Deck 2: Consumption, Investment and the Capital Market

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

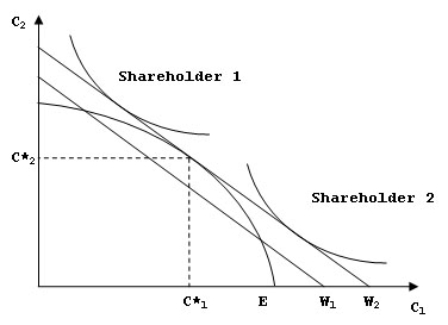

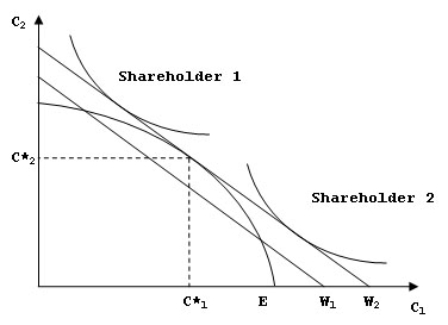

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 2: Consumption, Investment and the Capital Market

1

Given a perfect capital market and perfect certainty,the firm will always undertake a project where:

A)the future rate of return on the project is greater than the interest rate available in the capital market.

B)the future rate of return on the project is less than the interest rate available in the capital market.

C)the current rate of return on the project is less than the return available on projects undertaken by competitors.

D)the current rate of return on the project is greater than the opportunity cost of forgone consumption.

A)the future rate of return on the project is greater than the interest rate available in the capital market.

B)the future rate of return on the project is less than the interest rate available in the capital market.

C)the current rate of return on the project is less than the return available on projects undertaken by competitors.

D)the current rate of return on the project is greater than the opportunity cost of forgone consumption.

the future rate of return on the project is greater than the interest rate available in the capital market.

2

Fisher's separation theorem shows important relationships between:

A)companies and the capital market.

B)shareholders and the capital market.

C)companies and shareholders.

D)companies,their shareholders and the capital market.

A)companies and the capital market.

B)shareholders and the capital market.

C)companies and shareholders.

D)companies,their shareholders and the capital market.

companies,their shareholders and the capital market.

3

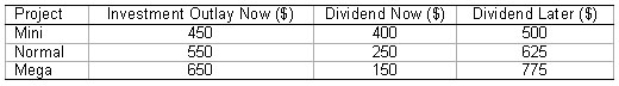

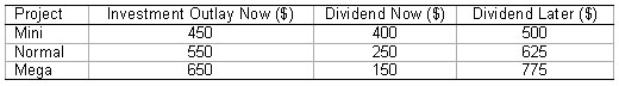

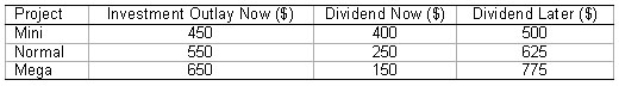

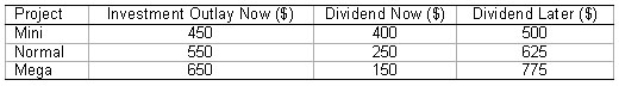

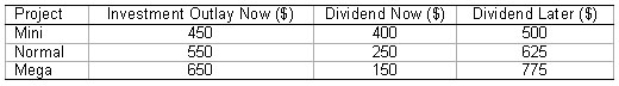

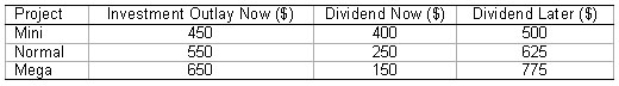

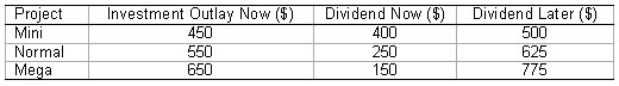

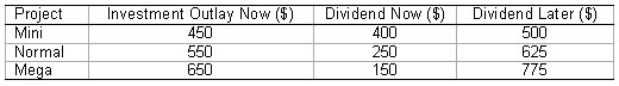

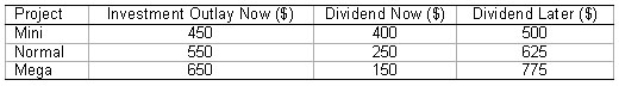

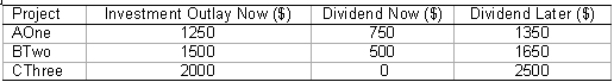

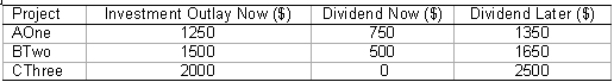

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Mega.

A)19.4%

B)19.2%

C)16.1%

D)23.1%

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Mega.

A)19.4%

B)19.2%

C)16.1%

D)23.1%

19.2%

4

When there is uncertainty,the effect on the share price due to decisions made by managers:

A)is no longer perfectly predictable.

B)can only be predicted by Fisher's separation theorem.

C)can only be predicted by the market opportunity line.

D)can be predicted by Fisher's separation theorem,but only to a limited extent.

A)is no longer perfectly predictable.

B)can only be predicted by Fisher's separation theorem.

C)can only be predicted by the market opportunity line.

D)can be predicted by Fisher's separation theorem,but only to a limited extent.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

To calculate a project's net present value (NPV),the project's required rate of return is used to:

A)compound cash flows to their future values.

B)convert future cash flows to their equivalent values today.

C)compute the weighted average cost of capital to discount the cash flows.

D)convert the non-operating cash flows into operating cash flows.

A)compound cash flows to their future values.

B)convert future cash flows to their equivalent values today.

C)compute the weighted average cost of capital to discount the cash flows.

D)convert the non-operating cash flows into operating cash flows.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

An important implication of Fisher's separation theorem is that:

A)while the level of investment will depend on management decisions (independent of shareholders' wishes),shareholders will have a preference for given levels of dividend.

B)shareholders and firm management will have separate interests and directions in decisions on investment,financing and especially dividends,and these have come to be known as an agency problem.

C)the extent to which a firm should invest can be determined by a simple rule.

D)the extent of investment undertaken will determine the amount of finance to be raised,and whether that finance will be debt or equity.

A)while the level of investment will depend on management decisions (independent of shareholders' wishes),shareholders will have a preference for given levels of dividend.

B)shareholders and firm management will have separate interests and directions in decisions on investment,financing and especially dividends,and these have come to be known as an agency problem.

C)the extent to which a firm should invest can be determined by a simple rule.

D)the extent of investment undertaken will determine the amount of finance to be raised,and whether that finance will be debt or equity.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

In Fisher's analysis of investment and consumption,the market opportunity line defines the:

A)combination of investment opportunities for the firm to increase market share and growth opportunities.

B)potential new market opportunities for the firm and new product options established by appropriate research.

C)options for consumption by the firm relative to the investment of the shareholders who own the firm.

D)Combinations of consumption possibilities consistent with the initial wealth of the investors in the firm.

A)combination of investment opportunities for the firm to increase market share and growth opportunities.

B)potential new market opportunities for the firm and new product options established by appropriate research.

C)options for consumption by the firm relative to the investment of the shareholders who own the firm.

D)Combinations of consumption possibilities consistent with the initial wealth of the investors in the firm.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

Fisher's separation theorem means that a company can make investment decisions with which:

A)no shareholders will agree.

B)most firms in the capital market will agree.

C)every shareholder will agree.

D)None of the given options as Fisher's analysis does not have any implications for the investment decision.

A)no shareholders will agree.

B)most firms in the capital market will agree.

C)every shareholder will agree.

D)None of the given options as Fisher's analysis does not have any implications for the investment decision.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

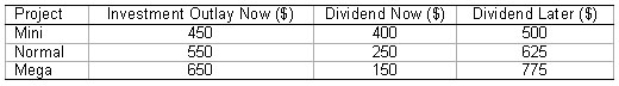

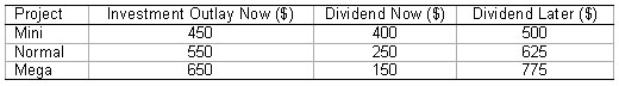

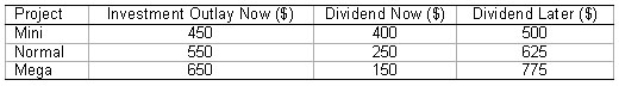

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Normal.

A)14.3%

B)120.0%

C)13.6%

D)150.0%

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Normal.

A)14.3%

B)120.0%

C)13.6%

D)150.0%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

Pursuing a goal of maximising the market value of a company's shares is easy when:

A)dividends are growing at a constant rate.

B)there is limited uncertainty.

C)there are limited market imperfections.

D)there are no market imperfections and no uncertainty.

A)dividends are growing at a constant rate.

B)there is limited uncertainty.

C)there are limited market imperfections.

D)there are no market imperfections and no uncertainty.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

What is the role of the capital market in Fisher's Theorem?

A)To ensure there is no simple decision rule that will satisfy all shareholders.

B)To increase the market interest rate.

C)To allow for a transfer between current and future resources.

D)To provide a market for companies to employ highly skilled individuals.

A)To ensure there is no simple decision rule that will satisfy all shareholders.

B)To increase the market interest rate.

C)To allow for a transfer between current and future resources.

D)To provide a market for companies to employ highly skilled individuals.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

A number of implications for investment,financing and dividend decisions can be drawn from Fisher's analysis.In terms of financing decisions Fisher's analysis states that:

A)the nominal rate is the true interest rate.

B)there is a single market interest rate.

C)the real rate is the true interest rate.

D)there are multiple market interest rates.

A)the nominal rate is the true interest rate.

B)there is a single market interest rate.

C)the real rate is the true interest rate.

D)there are multiple market interest rates.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

The curve showing a set of combinations that an individual derives equal utility from any combinations in the set is the:

A)indifference curve.

B)production possibilities curve.

C)production frontier curve.

D)differential curve.

A)indifference curve.

B)production possibilities curve.

C)production frontier curve.

D)differential curve.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

The line that shows the combinations of current and future consumption that an individual can achieve from a given wealth level using capital market transactions is the:

A)capital market line.

B)market opportunity line.

C)market line.

D)consumption opportunity line.

A)capital market line.

B)market opportunity line.

C)market line.

D)consumption opportunity line.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

In Fisher's analysis of investment and consumption,the participants include:

A)the firm's finance director,the firm's banker and the stock exchange.

B)the firm's management,market analysts and the financial press.

C)the firm's management,the firm's owners (shareholders)and the capital market.

D)the firm's general manager,the firm's finance director,and the capital market.

A)the firm's finance director,the firm's banker and the stock exchange.

B)the firm's management,market analysts and the financial press.

C)the firm's management,the firm's owners (shareholders)and the capital market.

D)the firm's general manager,the firm's finance director,and the capital market.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

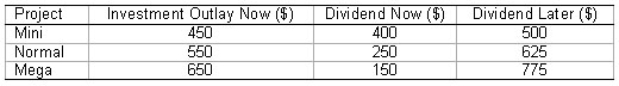

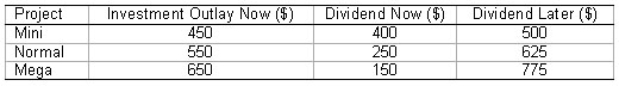

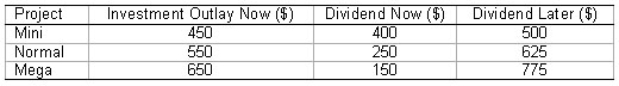

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Mini.

A)11.1%

B)0%

C)25%

D)-20%

Assume that the interest rate in the capital market is 12 per cent per period.Calculate the rate of return on Project Mini.

A)11.1%

B)0%

C)25%

D)-20%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

Under Fisher's separation theorem,the key factor that affects the way in which financial decisions are made is that:

A)it is critical that there are effective capital markets in place to allow firms to borrow from those lenders who choose the greater security of debt rather than equity.

B)regardless of an individual shareholder's preference between investment and consumption,there is an identifiable single decision for the firm that all shareholders will support.

C)shareholders are effectively separated from all decisions of the firm,in that they have no interest in the outcome of those decisions.

D)each and every shareholder's preference between investment and consumption is effectively separate in determining the activities of the firm.

A)it is critical that there are effective capital markets in place to allow firms to borrow from those lenders who choose the greater security of debt rather than equity.

B)regardless of an individual shareholder's preference between investment and consumption,there is an identifiable single decision for the firm that all shareholders will support.

C)shareholders are effectively separated from all decisions of the firm,in that they have no interest in the outcome of those decisions.

D)each and every shareholder's preference between investment and consumption is effectively separate in determining the activities of the firm.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

The curve that displays the investment opportunities and outcomes available to the company is the:

A)production probability curve.

B)production cost curve.

C)production possibilities curve.

D)production value curve.

A)production probability curve.

B)production cost curve.

C)production possibilities curve.

D)production value curve.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

The assumed overall financial objective of a company is to:

A)raise capital.

B)reduce debt.

C)maximise profits.

D)maximise the market value of its ordinary shares.

A)raise capital.

B)reduce debt.

C)maximise profits.

D)maximise the market value of its ordinary shares.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

A company has $25 million in cash and the interest rate is 12%.The company has decided to invest $20 million in assets,and the investment has a net present value of $5 million.What is the wealth of the company's shareholders immediately after the investment plan is announced?

A)$30 million.

B)$10 million.

C)$28 million.

D)$25 million.

A)$30 million.

B)$10 million.

C)$28 million.

D)$25 million.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

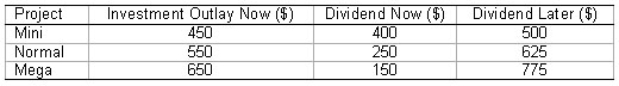

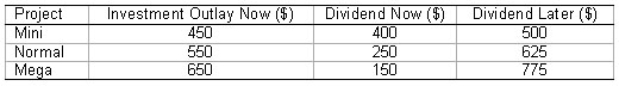

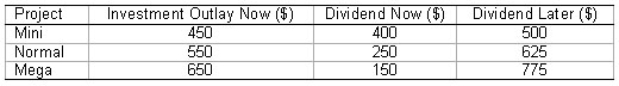

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period,and that the company has four equal shareholders (A,B,C and D).Also assume the company has chosen Projects Normal and Mega for investment.Suppose Shareholder B wishes to consume $165 now.What is his required repayment in the later period?

A)$65

B)$165

C)$72.80

D)$184.80

Assume that the interest rate in the capital market is 12 per cent per period,and that the company has four equal shareholders (A,B,C and D).Also assume the company has chosen Projects Normal and Mega for investment.Suppose Shareholder B wishes to consume $165 now.What is his required repayment in the later period?

A)$65

B)$165

C)$72.80

D)$184.80

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Fisher's separation theorem means that:

A)a company can make an investment decision even if all shareholders do not agree.

B)a company should invest beyond the point where the net present value of the marginal unit of investment is zero.

C)a company should invest up to a point where the rate of return on the marginal unit of investment equals the market interest rate.

D)none of the given options is correct.

A)a company can make an investment decision even if all shareholders do not agree.

B)a company should invest beyond the point where the net present value of the marginal unit of investment is zero.

C)a company should invest up to a point where the rate of return on the marginal unit of investment equals the market interest rate.

D)none of the given options is correct.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Also assume that the company has four equal shareholders (A,B,C and D).Will the shareholders support the company's decision to invest in Projects Normal and Mega instead of just Project Mega?

A)No,only Shareholder B will support such a decision.

B)We cannot tell,as no information has been provided with regards to the consumption choices of Shareholders C and D

C)Both Shareholders A and B will support this decision but we need to know the consumption choices of Shareholders C and D before being able to identify their preferences.

D)All the shareholders will support the company's decision.

Assume that the interest rate in the capital market is 12 per cent per period.Also assume that the company has four equal shareholders (A,B,C and D).Will the shareholders support the company's decision to invest in Projects Normal and Mega instead of just Project Mega?

A)No,only Shareholder B will support such a decision.

B)We cannot tell,as no information has been provided with regards to the consumption choices of Shareholders C and D

C)Both Shareholders A and B will support this decision but we need to know the consumption choices of Shareholders C and D before being able to identify their preferences.

D)All the shareholders will support the company's decision.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

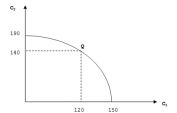

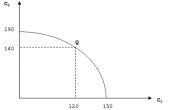

Consider the following production possibilities curve:

Point Q represents:

A)an intermediate case in which a dividend of 30 units is paid at Time 1.

B)an intermediate case in which 30 units is invested at Time 1.

C)an intermediate case in which a dividend of 50 units is paid at Time 2.

D)none of the given options.

Point Q represents:

A)an intermediate case in which a dividend of 30 units is paid at Time 1.

B)an intermediate case in which 30 units is invested at Time 1.

C)an intermediate case in which a dividend of 50 units is paid at Time 2.

D)none of the given options.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

Fama (1970)outlines the sufficient conditions in order for all shareholders to agree about the exact nature of uncertainty.Which of the following statements is not one of the specified sufficient conditions?

A)There are no transaction costs in trading securities.

B)All agree on the implication of current information for the future price and distributions of future prices of each security.

C)All information is costlessly available to all market participants.

D)None of the given options.

A)There are no transaction costs in trading securities.

B)All agree on the implication of current information for the future price and distributions of future prices of each security.

C)All information is costlessly available to all market participants.

D)None of the given options.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

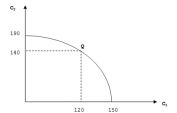

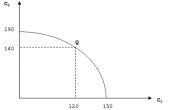

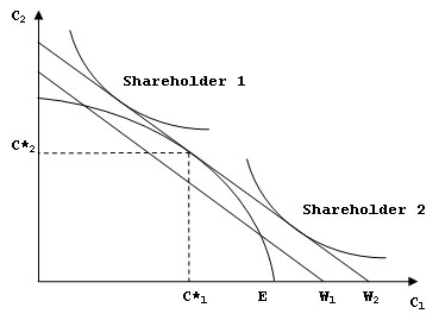

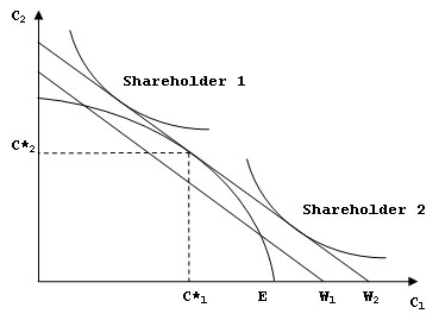

Consider the following graph.

Which of the following statements is false?

A)The Company has 150 units of resources available to it.

B)The point (150,0)represents a dividend payment of zero units at Time 1.

C)190 units would be available for consumption at Time 2 if no dividend were paid at Time 1.

D)None of the given options is false.

Which of the following statements is false?

A)The Company has 150 units of resources available to it.

B)The point (150,0)represents a dividend payment of zero units at Time 1.

C)190 units would be available for consumption at Time 2 if no dividend were paid at Time 1.

D)None of the given options is false.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

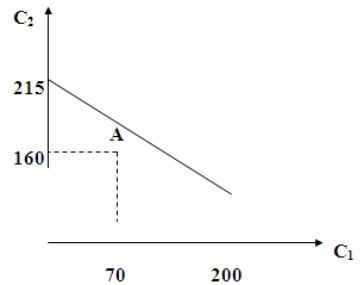

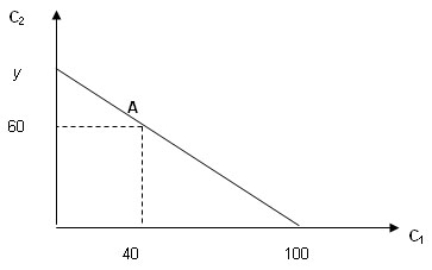

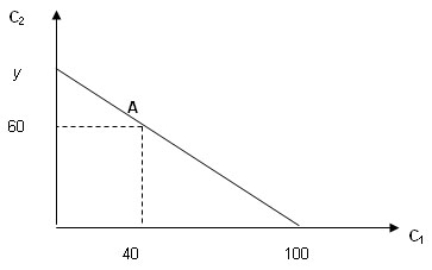

Consider the following graph:

What is the interest rate per period?

A)7.31%

B)7.14%

C)7.50%

D)25.00%

What is the interest rate per period?

A)7.31%

B)7.14%

C)7.50%

D)25.00%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Assume the company has four equal shareholders (A,B,C and D),and has chosen Project Mega for investment.Suppose Shareholder A wishes to consume $50 now.What is her required repayment in the later period?

A)$12.50

B)$56.00

C)$14.00

D)$42.00

Assume that the interest rate in the capital market is 12 per cent per period.Assume the company has four equal shareholders (A,B,C and D),and has chosen Project Mega for investment.Suppose Shareholder A wishes to consume $50 now.What is her required repayment in the later period?

A)$12.50

B)$56.00

C)$14.00

D)$42.00

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

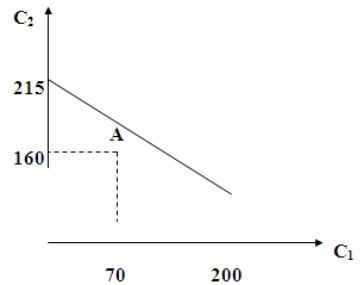

Consider the following graph:

Assume that the interest rate per period is 15 per cent.Calculate y.

A)115 units

B)106 units

C)92.17 units

D)100 units

Assume that the interest rate per period is 15 per cent.Calculate y.

A)115 units

B)106 units

C)92.17 units

D)100 units

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

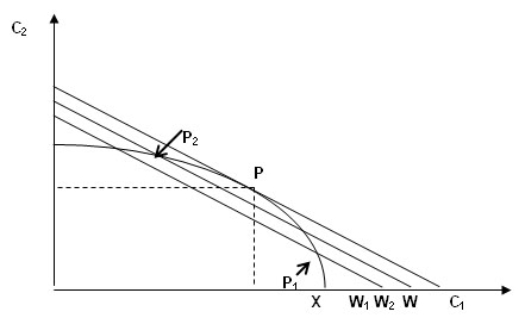

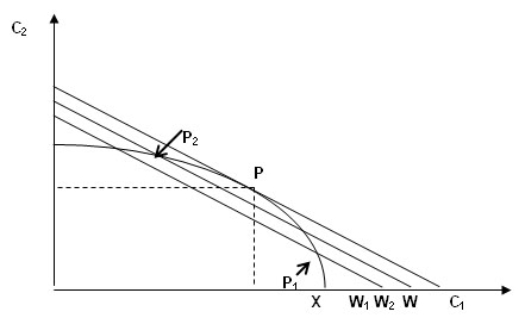

Suppose that a company has X units of resources and is considering three investment/dividend policies,P1,P2 and P.The following graph shows market opportunity lines drawn through each of these points:

The line through P1 shows that:

A)if policy P1 were adopted,the shareholders' wealth would decrease from W to W1.

B)if policy P1 were adopted,the shareholders' wealth would increase from X to W1.

C)if policy P1 were adopted,the shareholders' wealth would remain unchanged at W1.

D)none of the given options.

The line through P1 shows that:

A)if policy P1 were adopted,the shareholders' wealth would decrease from W to W1.

B)if policy P1 were adopted,the shareholders' wealth would increase from X to W1.

C)if policy P1 were adopted,the shareholders' wealth would remain unchanged at W1.

D)none of the given options.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Indifference curves are normally:

A)convex,which means they approach the horizontal axis as the level of C2 increases.

B)concave,which means they approach the vertical axis as the level of C2 increases.

C)convex,which means they approach the horizontal axis as the level of C1 increases.

D)concave,which means they approach the vertical axis as the level of C1 increases.

A)convex,which means they approach the horizontal axis as the level of C2 increases.

B)concave,which means they approach the vertical axis as the level of C2 increases.

C)convex,which means they approach the horizontal axis as the level of C1 increases.

D)concave,which means they approach the vertical axis as the level of C1 increases.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.Also assume the company has four equal shareholders (A,B,C and D),and has chosen Project Mega for investment.What amounts will Shareholder A have to finance her consumption in the later period,after consuming $50 in the first period?

A)$151.75

B)$181.25

C)$193.75

D)$179.75

Assume that the interest rate in the capital market is 12 per cent per period.Also assume the company has four equal shareholders (A,B,C and D),and has chosen Project Mega for investment.What amounts will Shareholder A have to finance her consumption in the later period,after consuming $50 in the first period?

A)$151.75

B)$181.25

C)$193.75

D)$179.75

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.What is the NPV of Project Mini?

A)($92.86)

B)($3.57)

C)$396.43

D)$4.06

Assume that the interest rate in the capital market is 12 per cent per period.What is the NPV of Project Mini?

A)($92.86)

B)($3.57)

C)$396.43

D)$4.06

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following correctly represents the equation of a market opportunity line?

A)C1 = [W1(1 + i)+ C2]/(1 + i)

B)C1(1 + i)= W1(1 + i)+ C2

C)W1(1 + i)- C2 = C1(1 + i)

D)C2 = -W1(1 + i)+ C1(1 + i)

A)C1 = [W1(1 + i)+ C2]/(1 + i)

B)C1(1 + i)= W1(1 + i)+ C2

C)W1(1 + i)- C2 = C1(1 + i)

D)C2 = -W1(1 + i)+ C1(1 + i)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.What is the NPV of Project Normal?

A)$66.96

B)$75.00

C)$8.04

D)$258.04

Assume that the interest rate in the capital market is 12 per cent per period.What is the NPV of Project Normal?

A)$66.96

B)$75.00

C)$8.04

D)$258.04

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is false?

A)If there is only one market interest rate,then the value of the company and the wealth of its shareholders are independent of the company's capital structure.

B)If any one point on a market opportunity line is attainable,then all other points on the line are also attainable by borrowing or lending.

C)The dividend decision does not affect shareholders' wealth,provided that the company does not alter its investment decision.

D)None of the given options.

A)If there is only one market interest rate,then the value of the company and the wealth of its shareholders are independent of the company's capital structure.

B)If any one point on a market opportunity line is attainable,then all other points on the line are also attainable by borrowing or lending.

C)The dividend decision does not affect shareholders' wealth,provided that the company does not alter its investment decision.

D)None of the given options.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Which statement is false with respect to the decision rule: accept a project if and only if [Return at Time 2 / (1 + i)- Δ] > 0?

A)The decision rule is completely consistent with Fisher's separation theorem.

B)The decision rule is the same as the net present value rule.

C)A company that always applies the decision rule to its investment decisions will be able to locate the optimal investment/dividend policy and will maximise the wealth of its shareholders.

D)None of the given options.

A)The decision rule is completely consistent with Fisher's separation theorem.

B)The decision rule is the same as the net present value rule.

C)A company that always applies the decision rule to its investment decisions will be able to locate the optimal investment/dividend policy and will maximise the wealth of its shareholders.

D)None of the given options.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

The slope of a market opportunity line is given by:

A)-(1 + i)

B)C1 /(1 + i)

C)C2 + C1(1 + i)

D)-C1 /(1 + i)

A)-(1 + i)

B)C1 /(1 + i)

C)C2 + C1(1 + i)

D)-C1 /(1 + i)

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period.The optimal decision would be to accept:

A)Project Mini.

B)Project Mega.

C)Projects Mini and Normal.

D)Projects Normal and Mega.

Assume that the interest rate in the capital market is 12 per cent per period.The optimal decision would be to accept:

A)Project Mini.

B)Project Mega.

C)Projects Mini and Normal.

D)Projects Normal and Mega.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

Consider the following set of indifference curves:

Investment Y is:

A)preferred to Investments X and Z and is as desirable as Investment W.

B)preferred to Investment W,but is inferior to Investments X and Z.

C)preferred to Investments X and Z,but is inferior to Investment W.

D)preferred to Investments X and Z,which provide an investor with equal utility,and is preferred to Investment W.

Investment Y is:

A)preferred to Investments X and Z and is as desirable as Investment W.

B)preferred to Investment W,but is inferior to Investments X and Z.

C)preferred to Investments X and Z,but is inferior to Investment W.

D)preferred to Investments X and Z,which provide an investor with equal utility,and is preferred to Investment W.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

A company can make optimal decisions to the benefit of all shareholders if they use the _________________ rule to analyse investment proposals.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

An indifference curve represents a set of possible consumption outcomes,which yields equal utility to the individual.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

In practice,managers are unable to predict with certainty the impact that a particular decision will have on a company's share price.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

Consider the following diagram:

In this diagram,if the optimal policy is chosen,the company invests the amount:

A)W1-E

B)W1-C*1

C)E-C*1

D)W2-E

In this diagram,if the optimal policy is chosen,the company invests the amount:

A)W1-E

B)W1-C*1

C)E-C*1

D)W2-E

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

B1 and B2 are equal shareholders in the company Banana Inc.They have each invested $200 in the company.The following graph shows on a per shareholder basis the production possibilities curve,B1 and B2's indifference curves and the market opportunity line.

(a)What is the interest rate?

(b)How much is invested by the company at the optimal point?

(c)Assuming that the company invests at the optimal point,complete the following table (where applicable)for shareholder B1. (d)Assuming that the company invests at the optimal point,complete the following table (where applicable)for B2.

(d)Assuming that the company invests at the optimal point,complete the following table (where applicable)for B2.

(a)What is the interest rate?

(b)How much is invested by the company at the optimal point?

(c)Assuming that the company invests at the optimal point,complete the following table (where applicable)for shareholder B1.

(d)Assuming that the company invests at the optimal point,complete the following table (where applicable)for B2.

(d)Assuming that the company invests at the optimal point,complete the following table (where applicable)for B2.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

The shape of the production possibilities curve determines the combinations of current dividend,investment and future dividend that a company can achieve.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the following diagram:

In the diagram,if the optimal policy is chosen then shareholder 2,with the lower indifference curve,will optimise her consumption by:

A)lending in the second period and borrowing in the first period.

B)borrowing in the first period and repaying in the second period.

C)lending in the first period and recieving in the second period.

D)borrowing in the first period and recieving in the second period.

In the diagram,if the optimal policy is chosen then shareholder 2,with the lower indifference curve,will optimise her consumption by:

A)lending in the second period and borrowing in the first period.

B)borrowing in the first period and repaying in the second period.

C)lending in the first period and recieving in the second period.

D)borrowing in the first period and recieving in the second period.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

In the absence of _______________ companies are unable to make decisions about dividend policy that will please all share holders.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Fisher's separation theorem has no implications for the investment decision.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Fisher's separation theorem assumes markets have imperfections.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

If a project costs $700 and is expected to return $790 to shareholders in one years time,then the rate of return on the investment is 12.86%.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

An _______________ is a curve that shows a set of combinations such that an individual derives equal utility from any combination in the set.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

The market opportunity line indicates the preferences of individuals for a given level of wealth.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

The AlhpaBeta company is considering considering several investment opportunities.The interest rate for both borrowing and lending is 15 per cent per period and the investment/dividend opportunities are given in the following table:

(a)What is the net present value of each project?

(b)Based on the NPV rule which project(s)should the company invest in?

(c)What is the IRR of project AOne?

(d)The company has 2 equal shareholders,Alpha and Beta,and invests in the project CThree.Alpha would prefer to consume $500 today.What can she do? How much will she be able to consume later?

(a)What is the net present value of each project?

(b)Based on the NPV rule which project(s)should the company invest in?

(c)What is the IRR of project AOne?

(d)The company has 2 equal shareholders,Alpha and Beta,and invests in the project CThree.Alpha would prefer to consume $500 today.What can she do? How much will she be able to consume later?

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Share prices change as a result of investors' reaction to _________ provided through investment,financing and dividend decisions made by the managers of a company.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

According to Fisher's Theorem,provided that the company does not alter its investment decision,the dividend decision does not affect _______________________.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck