Deck 19: The Corporation Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 19: The Corporation Tax

1

There are circumstances under which the corporation tax is equivalent to an economic profits tax.

True

2

In the short run,a tax on economic profits can be shifted.

False

3

Stockholders have limited liability for the acts of the corporation for which they hold stock.

True

4

When each stockholder incurs a tax liability on his or her share of the earnings of a corporation (whether or not the earnings are distributed),this is known as

A)being fully funded.

B)full integration.

C)full loss offset.

D)fully imputed rent.

A)being fully funded.

B)full integration.

C)full loss offset.

D)fully imputed rent.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

A plausible elasticity of investment with respect to the user cost is

A)0.52

B)1.62

C)0.40

D)2.22

A)0.52

B)1.62

C)0.40

D)2.22

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

Which one of these statements concerning the Tax Reform Act of 1986 is false?

A)The Act evened out tax rates on alternative types of investment.

B)The Act increased effective tax rates on equipment.

C)It raised the personal exemption substantially.

D)The Act had a specified time period of effectiveness.

A)The Act evened out tax rates on alternative types of investment.

B)The Act increased effective tax rates on equipment.

C)It raised the personal exemption substantially.

D)The Act had a specified time period of effectiveness.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

Most states do

A)not collect any corporate income taxes.

B)have corporate income taxes.

C)not recognize entities known as corporations.

D)none of the above.

A)not collect any corporate income taxes.

B)have corporate income taxes.

C)not recognize entities known as corporations.

D)none of the above.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

The difference between revenues and expenditures for inputs is known as

A)profits.

B)debits.

C)cash flow.

D)net revenue.

A)profits.

B)debits.

C)cash flow.

D)net revenue.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

The cost that a firm incurs as a consequence of owning an asset is known as

A)accelerated depreciation.

B)expensing.

C)user cost of capital.

D)economic depreciation.

A)accelerated depreciation.

B)expensing.

C)user cost of capital.

D)economic depreciation.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

When calculating the user cost of capital,the after?tax rate of return and the economic rate of depreciation interact by

A)multiplication.

B)subtraction.

C)division.

D)addition.

A)multiplication.

B)subtraction.

C)division.

D)addition.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Investment tax credits (ITCs)are _________ the firm's tax bill when particular capital assets are purchased.

A)deducted from

B)added to

C)close to zero for

D)none of the above for

A)deducted from

B)added to

C)close to zero for

D)none of the above for

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

For corporate taxes,the lowest tax bracket is

A)9 percent.

B)12 percent.

C)15 percent.

D)22 percent.

A)9 percent.

B)12 percent.

C)15 percent.

D)22 percent.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

According to research,after the Tax Reform Act of 1986,the effective marginal tax rate on equipment has

A)decreased substantially.

B)stayed basically the same.

C)increased.

D)decreased slightly.

A)decreased substantially.

B)stayed basically the same.

C)increased.

D)decreased slightly.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

The excess burden of the corporate income tax is

A)almost zero.

B)greatest when the interest elasticity of saving is zero.

C)a result of the combined distortion in the pattern of investment and a reduction in total investment.

D)none of the above.

A)almost zero.

B)greatest when the interest elasticity of saving is zero.

C)a result of the combined distortion in the pattern of investment and a reduction in total investment.

D)none of the above.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

U.S.multinational corporations are allowed tax _________ for taxes paid to foreign governments.

A)deductions

B)exemptions

C)loans

D)credits

A)deductions

B)exemptions

C)loans

D)credits

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

When one company is owned by a corporation but is chartered separately from the parent company,this is

A)a subsidiary.

B)a clone.

C)used for tax evasion.

D)illegal.

A)a subsidiary.

B)a clone.

C)used for tax evasion.

D)illegal.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

Before applying the 35 percent tax rate,firms may deduct

A)employee compensation.

B)interest payments.

C)depreciation allowances.

D)all of the above.

A)employee compensation.

B)interest payments.

C)depreciation allowances.

D)all of the above.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

Firms use the discount rate to

A)compute present value.

B)account for loss inventory.

C)calculate profit margins.

D)repatriate parent companies.

A)compute present value.

B)account for loss inventory.

C)calculate profit margins.

D)repatriate parent companies.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

Economic depreciation is

A)the change in the distribution of real income induced by a tax.

B)the extent to which an asset decreases in value during a period of time.

C)the money value of the net increase in an individual's power to consume during a period.

D)a subtraction from tax liability (as opposed to a subtraction from taxable income).

A)the change in the distribution of real income induced by a tax.

B)the extent to which an asset decreases in value during a period of time.

C)the money value of the net increase in an individual's power to consume during a period.

D)a subtraction from tax liability (as opposed to a subtraction from taxable income).

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Interest deductibility does not provide an incentive for debt finance.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

Profits earned by subsidiary are taxed even if it is not repatriated to the parent company as dividends because they are considered as income for the parent company.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

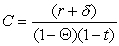

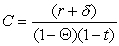

Assume that the user cost of capital (C)is simply

where r is the after tax rate of return,δ is the depreciation rate,Θ is the corporate tax rate and,r is the individual tax rate.Now assume further that the after?tax rate of return is 10 percent and the economic depreciation rate is 2 percent.The firm faces corporate taxes of 35 percent with an individual tax rate of 25 percent.What is the user cost of capital in this case?

where r is the after tax rate of return,δ is the depreciation rate,Θ is the corporate tax rate and,r is the individual tax rate.Now assume further that the after?tax rate of return is 10 percent and the economic depreciation rate is 2 percent.The firm faces corporate taxes of 35 percent with an individual tax rate of 25 percent.What is the user cost of capital in this case?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Suppose you are only concerned with national income maximization.You know that the marginal rate of return on foreign investment is 8 percent,but that the tax rate on foreign investment is 2 percent.What is the minimal tax rate necessary in the United States to maximize national income?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Your textbook highlights a debate that has been going on for some years.The issue is whether there should be a corporation tax,given that corporations are nothing more than groups of people.Should there be a corporation tax? Why or why not?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

A proprietorship is one with a single owner and unlimited liability.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

Oxnard Rims,Inc. ,has $5 million in assets and $2 million in debt.During the course of the year,it takes in $1 million in net revenue after deduction of all costs (except for interest)and incurs interest expenses of $500,000.Oxnard Rims,Inc. ,pays an average tax rate of 35% on its profit.

Calculate the percentage return on equity after taxes for the corporation.

If the market interest rate is 12.5%,do you think Oxnard Rims pleased its investor for the preceding year?

Calculate the percentage return on equity after taxes for the corporation.

If the market interest rate is 12.5%,do you think Oxnard Rims pleased its investor for the preceding year?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Corporations,like individuals,face an alternative minimum tax (AMT).

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Why do firms pay dividends? It would appear that they are subject to double taxation,giving more incentive to eliminate them.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Return to Question 17 above.Suppose that we now know that the present value of depreciation allowances is 0.20.In addition,there is an investment tax credit of 0.10.How does this new information change your answer to Question 17? What effect does this new information have on the user cost of capital?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

For firms,dividends are not deductible.They are,however,taxed preferentially at the individual level.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Large firms sometimes have manufacturing and development that take place in multiple states.Should they be subject to taxation in every state in which they do business?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

Firms deducting the asset's full cost at the time of acquisition from taxable income is called investment tax credit.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

This question is similar to Question 9 of Chapter 19 in your textbook.The ABC Corporation is contemplating purchasing a new computer system that would yield a before-tax return of 30 percent.The system would depreciate at a rate of 3 percent per year.The after-tax interest rate is 11 percent,the corporation tax rate is 35 percent,and a typical shareholder of ABC has a marginal tax rate of 30 percent.Assume for simplicity that there are no depreciation allowances or investment tax credits.Do you expect ABC to buy the new computer system?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Cash flow is the difference between assets and revenues.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

Estimates of the effect of the user cost on investment vary greatly.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck