Deck 19: Business Acquisitions and Divestitures-Tax-Deferred Sales

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 19: Business Acquisitions and Divestitures-Tax-Deferred Sales

1

Mr.and Mrs.Leon would like to transfer their family business to their son.However,their son does not have the required funds to purchase the company at this time.Which of the following can the Leons chose to do in order to make the transfer possible without any immediate tax effect for themselves?

A) A sale of their shares to their son

B) An amalgamation

C) A reorganization of share capital

D) A wind-up

A) A sale of their shares to their son

B) An amalgamation

C) A reorganization of share capital

D) A wind-up

C

2

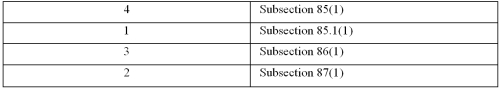

Match the following situations with the appropriate sections of the Income Tax Act.

Situation

1.Shares are exchanged between two corporations at their tax costs.As a formal tax agreement is not required,this is a useful method for public corporations with many shareholders.

2.Shares of two or more corporations are exchanged for shares of a new entity,and all of the assets of the corporations are transferred to the new entity.

3.Common shares are converted to preferred shares and held by the seller.New common shares are issued (often at a nominal value)to the purchaser.

4.Assets are sold from a vendor corporation to a buyer corporation at an elected value,usually the assets' tax costs (i.e.UCC or ACB),in exchange for shares and a non-share payment not exceeding the elected value.

Section from the Income Tax Act

_______ Subsection 85(1)

_______ Subsection 85.1(1)

_______ Subsection 86(1)

_______ Subsection 87(1)

Situation

1.Shares are exchanged between two corporations at their tax costs.As a formal tax agreement is not required,this is a useful method for public corporations with many shareholders.

2.Shares of two or more corporations are exchanged for shares of a new entity,and all of the assets of the corporations are transferred to the new entity.

3.Common shares are converted to preferred shares and held by the seller.New common shares are issued (often at a nominal value)to the purchaser.

4.Assets are sold from a vendor corporation to a buyer corporation at an elected value,usually the assets' tax costs (i.e.UCC or ACB),in exchange for shares and a non-share payment not exceeding the elected value.

Section from the Income Tax Act

_______ Subsection 85(1)

_______ Subsection 85.1(1)

_______ Subsection 86(1)

_______ Subsection 87(1)

3

Which of the following is not a common feature often associated with closely held corporations?

A) The corporation has only one, or relatively few, shareholders.

B) The corporation is often sold due to the owner's wish to retire.

C) The corporation may be sold to family members or employees who do not have enough cash to buy the business.

D) The corporation pays regular dividends to its public shareholders.

A) The corporation has only one, or relatively few, shareholders.

B) The corporation is often sold due to the owner's wish to retire.

C) The corporation may be sold to family members or employees who do not have enough cash to buy the business.

D) The corporation pays regular dividends to its public shareholders.

D

4

Brian Snow owns all of the common shares of Treeline Boots Ltd.,a Canadian-controlled private corporation.The shares have a fair market value of $150,000,an ACB of $30,000,and a PUC of $5,000.Brian would like to retire soon,so he has offered the company to his son,Walter.Walter is young and does not have a lot of disposable income,and as such,a Section 86(1)estate freeze has been recommended to Brian.Brian's common shares will be converted to preferred shares,which are redeemable for $150,000.

Required:

Discuss the tax consequences of this transaction for Brian,indicating the ACB and the PUC of the new shares.

Required:

Discuss the tax consequences of this transaction for Brian,indicating the ACB and the PUC of the new shares.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Samantha is an architect,and she is also the sole shareholder of Sam's Shoes Inc.She wants to semi-retire from the shoe business soon and her three employees have all expressed great interest in taking over the company,however,they do not have the financial resources necessary to make the purchase at this point in time.Samantha is not in a hurry to receive the proceeds from the business as she will continue with her architectural work for another five years.

Samantha has heard about something called a 'share reorganization' and she has asked you to explain what it means and if it would apply to her situation.

Required:

A)Explain what a Subsection 86(1)share reorganization is,and if it would be useful for Samantha in her plans to semi-retire from her shoe store.

B)What is a significant risk factor that might be involved with a share reorganization?

Samantha has heard about something called a 'share reorganization' and she has asked you to explain what it means and if it would apply to her situation.

Required:

A)Explain what a Subsection 86(1)share reorganization is,and if it would be useful for Samantha in her plans to semi-retire from her shoe store.

B)What is a significant risk factor that might be involved with a share reorganization?

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not typically used to defer taxes in business reorganizations?

A) Transfer of depreciable assets at their undepreciated capital costs, from one corporation to another.

B) Transfer of shares at their adjusted cost base, from one corporation to another.

C) Transfer of non-depreciable assets at their fair market values, from one corporation to another.

D) An amalgamation

A) Transfer of depreciable assets at their undepreciated capital costs, from one corporation to another.

B) Transfer of shares at their adjusted cost base, from one corporation to another.

C) Transfer of non-depreciable assets at their fair market values, from one corporation to another.

D) An amalgamation

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements most accurately describes an aspect of a tax-deferred sale of a business to a group of employees,through share reorganization?

A) The employees will purchase the corporation's original common shares from the vendor.

B) There is a risk to the original shareholder, as the value of his/her preferred shares depends on the success of the corporation following the sale.

C) This method of sale is appropriate when the vendor is unsure of the purchaser's ability to manage the business.

D) The vendor generally does not participate in financing the sale of the business.

A) The employees will purchase the corporation's original common shares from the vendor.

B) There is a risk to the original shareholder, as the value of his/her preferred shares depends on the success of the corporation following the sale.

C) This method of sale is appropriate when the vendor is unsure of the purchaser's ability to manage the business.

D) The vendor generally does not participate in financing the sale of the business.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Corporation A is selling a depreciable asset to Corporation

A) For legal purposes, the asset will be sold for $200,000.

B) The elected value for tax purposes would be $175,000.

B) The asset has a fair market value of $200,000. The original cost of the asset was $175,000 and the undepreciated capital cost is $160,000. The two corporations wish to structure the sale in a manner that will defer all taxes at this time. Corporation A has no unused losses. Which of the following is false?

C) The sale can include cash or a note receivable to a maximum value of $160,000.

D) Corporation A will receive shares from Corporation B in the transaction.

A) For legal purposes, the asset will be sold for $200,000.

B) The elected value for tax purposes would be $175,000.

B) The asset has a fair market value of $200,000. The original cost of the asset was $175,000 and the undepreciated capital cost is $160,000. The two corporations wish to structure the sale in a manner that will defer all taxes at this time. Corporation A has no unused losses. Which of the following is false?

C) The sale can include cash or a note receivable to a maximum value of $160,000.

D) Corporation A will receive shares from Corporation B in the transaction.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck