Deck 18: Reports on Audited Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 18: Reports on Audited Financial Statements

1

A basic assumption that underlies financial reporting is that an entity will continue as a going concern.

True

2

An auditor must disclaim an opinion when the auditor lacks independence.

True

3

A change in reporting entity is an example of an accounting change that affects comparability and requires an explanatory/emphasis-of-matter paragraph in the audit report.

True

4

A going concern issue requires a modification of the three-paragraph standard unqualified audit report (public company).

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

If the principal auditor decides to make reference to the other auditor's examination, the introductory paragraph must specifically indicate the

A) The portion of the financial statements examined by the other auditor.

B) Name of the other auditor.

C) Name of the consolidated subsidiary examined by the other auditor.

D) Type of opinion expressed by the other auditor.

A) The portion of the financial statements examined by the other auditor.

B) Name of the other auditor.

C) Name of the consolidated subsidiary examined by the other auditor.

D) Type of opinion expressed by the other auditor.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

Management believes and the auditor is satisfied, that a material loss probably will occur when pending litigation is resolved. Management is unable to make a reasonable estimate of the amount or range of the potential loss, but fully discloses the situation in the notes to the financial statements. If the auditor wishes to call attention to the matter and management does not make an accrual in the financial statements, the auditor should issue a(an)

A) Qualified report due to a scope limitation.

B) Qualified report due to a departure from GAAP.

C) Unqualified/unmodified report with an explanatory/emphasis-of-matter paragraph.

D) Unqualified/unmodified report in a standard auditor's report.

A) Qualified report due to a scope limitation.

B) Qualified report due to a departure from GAAP.

C) Unqualified/unmodified report with an explanatory/emphasis-of-matter paragraph.

D) Unqualified/unmodified report in a standard auditor's report.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

A change in accounting estimate is an example of an accounting change that affects comparability and requires an explanatory/emphasis-of-matter paragraph in the audit report.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

If the auditor believes that there is minimal likelihood that resolution of an uncertainty will have a material effect on the financial statements, the auditor would issue a(n)

A) "Except for" opinion.

B) Adverse opinion.

C) Unqualified/unmodified opinion.

D) Disclaimer of opinion.

A) "Except for" opinion.

B) Adverse opinion.

C) Unqualified/unmodified opinion.

D) Disclaimer of opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following situations will not result in modification of the auditor's report because of a scope limitation?

A) Restriction imposed by the client.

B) Reliance placed on the report of another auditor.

C) Inability to obtain sufficient appropriate evidential matter.

D) Inadequacy in the accounting records.

A) Restriction imposed by the client.

B) Reliance placed on the report of another auditor.

C) Inability to obtain sufficient appropriate evidential matter.

D) Inadequacy in the accounting records.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

When the audited financial statements of the prior year are presented together with those of the current year, the continuing auditor's report should cover

A) Both years.

B) Only the current year.

C) Only the current year, but the prior year's report should be presented.

D) Only the current year, but the prior year's report should be referred to.

A) Both years.

B) Only the current year.

C) Only the current year, but the prior year's report should be presented.

D) Only the current year, but the prior year's report should be referred to.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

When comparative financial statements are presented, the fourth standard of reporting, which refers to financial statements "taken as a whole," should be considered to apply to the financial statements of the

A) Periods presented plus the one preceding period.

B) Current period only.

C) Current period and those of the other periods presented.

D) Current and immediately preceding period only.

A) Periods presented plus the one preceding period.

B) Current period only.

C) Current period and those of the other periods presented.

D) Current and immediately preceding period only.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following parties is responsible for the fairness of the representations made in financial statements?

A) Entity's management.

B) Independent auditor.

C) Audit committee.

D) AICPA.

A) Entity's management.

B) Independent auditor.

C) Audit committee.

D) AICPA.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

Changes that do not affect consistency are normally disclosed in the footnotes but do not require an explanatory/emphasis-of-matter paragraph in the audit report.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

An opinion based in part on the report of another auditor requires an explanatory/emphasis-of-matter paragraph be added to the standard unqualified/unmodified audit report.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

An auditor may be unable to express an unqualified opinion if an immaterial departure from GAAP is present in the financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

The choice of which audit report to issue depends on the condition and the materiality of any departure.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

A predecessor auditor should complete the following before reissuing a report on statements presented on a comparative basis:

A) Read the financial statements of the current period.

B) Read the financial statements of the past five years.

C) Obtain a letter of representations from the current-year, successor auditor.

D) Read the financial statements of the current period and obtain a letter of representation from the current-year, successor auditor.

A) Read the financial statements of the current period.

B) Read the financial statements of the past five years.

C) Obtain a letter of representations from the current-year, successor auditor.

D) Read the financial statements of the current period and obtain a letter of representation from the current-year, successor auditor.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

A scope limitation results from an inability to obtain sufficient appropriate evidence about some component of the financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

For which of the following events would an auditor issue a report that does not include any reference to consistency?

A) A change in the method of accounting for inventories.

B) A change from an accounting principle that is not generally accepted to one that is generally accepted.

C) A change in the service life used to calculate depreciation expense.

D) A change in accounting principle without reasonable justification from management.

A) A change in the method of accounting for inventories.

B) A change from an accounting principle that is not generally accepted to one that is generally accepted.

C) A change in the service life used to calculate depreciation expense.

D) A change in accounting principle without reasonable justification from management.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

In connection with the examination of the consolidated financial statements of Mott Industries, Frazier, CPA, plans to refer to another CPA's examination of the financial statements of a subsidiary company. Under these circumstances, Frazier's report must disclose

A) The name of the other CPA and the type of report issued by the other CPA.

B) The portion of the financial statements examined by the other CPA.

C) The nature of Frazier's review of the other CPA's work.

D) In a footnote the portions of the financial statements that were covered by the examinations of both auditors.

A) The name of the other CPA and the type of report issued by the other CPA.

B) The portion of the financial statements examined by the other CPA.

C) The nature of Frazier's review of the other CPA's work.

D) In a footnote the portions of the financial statements that were covered by the examinations of both auditors.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

When the entity fails to include information that is necessary for the fair presentation of financial statements in the body of the statements or in the related footnotes, it is the responsibility of the auditor to present the information, if practicable, in the auditor's report and express a(n)

A) Qualified opinion or a disclaimer of opinion.

B) Qualified opinion or an adverse opinion.

C) Adverse opinion or a disclaimer of opinion.

D) Qualified opinion or an unqualified opinion.

A) Qualified opinion or a disclaimer of opinion.

B) Qualified opinion or an adverse opinion.

C) Adverse opinion or a disclaimer of opinion.

D) Qualified opinion or an unqualified opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following circumstances normally does not affect the consistency phrase in the auditor's standard report?

A) A change in accounting estimate.

B) A change in accounting principle.

C) A change in the companies included in combined financial statements.

D) A correction of an error in principle.

A) A change in accounting estimate.

B) A change in accounting principle.

C) A change in the companies included in combined financial statements.

D) A correction of an error in principle.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

Abbot, CPA, as principal auditor for consolidated financial statements, is using a qualified report of another auditor. Abbot does not consider the qualification material relative to the consolidated financial statements and Abbot is willing to accept responsibility for the work of the other auditor. What recognition, if any, must Abbot make in his report to the report of the other audit?

A) He need make no reference.

B) He must refer to the qualification of the other auditor and qualify his report likewise.

C) He must include the other auditor's report with his report but need not qualify his report.

D) He must include the other auditor's report with his report and give an explanation of its significance.

A) He need make no reference.

B) He must refer to the qualification of the other auditor and qualify his report likewise.

C) He must include the other auditor's report with his report but need not qualify his report.

D) He must include the other auditor's report with his report and give an explanation of its significance.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

When a question arises about an entity's continued existence, the auditor should consider factors tending to mitigate the significance of negative information concerning the entity's means for maintaining adequate cash flow. An example of such a factor is the

A) Possibility of purchasing certain assets rather than leasing them.

B) Capability of extending the due dates of existing debt.

C) Appropriateness of changing depreciation methods from double declining balance to straight line.

D) Marketability of property and equipment that management plans to keep.

A) Possibility of purchasing certain assets rather than leasing them.

B) Capability of extending the due dates of existing debt.

C) Appropriateness of changing depreciation methods from double declining balance to straight line.

D) Marketability of property and equipment that management plans to keep.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

In the auditor's report, the principal auditor decides not to make reference to another CPA who audited an entity's subsidiary. The principal auditor could justify this decision if, among other requirements, the principal auditor

A) Issues an unqualified/unmodified opinion on the consolidated financial statements.

B) Learns that the other CPA issued an unqualified/unmodified opinion on the subsidiary's financial statements.

C) Is unable to review the other CPA's audit programs and working papers.

D) Is satisfied as to the other CPA's independence and professional reputation.

A) Issues an unqualified/unmodified opinion on the consolidated financial statements.

B) Learns that the other CPA issued an unqualified/unmodified opinion on the subsidiary's financial statements.

C) Is unable to review the other CPA's audit programs and working papers.

D) Is satisfied as to the other CPA's independence and professional reputation.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

An auditor was unable to obtain audited financial statements or other evidence supporting an entity's investment in a large foreign subsidiary. Between which of the following reports should the auditor choose?

A) Adverse and unqualified/unmodified with an explanatory/emphasis-of-matter paragraph added.

B) Disclaimer and unqualified/unmodified with an explanatory/emphasis-of-matter paragraph added.

C) Qualified and adverse.

D) Qualified and disclaimer.

A) Adverse and unqualified/unmodified with an explanatory/emphasis-of-matter paragraph added.

B) Disclaimer and unqualified/unmodified with an explanatory/emphasis-of-matter paragraph added.

C) Qualified and adverse.

D) Qualified and disclaimer.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following conditions or events most likely would cause an auditor to have substantial doubt about an entity's ability to continue as a going concern?

A) Cash flows from operating activities are negative.

B) Research and development projects are postponed.

C) Significant related party transactions are pervasive.

D) Stock dividends replace annual cash dividends.

A) Cash flows from operating activities are negative.

B) Research and development projects are postponed.

C) Significant related party transactions are pervasive.

D) Stock dividends replace annual cash dividends.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

The predecessor auditor, after properly communicating with the successor auditor, has reissued a report because the entity desires comparative financial statements. The predecessor auditor's report should make

A) No reference to the report or the work of the successor auditor.

B) Reference to the work of the successor auditor in the scope paragraph.

C) Reference to both the work and the report of the successor auditor in the opinion paragraph.

D) Reference to the report of the successor auditor in the scope paragraph.

A) No reference to the report or the work of the successor auditor.

B) Reference to the work of the successor auditor in the scope paragraph.

C) Reference to both the work and the report of the successor auditor in the opinion paragraph.

D) Reference to the report of the successor auditor in the scope paragraph.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following would be considered a change that affects consistency?

A) Change in accounting estimate.

B) Change in accounting principle.

C) Change in classification and reclassification.

D) All of the other options are correct.

A) Change in accounting estimate.

B) Change in accounting principle.

C) Change in classification and reclassification.

D) All of the other options are correct.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

The adverse effects of events causing an auditor to believe there is substantial doubt about an entity's ability to continue as a going concern would most likely be mitigated by evidence relating to the

A) Ability to expand operations into new product lines in the future.

B) Feasibility of plans to purchase leased equipment at less than market value.

C) Marketability of assets that management plans to sell.

D) Committed arrangements to convert preferred stock to long-term debt.

A) Ability to expand operations into new product lines in the future.

B) Feasibility of plans to purchase leased equipment at less than market value.

C) Marketability of assets that management plans to sell.

D) Committed arrangements to convert preferred stock to long-term debt.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

Other bases of accounting (special purpose frameworks) include all of the following except:

A) Tax basis.

B) Non-GAAP methods used for internal reporting.

C) Cash basis.

D) Regulatory basis.

A) Tax basis.

B) Non-GAAP methods used for internal reporting.

C) Cash basis.

D) Regulatory basis.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

An auditor would issue an adverse opinion if

A) The audit was begun by other independent auditors who withdrew from the engagement.

B) A qualified opinion cannot be given because the auditor lacks independence.

C) A restriction on the scope of the audit was significant.

D) The statements taken as a whole do not fairly present the financial condition and results of operations of the company.

A) The audit was begun by other independent auditors who withdrew from the engagement.

B) A qualified opinion cannot be given because the auditor lacks independence.

C) A restriction on the scope of the audit was significant.

D) The statements taken as a whole do not fairly present the financial condition and results of operations of the company.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

When the auditor is unable to determine the amounts associated with the illegal acts of entity personnel because of an inability to obtain adequate evidence, the auditor should issue a(n)

A) "Subject to" qualified opinion.

B) Disclaimer of opinion.

C) Adverse opinion.

D) Unqualified/unmodified opinion with a separate explanatory/emphasis-of-matter paragraph.

A) "Subject to" qualified opinion.

B) Disclaimer of opinion.

C) Adverse opinion.

D) Unqualified/unmodified opinion with a separate explanatory/emphasis-of-matter paragraph.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following conditions or events most likely would cause an auditor to have substantial doubt about an entity's ability to continue as a going concern?

A) Significant related party transactions are pervasive.

B) Usual trade credit from suppliers is denied.

C) Arrearages in preferred stock dividends are paid.

D) Restrictions on the disposal of principal assets are present.

A) Significant related party transactions are pervasive.

B) Usual trade credit from suppliers is denied.

C) Arrearages in preferred stock dividends are paid.

D) Restrictions on the disposal of principal assets are present.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

An auditor includes a separate paragraph in an otherwise unmodified report to emphasize that the entity being reported on had significant transactions with related parties. The inclusion of this separate paragraph

A) Is considered an "except for" qualification of the opinion.

B) Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

C) Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation."

D) Is appropriate and would not negate the unqualified/unmodified opinion.

A) Is considered an "except for" qualification of the opinion.

B) Violates generally accepted auditing standards if this information is already disclosed in footnotes to the financial statements.

C) Necessitates a revision of the opinion paragraph to include the phrase "with the foregoing explanation."

D) Is appropriate and would not negate the unqualified/unmodified opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following auditing procedures most likely would assist an auditor in identifying conditions and events that may indicate substantial doubt about an entity's ability to continue as a going concern?

A) Inspecting title documents to verify whether any assets are pledged as collateral.

B) Confirming with third parties the details of arrangements to maintain financial support.

C) Reconciling the cash balance per books with the cut-off bank statement and the bank confirmation.

D) Comparing the entity's depreciation and asset capitalization policies to other entities in the industry.

A) Inspecting title documents to verify whether any assets are pledged as collateral.

B) Confirming with third parties the details of arrangements to maintain financial support.

C) Reconciling the cash balance per books with the cut-off bank statement and the bank confirmation.

D) Comparing the entity's depreciation and asset capitalization policies to other entities in the industry.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following circumstances should be recognized as a consistency modification in the auditor's report, whether or not the item is fully disclosed in the financial statements?

A) A change in accounting estimate.

B) A change from an unacceptable accounting principle to a generally accepted one.

C) Correction of an error not involving a change in accounting principle.

D) A change in classification.

A) A change in accounting estimate.

B) A change from an unacceptable accounting principle to a generally accepted one.

C) Correction of an error not involving a change in accounting principle.

D) A change in classification.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

An auditor is reporting on cash basis financial statements. These statements are best referred to in his or her report by which one of the following descriptions?

A) Financial position and results of operations arising from cash transactions.

B) Assets and liabilities arising from cash transactions and revenue collected and expenses paid.

C) Balance sheet and income statement resulting from cash transactions.

D) Cash balance sheet and the source and application of funds.

A) Financial position and results of operations arising from cash transactions.

B) Assets and liabilities arising from cash transactions and revenue collected and expenses paid.

C) Balance sheet and income statement resulting from cash transactions.

D) Cash balance sheet and the source and application of funds.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following would be considered a change that does not affect consistency?

A) Change expected to have a material future effect.

B) Change in accounting principle.

C) Correction of an error in principle.

D) None of these are considered changes that do not affect consistency.

A) Change expected to have a material future effect.

B) Change in accounting principle.

C) Correction of an error in principle.

D) None of these are considered changes that do not affect consistency.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

When an auditor expresses an adverse opinion, the opinion paragraph should include

A) The principal effects of the departure from generally accepted accounting principles.

B) A direct reference to a separate paragraph disclosing the basis for the opinion.

C) The substantive reasons for the financial statements being misleading.

D) A description of the uncertainty or scope limitation that prevents an unqualified opinion.

A) The principal effects of the departure from generally accepted accounting principles.

B) A direct reference to a separate paragraph disclosing the basis for the opinion.

C) The substantive reasons for the financial statements being misleading.

D) A description of the uncertainty or scope limitation that prevents an unqualified opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the generally accepted auditing standards of reporting would not normally apply to special reports such as cash basis statements?

A) First standard.

B) Second standard.

C) Third standard.

D) Fourth standard.

A) First standard.

B) Second standard.

C) Third standard.

D) Fourth standard.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

An engagement to express an opinion on a system of internal control will generally

A) Only require those procedures already applied in assessing control risk during a financial statement audit.

B) Increase the reliability of the financial statements that have already been audited.

C) Be more extensive in scope than the assessment of control risk made during a financial statement audit.

D) Be more limited in scope than the assessment of control risk made during a financial statement audit.

A) Only require those procedures already applied in assessing control risk during a financial statement audit.

B) Increase the reliability of the financial statements that have already been audited.

C) Be more extensive in scope than the assessment of control risk made during a financial statement audit.

D) Be more limited in scope than the assessment of control risk made during a financial statement audit.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

When an auditor reports on financial statements prepared on an entity's income tax basis, the auditor's report should

A) Be titled so that the financial statements are not confused with statements prepared to conform to generally accepted accounting principles.

B) Disclaim an opinion on whether the statements were examined in accordance with generally accepted auditing standards.

C) Not express an opinion on whether the statements are presented in conformity with the basis of accounting used.

D) Include an explanation of how the results of operations differ from the cash receipts and disbursements basis of accounting.

A) Be titled so that the financial statements are not confused with statements prepared to conform to generally accepted accounting principles.

B) Disclaim an opinion on whether the statements were examined in accordance with generally accepted auditing standards.

C) Not express an opinion on whether the statements are presented in conformity with the basis of accounting used.

D) Include an explanation of how the results of operations differ from the cash receipts and disbursements basis of accounting.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

An auditor may reasonably issue an "except for" qualified opinion for

A) A scope limitation or an unjustified accounting change.

B) A scope limitation, but not an unjustified accounting change.

C) An unjustified accounting change, but not a scope limitation.

D) Neither an unjustified accounting change nor a scope limitation.

A) A scope limitation or an unjustified accounting change.

B) A scope limitation, but not an unjustified accounting change.

C) An unjustified accounting change, but not a scope limitation.

D) Neither an unjustified accounting change nor a scope limitation.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

When an auditor concludes there is substantial doubt about an entity's ability to continue as a going concern for a reasonable period of time, the auditor's responsibility is to

A) Prepare prospective financial information to verify whether management's plans can be effectively implemented.

B) Project future conditions and events for a period of time not to exceed one year following the date of the financial statements.

C) Issue a qualified or adverse opinion, depending upon materiality, because of the possible effects on the financial statements.

D) Consider the adequacy of disclosure about the entity's possible inability to continue as a going concern.

A) Prepare prospective financial information to verify whether management's plans can be effectively implemented.

B) Project future conditions and events for a period of time not to exceed one year following the date of the financial statements.

C) Issue a qualified or adverse opinion, depending upon materiality, because of the possible effects on the financial statements.

D) Consider the adequacy of disclosure about the entity's possible inability to continue as a going concern.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

What is an auditor's responsibility for supplementary information, such as segment information, that is outside the basic financial statements, but required by the FASB?

A) The auditor has no responsibility for required supplementary information as long as it is outside the basic financial statements.

B) The auditor's only responsibility for required supplementary information is to assist in preparing the supplementary information.

C) The auditor is required to read the other information and consider whether such information is consistent with the information in the financial statements.

D) The auditor should apply tests of details of transactions and balances to the required supplementary information and report any material misstatements in such information.

A) The auditor has no responsibility for required supplementary information as long as it is outside the basic financial statements.

B) The auditor's only responsibility for required supplementary information is to assist in preparing the supplementary information.

C) The auditor is required to read the other information and consider whether such information is consistent with the information in the financial statements.

D) The auditor should apply tests of details of transactions and balances to the required supplementary information and report any material misstatements in such information.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

Comparative financial statements include the financial statements of a prior period that were examined by a predecessor auditor whose report is not presented. If the predecessor auditor's report was qualified, the successor auditor must

A) Obtain written approval from the predecessor auditor to include the prior year's financial statements.

B) Issue a standard comparative audit report indicating the division of responsibility.

C) Express an opinion on the current year statements alone and make no reference to the prior year statements.

D) Disclose the reasons for any qualification in the predecessor auditor's opinion.

A) Obtain written approval from the predecessor auditor to include the prior year's financial statements.

B) Issue a standard comparative audit report indicating the division of responsibility.

C) Express an opinion on the current year statements alone and make no reference to the prior year statements.

D) Disclose the reasons for any qualification in the predecessor auditor's opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

All of the following are true with respect to the auditor's consideration of information other than the audited financial statements that are included in an entity's annual report except:

A) The auditor is under no obligation to perform audit procedures on this other information.

B) The auditor must consider whether the other information is consistent with the information contained in the audited financial statements.

C) The auditor must request that material inconsistencies be corrected.

D) The auditor must perform audit procedures on this other information.

A) The auditor is under no obligation to perform audit procedures on this other information.

B) The auditor must consider whether the other information is consistent with the information contained in the audited financial statements.

C) The auditor must request that material inconsistencies be corrected.

D) The auditor must perform audit procedures on this other information.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

An auditor's report on financial statements prepared in accordance with a basis of accounting other than generally accepted accounting principles should include all of the following except:

A) An opinion as to whether the basis of accounting used is appropriate under the circumstances.

B) An opinion as to whether the financial statements are presented fairly in conformity with the other basis of accounting.

C) Reference to the note to the financial statements that describes the basis of presentation.

D) A statement that the basis of presentation is a basis of accounting other than generally accepted accounting principles.

A) An opinion as to whether the basis of accounting used is appropriate under the circumstances.

B) An opinion as to whether the financial statements are presented fairly in conformity with the other basis of accounting.

C) Reference to the note to the financial statements that describes the basis of presentation.

D) A statement that the basis of presentation is a basis of accounting other than generally accepted accounting principles.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

When reporting on comparative financial statements where the financial statements of the prior year have been examined by a predecessor auditor whose report is not presented, the successor auditor should make

A) No reference to the predecessor auditor.

B) Reference to the predecessor auditor only if the predecessor auditor expressed a qualified opinion.

C) Reference to the predecessor auditor only if the predecessor auditor expressed an unqualified/unmodified opinion.

D) Reference to the predecessor auditor regardless of the type of opinion expressed by the predecessor auditor.

A) No reference to the predecessor auditor.

B) Reference to the predecessor auditor only if the predecessor auditor expressed a qualified opinion.

C) Reference to the predecessor auditor only if the predecessor auditor expressed an unqualified/unmodified opinion.

D) Reference to the predecessor auditor regardless of the type of opinion expressed by the predecessor auditor.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

If a public company issues financial statements that purport to present its financial position and results of operations but omits the statement of cash flows, the auditor ordinarily will express a(an)

A) Disclaimer of opinion.

B) Qualified opinion.

C) Review report.

D) Unqualified opinion with a separate explanatory paragraph.

A) Disclaimer of opinion.

B) Qualified opinion.

C) Review report.

D) Unqualified opinion with a separate explanatory paragraph.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

The auditor's best course of action with respect to "other financial information" included in an annual report containing the auditor's report is to

A) Indicate in the auditor's report that the "other financial information" is unaudited.

B) Consider whether the "other financial information" is accurate by performing a limited review.

C) Obtain written representations from management as to the material accuracy of the "other financial information."

D) Read and consider the manner of presentation of the "other financial information."

A) Indicate in the auditor's report that the "other financial information" is unaudited.

B) Consider whether the "other financial information" is accurate by performing a limited review.

C) Obtain written representations from management as to the material accuracy of the "other financial information."

D) Read and consider the manner of presentation of the "other financial information."

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

When audited financial statements are presented in a document containing other information, the auditor

A) Has an obligation to perform auditing procedures to corroborate the other information.

B) Is required to issue an "except for" qualified opinion if the other information has a material misstatement of fact.

C) Should read the other information to consider whether it is inconsistent with the audited financial statements.

D) Has no responsibility for the other information because it is not part of the basic financial statements.

A) Has an obligation to perform auditing procedures to corroborate the other information.

B) Is required to issue an "except for" qualified opinion if the other information has a material misstatement of fact.

C) Should read the other information to consider whether it is inconsistent with the audited financial statements.

D) Has no responsibility for the other information because it is not part of the basic financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

An auditor concludes that there is substantial doubt about an entity's ability to continue as a going concern for a reasonable period of time. If the entity's financial statements adequately disclose its financial difficulties, the auditor's report is required to include an explanatory/emphasis-of-matter paragraph that specifically uses the phrase(s)

A) "Reasonable period of time, not to exceed one year" and "going concern."

B) "Reasonable period of time, not to exceed one year" but not "going concern."

C) "Going concern" but not "reasonable period of time, not to exceed one year."

D) Neither "going concern" nor "reasonable period of time, not to exceed one year."

A) "Reasonable period of time, not to exceed one year" and "going concern."

B) "Reasonable period of time, not to exceed one year" but not "going concern."

C) "Going concern" but not "reasonable period of time, not to exceed one year."

D) Neither "going concern" nor "reasonable period of time, not to exceed one year."

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

A CPA who is not independent and is associated with financial statements should disclaim an opinion with respect to those financial statements. The disclaimer should

A) Clearly state the specific reasons for lack of independence.

B) Not mention any reason for the disclaimer other than that the CPA was unable to conduct the examination in accordance with generally accepted auditing standards.

C) Not describe the reason for lack of independence but should state specifically that the CPA is not independent.

D) Include a middle paragraph clearly describing the CPA's association with the entity and explaining why the CPA was unable to gather sufficient appropriate evidential matter to warrant the expression of an opinion.

A) Clearly state the specific reasons for lack of independence.

B) Not mention any reason for the disclaimer other than that the CPA was unable to conduct the examination in accordance with generally accepted auditing standards.

C) Not describe the reason for lack of independence but should state specifically that the CPA is not independent.

D) Include a middle paragraph clearly describing the CPA's association with the entity and explaining why the CPA was unable to gather sufficient appropriate evidential matter to warrant the expression of an opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

When expressing an opinion on a specified account or item in the financial statements, the auditor need only consider that account or item. However, the auditor must have audited the entire set of financial statements if this engagement requires a report on the entity's

A) Net income.

B) Retained earnings.

C) Assets.

D) Working capital.

A) Net income.

B) Retained earnings.

C) Assets.

D) Working capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

Auditing standards define special purpose financial statements as including those prepared under the following base(s)

A) Regulatory basis.

B) Tax basis.

C) Contractual basis.

D) All of these.

A) Regulatory basis.

B) Tax basis.

C) Contractual basis.

D) All of these.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

When audited financial statements are presented in an entity's document containing other information, the auditor should

A) Perform inquiry and analytical procedures to ascertain whether the other information is reasonable.

B) Add an explanatory paragraph to the auditor's report without changing the opinion on the financial statements.

C) Perform the appropriate substantive auditing procedures to corroborate the other information.

D) Read the other information to determine that it is consistent with the audited financial statements.

A) Perform inquiry and analytical procedures to ascertain whether the other information is reasonable.

B) Add an explanatory paragraph to the auditor's report without changing the opinion on the financial statements.

C) Perform the appropriate substantive auditing procedures to corroborate the other information.

D) Read the other information to determine that it is consistent with the audited financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

When are an auditor's reporting responsibilities not met by attaching an explanation of the circumstances and a disclaimer of opinion to the entity's financial statement?

A) When the auditor believes the financial statements are misleading.

B) When the auditor was unable to observe the taking of the physical inventory.

C) When the auditor is uncertain about the outcome of a material uncertainty.

D) When the auditor has performed insufficient auditing procedures to express an opinion.

A) When the auditor believes the financial statements are misleading.

B) When the auditor was unable to observe the taking of the physical inventory.

C) When the auditor is uncertain about the outcome of a material uncertainty.

D) When the auditor has performed insufficient auditing procedures to express an opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would not require an explanatory/emphasis-of-matter paragraph in the auditor's report?

A) Additional emphasis.

B) Lack of consistency in the financial statements due to accounting changes.

C) Going concern.

D) Opinion based in part on the report of another auditor.

A) Additional emphasis.

B) Lack of consistency in the financial statements due to accounting changes.

C) Going concern.

D) Opinion based in part on the report of another auditor.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

For each of the following situations, indicate what type of audit report is most appropriate.

a. The auditor lacks independence in fact, but not necessarily in appearance.

b. There is a scope limitation and it is material but the overall financial statements are still presented fairly.

c. The uncorrected misstatements are immaterial.

d. There is a departure from GAAP and it is pervasively material.

a. The auditor lacks independence in fact, but not necessarily in appearance.

b. There is a scope limitation and it is material but the overall financial statements are still presented fairly.

c. The uncorrected misstatements are immaterial.

d. There is a departure from GAAP and it is pervasively material.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

In the first audit of an entity, because of the entity's record retention policies, an auditor was not able to gather sufficient evidence about the consistent application of accounting principles between the current and the prior year, as well as the amounts of assets or liabilities at the beginning of the current year. If the amounts in question could materially affect current operating results, the auditor would

A) Be unable to express an opinion on the current year's results of operations and cash flows.

B) Express a qualified opinion on the financial statements because of a client-imposed scope limitation.

C) Withdraw from the engagement and refuse to be associated with the financial statements.

D) Specifically state that the financial statements are not comparable to the prior year because of an uncertainty.

A) Be unable to express an opinion on the current year's results of operations and cash flows.

B) Express a qualified opinion on the financial statements because of a client-imposed scope limitation.

C) Withdraw from the engagement and refuse to be associated with the financial statements.

D) Specifically state that the financial statements are not comparable to the prior year because of an uncertainty.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

A scope limitation sufficient to preclude an unqualified opinion always will result when management

A) Prevents the auditor from reviewing the working papers of the predecessor auditor.

B) Engages the auditor after the year-end physical inventory is completed.

C) Requests that certain material accounts receivable not be confirmed.

D) Refuses to provide a representation letter acknowledging its responsibility for the fair presentation of the financial statements in conformity with GAAP.

A) Prevents the auditor from reviewing the working papers of the predecessor auditor.

B) Engages the auditor after the year-end physical inventory is completed.

C) Requests that certain material accounts receivable not be confirmed.

D) Refuses to provide a representation letter acknowledging its responsibility for the fair presentation of the financial statements in conformity with GAAP.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

Changes in an entity's accounting choices either affect "consistency" in the application of GAAP or they do not. For each item listed below, state whether the item affects consistency and identify the effect the change will have on the audit report.

1. Change in accounting estimate.

2. Correction of an error in principle.

3. Change in reporting entity.

4. Correction of an error that does not involve an accounting principle.

5. Change in accounting principle.

6. Change in classification and reclassification.

7. Change expected to have a material future effect.

1. Change in accounting estimate.

2. Correction of an error in principle.

3. Change in reporting entity.

4. Correction of an error that does not involve an accounting principle.

5. Change in accounting principle.

6. Change in classification and reclassification.

7. Change expected to have a material future effect.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

An auditor concludes that there is a material inconsistency in the other information in an annual report to shareholders containing audited financial statements. If the auditor concludes that the financial statements do not require revision, but the entity refuses to revise or eliminate the material inconsistency, the auditor may

A) Issue an "except for" qualified opinion after discussing the matter with the entity's board of directors.

B) Consider the matter closed since the other information is not in the audited financial statements.

C) Disclaim an opinion on the financial statements after explaining the material inconsistency in a separate explanatory/emphasis-of-matter paragraph.

D) Revise the auditor's report to include a separate explanatory/emphasis-of- matter paragraph describing the material inconsistency.

A) Issue an "except for" qualified opinion after discussing the matter with the entity's board of directors.

B) Consider the matter closed since the other information is not in the audited financial statements.

C) Disclaim an opinion on the financial statements after explaining the material inconsistency in a separate explanatory/emphasis-of-matter paragraph.

D) Revise the auditor's report to include a separate explanatory/emphasis-of- matter paragraph describing the material inconsistency.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

The following four situations require a modification to the standard unqualified/unmodified audit report. Identify the modification required for each.

a. Opinion based in part on the report of another auditor.

b. Going concern.

c. Lack of consistency.

d. Additional emphasis.

a. Opinion based in part on the report of another auditor.

b. Going concern.

c. Lack of consistency.

d. Additional emphasis.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

In which of the following situations would an auditor ordinarily choose between expressing an "except for" qualified opinion and expressing an adverse opinion?

A) The auditor did not observe the entity's physical inventory and is unable to become satisfied as to its balance by other auditing procedures.

B) The financial statements fail to disclose information that is required by generally accepted accounting principles.

C) The auditor is asked to report only on the entity's balance sheet and not on the other basic financial statements.

D) Events disclosed in the financial statements cause the auditor to have substantial doubt about the entity's ability to continue as a going concern.

A) The auditor did not observe the entity's physical inventory and is unable to become satisfied as to its balance by other auditing procedures.

B) The financial statements fail to disclose information that is required by generally accepted accounting principles.

C) The auditor is asked to report only on the entity's balance sheet and not on the other basic financial statements.

D) Events disclosed in the financial statements cause the auditor to have substantial doubt about the entity's ability to continue as a going concern.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

Discuss the conditions that prohibit the auditor from issuing an unqualified/unmodified opinion and the types of reports that the auditor may issue for a financial statement audit.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

Cravens was asked to perform the first audit of a wholesale business that does not maintain perpetual inventory records. Cravens has observed the current inventory but has not observed the physical inventory at the previous year-end date and concludes that the opening inventory balance, which is not auditable, is a material factor in the determination of cost of goods sold for the current year. Cravens will probably

A) Decline the engagement.

B) Express an unqualified/unmodified opinion on the balance sheet and income statement except for inventory.

C) Issue a disclaimer of opinion.

D) Issue an adverse opinion.

A) Decline the engagement.

B) Express an unqualified/unmodified opinion on the balance sheet and income statement except for inventory.

C) Issue a disclaimer of opinion.

D) Issue an adverse opinion.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

Jeff Johns is a staff accountant and has been assigned to the audit of Worldwide Enterprises, Inc. Subsequent to the completion of fieldwork, Jeff was assigned to draft the audit report. The content of one of the paragraphs he has drafted reads as follows:

As explained in Note 2 to the financial statements, Worldwide Enterprises has charged goodwill and certain other intangible assets acquired in two separate acquisitions directly to shareholders' equity. Under generally accepted accounting principles, these intangibles should have been recorded as assets and amortized to income over future periods. Had these intangibles been capitalized, total assets would have increased by $400,000 as of December 31, 2011 and net income and earnings per share would be increased by $380,000 and $2.25, respectively (assuming a 20-year amortization period).

a. Based on the contents of the paragraph above, which condition requiring a departure from a standard unqualified/unmodified opinion exists in the engagement?

b. Assuming that the engagement partner agrees with the paragraph Jeff has prepared above, where in the auditor's report should the paragraph be placed?

c. How would the materiality of the condition above affect the final choice of opinion?

As explained in Note 2 to the financial statements, Worldwide Enterprises has charged goodwill and certain other intangible assets acquired in two separate acquisitions directly to shareholders' equity. Under generally accepted accounting principles, these intangibles should have been recorded as assets and amortized to income over future periods. Had these intangibles been capitalized, total assets would have increased by $400,000 as of December 31, 2011 and net income and earnings per share would be increased by $380,000 and $2.25, respectively (assuming a 20-year amortization period).

a. Based on the contents of the paragraph above, which condition requiring a departure from a standard unqualified/unmodified opinion exists in the engagement?

b. Assuming that the engagement partner agrees with the paragraph Jeff has prepared above, where in the auditor's report should the paragraph be placed?

c. How would the materiality of the condition above affect the final choice of opinion?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

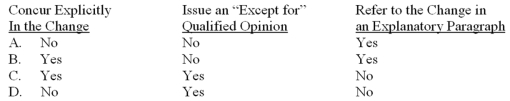

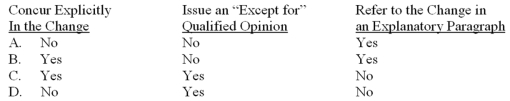

71

When there has been a change in accounting principle that materially affects the comparability of the comparative financial statements presented for a public company and the auditor concurs with the change, the auditor should

A) A.

B) B.

C) C.

D) D.

A) A.

B) B.

C) C.

D) D.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

A special report related to compliance with contractual provisions provides

A) Positive assurance.

B) Negative assurance.

C) No assurance.

D) None of these.

A) Positive assurance.

B) Negative assurance.

C) No assurance.

D) None of these.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

Identify the special purpose framework used in each of the following situations.

1. A real estate company reports to its partners on the basis used to complete the income tax return.

2. A company has its financial statements prepared on a price-level adjusted basis as required by its lender.

3. An insurance company reports in compliance with the rules of a state insurance commission.

4. A partnership reports on revenues received and expenses paid.

What modifications must be made to the standard auditor's report for these situations?

1. A real estate company reports to its partners on the basis used to complete the income tax return.

2. A company has its financial statements prepared on a price-level adjusted basis as required by its lender.

3. An insurance company reports in compliance with the rules of a state insurance commission.

4. A partnership reports on revenues received and expenses paid.

What modifications must be made to the standard auditor's report for these situations?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

In an engagement to express an opinion on one or more specified elements, accounts, or items of a financial statement, the auditor can generally audit only those specified elements and not the entire set of financial statements. However, the auditor is required to audit the entire set of financial statements if the elements specified include

A) Net Income.

B) Stockholders' Equity.

C) Net Income and Stockholders' Equity.

D) Assets.

A) Net Income.

B) Stockholders' Equity.

C) Net Income and Stockholders' Equity.

D) Assets.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck