Deck 17: Options and Corporate Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 17: Options and Corporate Finance

1

You can realize the same value as that derived from stock ownership if you:

A)sell a put option and invest at the risk-free rate of return.

B)buy a call option and write a put option on a stock and also lend out funds at the risk-free rate.

C)sell a put and buy a call on a stock as well as invest at the risk-free rate of return.

D)lend out funds at the risk-free rate of return and sell a put option on the stock.

E)borrow funds at the risk-free rate of return and invest the proceeds in equivalent

F)amounts of put and call options.

A)sell a put option and invest at the risk-free rate of return.

B)buy a call option and write a put option on a stock and also lend out funds at the risk-free rate.

C)sell a put and buy a call on a stock as well as invest at the risk-free rate of return.

D)lend out funds at the risk-free rate of return and sell a put option on the stock.

E)borrow funds at the risk-free rate of return and invest the proceeds in equivalent

F)amounts of put and call options.

sell a put and buy a call on a stock as well as invest at the risk-free rate of return.

2

An option that may be exercised only on the expiration date is called a(n)_____ option.

A)futures

B)American

C)Bermudan

D)European

E)Asian

A)futures

B)American

C)Bermudan

D)European

E)Asian

European

3

Which one of the following statements correctly describes your situation as the owner of an American call option?

A)You are obligated to buy at a set price at any time up to and including the expiration date.

B)You have the right to sell at a set price at any time up to and including the expiration date.

C)You have the right to buy at a set price only on the expiration date.

D)You are obligated to sell at a set price if the option is exercised.

E)You have the right to buy at a set price at any time up to and including the expiration date.

A)You are obligated to buy at a set price at any time up to and including the expiration date.

B)You have the right to sell at a set price at any time up to and including the expiration date.

C)You have the right to buy at a set price only on the expiration date.

D)You are obligated to sell at a set price if the option is exercised.

E)You have the right to buy at a set price at any time up to and including the expiration date.

You have the right to buy at a set price at any time up to and including the expiration date.

4

The value of an option if it were to immediately expire,that is,its lower pricing bound,is called an option's _____ value.

A)strike

B)intrinsic

C)time

D)volatility

E)market

A)strike

B)intrinsic

C)time

D)volatility

E)market

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

Given an exercise price E,time to maturity T and European put-call parity,the present value of the strike price E plus the call option is equal to:

A)the current market value of the stock.

B)the present value of the stock minus a put option.

C)a put option minus the market value of the share of stock.

D)the value of a U.S.Treasury bill.

E)the share of stock plus the put option.

A)the current market value of the stock.

B)the present value of the stock minus a put option.

C)a put option minus the market value of the share of stock.

D)the value of a U.S.Treasury bill.

E)the share of stock plus the put option.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

The last day on which an owner of an option can elect to exercise is the _____ date.

A)ex-payment

B)ex-option

C)opening

D)expiration

E)intrinsic

A)ex-payment

B)ex-option

C)opening

D)expiration

E)intrinsic

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

A _____ is a derivative security that gives the owner the right,but not the obligation,to sell an asset at a fixed price for a specified period of time.

A)futures contract

B)call option

C)forward contract

D)swap

E)put option

A)futures contract

B)call option

C)forward contract

D)swap

E)put option

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

The effect on an option's value of a small change in the value of the underlying asset is called the option:

A)vega.

B)theta.

C)rho.

D)gamma.

E)delta.

A)vega.

B)theta.

C)rho.

D)gamma.

E)delta.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

The fixed price in an option contract at which the owner can buy or sell the underlying asset is called the option's:

A)opening price.

B)intrinsic value.

C)strike price.

D)market price.

E)time value.

A)opening price.

B)intrinsic value.

C)strike price.

D)market price.

E)time value.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

An option that grants the right,but not the obligation,to sell shares of the underlying asset on a particular date at a specified price is called:

A)either an American or a European option.

B)an American put.

C)an American call.

D)a European call.

E)a European put.

A)either an American or a European option.

B)an American put.

C)an American call.

D)a European call.

E)a European put.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

A financial contract that gives its owner the right,but not the obligation,to buy or sell a specified asset at an agreed-upon price on or before a given future date is called a(n)_____ contract.

A)swap

B)futures

C)forward

D)option

E)straddle

A)swap

B)futures

C)forward

D)option

E)straddle

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

A trading opportunity that offers a riskless profit is called a(n):

A)put option.

B)call option.

C)market equilibrium.

D)arbitrage.

E)cross-hedge.

A)put option.

B)call option.

C)market equilibrium.

D)arbitrage.

E)cross-hedge.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following provides the option of selling a stock anytime during the option period at a specified price even if the market price of the stock declines to zero?

A)American put

B)European put

C)American call

D)European call

E)either an American or a European put

A)American put

B)European put

C)American call

D)European call

E)either an American or a European put

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

The difference between an American call and a European call is that the American call:

A)has a fixed exercise price while the European exercise price can vary within a small range.

B)is a right to buy while a European call is an obligation to buy.

C)has an expiration date while the European call does not.

D)is written on 100 shares of the underlying security while the European call covers 1,000 shares.

E)can be exercised at any time up and including to the expiration date while the European call can only be exercised on the expiration date.

A)has a fixed exercise price while the European exercise price can vary within a small range.

B)is a right to buy while a European call is an obligation to buy.

C)has an expiration date while the European call does not.

D)is written on 100 shares of the underlying security while the European call covers 1,000 shares.

E)can be exercised at any time up and including to the expiration date while the European call can only be exercised on the expiration date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Jillian owns an option which gives her the right to purchase shares of WAN stock at a price of $20 a share.Currently,WAN stock is selling for $24.50.Jillian would like to profit on this stock but is not permitted to exercise her option for another two weeks.Which of the following statements apply to this situation?

I.Jillian must own a European call option.

II.Jillian must own an American put option.

III.Jillian should sell her option today if she feels the price of WAN stock will decline significantly over the next two weeks.

IV.Jillian cannot profit today from the price increase in WAN stock.

A)I and III only

B)II and IV only

C)I and IV only

D)II and III only

E)I, III, and IV only

I.Jillian must own a European call option.

II.Jillian must own an American put option.

III.Jillian should sell her option today if she feels the price of WAN stock will decline significantly over the next two weeks.

IV.Jillian cannot profit today from the price increase in WAN stock.

A)I and III only

B)II and IV only

C)I and IV only

D)II and III only

E)I, III, and IV only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

A _____ is a derivative security that gives the owner the right,but not the obligation,to buy an asset at a fixed price for a specified period of time.

A)futures contract

B)call option

C)put option

D)swap

E)forward contract

A)futures contract

B)call option

C)put option

D)swap

E)forward contract

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

The act where an owner of an option buys or sells the underlying asset is called ______ the option.

A)exercising

B)striking

C)opening

D)splitting

E)strangling

A)exercising

B)striking

C)opening

D)splitting

E)strangling

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

The relationship between the prices of the underlying stock,a call option,a put option,and a riskless asset is referred to as the _____ relationship.

A)put-call parity

B)covered call

C)protective put

D)straddle

E)strangle

A)put-call parity

B)covered call

C)protective put

D)straddle

E)strangle

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Jeff opted to exercise his August option on August 10 and received $2,500 in exchange for his shares.Jeff must have owned a(n):

A)warrant.

B)American put.

C)American call.

D)European put.

E)European call.

A)warrant.

B)American put.

C)American call.

D)European put.

E)European call.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

An option that may be exercised at any time up its expiration date is called a(n)_____ option.

A)futures

B)Asian

C)Bermudan

D)European

E)American

A)futures

B)Asian

C)Bermudan

D)European

E)American

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

The lower bound on a call's value is either the:

A)stock price minus the exercise price or zero, whichever is greater.

B)strike price or zero, whichever is greater.

C)strike price or zero, whichever is lower.

D)strike price or the stock price, whichever is lower.

E)stock price minus the exercise price or zero, whichever is lower.

A)stock price minus the exercise price or zero, whichever is greater.

B)strike price or zero, whichever is greater.

C)strike price or zero, whichever is lower.

D)strike price or the stock price, whichever is lower.

E)stock price minus the exercise price or zero, whichever is lower.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

If you consider the equity of a firm to be an option on the firm's assets then the act of paying off debt is comparable to _____ on the assets of the firm.

A)purchasing a put option

B)purchasing a call option

C)exercising an in-the-money put option

D)exercising an in-the-money call option

E)selling a call option

A)purchasing a put option

B)purchasing a call option

C)exercising an in-the-money put option

D)exercising an in-the-money call option

E)selling a call option

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements are correct concerning option values?

I.The value of a call increases as the price of the underlying stock increases.

II.The value of a call decreases as the exercise price increases.

III.The value of a put increases as the price of the underlying stock increases.

IV.The value of a put decreases as the exercise price increases.

A)I and III only

B)II and IV only

C)I and II only

D)II and III only

E)I, II, and IV only

I.The value of a call increases as the price of the underlying stock increases.

II.The value of a call decreases as the exercise price increases.

III.The value of a put increases as the price of the underlying stock increases.

IV.The value of a put decreases as the exercise price increases.

