Deck 11: Financing: Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

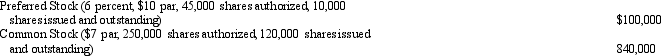

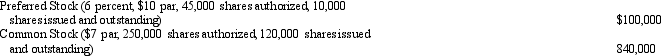

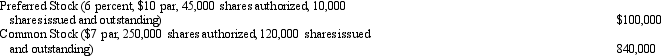

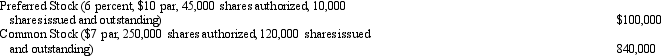

Question

Question

Question

Question

Question

Question

Question

Question

Question

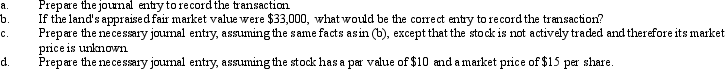

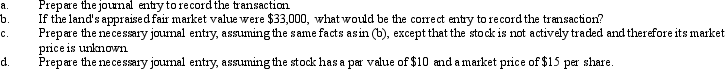

Question

Question

Question

Question

Question

Question

Question

Question

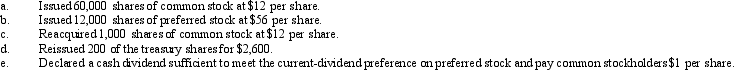

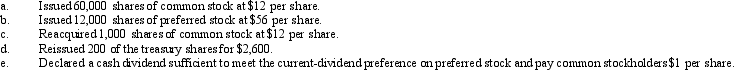

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 11: Financing: Equity

1

Which type of business organization is characterized by limited liability?

A) Corporation

B) Proprietorship

C) Partnership

D) Corporation, proprietorship, and partnership

A) Corporation

B) Proprietorship

C) Partnership

D) Corporation, proprietorship, and partnership

A

2

Which of the following is NOT a step that must be taken when starting a corporation that will operate across state lines?

A) Apply to the appropriate state official for a charter

B) Sell shares of stock in an initial public offering

C) Apply for a charter with the Securities and Exchange Commission

D) Provide a prospectus to each potential investor

A) Apply to the appropriate state official for a charter

B) Sell shares of stock in an initial public offering

C) Apply for a charter with the Securities and Exchange Commission

D) Provide a prospectus to each potential investor

C

3

Which of the following types of business organization is easy to start and easy to terminate?

A) Proprietorship

B) Partnership

C) Corporation

D) Only proprietorship and partnership

A) Proprietorship

B) Partnership

C) Corporation

D) Only proprietorship and partnership

D

4

Which of the following statements is true of a corporation?

A) Ownership rights can be transferred only after lengthy legal proceedings.

B) In the case of bankruptcy, owners are not personally liable to debt holders.

C) By law, the income of both corporation and owners is always taxed together.

D) Incorporation allows a company to enjoy increased freedom from government regulations.

A) Ownership rights can be transferred only after lengthy legal proceedings.

B) In the case of bankruptcy, owners are not personally liable to debt holders.

C) By law, the income of both corporation and owners is always taxed together.

D) Incorporation allows a company to enjoy increased freedom from government regulations.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

Which form of financing allows the source of the funds to share in the wealth if the company who received the financing does well?

A) A loan

B) An investment

C) Both a loan and an investment

D) Neither a loan nor an investment

A) A loan

B) An investment

C) Both a loan and an investment

D) Neither a loan nor an investment

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

Which type of business organization allows the business to be a separate, distinct entity from the owners?

A) Proprietorship

B) Partnership

C) Corporation

D) Proprietorship, partnership, and corporation

A) Proprietorship

B) Partnership

C) Corporation

D) Proprietorship, partnership, and corporation

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT a basic right of a common stockholder?

A) The right to vote for the board of directors

B) The preemptive right

C) The right to receive a dividend

D) The right to receive all excess assets once the obligations to others have been satisfied

A) The right to vote for the board of directors

B) The preemptive right

C) The right to receive a dividend

D) The right to receive all excess assets once the obligations to others have been satisfied

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT true of a corporation?

A) A corporation has easy transferability of ownership.

B) A corporation is taxed separately from its owners.

C) A corporation has the ability to raise large amounts of capital.

D) The owners of a corporation have unlimited liability.

A) A corporation has easy transferability of ownership.

B) A corporation is taxed separately from its owners.

C) A corporation has the ability to raise large amounts of capital.

D) The owners of a corporation have unlimited liability.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

The right of current stockholders to purchase additional shares in order to maintain the same percentage ownership of new shares is called

A) Liquidation

B) The voting rights privilege

C) Preemptive right

D) The cumulative preference

A) Liquidation

B) The voting rights privilege

C) Preemptive right

D) The cumulative preference

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is a characteristic of corporations?

A) They pay taxes on their profits.

B) They provide their investors with no liability.

C) A change in ownership usually affects the corporation's legal and economic status.

D) In case of bankruptcy, stockholders receive corporate assets before the claims of debt holders are satisfied.

A) They pay taxes on their profits.

B) They provide their investors with no liability.

C) A change in ownership usually affects the corporation's legal and economic status.

D) In case of bankruptcy, stockholders receive corporate assets before the claims of debt holders are satisfied.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

Which form of financing requires repayment, regardless of whether the company receiving the funds does well?

A) A loan

B) An investment

C) Both a loan and an investment

D) Neither a loan nor an investment

A) A loan

B) An investment

C) Both a loan and an investment

D) Neither a loan nor an investment

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following types of business organization is NOT a separate legal entity from its owner or owners?

A) Proprietorship

B) Partnership

C) Corporation

D) Only proprietorship and partnership

A) Proprietorship

B) Partnership

C) Corporation

D) Only proprietorship and partnership

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

Which type of business organization is characterized by unlimited liability and limited life?

A) Proprietorship

B) Partnership

C) Corporation

D) Proprietorship and partnership

A) Proprietorship

B) Partnership

C) Corporation

D) Proprietorship and partnership

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the basic stockholder rights do preferred stockholders normally give up?

A) The right to vote

B) The preemptive right

C) The right to receive dividends when they are declared

D) The right to excess assets after creditor claims are satisfied

A) The right to vote

B) The preemptive right

C) The right to receive dividends when they are declared

D) The right to excess assets after creditor claims are satisfied

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a basic right of a preferred stockholder?

A) The right to vote for the board of directors

B) The preemptive right

C) The right to receive a dividend

D) The right to excess assets after creditor claims are satisfied

A) The right to vote for the board of directors

B) The preemptive right

C) The right to receive a dividend

D) The right to excess assets after creditor claims are satisfied

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

The investors in a corporation are called

A) Management

B) Board of directors

C) Corporate owners

D) Stockholders

A) Management

B) Board of directors

C) Corporate owners

D) Stockholders

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following events would NOT dissolve a partnership?

A) The retirement of a partner

B) The earning of a partnership loss

C) The admission of a new partner

D) The bankruptcy of a partner

A) The retirement of a partner

B) The earning of a partnership loss

C) The admission of a new partner

D) The bankruptcy of a partner

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a characteristic of the corporate form of business organization?

A) Unlimited liability

B) Limited life

C) Ease of formation

D) Double taxation

A) Unlimited liability

B) Limited life

C) Ease of formation

D) Double taxation

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following types of business organization is owned by one person?

A) Corporation

B) Partnership

C) Proprietorship

D) Corporation, partnership, and proprietorship

A) Corporation

B) Partnership

C) Proprietorship

D) Corporation, partnership, and proprietorship

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following organizations has a Retained Earnings account?

A) Partnership

B) Proprietorship

C) Corporation

D) A Retained Earnings account is used in all three types of businesses

A) Partnership

B) Proprietorship

C) Corporation

D) A Retained Earnings account is used in all three types of businesses

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

If treasury stock is sold for less than its cost, and there were no previous treasury stock sales, the difference between the sales price and cost is debited to

A) Paid-In Capital, Treasury Stock

B) Common Stock

C) Retained Earnings

D) Paid-In Capital in Excess of Par

A) Paid-In Capital, Treasury Stock

B) Common Stock

C) Retained Earnings

D) Paid-In Capital in Excess of Par

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Moony Corporation had 20,000 shares of $4 par-value common stock outstanding on January 1, 2012. On January 10, 2012, the firm purchased 2,000 of its outstanding shares for $18 per share. On July 22, 2012, it reissued 1,000 shares at $22 per share. Given this information, the entry to record the reissuance of the stock on July 22 would include a credit to

A) Treasury Stock of $4,000

B) Common Stock of $4,000

C) Paid-In Capital, $18,000

D) Paid-In Capital, Treasury Stock of $4,000

A) Treasury Stock of $4,000

B) Common Stock of $4,000

C) Paid-In Capital, $18,000

D) Paid-In Capital, Treasury Stock of $4,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

When common stock is issued in exchange for a noncash asset and the market value of the stock is determinable, the acquired asset should usually be recorded at an amount equal to

A) The book value of the noncash asset

B) The par value of the stock

C) The market value of the stock

D) The market value of the noncash asset

A) The book value of the noncash asset

B) The par value of the stock

C) The market value of the stock

D) The market value of the noncash asset

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

On January 1, 2012, Georgi Company was authorized to issue 10,000 shares of $2 par common stock and 5,000 shares of $5 preferred stock. Given this information, if Georgi Company issued 2,000 shares of preferred stock for $20 per share on January 31, 2012, the entry to record the issuance of the stock would include a

A) Debit to Cash of $30,000

B) Credit to Paid-In Capital in Excess of Par, Preferred Stock of $10,000

C) Credit to Preferred Stock of $40,000

D) Debit to Cash of $40,000

A) Debit to Cash of $30,000

B) Credit to Paid-In Capital in Excess of Par, Preferred Stock of $10,000

C) Credit to Preferred Stock of $40,000

D) Debit to Cash of $40,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is NOT true regarding "legal capital"?

A) It is intended as a means to protect a company's creditors.

B) It represents an amount that cannot be returned to the owners so long as the corporation exists.

C) The dollar amount of legal capital is established by federal statutes.

D) It is intended to prevent corporations from paying excessive dividends.

A) It is intended as a means to protect a company's creditors.

B) It represents an amount that cannot be returned to the owners so long as the corporation exists.

C) The dollar amount of legal capital is established by federal statutes.

D) It is intended to prevent corporations from paying excessive dividends.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

On January 1, 2012, Georgi Company was authorized to issue 10,000 shares of $2 par common stock and 5,000 shares of $5 preferred stock. Given this information, if Georgi Company issued 2,000 shares of common stock (with no known market value) for land with a book value of $15,000 (market value $10,000), the entry to record the transaction would include a

A) Debit to Land of $10,000

B) Credit to Common Stock of $15,000

C) Credit to Paid-In Capital in Excess of Par, Common Stock of $11,000

D) Debit to Land of $15,000

A) Debit to Land of $10,000

B) Credit to Common Stock of $15,000

C) Credit to Paid-In Capital in Excess of Par, Common Stock of $11,000

D) Debit to Land of $15,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Treasury stock is classified on the balance sheet as what type of account?

A) Current asset

B) Long-term investment

C) Contributed capital

D) Contra-stockholders' equity

A) Current asset

B) Long-term investment

C) Contributed capital

D) Contra-stockholders' equity

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

At the beginning of the year, Salina Company issued 10,000 shares of no par common stock for $100 each. The journal entry to record this transaction would include a

A) Debit to Cash of $20,000

B) Credit to Common Stock of $1,000,000

C) Credit to Cash of $1,000,000

D) Debit to Common Stock of $1,000,000

A) Debit to Cash of $20,000

B) Credit to Common Stock of $1,000,000

C) Credit to Cash of $1,000,000

D) Debit to Common Stock of $1,000,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Treasury stock is stock that is

A) Authorized but not issued

B) Issued and outstanding

C) Issued but not outstanding

D) Authorized and outstanding

A) Authorized but not issued

B) Issued and outstanding

C) Issued but not outstanding

D) Authorized and outstanding

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

A loss on the sale of treasury stock is recognized when treasury stock is sold at

A) A higher price than the stock's market value

B) A higher price than the stock's cost

C) A higher price than the stock's par or stated value

D) None of these are correct

A) A higher price than the stock's market value

B) A higher price than the stock's cost

C) A higher price than the stock's par or stated value

D) None of these are correct

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

A corporation's contributed capital is

A) The total par value of the common and preferred stock, along with the associated amounts of paid-in capital in excess of par

B) The total par value of the common and preferred stock

C) The total par value of the common stock and the associated amounts of paid-in capital in excess of par

D) The total par value of the preferred stock and the associated amounts of paid-in capital in excess of par

A) The total par value of the common and preferred stock, along with the associated amounts of paid-in capital in excess of par

B) The total par value of the common and preferred stock

C) The total par value of the common stock and the associated amounts of paid-in capital in excess of par

D) The total par value of the preferred stock and the associated amounts of paid-in capital in excess of par

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Compared with preferred stock, common stock usually has a favorable preference in terms of

A) Dividends

B) Voting rights

C) Liquidated assets

D) Resale value

A) Dividends

B) Voting rights

C) Liquidated assets

D) Resale value

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT one of the common reasons for a firm to buy back its own stock?

A) Management feels that the stock is selling for an unusually low price and is a good buy

B) Management wants to remove some shares from the market in order to promote a hostile takeover

C) Management wants to stimulate trading in the company's stock

D) Management wants to increase earnings per share by reducing the number of shares of stock outstanding

A) Management feels that the stock is selling for an unusually low price and is a good buy

B) Management wants to remove some shares from the market in order to promote a hostile takeover

C) Management wants to stimulate trading in the company's stock

D) Management wants to increase earnings per share by reducing the number of shares of stock outstanding

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

A Paid-In Capital account can be credited with all of the following transactions EXCEPT

A) The issuance of par stock issued at a price greater than par value

B) The issuance of no-par stock with a stated value

C) The reissuance of treasury stock

D) The purchase of treasury stock

A) The issuance of par stock issued at a price greater than par value

B) The issuance of no-par stock with a stated value

C) The reissuance of treasury stock

D) The purchase of treasury stock

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is true of treasury stock?

A) It is classified as an asset on the balance sheet.

B) It allows management to vote for members of the board of directors.

C) It is considered outstanding stock.

D) It usually has a debit balance.

A) It is classified as an asset on the balance sheet.

B) It allows management to vote for members of the board of directors.

C) It is considered outstanding stock.

D) It usually has a debit balance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

On January 1, 2012, Georgi Company was authorized to issue 10,000 shares of $2 par common stock and 5,000 shares of $5 preferred stock. Given this information, if Georgi Company issued 3,000 shares of common stock for $7 per share on January 10, 2012, the entry to record the issuance of the stock would include a

A) Debit to Cash of $6,000

B) Credit to Paid-In Capital in Excess of Par, Common Stock of $6,000

C) Credit to Common Stock of $6,000

D) Debit to Cash of $15,000

A) Debit to Cash of $6,000

B) Credit to Paid-In Capital in Excess of Par, Common Stock of $6,000

C) Credit to Common Stock of $6,000

D) Debit to Cash of $15,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

Moony Corporation had 20,000 shares of $4 par-value common stock outstanding on January 1, 2012. On January 10, 2012, the firm purchased 2,000 of its outstanding shares for $18 per share. On July 22, 2012, it reissued 1,000 shares at $22 per share. Given this information, the entry to record the purchase of this stock on January 10 would include a debit to

A) Treasury Stock of $36,000

B) Common Stock of $36,000

C) Treasury Stock of $8,000

D) Common Stock of $8,000

A) Treasury Stock of $36,000

B) Common Stock of $36,000

C) Treasury Stock of $8,000

D) Common Stock of $8,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

At the beginning of the year, Brandt Company issued 5,000 shares of $1 par common stock in exchange for land with a book value of $130,000 and a market value of $100,000. The market value of the stock at the date of the transaction was $20 per share. The entry to record this transaction would include a

A) Debit to Land of $130,000

B) Credit to Common Stock for $100,000

C) Credit to Paid-in Capital in Excess of Par, Common Stock of $95,000

D) Debit to Common Stock for $5,000

A) Debit to Land of $130,000

B) Credit to Common Stock for $100,000

C) Credit to Paid-in Capital in Excess of Par, Common Stock of $95,000

D) Debit to Common Stock for $5,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

When 30,000 shares of $10 par-value common stock are issued at $30 per share, Paid-In Capital in Excess of Par, Common Stock is credited for

A) $300,000

B) $900,000

C) $600,000

D) $30,000

A) $300,000

B) $900,000

C) $600,000

D) $30,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

When common stock is issued in exchange for a noncash asset and the market value of the stock cannot be determined, the acquired asset should usually be recorded at an amount equal to the

A) Book value of the stock

B) Book value of the noncash asset

C) Market value of the noncash asset

D) Undepreciated cost of the noncash asset

A) Book value of the stock

B) Book value of the noncash asset

C) Market value of the noncash asset

D) Undepreciated cost of the noncash asset

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Dividends in arrears are associated with the

A) Current-dividend preference

B) Cumulative-dividend preference

C) Noncumulative-dividend preference

D) None of these are correct

A) Current-dividend preference

B) Cumulative-dividend preference

C) Noncumulative-dividend preference

D) None of these are correct

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following dividend preferences is associated with common stock?

A) Cumulative-dividend preference

B) Current-dividend preference

C) Both cumulative-dividend and current-dividend preference

D) Neither cumulative-dividend nor current-dividend preference

A) Cumulative-dividend preference

B) Current-dividend preference

C) Both cumulative-dividend and current-dividend preference

D) Neither cumulative-dividend nor current-dividend preference

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

Dividends in arrears on preferred stock are classified as

A) A current liability account

B) A stockholder's equity account

C) A long-term liability account

D) None of these are correct

A) A current liability account

B) A stockholder's equity account

C) A long-term liability account

D) None of these are correct

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Goshen Co. has 24,000 shares of no-par common stock with a $20 stated value and 10,000 shares of $30 par, 5 percent noncumulative preferred stock outstanding. If the company declares cash dividends of $68,000, the total amount of the dividend paid to preferred stockholders is

A) $5,000

B) $17,000

C) $15,000

D) $8,500

A) $5,000

B) $17,000

C) $15,000

D) $8,500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

The declaration of a common cash dividend

A) Decreases a company's retained earnings balance

B) Decreases the par value of outstanding stock

C) Decreases the number of shares of outstanding stock

D) Decreases the amount of cash

A) Decreases a company's retained earnings balance

B) Decreases the par value of outstanding stock

C) Decreases the number of shares of outstanding stock

D) Decreases the amount of cash

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements about retained earnings is true?

A) It is the amount of cash that has been retained from a company's earnings.

B) It is the amount of creditors' claims on assets.

C) It is increased when treasury stock is bought.

D) It is the amount of corporate earnings that have been reinvested in the business

A) It is the amount of cash that has been retained from a company's earnings.

B) It is the amount of creditors' claims on assets.

C) It is increased when treasury stock is bought.

D) It is the amount of corporate earnings that have been reinvested in the business

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

During the year, Trenton Company purchased 3,000 shares of its $10 par common stock at $50 per share and later sold it for $40 per share. How much did total stockholders' equity change because of these treasury stock transactions?

A) $150,000 decrease

B) $120,000 increase

C) $30,000 decrease

D) $20,000 decrease

A) $150,000 decrease

B) $120,000 increase

C) $30,000 decrease

D) $20,000 decrease

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

On April 30, 2012, Loufti Company declared a dividend of $40,000. Loufti Company decided that the dividend would be paid on June 15, 2012, to all shareholders of record on May 25, 2012. The journal entry to record the date of record on May 25 would include a

A) Credit to Dividends Payable of $40,000

B) Debit to Dividends of $40,000

C) Debit to Cash of $40,000

D) No entry would be recorded on this date

A) Credit to Dividends Payable of $40,000

B) Debit to Dividends of $40,000

C) Debit to Cash of $40,000

D) No entry would be recorded on this date

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is NOT an important date associated with dividends?

A) Dividend payment date

B) Date of information

C) Date of record

D) Declaration date

A) Dividend payment date

B) Date of information

C) Date of record

D) Declaration date

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following groups of stockholders receive first priority to the receipt of a dividend?

A) Current-dividend preference

B) Cumulative-dividend preference

C) Common

D) Both current-dividend preference and cumulative-dividend preference

A) Current-dividend preference

B) Cumulative-dividend preference

C) Common

D) Both current-dividend preference and cumulative-dividend preference

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

The declaration of dividends by a company

A) Always decreases the balance in Retained Earnings

B) Always reduces the Cash balance

C) Always increases the balance in Retained Earnings

D) Always increases the balance in Common Stock

A) Always decreases the balance in Retained Earnings

B) Always reduces the Cash balance

C) Always increases the balance in Retained Earnings

D) Always increases the balance in Common Stock

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

On April 30, 2012, Loufti Company declared a dividend of $40,000. Loufti Company decided that the dividend would be paid on June 15, 2012, to all shareholders of record on May 25, 2012. The journal entry to record the payment of the dividend on June 15 would include a

A) Credit to Dividends of $40,000

B) Debit to Dividends of $40,000

C) Debit to Cash of $40,000

D) Debit to Dividends Payable of $40,000

A) Credit to Dividends of $40,000

B) Debit to Dividends of $40,000

C) Debit to Cash of $40,000

D) Debit to Dividends Payable of $40,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

Dividends in arrears on preferred stock are

A) A current liability account

B) A stockholder's equity account

C) A long-term liability account

D) Disclosed in the notes to the financial statements

A) A current liability account

B) A stockholder's equity account

C) A long-term liability account

D) Disclosed in the notes to the financial statements

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

The dividend payout ratio is a measure of

A) Percentage of net income paid in dividends

B) Capital structure

C) Common stock outstanding

D) Efficiency

A) Percentage of net income paid in dividends

B) Capital structure

C) Common stock outstanding

D) Efficiency

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

The declaration and payment of cash dividends

A) Reduces the amount of resources a company has to invest in productive assets

B) Sometimes does not reduce a company's retained earnings balance

C) Reduces a company's net income

D) Sometimes does not reduce a company's cash balance

A) Reduces the amount of resources a company has to invest in productive assets

B) Sometimes does not reduce a company's retained earnings balance

C) Reduces a company's net income

D) Sometimes does not reduce a company's cash balance

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

On April 30, 2012, Loufti Company declared a dividend of $40,000. Loufti Company decided that the dividend would be paid on June 15, 2012, to all shareholders of record on May 25, 2012. The journal entry to record the declaration of the dividend on April 30 would include a

A) Credit to Dividends of $40,000

B) Debit to Dividends Payable of $40,000

C) Debit to Cash of $40,000

D) Credit to Dividends Payable of $40,000

A) Credit to Dividends of $40,000

B) Debit to Dividends Payable of $40,000

C) Debit to Cash of $40,000

D) Credit to Dividends Payable of $40,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Moony Corporation had 20,000 shares of $4 par-value common stock outstanding on January 1, 2012. On January 10, 2012, the firm purchased 2,000 of its outstanding shares for $18 per share. On July 22, 2012, it reissued 1,000 shares at $22 per share. Given this information, the entry to record the reissuing of the remaining 1,000 shares on August 17, 2012, at $12 per share would probably include a

A) Credit to Treasury Stock of $4,000

B) Debit to Retained Earnings of $2,000

C) Debit to Paid-In Capital, Treasury Stock of $6,000

D) Debit to Loss on Sale of Stock of $6,000

A) Credit to Treasury Stock of $4,000

B) Debit to Retained Earnings of $2,000

C) Debit to Paid-In Capital, Treasury Stock of $6,000

D) Debit to Loss on Sale of Stock of $6,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Dividends declared are reported on the

A) Income statement as an expense

B) Balance sheet as an asset

C) Statement of retained earnings

D) Income statement as a revenue

A) Income statement as an expense

B) Balance sheet as an asset

C) Statement of retained earnings

D) Income statement as a revenue

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

When do dividends become liabilities?

A) On the date of record

B) On the declaration date

C) On the payment date

D) Dividends are never liabilities because a company is not legally required to pay dividends

A) On the date of record

B) On the declaration date

C) On the payment date

D) Dividends are never liabilities because a company is not legally required to pay dividends

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

As compared with preferred stock, common stock usually has favorable preferences in terms of

A) Liquidated assets

B) Dividends

C) Voting rights

D) Both liquidated assets and voting rights

A) Liquidated assets

B) Dividends

C) Voting rights

D) Both liquidated assets and voting rights

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

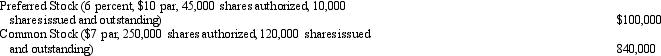

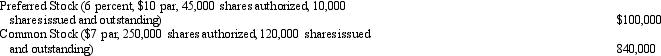

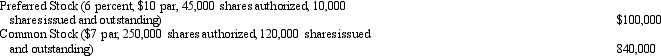

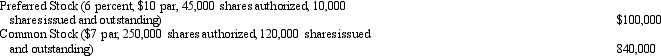

Exhibit 11-1 Pelletier Corporation has the following stock outstanding:

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $108,000 dividend, and if the preferred stock is cumulative and three years' dividends are in arrears, preferred stock will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $108,000 dividend, and if the preferred stock is cumulative and three years' dividends are in arrears, preferred stock will receive

A) $18,000

B) $24,000

C) $90,000

D) $84,000

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $108,000 dividend, and if the preferred stock is cumulative and three years' dividends are in arrears, preferred stock will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $108,000 dividend, and if the preferred stock is cumulative and three years' dividends are in arrears, preferred stock will receiveA) $18,000

B) $24,000

C) $90,000

D) $84,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

Exhibit 11-1 Pelletier Corporation has the following stock outstanding:

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is cumulative and two years' dividends are in arrears, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is cumulative and two years' dividends are in arrears, common stockholders will receive

A) $32,000

B) $52,000

C) $58,000

D) $46,000

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is cumulative and two years' dividends are in arrears, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is cumulative and two years' dividends are in arrears, common stockholders will receiveA) $32,000

B) $52,000

C) $58,000

D) $46,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

Identify the two types of stock that are sold by a corporation and list the characteristics of each one.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

The purpose of a statement of stockholders' equity is to

A) Report the balances in the stockholders' equity accounts as of a particular date

B) Reconcile beginning and ending balances of all stockholders' equity accounts reported on the balance sheet

C) Report changes in all stockholders' equity accounts except Retained Earnings

D) Summarize treasury stock transactions for a period of time

A) Report the balances in the stockholders' equity accounts as of a particular date

B) Reconcile beginning and ending balances of all stockholders' equity accounts reported on the balance sheet

C) Report changes in all stockholders' equity accounts except Retained Earnings

D) Summarize treasury stock transactions for a period of time

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

The Retained Earnings balance of Mantua Company was $128,700 on January 1, 2012. Net income for 2012 was $72,820. If Retained Earnings had a credit balance of $57,750 after closing entries were posted on December 31, 2012, and if additional stock of $35,750 was issued during the year, dividends declared during 2012 were

A) $106,700

B) $143,770

C) $179,520

D) $158,125

A) $106,700

B) $143,770

C) $179,520

D) $158,125

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is NOT a component of comprehensive income?

A) Net income

B) Foreign currency translation adjustment

C) Unrealized gains and losses on available-for-sale securities

D) Treasury stock

A) Net income

B) Foreign currency translation adjustment

C) Unrealized gains and losses on available-for-sale securities

D) Treasury stock

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

Unrealized gains and losses on available-for-sale securities are reported in the

A) Gains and losses section of the income statement

B) Equity section of the balance sheet

C) Extraordinary items section of the income statement

D) Investments section of the balance sheet

A) Gains and losses section of the income statement

B) Equity section of the balance sheet

C) Extraordinary items section of the income statement

D) Investments section of the balance sheet

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

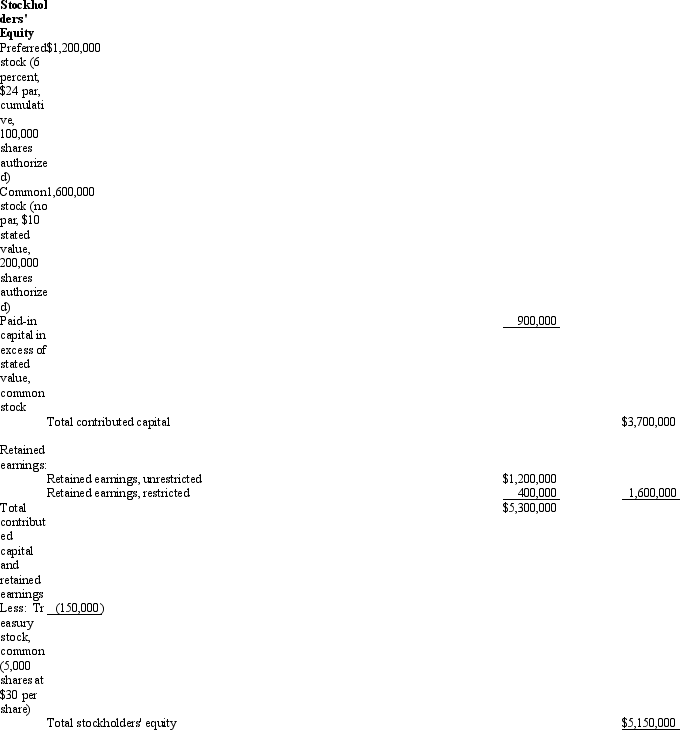

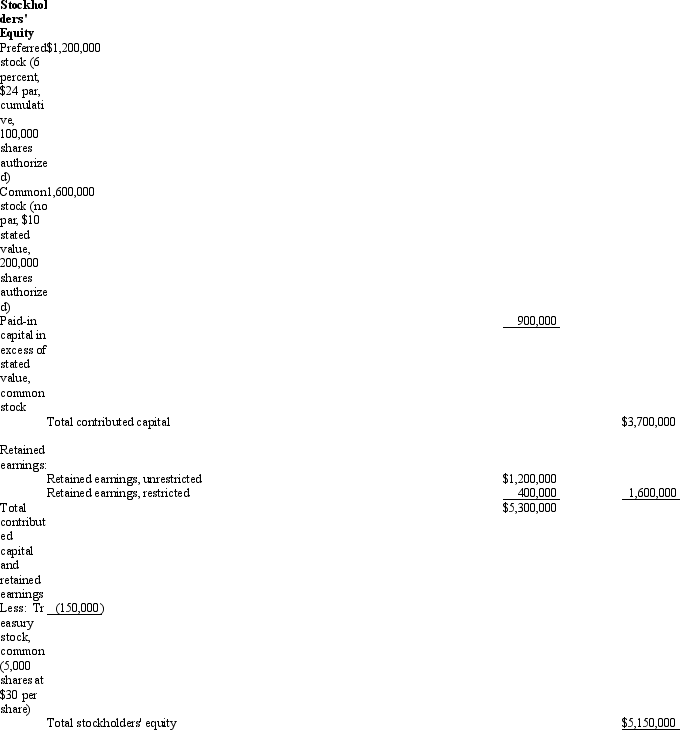

The stockholders' equity section of the balance sheet for Beryl Corporation as of December 31, 2012, is as follows:

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

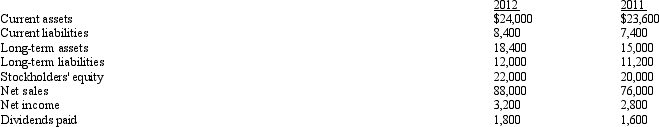

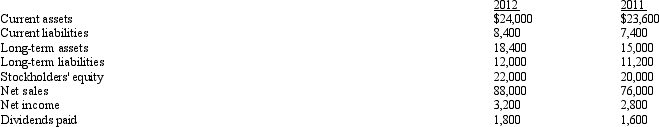

The following information is available for Snipes Company:  The dividend payout ratio for 2012 is

The dividend payout ratio for 2012 is

A) 17.77%

B) 88.89%

C) 57.14%

D) 56.25%

The dividend payout ratio for 2012 is

The dividend payout ratio for 2012 isA) 17.77%

B) 88.89%

C) 57.14%

D) 56.25%

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Assume that 2,000 shares of common stock with a par value of $12 and a market price of $16 per share are issued in exchange for land with a fair market value of $32,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

Identify the three types of organizations and list the characteristics of each one.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

Exhibit 11-1 Pelletier Corporation has the following stock outstanding:

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is noncumulative and the two previous years' dividends have not been paid, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is noncumulative and the two previous years' dividends have not been paid, common stockholders will receive

A) $32,000

B) $52,000

C) $58,000

D) $46,000

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is noncumulative and the two previous years' dividends have not been paid, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $64,000 dividend, and if the preferred stock is noncumulative and the two previous years' dividends have not been paid, common stockholders will receiveA) $32,000

B) $52,000

C) $58,000

D) $46,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

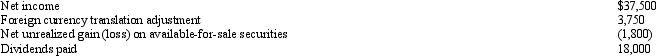

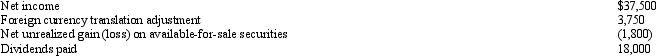

The following information is available for Janeway Corporation for the year 2012:  Given this information, what is Janeway's comprehensive income for 2012?

Given this information, what is Janeway's comprehensive income for 2012?

A) $41,250

B) $39,450

C) $37,500

D) $57,450

Given this information, what is Janeway's comprehensive income for 2012?

Given this information, what is Janeway's comprehensive income for 2012?A) $41,250

B) $39,450

C) $37,500

D) $57,450

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

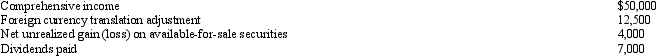

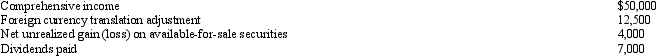

The following information is available for Pluto Company for the year 2012:  Given this information, what is Pluto's net income for 2012?

Given this information, what is Pluto's net income for 2012?

A) $26,500

B) $40,500

C) $37,500

D) $33,500

Given this information, what is Pluto's net income for 2012?

Given this information, what is Pluto's net income for 2012?A) $26,500

B) $40,500

C) $37,500

D) $33,500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

The term used to describe the equity section of the balance sheet that reports the effect on equity that results from market-related gains and losses that are NOT included in the computation of net income is

A) Equity income

B) Market income

C) Accumulated other comprehensive income

D) Valuation income

A) Equity income

B) Market income

C) Accumulated other comprehensive income

D) Valuation income

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following would NOT appear on a statement of stockholders' equity?

A) Unrealized gains and losses on trading securities

B) Accumulated other comprehensive income

C) Treasury stock

D) Additional paid-in capital

A) Unrealized gains and losses on trading securities

B) Accumulated other comprehensive income

C) Treasury stock

D) Additional paid-in capital

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

The foreign currency translation adjustment is reported in the

A) Gains and losses section of the income statement

B) Equity section of the balance sheet

C) Extraordinary items section of the income statement

D) Investments section of the balance sheet

A) Gains and losses section of the income statement

B) Equity section of the balance sheet

C) Extraordinary items section of the income statement

D) Investments section of the balance sheet

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2012, Dkembe Corporation was authorized to issue 100,000 shares of common stock, par value $5 per share, and 20,000 shares of 5 percent cumulative preferred stock, par value $40 per share.

Prepare journal entries to record the following 2012 transactions:

Prepare journal entries to record the following 2012 transactions:

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Exhibit 11-1 Pelletier Corporation has the following stock outstanding:

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $9,000 cash dividend, and if the preferred stock is noncumulative, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $9,000 cash dividend, and if the preferred stock is noncumulative, common stockholders will receive

A) $3,000

B) $9,000

C) $6,000

D) $4,500

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $9,000 cash dividend, and if the preferred stock is noncumulative, common stockholders will receive

Refer to Exhibit 11-1. Given the information above, if Pelletier pays a $9,000 cash dividend, and if the preferred stock is noncumulative, common stockholders will receiveA) $3,000

B) $9,000

C) $6,000

D) $4,500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following arises because of the change in the equity of foreign subsidiaries that occurs as a result of changes in foreign currency exchange rates?

A) Unrealized gains on available-for-sale securities

B) Unrealized losses on available-for-sale securities

C) Foreign currency translation adjustment

D) Minimum pension liability

A) Unrealized gains on available-for-sale securities

B) Unrealized losses on available-for-sale securities

C) Foreign currency translation adjustment

D) Minimum pension liability

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck