Deck 4: Job Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/118

Play

Full screen (f)

Deck 4: Job Costing

1

Which one of the following documents records and summarizes the costs of direct materials, direct labor, and factory overhead for a particular job?

A)Purchase order.

B)Material requisition form.

C)Job product cost document.

D)Bill of materials.

E)Job cost sheet.

A)Purchase order.

B)Material requisition form.

C)Job product cost document.

D)Bill of materials.

E)Job cost sheet.

E

2

Which one of the following is the amount that actual factory overhead exceeds the factory overhead applied?

A)Factory overhead applied.

B)Actual factory overhead.

C)Overapplied overhead.

D)Allocated factory overhead.

E)Underapplied overhead.

A)Factory overhead applied.

B)Actual factory overhead.

C)Overapplied overhead.

D)Allocated factory overhead.

E)Underapplied overhead.

E

3

Cost system design/selection should consider all but which one of the following?

A)Cost/benefit of system design/selection and operation.

B)A firm's strategy and management information needs.

C)Customer needs.

D)Nature of the business, product, or service.

A)Cost/benefit of system design/selection and operation.

B)A firm's strategy and management information needs.

C)Customer needs.

D)Nature of the business, product, or service.

C

4

If a firm is following the cost leadership strategy, and overhead accounts are complex, then the:

A)Firm should use a process costing system.

B)Firm can use either a project or job costing system.

C)Traditional volume-based job costing will not usually provide the needed cost accuracy.

D)Only recourse is to install a hybrid costing system.

E)Firm should attempt to collect only material and labor costs.

A)Firm should use a process costing system.

B)Firm can use either a project or job costing system.

C)Traditional volume-based job costing will not usually provide the needed cost accuracy.

D)Only recourse is to install a hybrid costing system.

E)Firm should attempt to collect only material and labor costs.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

5

Departmental rates are appropriate when all the following exist except:

A)Not all products pass through the same processes.

B)Departments are not similar in function.

C)Departments have dissimilar cost drivers.

D)All departments have similar cost drivers and cost usage characteristics.

E)Products consume departmental resources in a significantly different manner.

A)Not all products pass through the same processes.

B)Departments are not similar in function.

C)Departments have dissimilar cost drivers.

D)All departments have similar cost drivers and cost usage characteristics.

E)Products consume departmental resources in a significantly different manner.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

6

The key distinction between job costing and process costing is:

A)The difference in detail required by each approach.

B)The use made of the collected data.

C)The journal entries required.

D)The cost object for which costs are accumulated.

E)The standards applied.

A)The difference in detail required by each approach.

B)The use made of the collected data.

C)The journal entries required.

D)The cost object for which costs are accumulated.

E)The standards applied.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following is used by the production department supervisor to request the materials for production?

A)Purchase order.

B)Material requisition.

C)Bill of materials.

D)Product job cost schedule.

E)Job cost sheet.

A)Purchase order.

B)Material requisition.

C)Bill of materials.

D)Product job cost schedule.

E)Job cost sheet.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

8

The three major differences between process and job order costing systems are those relating to:

A)Quantity, quality, and cost.

B)Speed, accuracy, and design.

C)Cost object, product or service variety, and timing of unit cost calculation.

D)Responsibility for cost, system design, and authorization codes.

E)None of the above is correct.

A)Quantity, quality, and cost.

B)Speed, accuracy, and design.

C)Cost object, product or service variety, and timing of unit cost calculation.

D)Responsibility for cost, system design, and authorization codes.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

9

Standard costs are:

A)Planned costs the firm should attain.

B)Associated with direct materials and factory overhead only.

C)Associated with direct labor and factory overhead only.

D)Targeted low costs the firm should strive for.

E)None of the above.

A)Planned costs the firm should attain.

B)Associated with direct materials and factory overhead only.

C)Associated with direct labor and factory overhead only.

D)Targeted low costs the firm should strive for.

E)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

10

Volume-based cost accounting systems often do a poor job of product costing because they:

A)Use only volume-based cost drivers.

B)Fail to recognize the impact of overhead in product cost.

C)Often do not reflect changes in major cost categories caused by plant automation.

D)Too often use an allocation base that does not have a cause-effect relationship to resource usage.

E)Product costs involve both fixed and variable costs

A)Use only volume-based cost drivers.

B)Fail to recognize the impact of overhead in product cost.

C)Often do not reflect changes in major cost categories caused by plant automation.

D)Too often use an allocation base that does not have a cause-effect relationship to resource usage.

E)Product costs involve both fixed and variable costs

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

11

Which one of the following is the amount of factory overhead applied that exceeds the actual factory overhead cost?

A)Factory overhead applied.

B)Actual factory overhead.

C)Overapplied overhead.

D)Allocated factory overhead.

E)Underapplied overhead.

A)Factory overhead applied.

B)Actual factory overhead.

C)Overapplied overhead.

D)Allocated factory overhead.

E)Underapplied overhead.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

12

Under job costing, factory overhead costs are assigned to products or services using labor or machine hours which are:

A)Multiple cost pools.

B)A homogeneous cost pool.

C)Volume-based cost drivers.

D)Non-volume-based cost drivers only.

E)Activity-based cost drivers.

A)Multiple cost pools.

B)A homogeneous cost pool.

C)Volume-based cost drivers.

D)Non-volume-based cost drivers only.

E)Activity-based cost drivers.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

13

Volume-based rates are appropriate in situations where the incurrence of factory overhead:

A)Is related to multiple cost drivers.

B)Is related to several non-homogeneous cost drivers.

C)Is related to a single, common cost driver.

D)Varies considerably from period to period.

E)Is relatively small in amount.

A)Is related to multiple cost drivers.

B)Is related to several non-homogeneous cost drivers.

C)Is related to a single, common cost driver.

D)Varies considerably from period to period.

E)Is relatively small in amount.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

14

The ideal criterion for choosing an allocation base for overhead is:

A)Ease of calculation.

B)A cause-and-effect relationship.

C)Ease of use.

D)Its preciseness.

E)Its applicability.

A)Ease of calculation.

B)A cause-and-effect relationship.

C)Ease of use.

D)Its preciseness.

E)Its applicability.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following can produce unit product costs that fluctuate significantly?

A)Actual costing system.

B)Standard costing system.

C)Normal costing system.

D)Industry costing system.

E)None of the above.

A)Actual costing system.

B)Standard costing system.

C)Normal costing system.

D)Industry costing system.

E)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

16

A normal costing system uses actual costs for direct materials and direct labor, and:

A)Actual costs for factory overhead.

B)Estimated factory overhead costs based on material cost.

C)Estimated factory overhead costs based on labor cost.

D)Estimated costs for factory overhead.

E)Charges actual factory overhead as a lump sum.

A)Actual costs for factory overhead.

B)Estimated factory overhead costs based on material cost.

C)Estimated factory overhead costs based on labor cost.

D)Estimated costs for factory overhead.

E)Charges actual factory overhead as a lump sum.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

17

The two main advantages of using predetermined factory overhead rates are to provide more accurate unit cost information and to:

A)Simplify the accounting process.

B)Provide cost information on a timely basis.

C)Insure transmission of correct data.

D)Extend the useful life of the cost data.

E)Adjust for variances in data sources.

A)Simplify the accounting process.

B)Provide cost information on a timely basis.

C)Insure transmission of correct data.

D)Extend the useful life of the cost data.

E)Adjust for variances in data sources.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

18

Product costing system design or selection:

A)Is cost management expertise.

B)Requires an understanding of the nature of the business.

C)Should provide useful cost information for strategic and operational decision needs.

D)Should be cost effective in design and operation.

E)All the above answers are correct.

A)Is cost management expertise.

B)Requires an understanding of the nature of the business.

C)Should provide useful cost information for strategic and operational decision needs.

D)Should be cost effective in design and operation.

E)All the above answers are correct.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

19

Product costing provides useful cost information for all the following except:

A)Both manufacturing and non-manufacturing firms.

B)For non-manufacturing firms.

C)Management planning, cost control, and performance evaluation

D)Financial statement reporting.

E)Identifying and hiring competent managers.

A)Both manufacturing and non-manufacturing firms.

B)For non-manufacturing firms.

C)Management planning, cost control, and performance evaluation

D)Financial statement reporting.

E)Identifying and hiring competent managers.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

20

Operation costing is a hybrid costing system for products and services that uses:

A)Job costing to assign direct material costs and standard costing for conversion cost.

B)Process costing to assign conversion costs and normal costing for materials cost.

C)Job costing for direct materials costs and process costing for conversion cost.

D)Normal costing for conversion cost and process costing for materials cost.

A)Job costing to assign direct material costs and standard costing for conversion cost.

B)Process costing to assign conversion costs and normal costing for materials cost.

C)Job costing for direct materials costs and process costing for conversion cost.

D)Normal costing for conversion cost and process costing for materials cost.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

21

When completed units are sold:

A)Cost of Goods Sold account is credited.

B)Cost of Goods Manufactured account is credited.

C)Finished Goods Inventory account is credited.

D)Work-in-Process Inventory account is credited.

E)Finished Goods Inventory account is debited.

A)Cost of Goods Sold account is credited.

B)Cost of Goods Manufactured account is credited.

C)Finished Goods Inventory account is credited.

D)Work-in-Process Inventory account is credited.

E)Finished Goods Inventory account is debited.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

22

For job costing in service industries, overhead costs are usually applied to jobs based on:

A)Factory overhead.

B)Indirect labor.

C)Indirect materials.

D)Direct labor-hours or dollars.

E)Direct materials.

A)Factory overhead.

B)Indirect labor.

C)Indirect materials.

D)Direct labor-hours or dollars.

E)Direct materials.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

23

The total cost of direct materials, direct labor, and factory overhead transferred from the Work-in-Process Inventory account to the Finished Goods Inventory account during an accounting period is:

A)Normal cost of goods sold.

B)Adjusted cost of goods sold.

C)Total manufacturing cost.

D)Cost of goods manufactured.

E)Actual cost of goods sold.

A)Normal cost of goods sold.

B)Adjusted cost of goods sold.

C)Total manufacturing cost.

D)Cost of goods manufactured.

E)Actual cost of goods sold.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

24

Abnormal spoilage:

A)Is considered part of good production.

B)Arises under efficient operating conditions.

C)Is controllable in the short run.

D)Is unacceptable spoilage that should not occur under efficient operating conditions.

E)Is part of inventory product cost.

A)Is considered part of good production.

B)Arises under efficient operating conditions.

C)Is controllable in the short run.

D)Is unacceptable spoilage that should not occur under efficient operating conditions.

E)Is part of inventory product cost.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

25

Beckner Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 133,000 and estimated factory overhead is $784,700. The following information is for September. Job X was completed during September, while Job Y was started but not finished. The underapplied or overapplied overhead for September is:

A)$2,350 underapplied.

B)$2,350 overapplied.

C)$950 overapplied.

D)$950 underapplied.

E)$1,450 underapplied.

A)$2,350 underapplied.

B)$2,350 overapplied.

C)$950 overapplied.

D)$950 underapplied.

E)$1,450 underapplied.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

26

Badour Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 114,000 and estimated factory overhead was $695,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished. The total factory overhead applied during September is:

A)$59,300.

B)$57,950.

C)$57,848.

D)$56,120.

E)$57,710.

A)$59,300.

B)$57,950.

C)$57,848.

D)$56,120.

E)$57,710.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

27

Beckner Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 133,000 and estimated factory overhead is $784,700. The following information is for September. Job X was completed during September, while Job Y was started but not finished. The total ending work-in-process for September is:

A)$68,000

B)$101,000

C)$133,450

D)$157,300

E)$53,400

A)$68,000

B)$101,000

C)$133,450

D)$157,300

E)$53,400

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

28

ABC Company listed the following data for the current year: Assuming ABC Company applied overhead based on direct labor hours, the company's predetermined overhead rate for the year is:

A)$43.95 per direct labor hour.

B)$15.50 per direct labor hour.

C)$15.00 per direct labor hour.

D)$14.28 per direct labor hour.

E)$14.00 per direct labor hour.

A)$43.95 per direct labor hour.

B)$15.50 per direct labor hour.

C)$15.00 per direct labor hour.

D)$14.28 per direct labor hour.

E)$14.00 per direct labor hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

29

Beckner Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 133,000 and estimated factory overhead is $784,700. The following information is for September. Job X was completed during September, while Job Y was started but not finished. The total factory overhead applied during September is:

A)$79,300.

B)$57,572.

C)$73,750.

D)$68,120.

E)$51,710.

A)$79,300.

B)$57,572.

C)$73,750.

D)$68,120.

E)$51,710.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

30

Badour Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 114,000 and estimated factory overhead was $695,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished.

The underapplied or overapplied overhead for September is:

A)$2,750 underapplied.

B)$2,750 overapplied.

C)$920 overapplied.

D)$920 underapplied.

E)$1,450 underapplied.

The underapplied or overapplied overhead for September is:

A)$2,750 underapplied.

B)$2,750 overapplied.

C)$920 overapplied.

D)$920 underapplied.

E)$1,450 underapplied.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

31

Beckner Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 133,000 and estimated factory overhead is $784,700. The following information is for September. Job X was completed during September, while Job Y was started but not finished. Cost of goods manufactured for September is:

A)$105,600

B)$157,300

C)$169,400

D)$145,500

E)$210,700

A)$105,600

B)$157,300

C)$169,400

D)$145,500

E)$210,700

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following industries is more suitable for using a job costing system?

A)Chemical plants.

B)Petroleum product manufacturing.

C)Medical clinics.

D)Cement manufacturing.

E)Food processing.

A)Chemical plants.

B)Petroleum product manufacturing.

C)Medical clinics.

D)Cement manufacturing.

E)Food processing.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

33

The system where the cost of a product or service is obtained by assigning costs to masses of similar units in each department and then computing unit cost on an average basis is called

A)A process costing system.

B)A job costing system.

C)An activity-based costing system.

D)An inventory materials control system.

E)None of the above.

A)A process costing system.

B)A job costing system.

C)An activity-based costing system.

D)An inventory materials control system.

E)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

34

Factory overhead can be over-or under-applied because:

A)Some actual factory overhead cost varies from the expected.

B)Some actual factory overhead costs are incurred unexpectedly.

C)Production volume may vary from expected volume.

D)All of the above.

E)None of the above.(A, B or C)

A)Some actual factory overhead cost varies from the expected.

B)Some actual factory overhead costs are incurred unexpectedly.

C)Production volume may vary from expected volume.

D)All of the above.

E)None of the above.(A, B or C)

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

35

Badour Inc. is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 114,000 and estimated factory overhead was $695,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished. The total cost of Job X is:

A)$152,400.

B)$128,200.

C)$151,900.

D)$129,600.

E)$140,800.

A)$152,400.

B)$128,200.

C)$151,900.

D)$129,600.

E)$140,800.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

36

A hybrid costing system that uses job costing to assign direct materials costs, and process costing to assign conversion costs to products or services is:

A)Process costing.

B)Operation costing.

C)Actual costing.

D)Product costing.

E)Job costing.

A)Process costing.

B)Operation costing.

C)Actual costing.

D)Product costing.

E)Job costing.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

37

The journal entry required to record factory depreciation includes:

A)A debit to the Cost of Goods Manufactured account.

B)A debit to the Factory Overhead account.

C)A debit to the Depreciation Expense account.

D)A debit to the Accumulated Depreciation account.

E)None of the above.

A)A debit to the Cost of Goods Manufactured account.

B)A debit to the Factory Overhead account.

C)A debit to the Depreciation Expense account.

D)A debit to the Accumulated Depreciation account.

E)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

38

When completed units are transferred to the warehouse:

A)Cost of Goods Sold account is debited.

B)Cost of Goods Manufactured account is debited.

C)Finished Goods Inventory account is debited.

D)Work-in-Process Inventory account is debited.

E)Finished Goods Inventory account is credited.

A)Cost of Goods Sold account is debited.

B)Cost of Goods Manufactured account is debited.

C)Finished Goods Inventory account is debited.

D)Work-in-Process Inventory account is debited.

E)Finished Goods Inventory account is credited.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

39

All of the following items are debited to the Work-in-Process Inventory account except:

A)Cost of the completed goods being transferred out of the plant.

B)Direct labor cost consumed/incurred.

C)Direct materials cost consumed/used.

D)Applied factory overhead cost.

A)Cost of the completed goods being transferred out of the plant.

B)Direct labor cost consumed/incurred.

C)Direct materials cost consumed/used.

D)Applied factory overhead cost.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

40

Normal spoilage is defined as:

A)Spoilage that occurs under efficient operations.

B)Scrap.

C)Uncontrollable waste as a result of a special production run.

D)Spoilage that arises under inefficient operations.

E)Controllable spoilage.

A)Spoilage that occurs under efficient operations.

B)Scrap.

C)Uncontrollable waste as a result of a special production run.

D)Spoilage that arises under inefficient operations.

E)Controllable spoilage.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

41

ABC Company listed the following data for the current year: If overhead is applied based on machine hours, the overapplied/underapplied overhead is:

A)$15,300 underapplied.

B)$15,300 overapplied.

C)$10,800 underapplied.

D)$10,800 overapplied.

E)$-0-.

A)$15,300 underapplied.

B)$15,300 overapplied.

C)$10,800 underapplied.

D)$10,800 overapplied.

E)$-0-.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

42

A job in which a quantity of products is ordered by a single customer is more likely to be an example of:

A)the pull method of production.

B)the resource-based method.

C)the push method of production.

D)the lean method of production.

E)none of the above.

A)the pull method of production.

B)the resource-based method.

C)the push method of production.

D)the lean method of production.

E)none of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

43

ABC Company listed the following data for the current year: Assuming ABC applied overhead based on machine hours, the company's predetermined overhead rate for the year is:

A)$43.95 per machine hour.

B)$14.38 per machine hour.

C)$43.50 per machine hour.

D)$14.50 per machine hour.

E)$14.28 per machine hour.

A)$43.95 per machine hour.

B)$14.38 per machine hour.

C)$43.50 per machine hour.

D)$14.50 per machine hour.

E)$14.28 per machine hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

44

Randall Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. Factory overhead cost was applied at 125% of direct labor cost. Selected data concerning the past year's operation of the company are presented below. The cost of direct materials used for production is:

A)$351,000.

B)$297,000.

C)$361,000.

D)$306,000.

E)$324,000.

A)$351,000.

B)$297,000.

C)$361,000.

D)$306,000.

E)$324,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

45

Randall Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. Factory overhead cost was applied at 125% of direct labor cost. Selected data concerning the past year's operation of the company are presented below. The total manufacturing costs for the year are:

A)$850,000.

B)$348,000.

C)$867,000.

D)$835,000.

E)$811,000.

A)$850,000.

B)$348,000.

C)$867,000.

D)$835,000.

E)$811,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

46

Job costing in the printing industry often has the following general framework.Job cost equals:

A)direct materials cost plus direct labor plus applied overhead based on machine hours

B)direct materials cost plus conversion costs applied on the basis of labor hours

C)direct materials cost, plus outside purchase costs, plus cost applied on the basis of labor hours.

D)materials purchases, labor incurred and applied overhead based on labor hours.

E)none of the above.

A)direct materials cost plus direct labor plus applied overhead based on machine hours

B)direct materials cost plus conversion costs applied on the basis of labor hours

C)direct materials cost, plus outside purchase costs, plus cost applied on the basis of labor hours.

D)materials purchases, labor incurred and applied overhead based on labor hours.

E)none of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

47

In job costing, the job might consist of:

A)a single product.

B)a batch of identical products.

C)a batch of similar products.

D)a single, well-defined project.

E)a single product, a batch of products, or a single well-defined project.

A)a single product.

B)a batch of identical products.

C)a batch of similar products.

D)a single, well-defined project.

E)a single product, a batch of products, or a single well-defined project.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

48

Sutherland Company listed the following data for 2019: If overhead is applied based on machine hours, the overapplied/underapplied overhead is:

A)$187,298 underapplied.

B)$187,298 overapplied.

C)$176,358 underapplied.

D)$176,358 overapplied.

E)$-0-.

A)$187,298 underapplied.

B)$187,298 overapplied.

C)$176,358 underapplied.

D)$176,358 overapplied.

E)$-0-.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

49

Jackson Inc. listed the following data for 2019: Assuming Jackson Inc.applied overhead based on direct labor hours, the firm's predetermined overhead rate for 2019 is:(round calculations to 2 significant digits):

A)$14.20 per direct labor hour.

B)$14.38 per direct labor hour.

C)$15.24 per direct labor hour.

D)$15.50 per direct labor hour.

E)$15.85 per direct labor hour.

A)$14.20 per direct labor hour.

B)$14.38 per direct labor hour.

C)$15.24 per direct labor hour.

D)$15.50 per direct labor hour.

E)$15.85 per direct labor hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

50

Sutherland Company listed the following data for 2019: Assuming Sutherland applied overhead based on direct labor hours, the company's predetermined overhead rate for 2019 is (round to two significant digits):

A)$23.20 per direct labor hour.

B)$23.60 per direct labor hour.

C)$22.24 per direct labor hour.

D)$22.50 per direct labor hour.

E)$22.85 per direct labor hour.

A)$23.20 per direct labor hour.

B)$23.60 per direct labor hour.

C)$22.24 per direct labor hour.

D)$22.50 per direct labor hour.

E)$22.85 per direct labor hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

51

ABC Company listed the following data for the current year: If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:

A)$15,300 underapplied.

B)$15,300 overapplied.

C)$51,600 underapplied.

D)$51,600 overapplied.

E)$-0-

A)$15,300 underapplied.

B)$15,300 overapplied.

C)$51,600 underapplied.

D)$51,600 overapplied.

E)$-0-

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

52

Jackson Inc. listed the following data for 2019: Assuming Jackson Inc.applied overhead based on machine hours, the firm's predetermined overhead rate for 2019 is:

A)$28.42 per machine hour.

B)$32.25 per machine hour.

C)$31.00 per machine hour.

D)$33.50 per machine hour.

E)$37.41 per machine hour.

A)$28.42 per machine hour.

B)$32.25 per machine hour.

C)$31.00 per machine hour.

D)$33.50 per machine hour.

E)$37.41 per machine hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

53

Randall Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. Factory overhead cost was applied at 125% of direct labor cost. Selected data concerning the past year's operation of the company are presented below. The cost of goods manufactured during the year is:

A)$850,000.

B)$348,000.

C)$672,000.

D)$835,000.

E)$811,000.

A)$850,000.

B)$348,000.

C)$672,000.

D)$835,000.

E)$811,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

54

Sutherland Company listed the following data for 2019: Assuming Sutherland applied overhead based on machine hours, the company's predetermined overhead rate for 2019 is (round to two significant digits):

A)$44.00 per machine hour.

B)$41.98 per machine hour.

C)$38.31 per machine hour.

D)$35.90 per machine hour.

E)$41.18 per machine hour.

A)$44.00 per machine hour.

B)$41.98 per machine hour.

C)$38.31 per machine hour.

D)$35.90 per machine hour.

E)$41.18 per machine hour.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

55

An good example of a software system(s) that can be used to prepare job cost reports is:

A)Oracle.

B)Microsoft Access.

C)There are a variety of software systems, often designed specifically for a particular industry.

D)Microsoft Excel.

E)None of the above.

A)Oracle.

B)Microsoft Access.

C)There are a variety of software systems, often designed specifically for a particular industry.

D)Microsoft Excel.

E)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

56

Jackson Inc. listed the following data for 2019: If overhead is applied based on machine hours, the overapplied/underapplied overhead is:

A)$20,400 underapplied.

B)$20,400 overapplied.

C)$48,374 underapplied.

D)$48,374 overapplied.

E)$-0-.

A)$20,400 underapplied.

B)$20,400 overapplied.

C)$48,374 underapplied.

D)$48,374 overapplied.

E)$-0-.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

57

Jackson Inc. listed the following data for 2019: If overhead is applied based on direct labor hours, overapplied/underapplied overhead is:

A)$136,650 overapplied.

B)$136,650 underapplied.

C)$174,775 underapplied.

D)$174,775 overapplied.

E)$-0-.

A)$136,650 overapplied.

B)$136,650 underapplied.

C)$174,775 underapplied.

D)$174,775 overapplied.

E)$-0-.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

58

Randall Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. Factory overhead cost was applied at 125% of direct labor cost. Selected data concerning the past year's operation of the company are presented below. The cost of goods sold (before adjustment for under or overapplied overhead) is:

A)$850,000.

B)$348,000.

C)$867,000.

D)$835,000.

E)$811,000.

A)$850,000.

B)$348,000.

C)$867,000.

D)$835,000.

E)$811,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

59

The journal entry to dispose of overapplied or underapplied overhead, if overhead is applied based on direct labor hours, would include a credit to:

A)Work-in-Process Inventory.

B)Cost of Goods Sold.

C)Finished Goods Inventory.

D)Factory Overhead Control.

E)Materials Inventory.

A)Work-in-Process Inventory.

B)Cost of Goods Sold.

C)Finished Goods Inventory.

D)Factory Overhead Control.

E)Materials Inventory.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

60

Sutherland Company listed the following data for 2019: If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:

A)$214,376 underapplied.

B)$214,376 overapplied.

C)$256,312 underapplied.

D)$256,312 overapplied.

E)$225,680 underapplied.

A)$214,376 underapplied.

B)$214,376 overapplied.

C)$256,312 underapplied.

D)$256,312 overapplied.

E)$225,680 underapplied.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

61

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges direct materials to WIP, while indirect materials are charged to the Factory Overhead account. During the month of April, the company has the following cost information: The credit to the materials inventory account for materials used is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

62

Randall Company manufactures products to customer specifications. A job costing system is used to accumulate production costs. Factory overhead cost was applied at 125% of direct labor cost. Selected data concerning the past year's operation of the company are presented below. The amount of underapplied or overapplied overhead is:

A)$60,000 overapplied.

B)$60,000 underapplied.

C)$10,000 overapplied.

D)$10,000 underapplied.

E)$0.

A)$60,000 overapplied.

B)$60,000 underapplied.

C)$10,000 overapplied.

D)$10,000 underapplied.

E)$0.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

63

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges direct materials to WIP, while indirect materials are charged to the Factory Overhead account. During the month of April, the company has the following cost The amount of direct materials issued is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

64

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The cost of goods manufactured during the year is:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,600.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The cost of goods manufactured during the year is:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,600.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

65

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges direct materials to WIP, while indirect materials are charged to the Factory Overhead account. During the month of April, the company has the following cost information:

The ending materials inventory cost is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

The ending materials inventory cost is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

66

C.M.Fly, owner of Falcon Aircraft Co., is preparing the accounting record for the year just ended.During the year, he had projected that the company would produce 300 Falcon Aircraft for its clients with a factory overhead cost of $150,000,000.However, business was better than expected and the company was able to produce 400 aircraft at factory overhead cost of $175,000,000.What is the amount per unit that Falcon Aircraft has over or underapplied factory overhead?

A)$62,500 overapplied.

B)$62,500 underapplied.

C)$125,000 overapplied.

D)$125,000 underapplied.

E)None of the abovE.1) $150,000,000/300 = $500,000 estimated overhead per Falcon Aircraft

A)$62,500 overapplied.

B)$62,500 underapplied.

C)$125,000 overapplied.

D)$125,000 underapplied.

E)None of the abovE.1) $150,000,000/300 = $500,000 estimated overhead per Falcon Aircraft

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

67

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The total manufacturing costs for the year are:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,300.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The total manufacturing costs for the year are:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,300.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

68

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The adjusted cost of goods sold, after under or overapplied overhead, is: (Round your "predetermined overhead rate" to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,357,600.

D)$1,373,600.

E)$1,339,300.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The adjusted cost of goods sold, after under or overapplied overhead, is: (Round your "predetermined overhead rate" to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,357,600.

D)$1,373,600.

E)$1,339,300.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

69

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges direct materials to WIP, while indirect materials are charged to the Factory Overhead account. During the month of April, the company has the following cost information: The debit to Work-in-Process Inventory account for materials is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50.000.

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50.000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

70

At the end of a fiscal year, overapplied factory overhead should be:

A)Debited to Cost of Goods sold.

B)Credited to Cost of Goods sold.

C)Debited to Cost of Good Manufactured.

D)None of the above.

A)Debited to Cost of Goods sold.

B)Credited to Cost of Goods sold.

C)Debited to Cost of Good Manufactured.

D)None of the above.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

71

ABC Company uses a Materials Inventory account to record both direct and indirect materials. ABC charges direct materials to WIP, while indirect materials are charged to the Factory Overhead account. During the month of April, the company has the following cost information: The debit to the Factory Overhead account is:

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

A)$110,000.

B)$30,000.

C)$90,000.

D)$80,000.

E)$50,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

72

Operation costing uses which of the following costing systems?

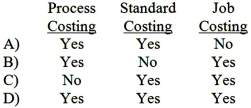

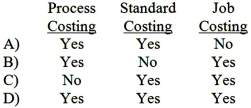

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

73

L & L, CPAs, employs two full-time professional CPAs and five support employees.Budgeted direct salary costs include $160,000 for each CPA.The support employees are considered as indirect costs, and this cost was budgeted for $200,000 though the actual cost was $225,000.Actual salaries were $155,000 for each CPA.Direct and indirect costs are applied on a CPA-labor-hour basis.Total budgeted CPA-labor-hours were 5,000.If a client used 500 labor-hours, what are the budgeted direct-cost rate and the budgeted indirect-cost rate, respectively?

A)$100; $40.

B)$62; $40.

C)$90; $40.

D)$64; $40.

E)$62; $45.

A)$100; $40.

B)$62; $40.

C)$90; $40.

D)$64; $40.

E)$62; $45.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

74

If estimated annual factory overhead is $480,000; overhead is applied using direct labor hours; estimated annual direct labor hours are 200,000; actual March factory overhead is $42,000; and actual March direct labor hours are 17,000; then overhead is:

A)$800 overapplied.

B)$200 overapplied.

C)$800 underapplied.

D)$200 underapplied.

E)$1,200 underapplied.

A)$800 overapplied.

B)$200 overapplied.

C)$800 underapplied.

D)$200 underapplied.

E)$1,200 underapplied.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

75

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The predetermined factory overhead rate is:

A)212% of direct labor costs.

B)215% of direct labor costs.

C)222% of direct labor costs.

D)203% of direct labor costs.

E)210% of direct labor costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The predetermined factory overhead rate is:

A)212% of direct labor costs.

B)215% of direct labor costs.

C)222% of direct labor costs.

D)203% of direct labor costs.

E)210% of direct labor costs.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

76

If Orange, Inc.uses direct labor hours to assign overhead, the unit product cost for Product X will be:

A)$60.00.

B)$70.00.

C)$80.00.

D)$90.00.

E)$180.00.

A)$60.00.

B)$70.00.

C)$80.00.

D)$90.00.

E)$180.00.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

77

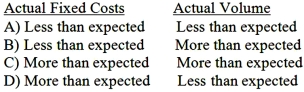

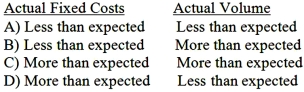

Dye Co.uses a job cost system and predetermines a factory overhead rate based on the amount of expected fixed costs and expected volume.At the conclusion of the fiscal year, overapplied overhead could be explained by which of the following?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

78

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The amount of direct materials purchased during the year is:

A)$391,000.

B)$388,000.

C)$377,000.

D)$380,000.

E)$374,000.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The amount of direct materials purchased during the year is:

A)$391,000.

B)$388,000.

C)$377,000.

D)$380,000.

E)$374,000.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

79

Maple Mount Fishery is a canning company in Astoria. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,400, and management budgeted $324,000 of direct labor costs. During the year, the company incurred the following actual costs.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The normal cost of goods sold, before under or overapplied overhead is:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,300.

The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year.

The normal cost of goods sold, before under or overapplied overhead is:(Round your intermediate calculations to 1 decimal place.)

A)$1,332,600.

B)$1,354,700.

C)$1,336,700.

D)$1,373,600.

E)$1,339,300.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck

80

If Orange, Inc.uses machine hours to allocate overhead cost, the unit product cost of Product X will be:

A)$60.00.

B)$80.00.

C)$90.00.

D)$110.00.

E)$130.00.

A)$60.00.

B)$80.00.

C)$90.00.

D)$110.00.

E)$130.00.

Unlock Deck

Unlock for access to all 118 flashcards in this deck.

Unlock Deck

k this deck