A)I and III only

B)II and IV only

C)I and II only

D)II and III only

E)I, II, and IV only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

The intrinsic value of a put is equal to the:

A)lesser of the stock price minus the exercise price or zero.

B)greater of the strike price minus the stock price or zero.

C)lesser of the stock price or zero.

D)lesser of the strike price or the stock price.

E)greater of the stock price minus the exercise price or zero.

A)lesser of the stock price minus the exercise price or zero.

B)greater of the strike price minus the stock price or zero.

C)lesser of the stock price or zero.

D)lesser of the strike price or the stock price.

E)greater of the stock price minus the exercise price or zero.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

To compute the value of a put using the Black-Scholes option pricing model,you:

A)first have to compute the value of the put as if it is a call.

B)first have to apply the put-call parity relationship.

C)compute the value of an equivalent call and then subtract that value from one.

D)compute the value of an equivalent call and then subtract that value from the market price of the stock.

E)compute the value of an equivalent call and then multiply that value by e-RT.

A)first have to compute the value of the put as if it is a call.

B)first have to apply the put-call parity relationship.

C)compute the value of an equivalent call and then subtract that value from one.

D)compute the value of an equivalent call and then subtract that value from the market price of the stock.

E)compute the value of an equivalent call and then multiply that value by e-RT.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

You own stock in a firm that has a pure discount loan due in six months.The loan has a face value of $50,000.The assets of the firm are currently worth $62,000.The stockholders in this firm basically own a _____ option on the assets of the firm with a strike price of:

A)put; $62,000.

B)call; $50,000.

C)warrant; $62,000.

D)call; $62,000.

E)put; $50,000.

A)put; $62,000.

B)call; $50,000.

C)warrant; $62,000.

D)call; $62,000.

E)put; $50,000.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

If a call has a positive intrinsic value at expiration the call is said to be:

A)at the money.

B)in the money.

C)out of the money.

D)funded.

E)unfunded.

A)at the money.

B)in the money.

C)out of the money.

D)funded.

E)unfunded.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

You own both a May 20 call and a May 20 put.If the call finishes in the money,then the put will:

A)also finish in the money.

B)finish out of the money.

C)finish at the money.

D)either finish at the money or out of the money.

E)either finish at the money or in the money.

A)also finish in the money.

B)finish out of the money.

C)finish at the money.

D)either finish at the money or out of the money.

E)either finish at the money or in the money.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

Assume that you own both a May 40 put and a May 40 call on ABC stock.Which one of the following statements is correct concerning your option positions? Ignore taxes and transaction costs.

A)Both a May 45 put and a May 45 call will have higher values than your May 40 options.

B)An increase in the stock price will increase the value of your put and decrease the value of your call.

C)A decrease in the stock price will decrease the value of both of your options.

D)The time premiums on both your put and call are less than the time premiums on fequivalent June options.

E)You cannot profit on your position as your profits on one option will be offset by losses on the other option.

A)Both a May 45 put and a May 45 call will have higher values than your May 40 options.

B)An increase in the stock price will increase the value of your put and decrease the value of your call.

C)A decrease in the stock price will decrease the value of both of your options.

D)The time premiums on both your put and call are less than the time premiums on fequivalent June options.

E)You cannot profit on your position as your profits on one option will be offset by losses on the other option.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

A 35 put option on ABC stock expires today.The current price of ABC stock is $36. The put is:

A)at the money.

B)in the money.

C)out of the money.

D)funded.

E)unfunded.

A)at the money.

B)in the money.

C)out of the money.

D)funded.

E)unfunded.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following will cause the value of a call to decrease?

A)Lowering the exercise price

B)Increasing the time to expiration

C)Increasing the risk-free rate

D)Lowering the risk level of the underlying security

E)Increasing the stock price

A)Lowering the exercise price

B)Increasing the time to expiration

C)Increasing the risk-free rate

D)Lowering the risk level of the underlying security

E)Increasing the stock price

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

The buyer of a European call option has the:

A)right but not the obligation to buy a stock at a specified price during a specified period of time.

B)right but not the obligation to buy a stock at a specified price on a specified date.

C)obligation to buy a stock on a specified date but only at the specified price.

D)obligation to buy a stock sometime during a specified period of time at the specified price.

E)obligation to buy a stock at the lower of the exercise price or the market price on the expiration date.

A)right but not the obligation to buy a stock at a specified price during a specified period of time.

B)right but not the obligation to buy a stock at a specified price on a specified date.

C)obligation to buy a stock on a specified date but only at the specified price.

D)obligation to buy a stock sometime during a specified period of time at the specified price.

E)obligation to buy a stock at the lower of the exercise price or the market price on the expiration date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

For every positive net present value project that a firm undertakes,the equity in the firm will increase the most if the delta of the call option on the firm's assets is:

A)equal to one.

B)between zero and one.

C)equal to zero.

D)between zero and minus one.

E)equal to minus one.

A)equal to one.

B)between zero and one.

C)equal to zero.

D)between zero and minus one.

E)equal to minus one.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

Shareholders in a leveraged firm might wish to accept a negative net present value project if:

A)it lowers the risk level of the firm.

B)it lowers the variance of the returns on the firm's assets.

C)it increases the standard deviation of the returns on the firm's assets.

D)it decreases the risk that a firm will default on its debt.

E)it diversifies the cash flows of the firm.

A)it lowers the risk level of the firm.

B)it lowers the variance of the returns on the firm's assets.

C)it increases the standard deviation of the returns on the firm's assets.

D)it decreases the risk that a firm will default on its debt.

E)it diversifies the cash flows of the firm.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

The intrinsic value of a call is:

I.the value of the call if it were about to expire.

II.equal to the lower bound of a call's value.

III.another name for the market price of a call.

IV.always equal to zero if the call is currently out of the money.

A)I and III only

B)II and IV only

C)I and II only

D)II, III, and IV only

E)I, II, and IV only

I.the value of the call if it were about to expire.

II.equal to the lower bound of a call's value.

III.another name for the market price of a call.

IV.always equal to zero if the call is currently out of the money.

A)I and III only

B)II and IV only

C)I and II only

D)II, III, and IV only

E)I, II, and IV only

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

In the Black-Scholes option pricing formula,N(d1)is the probability that a standardized,normally distributed random variable is:

A)less than or equal to N(d2).

B)less than one.

C)equal to one.

D)equal to d1.

E)less than or equal to d1.

A)less than or equal to N(d2).

B)less than one.

C)equal to one.

D)equal to d1.

E)less than or equal to d1.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

The value of a call increases when:

I.the time to expiration increases.

II.the stock price increases.

III.the risk-free rate of return increases.

IV.the volatility of the price of the underlying stock increases.

A)I and III only

B)II, III, and IV only

C)I, III, and IV only

D)I, II, and III only

E)I, II, III, and IV

I.the time to expiration increases.

II.the stock price increases.

III.the risk-free rate of return increases.

IV.the volatility of the price of the underlying stock increases.

A)I and III only

B)II, III, and IV only

C)I, III, and IV only

D)I, II, and III only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

The lower bound of a call option:

A)can be a negative value regardless of the stock or exercise prices.

B)can be a negative value but only when the stock price exceeds the exercise price.

C)can be a negative value but only when the exercise price exceeds the stock price.

D)can be equal to zero.

E)must be greater than zero.

A)can be a negative value regardless of the stock or exercise prices.

B)can be a negative value but only when the stock price exceeds the exercise price.

C)can be a negative value but only when the exercise price exceeds the stock price.

D)can be equal to zero.

E)must be greater than zero.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

The maximum value of a call option is equal to:

A)the strike price minus the initial cost of the option.

B)the exercise price plus the price of the underlying stock.

C)the strike price.

D)the price of the underlying stock.

E)the purchase price.

A)the strike price minus the initial cost of the option.

B)the exercise price plus the price of the underlying stock.

C)the strike price.

D)the price of the underlying stock.

E)the purchase price.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is true?

A)American options are options on securities of U.S.corporations, and the options are traded on American exchanges.European options are options on securities of U.S.corporations, but the options are traded on European exchanges.

B)American options are options on securities which are traded on American exchanges.European options, also traded on American exchanges, are options on European corporations.

C)American options give the holder the right to the dividend payment.European options do not.

D)American options may be exercised anytime up to expiration.European options may be exercised only at expiration.

E)None of the above.

A)American options are options on securities of U.S.corporations, and the options are traded on American exchanges.European options are options on securities of U.S.corporations, but the options are traded on European exchanges.

B)American options are options on securities which are traded on American exchanges.European options, also traded on American exchanges, are options on European corporations.

C)American options give the holder the right to the dividend payment.European options do not.

D)American options may be exercised anytime up to expiration.European options may be exercised only at expiration.

E)None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

You purchased four WXO 30 call option contracts at a quoted price of $.34.What is your net gain or loss on this investment if the price of WXO is $33.60 on the option expiration date?

A)-$1,576

B)-$136

C)$1,304

D)$1,440

E)$1,576

A)-$1,576

B)-$136

C)$1,304

D)$1,440

E)$1,576

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

The Black-Scholes option pricing model is dependent on which five parameters?

A)Stock price, exercise price, risk free rate, probability, and time to maturity.

B)Stock price, risk free rate, probability, time to maturity, and variance.

C)Stock price, risk free rate, probability, variance and exercise price.

D)Stock price, exercise price, risk free rate, variance and time to maturity.

E)Exercise price, probability, stock price, variance and time to maturity.

A)Stock price, exercise price, risk free rate, probability, and time to maturity.

B)Stock price, risk free rate, probability, time to maturity, and variance.

C)Stock price, risk free rate, probability, variance and exercise price.

D)Stock price, exercise price, risk free rate, variance and time to maturity.

E)Exercise price, probability, stock price, variance and time to maturity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Three months ago,you purchased a put option on WXX stock with a strike price of $60 and an option price of $.55.The option expires today when the value of WXX stock is $62.50.Ignoring trading costs and taxes,what is your total profit or loss on your investment?

A)-$310

B)-$55

C)$0

D)$55

E)$190

A)-$310

B)-$55

C)$0

D)$55

E)$190

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

An out-of-the-money call option is one that:

A)has an exercise price above the current market price of the underlying security.

B)should not be exercised.

C)has an exercise price below the current market price of the underlying security.

D)Both A and B.

E)Both B and C.

A)has an exercise price above the current market price of the underlying security.

B)should not be exercised.

C)has an exercise price below the current market price of the underlying security.

D)Both A and B.

E)Both B and C.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

The delta of a call measures:

A)the change in the ending option value.

B)the change in the ending stock value.

C)variance in stock price.

D)the swing in the price of the call relative to the swing in stock price.

E)None of the above.

A)the change in the ending option value.

B)the change in the ending stock value.

C)variance in stock price.

D)the swing in the price of the call relative to the swing in stock price.

E)None of the above.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not true concerning call option writers?

A)Writers promise to deliver shares if exercised by the buyer.

B)The writer's liability is zero if the option expires out-of-the-money.

C)The writer has the option to sell shares but not an obligation.

D)The writer has a loss if the market price rises substantially above the exercise price.

E)The writer receives a cash payment from the buyer at the time the option is purchased.

A)Writers promise to deliver shares if exercised by the buyer.

B)The writer's liability is zero if the option expires out-of-the-money.

C)The writer has the option to sell shares but not an obligation.

D)The writer has a loss if the market price rises substantially above the exercise price.

E)The writer receives a cash payment from the buyer at the time the option is purchased.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is true?

A)At expiration the maximum price of a call is the greater of (Stock Price - Exercise)or 0.

B)At expiration the maximum price of a call is the greater of (Exercise - Stock Price)or 0.

C)At expiration the maximum price of a put is the greater of (Stock Price - Exercise)or 0.

D)At expiration the maximum price of a put is the greater of (Exercise - Stock Price)or 0.

E)Both A and D.

A)At expiration the maximum price of a call is the greater of (Stock Price - Exercise)or 0.

B)At expiration the maximum price of a call is the greater of (Exercise - Stock Price)or 0.

C)At expiration the maximum price of a put is the greater of (Stock Price - Exercise)or 0.

D)At expiration the maximum price of a put is the greater of (Exercise - Stock Price)or 0.

E)Both A and D.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

You wrote eight call option contracts on JIG stock with a strike price of $40 and an option price of $.40.What is your net gain or loss on this investment if the price of JIG is $46.05 on the option expiration date?

A)-$5,450

B)-$4,520

C)$400

D)$4,250

E)$5,450

A)-$5,450

B)-$4,520

C)$400

D)$4,250

E)$5,450

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

The market price of ABC stock has been very volatile and you think this volatility will continue for a few weeks.Thus,you decide to purchase a one-month call option contract on ABC stock with a strike price of $25 and an option price of $1.30.You also purchase a one-month put option on ABC stock with a strike price of $25 and an option price of $.50.What will be your total profit or loss on these option positions if the stock price is $24.60 on the day the options expire?

A)-$180

B)-$140

C)-$100

D)$0

E)$180

A)-$180

B)-$140

C)-$100

D)$0

E)$180

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Put-call parity can be used to show:

A)how far in-the-money put options can get.

B)how far in-the-money call options can get.

C)the precise relationship between put and call prices given equal exercise prices and equal expiration dates.

D)that the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates.

E)that the value of a call option is always half that of a put given equal exercise prices and equal expiration dates.

A)how far in-the-money put options can get.

B)how far in-the-money call options can get.

C)the precise relationship between put and call prices given equal exercise prices and equal expiration dates.

D)that the value of a call option is always twice that of a put given equal exercise prices and equal expiration dates.

E)that the value of a call option is always half that of a put given equal exercise prices and equal expiration dates.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

Several rumors concerning Wyslow,Inc.stock have started circulating.These rumors are causing the market price of the stock to be quite volatile.Given this situation,you decide to buy both a one-month put and a call option on this stock with an exercise price of $15.You purchased the call at a quoted price of $.20 and the put at a price of $2.10.What will be your total profit or loss on these option positions if the stock price is $4 on the day the options expire?

A)-$230

B)$870

C)$890

D)$910

E)$1,310

A)-$230

B)$870

C)$890

D)$910

E)$1,310

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following correctly identifies the impact of these changes on the call option of Tele-Tech Com?

A)Both changes cause the price of the call option to increase.

B)Both changes cause the price of the call option to decrease.

C)The greater uncertainty will cause the price of the call option to decrease.The higher price of the stock will cause the price of the call option to increase.

D)The greater uncertainty will cause the price of the call option to increase.The higher price of the stock will cause the price of the call option to decrease.

E)The greater uncertainty has no direct effect on the price of the call option.The higher price of the stock will cause the price of the call option to decrease.

A)Both changes cause the price of the call option to increase.

B)Both changes cause the price of the call option to decrease.

C)The greater uncertainty will cause the price of the call option to decrease.The higher price of the stock will cause the price of the call option to increase.

D)The greater uncertainty will cause the price of the call option to increase.The higher price of the stock will cause the price of the call option to decrease.

E)The greater uncertainty has no direct effect on the price of the call option.The higher price of the stock will cause the price of the call option to decrease.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following correctly identifies the impact of these changes on the put option of Tele-Tech Com?

A)Both changes cause the price of the put option to decrease.

B)Both changes cause the price of the put option to increase.

C)The greater uncertainty will cause the price of the put option to decrease.The higher price of the stock will cause the price of the put option to increase.

D)The greater uncertainty will cause the price of the put option to increase.The higher price of the stock will cause the price of the put option to decrease.

E)The greater uncertainty has no direct effect on the price of the put option.The higher price of the stock will cause the price of the put option to decrease.

A)Both changes cause the price of the put option to decrease.

B)Both changes cause the price of the put option to increase.

C)The greater uncertainty will cause the price of the put option to decrease.The higher price of the stock will cause the price of the put option to increase.

D)The greater uncertainty will cause the price of the put option to increase.The higher price of the stock will cause the price of the put option to decrease.

E)The greater uncertainty has no direct effect on the price of the put option.The higher price of the stock will cause the price of the put option to decrease.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

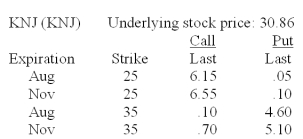

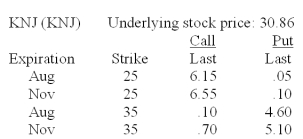

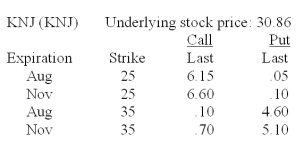

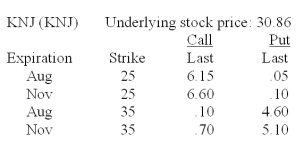

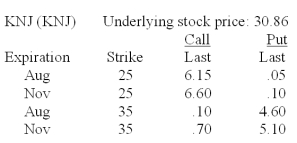

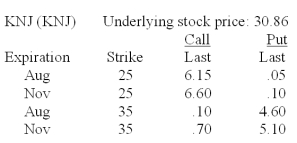

What is the cost of five November 25 call option contracts on KNJ stock given the following price quotes?

A)$615

B)$655

C)$2,500

D)$3,075

E)$3,275

A)$615

B)$655

C)$2,500

D)$3,075

E)$3,275

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

You sold a put contract on EDF stock at an option price of $.40.The option had an exercise price of $20.The option was exercised.Today,EDF stock is selling for $19 a share.What is your total profit or loss on all of your transactions related to EDF stock assuming that you close out your positions in this stock today? Ignore transaction costs and taxes.

A)-$140

B)-$60

C)$40

D)$60

E)$140

A)-$140

B)-$60

C)$40

D)$60

E)$140

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

You sold eight put option contracts on PLT stock with an exercise price of $32.50 and an option price of $1.10.Today,the option expires and the underlying stock is selling for $34.30 a share.Ignoring trading costs and taxes,what is your total profit or loss on this investment?

A)-$2,900

B)-$880

C)$880

D)$1,100

E)$2,900

A)-$2,900

B)-$880

C)$880

D)$1,100

E)$2,900

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

What is the value of one August 35 put contract?

A)$70

B)$460

C)$510

D)$4,600

E)$5,100

A)$70

B)$460

C)$510

D)$4,600

E)$5,100

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

What is the intrinsic value of the November 25 call?

A)$.10

B)$5.86

C)$6.15

D)$10.00

E)$25.00

A)$.10

B)$5.86

C)$6.15

D)$10.00

E)$25.00

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

An in-the-money put option is one that:

A)has an exercise price greater than the underlying stock price.

B)has an exercise price less than the underlying stock price.

C)has an exercise price equal to the underlying stock price.

D)should not be exercised at expiration.

E)should not be exercised at any time.

A)has an exercise price greater than the underlying stock price.

B)has an exercise price less than the underlying stock price.

C)has an exercise price equal to the underlying stock price.

D)should not be exercised at expiration.

E)should not be exercised at any time.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

You purchased five TJH call option contracts with a strike price of $40 when the option was quoted at $1.30.The option expires today when the value of TJH stock is $41.90.Ignoring trading costs and taxes,what is your total profit or loss on your investment?

A)$60

B)$300

C)$360

D)$420

E)$540

A)$60

B)$300

C)$360

D)$420

E)$540

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

The common stock of Winsson,Inc.is currently priced at $52.50 a share.One year from now,the stock price is expected to be either $54 or $60 a share.The risk-free rate of return is 4 percent.What is the value of one call option on Winsson stock with an exercise price of $55?

A)$.39

B)$.41

C)$.45

D)$.48

E)$.51

A)$.39

B)$.41

C)$.45

D)$.48

E)$.51

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

You own two call option contracts on ABC stock with a strike price of $15.When you purchased the shares the option price was $1.20 and the stock price was $15.90.What is the total intrinsic value of these options if ABC stock is currently selling for $13.50 a share?

A)-$280

B)-$180

C)$0

D)$100

E)$180

A)-$280

B)-$180

C)$0

D)$100

E)$180

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

J&L,Inc.stock has a current market price of $55 a share.The one-year call on J&L stock with a strike price of $55 is priced at $2.50 while the one-year put with a strike price of $55 is priced at $1.What is the risk-free rate of return?

A)2.71 percent

B)2.76 percent

C)2.80 percent

D)2.84 percent

E)2.87 percent

A)2.71 percent

B)2.76 percent

C)2.80 percent

D)2.84 percent

E)2.87 percent

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Martha B's has total assets of $1,750.These assets are expected to increase in value to either $1,800 or $2,400 by next year.The company has a pure discount bond outstanding with a face value of $2,000.This bond matures in one year.Currently,U.S.Treasury bills are yielding 6 percent.What is the value of the equity in this firm?

A)$16.98

B)$34.59

C)$36.67

D)$37.08

E)$51.89

A)$16.98

B)$34.59

C)$36.67

D)$37.08

E)$51.89

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

What is the value of a 9-month call with a strike price of $45 given the Black-Scholes Option Pricing Model and the following information?

Stock price $48

Exercise price $45

Time to expiration .75

Risk-free rate .05

N(d1).718891

N(d2).641713

A)$2.03

B)$4.86

C)$6.69

D)$8.81

E)$9.27

Stock price $48

Exercise price $45

Time to expiration .75

Risk-free rate .05

N(d1).718891

N(d2).641713

A)$2.03

B)$4.86

C)$6.69

D)$8.81

E)$9.27

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

The current market value of the assets of Bigelow,Inc.is $86 million,with a standard deviation of 15 percent per year.The firm has zero-coupon bonds outstanding with a total face value of $45 million.These bonds mature in 2 years.The risk-free rate is 4 percent per year compounded continuously.What is the value of d1?

A)3.54

B)3.62

C)3.68

D)3.71

E)3.75

A)3.54

B)3.62

C)3.68

D)3.71

E)3.75

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

Tru-U stock is selling for $36 a share.A 3-month call on Tru-U stock with a strike price of $40 is priced at $1.Risk-free assets are currently returning 0.15 percent per month.What is the price of a 3-month put on Tru-U stock with a strike price of $40?

A)$2.98

B)$3.00

C)$4.03

D)$4.70

E)$4.82

A)$2.98

B)$3.00

C)$4.03

D)$4.70

E)$4.82

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

You own a call option on Jasper Co.stock that expires in one year.The exercise price is $42.50.The current price of the stock is $56.00 and the risk-free rate of return is 3.5 percent.Assume that the option will finish in the money.What is the current value of the call option?

A)$13.04

B)$13.50

C)$13.97

D)$14.94

E)$15.46

A)$13.04

B)$13.50

C)$13.97

D)$14.94

E)$15.46

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Assume that the delta of a call option on a firm's assets is .876.This means that a $50,000 project will increase the value of equity by:

A)$27,902.

B)$39,600.

C)$43,800.

D)$63,131.

E)$89,600.

A)$27,902.

B)$39,600.

C)$43,800.

D)$63,131.

E)$89,600.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

The assets of Blue Light Specials are currently worth $2,100.These assets are expected to be worth either $1,800 or $2,300 one year from now.The company has a pure discount bond outstanding with a $2,000 face value and a maturity date of one year.The risk-free rate is 5 percent.What is the value of the equity in this firm?

A)$166.67

B)$231.42

C)$385.71

D)$405.00

E)$714.29

A)$166.67

B)$231.42

C)$385.71

D)$405.00

E)$714.29

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

You currently own a one-year call option on Way-One,Inc.stock.The current stock price is $26.50 and the risk-free rate of return is 4 percent.Your option has a strike price of $20 and you assume that it will finish in the money.What is the current value of your call option?

A)$6.25

B)$6.50

C)$6.76

D)$7.13

E)$7.27

A)$6.25

B)$6.50

C)$6.76

D)$7.13

E)$7.27

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Three weeks ago,you purchased a July 45 put option on RPJ stock at an option price of $3.20.The market price of RPJ stock three weeks ago was $42.70.Today,RPJ stock is selling at $44.75 a share and the July 45 put is priced at $.80.What is the intrinsic value of your put contract?

A)-$295

B)-$210

C)$0

D)$25

E)$110

A)-$295

B)-$210

C)$0

D)$25

E)$110

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

Given the following information,what is the value of d2 as it is used in the Black-Scholes Option Pricing Model?

Stock price $42

Time to expiration .35

Risk-free rate .055

Standard deviation .50

D1 .375161

A).021608

B).079357

C).175608

D).200161

E).250161

Stock price $42

Time to expiration .35

Risk-free rate .055

Standard deviation .50

D1 .375161

A).021608

B).079357

C).175608

D).200161

E).250161

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

What is the value of d2 given the following information on a stock?

Stock price $63

Exercise price $60

Time to expiration .45

Risk-free rate 6%

Standard deviation 20%

D1 .627841

A).3133

B).4937

C).5460

D).6867

E).7349

Stock price $63

Exercise price $60

Time to expiration .45

Risk-free rate 6%

Standard deviation 20%

D1 .627841

A).3133

B).4937

C).5460

D).6867

E).7349

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

You own one call option with an exercise price of $30 on Nadia Interiors stock.This stock is currently selling for $27.80 a share but is expected to increase to either $28 or $34 a share over the next year.The risk-free rate of return is 5 percent and the inflation rate is 3 percent.What is the current value of your option if it expires in one year?

A)$.76

B)$.79

C)$.89

D)$.92

E)$.95

A)$.76

B)$.79

C)$.89

D)$.92

E)$.95

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

Big Ed's Electrical has a pure discount bond that comes due in one year and has a face value of $1,000.The risk-free rate of return is 4 percent.The assets of Big Ed's are expected to be worth either $800 or $1,300 in one year.Currently,these assets are worth $1,140.What is the current value of the debt of Big Ed's Electrical?

A)$222.46

B)$370.77

C)$514.28

D)$769.23

E)$917.54

A)$222.46

B)$370.77

C)$514.28

D)$769.23

E)$917.54

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

You own five put option contracts on XYZ stock with an exercise price of $25.What is the total intrinsic value of these contracts if XYZ stock is currently selling for $24.50 a share?

A)-$250

B)-$50

C)$0

D)$50

E)$250

A)-$250

B)-$50

C)$0

D)$50

E)$250

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

The common stock of Mercury Motors is selling for $43.90 a share.U.S.Treasury bills are currently yielding 3.5 percent.What is the current value of a one-year call option on Mercury Motors stock if the exercise price is $37.50 and you assume the option will finish in the money?

A)$6.12

B)$6.40

C)$6.69

D)$7.67

E)$8.01

A)$6.12

B)$6.40

C)$6.69

D)$7.67

E)$8.01

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

GS,Inc.stock is selling for $28 a share.A 3-month call on GS stock with a strike price of $30 is priced at $1.50.Risk-free assets are currently returning 0.25 percent per month.What is the price of a 3-month put on GS stock with a strike price of $30?

A)$.50

B)$2.02

C)$2.73

D)$3.03

E)$3.28

A)$.50

B)$2.02

C)$2.73

D)$3.03

E)$3.28

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

Last week,you purchased a call option on Denver,Inc.stock at an option price of $1.05.The stock price last week was $28.10.The strike price is $27.50.What is the intrinsic value per share if Denver,Inc.stock is currently priced at $30.03?

A)-$2.53

B)$0

C)$1.48

D)$1.93

E)$2.53

A)-$2.53

B)$0

C)$1.48

D)$1.93

E)$2.53

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck