Deck 5: Income From Business

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/10

Play

Full screen (f)

Deck 5: Income From Business

1

Joe invested in a piece of land seven years ago when real estate prices were rising in his area,and he hoped that the land would double in value within five years.The land remained vacant and was only used in 20X0 when Joe was approached by a businessman to rent the land for two weeks for a local carnival for a fee of $1,000.It is now 20X2 and Joe has been offered a significant sum of money for his land in response to an advertisement he placed in a local newspaper.Based on Joe's primary intention for the land,the gain on the sale would be classified as:

A) business income.

B) property income.

C) a capital gain.

D) exempt income.

A) business income.

B) property income.

C) a capital gain.

D) exempt income.

A

2

Which of the following regarding farming income is TRUE?

A) Farming income must be calculated on an accrual basis.

B) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $17,500.

C) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $21,250.

D) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $40,000.

A) Farming income must be calculated on an accrual basis.

B) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $17,500.

C) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $21,250.

D) A taxpayer who earns a full-time income as a lawyer recognized a $40,000 loss this year from her recreational farming activities. The maximum deduction allowed this year from the farm loss is $40,000.

B

3

Which of the following expenses would be denied as a deduction in the Income Tax Act?

A) Maintenance fees on a yacht at Yellow Yacht Leasing Inc.

B) Legal and accounting fees incurred during the construction of a building.

C) Advertising costs in a non-Canadian newspaper directed at an American market.

D) Work space in a home used as a taxpayer's principal place of business.

A) Maintenance fees on a yacht at Yellow Yacht Leasing Inc.

B) Legal and accounting fees incurred during the construction of a building.

C) Advertising costs in a non-Canadian newspaper directed at an American market.

D) Work space in a home used as a taxpayer's principal place of business.

B

4

Sam runs a proprietorship that generated $75,000 in profits in 20X0.Included in these profits are: a)$10,000 of amortization expense; b)$5,000 bad debt expense; c)$55,000 cost of goods sold; and $8,000 meals and entertainment with clients.Sam's capital cost allowance has been accurately calculated at $8,500 for the year.How much is Sam's business income for tax purposes?

A) $73,500

B) $75,000

C) $80,500

D) $89,000

A) $73,500

B) $75,000

C) $80,500

D) $89,000

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

5

KM Ltd.is a Canadian-controlled private corporation,operating a small gift store in Vancouver.The company has a December 31st year-end.KM's financial statements reported net income before taxes of $210,000 in 20X0.

Financial information relating to 20X0 is as follows:

Land adjacent to the gift shop was purchased with a bank loan during year for $75,000 to allow for an outdoor sales area during warm weather.Interest expense on the loan for the year was $9,600,and the cost to prepare the loan was $1,000.Both the interest and the preparation costs were expensed by KM.

The company hired a contractor to landscape the land.The $5,000 bill for the landscaping was paid in full during the year and capitalized on the Balance Sheet.

Amortization expense of $21,000 was deducted during the year.CCA of $16,000 was accurately recorded in the tax accounts,but was not transferred to the financial statements.

During the year,a new display case worth $2,000 was expensed on the books.

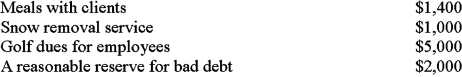

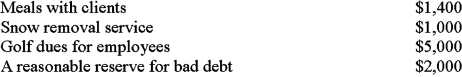

The following were also expensed during the year:

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed that day.The employee will receive the bonus in 20X1 in equal payments of $2,500,to be issued on January 30th and July 30th.

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed that day.The employee will receive the bonus in 20X1 in equal payments of $2,500,to be issued on January 30th and July 30th.

Required:

Determine KM Ltd.'s net income for tax purposes for 20X0

Financial information relating to 20X0 is as follows:

Land adjacent to the gift shop was purchased with a bank loan during year for $75,000 to allow for an outdoor sales area during warm weather.Interest expense on the loan for the year was $9,600,and the cost to prepare the loan was $1,000.Both the interest and the preparation costs were expensed by KM.

The company hired a contractor to landscape the land.The $5,000 bill for the landscaping was paid in full during the year and capitalized on the Balance Sheet.

Amortization expense of $21,000 was deducted during the year.CCA of $16,000 was accurately recorded in the tax accounts,but was not transferred to the financial statements.

During the year,a new display case worth $2,000 was expensed on the books.

The following were also expensed during the year:

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed that day.The employee will receive the bonus in 20X1 in equal payments of $2,500,to be issued on January 30th and July 30th.

On December 30th,KM's president announced a bonus to be paid to the company's key employee in the amount of $5,000,which was expensed that day.The employee will receive the bonus in 20X1 in equal payments of $2,500,to be issued on January 30th and July 30th.Required:

Determine KM Ltd.'s net income for tax purposes for 20X0

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

6

List the six general limitations to business profit determination and give an example for three of the items.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

7

Alice Smith has provided you with the following information pertaining to her 20X0 taxes:

• Her dental practice generated $110,000 in income.$35,000 of this income consisted of unbilled work in progress.There was no unbilled work in progress in the prior year.Alice has made a Section 34 election.

• Alice conducted scientific research and experimental development (SR&ED)in 20X0.She met with a CRA agent who verified that $40,000 of her expenditures were qualified SR&ED activities.These costs were treated as capital items on her financial statements.

• Alice raises sheep on her land at her home in the country.She had a farming loss of $9,000 in 20X0.

Required:

Calculate Alice's minimum net income for tax purposes for 20X0.

• Her dental practice generated $110,000 in income.$35,000 of this income consisted of unbilled work in progress.There was no unbilled work in progress in the prior year.Alice has made a Section 34 election.

• Alice conducted scientific research and experimental development (SR&ED)in 20X0.She met with a CRA agent who verified that $40,000 of her expenditures were qualified SR&ED activities.These costs were treated as capital items on her financial statements.

• Alice raises sheep on her land at her home in the country.She had a farming loss of $9,000 in 20X0.

Required:

Calculate Alice's minimum net income for tax purposes for 20X0.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

8

Ken Gray runs a small proprietorship (Ken's Fish)that specializes in fishing gear.He has provided you with the following information:

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

9

TriStar Industries was recently denied the deduction of the life insurance premiums on the life insurance policies of their key executives on its most recent tax return.Which of the following general limitations to business profit determination best describes the reason for the Canada Revenue Agency's decision?

A) exempt-income test

B) personal-expense test

C) insurance proceeds exemption

D) reserve test

A) exempt-income test

B) personal-expense test

C) insurance proceeds exemption

D) reserve test

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck

10

Determine whether the transactions concerning the following assets (shown in italics)would be classified as a)income from capital for tax purposes,b)business income for tax purposes,or c)neither; and briefly explain the reason for your decision.

Unlock Deck

Unlock for access to all 10 flashcards in this deck.

Unlock Deck

k this deck