Deck 18: Business Acquisitions and Divestitures-Assets Versus Shares

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 18: Business Acquisitions and Divestitures-Assets Versus Shares

1

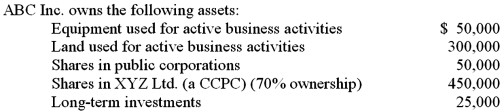

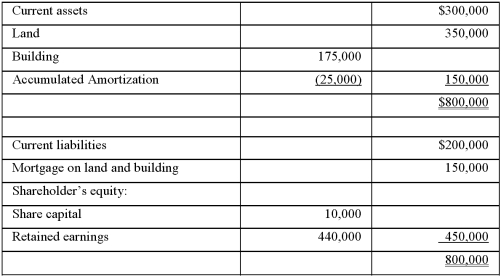

ABC Inc.(a CCPC)is for sale,and Jane,the sole shareholder would like to know if the company is currently a small business corporation.Jane has provided you with the following information:

All of the business activities of ABC Inc.have taken place in Canada.

The following amounts represent fair market values.

All of the business activities of ABC Inc.have taken place in Canada.

The following amounts represent fair market values.

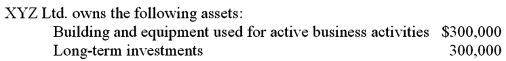

All of the business activities of XYZ Ltd.have taken place in Canada.

All of the business activities of XYZ Ltd.have taken place in Canada.  The shares have not changed hands since the companies began operations four years ago.The asset values have remained constant for the past three and a half years.

The shares have not changed hands since the companies began operations four years ago.The asset values have remained constant for the past three and a half years.Required:

Determine if ABC Inc.is a 'small business corporation'.Show calculations to support your answer.

List three reasons from a tax perspective as to why the status of 'small business corporation' may be significant.

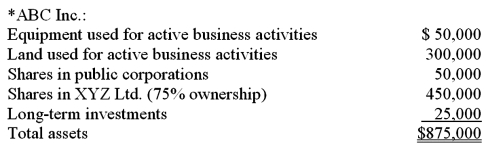

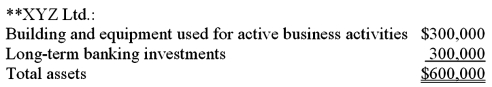

ABC Inc.is not a small business corporation.

ABC cannot meet the 90% test based solely on its assets in active business: 50,000 + 300,000 = 350,000/875,000 = 40%

The rule that 90% or more of the fair market value of ABC's assets are a combination of 1)assets used in active business in Canada,and 2)the shares of a connected SBC has not been met,either.While '90%* or more of the fair market value of its assets' are a combination of 1)assets used in active business in Canada,and 2)the shares of XYZ Ltd.(a connected corporation),XYZ Ltd.is not a small business corporation since only 50%** of its assets are used in active business.

50,000 + 300,000 + 450,000 = 800,000/875,000 = 91.4%

50,000 + 300,000 + 450,000 = 800,000/875,000 = 91.4%  300,000/600,000 = 50%

300,000/600,000 = 50%b)If a CCPC is a small business corporation,the following may be applied in situations where applicable:

1)Capital gains deduction may apply if QSBC test is also met

2)Allowable business investment loss

3)Corporate attribution rules on transfer and loans to corporations

2

When deciding whether to purchase the shares or assets in business acquisitions,which of the following are the three major tax considerations for the purchaser?

A) Future tax rates, impact on cash flow, potential tax liability after share acquisition if assets are sold

B) Future tax rates, impact on cash flow, potential tax liability after share acquisition if new assets are purchased

C) Future interest rates, impact on cash flow, potential tax liability after share acquisition if assets are sold

D) Future interest rates, impact on cash flow, potential tax liability after share acquisition if new assets are purchased

A) Future tax rates, impact on cash flow, potential tax liability after share acquisition if assets are sold

B) Future tax rates, impact on cash flow, potential tax liability after share acquisition if new assets are purchased

C) Future interest rates, impact on cash flow, potential tax liability after share acquisition if assets are sold

D) Future interest rates, impact on cash flow, potential tax liability after share acquisition if new assets are purchased

A

3

The Flower Company is for sale.The anticipated average profits for the next five years of the business have been calculated at $150,000.The business has been valued at $750,000 using the earnings method.The net tangible assets have been appraised at $625,000.Which of the following is true for the Flower Company?

A) The company is expected to yield a 20% return for the purchaser, and the cost of the business is too low.

B) The company is expected to yield a 20% return for the purchaser, and goodwill of $125,000 is present.

C) The company is expected to yield a 24% return for the purchaser, and goodwill of $125,000 is present.

D) The company is expected to yield a 24% return for the purchaser, and goodwill of $475,000 is present.

A) The company is expected to yield a 20% return for the purchaser, and the cost of the business is too low.

B) The company is expected to yield a 20% return for the purchaser, and goodwill of $125,000 is present.

C) The company is expected to yield a 24% return for the purchaser, and goodwill of $125,000 is present.

D) The company is expected to yield a 24% return for the purchaser, and goodwill of $475,000 is present.

B

4

Stick Co.owns land with a fair market value of $100,000,a building with a fair market value of $75,000,and equipment with a fair market value of $25,000.These assets are used for active business conducted in Canada.Which of the following would disqualify Stick Co.from being a small business corporation?

A) Stick Co. also owns 40% of the shares of Rock Co. (a small business corporation), which have a fair market value of $20,000.

B) Stick Co. also owns shares in Leaf Co., (a public corporation), which have a fair market value of $5,000.

C) Stick Co. also has long-term investments valued at $30,000.

D) Stick Co. sold the equipment and used the funds to purchase 35% of the shares of Tree Co., a small business corporation.

A) Stick Co. also owns 40% of the shares of Rock Co. (a small business corporation), which have a fair market value of $20,000.

B) Stick Co. also owns shares in Leaf Co., (a public corporation), which have a fair market value of $5,000.

C) Stick Co. also has long-term investments valued at $30,000.

D) Stick Co. sold the equipment and used the funds to purchase 35% of the shares of Tree Co., a small business corporation.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

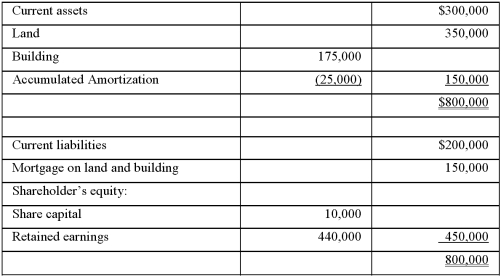

Mountain Wear Inc.(MWI)is a Canadian-controlled private corporation owned 100% by Fred Martin.The ACB of Fred's shares in MWI is $10,000.The year-end balance sheet for MWI is as follows:  Additional information is available for MWI:

Additional information is available for MWI:

The current assets consist of accounts receivables and inventory,which have costs equal to their market values.

The UCC of the building is $160,000.

The land is currently valued at $450,000.

The building has a FMV of $205,000.

Additionally:

Fred has used all of his capital gains exemption.

MWI is not associated with any other corporations for tax purposes.

Fred has recently been offered $450,000 for his shares by a local competitor.

Fred is in a 45% tax bracket.

Due to the timing of the sale,if assets are sold,the small business deduction will be available.

Assume a 15% tax rate on earnings subject to the small business deduction.

Assume a combined 44 2/3% tax rate on corporate investment income.

Required:

A)Calculate the after-tax proceeds of the sale if the shares of MWI are sold.

B)Calculate the amount of proceeds available for distribution if the assets of MWI are sold.

C)If the proceeds are distributed in a wind-up,what type of taxes will Fred be subject to? (It is not necessary to show calculations for this part of the question.)

Additional information is available for MWI:

Additional information is available for MWI:The current assets consist of accounts receivables and inventory,which have costs equal to their market values.

The UCC of the building is $160,000.

The land is currently valued at $450,000.

The building has a FMV of $205,000.

Additionally:

Fred has used all of his capital gains exemption.

MWI is not associated with any other corporations for tax purposes.

Fred has recently been offered $450,000 for his shares by a local competitor.

Fred is in a 45% tax bracket.

Due to the timing of the sale,if assets are sold,the small business deduction will be available.

Assume a 15% tax rate on earnings subject to the small business deduction.

Assume a combined 44 2/3% tax rate on corporate investment income.

Required:

A)Calculate the after-tax proceeds of the sale if the shares of MWI are sold.

B)Calculate the amount of proceeds available for distribution if the assets of MWI are sold.

C)If the proceeds are distributed in a wind-up,what type of taxes will Fred be subject to? (It is not necessary to show calculations for this part of the question.)

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Sam Sherwood wishes to purchase Kitchen Cabinets,Inc.(KCI),from its sole shareholder,Steve Oaks.Which of the following is TRUE if Sam purchases the assets rather than the shares of the corporation?

A) Payment of the purchase price will flow directly to Steve Oaks.

B) Sam will have no choice but to assume the liabilities of KCI.

C) Kitchen Cabinets Inc. may be subject to business income and capital gains.

D) Sam will have to acquire all of the assets of KCI.

A) Payment of the purchase price will flow directly to Steve Oaks.

B) Sam will have no choice but to assume the liabilities of KCI.

C) Kitchen Cabinets Inc. may be subject to business income and capital gains.

D) Sam will have to acquire all of the assets of KCI.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

Identify the tax effects for 1)the vendor and 2)the purchaser when a business divestiture and acquisition involves a)the sale of assets,and b)the sale of shares.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

A purchaser has agreed to purchase all of the shares of Tee Co.,a CCPC.Tee Co.owns fifteen significant capital assets,some of which have appreciated in value.Which of the following is TRUE?

A) The purchaser will obtain a cost base of the assets equal to fair market value.

B) The capital cost allowance on the assets will be higher for the purchaser than it was for the vendor.

C) The sale will result in business income for the vendor.

D) The purchaser will be responsible for the liabilities of Tee Co.

A) The purchaser will obtain a cost base of the assets equal to fair market value.

B) The capital cost allowance on the assets will be higher for the purchaser than it was for the vendor.

C) The sale will result in business income for the vendor.

D) The purchaser will be responsible for the liabilities of Tee Co.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck