.

B) The Efficient Market Hypothesis states that security prices fully reflect all available information.

C) The security market line shows the relationship between return and risk as measured by beta.

D) None of these statements are correct.

A) The capital market line shows the relationship between return and risk as measured by the standard deviation.

B) The Efficient Market Hypothesis states that security prices fully reflect all available information.

C) The security market line shows the relationship between return and risk as measured by beta.

D) None of these statements are correct.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is correct?

A) Hedge funds often sell stock they don't even own.

B) Hedge funds maintain secrecy about their holdings, trading and strategies.

C) Hedge funds are limited to sophisticated investors.

D) All of these statements are correct.

A) Hedge funds often sell stock they don't even own.

B) Hedge funds maintain secrecy about their holdings, trading and strategies.

C) Hedge funds are limited to sophisticated investors.

D) All of these statements are correct.

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck

80

You own $10,000 of Denny's Corp stock that has a beta of 3.2. You also own $15,000 of Qwest Communications (beta = 1.9) and $15,000 of Southwest Airlines (beta = 0.4). Assume that the market return will be 13 percent and the risk-free rate is 5.5 percent. What is the risk premium of the portfolio?

A) 10.51%

B) 11.49%

C) 12.45%

D) 13.62%

A) 10.51%

B) 11.49%

C) 12.45%

D) 13.62%

Unlock Deck

Unlock for access to all 106 flashcards in this deck.

Unlock Deck

k this deck