Deck 16: Auditing the Financinginvesting Process: Cash and Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 16: Auditing the Financinginvesting Process: Cash and Investments

1

The cash account is affected by all of the entity's business processes.

True

2

An imprest cash account is used for specific purposes and generally maintains a very small balance.

True

3

It is generally more efficient to follow a substantive strategy for auditing investments.

True

4

The general cash account is normally the principal account used to disburse payroll.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

If the entity maintains custody of its investments, the auditor normally examines the actual securities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following internal controls most likely would reduce the risk of diversion of customer receipts by an entity's employees?

A) A bank lockbox system.

B) Prenumbered remittance advices.

C) Monthly bank reconciliations.

D) Daily deposit of cash receipts.

A) A bank lockbox system.

B) Prenumbered remittance advices.

C) Monthly bank reconciliations.

D) Daily deposit of cash receipts.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

To satisfy the valuation assertion when auditing an investment accounted for by the equity method, an auditor most likely would

A) Inspect the stock certificates evidencing the investment.

B) Examine the audited financial statements of the investee company.

C) Review the broker's advice or canceled check for the investment's acquisition.

D) Obtain market quotations from financial newspapers or periodicals.

A) Inspect the stock certificates evidencing the investment.

B) Examine the audited financial statements of the investee company.

C) Review the broker's advice or canceled check for the investment's acquisition.

D) Obtain market quotations from financial newspapers or periodicals.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

An auditor testing long-term investments would ordinarily use substantive analytical procedures as the primary audit evidence to support the reasonableness of the

A) Valuation of marketable equity securities.

B) Classification of gains and losses on the disposal of securities.

C) Completeness of recorded investment income.

D) Existence and ownership of investments.

A) Valuation of marketable equity securities.

B) Classification of gains and losses on the disposal of securities.

C) Completeness of recorded investment income.

D) Existence and ownership of investments.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Kiting is an audit procedure used to test the accuracy of the cash receipts.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

An unrecorded check issued during the last week of the year would most likely be discovered by the auditor when the

A) Check register for the last month is reviewed.

B) Cutoff bank statement is reconciled.

C) Bank confirmation is reviewed.

D) Search for unrecorded liabilities is performed.

A) Check register for the last month is reviewed.

B) Cutoff bank statement is reconciled.

C) Bank confirmation is reviewed.

D) Search for unrecorded liabilities is performed.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

An interbank transfer schedule

A) Is another name for the proof of cash.

B) Helps the auditor test for kiting.

C) Is on a standard bank confirmation.

D) Is used to examine entity bank reconciliations.

A) Is another name for the proof of cash.

B) Helps the auditor test for kiting.

C) Is on a standard bank confirmation.

D) Is used to examine entity bank reconciliations.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is one of the better auditing techniques that might be used by an auditor to detect kiting between intercompany banks?

A) Review the composition of authenticated deposit slips.

B) Review subsequent bank statements received directly from the banks.

C) Prepare a schedule of bank transfers.

D) Prepare year-end bank reconciliations.

A) Review the composition of authenticated deposit slips.

B) Review subsequent bank statements received directly from the banks.

C) Prepare a schedule of bank transfers.

D) Prepare year-end bank reconciliations.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

A major control that directly affects the audit of cash is the bank reconciliation prepared by the auditor.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

The least crucial element of internal control over cash is

A) Separation of cash record-keeping from custody of cash.

B) Preparation of the monthly bank reconciliation.

C) Batch processing of checks.

D) Separation of cash receipts from cash disbursements.

A) Separation of cash record-keeping from custody of cash.

B) Preparation of the monthly bank reconciliation.

C) Batch processing of checks.

D) Separation of cash receipts from cash disbursements.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

The auditor's use of analytical procedures for auditing cash is limited.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Level 1 inputs are more risky and difficult to audit than Level 3 inputs to a valuation model.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following audit procedures is the most appropriate when internal control over cash is weak or when an entity requests an investigation of cash transactions?

A) Proof of cash.

B) Bank reconciliation.

C) Cash confirmation.

D) Evaluate ratio of cash to current liabilities.

A) Proof of cash.

B) Bank reconciliation.

C) Cash confirmation.

D) Evaluate ratio of cash to current liabilities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Of the following, which is the most efficient audit procedure for verification of interest earned on bond investments?

A) Tracing interest declarations to an independent record book.

B) Recomputing interest earned using the interest rate and bond amount.

C) Confirming the interest rate with the issuer of the bonds.

D) Vouching the receipt and deposit of interest checks.

A) Tracing interest declarations to an independent record book.

B) Recomputing interest earned using the interest rate and bond amount.

C) Confirming the interest rate with the issuer of the bonds.

D) Vouching the receipt and deposit of interest checks.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

If fraud is suspected, auditors may complete all of the following procedures except:

A) Testing for kiting.

B) Footing the bank reconciliation and the outstanding checks listing.

C) Performing a proof of cash.

D) Performing extended bank reconciliation procedures, including detailed examination of reconciling items.

A) Testing for kiting.

B) Footing the bank reconciliation and the outstanding checks listing.

C) Performing a proof of cash.

D) Performing extended bank reconciliation procedures, including detailed examination of reconciling items.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

A cutoff bank statement is used to verify the propriety of the reconciling items shown on the bank reconciliation.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following procedures most likely would give the greatest assurance that securities held as investments are safeguarded?

A) There is no access to securities between the year-end and the date of the auditor's security count.

B) Proceeds from the sale of investments are received by an employee who does not have access to securities.

C) Investment acquisitions are authorized by a member of the Board of Directors before execution.

D) Access to securities requires the presence of two designated officials.

A) There is no access to securities between the year-end and the date of the auditor's security count.

B) Proceeds from the sale of investments are received by an employee who does not have access to securities.

C) Investment acquisitions are authorized by a member of the Board of Directors before execution.

D) Access to securities requires the presence of two designated officials.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

An auditor who is engaged to examine the financial statements of a business enterprise will request a cutoff bank statement primarily to

A) Verify the cash balance reported on the bank confirmation inquiry form.

B) Verify reconciling items on the entity's bank reconciliation.

C) Detect lapping.

D) Detect kiting.

A) Verify the cash balance reported on the bank confirmation inquiry form.

B) Verify reconciling items on the entity's bank reconciliation.

C) Detect lapping.

D) Detect kiting.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

An imprest cash account is

A) Used for investing in marketable securities.

B) The principal cash account for an entity.

C) One that contains a stipulated amount of money and is used for limited purposes.

D) The principal checking account for a branch of an entity.

A) Used for investing in marketable securities.

B) The principal cash account for an entity.

C) One that contains a stipulated amount of money and is used for limited purposes.

D) The principal checking account for a branch of an entity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following pairs of accounts would an auditor most likely analyze on the same working paper?

A) Notes receivable and interest income.

B) Accrued interest receivable and accrued interest payable.

C) Notes payable and notes receivable.

D) Interest income and interest expense.

A) Notes receivable and interest income.

B) Accrued interest receivable and accrued interest payable.

C) Notes payable and notes receivable.

D) Interest income and interest expense.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

Tracing a sample of remittance advices to entries in the cash receipts journal tests which of the following assertions for cash?

A) Occurrence.

B) Completeness.

C) Authorization.

D) Cutoff.

A) Occurrence.

B) Completeness.

C) Authorization.

D) Cutoff.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

A company has additional temporary funds to invest. The Board of Directors decided to purchase marketable securities and assigned the future purchase and sale decisions to a responsible financial executive. The best person(s) to make periodic reviews of the investment activity authorized by that executive should be

A) An investment committee of the Board of Directors.

B) The chief operating officer.

C) The corporate controller.

D) The treasurer.

A) An investment committee of the Board of Directors.

B) The chief operating officer.

C) The corporate controller.

D) The treasurer.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following can assist the auditor in testing the existence assertion for investment securities except:

A) Physical examination.

B) Comparing fair value to cost.

C) Confirmation with the issuer.

D) Confirmation with the custodian.

A) Physical examination.

B) Comparing fair value to cost.

C) Confirmation with the issuer.

D) Confirmation with the custodian.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

Examining a sample of cancelled checks for an authorized signature tests which of the following assertions for cash?

A) Authorization.

B) Completeness.

C) Cutoff.

D) Accuracy.

A) Authorization.

B) Completeness.

C) Cutoff.

D) Accuracy.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following controls would an entity most likely use in safeguarding against the loss of marketable securities?

A) An independent trust company that has no direct contact with the employees who have recordkeeping responsibilities has possession of the securities.

B) The internal auditor verifies the marketable securities in the entity's safe each year on the balance sheet date.

C) The independent auditor traces all purchases and sales of marketable securities through the subsidiary ledgers to the general ledger.

D) A designated member of the board of directors controls the securities in a bank safe-deposit box.

A) An independent trust company that has no direct contact with the employees who have recordkeeping responsibilities has possession of the securities.

B) The internal auditor verifies the marketable securities in the entity's safe each year on the balance sheet date.

C) The independent auditor traces all purchases and sales of marketable securities through the subsidiary ledgers to the general ledger.

D) A designated member of the board of directors controls the securities in a bank safe-deposit box.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

To gather evidence regarding the balance per bank in a bank reconciliation, an auditor would examine all of the following except the:

A) Cutoff bank statement.

B) Year-end bank statement.

C) Bank confirmation.

D) General ledger.

A) Cutoff bank statement.

B) Year-end bank statement.

C) Bank confirmation.

D) General ledger.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

In confirming with an outside agent, such as a financial institution, that the agent is holding investment securities in the entity's name, an auditor most likely gathers evidence in support of management's financial statement assertions regarding

A) Existence.

B) Rights and obligations.

C) Completeness.

D) All of these.

A) Existence.

B) Rights and obligations.

C) Completeness.

D) All of these.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

The auditor should ordinarily mail confirmation requests to all banks with which the entity has conducted any business during the year, regardless of the year-end balance, since

A) The confirmation form also seeks information about indebtedness to the bank.

B) This procedure will detect kiting activities that would otherwise not be detected.

C) The mailing of confirmation forms to all such banks is required by generally accepted auditing standards.

D) This procedure relieves the auditor of any responsibility with respect to nondetection of forged checks.

A) The confirmation form also seeks information about indebtedness to the bank.

B) This procedure will detect kiting activities that would otherwise not be detected.

C) The mailing of confirmation forms to all such banks is required by generally accepted auditing standards.

D) This procedure relieves the auditor of any responsibility with respect to nondetection of forged checks.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

The cashier of Brooke Company covered a shortage in the cash working fund with cash obtained on December 31 from a local bank by cashing, but not recording, a check drawn on the company's out-of-town bank. How would the auditor discover this manipulation?

A) Confirming all December 31 bank balances.

B) Counting the cash working fund at the close of business on December 31.

C) Preparing independent bank reconciliations as of December 31.

D) Preparing and detail testing a bank transfer schedule.

A) Confirming all December 31 bank balances.

B) Counting the cash working fund at the close of business on December 31.

C) Preparing independent bank reconciliations as of December 31.

D) Preparing and detail testing a bank transfer schedule.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

A company holds bearer bonds as a short-term investment. Responsibility for custody of these bonds and submission of coupons for collections of periodic interest probably should be delegated to the

A) Chief Accountant.

B) Internal Auditor.

C) Cashier.

D) Treasurer.

A) Chief Accountant.

B) Internal Auditor.

C) Cashier.

D) Treasurer.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

An auditor should trace interbank transfers for the last part of the audit period and first part of the subsequent period to detect whether

A) The cash receipts journal was held open for a few days after the year-end.

B) The last checks recorded before the year end were actually mailed by the year-end.

C) Cash balances were overstated because of kiting.

D) Any unusual payments to or receipts from related parties occurred.

A) The cash receipts journal was held open for a few days after the year-end.

B) The last checks recorded before the year end were actually mailed by the year-end.

C) Cash balances were overstated because of kiting.

D) Any unusual payments to or receipts from related parties occurred.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

An auditor usually tests the reasonableness of dividend income from investments in stock of public companies by computing the amounts that should have been received by referring to

A) Dividend record books produced by investment advisory services.

B) Stock indentures published by corporate transfer agents.

C) Stock ledgers maintained by independent registrars.

D) Annual audited financial statements issued by the investee companies.

A) Dividend record books produced by investment advisory services.

B) Stock indentures published by corporate transfer agents.

C) Stock ledgers maintained by independent registrars.

D) Annual audited financial statements issued by the investee companies.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

A primary purpose of the proof of cash is to

A) Prevent fraud.

B) Reconcile actual cash receipts and disbursements to budgeted receipts and disbursements.

C) Investigate variances from expected cash balances.

D) Ensure that all cash receipts recorded in the cash receipts journal were deposited in the bank account.

A) Prevent fraud.

B) Reconcile actual cash receipts and disbursements to budgeted receipts and disbursements.

C) Investigate variances from expected cash balances.

D) Ensure that all cash receipts recorded in the cash receipts journal were deposited in the bank account.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

An auditor ordinarily should send a standard confirmation request to all banks with which the entity has done business during the year under audit, regardless of the year-end balance, because this procedure

A) Provides for confirmation regarding compensating balance arrangements.

B) Detects kiting activities that may not otherwise be discovered.

C) Seeks information about indebtedness to the bank.

D) Verifies securities held by the bank in safekeeping.

A) Provides for confirmation regarding compensating balance arrangements.

B) Detects kiting activities that may not otherwise be discovered.

C) Seeks information about indebtedness to the bank.

D) Verifies securities held by the bank in safekeeping.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Which one of the following would the auditor consider to be an incompatible operation if the cashier receives remittances from the mailroom?

A) The cashier posts the receipts to the accounts receivable subsidiary ledger cards.

B) The cashier makes the daily deposit at a local bank.

C) The cashier prepares the daily deposit.

D) The cashier endorses the checks.

A) The cashier posts the receipts to the accounts receivable subsidiary ledger cards.

B) The cashier makes the daily deposit at a local bank.

C) The cashier prepares the daily deposit.

D) The cashier endorses the checks.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

When an entity uses a trust company as custodian of its marketable securities, the possibility of concealing fraud most likely would be reduced if the

A) Trust company has no direct contact with the entity employees responsible for maintaining investment accounting records.

B) Securities are registered in the name of the trust company, rather than the entity itself.

C) Interest and dividend checks are mailed directly to an entity employee who is authorized to sell securities.

D) Trust company places the securities in a bank safe-deposit vault under the custodian's exclusive control.

A) Trust company has no direct contact with the entity employees responsible for maintaining investment accounting records.

B) Securities are registered in the name of the trust company, rather than the entity itself.

C) Interest and dividend checks are mailed directly to an entity employee who is authorized to sell securities.

D) Trust company places the securities in a bank safe-deposit vault under the custodian's exclusive control.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

In a manufacturing company, which one of the following audit procedures would give the least assurance for the existence of the general ledger balance of investment in stocks and bonds at the audit date?

A) Confirmation from the broker.

B) Inspection and count of stocks and bonds.

C) Vouching all changes during the year to brokers' advices and statements.

D) Examination of canceled checks issued in payment of securities purchased.

A) Confirmation from the broker.

B) Inspection and count of stocks and bonds.

C) Vouching all changes during the year to brokers' advices and statements.

D) Examination of canceled checks issued in payment of securities purchased.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

Explain how cash plays a role in all business processes.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

Auditors will need to perform more substantive tests than normal to obtain sufficient appropriate evidence that a financial instrument is fairly stated if which of the following conditions exist?

A) Management is objective and transparent in their assumptions.

B) Management's key assumptions are subject to volatility.

C) The entity's portfolio is composed of only stocks issued by Fortune 100 firms traded in an active market.

D) The entity does not have control weaknesses in its valuation processes.

A) Management is objective and transparent in their assumptions.

B) Management's key assumptions are subject to volatility.

C) The entity's portfolio is composed of only stocks issued by Fortune 100 firms traded in an active market.

D) The entity does not have control weaknesses in its valuation processes.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

The auditor should insist that a representative of the entity be present during the physical examination of securities in order to

A) Lend authority to the auditor's directives.

B) Detect forged securities.

C) Coordinate the return of all securities to proper locations.

D) Acknowledge the receipt of securities returned.

A) Lend authority to the auditor's directives.

B) Detect forged securities.

C) Coordinate the return of all securities to proper locations.

D) Acknowledge the receipt of securities returned.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Under which of the following circumstances would an auditor be most likely to intensify an examination of a $1,000 petty cash fund maintained on an imprest basis?

A) Reimbursement vouchers are not prenumbered.

B) Reimbursement of the fund from the general cash account occurs twice or more each week.

C) The custodian occasionally uses the cash fund to cash employee checks.

D) The custodian endorses reimbursement checks.

A) Reimbursement vouchers are not prenumbered.

B) Reimbursement of the fund from the general cash account occurs twice or more each week.

C) The custodian occasionally uses the cash fund to cash employee checks.

D) The custodian endorses reimbursement checks.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Jones was engaged to examine the financial statements of Virginia Corporation for the year ended June 30. Having completed an examination of the investment securities, which of the following is the best method of verifying the accuracy of recorded dividend income?

A) Tracing recorded dividend income to cash receipts records and validated deposit slips.

B) Utilizing analytical procedures and statistical sampling.

C) Comparing recorded dividends with amounts appearing on federal information forms 1099.

D) Comparing recorded dividends with a standard financial reporting service's record of dividends.

A) Tracing recorded dividend income to cash receipts records and validated deposit slips.

B) Utilizing analytical procedures and statistical sampling.

C) Comparing recorded dividends with amounts appearing on federal information forms 1099.

D) Comparing recorded dividends with a standard financial reporting service's record of dividends.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following would provide the best form of evidential matter pertaining to the annual valuation of a long-term investment in which the entity owns a 45 percent voting interest?

A) Market quotations of the investee company's stock.

B) The current fair value of the investee company's assets.

C) Historical costs of the investee company's assets.

D) Audited financial statements of the investee company.

A) Market quotations of the investee company's stock.

B) The current fair value of the investee company's assets.

C) Historical costs of the investee company's assets.

D) Audited financial statements of the investee company.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following procedures would be most important in the audit of an investment valued at fair value?

A) Compare the balance in the investment account to the prior year.

B) Read the footnote disclosure related to the investment.

C) Inquire of management's regarding the accuracy and reliability of the underlying data.

D) Develop an independent estimate of the fair value measurement.

A) Compare the balance in the investment account to the prior year.

B) Read the footnote disclosure related to the investment.

C) Inquire of management's regarding the accuracy and reliability of the underlying data.

D) Develop an independent estimate of the fair value measurement.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following control activities would an entity most likely use to assist in satisfying the completeness assertion related to long-term investments?

A) Senior management verifies that securities in the bank safe-deposit box are registered in the entity's name.

B) The internal auditor compares the securities in the bank safe-deposit box with recorded investments.

C) The treasurer vouches the acquisition of securities by comparing brokers' advices with canceled checks.

D) The controller compares the current market prices of recorded investments with the brokers' advices on file.

A) Senior management verifies that securities in the bank safe-deposit box are registered in the entity's name.

B) The internal auditor compares the securities in the bank safe-deposit box with recorded investments.

C) The treasurer vouches the acquisition of securities by comparing brokers' advices with canceled checks.

D) The controller compares the current market prices of recorded investments with the brokers' advices on file.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Examining brokers' advices for a sample of securities purchased during the year is a test for the assertion of

A) Completeness.

B) Disclosure.

C) Valuation and allocation.

D) Rights and obligations.

A) Completeness.

B) Disclosure.

C) Valuation and allocation.

D) Rights and obligations.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

For each assertion about cash listed below, give an example of a test of transactions for (1) cash receipts and (2) cash disbursements.

a. Classification.

b. Occurrence.

c. Authorization.

d. Completeness.

a. Classification.

b. Occurrence.

c. Authorization.

d. Completeness.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

When there is a large number of negotiable securities in multiple locations, careful planning of the physical inspection and count of the securities by the auditor is necessary to guard against

A) Unauthorized negotiation of the securities before they are counted.

B) Unrecorded sales of securities after they are counted.

C) Substitution of securities already counted at one location for other securities that should be on hand at a different location but are not.

D) Substitution of authentic securities with counterfeit securities.

A) Unauthorized negotiation of the securities before they are counted.

B) Unrecorded sales of securities after they are counted.

C) Substitution of securities already counted at one location for other securities that should be on hand at a different location but are not.

D) Substitution of authentic securities with counterfeit securities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

An entity has a large and active investment portfolio that is kept in a bank safe-deposit box. If the auditor is unable to examine and count the securities at the balance sheet date but will examine and count the securities shortly thereafter, the auditor most likely will

A) Request that the bank confirm to the auditor the contents of the safe-deposit box at the balance sheet date.

B) Examine supporting evidence for transactions occurring during the year.

C) Count the securities at a subsequent date and confirm with the bank whether securities were added or removed since the balance sheet date.

D) Request that the entity have the bank seal the safe-deposit box until the auditor can count the securities at a subsequent date.

A) Request that the bank confirm to the auditor the contents of the safe-deposit box at the balance sheet date.

B) Examine supporting evidence for transactions occurring during the year.

C) Count the securities at a subsequent date and confirm with the bank whether securities were added or removed since the balance sheet date.

D) Request that the entity have the bank seal the safe-deposit box until the auditor can count the securities at a subsequent date.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

As one of the year-end audit procedures, the auditor instructed the entity's personnel to prepare a standard bank confirmation request for a bank account that had been closed during the year. After the entity's treasurer had signed the request, it was mailed to the bank by the assistant treasurer. What is the major flaw in this audit procedure?

A) The confirmation request was signed by the treasurer.

B) Sending the request was meaningless because the account was closed before the year-end.

C) The request was mailed by the assistant treasurer.

D) The CPA did not sign the confirmation request before it was mailed.

A) The confirmation request was signed by the treasurer.

B) Sending the request was meaningless because the account was closed before the year-end.

C) The request was mailed by the assistant treasurer.

D) The CPA did not sign the confirmation request before it was mailed.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not one of the auditor's primary objectives in an examination of marketable securities?

A) To determine whether securities are authentic.

B) To determine whether securities are the property of the entity.

C) To determine whether securities actually exist.

D) To determine whether securities are properly classified on the balance sheet.

A) To determine whether securities are authentic.

B) To determine whether securities are the property of the entity.

C) To determine whether securities actually exist.

D) To determine whether securities are properly classified on the balance sheet.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

When an auditor is unable to inspect and count an entity's investment securities until after the balance sheet date, the bank where the securities are held in a safe-deposit box should be notified on or before the balance sheet date that it will be asked to

A) Verify any differences between the contents of the box and the balances in the entity's subsidiary ledger.

B) Provide a list of securities added and removed from the box between the balance sheet date and the security-count date.

C) Confirm that there has been no access to the box between the balance sheet date and the security-count date.

D) Count the securities in the box so that the auditor will have an independent direct verification.

A) Verify any differences between the contents of the box and the balances in the entity's subsidiary ledger.

B) Provide a list of securities added and removed from the box between the balance sheet date and the security-count date.

C) Confirm that there has been no access to the box between the balance sheet date and the security-count date.

D) Count the securities in the box so that the auditor will have an independent direct verification.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following controls would a company most likely use to safeguard marketable securities when an independent trust agent is not employed?

A) The investment committee of the board of directors periodically reviews the investment decisions delegated to the treasurer.

B) Two company officials must be present to access marketable securities, which are kept in a bank safe-deposit box.

C) The internal auditor and the controller independently trace all purchases and sales of marketable securities from the subsidiary ledgers to the general ledger.

D) The chairman of the board verifies the marketable securities, which are kept in a bank safe-deposit box, each year on the balance sheet date.

A) The investment committee of the board of directors periodically reviews the investment decisions delegated to the treasurer.

B) Two company officials must be present to access marketable securities, which are kept in a bank safe-deposit box.

C) The internal auditor and the controller independently trace all purchases and sales of marketable securities from the subsidiary ledgers to the general ledger.

D) The chairman of the board verifies the marketable securities, which are kept in a bank safe-deposit box, each year on the balance sheet date.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

The primary purpose of sending a standard confirmation request to financial institutions with which the entity has done business during the year is to

A) Detect kiting activities that may otherwise not be discovered.

B) Corroborate information regarding deposit and loan balances.

C) Provide the data necessary to prepare a proof of cash.

D) Request information about contingent liabilities and secured transactions.

A) Detect kiting activities that may otherwise not be discovered.

B) Corroborate information regarding deposit and loan balances.

C) Provide the data necessary to prepare a proof of cash.

D) Request information about contingent liabilities and secured transactions.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

In establishing the existence and ownership of a long-term investment in stock of a publicly traded company, an auditor should inspect the securities or

A) Correspond with the investee company to verify the number of shares owned.

B) Inspect the audited financial statements of the investee company.

C) Confirm the number of shares owned that are held by an independent custodian.

D) Determine that the investment is carried at the lower-of-cost-or-market.

A) Correspond with the investee company to verify the number of shares owned.

B) Inspect the audited financial statements of the investee company.

C) Confirm the number of shares owned that are held by an independent custodian.

D) Determine that the investment is carried at the lower-of-cost-or-market.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Explain the importance of the bank reconciliation to the audit and list some of the items found on the reconciliation.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

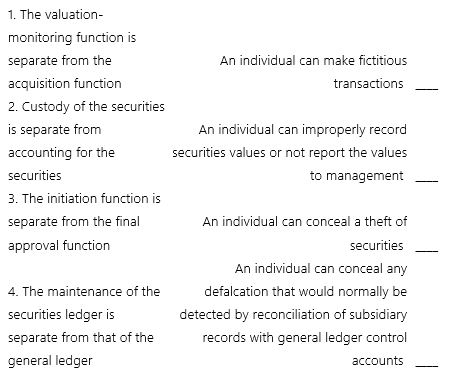

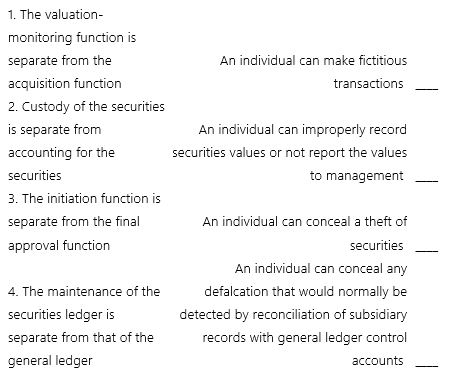

Match the segregation of duties for investments with the misstatement (due to error or fraud) it can help prevent.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

What should an auditor look for when testing for proper classification of securities?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

What are the factors that must be considered to determine if a permanent decline in the value of an investment security has occurred?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

For each test of transactions and each test of account balances for investments listed below, identify the assertion for which the test provides evidence.

1. Determine whether there has been any permanent impairment in the value of the cost basis of an individual security.

2. Inspect securities if they are maintained by the entity or obtain a confirmation from an independent custodian.

3. Search for purchases of securities by examining transactions for a few days after year-end.

4. Examine brokers' advices for a sample of securities purchased during the year.

1. Determine whether there has been any permanent impairment in the value of the cost basis of an individual security.

2. Inspect securities if they are maintained by the entity or obtain a confirmation from an independent custodian.

3. Search for purchases of securities by examining transactions for a few days after year-end.

4. Examine brokers' advices for a sample of securities purchased during the year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

Match the type of bank account with its definition:

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

The first step in auditing petty cash is to gain an understanding of the entity's controls over petty cash. Describe some important controls an entity should have over its petty cash fund.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

Identify 3 of the 6 tests an auditor uses on the bank reconciliation.

(Only 3 are required for the student's answer)

(Only 3 are required for the student's answer)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

You are auditing cash for Moonbeam, Inc. In meeting with the CFO during the planning stages of the audit, she indicated that there was a high risk of misstatement due to fraud in the cash account, given the lack of proper segregation of duties. As the auditor, what tests could you perform to detect fraudulent activities in the cash account?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck