Deck 16: Limited Partnerships and Joint Ventures

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 16: Limited Partnerships and Joint Ventures

1

A friend of yours is considering entering into a joint venture but knows very little about this form of business structure.You have been asked to provide the following information:

A)What is the purpose of a joint venture?

B)How are joint ventures taxed?

C)Give an example of a joint venture.

A)What is the purpose of a joint venture?

B)How are joint ventures taxed?

C)Give an example of a joint venture.

A)The purpose of a joint venture is to carry out a single transaction or to engage in an activity of limited duration.

B)A joint venture is not a separate taxable entity.The income from a joint venture is distributed to its members,and members can individually choose the timing and use of some expenses,such as CCA and doubtful accounts.

C)Examples of joint ventures are: construction projects,resource exploration activities,research and development projects,entertainment projects-i.e.movies,concerts,and plays

B)A joint venture is not a separate taxable entity.The income from a joint venture is distributed to its members,and members can individually choose the timing and use of some expenses,such as CCA and doubtful accounts.

C)Examples of joint ventures are: construction projects,resource exploration activities,research and development projects,entertainment projects-i.e.movies,concerts,and plays

2

While partnerships and joint ventures have some similarities,they have significant differences.Which of the following is FALSE with regard to partnerships and joint ventures?

A) Neither joint ventures nor partnerships are separate taxable entities.

B) All partners in a partnership are subject to the same CCA decision in a given tax year, while members of a joint venture may each decide their own amount of CCA to be deducted.

C) Partners in a partnership and members of a joint venture are both restricted to their profit-sharing ratio of the $500,000 small business deduction limit.

D) Joint ventures are more limited in their use than partnerships, although they have more flexibility with regard to their tax decisions.

A) Neither joint ventures nor partnerships are separate taxable entities.

B) All partners in a partnership are subject to the same CCA decision in a given tax year, while members of a joint venture may each decide their own amount of CCA to be deducted.

C) Partners in a partnership and members of a joint venture are both restricted to their profit-sharing ratio of the $500,000 small business deduction limit.

D) Joint ventures are more limited in their use than partnerships, although they have more flexibility with regard to their tax decisions.

C

3

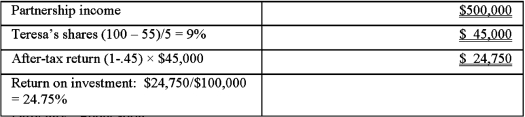

Teresa White is one of 5 equal limited partners in House Designs Enterprises (HDE).She contributed $100,000 five years ago when the enterprise began.During the year,HDE generated pre-tax profits of $500,000.The sole general partner,Betty Carmel,receives 55% of the company's profits.Both Teresa and Betty are subject to a 45% marginal personal tax rate.

Required:

Calculate Teresa's after-tax rate of return on her investment.

Required:

Calculate Teresa's after-tax rate of return on her investment.

4

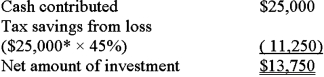

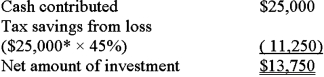

Steven Howe invested $25,000 as an outside passive investor in a limited partnership.His partnership interest is 30%.During the first year,the partnership had a business loss of $100,000.Steven is in a 45% tax bracket.What was the net amount of Steven's investment at the end of the year?

A) $11,250

B) $11,500

C) $13,500

D) $13,750

A) $11,250

B) $11,500

C) $13,500

D) $13,750

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

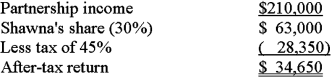

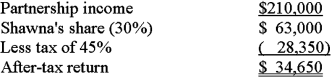

Three Hills Partnership had profits of $210,000 in 20X1.Shawna Hill had invested $100,000 as a limited partner,and her partnership interest is 30%.Shawna is in a 45% tax bracket.What is Shawna's after-tax return on her investment in the partnership? (Rounded)

A) 30%

B) 35%

C) 48%

D) 63%

A) 30%

B) 35%

C) 48%

D) 63%

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Wayne and Wendy are equal partners in ABC Windows.Wayne is a general partner and Wendy is a limited partner.Both partners have invested $20,000 in the company.ABC Windows experienced a loss of $50,000 this year.Which of the following statements regarding this loss is TRUE?

A) Wayne may claim a loss for tax purposes of $25,000 this year.

B) Wendy may claim a loss for tax purposes of $25,000 this year.

C) Wayne may claim a loss for tax purposes of $50,000 this year.

D) Wendy may claim a loss for tax purposes of $50,000 this year.

A) Wayne may claim a loss for tax purposes of $25,000 this year.

B) Wendy may claim a loss for tax purposes of $25,000 this year.

C) Wayne may claim a loss for tax purposes of $50,000 this year.

D) Wendy may claim a loss for tax purposes of $50,000 this year.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

An outside passive investor has $50,000 to invest in a limited partnership.The individual will be one of several limited partners in the business.The business is not expected to make a profit for at least five years,and there is a chance that it may not succeed at all due to its nature.Why has the investor most likely chosen to invest in this business?

A) The investor will be guaranteed to receive the $50,000 back if the venture fails.

B) The flow-through of losses is an important issue for the investor.

C) The investor is not in a hurry to recover his/her investment.

D) None of the above. An investor would never choose to invest in such a business.

A) The investor will be guaranteed to receive the $50,000 back if the venture fails.

B) The flow-through of losses is an important issue for the investor.

C) The investor is not in a hurry to recover his/her investment.

D) None of the above. An investor would never choose to invest in such a business.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Jerome has a 10% interest in a limited partnership.The adjusted cost base of Jerome's partnership interest at the beginning of 20X0 was $30,000.During 20X0 the partnership reported a $10,000 taxable capital gain and $150,000 in business income.At the end of 20X0 Jerome had an outstanding loan balance of $10,000 with the partnership.

Required:

Determine Jerome's "at-risk amount" at the end of 20X0.

Required:

Determine Jerome's "at-risk amount" at the end of 20X0.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck