Deck 15: Partnerships

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 15: Partnerships

1

ABC Co.and XYZ Co.have entered into a 50/50 partnership for business purposes.Both companies are CCPCs and they share the profits and losses of the business equally.During the year,the partnership earned $200,000 of active business income,and ABC Co.earned $450,000 in business income from operations other than the partnership.All of the companies have a December 31st year-end.How much of ABC Co.'s share of the partnership profits will be eligible for the small business deduction.

A) $200,000

B) $100,000

C) $50,000

D) $0

A) $200,000

B) $100,000

C) $50,000

D) $0

C

2

Small Corp.and Big Corp.are equal partners in Medium Enterprises.The total partnership has a net worth of $210,000,split 50/50 between the two corporations.Size Co.has been asked to join the partnership.When the transaction is complete,all three partners will have an equal interest.To accomplish this structural change,Size Co.will contribute $105,000 to the partnership treasury.This transaction which

A) dilute the original partners' interests.

B) increase the original partners' interests.

C) result in a capital gain for the partners.

D) result in a capital loss for the partners.

A) dilute the original partners' interests.

B) increase the original partners' interests.

C) result in a capital gain for the partners.

D) result in a capital loss for the partners.

A

3

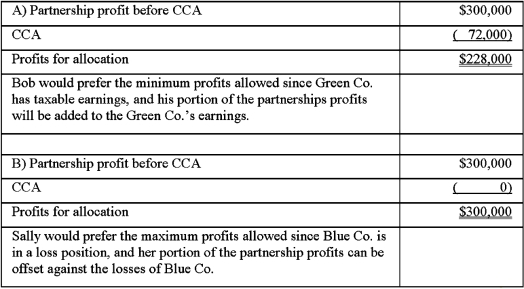

Green Co.and Blue Co.are equal partners in Turquoise Paint.Turquoise Paint had profits this year of $300,000,before CCA.

Green Co.is a CCPC owned by Bob.Green Co.'s net income for tax purposes is $200,000.

Blue Co.is a CCPC owned by Sally.Blue Co.has suffered losses over the past five years.This year Blue Co.had a loss of $150,000.Blue Co.has carry-forward non-capital losses of $200,000.

The capital cost allowance for Turquoise Paint this year is $72,000.

Required:

A)Calculate the partnership's business income for tax purposes that Bob would prefer to use,and explain why.

B)Calculate the partnership's business income for tax purposes that Sally would prefer to use,and explain why.

Green Co.is a CCPC owned by Bob.Green Co.'s net income for tax purposes is $200,000.

Blue Co.is a CCPC owned by Sally.Blue Co.has suffered losses over the past five years.This year Blue Co.had a loss of $150,000.Blue Co.has carry-forward non-capital losses of $200,000.

The capital cost allowance for Turquoise Paint this year is $72,000.

Required:

A)Calculate the partnership's business income for tax purposes that Bob would prefer to use,and explain why.

B)Calculate the partnership's business income for tax purposes that Sally would prefer to use,and explain why.

4

Sharon is a forty percent partner in Green Nursery.She also works full-time as an engineer,earning a gross salary of $100,000,annually.Green Nursery's net income for tax purposes is $210,000.During the year,Green Nursery received $10,000 in non-eligible dividends from a CCPC.The company sold a capital asset and recognized a gain of $16,000.(The dividend income and capital gains income have been included in the net income.)Sharon withdrew $20,000 from the partnership.The ACB of Sharon's partnership interest was $75,000 at the end of the previous year.

Required:

A)Calculate the partnership's business income for 2013.

B)Calculate Sharon's net income for tax purposes for 2013.

C)Calculate the ACB of Sharon's partnership interest for the year for 2013.

Required:

A)Calculate the partnership's business income for 2013.

B)Calculate Sharon's net income for tax purposes for 2013.

C)Calculate the ACB of Sharon's partnership interest for the year for 2013.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

Small Corp.and Big Corp.are equal partners in Medium Enterprises.The partnership has a net worth of $210,000,split 50/50 between the two corporations.Size Co.has been asked to join the partnership in a manner that will not have a tax consequence to the existing partners.When the transaction is complete,all three partners will have an equal interest.To accomplish this structural change,Size Co.must

A) contribute $210,000 to the partnership treasury.

B) contribute $105,000 to the partnership treasury.

C) pay $105,000 to each of the partners.

D) pay $70,000 to each of the partners.

A) contribute $210,000 to the partnership treasury.

B) contribute $105,000 to the partnership treasury.

C) pay $105,000 to each of the partners.

D) pay $70,000 to each of the partners.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements regarding partnerships is true?

A) Partners must contribute equal portions of capital to the partnership.

B) It is possible that a minority partner will have significant influence over the partnership.

C) A holding corporation cannot act as a partner.

D) A general partnership is a protected legal entity, separate from the partner's affairs.

A) Partners must contribute equal portions of capital to the partnership.

B) It is possible that a minority partner will have significant influence over the partnership.

C) A holding corporation cannot act as a partner.

D) A general partnership is a protected legal entity, separate from the partner's affairs.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

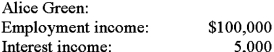

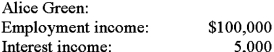

John Brown and Alice Green want to start a business together.They will have equal ownership of the company.Alice would like to know whether a partnership or a corporation would be the best form of business (in her situation),strictly from a tax perspective.Alice would not take any form of payment from the company in the first year.

The following information is available for Alice.

Assume a constant tax rate of 41%.

Assume a constant tax rate of 41%.

A loss of $25,000 is anticipated for Year 1 of the business.

The corporate tax rate is 15%.

Required:

Based solely on minimizing Alice's Year 1's tax liability,which form of business will be most beneficial to Alice? Support your answer with calculations.

The following information is available for Alice.

Assume a constant tax rate of 41%.

Assume a constant tax rate of 41%.A loss of $25,000 is anticipated for Year 1 of the business.

The corporate tax rate is 15%.

Required:

Based solely on minimizing Alice's Year 1's tax liability,which form of business will be most beneficial to Alice? Support your answer with calculations.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements regarding partnerships is TRUE?

A) Partnership income is taxed in the partnership.

B) Partnership losses cannot be offset against the partner's other income.

C) Partnership income does not have to be reported to the Canada Revenue Agency.

D) Partnerships may earn business income, property income, and capital gains.

A) Partnership income is taxed in the partnership.

B) Partnership losses cannot be offset against the partner's other income.

C) Partnership income does not have to be reported to the Canada Revenue Agency.

D) Partnerships may earn business income, property income, and capital gains.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck