Deck 8: Behavioral Finance and the Psychology of Investing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 8: Behavioral Finance and the Psychology of Investing

1

The belief that information you hold is superior to information held by other investors best describes:

A) over-confidence.

B) the snakebite effect.

C) the illusion of knowledge.

D) the clustering illusion.

E) loss aversion.

A) over-confidence.

B) the snakebite effect.

C) the illusion of knowledge.

D) the clustering illusion.

E) loss aversion.

C

2

Prospect theory is based on the concept that investors are:

A) always risk takers.

B) risk-adverse regarding losses.

C) risk-taking regarding losses.

D) always risk-averse.

E) neutral regarding risk.

A) always risk takers.

B) risk-adverse regarding losses.

C) risk-taking regarding losses.

D) always risk-averse.

E) neutral regarding risk.

C

3

Which one of the following is the tendency to believe that random events that occur in clusters are not really random?

A) clustering illusion

B) sequential clustering

C) random grouping

D) representativeness heuristic

E) gambler's fallacy

A) clustering illusion

B) sequential clustering

C) random grouping

D) representativeness heuristic

E) gambler's fallacy

A

4

The concept that well-capitalized,rational traders may be unable to correct a mispricing defines which one of the following terms?

A) noise trading bounds

B) market bounds

C) limits to arbitrage

D) implementation limits

E) sentiment borders

A) noise trading bounds

B) market bounds

C) limits to arbitrage

D) implementation limits

E) sentiment borders

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

Dow theory is a method of predicting future market movements based on which of the following Dow Jones averages?

I)industrial

II)transportation

III)utilities

IV)commodities

A) I and II only

B) II and III only

C) III and IV only

D) I and IV only

E) I, II, and III only

I)industrial

II)transportation

III)utilities

IV)commodities

A) I and II only

B) II and III only

C) III and IV only

D) I and IV only

E) I, II, and III only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

Loss aversion is defined as:

A) the inability to mentally acknowledge a loss on a security.

B) selling any security for less than the price paid to acquire it.

C) selling a security as soon as it has increased significantly in value.

D) the reluctance to sell a security after it has decreased in value.

E) the tendency to quickly sell any investment that has decreased in value.

A) the inability to mentally acknowledge a loss on a security.

B) selling any security for less than the price paid to acquire it.

C) selling a security as soon as it has increased significantly in value.

D) the reluctance to sell a security after it has decreased in value.

E) the tendency to quickly sell any investment that has decreased in value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

An unwillingness to take a risk after a loss describes:

A) over-confidence.

B) the snakebite effect.

C) the illusion of knowledge.

D) the clustering illusion.

E) loss aversion.

A) over-confidence.

B) the snakebite effect.

C) the illusion of knowledge.

D) the clustering illusion.

E) loss aversion.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

The minimum price at which a security is expected to trade is called the:

A) stop value.

B) par value.

C) Elliott wave price.

D) resistance level.

E) support level.

A) stop value.

B) par value.

C) Elliott wave price.

D) resistance level.

E) support level.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following is the basis for prospect theory?

A) Investors react differently to prospective gains and losses.

B) Investors make cognitive errors.

C) Some investors are irrational.

D) Investors react differently depending on the day of the week.

E) Investors suffer from money illusion.

A) Investors react differently to prospective gains and losses.

B) Investors make cognitive errors.

C) Some investors are irrational.

D) Investors react differently depending on the day of the week.

E) Investors suffer from money illusion.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

The measure of performance of one investment compared to another investment is called the:

A) wave height.

B) relative arm.

C) relative strength.

D) bar height.

E) support factor.

A) wave height.

B) relative arm.

C) relative strength.

D) bar height.

E) support factor.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following is a trader whose trades are not based on meaningful financial analysis or information?

A) specialist

B) arbitrageur

C) noise trader

D) sentiment trader

E) market maker

A) specialist

B) arbitrageur

C) noise trader

D) sentiment trader

E) market maker

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

Technical analysis studies which of the following as the basis for trading?

A) systematic risk

B) historical prices

C) dividend growth

D) financial statements

E) investor's required return

A) systematic risk

B) historical prices

C) dividend growth

D) financial statements

E) investor's required return

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following risks is related to irrational beliefs?

A) systematic

B) firm-specific

C) industry-specific

D) sentiment-based

E) market

A) systematic

B) firm-specific

C) industry-specific

D) sentiment-based

E) market

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

Representativeness heuristic is best explained as:

A) the process of assuming events are random even when they are not.

B) the creation of patterns in planned events.

C) concluding that casual factors cause random events when in fact they do not.

D) believing that random events that occur in clusters are truly random.

E) overconfidence in one's own skills as an investor.

A) the process of assuming events are random even when they are not.

B) the creation of patterns in planned events.

C) concluding that casual factors cause random events when in fact they do not.

D) believing that random events that occur in clusters are truly random.

E) overconfidence in one's own skills as an investor.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

According to Elliott wave theory,market predictions should be based on which one of the following?

A) eight-week repetitive trading patterns

B) the tidal waves created by the gravitational pull of the moon

C) series of historical market price swings

D) an industry's historical rate of growth

E) market fads and trends

A) eight-week repetitive trading patterns

B) the tidal waves created by the gravitational pull of the moon

C) series of historical market price swings

D) an industry's historical rate of growth

E) market fads and trends

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Mental accounting is the process of associating a stock with its:

A) prior day's market value.

B) expected value.

C) desired value.

D) purchase price.

E) lowest value.

A) prior day's market value.

B) expected value.

C) desired value.

D) purchase price.

E) lowest value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

The maximum price at which a security is expected to trade is called the:

A) fourth wave.

B) stop limit.

C) relative point.

D) resistance level.

E) support level.

A) fourth wave.

B) stop limit.

C) relative point.

D) resistance level.

E) support level.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following defines frame dependence?

A) Investors react differently to prospective gains and losses.

B) Investors tend to make more cognitive errors when they view investing as gambling.

C) Investors tend to be more irrational in bear markets than in bull markets.

D) Investors react differently depending on how an opportunity is presented.

E) Investors suffer from money illusion in bull markets but not in bear markets.

A) Investors react differently to prospective gains and losses.

B) Investors tend to make more cognitive errors when they view investing as gambling.

C) Investors tend to be more irrational in bear markets than in bull markets.

D) Investors react differently depending on how an opportunity is presented.

E) Investors suffer from money illusion in bull markets but not in bear markets.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

What is the area of finance called that addresses issues such as how reasoning errors affect investment decisions?

A) logical

B) individual

C) behavioral

D) rational

E) personal

A) logical

B) individual

C) behavioral

D) rational

E) personal

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of the following best describes heuristics?

A) clustering

B) rules of thumb

C) grouping

D) representativeness

E) herding

A) clustering

B) rules of thumb

C) grouping

D) representativeness

E) herding

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

The tendency to overvalue an item because you own it is referred to as which one of the following?

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following is a characteristic of the self-attribution bias?

A) believing what you wish to believe

B) placing too much weight on information which you can gather easily

C) believing that other investors agree with your thinking

D) taking credit for the wins and blaming the losses on bad luck

E) believing that your recent performance is an indication of your future performance

A) believing what you wish to believe

B) placing too much weight on information which you can gather easily

C) believing that other investors agree with your thinking

D) taking credit for the wins and blaming the losses on bad luck

E) believing that your recent performance is an indication of your future performance

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following statements is correct regarding prospect theory?

A) Average investors tend to lose more money than they earn from investing.

B) Typical investors feel that losing $1 is twice as painful as the pleasure derived from making $1.

C) Investors should focus on gains and losses in individual securities rather than their portfolio's total value.

D) Typical investors tend to react irrationally only when focusing on total portfolio value.

E) Average investors tend to prefer higher levels of risk.

A) Average investors tend to lose more money than they earn from investing.

B) Typical investors feel that losing $1 is twice as painful as the pleasure derived from making $1.

C) Investors should focus on gains and losses in individual securities rather than their portfolio's total value.

D) Typical investors tend to react irrationally only when focusing on total portfolio value.

E) Average investors tend to prefer higher levels of risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

According to the theory of recency bias,investors tend to believe the financial markets will:

A) gravitate to their long-term average rates of return.

B) react over the next year in direct opposition to the performance of the prior year.

C) have a maximum of three years of positive annual returns before declining somewhat.

D) continue to perform as they have over the past couple of years.

E) tend to reverse direction at least every five years.

A) gravitate to their long-term average rates of return.

B) react over the next year in direct opposition to the performance of the prior year.

C) have a maximum of three years of positive annual returns before declining somewhat.

D) continue to perform as they have over the past couple of years.

E) tend to reverse direction at least every five years.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

Tricia has lost money on a particular stock for the past three years.Thus,she believes the stock will have a high positive rate of return this year because earning a good return is long overdue.This assumption is best described as the:

A) law of small numbers.

B) house money effect.

C) gambler's fallacy.

D) false consensus.

E) recency bias.

A) law of small numbers.

B) house money effect.

C) gambler's fallacy.

D) false consensus.

E) recency bias.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of the following is an example of mental accounting?

A) associating a security's gains or losses based on its purchase price

B) calculating the gain or loss on a security on a daily basis

C) computing the amount of tax due on the gain from a stock sale

D) considering the gain realized when a stock pays a dividend

E) comparing the gains and losses on a portfolio to those of the overall market

A) associating a security's gains or losses based on its purchase price

B) calculating the gain or loss on a security on a daily basis

C) computing the amount of tax due on the gain from a stock sale

D) considering the gain realized when a stock pays a dividend

E) comparing the gains and losses on a portfolio to those of the overall market

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following market sentiment index (MSI)values indicates that all polled investors were bearish?

A) -1

B) 0

C) 1

D) 50

E) 100

A) -1

B) 0

C) 1

D) 50

E) 100

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Investors tend to make better decisions when looking at a decision:

A) based on historical performance.

B) only in respect to potential losses.

C) based on individual securities.

D) in broad terms.

E) based on historical costs.

A) based on historical performance.

B) only in respect to potential losses.

C) based on individual securities.

D) in broad terms.

E) based on historical costs.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following are impediments to the correction of a security's mispricing?

I)sentiment-based risk

II)implementation costs

III)firm-specific risk

IV)noise trader risk

A) II only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

I)sentiment-based risk

II)implementation costs

III)firm-specific risk

IV)noise trader risk

A) II only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

The increased cash flows into mutual funds that have recently had superior returns is most associated with which one of the following characteristics?

A) overconfidence

B) excess trading

C) clustering illusion

D) diversification

E) risk aversion

A) overconfidence

B) excess trading

C) clustering illusion

D) diversification

E) risk aversion

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

Four of the last five stocks your investment adviser recommended have outperformed the market.Thus,you believe that if you continue to follow her advice,that 80 percent of your investments will outperform the market over the long term.This belief is based on the:

A) gambler's fallacy.

B) law of small numbers.

C) law of large numbers.

D) clustering illusion.

E) positive performance illusion.

A) gambler's fallacy.

B) law of small numbers.

C) law of large numbers.

D) clustering illusion.

E) positive performance illusion.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

Yesterday,Krista stated that Overland stock was only worth $12 a share and since it was selling for $15 a share,she declared it overpriced and refused to buy any shares.This morning,she learned that she is inheriting 3,500 shares of Overland stock from her grandmother.Suddenly,she is saying that Overland stock is a great buy at $15 and is probably worth at least $17 a share.This is an example of which one of the following?

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Which one of the following statements appears to be correct based on current research?

A) Single, female investors tend to earn lower returns than their male counterparts.

B) Overconfidence tends to result in lower returns.

C) Excessive trading tends to increase returns.

D) Men tend to trade less frequently than women.

E) Investors with higher incomes tend to be more risk-adverse than other investors.

A) Single, female investors tend to earn lower returns than their male counterparts.

B) Overconfidence tends to result in lower returns.

C) Excessive trading tends to increase returns.

D) Men tend to trade less frequently than women.

E) Investors with higher incomes tend to be more risk-adverse than other investors.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

Ted constantly ignores the effects of inflation on money.Ted is suffering from which one of the following?

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

A) endowment effect

B) money illusion

C) regret aversion

D) myopic loss aversion

E) sunk cost fallacy

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Which one of the following market sentiment index (MSI)values represents the best buying opportunity?

A) 0.16

B) 0.29

C) 0.48

D) 0.61

E) 0.82

A) 0.16

B) 0.29

C) 0.48

D) 0.61

E) 0.82

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Patrick is a contestant on a game show.At this point in the game,he can either accept $500 or spin a wheel for a chance of winning $100,000.Which type of behavior is he displaying if he spins the wheel?

A) forward-looking

B) risk-adverse

C) prospective

D) introspective

E) risk-taking

A) forward-looking

B) risk-adverse

C) prospective

D) introspective

E) risk-taking

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

According to the concept of house money,individual investors are most apt to do which one of the following?

A) take more risks with their initial investment than with the gains on that investment

B) value money differently depending upon its source

C) treat paper profits the same as initial cash investments

D) apply the same level of risk-aversion to all investments

E) place high value on paper profits but low value on paper losses

A) take more risks with their initial investment than with the gains on that investment

B) value money differently depending upon its source

C) treat paper profits the same as initial cash investments

D) apply the same level of risk-aversion to all investments

E) place high value on paper profits but low value on paper losses

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

Investors who tend to invest too heavily in the securities issued by their employer suffer from the condition known as:

A) overconfidence.

B) loyalty adherence.

C) status quo.

D) local adhesion.

E) familiarity.

A) overconfidence.

B) loyalty adherence.

C) status quo.

D) local adhesion.

E) familiarity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

According to the concept of loss aversion,individual investors are most apt to do which one of the following?

A) sell stocks with gains more frequently than stocks with losses

B) sell stocks with losses more frequently than stocks with gains

C) hold stocks with gains and sell stocks with losses

D) sell all stocks after a pre-determined length of time

E) hold all stocks unless they decline more than ten percent in value

A) sell stocks with gains more frequently than stocks with losses

B) sell stocks with losses more frequently than stocks with gains

C) hold stocks with gains and sell stocks with losses

D) sell all stocks after a pre-determined length of time

E) hold all stocks unless they decline more than ten percent in value

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Peter hesitates when it comes to picking an individual stock to purchase as he feels that he will later realize that a different stock would have been a better investment.Peter is suffering from:

A) money illusion.

B) frame dependence.

C) regret aversion.

D) risk-taking.

E) mental accounting.

A) money illusion.

B) frame dependence.

C) regret aversion.

D) risk-taking.

E) mental accounting.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

Bollinger bands:

A) graphically reflect the differences between two moving averages.

B) graphically depict the relative strength of a security as compared to the market.

C) are a graphical representation of an exponential moving average.

D) depict a 2-standard deviation bound around a moving average.

E) are equal to the 20-day moving average plus or minus one standard deviation.

A) graphically reflect the differences between two moving averages.

B) graphically depict the relative strength of a security as compared to the market.

C) are a graphical representation of an exponential moving average.

D) depict a 2-standard deviation bound around a moving average.

E) are equal to the 20-day moving average plus or minus one standard deviation.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

A "block trade" is a trade in excess of how many shares?

A) 1,000

B) 5,000

C) 10,000

D) 50,000

E) 100,000

A) 1,000

B) 5,000

C) 10,000

D) 50,000

E) 100,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

Which one of the following statements is correct regarding moving averages?

A) The 50-day moving average reflects the long-term trend of the market.

B) An exponential moving average is a weighted average.

C) Moving averages are used primarily to measure trading volume.

D) Short-term and long-term moving averages always move in the same direction.

E) Moving averages are generally computed using average daily prices.

A) The 50-day moving average reflects the long-term trend of the market.

B) An exponential moving average is a weighted average.

C) Moving averages are used primarily to measure trading volume.

D) Short-term and long-term moving averages always move in the same direction.

E) Moving averages are generally computed using average daily prices.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

What is the primary purpose of Dow theory?

A) to measure the level of investor optimism and pessimism

B) to analyze daily market movements

C) to identify and measure market waves

D) to eliminate market corrections

E) to signal changes in the market's primary direction

A) to measure the level of investor optimism and pessimism

B) to analyze daily market movements

C) to identify and measure market waves

D) to eliminate market corrections

E) to signal changes in the market's primary direction

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

According to technical analysis,which one of the following is best seen as a buying opportunity?

A) a breakout of a resistance level

B) an MSI value of 0.1 or less

C) a downward sloping advance/decline line

D) a flat advance/decline line

E) top of Elliott wave 5

A) a breakout of a resistance level

B) an MSI value of 0.1 or less

C) a downward sloping advance/decline line

D) a flat advance/decline line

E) top of Elliott wave 5

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

Which one of the following is correct concerning a head and shoulders top pattern?

A) The outside of the right shoulder is a bullish signal.

B) The shoulders are higher than the head.

C) The left shoulder must be higher than the right shoulder, but lower than the head.

D) A piercing of the neckline is a reversal signal.

E) The trend line must be relatively flat throughout the pattern.

A) The outside of the right shoulder is a bullish signal.

B) The shoulders are higher than the head.

C) The left shoulder must be higher than the right shoulder, but lower than the head.

D) A piercing of the neckline is a reversal signal.

E) The trend line must be relatively flat throughout the pattern.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

If the closing tick of the day is +32,this means that the:

A) DJIA ended the day up 32 basis points.

B) discount rate at the end of the day was 3.20 percent.

C) number of stocks closing on an uptick was 32.

D) number of stocks closing on an uptick exceeded those closing on a downtick by 32.

E) number of stocks closing on an uptick was 32 more than on the prior trading day.

A) DJIA ended the day up 32 basis points.

B) discount rate at the end of the day was 3.20 percent.

C) number of stocks closing on an uptick was 32.

D) number of stocks closing on an uptick exceeded those closing on a downtick by 32.

E) number of stocks closing on an uptick was 32 more than on the prior trading day.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

Which one of the following statements is correct concerning an open-high-low-close bar chart?

A) The prices indicated by the two horizontal lines are the maximum and minimum daily prices.

B) The upper trendline indicates the support level.

C) If the overall price movement is downward, the lower trendline is called the channel line.

D) If the overall price movement is upward, the upper trendline is called the head line.

E) The final price of the day is indicated by a horizontal line to the left side of the vertical line.

A) The prices indicated by the two horizontal lines are the maximum and minimum daily prices.

B) The upper trendline indicates the support level.

C) If the overall price movement is downward, the lower trendline is called the channel line.

D) If the overall price movement is upward, the upper trendline is called the head line.

E) The final price of the day is indicated by a horizontal line to the left side of the vertical line.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

According to technical analysts,pricing patterns such as the head and shoulders are indicators of potential:

A) reversals from the main trend line.

B) upcoming corrections which will return the market to the current main trend line.

C) increasing strength for the main trend line.

D) decreasing market activity.

E) increasing market activity.

A) reversals from the main trend line.

B) upcoming corrections which will return the market to the current main trend line.

C) increasing strength for the main trend line.

D) decreasing market activity.

E) increasing market activity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

If you are a proponent of the Elliott wave theory,you are most apt to do which one of the following?

A) sell on wave 2

B) sell on wave 3

C) buy on wave A

D) buy on wave 2

E) buy on wave 5

A) sell on wave 2

B) sell on wave 3

C) buy on wave A

D) buy on wave 2

E) buy on wave 5

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

Assume the 50-day moving average is currently intersecting the 200-day moving average.Also assume the 50-day average is downward sloping and the 200-day average is upward sloping.Which one of the following statements is accurate based on this information?

A) The 50-day moving average is bullish.

B) The short-term forecast is bullish.

C) The long-term trend may be preparing to change.

D) The long-term outlook is bearish.

E) The short-term trend will change to match the long-term trend.

A) The 50-day moving average is bullish.

B) The short-term forecast is bullish.

C) The long-term trend may be preparing to change.

D) The long-term outlook is bearish.

E) The short-term trend will change to match the long-term trend.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

According to Dow theory,which one of the following is the primary means of eliminating secondary market trends?

A) corrections

B) confirmations

C) continuations

D) conversions

E) coordinated trades

A) corrections

B) confirmations

C) continuations

D) conversions

E) coordinated trades

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

Which one of the following advance/decline lines is the most bullish signal?

A) relatively flat

B) slightly upward sloping

C) slightly downward sloping

D) steeply upward sloping

E) steeply downward sloping

A) relatively flat

B) slightly upward sloping

C) slightly downward sloping

D) steeply upward sloping

E) steeply downward sloping

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

You recently heard a news announcer state that the market is approaching its support level.Which one of the following is the best interpretation of that statement?

A) The market is approaching the lowest level that is reasonably expected.

B) The federal government will step in to help the market retain its value should the market slip much further.

C) The market is almost at a peak and is expected to start declining in the near future.

D) The market is almost to the point where trading will be suspended temporarily.

E) The market is almost equivalent in value to the international markets so price stabilization is expected.

A) The market is approaching the lowest level that is reasonably expected.

B) The federal government will step in to help the market retain its value should the market slip much further.

C) The market is almost at a peak and is expected to start declining in the near future.

D) The market is almost to the point where trading will be suspended temporarily.

E) The market is almost equivalent in value to the international markets so price stabilization is expected.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

For the past year,a particular stock has a relative strength value of 1.03 as compared to the market.This means that the stock:

A) increased in value 3 percent more than the market for the day.

B) has 3 percent more risk than the average security.

C) outperformed the market for the period.

D) had 3 percent higher trading volume on a growth basis as compared to the market.

E) is selling for 103 percent of the market value per share.

A) increased in value 3 percent more than the market for the day.

B) has 3 percent more risk than the average security.

C) outperformed the market for the period.

D) had 3 percent higher trading volume on a growth basis as compared to the market.

E) is selling for 103 percent of the market value per share.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

Which one of the following indicates the long-run direction of the market according to Dow Theory?

A) daily fluctuations

B) secondary reaction

C) monthly changes

D) primary trend

E) tertiary trend

A) daily fluctuations

B) secondary reaction

C) monthly changes

D) primary trend

E) tertiary trend

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following are bullish indicators?

I)flat advance/decline line

II)breakout of a support level

III)Arms ratio of .38

IV)heavy advancing volume

A) I and II only

B) III and IV only

C) I and III only

D) II and III only

E) I and IV only

I)flat advance/decline line

II)breakout of a support level

III)Arms ratio of .38

IV)heavy advancing volume

A) I and II only

B) III and IV only

C) I and III only

D) II and III only

E) I and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of the following Arms values is the most bearish?

A) )28

B) )45

C) )88

D) 1.03

E) 1.26

A) )28

B) )45

C) )88

D) 1.03

E) 1.26

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

Investors who use the MACD indicator as a signal for trading are most apt to buy a security when the MACD:

A) equals zero.

B) is equal to 1.0.

C) rises above the signal line.

D) parallels the signal line.

E) falls below the signal line.

A) equals zero.

B) is equal to 1.0.

C) rises above the signal line.

D) parallels the signal line.

E) falls below the signal line.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

A stock's price has been relatively constant for an extended period of time.In this instance,the Bollinger bands are:

A) relatively close to each other.

B) non-existent.

C) vertical.

D) steeply upsloping.

E) steeply downsloping.

A) relatively close to each other.

B) non-existent.

C) vertical.

D) steeply upsloping.

E) steeply downsloping.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

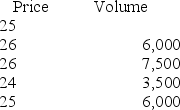

Given the following information,what is the net money flow at the end of the trading day?

A) -290,500

B) -85,100

C) 222,000

D) -222,000

E) 306,000

A) -290,500

B) -85,100

C) 222,000

D) -222,000

E) 306,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

A recent survey indicates that 1,731 people are bearish on the market for every 1,000 that are bullish.What is the value of the market sentiment index based on this information?

A) )36

B) )43

C) )57

D) )63

E) )75

A) )36

B) )43

C) )57

D) )63

E) )75

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following are considered in the computation of money flows?

I)last trade price

II)current trade price

III)volume of each trade

IV)time of each trade

A) I and IV only

B) II and III only

C) I, II, and III only

D) II, III, and IV only

E) I, II, III, and IV

I)last trade price

II)current trade price

III)volume of each trade

IV)time of each trade

A) I and IV only

B) II and III only

C) I, II, and III only

D) II, III, and IV only

E) I, II, III, and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

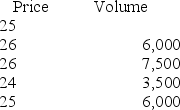

Given the following information,what is the net money flow at the end of the trading day?

A) -213,500

B) -103,000

C) 91,200

D) 187,600

E) 257,800

A) -213,500

B) -103,000

C) 91,200

D) 187,600

E) 257,800

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Last year,Kate purchased 4 shares of stock A at $40 a share.At the same time,she purchased 6 shares of stock B at $40 a share.Today,stock A is valued at $56 a share and stock B is worth $42 a share.What is the relative strength of stock A as compared to stock B?

A) 0.84

B) 0.89

C) 0.93

D) 1.04

E) 1.14

A) 0.84

B) 0.89

C) 0.93

D) 1.04

E) 1.14

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

Assume a stock's price remains relatively stable while the money flow becomes highly positive.Which one of the following is most expected given this scenario?

A) price decrease

B) stable price

C) price increase

D) increasing trading volume

E) decreasing trading volume

A) price decrease

B) stable price

C) price increase

D) increasing trading volume

E) decreasing trading volume

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Some technical analysts use Fibonacci numbers to predict:

A) primary trend breakthroughs.

B) market turnarounds.

C) secondary market trend lines.

D) relative performance values.

E) resistance and support levels.

A) primary trend breakthroughs.

B) market turnarounds.

C) secondary market trend lines.

D) relative performance values.

E) resistance and support levels.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

A survey of 75 of your fellow classmates determines that 29 of them are bullish on the market while the remainder is bearish.What is the market sentiment index for this group of individuals?

A) )28

B) )33

C) )44

D) )61

E) )70

A) )28

B) )33

C) )44

D) )61

E) )70

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

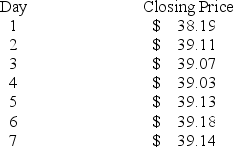

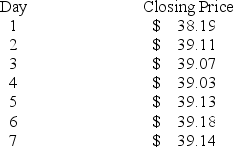

What is the 3-day exponential moving average as of day 5 assuming that a weight of 60 percent is placed on the most recent price?

A) $39.04

B) $39.07

C) $39.13

D) $39.22

E) $39.28

A) $39.04

B) $39.07

C) $39.13

D) $39.22

E) $39.28

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

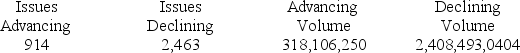

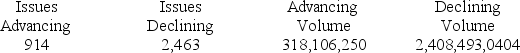

70

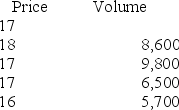

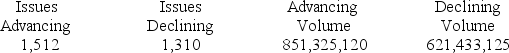

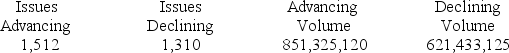

Given the following information,what is the value of the closing Arms?

A) )82

B) )84

C) )92

D) 1.11

E) 1.22

A) )82

B) )84

C) )92

D) 1.11

E) 1.22

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

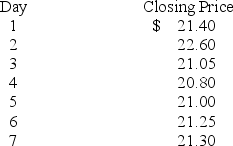

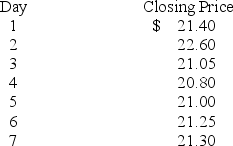

71

What is the 3-day exponential moving average as of day 4 assuming that a weight of 70 percent is placed on the most recent price?

A) $20.81

B) $20.84

C) $20.87

D) $20.90

E) $20.94

A) $20.81

B) $20.84

C) $20.87

D) $20.90

E) $20.94

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

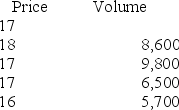

Given the following information,what is the value of the closing Arms?

A) 0.29

B) 0.36

C) 0.42

D) 2.81

E) 3.45

A) 0.29

B) 0.36

C) 0.42

D) 2.81

E) 3.45

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

The series of Fibonacci numbers contains the sequential values of 610 and 987.What is the next number in this series?

A) 1,264

B) 1,364

C) 1,419

D) 1,597

E) 1,633

A) 1,264

B) 1,364

C) 1,419

D) 1,597

E) 1,633

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

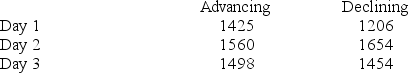

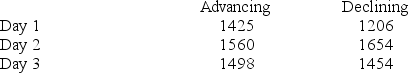

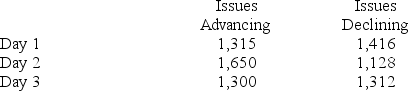

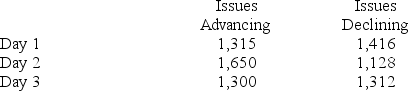

Given the following information,what is the value of the advance/decline line on the second day of this 3-day period?

A) -889

B) -804

C) -294

D) +125

E) +402

A) -889

B) -804

C) -294

D) +125

E) +402

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

The price of a stock increased from $32 to $38.Using phi,what are the primary and secondary support areas for the stock?

A) $35.33; $33.67

B) $33.67; $35.33

C) $35.71; $34.29

D) $38.14; $36.99

E) $36.99; $38.14

A) $35.33; $33.67

B) $33.67; $35.33

C) $35.71; $34.29

D) $38.14; $36.99

E) $36.99; $38.14

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

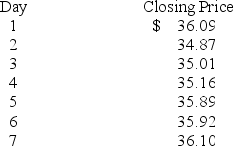

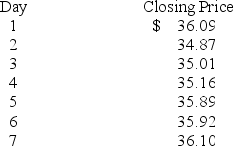

What is the 3-day simple moving average as of day 5,given the following information?

A) $35.28

B) $35.35

C) $35.41

D) $35.57

E) $35.62

A) $35.28

B) $35.35

C) $35.41

D) $35.57

E) $35.62

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

Fibonacci numbers:

A) are all odd numbers of increasing value.

B) result in a golden mean which has an approximate value of 1.618.

C) are the square roots of the products of the two previous numbers in the series.

D) result in a phi which is approximately equal to .382.

E) are a series of numbers which are equal to the product of the two previous numbers.

A) are all odd numbers of increasing value.

B) result in a golden mean which has an approximate value of 1.618.

C) are the square roots of the products of the two previous numbers in the series.

D) result in a phi which is approximately equal to .382.

E) are a series of numbers which are equal to the product of the two previous numbers.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

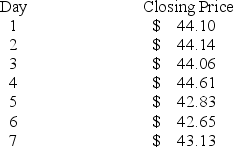

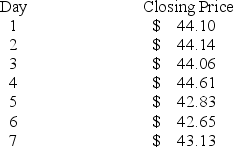

What is the 4-day simple moving average as of day 7,given the following information?

A) $42.88

B) $43.13

C) $43.22

D) $43.31

E) $44.61

A) $42.88

B) $43.13

C) $43.22

D) $43.31

E) $44.61

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

Given the following information,what is the value of the advance/decline line on the third day of this 3-day period?

A) -277

B) -198

C) +202

D) +326

E) +409

A) -277

B) -198

C) +202

D) +326

E) +409

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

Which one of the following is seen as a bearish indicator?

A) decreased short selling

B) increased buying by odd-lot traders

C) shorter skirt lengths

D) a Super Bowl win by a National Football League team

E) tight Bollinger bands

A) decreased short selling

B) increased buying by odd-lot traders

C) shorter skirt lengths

D) a Super Bowl win by a National Football League team

E) tight Bollinger bands

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck