Deck 3: Financial Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/124

Play

Full screen (f)

Deck 3: Financial Analysis

1

Disinflation may cause:

A) an increase in the value of gold,silver,and gems.

B) a reduced required return demanded by investors on financial assets.

C) increased return demanded by investors on non-financial assets.

D) additional profits through rising inventory costs.

A) an increase in the value of gold,silver,and gems.

B) a reduced required return demanded by investors on financial assets.

C) increased return demanded by investors on non-financial assets.

D) additional profits through rising inventory costs.

B

2

Total asset turnover indicates the firm's:

A) liquidity.

B) debt position.

C) ability to use its assets to generate sales.

D) profitability.

A) liquidity.

B) debt position.

C) ability to use its assets to generate sales.

D) profitability.

C

3

Ratio analysis is not useful for:

A) historical trend analysis within a firm.

B) comparison of ratios within a single industry.

C) measuring the effects of financing.

D) measuring employee satisfaction.

A) historical trend analysis within a firm.

B) comparison of ratios within a single industry.

C) measuring the effects of financing.

D) measuring employee satisfaction.

D

4

Industries most sensitive to inflation-induced profits are those with:

A) seasonal products.

B) cyclical products.

C) consumer products.

D) high-profit products.

A) seasonal products.

B) cyclical products.

C) consumer products.

D) high-profit products.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

5

A short-term creditor would be most interested in:

A) profitability ratios.

B) asset utilization ratios.

C) liquidity ratios.

D) debt utilization ratios.

A) profitability ratios.

B) asset utilization ratios.

C) liquidity ratios.

D) debt utilization ratios.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

6

During inflation,replacement cost accounting will:

A) decrease the value of assets.

B) raise the debt to asset ratio.

C) increase incomes.

D) reduce incomes.

A) decrease the value of assets.

B) raise the debt to asset ratio.

C) increase incomes.

D) reduce incomes.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

7

ABC Co.has an average collection period of 60 days.Total credit sales for the year were $3,285,000.What is the balance in accounts receivable at year-end? (Use 365 days in a year.)

A) $54,750

B) $109,500

C) $540,000

D) $547,500

A) $54,750

B) $109,500

C) $540,000

D) $547,500

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a potential problem of utilizing ratio analysis?

A) Trends and industry averages are futuristic in nature

B) Financial data is identical due to price-level changes

C) Firms within an industry use similar accounting principles and application

D) Firms within an industry may not use similar accounting methods

A) Trends and industry averages are futuristic in nature

B) Financial data is identical due to price-level changes

C) Firms within an industry use similar accounting principles and application

D) Firms within an industry may not use similar accounting methods

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

9

A firm has current assets of $75,000 and total assets of $375,000.The firm's sales are $900,000.The firm's capital asset turnover is:

A) 3.0x.

B) 12.0x.

C) 2.4x.

D) 5.0x.

A) 3.0x.

B) 12.0x.

C) 2.4x.

D) 5.0x.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

10

Asset utilization ratios:

A) relate the balance sheet assets to the income statement sales.

B) measure how much cash is available for reinvestment into current assets.

C) are most important to shareholders.

D) measures the firm's ability to generate a profit on sales.

A) relate the balance sheet assets to the income statement sales.

B) measure how much cash is available for reinvestment into current assets.

C) are most important to shareholders.

D) measures the firm's ability to generate a profit on sales.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

11

A firm has operating profit of $120,000 after deducting lease payments of $20,000.Interest expense is $40,000.What is the firm's fixed charge coverage?

A) 6.00x

B) 4.00x

C) 3.50x

D) 2.33x

A) 6.00x

B) 4.00x

C) 3.50x

D) 2.33x

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

12

Which two ratios are used in the DuPont system to create return on assets?

A) Return on assets and asset turnover

B) Profit margin and asset turnover

C) Return on total capital and the profit margin

D) Inventory turnover and return on capital assets

A) Return on assets and asset turnover

B) Profit margin and asset turnover

C) Return on total capital and the profit margin

D) Inventory turnover and return on capital assets

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

13

Replacement cost accounting (current cost method)will usually:

A) increase assets,decrease net income before taxes,and lower the return on equity.

B) increase assets,increase net income before taxes,and increase the return on equity.

C) decrease assets,increase net income before taxes,and increase the return on equity.

D) increase assets,increase net income before taxes,and lower the return on equity.

A) increase assets,decrease net income before taxes,and lower the return on equity.

B) increase assets,increase net income before taxes,and increase the return on equity.

C) decrease assets,increase net income before taxes,and increase the return on equity.

D) increase assets,increase net income before taxes,and lower the return on equity.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

14

If a firm has both interest expense and lease payments:

A) times interest earned will be smaller than fixed charge coverage.

B) times interest earned will be greater than fixed charge coverage.

C) times interest earned will be the same as fixed charge coverage.

D) fixed charge coverage cannot be computed.

A) times interest earned will be smaller than fixed charge coverage.

B) times interest earned will be greater than fixed charge coverage.

C) times interest earned will be the same as fixed charge coverage.

D) fixed charge coverage cannot be computed.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

15

The ______________ method of inventory costing is most likely to lead to inflation-induced profits.

A) FIFO

B) Specific item

C) Weighted average

D) Lower of cost or market

A) FIFO

B) Specific item

C) Weighted average

D) Lower of cost or market

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

16

In addition to comparison with industry ratios,it is also helpful to analyze ratios using:

A) ethical behaviour.

B) comparison of industry benchmarks.

C) focus groups.

D) trend analysis.

A) ethical behaviour.

B) comparison of industry benchmarks.

C) focus groups.

D) trend analysis.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

17

A quick ratio much smaller than the current ratio reflects:

A) a small portion of current assets is in inventory.

B) a large portion of current assets is in inventory.

C) that the firm will have a high inventory turnover.

D) that the firm will have a high return on assets.

A) a small portion of current assets is in inventory.

B) a large portion of current assets is in inventory.

C) that the firm will have a high inventory turnover.

D) that the firm will have a high return on assets.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not an asset utilization ratio?

A) Inventory turnover

B) Return on assets

C) Capital asset turnover

D) Average collection period

A) Inventory turnover

B) Return on assets

C) Capital asset turnover

D) Average collection period

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

19

Income can be distorted by factors other than inflation.The most important causes of distortion for inter-industry comparisons are:

A) accounting trends.

B) application of IFRS.

C) timing of revenue receipts and nonrecurring gains or losses.

D) cash reinvestment.

A) accounting trends.

B) application of IFRS.

C) timing of revenue receipts and nonrecurring gains or losses.

D) cash reinvestment.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

20

In examining the liquidity ratios,the primary emphasis is the firm's:

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to earn an adequate return.

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to earn an adequate return.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

21

A firm has total assets of $2,000,000.It has $900,000 in long-term debt.The shareholders' equity is $900,000.What is the total debt to asset ratio?

A) 45%

B) 40%

C) 55%

D) 100%

A) 45%

B) 40%

C) 55%

D) 100%

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

22

The Bubba Corp.had net income before taxes of $200,000 and sales of $2,000,000.If it is in the 50% tax bracket its after tax profit margin is:

A) 5%

B) 12%

C) 20%

D) 25%

A) 5%

B) 12%

C) 20%

D) 25%

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

23

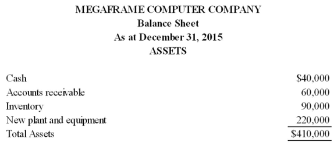

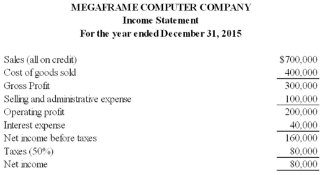

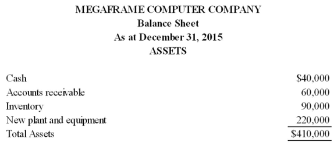

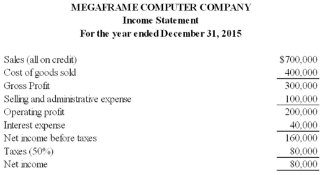

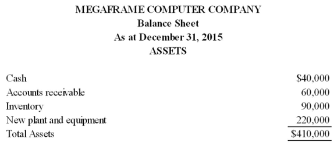

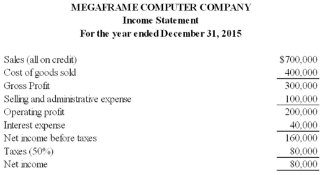

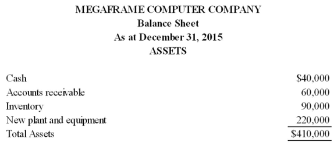

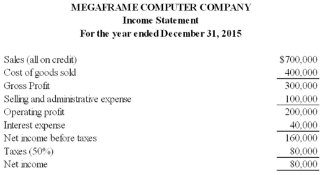

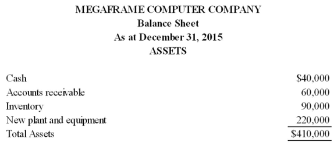

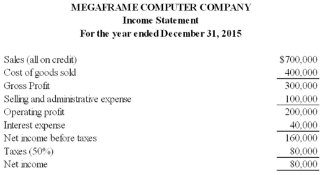

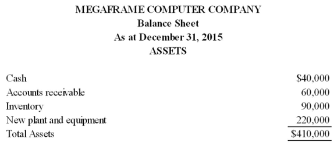

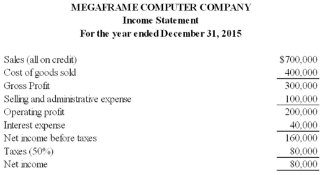

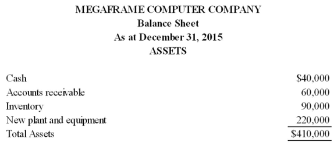

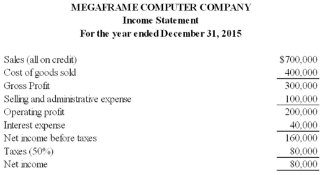

-Using the DuPont method,return on assets (investment)for Megaframe Computer is approximately:

A) 15%.

B) 25%.

C) 29%.

D) 20%.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

24

Which industry places the most value on intangible assets?

A) Professional services

B) Manufacturing industry

C) Production facility

D) Assembly facility

A) Professional services

B) Manufacturing industry

C) Production facility

D) Assembly facility

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

25

If government bonds pay 8.5% interest and CDIC insured savings accounts pay 5.5% interest,shareholders in a moderately risky firm would expect return-on-equity values of:

A) 5.5%.

B) 8.5%.

C) 12.0%.

D) above 8.5%,but the exact amount is uncertain.

A) 5.5%.

B) 8.5%.

C) 12.0%.

D) above 8.5%,but the exact amount is uncertain.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is not considered to be a profitability ratio?

A) Profit margin

B) Times interest earned

C) Return on equity

D) Return on assets (investment)

A) Profit margin

B) Times interest earned

C) Return on equity

D) Return on assets (investment)

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

27

For a given level of profitability as measured by profit margin,the firm's return on equity will:

A) increase as its debt-to-assets ratio decreases.

B) decrease as its current ratio increases.

C) increase as its debt-to assets ratio increases.

D) decrease as its times-interest-earned ratio decreases.

A) increase as its debt-to-assets ratio decreases.

B) decrease as its current ratio increases.

C) increase as its debt-to assets ratio increases.

D) decrease as its times-interest-earned ratio decreases.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

28

-Megaframe's current ratio is:

A) 1.9:1.

B) 0.6:1.

C) 1:1.

D) 0.86:1.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

29

-Times interest earned for Megaframe Computer is:

A) 2x.

B) 5x.

C) 4x.

D) 10x.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

30

A firm has a debt to equity ratio of 50%,debt of $300,000,and net income of $90,000.The return on equity is:

A) 60%

B) 15%

C) 30%

D) not enough information.

A) 60%

B) 15%

C) 30%

D) not enough information.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

31

Investors and financial analysts wanting to evaluate the operating efficiency of a firm's,managers would probably look primarily at the firm's:

A) debt utilization ratios.

B) liquidity ratios.

C) asset utilization ratios.

D) profitability ratios.

A) debt utilization ratios.

B) liquidity ratios.

C) asset utilization ratios.

D) profitability ratios.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

32

-What is Megaframe Computer's total asset turnover?

A) 3.68x.

B) 3.18x.

C) 2.00x.

D) 1.71x.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

33

A firm's long term assets = $75,000,total assets = $200,000,inventory = $25,000 and current liabilities = $50,000.Calculate the current ratio and quick ratio.

A) Current ratio = 0.5; Quick ratio = 1.5

B) Current ratio = 1.0; Quick ratio = 2.0

C) Current ratio = 1.5; Quick ratio = 2.0

D) Current ratio = 2.5; Quick ratio = 2.0

A) Current ratio = 0.5; Quick ratio = 1.5

B) Current ratio = 1.0; Quick ratio = 2.0

C) Current ratio = 1.5; Quick ratio = 2.0

D) Current ratio = 2.5; Quick ratio = 2.0

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

34

The higher a firm's debt utilization ratios,excluding debt-to-total assets,the:

A) less risky the firm's financial position.

B) more risky the firm's financial position.

C) more easily the firm will be able to pay dividends.

D) less easily the firm will be able to pay dividends.

A) less risky the firm's financial position.

B) more risky the firm's financial position.

C) more easily the firm will be able to pay dividends.

D) less easily the firm will be able to pay dividends.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

35

A firm has a debt to asset ratio of 75%,$240,000 in debt,and net income of $48,000.Calculate return on equity.

A) 60%

B) 20%

C) 26%

D) Not enough information

A) 60%

B) 20%

C) 26%

D) Not enough information

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

36

The most rigorous test of a firm's ability to pay its short-term obligations is its:

A) current ratio.

B) quick ratio.

C) debt-to-assets ratio.

D) times-interest-earned ratio.

A) current ratio.

B) quick ratio.

C) debt-to-assets ratio.

D) times-interest-earned ratio.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

37

XYZ's receivables turnover is 10x.The accounts receivable at year-end are $600,000.What was the sales figure for the year?

A) $60,000

B) $6,000,000

C) $7,200,000

D) $6,600,000

A) $60,000

B) $6,000,000

C) $7,200,000

D) $6,600,000

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

38

-Megaframe's quick ratio is:

A) 1:1.

B) 1:2.

C) 1.6:1.

D) 3:1.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

39

-The firm's average collection period is: (Use 365 days in a year.)

A) 31 days.

B) 25 days.

C) 12 days.

D) 20 days.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

40

-Megaframe's debt to asset ratio is:

A) 56.1%.

B) 75.61%.

C) 80.49%.

D) 90.62%

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

41

A decreasing average collection period could be associated with:

A) increasing sales.

B) decreasing sales.

C) increasing accounts receivable.

D) increasing profits.

A) increasing sales.

B) decreasing sales.

C) increasing accounts receivable.

D) increasing profits.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

42

Return on assets (ROA)can be distorted by:

A) current liabilities.

B) noncurrent liabilities.

C) bond principle payments.

D) bond interest payments.

A) current liabilities.

B) noncurrent liabilities.

C) bond principle payments.

D) bond interest payments.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

43

If accounts receivable stays the same,and credit sales go up:

A) the average collection period will go up.

B) the average collection period will go down.

C) accounts receivable turnover will decrease.

D) no changes will occur.

A) the average collection period will go up.

B) the average collection period will go down.

C) accounts receivable turnover will decrease.

D) no changes will occur.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

44

A large extraordinary loss has what effect on cost of goods sold?

A) It raises it.

B) It lowers it.

C) It has no effect.

D) Need more information.

A) It raises it.

B) It lowers it.

C) It has no effect.

D) Need more information.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not a debt utilization ratio?

A) Debt to total assets

B) Times interest earned

C) Current ratio

D) Fixed charge coverage

A) Debt to total assets

B) Times interest earned

C) Current ratio

D) Fixed charge coverage

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

46

An increasing average collection period indicates:

A) the firm is generating more income.

B) accounts receivable is going down.

C) the company is becoming more efficient in its collection policy.

D) the company is becoming less efficient in its collection policy.

A) the firm is generating more income.

B) accounts receivable is going down.

C) the company is becoming more efficient in its collection policy.

D) the company is becoming less efficient in its collection policy.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

47

A non-Canadian company experiencing rapid price increases for its product would take the most conservative approach by using:

A) FIFO accounting.

B) LIFO accounting.

C) average cost accounting.

D) weighted average.

A) FIFO accounting.

B) LIFO accounting.

C) average cost accounting.

D) weighted average.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

48

Disinflation as compared to inflation would normally be good for investments in:

A) bonds.

B) gold.

C) collectible antiques.

D) text books.

A) bonds.

B) gold.

C) collectible antiques.

D) text books.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

49

A firm has current assets of $150,000 and total assets of $750,000.The firm's sales are $1,800,000.The firm's capital asset turnover is:

A) 3.0x

B) 12.0x

C) 2.4x

D) 5.0x

A) 3.0x

B) 12.0x

C) 2.4x

D) 5.0x

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

50

-Megaframe's return on equity is:

A) 44.44%.

B) 80.00%.

C) 50.05%.

D) 100.0%.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

51

According the DuPont system,which of the following is not a factor in achieving a satisfactory return on assets?

A) Use of debt

B) Low inventory levels

C) Rapid turnover of assets

D) High profit margins

A) Use of debt

B) Low inventory levels

C) Rapid turnover of assets

D) High profit margins

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is an asset utilization ratio?

A) Profit margin

B) Inventory turnover

C) Return on equity

D) Return on assets

A) Profit margin

B) Inventory turnover

C) Return on equity

D) Return on assets

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

53

-Compute Megaframe's after tax profit margin.

A) 10.0%

B) 14.29%

C) 11.43%

D) 46.34%

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

54

If a company's accounts receivable turnover is increasing,the average collection period:

A) is going up slightly.

B) is going down.

C) could be moving in either direction.

D) is going up by a significant amount.

A) is going up slightly.

B) is going down.

C) could be moving in either direction.

D) is going up by a significant amount.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

55

What happens if lease payments are reduced?

A) Times interest earned goes up.

B) Fixed charge coverage goes up.

C) Fixed charge coverage stays the same.

D) Fixed charge coverage goes down.

A) Times interest earned goes up.

B) Fixed charge coverage goes up.

C) Fixed charge coverage stays the same.

D) Fixed charge coverage goes down.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

56

In examining the debt utilization ratios,the primary purpose is to measure:

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to generate timely cash flows.

A) ability to effectively employ its resources.

B) overall debt position.

C) ability to pay short-term obligations on time.

D) ability to generate timely cash flows.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is a profitability ratio?

A) Quick ratio

B) Return on assets

C) Inventory turnover

D) Capital asset turnover

A) Quick ratio

B) Return on assets

C) Inventory turnover

D) Capital asset turnover

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

58

-Megaframe's receivable turnover is:

A) 4.4x.

B) 10x.

C) 11.67x.

D) 14.4x.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

59

What do coverage ratios demonstrate?

A) How a firm is expected to handle current asset balances.

B) Debt management of the firm and ability to meet financial obligations.

C) Profit margin of the firm.

D) The return on assets of the firm.

A) How a firm is expected to handle current asset balances.

B) Debt management of the firm and ability to meet financial obligations.

C) Profit margin of the firm.

D) The return on assets of the firm.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

60

Historical cost based amortization tends to ________ immediately when there is inflation.

A) lower taxes

B) decrease profits

C) increase profits

D) increase assets

A) lower taxes

B) decrease profits

C) increase profits

D) increase assets

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

61

A decreasing average collection period indicates:

A) the firm is generating more income.

B) accounts receivable is going up.

C) the company is becoming more efficient in its collection policy.

D) the company is becoming less efficient in its collection policy.

A) the firm is generating more income.

B) accounts receivable is going up.

C) the company is becoming more efficient in its collection policy.

D) the company is becoming less efficient in its collection policy.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

62

Absolute values taken from financial statements are more useful than relative values.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

63

Jones and Co.,reported average receivables of $550,000 in its most recent annual report.If total credit sales were $3,000,000 what was Jones and Co.'s average collection period? (Use 365 days in a year.)

A) 67 days

B) 29 days

C) 82 days

D) 21 days

A) 67 days

B) 29 days

C) 82 days

D) 21 days

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

64

Ratios are used to compare different firms in the same industry.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

65

A firm's long term assets = $150,000,total assets = $400,000,inventory = $50,000,and current liabilities = $100,000.Calculate the current ratio and quick ratio.

A) Current ratio = 0.5; Quick ratio = 1.5

B) Current ratio = 1.0; Quick ratio = 2.0

C) Current ratio = 1.5; Quick ratio = 2.0

D) Current ratio = 2.5; Quick ratio = 2.0

A) Current ratio = 0.5; Quick ratio = 1.5

B) Current ratio = 1.0; Quick ratio = 2.0

C) Current ratio = 1.5; Quick ratio = 2.0

D) Current ratio = 2.5; Quick ratio = 2.0

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

66

If the company's accounts receivable turnover is decreasing,the average collection period:

A) is going up.

B) is going down.

C) could be moving in either direction.

D) is going down slightly.

A) is going up.

B) is going down.

C) could be moving in either direction.

D) is going down slightly.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

67

As long as prices continue to rise faster than costs in an inflationary environment,reported profits will generally continue to rise.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

68

If a company has a return on investment of 17%,and its equity multiplier is 1.75,its ROE would be _______?

A) 64.75%

B) 29.75%

C) 18.25%

D) 16.50%

A) 64.75%

B) 29.75%

C) 18.25%

D) 16.50%

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

69

Juniper,Ltd.report total sales of $10,000,000 in the prior year.If these sales were 15.50X total capital assets what was the company's capital asset position in the year?

A) $15,000,000

B) $155,000,000

C) $645,161

D) $6,451,613

A) $15,000,000

B) $155,000,000

C) $645,161

D) $6,451,613

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

70

A current ratio of 2 to 1 is always acceptable,for a company in any industry.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

71

In analyzing ratios,the age of the firm's assets need not be considered.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

72

Heavy use of long-term debt can be of benefit to a firm.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

73

If a company's profit margin was 32%,what were its reported sales if its reported net income was $650,000?

A) $10,000,000

B) $9,758,982

C) $1,008,332

D) $2,031,250

A) $10,000,000

B) $9,758,982

C) $1,008,332

D) $2,031,250

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

74

To compute the quick ratio,accounts receivable are not included in current assets.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

75

An increasing average collection period could be associated with:

A) decreasing average daily cash sales.

B) increasing average daily credit sales.

C) decreasing accounts receivable.

D) increasing accounts receivable.

A) decreasing average daily cash sales.

B) increasing average daily credit sales.

C) decreasing accounts receivable.

D) increasing accounts receivable.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

76

Flounders Co.has an average collection period of 60 days.Total credit sales for the year were $9,855,000.What is the balance in accounts receivable at year-end? (Use 365 days in a year.)

A) $164,250

B) $328,500

C) $1,620,000

D) $1,642,500

A) $164,250

B) $328,500

C) $1,620,000

D) $1,642,500

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

77

A firm has operating profit of $200,000 after deducting lease payments of $40,000.Interest expense is $60,000.What is the firm's fixed charge coverage?

A) 5.00x

B) 4.00x

C) 3.33x

D) 2.40x

A) 5.00x

B) 4.00x

C) 3.33x

D) 2.40x

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

78

Under International Financial Reporting Standards,two companies with identical operating results may not report identical net incomes.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

79

The stock market tends to move up when inflation goes up.

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck

80

A firm has a Debt-to-Asset ratio of 35% and Total Assets of $350,000.What is the firm's Total Debt?

A) $122,500

B) $650,000

C) $100,000

D) $60,000

A) $122,500

B) $650,000

C) $100,000

D) $60,000

Unlock Deck

Unlock for access to all 124 flashcards in this deck.

Unlock Deck

k this deck