Deck 21: Fundamental Tax Reform: Taxes on Consumption and Wealth

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/37

Play

Full screen (f)

Deck 21: Fundamental Tax Reform: Taxes on Consumption and Wealth

1

When each firm is liable for taxes on total sales but can claim the taxes already paid by suppliers as a credit against liability we are using the

A)reserve method.

B)chain method.

C)invoice method.

D)VAT method.

A)reserve method.

B)chain method.

C)invoice method.

D)VAT method.

invoice method.

2

A trust that is the legal owner of a life insurance policy is

A)a policy holder.

B)a insurance trust.

C)a trust fund.

D)none of the above.

A)a policy holder.

B)a insurance trust.

C)a trust fund.

D)none of the above.

a insurance trust.

3

A tax,in which amounts transferred as gifts and bequests are jointly taken into account,is known as

A)inheritance tax.

B)death tax.

C)accessions tax.

D)unified transfer tax.

A)inheritance tax.

B)death tax.

C)accessions tax.

D)unified transfer tax.

unified transfer tax.

4

The Value Added Tax (VAT)is

A)not often used in the United States.

B)a percentage tax.

C)added at each stage to production.

D)all of the above.

A)not often used in the United States.

B)a percentage tax.

C)added at each stage to production.

D)all of the above.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

5

President Obama has proposed making the _____ estate tax rate permanent.

A)13.0%

B)45.0%

C)51.3%

D)55.0%

A)13.0%

B)45.0%

C)51.3%

D)55.0%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

6

A tax levied on an individual's total lifetime acquisitions from inheritances and gifts is known as

A)inheritance tax.

B)death tax.

C)accessions tax.

D)unified transfer tax.

A)inheritance tax.

B)death tax.

C)accessions tax.

D)unified transfer tax.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

7

The largest source of tax revenues for states is

A)general sales.

B)motor fuel.

C)alcoholic beverages.

D)tobacco.

A)general sales.

B)motor fuel.

C)alcoholic beverages.

D)tobacco.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

8

A wealth tax can be justified because it

A)helps to correct certain (inevitable)problems that arise in the administration of an income tax.

B)the higher an individuals wealth,the greater his or her ability to pay,other things- including income - being the same.

C)reduces the concentration of wealth,which is desirable socially and politically.

D)are payments for benefits that wealth holders receive from government.

E)all of the above.

A)helps to correct certain (inevitable)problems that arise in the administration of an income tax.

B)the higher an individuals wealth,the greater his or her ability to pay,other things- including income - being the same.

C)reduces the concentration of wealth,which is desirable socially and politically.

D)are payments for benefits that wealth holders receive from government.

E)all of the above.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

9

The gross estate is

A)very disgusting.

B)all property owned by decedent at time of death.

C)general property that is held in a trust.

D)being phased out of current tax law.

A)very disgusting.

B)all property owned by decedent at time of death.

C)general property that is held in a trust.

D)being phased out of current tax law.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

10

Sale taxes are

A)easy to administer at lower rates.

B)correctives for externalities.

C)substitutes for user fees.

D)all of the above.

A)easy to administer at lower rates.

B)correctives for externalities.

C)substitutes for user fees.

D)all of the above.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is a unit excise tax?

A)a tax of 15%

B)an admission fee of $2.00 on each ticket purchased

C)an ad valorem tax of $3.00

D)an income tax of $3.00

A)a tax of 15%

B)an admission fee of $2.00 on each ticket purchased

C)an ad valorem tax of $3.00

D)an income tax of $3.00

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

12

Optimal commodity taxation would

A)put a tax on leisure time,which is currently untaxed.

B)have the smallest amount of excess burden possible for a given amount of tax revenue.

C)optimize tax rates on the wealthiest Americans.

D)eliminate tax evasion in the United States.

A)put a tax on leisure time,which is currently untaxed.

B)have the smallest amount of excess burden possible for a given amount of tax revenue.

C)optimize tax rates on the wealthiest Americans.

D)eliminate tax evasion in the United States.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

13

Wealth taxes are assessed on a stock of assets instead of a flow such as income or sales.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

14

Disadvantages of a consumption tax are

A)the administrative problems.

B)the transitional problems.

C)dealing with gifts and bequests.

D)all of the above.

A)the administrative problems.

B)the transitional problems.

C)dealing with gifts and bequests.

D)all of the above.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

15

Why might an individual set up trusts?

A)as a strategy to avoid taxes on wealth.

B)for lower insurance premiums.

C)to insure the security of a loan.

D)to have a steady stream of income during retirement.

A)as a strategy to avoid taxes on wealth.

B)for lower insurance premiums.

C)to insure the security of a loan.

D)to have a steady stream of income during retirement.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

16

Consumption taxes are generally viewed as

A)regressive.

B)progressive.

C)simple to calculate.

D)multiplicative.

A)regressive.

B)progressive.

C)simple to calculate.

D)multiplicative.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

17

A tax on consumption for those who are nonsavers

A)is equivalent to a tax on income.

B)causes income gains to increase dramatically.

C)would be preferred to a tax on wealth.

D)makes it difficult to tell what the result for the nonsavers would be.

A)is equivalent to a tax on income.

B)causes income gains to increase dramatically.

C)would be preferred to a tax on wealth.

D)makes it difficult to tell what the result for the nonsavers would be.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

18

A unit tax is

A)levied at different rates on the purchase of different commodities.

B)less than 0.

C)a percentage of the value of the purchase.

D)a given amount for each unit purchased.

A)levied at different rates on the purchase of different commodities.

B)less than 0.

C)a percentage of the value of the purchase.

D)a given amount for each unit purchased.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

19

Who pays a consumption tax?

A)people who purchase goods

B)firms who purchase goods

C)the elderly when they purchase goods

D)all of the above

A)people who purchase goods

B)firms who purchase goods

C)the elderly when they purchase goods

D)all of the above

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

20

Excise taxes are distortionary taxes.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

21

A gross estate is all of the taxable assets of a person at the time of death.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

22

A differential commodity tax is the same as an excise tax.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

23

This chapter has spent a lot of time dealing with issues of wealth and consumption.One suggestion has been to have a tax on wealth.What are some of the benefits of this proposal?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

24

Refer to Question 22 above.Your textbook points out the importance of not deducting payments made as wages.What difference would it make in total tax revenue collected using the consumption-type VAT if this deduction were allowed at the firm level,but individuals were subject to the same tax on their wages?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

25

Value-added taxes (VAT)are very popular in the United States.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

26

Refer to Figure 16.1 in your textbook.Suppose that the total number of hours (T)is 720 and the wage rate is $10.Suppose further that all income is spent on consumption,so that the vertical axis is also total consumption.

(A)Sketch this graph.

(B)Sketch the graph if a 5% consumption tax is imposed.

(C)Can you say conclusively that a consumption tax will lower hours worked?

(A)Sketch this graph.

(B)Sketch the graph if a 5% consumption tax is imposed.

(C)Can you say conclusively that a consumption tax will lower hours worked?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

27

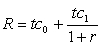

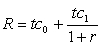

Assume two people,Tom and Rose,live for two periods and are taxed on consumption in both periods.In period 0,Rose has consumption of 50.In period 1,Rose has consumption of 50.Tom has consumption of 40 in period 0.Use the formula below for lifetime consumption tax liability,Ri,to find out what Tom's period 1 consumption must be,to ensure that tax liabilities between the two are equal,if the consumption tax rate is 9% and the rate of interest is 4%,

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

28

One advantage of a consumption tax is that there are fewer problems with inflation.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

29

General sales taxes totaled 226.7 billion dollars as a source of state revenue in 2008.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

30

The general tax can be considered a retail sales tax.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

31

Many states have no state-level personal income tax.How do you think that effects expenditure decisions?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

32

A publisher sells $400,000 worth of books,magazines,and other reading materials in a given year.The publisher earns a profit of $100,000 that year.Her purchase invoices indicate that she bought $100,000 worth of glue,paper,and other materials during the year.Her labor costs were $150,000,and she purchased $45,000 of new equipment that year.Calculate her tax liability under a 12% consumption-type,value-added tax.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

33

Under a consumption tax,only current expenditures are taxed.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

34

A consumption tax generally will be borne according to labor earnings.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

35

Sales taxes are generally progressive.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

36

Throughout this discussion of taxes,there has been repeated mention of the need for progressivity in the tax system.Why is this an important goal for tax systems in most societies?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

37

Little Percy lives in two periods.His earnings in the present are 150;in the future he will earn 10% more than today.The interest rate is 5 percent.If his consumption today is 160,what is the most he can consume in the future?

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck