Deck 5: Employer Payroll Taxes and Labor Planning

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 5: Employer Payroll Taxes and Labor Planning

1

Form 940 is the report of tax liability for monthly schedule depositors.

False

2

PCD Inc.operates as a Nevada business.The SUTA wage base for Nevada is $27,800.PCD Inc.'s SUTA tax rate is 4.5%.The employees' annual earnings for the past calendar year are as follows: Annabelle $36,750,Beatrice $24,880,Michael $42,200,Howard $26,500

What is PCD Inc.'s SUTA tax liability for the year?

A) $5,864.85

B) $ 4,814.10

C) $6,037.82

D) $4,733.72

What is PCD Inc.'s SUTA tax liability for the year?

A) $5,864.85

B) $ 4,814.10

C) $6,037.82

D) $4,733.72

B

3

On a recent paycheck,Mayim's taxes were as follows: Federal withholding,$32;Social Security tax,$35.94;Medicare,$8.90;and state income tax,$10.50.What is the employer's share for these taxes?

A) $87.34

B) $55.34

C) $44.84

D) $35.94

A) $87.34

B) $55.34

C) $44.84

D) $35.94

C

4

Johnny's Tavern had 16 employees and total annual wages of $376,948 during the previous year.All employees earned more than $7,000 during the year.What is Johnny's Tavern's FUTA tax liability?

A) $22,616.88

B) $1,589.69

C) $7,000.00

D) $672.00

A) $22,616.88

B) $1,589.69

C) $7,000.00

D) $672.00

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

Employers who inadvertently fail to file quarterly or annual reports may be subject to monetary penalties.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

Form W-3 is the report of wages issued to independent contractors and is due to the IRS by January 31 of the following year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

What is the term for the employer's mandatory payroll taxes that the government has written into law?

A) Mandated taxes

B) Legislated deductions

C) Statutory deductions

D) Legal deductions

A) Mandated taxes

B) Legislated deductions

C) Statutory deductions

D) Legal deductions

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

FUTA tax rates vary from state to state.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

Schedule B must accompany Form 941 for a firm classified as a semi-weekly payroll tax depositor.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

Jeremiah is a full-time exempt employee who earns an annual salary of $215,000.What is the employer's annual FICA tax responsibility for Jeremiah's salary,based on an annual Social Security tax wage base of $118,500?

A) $10,464.50

B) $10,506.50

C) $16,447.50

D) $16,582.50

A) $10,464.50

B) $10,506.50

C) $16,447.50

D) $16,582.50

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

Electronic tax deposits are usually processed through the

A) AFTPS.

B) ESTPF.

C) EPS.

D) EFTPS.

A) AFTPS.

B) ESTPF.

C) EPS.

D) EFTPS.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

The time period that the IRS uses to determine a firm's payroll tax deposit schedule is called the:

A) Evaluation period.

B) Tax lookback.

C) Lookback period.

D) Prior year.

A) Evaluation period.

B) Tax lookback.

C) Lookback period.

D) Prior year.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

A firm's frequency of tax deposits is determined by payroll tax liability during the lookback period.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

Mandatory employer-paid payroll taxes are known as statutory deductions.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

A firm that had $55,650 in annual payroll tax liability during the lookback period will be a monthly schedule depositor.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

What deposit schedule must all new employers follow (unless their payroll tax liability exceeds $100,000 on any pay date)?

A) Annual

B) Monthly

C) Semi-weekly

D) Next business day

A) Annual

B) Monthly

C) Semi-weekly

D) Next business day

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following items is always the employer's sole responsibility?

A) SUTA taxes

B) FUTA taxes

C) Federal income tax

D) FICA taxes

A) SUTA taxes

B) FUTA taxes

C) Federal income tax

D) FICA taxes

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Van Buuren Enterprises had payroll tax liability of $42,450 during the lookback period.How frequently will the firm deposit its payroll taxes?

A) Monthly

B) Annually

C) Semi-weekly

D) Next Business Day

A) Monthly

B) Annually

C) Semi-weekly

D) Next Business Day

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

An employer files Form 941 on either a quarterly basis or when they deposit payroll taxes,whichever is more frequent.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Payroll taxes for which the employer is responsible for paying a percent of employee compensation include FICA taxes,federal income tax,and FUTA tax.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Which copy of Form W-2 should be retained by the employee?

A) Copy 1

B) Copy D

C) Copy 3

D) Copy C

A) Copy 1

B) Copy D

C) Copy 3

D) Copy C

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

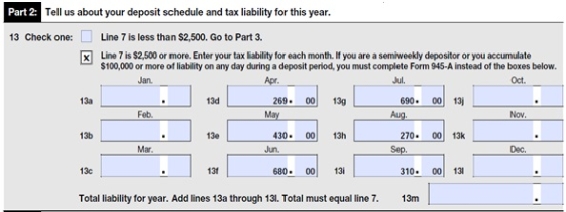

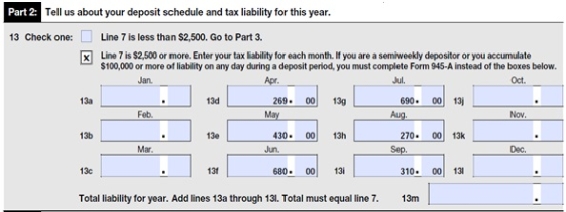

Collin's Pool Service files a Form 944 to report its payroll tax liability.Line 5 had a total of $2,648.96.Line 13m in Part 2 reported wages of $2,649.00.What needs to be done to reconcile the two amounts?

A) $0.04 needs to be added via line 6 for the current year's adjustments.

B) $0.04 needs to be subtracted via line 6 for the current year's adjustments.

C) Nothing needs to be done because both totals are correctly computed.

D) Change line 5 to match line 13m.

A) $0.04 needs to be added via line 6 for the current year's adjustments.

B) $0.04 needs to be subtracted via line 6 for the current year's adjustments.

C) Nothing needs to be done because both totals are correctly computed.

D) Change line 5 to match line 13m.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

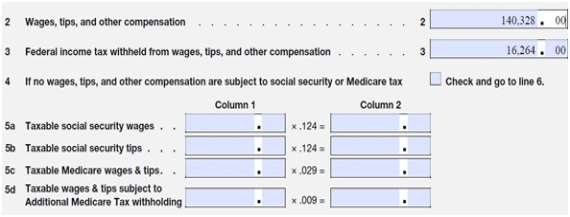

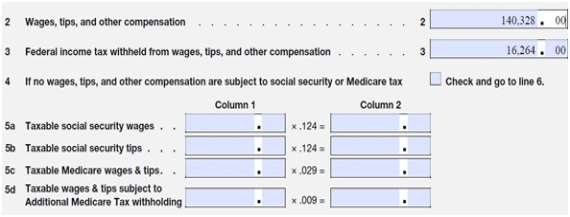

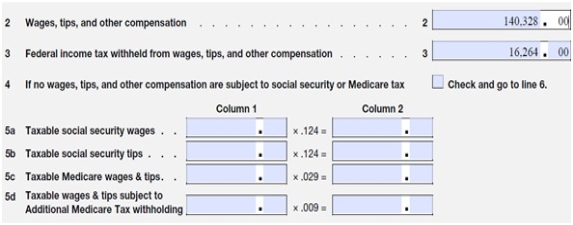

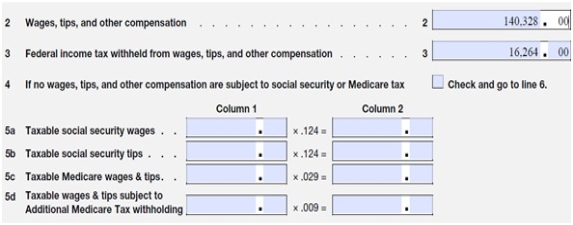

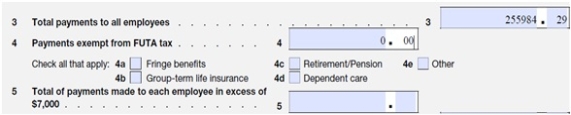

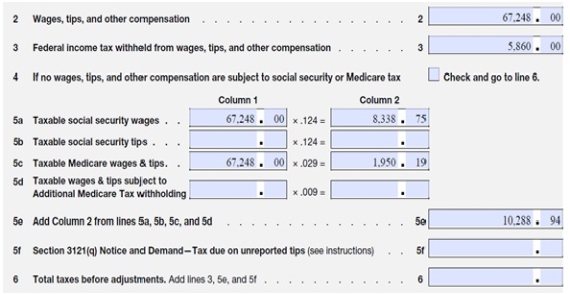

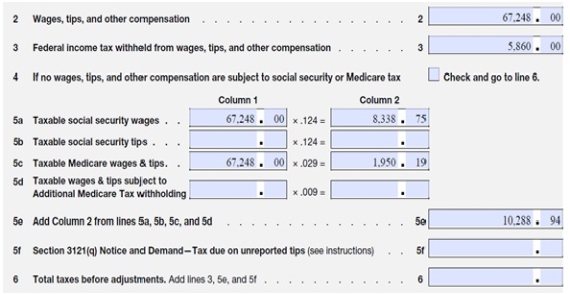

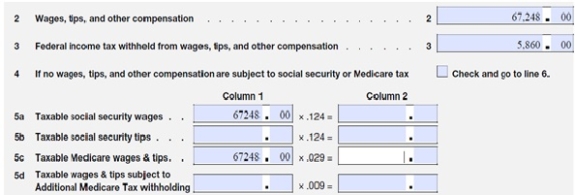

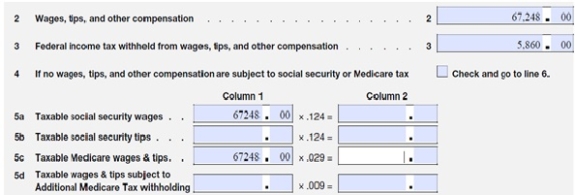

McBean Farms has the following information on their Form 941:

What amount should be entered in Column 2,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $17,400.67 and $4,069.51,respectively

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

What amount should be entered in Column 2,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $17,400.67 and $4,069.51,respectively

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

Hodgdon Industries,a semi-weekly schedule depositor,pays its employees semimonthly on the 1st and 15th of the month.Per company policy,employees are paid their annual bonuses on December 15,the final payday of the year 2016.On Thursday,December 15,the bonuses were paid and the payroll tax liability was $103,850.When are the payroll tax deposits due for the December 15 pay date?

A) Monday,December 19

B) Friday,December 23

C) Wednesday,December 21

D) Friday,December 16

A) Monday,December 19

B) Friday,December 23

C) Wednesday,December 21

D) Friday,December 16

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

Patalano's Pros is a semi-weekly schedule depositor.Which forms must they file to reconcile their payroll taxes?

A) Forms 940 and 944

B) Forms 941 and 944

C) Form 944 and Schedule B

D) Form 941 and Schedule B

A) Forms 940 and 944

B) Forms 941 and 944

C) Form 944 and Schedule B

D) Form 941 and Schedule B

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

Collin's Pool Service files a Form 944 to report its payroll tax liability.Line 5 had a total of $2,648.96.Part 2 contained the following information:

What amount belongs in box 13m?

A) $2,500.00

B) $1,379.00

C) $2,649.00

D) $2,648.96

What amount belongs in box 13m?

A) $2,500.00

B) $1,379.00

C) $2,649.00

D) $2,648.96

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

Andreosatos Enterprises has received a letter from the IRS that due to their tax liability of $1,950 during the lookback period,they are an annual depositor.Which tax form should they file to report their payroll taxes?

A) Form 940

B) Form 945

C) Form 944

D) Form 941

A) Form 940

B) Form 945

C) Form 944

D) Form 941

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

McBean Farms has the following information on their Form 941:

What amount should be entered in Column 1,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $16,264.00

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

What amount should be entered in Column 1,Lines 5a and 5c? (Assume no Section 125 health insurance and that none of the employees had exceeded the Social Security wage base. )

A) $16,264.00

B) $140,328.00

C) $8,700.34 and $2,034.76,respectively

D) $156,592

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

Van Oot's Bicycles had $19,489 of payroll tax liability during their lookback period.They pay their employees on a semimonthly basis.Assuming that no payday has a tax liability in excess of $100,000,when is their payroll tax deposit due?

A) On the last day of the current month

B) By the 10th of the following month

C) By the 15th of the following month

D) By the last day of the following month

A) On the last day of the current month

B) By the 10th of the following month

C) By the 15th of the following month

D) By the last day of the following month

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

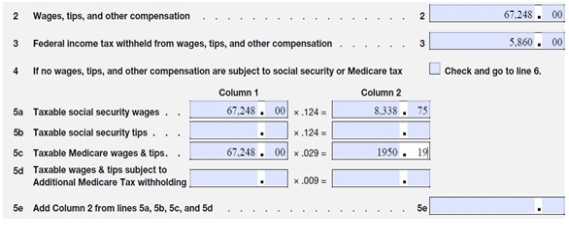

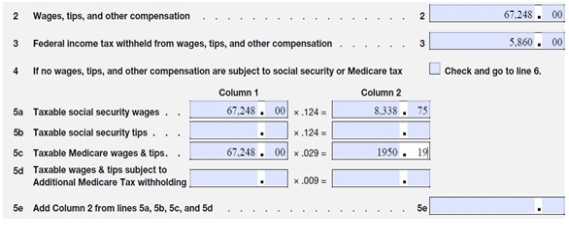

Daigneault Designs has the following amounts listed on their Form 941:

What amount belongs on line 5e?

A) $67,248.00

B) $8,338.75

C) $10,288.94

D) $5,860.00

What amount belongs on line 5e?

A) $67,248.00

B) $8,338.75

C) $10,288.94

D) $5,860.00

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

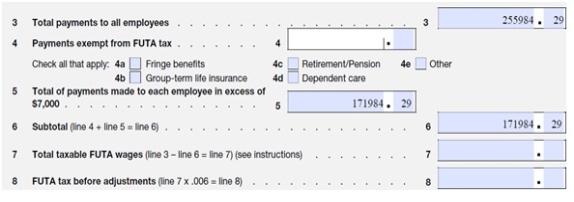

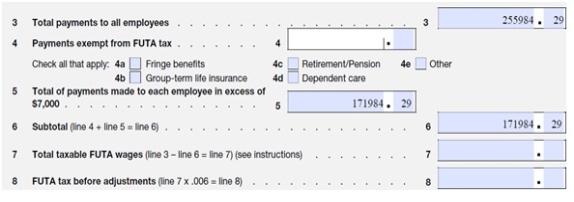

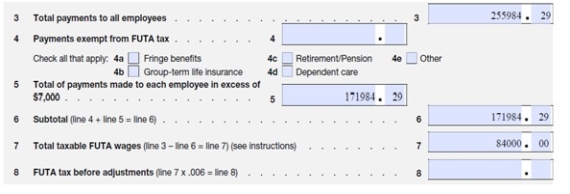

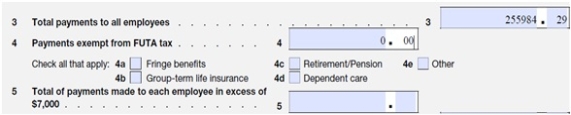

Cralic Company has 12 employees and operates in Texas.The Form 940 for the previous year contained the following information:

What amount should be entered on line 7?

A) $84,000

B) $1,535.91

C) $171,984.29

D) $1,031.91

What amount should be entered on line 7?

A) $84,000

B) $1,535.91

C) $171,984.29

D) $1,031.91

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

Kohlmeier Industries had $87,950 of annual payroll taxes during the lookback period.The firm pays its employees biweekly on Wednesdays.Assuming that no payday has a tax liability in excess of $100,000,when are the payroll tax deposits due?

A) By the end of the current month

B) Within two weeks of the pay date

C) By Friday of the current week

D) By Wednesday of the following week

A) By the end of the current month

B) Within two weeks of the pay date

C) By Friday of the current week

D) By Wednesday of the following week

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

Lesch & Sons has been and is currently a monthly schedule depositor.During the current year,they experienced an economic downturn during which the firm had to layoff all but one employee.Their payroll taxes have decreased to less than $500 per month.Which form should they file to reconcile their taxes?

A) Form 944

B) Form 943

C) Form 942

D) Form 941

A) Form 944

B) Form 943

C) Form 942

D) Form 941

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

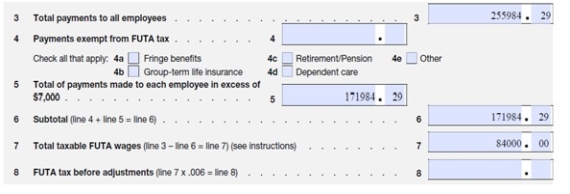

Cralic Company has 12 employees and operates in Texas.The Form 940 for the previous year contained the following information:

What amount should be entered on line 8?

A) $504.00

B) $1,008.00

C) $1,535.91

D) $1,031.91

What amount should be entered on line 8?

A) $504.00

B) $1,008.00

C) $1,535.91

D) $1,031.91

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

Annabelle is employed as an administrator for GRM Industries.She noticed that her Box 1 and Box 3 amounts on her W-2 were different.

What is a reason why the amounts in boxes 1 and 3 would be different?

A) Annabelle received tips,which are not subject to Social Security taxes.

B) Annabelle has contributed to a pre-tax 401(k)that reduced her taxable wages.

C) Annabelle changed her withholding allowances on her W-4.

D) Annabelle's wages were subject to a pre-tax garnishment.

What is a reason why the amounts in boxes 1 and 3 would be different?

A) Annabelle received tips,which are not subject to Social Security taxes.

B) Annabelle has contributed to a pre-tax 401(k)that reduced her taxable wages.

C) Annabelle changed her withholding allowances on her W-4.

D) Annabelle's wages were subject to a pre-tax garnishment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

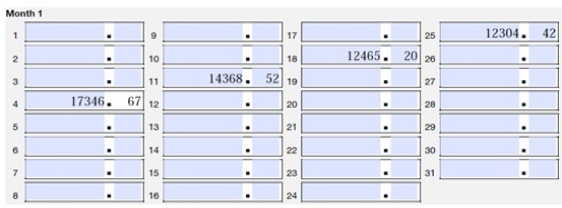

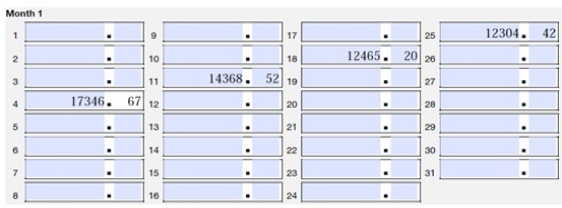

Red's Waterworks is a semiweekly depositor.One month of the recent quarter's Schedule B had the following information:

What is Red Waterworks' tax liability for Month 1?

A) $29,811.87

B) $42,116.29

C) $56,484.81

D) $39,138.14

What is Red Waterworks' tax liability for Month 1?

A) $29,811.87

B) $42,116.29

C) $56,484.81

D) $39,138.14

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

Faith,the accountant for Harris's Meats,filed Form 941 for the first quarter on May 12.The amount of taxes due to be paid with Form 941 was $8,975.The first failure to file notice was dated May 5.What is the amount that must be remitted,including the IRS penalty for the failure to file?

A) $8,975.00

B) $9,154.50

C) $9,423.75

D) $9,872.50

A) $8,975.00

B) $9,154.50

C) $9,423.75

D) $9,872.50

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

Cralic Company has 12 employees and operates in Texas.The Form 940 for the previous year contained the following information:

What amount should be entered on line 5? (Assume that all employees had exceeded the FUTA wage base. )

A) $84,000

B) $1,535.91

C) $171,984.29

D) $1,031.91

What amount should be entered on line 5? (Assume that all employees had exceeded the FUTA wage base. )

A) $84,000

B) $1,535.91

C) $171,984.29

D) $1,031.91

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

Daigneault Designs has the following amounts listed on their Form 941:

Assuming that Daigneault Designs has no tipped employees,what amount belongs on line 6?

A) $10,288.94

B) $16,148.94

C) $83,396.94

D) $20,577.89

Assuming that Daigneault Designs has no tipped employees,what amount belongs on line 6?

A) $10,288.94

B) $16,148.94

C) $83,396.94

D) $20,577.89

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

Daigneault Designs has the following amounts listed on their Form 941:

What amounts belong in Column 2,Lines 5a and 5c?

A) $4,169.38 and $1,950.19,respectively

B) $4,169.28 and $975.19,respectively

C) $8,338.75 and $1,950.19,respectively

D) $8,338.75 and $975.19,respectively

What amounts belong in Column 2,Lines 5a and 5c?

A) $4,169.38 and $1,950.19,respectively

B) $4,169.28 and $975.19,respectively

C) $8,338.75 and $1,950.19,respectively

D) $8,338.75 and $975.19,respectively

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

What factor is not included in an employee's total compensation report?

A) Federal income tax deductions

B) Paid time off like sick and vacation time

C) Health and worker's compensation insurance premiums

D) Bonuses and other incentive programs

A) Federal income tax deductions

B) Paid time off like sick and vacation time

C) Health and worker's compensation insurance premiums

D) Bonuses and other incentive programs

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

Anadama Painters has 15 employees and is located in South Dakota.The total wages for the last year was $389,458.What was the FUTA tax liability for the year? (Assume that all employees have exceeded the annual FUTA wage base of $7,000 per employee and that the FUTA rate is 0.6%. )

A) $608

B) $645

C) $630

D) $620

A) $608

B) $645

C) $630

D) $620

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

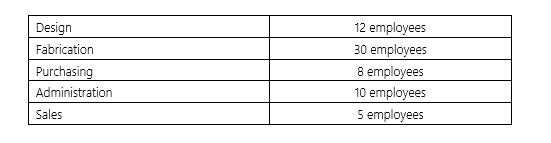

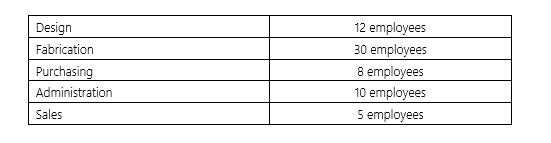

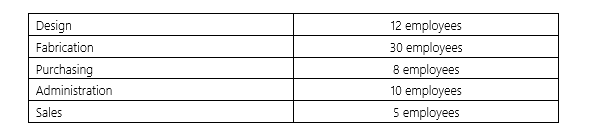

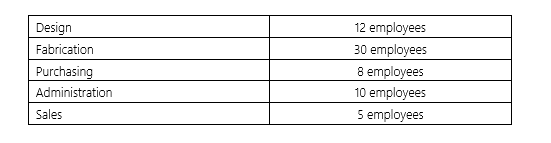

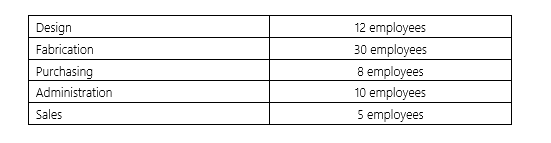

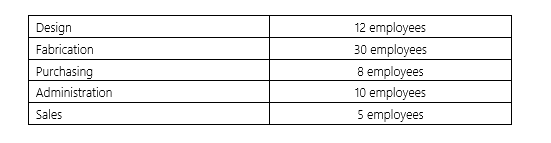

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Purchasing department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Purchasing department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $128,375.38

B) $160,469.23

C) $176,516.15

D) $120,351.92

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Purchasing department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Purchasing department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )A) $128,375.38

B) $160,469.23

C) $176,516.15

D) $120,351.92

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

Maeisha works for Brown Corporation,where she earns $45,000.Her employer contributes 1% of her pay to her pension fund and pays the following monthly amounts for her insurance: health,$300;life,$50;AD&D,$25.She receives $40 per month for her gym membership and receives a $400 bonus at the end of the year.Brown Corporation pays employer-only taxes and insurance that comprises an additional 12% of Maiesha's annual salary.What is Maeisha's total annual compensation?

A) $56,230.00

B) $54,849.30

C) $50,766.80

D) $54,451.30

A) $56,230.00

B) $54,849.30

C) $50,766.80

D) $54,451.30

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following documents could contain annual compensation report data (Select all that apply)?

A) Employee earnings report

B) Vendor invoices

C) Payroll tax reports

D) Employee questionnaires

A) Employee earnings report

B) Vendor invoices

C) Payroll tax reports

D) Employee questionnaires

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

The number of employees contained in the different departments of a company is known as the:

A) Employee concentration.

B) Department classification.

C) Labor distribution.

D) Company division.

A) Employee concentration.

B) Department classification.

C) Labor distribution.

D) Company division.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

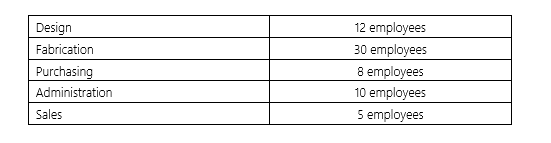

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?

A) $153,910

B) $202,850

C) $208,610

D) $260,763

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does not use departmental classification,how much is allocated to each department?A) $153,910

B) $202,850

C) $208,610

D) $260,763

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

How might a business improve its operations by generating and reviewing a benefit analysis report (Select all that apply)?

A) Incorrect departmental labor distribution

B) Awareness of employee-related costs

C) Increased departmental profitability

D) Well-designed budgets

A) Incorrect departmental labor distribution

B) Awareness of employee-related costs

C) Increased departmental profitability

D) Well-designed budgets

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

Cordelia is an employee of Snaktyme Foods in Missouri.She earns $24,000 annually.Snaktyme has provided uniforms worth $350 and training worth $850 as part of her employment.She contributes 4% to her 401(k),of which her employer matches half.Cordelia's employer pays the following monthly amounts toward her insurance: health,$125;life,$50;AD&D,$30.Snaktyme Foods pays employer-only taxes and insurance that comprises an additional 14% of Cordelia's annual salary.What is Cordelia's total annual compensation?

A) $28,000

B) $31,500

C) $29,260

D) $32,900

A) $28,000

B) $31,500

C) $29,260

D) $32,900

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

Francesca earns $2,400 per pay period.Compute the FICA taxes for both employee and employer share.What is the total FICA tax liability for Francesca's pay per pay period? (Assume that Francesca has not met the FICA wage base. )

A) $297.60

B) $332.40

C) $218.40

D) $367.20

A) $297.60

B) $332.40

C) $218.40

D) $367.20

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

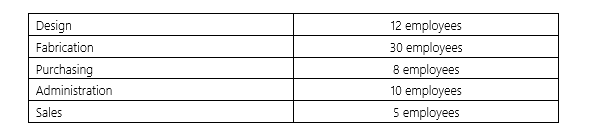

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Administration department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Administration department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $192,563.08

B) $240,703.85

C) $208,610.00

D) $160,469.23

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Administration department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Administration department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )A) $192,563.08

B) $240,703.85

C) $208,610.00

D) $160,469.23

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

John works for Heinlein Hillclimbers in Wyoming,where he earns $26,500 annually.He contributes $150 per month to his 401(k),of which his employer matches half of his contribution.Heinlein Hillclimbers contributes $150 per month to his health insurance,$30 per month to his life insurance,and $50 per month to his AD&D policy.He receives a 2% profit-sharing bonus at the end of each year and $5,250 in tuition reimbursement.Heinlein pays employer-only taxes and insurance that comprises an additional 18% of John's annual salary.What is John's total annual compensation?

A) $26,500.00

B) $39,675.25

C) $40,710.00

D) $39,633.25

A) $26,500.00

B) $39,675.25

C) $40,710.00

D) $39,633.25

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

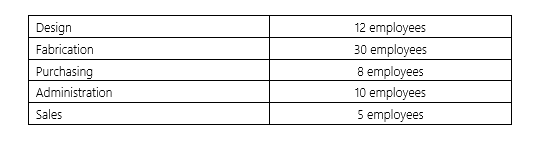

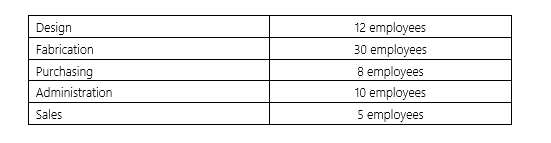

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Design department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Design department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $208,210.50

B) $192,563.08

C) $128,375.38

D) $160,469.23

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Design department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Design department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )A) $208,210.50

B) $192,563.08

C) $128,375.38

D) $160,469.23

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Sales department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Sales department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $101,429.78

B) $80,234.62

C) $64,187.69

D) $96,281.54

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Sales department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Sales department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )A) $101,429.78

B) $80,234.62

C) $64,187.69

D) $96,281.54

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

Jamie earns $232,000 annually.Compute the FICA taxes for both the employee and employer share.The Social Security wage base is $118,500.What is the total annual FICA tax liability for Jamie's pay?

A) $21,710

B) $19,270

C) $18,160

D) $17,872

A) $21,710

B) $19,270

C) $18,160

D) $17,872

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

Leah works for Toffolon Technicians in New Hampshire,where she earns $30,000 annually.She contributes 3% to her 401(k),of which her employer matches 1.5%.Her employer contributes $200 per month for her health insurance,$50 per month for her life insurance,and $25 per month for her AD&D insurance.Toffolon Technicians pays employer-only taxes and insurance that comprises an additional 15% of Leah's annual salary.What is Leah's total annual compensation?

A) $30,000

B) $34,445

C) $38,250

D) $31,467

A) $30,000

B) $34,445

C) $38,250

D) $31,467

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

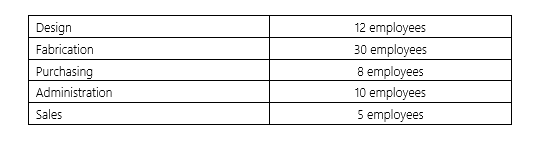

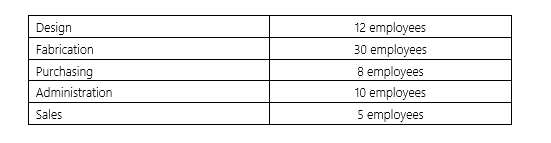

Trick's Costumes has 65 employees,who are distributed as follows:

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

A) $563,190.56

B) $401,173.10

C) $433,266.92

D) $481,407.69

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )

The payroll-related costs for the year are $1,043,050.If Trick's Costumes does use departmental classification,how much is allocated to the Fabrication department? (Do not round intermediate calculations.Round final answer to 2 decimal places. )A) $563,190.56

B) $401,173.10

C) $433,266.92

D) $481,407.69

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not an example of an employer's payroll-related business expense?

A) Tax deposits and filings

B) Voluntary deduction receipt

C) Tax withholding and matching

D) Employee compensation and accountability

A) Tax deposits and filings

B) Voluntary deduction receipt

C) Tax withholding and matching

D) Employee compensation and accountability

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following best describes the function of a benefit analysis report?

A) It is an analysis of the benefits paid to employees.

B) It is an analysis of each employee's benefit package.

C) It is an analysis of the effect of labor costs on departmental profitability.

D) It is an analysis of each department's benefit to the company.

A) It is an analysis of the benefits paid to employees.

B) It is an analysis of each employee's benefit package.

C) It is an analysis of the effect of labor costs on departmental profitability.

D) It is an analysis of each department's benefit to the company.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following tasks could use data from the Benefit Analysis Report (Select all that apply)?

A) Budgeting

B) Benchmarking

C) Departmental Reporting

D) Labor Planning

A) Budgeting

B) Benchmarking

C) Departmental Reporting

D) Labor Planning

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

The payroll tax(es)for which an employer must match the entire amount of the employee's deduction include _______________________.

A) FICA and Federal withholding tax.

B) FUTA and SUTA.

C) Social Security and Medicare (up to $118,500 and $200,000 in annual compensation respectively).

D) Federal withholding tax.

A) FICA and Federal withholding tax.

B) FUTA and SUTA.

C) Social Security and Medicare (up to $118,500 and $200,000 in annual compensation respectively).

D) Federal withholding tax.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

_________________________ allows firms to allocate costs accurately among departments.

A) Labor costing

B) Labor distribution

C) Compensation analysis

D) Benefit analysis

A) Labor costing

B) Labor distribution

C) Compensation analysis

D) Benefit analysis

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

The total of a firm's annual wages and salaries must match on Forms _________________.

A) W-2 and W-3

B) 940 and W-2

C) W-3 and 941

D) 941 and W-2

A) W-2 and W-3

B) 940 and W-2

C) W-3 and 941

D) 941 and W-2

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

Employee expenses like benefits and other non-wage compensation may amount to at least another _______________ of each employee's annual pay.

A) 40%

B) 60%

C) 70%

D) 50%

A) 40%

B) 60%

C) 70%

D) 50%

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

The IRS uses the ___________________________ to determine how often a company must deposit payroll taxes.

A) Previous year's payroll tax deposits

B) Firm's income tax filings

C) Lookback period

D) Financial statements

A) Previous year's payroll tax deposits

B) Firm's income tax filings

C) Lookback period

D) Financial statements

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

Deschutes Companies located in Oregon has a SUTA tax rate of 4.10% and a wage base of $36,900.During the last calendar year the company paid $393,750 in wages and salaries for 11 employees.What is the total of the FUTA and SUTA tax liabilities for Deschutes Companies? (Assume that all employees have exceeded the FUTA and SUTA wage bases. )

A) $17,103.90

B) $16,709.50

C) $18,323.40.

D) $15,785.60

A) $17,103.90

B) $16,709.50

C) $18,323.40.

D) $15,785.60

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

If an employer fails to make payroll tax deposits on time,the firm will be penalized if the IRS finds evidence of _____________________________.

A) Willful disregard

B) Inadvertent negligence

C) Incompetent reporting

D) Mistaken analysis

A) Willful disregard

B) Inadvertent negligence

C) Incompetent reporting

D) Mistaken analysis

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

The form that employers use to report their quarterly Federal income tax liability is _________________.

A) Form 940

B) Form 944

C) Form 943

D) Form 941

A) Form 940

B) Form 944

C) Form 943

D) Form 941

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

A benefit analysis report may be compiled to reveal _________________________.

A) Department profitability

B) Employee productivity

C) Labor distribution

D) Departmental effectiveness

A) Department profitability

B) Employee productivity

C) Labor distribution

D) Departmental effectiveness

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

A(n)_________________ reflects the total of salary/wages,bonuses,benefits,and employer paid costs in an employee's pay.

A) Financial position report

B) Employee analysis report

C) Form EM-42

D) Total compensation report

A) Financial position report

B) Employee analysis report

C) Form EM-42

D) Total compensation report

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

The payroll-related taxes that an employer must pay are known as _______________________.

A) Mandatory taxes

B) Statutory deductions

C) FICA taxes

D) FUTA taxes

A) Mandatory taxes

B) Statutory deductions

C) FICA taxes

D) FUTA taxes

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck