Deck 9: Investments: Property, Plant, and Equipment and Intangible Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 9: Investments: Property, Plant, and Equipment and Intangible Assets

1

Freight costs incurred when an operating asset is purchased should generally be

A) Expensed in the period incurred

B) Deducted from the accumulated depreciation account

C) Added to the cost of the new asset

D) Not recorded in the accounts

A) Expensed in the period incurred

B) Deducted from the accumulated depreciation account

C) Added to the cost of the new asset

D) Not recorded in the accounts

C

2

How would a company classify a 2-year lease that requires monthly rental payments of $1,000 and also requires that the company must move out of the building, or negotiate a new lease when the current one ends?

A) Capital lease

B) Sales lease

C) Operating lease

D) Buy-back lease

A) Capital lease

B) Sales lease

C) Operating lease

D) Buy-back lease

C

3

Which of the following is NOT a reason for leasing rather than purchasing an asset?

A) Avoiding a significant cash outlay for a down payment

B) Avoiding the risks of obsolescence

C) Avoiding the recognition of additional debt on the balance sheet

D) All of these are reasons for leasing rather than purchasing an asset

A) Avoiding a significant cash outlay for a down payment

B) Avoiding the risks of obsolescence

C) Avoiding the recognition of additional debt on the balance sheet

D) All of these are reasons for leasing rather than purchasing an asset

D

4

The cost assigned to the individual assets acquired in a basket purchase is based on their relative

A) Historical costs

B) Fair market values

C) Book values

D) Depreciable costs

A) Historical costs

B) Fair market values

C) Book values

D) Depreciable costs

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

The caption "property, plant, and equipment" generally includes

A) Assets purchased for sale

B) Depreciable assets

C) Current assets

D) Assets that have no future service potential

A) Assets purchased for sale

B) Depreciable assets

C) Current assets

D) Assets that have no future service potential

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

The process of comparing the cost of an asset to the value of expected cash inflows, after adjusting for the time value of money, is called

A) Acquisition analysis

B) Present value analysis

C) Capital budgeting

D) Long-term asset budgeting

A) Acquisition analysis

B) Present value analysis

C) Capital budgeting

D) Long-term asset budgeting

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT a current asset?

A) Marketable Securities

B) Cash

C) Accounts Receivable

D) Property, Plant, and Equipment

A) Marketable Securities

B) Cash

C) Accounts Receivable

D) Property, Plant, and Equipment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

Assets that are NOT acquired for resale, but used by a business to generate revenues, are

A) Land

B) Goodwill

C) Inventory

D) Both land and goodwill

A) Land

B) Goodwill

C) Inventory

D) Both land and goodwill

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

When purchasing an entire company, what is the accounting term for the purchase price in excess of identifiable assets?

A) Goodwill

B) Excess value

C) Patent

D) Intangible asset

A) Goodwill

B) Excess value

C) Patent

D) Intangible asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

The party who owns an asset that is rented to another is referred to as the

A) Lessor

B) Mortgagee

C) Lessee

D) Principal

A) Lessor

B) Mortgagee

C) Lessee

D) Principal

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

Long-term operating assets have value because they are expected to

A) Help a company generate expenses this period

B) Help a company generate cash flows this period

C) Help a company generate expenses in the future

D) Help a company generate cash flows in the future

A) Help a company generate expenses this period

B) Help a company generate cash flows this period

C) Help a company generate expenses in the future

D) Help a company generate cash flows in the future

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

How many of the criteria for determining whether a lease should be classified as an operating lease or a capital lease must a noncancelable lease meet to be recorded as a capital lease?

A) 1

B) 2

C) 3

D) 4

A) 1

B) 2

C) 3

D) 4

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

A noncancelable lease should be recorded as a capital lease if

A) The present value of the lease payments is 75% or more of the fair market value of the leased asset

B) Title to the asset transfers to the lessee by the end of the lease term

C) The lessee is given an option to purchase the asset at its fair market value

D) Any one of these criterion are met

A) The present value of the lease payments is 75% or more of the fair market value of the leased asset

B) Title to the asset transfers to the lessee by the end of the lease term

C) The lessee is given an option to purchase the asset at its fair market value

D) Any one of these criterion are met

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is an asset that does NOT have physical substance?

A) Land

B) Patents

C) Equipment

D) Supplies

A) Land

B) Patents

C) Equipment

D) Supplies

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is considered to be a long-term asset?

A) Land

B) Goodwill

C) Equipment

D) All of these are long-term assets

A) Land

B) Goodwill

C) Equipment

D) All of these are long-term assets

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

To properly evaluate the purchase of a long-term asset, the expected future cash flows must be adjusted for

A) Property taxes

B) Interest

C) Time value of money

D) Future revenues

A) Property taxes

B) Interest

C) Time value of money

D) Future revenues

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

A long-term operating asset should be acquired if

A) The cost of purchasing the long-term operating asset is less than the expected cash inflows, adjusted for the time-value of money, generated by the long-term operating asset

B) The cost of purchasing the long-term operating asset is more than the expected cash inflows, adjusted for the time-value of money, generated by the long-term operating asset

C) The cost of purchasing the long-term operating asset is less than the expected cash inflows, not adjusted for the time-value of money, generated by the long-term operating asset

D) The cost of purchasing the long-term operating asset is more than the expected cash inflows, not adjusted for the time-value of money, generated by the long-term operating asset

A) The cost of purchasing the long-term operating asset is less than the expected cash inflows, adjusted for the time-value of money, generated by the long-term operating asset

B) The cost of purchasing the long-term operating asset is more than the expected cash inflows, adjusted for the time-value of money, generated by the long-term operating asset

C) The cost of purchasing the long-term operating asset is less than the expected cash inflows, not adjusted for the time-value of money, generated by the long-term operating asset

D) The cost of purchasing the long-term operating asset is more than the expected cash inflows, not adjusted for the time-value of money, generated by the long-term operating asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is NOT a consideration in classifying a lease?

A) Value of the asset on the lessor's books

B) Economic life of the asset

C) Present value of the lease payments

D) Whether the lease is cancelable

A) Value of the asset on the lessor's books

B) Economic life of the asset

C) Present value of the lease payments

D) Whether the lease is cancelable

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a capitalizable cost on a self-constructed asset?

A) Total materials used

B) Total labor costs incurred

C) Total company overhead

D) Interest associated with money borrowed to finance the construction project

A) Total materials used

B) Total labor costs incurred

C) Total company overhead

D) Interest associated with money borrowed to finance the construction project

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

Leased assets are capitalized at

A) Their historical cost

B) The future value of the future lease payments

C) The sum of the future lease payments

D) The present value of the future lease payments

A) Their historical cost

B) The future value of the future lease payments

C) The sum of the future lease payments

D) The present value of the future lease payments

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

During 2012, Bernard Inc. constructed a new factory. Bernard used its current employees to build the factory. Building material costs for the new factory were $2,700,000; total labor costs were $1,400,000; total company overhead was $7,500,000 (20% of which could be assigned to the new project); and interest paid on a new construction loan for the project was $750,000. What was the total cost of the self-constructed factory?

A) $6,350,000

B) $4,850,000

C) $5,600,000

D) $12,350,000

A) $6,350,000

B) $4,850,000

C) $5,600,000

D) $12,350,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Furniture with a list price of $6,000 is purchased on account for $5,000. Which of the following entries properly records this transaction?

A) Furniture 5,000 Cash 5,000

B) Furniture 6,000 Accounts Payable 6,000

C) Furniture 5,000 Accounts Payable 5,000

D) Furniture 6,000 Cash 6,000

A) Furniture 5,000 Cash 5,000

B) Furniture 6,000 Accounts Payable 6,000

C) Furniture 5,000 Accounts Payable 5,000

D) Furniture 6,000 Cash 6,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

Assume a company enters into a capital lease on January 1, 2012, to acquire the use of a machine for 5 years. The present value of the lease payments is $60,000, and the interest rate is 12 percent. If annual rental payments of $18,000 are due at the end of each year, the journal entry to record the first annual payment on December 31, 2012, would include a debit to

A) Lease Expense, $18,000

B) Interest Expense, $7,200 and Lease Expense, $10,800

C) Interest Expense, $7,200 and Lease Liability, $10,800

D) Interest Expense, $9,000 and Lease Liability, $9,000

A) Lease Expense, $18,000

B) Interest Expense, $7,200 and Lease Expense, $10,800

C) Interest Expense, $7,200 and Lease Liability, $10,800

D) Interest Expense, $9,000 and Lease Liability, $9,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

A company leases an asset for a 7-year period under a capital lease and agrees to pay an annual rental of $15,000. The initial entry to record this transaction, assuming the present value of the lease payments is $84,000, would include

A) Debit to Lease Expense for $15,000

B) Debit to Lease Expense for $12,000

C) Debit to Lease Asset for $84,000

D) Credit to Lease Liability for $12,000

A) Debit to Lease Expense for $15,000

B) Debit to Lease Expense for $12,000

C) Debit to Lease Asset for $84,000

D) Credit to Lease Liability for $12,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

Land and a building were purchased for a sum of $200,000. If appraisals set the value of the land at $140,000 and the building at $70,000, the building will be recorded at

A) $60,000

B) $66,667

C) $80,000

D) $133,333

A) $60,000

B) $66,667

C) $80,000

D) $133,333

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

A depreciable asset's book value can never be less than its

A) Historical cost

B) Fair market value

C) Capitalized cost

D) Salvage value

A) Historical cost

B) Fair market value

C) Capitalized cost

D) Salvage value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

How is Accumulated Depreciation classified?

A) Equity

B) Liability

C) Contra-asset

D) Expense

A) Equity

B) Liability

C) Contra-asset

D) Expense

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

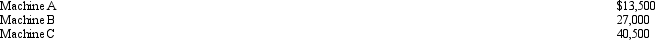

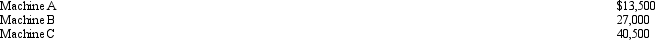

Henner Corporation made a basket purchase of three pieces of machinery for $72,000. The fair market values of the machinery were determined to be as follows:  What cost should Henner record for Machine C?

What cost should Henner record for Machine C?

A) $40,500

B) $31,500

C) $27,000

D) $36,000

What cost should Henner record for Machine C?

What cost should Henner record for Machine C?A) $40,500

B) $31,500

C) $27,000

D) $36,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

Boone Company purchased a piece of machinery by paying $5,000 cash. In addition to the purchase price, the company incurred $100 freight charges. The machine has an estimated useful life of 5 years and will require $125 for insurance over that period. Boone Company would record the cost of the machine at

A) $5,000

B) $5,100

C) $5,125

D) $5,225

A) $5,000

B) $5,100

C) $5,125

D) $5,225

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

Depreciation can best be described as a method of

A) Accumulating funds for the replacement of assets

B) Reducing the carrying cost of assets to current market values

C) Deriving tax benefits

D) Allocating the costs of assets over their useful lives

A) Accumulating funds for the replacement of assets

B) Reducing the carrying cost of assets to current market values

C) Deriving tax benefits

D) Allocating the costs of assets over their useful lives

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

On January 1, 2012, Alberta Company purchased land and a building for $1,120,000. At the time of the purchase, it was estimated that the building had a market value of $700,000. On January 5, Alberta installed a fence around the property at a cost of $7,000. Given this information, the journal entry to record the purchase of the land and building would include a

A) Debit to Land for $427,000

B) Debit to Land for $420,000

C) Debit to Land for $413,000

D) Debit to Land for $700,000

A) Debit to Land for $427,000

B) Debit to Land for $420,000

C) Debit to Land for $413,000

D) Debit to Land for $700,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

The undepreciated cost of an asset is referred to as

A) Salvage value

B) Book value

C) Market value

D) Sales value

A) Salvage value

B) Book value

C) Market value

D) Sales value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Another name for residual value is

A) Book value

B) Salvage value

C) Carrying value

D) Current value

A) Book value

B) Salvage value

C) Carrying value

D) Current value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

Radner Shipping purchased a truck and a trailer for $54,000. An appraisal has set the fair market values of the truck and the trailer at $19,000 and $38,000, respectively. At what amount should Radner record the truck?

A) $18,000

B) $19,000

C) $36,000

D) $38,000

A) $18,000

B) $19,000

C) $36,000

D) $38,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

The Accumulated Depreciation account is credited when

A) An asset is traded for a similar asset

B) A new asset is purchased

C) The depreciation expense for the year is recorded

D) An asset is traded for a dissimilar asset

A) An asset is traded for a similar asset

B) A new asset is purchased

C) The depreciation expense for the year is recorded

D) An asset is traded for a dissimilar asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

On January 1, 2012, Eugene Inc. entered into a capital lease to acquire the use of a computer for 5 years. The present value of the lease payments is $85,000, the applicable interest rate is 10 percent, and payments of $24,000 are due at the end of each year. The entry to record the first $24,000 payment on December 31, 2012, will include a debit to

A) Lease Expense, $24,000

B) Interest Expense, $24,000

C) Leased Computer, $85,000

D) Lease Liability, $15,500

A) Lease Expense, $24,000

B) Interest Expense, $24,000

C) Leased Computer, $85,000

D) Lease Liability, $15,500

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Assume that a company leases equipment for a 5-year period under a capital lease and agrees to pay an annual rental of $16,000 at the end of each year. If the present value of the lease payments is $59,200, the entry to record the leasing transaction would include

A) A debit to Lease Expense of $59,200

B) A debit to Leased Equipment of $59,200

C) A debit to Leased Equipment of $80,000

D) A credit to Rent Payable of $16,000

A) A debit to Lease Expense of $59,200

B) A debit to Leased Equipment of $59,200

C) A debit to Leased Equipment of $80,000

D) A credit to Rent Payable of $16,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

Chapman Company purchased Horace Company for $54,000,000. At the time of purchase, Horaces's identifiable assets equaled $30,000,000. What was the amount of goodwill recorded by Chapman Company at the time of purchase?

A) $84,000,000

B) $54,000,000

C) $30,000,000

D) $24,000,000

A) $84,000,000

B) $54,000,000

C) $30,000,000

D) $24,000,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

The book value of an asset is the

A) Original cost of the asset

B) Market value of the asset

C) Total of all expenses associated with the asset

D) Acquisition cost of the asset less any accumulated depreciation on the asset

A) Original cost of the asset

B) Market value of the asset

C) Total of all expenses associated with the asset

D) Acquisition cost of the asset less any accumulated depreciation on the asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following assets is NOT usually depreciated, depleted, or amortized?

A) Furniture

B) Mineral deposits

C) Land

D) Patents

A) Furniture

B) Mineral deposits

C) Land

D) Patents

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

In order to calculate periodic depreciation expense, which of the following need NOT be known about an asset?

A) Its acquisition cost

B) Its estimated salvage value

C) The amount of the cash down payment

D) Its estimated useful life

A) Its acquisition cost

B) Its estimated salvage value

C) The amount of the cash down payment

D) Its estimated useful life

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

Rapid Deliveries purchased a delivery truck on July 1, 2012, at a cost of $16,800. The truck has an estimated useful life of 4 years or 40,000 miles and a salvage value of $1,200. If the truck was driven 5,200 miles during 2012, the depreciation expense for 2012 under the units-of-production method would be

A) $1,950

B) $2,028

C) $2,184

D) $1,092

A) $1,950

B) $2,028

C) $2,184

D) $1,092

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

Coppola Company purchased a machine on January 1, 2011, for $20,000 cash. In addition, Coppola paid $4,000 to have the machine delivered and installed. The estimated useful life of the machine is 4 years, after which time it is expected to have a salvage value of $8,000. It is also estimated that the machine will produce 200,000 units of product during its useful life. Assuming that the straight-line depreciation method is used, what will be the machine's book value on December 31, 2013?

A) $8,000

B) $12,000

C) $16,000

D) $14,000

A) $8,000

B) $12,000

C) $16,000

D) $14,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1, 2012, Salina Company purchased land and a building for $2,240,000. At the time of the purchase, it was estimated that the building had a market value of $1,400,000. On January 5, Alberta installed a fence around the property at a cost of $14,000. Given this information, the entry to record the cost of the fence would include a

A) Debit to Land for $14,000

B) Debit to Fence Expense for $14,000

C) Credit to Land for $14,000

D) Debit to Land Improvements Expense for $14,000

A) Debit to Land for $14,000

B) Debit to Fence Expense for $14,000

C) Credit to Land for $14,000

D) Debit to Land Improvements Expense for $14,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

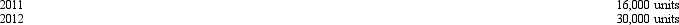

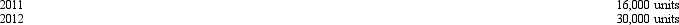

Wings Manufacturing Company purchased a new machine on July 1, 2011. It was expected to produce 200,000 units of product over its estimated useful life of eight years. Total cost of the machine was $600,000, and salvage value was estimated to be $60,000. Actual units produced by the machine in 2011 and 2012 are shown below:  Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

A) $124,200

B) $90,000

C) $81,000

D) $74,520

Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would be

Wings reports on a calendar-year basis and uses the units-of-production method of depreciation. The amount of depreciation expense for this machine in 2012 would beA) $124,200

B) $90,000

C) $81,000

D) $74,520

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is a criterion for a capital expenditure?

A) It must be significant in amount

B) It should benefit several periods

C) It should increase the productive life or capacity of an asset

D) All of these are criteria for a capital expenditure

A) It must be significant in amount

B) It should benefit several periods

C) It should increase the productive life or capacity of an asset

D) All of these are criteria for a capital expenditure

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, 2012, Brown Company purchased a mine for $100,000. On this same date, it was estimated that the mine contained 1,000 tons of ore. During 2012, 300 tons of ore were extracted from the mine. The amount of depletion expense for 2012 would be

A) $3,000

B) $100,000

C) $1,000

D) $30,000

A) $3,000

B) $100,000

C) $1,000

D) $30,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

On January 1, 2012, Bushong Company purchased equipment at a cost of $12,600. The equipment had an estimated useful life of 6 years or 30,000 hours. The equipment will have a $1,200 salvage value at the end of its life. The depreciation expense for the year ending December 31, 2012, using the straight-line method would be

A) $1,900

B) $1,883

C) $475

D) $471

A) $1,900

B) $1,883

C) $475

D) $471

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

The entry to record a gain on the increase in value of land would include which of the following?

A) Credit to Gain on Land Increase

B) Debit to Land

C) Credit to Non-Impairment of Land

D) No entry is required

A) Credit to Gain on Land Increase

B) Debit to Land

C) Credit to Non-Impairment of Land

D) No entry is required

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

If a truck's engine is overhauled for $8,000, the journal entry would normally include a debit to

A) Truck

B) Notes Payable

C) Depreciation

D) Cash

A) Truck

B) Notes Payable

C) Depreciation

D) Cash

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

Rapid Deliveries purchased a delivery truck on July 1, 2012, at a cost of $16,800. The truck has an estimated useful life of 4 years or 40,000 miles and a salvage value of $1,200. The depreciation expense for the year ending December 31, 2012, under the straight-line depreciation method would be

A) $1,950

B) $1,352

C) $3,900

D) $1,092

A) $1,950

B) $1,352

C) $3,900

D) $1,092

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

On January 1, 2010, Wayne's Waffle House purchased a freezer for $45,000. The freezer had an estimated useful life of 10 years and an estimated residual value of $3,000 at the time of purchase. Wayne spent $10,000 on January 1, 2012, to replace the freezer motor. This replacement increased the freezer's life by 5 years and the residual value by $2,000. Assuming that straight-line depreciation is used, what will be the depreciation expense for 2012?

A) $3,200

B) $3,585

C) $8,320

D) $3,431

A) $3,200

B) $3,585

C) $8,320

D) $3,431

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

Spears Corporation bought a machine on January 1, 2011. In purchasing the machine, the company paid $50,000 cash and signed an interest-bearing note for $100,000. The estimated useful life of the machine is 5 years, after which time the salvage value is expected to be $15,000. The machine is expected to produce 67,500 widgets during its useful life. Given this information, if 10,000 widgets are produced in 2012, how much depreciation should be recorded in 2012, assuming that Spears Corporation uses the units-of-production depreciation method?

A) $22,222

B) $20,000

C) $30,000

D) $40,000

A) $22,222

B) $20,000

C) $30,000

D) $40,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

On January 1, 2012, Bushong Company purchased equipment at a cost of $12,600. The equipment had an estimated useful life of 6 years or 30,000 hours. The equipment will have a $1,200 salvage value at the end of its life. The equipment was used 6,500 hours in 2012. The depreciation expense for the year ending December 31, 2012, using the units-of-production method would be

A) $3,800

B) $2,470

C) $6,500

D) $2,730

A) $3,800

B) $2,470

C) $6,500

D) $2,730

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

The calculation for depletion of natural resources is similar to the calculation for

A) Straight-line depreciation

B) Units-of-production depreciation

C) Sum-of-the-years'-digits depreciation

D) Declining-balance depreciation

A) Straight-line depreciation

B) Units-of-production depreciation

C) Sum-of-the-years'-digits depreciation

D) Declining-balance depreciation

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

When the cost of equipment is divided by its estimated useful life, the result is referred to as

A) Book value

B) Accumulated depreciation

C) Carrying value

D) Depreciation expense

A) Book value

B) Accumulated depreciation

C) Carrying value

D) Depreciation expense

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Occasionally, events occur that change an asset's value after purchase. Which of the following is true regarding these changes in value?

A) Reductions in asset value are recognized.

B) Increases in asset value are recognized.

C) Both decreases and increases are recognized.

D) Neither decreases nor increases are recognized.

A) Reductions in asset value are recognized.

B) Increases in asset value are recognized.

C) Both decreases and increases are recognized.

D) Neither decreases nor increases are recognized.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

The Giovanni Company purchased a tooling machine in 2002 for $120,000. The machine was being depreciated by the straight-line method over an estimated useful life of 20 years, with no salvage value. At the beginning of 2012, after 10 years of use, Giovanni paid $20,000 to overhaul the machine. Because of this improvement, the machine's estimated useful life would be extended an additional 5 years. What would be the depreciation expense recorded for the above machine in 2012?

A) $4,000

B) $5,333

C) $6,000

D) $7,333

A) $4,000

B) $5,333

C) $6,000

D) $7,333

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

The entry to record an impairment loss on equipment would include which of the following?

A) Credit to Loss on Impairment of Equipment

B) Credit to Equipment Impairment

C) Debit to Accumulated Depreciation, Equipment

D) Debit to Cash

A) Credit to Loss on Impairment of Equipment

B) Credit to Equipment Impairment

C) Debit to Accumulated Depreciation, Equipment

D) Debit to Cash

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

An expenditure for the repair of an asset must be capitalized if it

A) Maintains an asset in working order

B) Requires prior approval by management

C) Exceeds a fixed percentage of the asset's book value

D) Benefits the company over several periods

A) Maintains an asset in working order

B) Requires prior approval by management

C) Exceeds a fixed percentage of the asset's book value

D) Benefits the company over several periods

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

When a franchisee purchases a franchise, the amount recorded in the books for the franchise asset would be equal to

A) The value of the franchise

B) The total cost paid for the franchise

C) The cost paid for the franchise less expenses for equipment

D) None of these are correct

A) The value of the franchise

B) The total cost paid for the franchise

C) The cost paid for the franchise less expenses for equipment

D) None of these are correct

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

A truck that cost $19,200 and was expected to last 5 years was scrapped after 3 years. If the truck was being depreciated on a straight-line basis (with no salvage value), the loss recognized on disposal would be

A) $19,200

B) $7,680

C) $9,600

D) $11,520

A) $19,200

B) $7,680

C) $9,600

D) $11,520

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

Intangible assets are usually amortized using

A) The straight-line method

B) The units-of-production method

C) The declining-balance method

D) The sum-of-the-years'-digits method

A) The straight-line method

B) The units-of-production method

C) The declining-balance method

D) The sum-of-the-years'-digits method

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following assets would normally involve a straight-line method of cost allocation?

A) An oil well

B) Land

C) A timber tract

D) Patent

A) An oil well

B) Land

C) A timber tract

D) Patent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

The exclusive right to use a certain name or symbol is called a

A) Franchise

B) Patent

C) Trademark

D) Copyright

A) Franchise

B) Patent

C) Trademark

D) Copyright

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

A truck that cost $19,200 and was expected to last 5 years was scrapped after 3 years. If the truck was being depreciated on a straight-line basis (with no salvage value), the book value of the truck at the time of disposal was

A) $19,200

B) $11,520

C) $4,800

D) $7,680

A) $19,200

B) $11,520

C) $4,800

D) $7,680

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

On January 1, 2011, Kinnear Company purchased equipment at a cost of $20,000. The equipment has an estimated useful life of 5 years and a salvage value of $2,000. Kinnear Company uses the straight-line depreciation method for all its assets. Given this information, if Kinnear Company sells the equipment for $13,600 on December 31, 2012, it will have a(n)

A) $2,000 loss

B) $2,000 gain

C) $800 loss

D) $800 gain

A) $2,000 loss

B) $2,000 gain

C) $800 loss

D) $800 gain

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

Zenda Corporation purchased a building for $800,000. The current book value of the building is $400,000 and the fair value is $360,000. The sum of future cash flows from the building is $320,000. The amount of impairment loss that should be recognized is

A) $0

B) $40,000

C) $80,000

D) $240,000

A) $0

B) $40,000

C) $80,000

D) $240,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

The Suvari Company purchased a machine on November 1, 2003, for $148,000. At the time of acquisition, the machine was estimated to have a useful life of 10 years and a salvage value of $4,000. Suvari recorded monthly depreciation using the straight-line method. On July 1, 2012, the machine was sold for $13,000. What should be the loss recognized from the sale of the machine?

A) $4,000

B) $5,000

C) $10,200

D) $13,000

A) $4,000

B) $5,000

C) $10,200

D) $13,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is necessary when recording the disposal of a piece of equipment?

A) Update the depreciation expense on the equipment to the date of sale

B) Remove the equipment and related accumulated depreciation balances from the accounts

C) Record any gain or loss on the disposal

D) All of these are necessary when recording the disposal of a piece of equipment

A) Update the depreciation expense on the equipment to the date of sale

B) Remove the equipment and related accumulated depreciation balances from the accounts

C) Record any gain or loss on the disposal

D) All of these are necessary when recording the disposal of a piece of equipment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

The balance sheet category "intangible assets" includes

A) Patents, trademarks, and franchises

B) Equipment, land, and buildings

C) Investments, receivables, and customer lists

D) Goodwill, inventory, and furnishings

A) Patents, trademarks, and franchises

B) Equipment, land, and buildings

C) Investments, receivables, and customer lists

D) Goodwill, inventory, and furnishings

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Tanner Company purchased a building during 2010 for $600,000. From 2010 to 2012, $240,000 of depreciation was recorded. The current fair value is $350,000 and the sum of future cash flows from the building is $370,000. The amount of impairment that should be recognized is

A) $0

B) $10,000

C) $20,000

D) $30,000

A) $0

B) $10,000

C) $20,000

D) $30,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

If an asset value recovers after an impairment loss has been recognized for the asset, what amount of restoration of that loss is recognized?

A) The difference between the original loss and the new value

B) The difference between the original cost and the new value

C) The difference between the value recognized at the impairment and the new value

D) None of the recovered value is recognized

A) The difference between the original loss and the new value

B) The difference between the original cost and the new value

C) The difference between the value recognized at the impairment and the new value

D) None of the recovered value is recognized

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

Once an asset has been determined to be impaired, the amount of impairment is measured as

A) The asset's book value minus the fair value

B) The asset's future cash inflows minus the book value

C) The asset's cost minus the book value

D) The asset's cost minus the fair value

A) The asset's book value minus the fair value

B) The asset's future cash inflows minus the book value

C) The asset's cost minus the book value

D) The asset's cost minus the fair value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

The periodic allocation to expense of an intangible asset's cost is

A) Amortization

B) Depletion

C) Depreciation

D) Allocation

A) Amortization

B) Depletion

C) Depreciation

D) Allocation

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

Under U.S. accounting rules (generally accepted accounting principles), an asset is impaired when

A) The asset's fair value is less than the book value

B) The asset's future cash inflows are less than the book value

C) The asset's market value is less than the book value

D) The asset's cost is less than the book value

A) The asset's fair value is less than the book value

B) The asset's future cash inflows are less than the book value

C) The asset's market value is less than the book value

D) The asset's cost is less than the book value

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is NOT a way to dispose of an asset?

A) Discard or scrap it

B) Sell it

C) Exchange it for another asset

D) All of these are ways to dispose of an asset

A) Discard or scrap it

B) Sell it

C) Exchange it for another asset

D) All of these are ways to dispose of an asset

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2011, Kinnear Company purchased equipment at a cost of $20,000. The equipment has an estimated useful life of 5 years and a salvage value of $2,000. Kinnear Company uses the straight-line depreciation method for all its assets. Given this information, if Kinnear Company scraps the equipment on December 31, 2012, it will have a loss of

A) $18,000

B) $0

C) $12,800

D) $5,600

A) $18,000

B) $0

C) $12,800

D) $5,600

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is considered to be an intangible asset?

A) A gold mine

B) A copyright

C) Land improvement

D) Building

A) A gold mine

B) A copyright

C) Land improvement

D) Building

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

What is the gain or loss on the sale of an asset that originally cost $12,000, has accumulated depreciation of $5,000, and is sold for $6,000?

A) $1,000 loss

B) $3,000 loss

C) $1,000 gain

D) $6,000 loss

A) $1,000 loss

B) $3,000 loss

C) $1,000 gain

D) $6,000 loss

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck