Deck 23: Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 23: Capital Investment Decisions

1

The formula for computing the payback period is:

A) Investment cost divided by annual revenues from investment

B) Investment cost divided by annual net cash inflows

C) Net cash inflows divided by investment cost

D) Annual revenues from investment divided by investment cost

A) Investment cost divided by annual revenues from investment

B) Investment cost divided by annual net cash inflows

C) Net cash inflows divided by investment cost

D) Annual revenues from investment divided by investment cost

B

2

Which method measures the amount of time it will take for net cash flows of an investment to equal the cash outlay?

A) Unadjusted rate of return method

B) Internal rate of return method

C) Payback method

D) Net present value method

A) Unadjusted rate of return method

B) Internal rate of return method

C) Payback method

D) Net present value method

C

3

Another name for the accounting rate of return is the:

A) Internal rate of return

B) Discounted present value

C) Payback period

D) Unadjusted rate of return

A) Internal rate of return

B) Discounted present value

C) Payback period

D) Unadjusted rate of return

D

4

Which of the following capital budgeting methods ignores the time value of money?

A) Internal rate of return method

B) Net present value method

C) Payback method

D) All of these consider the time value of money

A) Internal rate of return method

B) Net present value method

C) Payback method

D) All of these consider the time value of money

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

Which of these factors is necessary to compute the payback period for an investment?

A) Useful life

B) Net present value

C) Annual net cash inflow

D) Minimum desired rate of return

A) Useful life

B) Net present value

C) Annual net cash inflow

D) Minimum desired rate of return

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

The formula, Investment Cost divided by Annual Net Cash Inflows, is used to determine an interval of time in which method?

A) Net present value method

B) Payback method

C) Internal rate of return method

D) Unadjusted rate of return method

A) Net present value method

B) Payback method

C) Internal rate of return method

D) Unadjusted rate of return method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

The formula for computing unadjusted rate of return is:

A) Increase in future average annual revenues divided by initial investment cost

B) Increase in future average annual net income divided by initial investment cost

C) Initial investment cost divided by increase in future annual revenues

D) Initial investment cost divided by increase in future annual net income

A) Increase in future average annual revenues divided by initial investment cost

B) Increase in future average annual net income divided by initial investment cost

C) Initial investment cost divided by increase in future annual revenues

D) Initial investment cost divided by increase in future annual net income

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a strength of the payback method?

A) It is difficult to compute

B) It considers the investment's overall profitability

C) It takes into account the time value of money

D) It determines whether an investment fits into a specific period for the use of funds

A) It is difficult to compute

B) It considers the investment's overall profitability

C) It takes into account the time value of money

D) It determines whether an investment fits into a specific period for the use of funds

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

The present value of $1 to be received 2 years in the future is:

A) Greater than $1

B) Less than $1

C) Equal to $1

D) None of these are correct

A) Greater than $1

B) Less than $1

C) Equal to $1

D) None of these are correct

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

All of the following define capital EXCEPT:

A) Material wealth

B) Money used for investment

C) Resources used for future benefit

D) Depreciable assets

A) Material wealth

B) Money used for investment

C) Resources used for future benefit

D) Depreciable assets

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

All of the following are characteristics of the capital investment decisions that are critical to long-run profitability EXCEPT:

A) They affect earnings over a long period

B) They are much less liquid than other assets

C) They involve fixed assets

D) They require large outlays of capital

A) They affect earnings over a long period

B) They are much less liquid than other assets

C) They involve fixed assets

D) They require large outlays of capital

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is LEAST preferable for measuring profitability of an investment?

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

Cash outlays for capital assets include all the following EXCEPT:

A) The original purchase price

B) The annual operating costs

C) The salvage value

D) All of these are correct

A) The original purchase price

B) The annual operating costs

C) The salvage value

D) All of these are correct

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

When making a capital budgeting decision, which of the following is usually NOT discounted?

A) The original purchase price paid in cash

B) The annual operating expenses

C) The annual operating revenues

D) The salvage value of the purchased asset

A) The original purchase price paid in cash

B) The annual operating expenses

C) The annual operating revenues

D) The salvage value of the purchased asset

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Determining whether capital investment projects meet minimum standards of financial acceptability is called:

A) The ranking function

B) The screening function

C) The selecting function

D) The acceptance function

A) The ranking function

B) The screening function

C) The selecting function

D) The acceptance function

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is true when making capital budgeting decisions?

A) Both quantitative and qualitative factors should be considered

B) Only quantitative factors should be considered

C) Only qualitative factors should be considered

D) Neither quantitative nor qualitative factors should be considered

A) Both quantitative and qualitative factors should be considered

B) Only quantitative factors should be considered

C) Only qualitative factors should be considered

D) Neither quantitative nor qualitative factors should be considered

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following investments has the greatest present value?

A) An investment that provides $100,000 in 1 year

B) An investment that provides $50,000 at the end of each year for 2 years

C) An investment that provides $33,333 at the end of each year for 3 years

D) An investment that provides $25,000 at the end of each year for 4 years

A) An investment that provides $100,000 in 1 year

B) An investment that provides $50,000 at the end of each year for 2 years

C) An investment that provides $33,333 at the end of each year for 3 years

D) An investment that provides $25,000 at the end of each year for 4 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

Determining whether or not a given investment is best among all acceptable alternatives is called:

A) The ranking function

B) The screening function

C) The selection function

D) The acceptance function

A) The ranking function

B) The screening function

C) The selection function

D) The acceptance function

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following does NOT consider the time value of money?

A) Internal rate of return method

B) Unadjusted rate of return method

C) Net present value method

D) None of these consider the time value of money

A) Internal rate of return method

B) Unadjusted rate of return method

C) Net present value method

D) None of these consider the time value of money

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following expenses are often ignored when making capital budgeting decisions?

A) Maintenance expense

B) Utilities expense

C) Depreciation expense

D) Rent expense

A) Maintenance expense

B) Utilities expense

C) Depreciation expense

D) Rent expense

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Tootie Clothing Store is considering opening a new store. The expected purchase price is $270,000, expected annual revenues are $150,000, and expected annual costs are $90,000, including $22,500 of depreciation. The store has a payback period of approximately:

A) 1.8 years

B) 3.0 years

C) 3.3 years

D) 4.5 years

A) 1.8 years

B) 3.0 years

C) 3.3 years

D) 4.5 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

If an investment has a payback period of 13 years and provides annual cash inflows of $14,500, its cost is:

A) $4,460

B) $102,000

C) $120,000

D) $188,500

A) $4,460

B) $102,000

C) $120,000

D) $188,500

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Tootie Clothing Store is considering opening a new store. The expected purchase price is $270,000, expected annual revenues are $150,000, and expected annual costs are $90,000, including $22,500 of depreciation. The store has an unadjusted rate of return of approximately:

A) 55.6%

B) 33.3%

C) 30.6%

D) 22.2%

A) 55.6%

B) 33.3%

C) 30.6%

D) 22.2%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Curritt Company purchased equipment for $360,000 that is expected to generate cash inflows from operations of $108,000 in each of the next 5 years. The machine will be depreciated on a straight-line basis with no salvage value. What is the payback period for the investment by Curritt Company?

A) 2.0 years

B) 3.3 years

C) 4.0 years

D) 4.7 years

A) 2.0 years

B) 3.3 years

C) 4.0 years

D) 4.7 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

Which method is best to help managers make capital investment decisions that will be LEAST costly to the organization?

A) Non-discounted cash flow method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

A) Non-discounted cash flow method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Boone Corporation expects to buy a machine for $126,000, which will be depreciated over an 8-year period on a straight-line basis with no salvage value. The machine is expected to generate a net cash flow of $42,000 per year. What is the payback period?

A) 3.0 years

B) 3.5 years

C) 5.0 years

D) 6.4 years

A) 3.0 years

B) 3.5 years

C) 5.0 years

D) 6.4 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

SkiTime Photos plans to spend $74,400 for a new machine, which is expected to generate cash inflows of $18,600 per year over its useful life of 10 years. The new machine will be depreciated on a straight-line basis over 10 years with no salvage value. What is the payback period?

A) 4 years

B) 5 years

C) 8 years

D) 10 years

A) 4 years

B) 5 years

C) 8 years

D) 10 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

Which two capital budgeting techniques take the time value of money into consideration?

A) Net present value method and unadjusted rate of return method

B) Payback method and internal rate of return method

C) Net present value method and internal rate of return method

D) Unadjusted rate of return method and payback method

A) Net present value method and unadjusted rate of return method

B) Payback method and internal rate of return method

C) Net present value method and internal rate of return method

D) Unadjusted rate of return method and payback method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Interpolation is usually associated with which of the following capital budgeting methods?

A) The unadjusted rate of return method

B) The internal rate of return method

C) The accounting rate of return method

D) The net present value method

A) The unadjusted rate of return method

B) The internal rate of return method

C) The accounting rate of return method

D) The net present value method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

Curritt Company purchased equipment for $360,000 that is expected to increase revenues $115,200 in each of the next 5 years. The machine will be depreciated on a straight-line basis with no salvage value. What is the unadjusted rate of return on the initial investment by Curritt Company?

A) 10%

B) 12%

C) 15%

D) 20%

A) 10%

B) 12%

C) 15%

D) 20%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

Merriam Corporation is considering the purchase of a new machine that costs $18,000, has an expected useful life of 10 years, and has no salvage value. Merriam estimates that the machine will give the company a net income of $3,000 per year over the 10-year life. The company's hurdle rate is 12%. Given the data provided, the unadjusted rate of return for the machine is:

A) 6.7%

B) 16.7%

C) 12%

D) 10%

A) 6.7%

B) 16.7%

C) 12%

D) 10%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

When would a project be rejected under the net present value method?

A) If its net present value is less than zero

B) If its net present value is equal to zero

C) If its net present value is greater than zero

D) All of these are true

A) If its net present value is less than zero

B) If its net present value is equal to zero

C) If its net present value is greater than zero

D) All of these are true

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

Merriam Corporation is considering the purchase of a new machine that costs $18,000, has an expected useful life of 10 years, and has no salvage value. Merriam estimates that the machine will save the company $3,000 per year over the 10-year life. The company's hurdle rate is 12%. Given the data provided, the payback period for the machine is:

A) 4 years

B) 5 years

C) 6 years

D) 9 years

A) 4 years

B) 5 years

C) 6 years

D) 9 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

In order for a project to be acceptable, the rate of return must be larger than the:

A) Hurdle rate

B) Accounting rate

C) Capital rate

D) Unadjusted rate

A) Hurdle rate

B) Accounting rate

C) Capital rate

D) Unadjusted rate

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

What is the average cost of a firm's debt and its equity?

A) Internal rate of return

B) Hurdle rate

C) Net present value

D) Cost of capital

A) Internal rate of return

B) Hurdle rate

C) Net present value

D) Cost of capital

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following would be considered a discounted cash flow method?

A) The payback period method

B) The unadjusted rate of return method

C) The net present value method

D) The capital budgeting method

A) The payback period method

B) The unadjusted rate of return method

C) The net present value method

D) The capital budgeting method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is true?

A) Present value concepts are used to determine accounting income

B) The higher the hurdle rate, the larger the present value of the amount being discounted

C) The further in the future a cash flow is, the smaller its present value will be

D) None of these are true

A) Present value concepts are used to determine accounting income

B) The higher the hurdle rate, the larger the present value of the amount being discounted

C) The further in the future a cash flow is, the smaller its present value will be

D) None of these are true

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

The "true" discount rate of a capital investment is calculated by using the:

A) Internal rate of return method

B) Unadjusted rate of return method

C) The accounting rate of return method

D) The net present value method

A) Internal rate of return method

B) Unadjusted rate of return method

C) The accounting rate of return method

D) The net present value method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

A $240,000 asset that is being depreciated at a rate of 10% per year and will increase a company's annual net income by $40,000 a year provides an approximate unadjusted rate of return of:

A) 6.7%

B) 16.7%

C) 26.7%

D) 29.7%

A) 6.7%

B) 16.7%

C) 26.7%

D) 29.7%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a characteristic of the unadjusted rate of return?

A) It takes into account annual cash flows

B) It provides a measure of GAAP-based profitability

C) It takes into account the time value of money

D) It determines whether an investment fits into a specific period for the use of funds

A) It takes into account annual cash flows

B) It provides a measure of GAAP-based profitability

C) It takes into account the time value of money

D) It determines whether an investment fits into a specific period for the use of funds

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

Gallatin Co. is considering the purchase of a new machine that costs $300,000. It is anticipated that it will provide net annual cash inflows of $80,000. The machine has an expected life of 5 years with no salvage value. Gallatin's hurdle rate is 7%. The present value annuity factors for 5 years are 4.1002 at 7%, 3.9927 at 8%, 3.8897 at 9%, 3.7908 at 10%, and 3.6048 at 12%. The internal rate of return for the purchase is:

A) Between 10% and 12%

B) Between 9% and 10%

C) Between 8% and 9%

D) Between 7% and 8%

A) Between 10% and 12%

B) Between 9% and 10%

C) Between 8% and 9%

D) Between 7% and 8%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

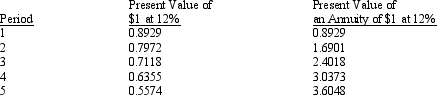

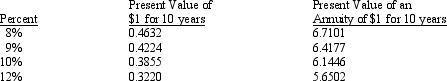

Clarke Company purchased equipment for $100,000 that is expected to generate cash inflows from operations of $30,000 in each of the next 5 years. The machine will be depreciated on a straight-line basis with no salvage value. Assume the following present value factors:  What would be the net present value of the investment by Clarke Company?

What would be the net present value of the investment by Clarke Company?

A) $8,144

B) $8,881

C) $12,100

D) $16,288

What would be the net present value of the investment by Clarke Company?

What would be the net present value of the investment by Clarke Company?A) $8,144

B) $8,881

C) $12,100

D) $16,288

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

The internal rate of return method provides a rate of return that approximates:

A) The accounting rate of return

B) The unadjusted rate of return

C) Both the accounting rate of return and the unadjusted rate of return

D) Neither the accounting rate of return nor the unadjusted rate of return

A) The accounting rate of return

B) The unadjusted rate of return

C) Both the accounting rate of return and the unadjusted rate of return

D) Neither the accounting rate of return nor the unadjusted rate of return

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

When using the internal rate of return method, a project will be rejected if:

A) The internal rate of return is greater than the hurdle rate

B) The internal rate of return is equal to the hurdle rate

C) The internal rate of return is less than the hurdle rate

D) None of these are correct

A) The internal rate of return is greater than the hurdle rate

B) The internal rate of return is equal to the hurdle rate

C) The internal rate of return is less than the hurdle rate

D) None of these are correct

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

The net present value of a proposed investment represents the:

A) Present value of the cash inflows less the present value of the cash outflows

B) Cash flows less the original investment

C) Cash flows less the present value of the cash flows

D) Present value of the cash flows plus the present value of the original investment

A) Present value of the cash inflows less the present value of the cash outflows

B) Cash flows less the original investment

C) Cash flows less the present value of the cash flows

D) Present value of the cash flows plus the present value of the original investment

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

If the net present value of an investment is positive, this represents the:

A) Net contribution margin of the investment

B) Net profit of the investment

C) Net tax benefit of the investment

D) Net value gain of the investment above the hurdle rate

A) Net contribution margin of the investment

B) Net profit of the investment

C) Net tax benefit of the investment

D) Net value gain of the investment above the hurdle rate

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

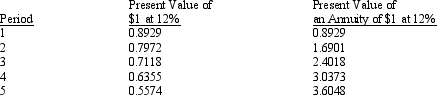

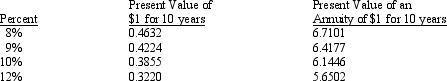

Crawford Company expects to invest $144,000 in an asset with a 10-year life. The annual cash inflows from using the asset are estimated to be $24,000. The company's expected rate of return for this type of asset is 10%. The following present value information is available:  The company's actual rate of return on this asset is:

The company's actual rate of return on this asset is:

A) 10%

B) 12%

C) Less than 10%, but more than 0%

D) More than 10%, but less than 12%

The company's actual rate of return on this asset is:

The company's actual rate of return on this asset is:A) 10%

B) 12%

C) Less than 10%, but more than 0%

D) More than 10%, but less than 12%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

Linex Corporation is considering the purchase of a new machine that costs $18,000 and has an expected useful life of 10 years. Linex estimates that the machine will save the company $3,000 per year over the 10-year life. The company's hurdle rate is 12%. The present value annuity factors of 10, 12, and 14% for 10 years are 6.145, 5.650, and 5.216, respectively. The present value of $1 discounted for 10 years at 12% is 0.322. Given the data provided, if the machine had a salvage value of $4,000, the net present value of the machine would be:

A) $238

B) $957

C) $1,723

D) $2,950

A) $238

B) $957

C) $1,723

D) $2,950

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

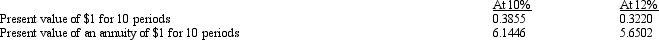

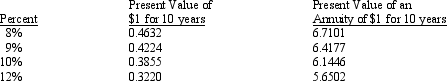

An asset is purchased for $100,000. It is expected to provide an additional $14,800 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $6,000. The hurdle rate is 9%. Assume the following present value factors:  Given the data provided, the net present value would be approximately:

Given the data provided, the net present value would be approximately:

A) $4,868

B) $51

C) $(4,434)

D) $(5,018)

Given the data provided, the net present value would be approximately:

Given the data provided, the net present value would be approximately:A) $4,868

B) $51

C) $(4,434)

D) $(5,018)

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

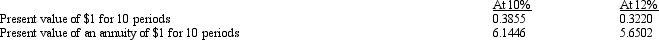

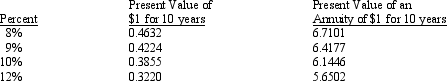

An asset is purchased for $100,000. It is expected to provide an additional $15,600 of annual net cash inflows. The asset has a 10-year life and no expected salvage value. The hurdle rate is 10%. Assume the following present value factors:  Given the data provided, the internal rate of return would be approximately:

Given the data provided, the internal rate of return would be approximately:

A) 12%

B) 10%

C) 9%

D) 8%

Given the data provided, the internal rate of return would be approximately:

Given the data provided, the internal rate of return would be approximately:A) 12%

B) 10%

C) 9%

D) 8%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following situations is one in which a least-cost decision would be used?

A) Deciding whether to replace existing machinery or keep the old

B) Deciding whether to buy a new delivery truck

C) Deciding which of three pieces of safety equipment should be purchased in order to comply with state regulations

D) Deciding whether to invest in a new warehouse or an updated computer system

A) Deciding whether to replace existing machinery or keep the old

B) Deciding whether to buy a new delivery truck

C) Deciding which of three pieces of safety equipment should be purchased in order to comply with state regulations

D) Deciding whether to invest in a new warehouse or an updated computer system

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

An asset is purchased for $40,000. It is expected to provide an additional $10,000 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $3,300. The hurdle rate is 10%. The present value of an annuity factor of 10% for 10 years is 6.1446. The present value of $1 discounted for 10 years at 10% is 0.3855. Given the data provided, the net present value of the investment is approximately:

A) $62,718

B) $22,718

C) $21,446

D) $0

A) $62,718

B) $22,718

C) $21,446

D) $0

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

A company's hurdle rate is the:

A) Unadjusted rate of return on a capital investment

B) True rate of return on a capital investment

C) Internal rate of return on a capital investment

D) Minimum rate of return that an investment must provide in order to be acceptable

A) Unadjusted rate of return on a capital investment

B) True rate of return on a capital investment

C) Internal rate of return on a capital investment

D) Minimum rate of return that an investment must provide in order to be acceptable

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Hildale Hotels has been told that it must install a fire sprinkler system. System A would cost $400,000 immediately, but it would not add to annual operating costs. System B costs only $250,000, but it would add $25,000 a year to operating costs. Both systems have a useful life of 10 years. The hotel's hurdle rate is 12%. Given the data provided, with a present value of an annuity for 10 years at 12% of 5.650 and a present value of $1 for 10 years at 12% of 0.322, the company should:

A) Select System A

B) Select System B

C) Be indifferent about the two alternatives

D) Try to obtain additional data; as is, the answer cannot be determined

A) Select System A

B) Select System B

C) Be indifferent about the two alternatives

D) Try to obtain additional data; as is, the answer cannot be determined

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Linex Corporation is considering the purchase of a new machine that costs $18,000, has an expected useful life of 10 years, and has no salvage value. Linex estimates that the machine will save the company $3,000 per year over the 10-year life. The company's hurdle rate is 12%. The present value annuity factors of 10, 12, and 14% for 10 years are 6.145, 5.650, and 5.216, respectively. The present value of $1 discounted for 10 years at 12% is 0.322. Given the data provided, the internal rate of return on the machine is:

A) Less than 10%

B) Between 10% and 12%

C) Between 12% and 14%

D) Greater than 14%

A) Less than 10%

B) Between 10% and 12%

C) Between 12% and 14%

D) Greater than 14%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

Linex Corporation is considering the purchase of a new machine that costs $18,000, has an expected useful life of 10 years, and has no salvage value. Linex estimates that the machine will save the company $3,000 per year over the 10-year life. The company's hurdle rate is 12%. The present value annuity factors of 10, 12, and 14% for 10 years are 6.145, 5.650, and 5.216, respectively, and the present value of $1 discounted for 10 years at 12% is 0.322. Given the data provided, the net present value of the machine is:

A) $435

B) $(1,050)

C) $(2,358)

D) $(8,340)

A) $435

B) $(1,050)

C) $(2,358)

D) $(8,340)

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

The internal rate of return capital budgeting method uses the same formula as which of the following?

A) The payback method

B) The unadjusted rate of return method

C) The accounting rate of return method

D) The net present value method

A) The payback method

B) The unadjusted rate of return method

C) The accounting rate of return method

D) The net present value method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following capital budgeting methods considers the time value of money?

A) Internal rate of return method

B) Net present value method

C) Unadjusted rate of return

D) Both the internal rate of return method and the net present value method

A) Internal rate of return method

B) Net present value method

C) Unadjusted rate of return

D) Both the internal rate of return method and the net present value method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following would have the greatest impact on the net present value of an investment?

A) The initial cost of the investment is understated by $7,000

B) The net annual cash inflows are understated by $1,400 for 5 years

C) The salvage value is understated by $7,000

D) All of these should have the same impact

A) The initial cost of the investment is understated by $7,000

B) The net annual cash inflows are understated by $1,400 for 5 years

C) The salvage value is understated by $7,000

D) All of these should have the same impact

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

The internal rate of return and the net present value methods for making capital budgeting decisions are superior to the payback method because they:

A) Require less input

B) Are easier to implement

C) Consider the time value of money

D) Reflect depreciation and income taxes

A) Require less input

B) Are easier to implement

C) Consider the time value of money

D) Reflect depreciation and income taxes

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

An asset is purchased for $120,000. It is expected to provide an additional $28,000 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $12,000. The hurdle rate is 10%. The present value of an annuity factor of 10% for 10 years is 6.1446, and the present value of $1 discounted for 10 years at 10% is 0.3855. The present value of annuity factors at 10% for 3, 4, 5, 6, 7, 8, and 9 years are 2.4869, 3.1699, 3.7908, 4.3553, 4.8684, 5.3349, and 5.7590, respectively. The minimum useful life that would provide a 10% return is between:

A) 3 and 4 years

B) 5 and 6 years

C) 7 and 8 years

D) 9 and 10 years

A) 3 and 4 years

B) 5 and 6 years

C) 7 and 8 years

D) 9 and 10 years

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following items would NOT have an impact on income taxes related to a capital budgeting decision?

A) Extra revenue generated by a new machine

B) Deductions for the cost of the new machine

C) Depreciation on a new machine

D) All of these impact income taxes

A) Extra revenue generated by a new machine

B) Deductions for the cost of the new machine

C) Depreciation on a new machine

D) All of these impact income taxes

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

The use of a profitability index is required when ranking projects for capital rationing under which method?

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Unadjusted rate of return method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

When a company has an opportunity to invest in several projects but has limited resources, it should select those projects with the highest:

A) Net present value

B) Net annual cash inflows

C) Profitability index

D) Annual cash inflows

A) Net present value

B) Net annual cash inflows

C) Profitability index

D) Annual cash inflows

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following are correct capital budgeting decision rules when using the profitability index (PI)?

A) PI < 1, invest; PIa > PIb, pick a, etc.

B) PI = 1, invest; PIa > PIb, pick a, etc.

C) PI < 1, don't invest; PIb > PIa, pick a, etc.

D) PI > 1, invest; PIa > PIb, pick a, etc.

A) PI < 1, invest; PIa > PIb, pick a, etc.

B) PI = 1, invest; PIa > PIb, pick a, etc.

C) PI < 1, don't invest; PIb > PIa, pick a, etc.

D) PI > 1, invest; PIa > PIb, pick a, etc.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

Pulaski Corporation is considering a capital investment that has a profitability index of 1.2. If the initial investment is $1,200,000, the net present value must be:

A) $240,000

B) $1,000,000

C) $1,440,000

D) $1,680,000

A) $240,000

B) $1,000,000

C) $1,440,000

D) $1,680,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

Which method is preferred for capital rationing?

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Both internal rate of return method and net present value method

A) Internal rate of return method

B) Payback method

C) Net present value method

D) Both internal rate of return method and net present value method

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

Allin Company is considering two projects. Project W has an investment cost of $15,000 and a present value of net cash inflows of $21,000. Project T has an investment cost of $20,000 and a present value of net cash inflows of $29,000. Due to limited resources, Allin can invest in only one project. What should Allin do?

A) Invest in Project W

B) Invest in Project T

C) Invest in either Project W or Project T because both have positive net present values

D) The answer cannot be determined

A) Invest in Project W

B) Invest in Project T

C) Invest in either Project W or Project T because both have positive net present values

D) The answer cannot be determined

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

A profitability index is a method of:

A) Ranking alternative projects using net present values

B) Ranking alternative projects using internal rate of return

C) Screening alternative projects using internal rate of return

D) Screening alternative projects using net present value

A) Ranking alternative projects using net present values

B) Ranking alternative projects using internal rate of return

C) Screening alternative projects using internal rate of return

D) Screening alternative projects using net present value

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

Collins Company is considering the purchase of a new machine. The initial investment in the machine was $39,000 and the present value of net cash inflows is $45,500. The profitability index is:

A) 7.00

B) 6.00

C) 1.17

D) 0.86

A) 7.00

B) 6.00

C) 1.17

D) 0.86

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

Boggs Corporation is considering the purchase of a machine with an initial cost of $26,000, a useful life of 10 years, and a salvage value of $2,000. The company desires a 12% rate of return. Given the data provided, at a present value of an annuity for 10 years at 12% of 5.650 and a present value of $1 for 10 years at 12% of 0.322, the machine should be purchased only if annual net cash inflows are:

A) Greater than $4,487

B) Greater than $2,400

C) Greater than $2,600

D) Greater than $2,000

A) Greater than $4,487

B) Greater than $2,400

C) Greater than $2,600

D) Greater than $2,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

The process of determining which investment is best among acceptable alternatives is:

A) The ranking function

B) The screening function

C) The selecting function

D) The rationing function

A) The ranking function

B) The screening function

C) The selecting function

D) The rationing function

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

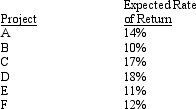

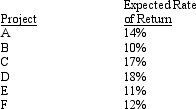

Blakeley Company is considering the following six capital investment projects:  Blakeley has a minimum required rate of return of 12%. Given this information, what ranking should Blakeley use on the capital investment projects?

Blakeley has a minimum required rate of return of 12%. Given this information, what ranking should Blakeley use on the capital investment projects?

A) C, A, F, D,

B) A, B, C, D,

C) D, C, B, E,

D) D, C, A, F

Blakeley has a minimum required rate of return of 12%. Given this information, what ranking should Blakeley use on the capital investment projects?

Blakeley has a minimum required rate of return of 12%. Given this information, what ranking should Blakeley use on the capital investment projects?A) C, A, F, D,

B) A, B, C, D,

C) D, C, B, E,

D) D, C, A, F

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

A company may decide to invest in a project even if the investment returns less than the cost of capital. The qualitative reasons for doing so include all BUT which of the following?

A) To improve product quality

B) To deliver products to customers faster

C) To increase managers' bonuses

D) To reduce the number of defective products produced

A) To improve product quality

B) To deliver products to customers faster

C) To increase managers' bonuses

D) To reduce the number of defective products produced

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

The technique used to consider a range of possibilities in capital budgeting decisions is called:

A) Discounted cash flow

B) Net present value

C) Sensitivity analysis

D) Ranking

A) Discounted cash flow

B) Net present value

C) Sensitivity analysis

D) Ranking

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is NOT typically a qualitative factor that management must consider in strategic and capital investment decisions?

A) Environmental concerns

B) Cost efficiency

C) Government regulations

D) Owner preferences

A) Environmental concerns

B) Cost efficiency

C) Government regulations

D) Owner preferences

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

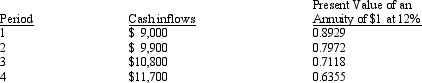

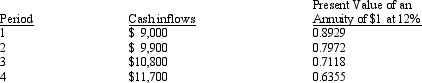

Stanley Company invested in an asset with a useful life of 4 years and no salvage value. The company's expected rate of return is 12%. The cash inflows and present value factors for 4 years are as follows:  If the asset generates a positive net present value of $3,000, what was the amount of the original investment?

If the asset generates a positive net present value of $3,000, what was the amount of the original investment?

A) $8,036

B) $28,050

C) $31,050

D) $34,050

If the asset generates a positive net present value of $3,000, what was the amount of the original investment?

If the asset generates a positive net present value of $3,000, what was the amount of the original investment?A) $8,036

B) $28,050

C) $31,050

D) $34,050

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

Windham Company is considering a project with annual cash inflows of $3,000 a year, an estimated life of 12 years, no salvage value, and a net present value of $(7,088). If the present value of an annuity factor used to calculate the net present value was 6.222, the initial investment is:

A) $17,500

B) $18,666

C) $25,754

D) $30,000

A) $17,500

B) $18,666

C) $25,754

D) $30,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

Sensitivity analysis can be used to evaluate the uncertainty of:

A) Expected cash flows

B) Expected useful life

C) Expected salvage value

D) All of these are correct

A) Expected cash flows

B) Expected useful life

C) Expected salvage value

D) All of these are correct

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

An asset is purchased for $50,000. It is expected to provide an additional $12,000 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $4,000. The hurdle rate is 10%. The present value of an annuity factor of 10% for 10 years is 6.1446, and the present value of $1 discounted for 10 years at 10% is 0.3855. Given the data provided, the minimum amount of annual cash inflows that would provide the 10% return is approximately:

A) $7,500

B) $7,900

C) $8,150

D) $8,500

A) $7,500

B) $7,900

C) $8,150

D) $8,500

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck