Deck 19: Financing and Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/84

Play

Full screen (f)

Deck 19: Financing and Valuation

1

To calculate the total value of the firm (V),one should rely on the:

A)market values of debt and equity.

B)market value of debt and the book value of equity.

C)book values of debt and the market value of equity.

D)book values of debt and equity.

A)market values of debt and equity.

B)market value of debt and the book value of equity.

C)book values of debt and the market value of equity.

D)book values of debt and equity.

market values of debt and equity.

2

A firm has a total market value of $10 million while its debt has a market value of $4 million.What is the after-tax weighted average cost of capital if the before-tax cost of debt is 10%,the cost of equity is 15%,and the tax rate is 35%?

A)13.0%

B)11.6%

C)8.8%

D)10.4%

A)13.0%

B)11.6%

C)8.8%

D)10.4%

11.6%

3

Consider the following data:

FCF1 = $20 million; FCF2 = $20 million; FCF3 = $20 million.Assume that free cash flow grows at a rate of 5% for year 4 and beyond.If the weighted average cost of capital is 12%,calculate the value of the firm.

A)$300 million

B)$261.57 million

C)$213.53 million

D)$238.69 million

FCF1 = $20 million; FCF2 = $20 million; FCF3 = $20 million.Assume that free cash flow grows at a rate of 5% for year 4 and beyond.If the weighted average cost of capital is 12%,calculate the value of the firm.

A)$300 million

B)$261.57 million

C)$213.53 million

D)$238.69 million

$261.57 million

4

Given are the following data for year 1:

Profits after taxes = $14 million; Depreciation = $6 million; Interest expense = $6 million; Investment in fixed assets = $12 million; Investment in working capital = $3 million.Calculate the free cash flow (FCF)for year 1:

A)$4 million.

B)$5 million.

C)$6 million.

D)$7 million.

Profits after taxes = $14 million; Depreciation = $6 million; Interest expense = $6 million; Investment in fixed assets = $12 million; Investment in working capital = $3 million.Calculate the free cash flow (FCF)for year 1:

A)$4 million.

B)$5 million.

C)$6 million.

D)$7 million.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

5

Consider the following data:

FCF1 = $7 million; FCF2 = $45 million; FCF3 = $55 million.Assume that free cash flow grows at a rate of 4% for year 4 and beyond.If the weighted average cost of capital is 10%,calculate the value of the firm.

A)$953.33 million

B)$801.12 million

C)$716.25 million

D)$736.02 million

FCF1 = $7 million; FCF2 = $45 million; FCF3 = $55 million.Assume that free cash flow grows at a rate of 4% for year 4 and beyond.If the weighted average cost of capital is 10%,calculate the value of the firm.

A)$953.33 million

B)$801.12 million

C)$716.25 million

D)$736.02 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

6

Project M requires an initial investment of $25 million.The project is expected to generate $2.25 million in after-tax cash flow each year forever.Calculate the IRR for the project.

A)10%

B)9%

C)8%

D)7%

A)10%

B)9%

C)8%

D)7%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

7

Project M requires an initial investment of $25 million.The project is expected to generate $2.25 million in after-tax cash flow each year forever.If the weighted average cost of capital (WACC)is 9%,calculate the NPV of the project.

A)-2.5 million

B)+2.5 million

C)zero

D)+2.1 million

A)-2.5 million

B)+2.5 million

C)zero

D)+2.1 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

8

One should determine the after-tax weighted average cost of capital by:

A)multiplying the weighted average after-tax cost of debt by the weighted average cost of equity.

B)adding the weighted average before-tax cost of debt to the weighted average cost of equity.

C)adding the weighted average after-tax cost of debt to the weighted average cost of equity.

D)dividing the weighted average before-tax cost of debt to the weighted average cost of equity.

A)multiplying the weighted average after-tax cost of debt by the weighted average cost of equity.

B)adding the weighted average before-tax cost of debt to the weighted average cost of equity.

C)adding the weighted average after-tax cost of debt to the weighted average cost of equity.

D)dividing the weighted average before-tax cost of debt to the weighted average cost of equity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

9

When using the weighted average cost of capital (WACC)to discount cash flows from a project,we assume the following:

I.The project's risks are the same as those of the firm's other assets and remain so for the life of the project.

II.The project supports the same fraction of debt to value as the firm's overall capital structure,and that fraction remains constant for the life of the project.

III.The cash flows from the project occur in perpetuity.

A)I only

B)II only

C)I and II only

D)I,II,and III

I.The project's risks are the same as those of the firm's other assets and remain so for the life of the project.

II.The project supports the same fraction of debt to value as the firm's overall capital structure,and that fraction remains constant for the life of the project.

III.The cash flows from the project occur in perpetuity.

A)I only

B)II only

C)I and II only

D)I,II,and III

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

10

Calculate the value of the firm:

A)$90.4 million.

B)$104 million.

C)$82.6 million.

D)$83.3 million.

A)$90.4 million.

B)$104 million.

C)$82.6 million.

D)$83.3 million.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

11

Capital budgeting projects that incorporate both investment and financing decision side effects can be properly analyzed by:

I.adjusting the project's present value (APV);

II.adjusting the project's discount rate (WACC);

III.relying only on MM Propositions I and II

A)I only

B)II only

C)III only

D)I and II only

I.adjusting the project's present value (APV);

II.adjusting the project's discount rate (WACC);

III.relying only on MM Propositions I and II

A)I only

B)II only

C)III only

D)I and II only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

12

When one uses the weighted average cost of capital (WACC)to value a levered firm,the interest tax shield is:

A)not accounted for by the use of the WACC

B)considered by deducting the interest payment from the cash flows

C)automatically considered because the after-tax cost of debt is included within the WACC formula

D)capitalized by the levered cost of equity

A)not accounted for by the use of the WACC

B)considered by deducting the interest payment from the cash flows

C)automatically considered because the after-tax cost of debt is included within the WACC formula

D)capitalized by the levered cost of equity

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

13

Free cash flow (FCF)and net income (NI)differ in the following ways:

I.Net income accrues to shareholders,calculated after interest expense; free cash flow is calculated before interest.

II.Net income is calculated after various noncash expenses,including depreciation; FCF adds back depreciation.

III.Capital expenditures and investments in working capital do not appear in net income calculations; they do reduce free cash flows.

IV.Net income is never negative; free cash flows can be negative for rapidly growing firms,even if the firm is profitable,because investments can exceed cash flows from operations.

A)I only

B)I and II only

C)I,II,and III only

D)I,II,III,and IV

I.Net income accrues to shareholders,calculated after interest expense; free cash flow is calculated before interest.

II.Net income is calculated after various noncash expenses,including depreciation; FCF adds back depreciation.

III.Capital expenditures and investments in working capital do not appear in net income calculations; they do reduce free cash flows.

IV.Net income is never negative; free cash flows can be negative for rapidly growing firms,even if the firm is profitable,because investments can exceed cash flows from operations.

A)I only

B)I and II only

C)I,II,and III only

D)I,II,III,and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

14

While calculating the weighted average cost of capital,which values should one use for D,E,and V?

A)Book values

B)Liquidating values

C)Market values

D)Market value of debt and book value of equity

A)Book values

B)Liquidating values

C)Market values

D)Market value of debt and book value of equity

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

15

The following situations typically require that the financial manager value an entire business:

I.If firm A is about make a takeover offer for firm B,then A's financial managers have to decide how much the combined business A + B is worth under A's management.

II.If firm C is considering the sale of one of its divisions or a business line,it has to decide what the division or the business line is worth in order to negotiate with potential buyers.

III.When a firm goes public,the investment bank must evaluate how much the firm is worth in order to set the price.

A)I only

B)I and II only

C)III only

D)I,II,and III

I.If firm A is about make a takeover offer for firm B,then A's financial managers have to decide how much the combined business A + B is worth under A's management.

II.If firm C is considering the sale of one of its divisions or a business line,it has to decide what the division or the business line is worth in order to negotiate with potential buyers.

III.When a firm goes public,the investment bank must evaluate how much the firm is worth in order to set the price.

A)I only

B)I and II only

C)III only

D)I,II,and III

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

16

Given are the following data for year 1: Profit after taxes = $5 million; Depreciation = $2 million; Investment in fixed assets = $4 million; Investment net working capital = $1 million.Calculate the free cash flow (FCF)for year 1:

A)$7 million.

B)$3 million.

C)$11 million.

D)$2 million.

A)$7 million.

B)$3 million.

C)$11 million.

D)$2 million.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

17

Given are the following data for year 1:

Profits after taxes = $20 million; Depreciation = $6 million; Interest expense = $4 million; Investment in fixed assets = $12 million; Investment in working capital = $4 million.Calculate the free cash flow (FCF)for year 1:

A)$4 million.

B)$6 million.

C)$8 million.

D)$10 million.

Profits after taxes = $20 million; Depreciation = $6 million; Interest expense = $4 million; Investment in fixed assets = $12 million; Investment in working capital = $4 million.Calculate the free cash flow (FCF)for year 1:

A)$4 million.

B)$6 million.

C)$8 million.

D)$10 million.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

18

Given are the following data: Cost of debt = rD = 6.0%; Cost of equity = rE = 12.1%; Marginal tax rate = 35%; and the firm has 50% debt and 50% equity.Calculate the after-tax weighted average cost of capital (WACC):

A)8.0%.

B)7.1%.

C)9.0%.

D)5.9%.

A)8.0%.

B)7.1%.

C)9.0%.

D)5.9%.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

19

Given are the following data for Golf Corporation:

Market price/share = $12; Book value/share = $10; Number of shares outstanding = 100 million; Market price/bond = $800; Face value/bond = $1,000; Number of bonds outstanding = 1 million.Calculate the proportions of debt (D/V)and equity (E/V)for Golf Corporation that you should use for estimating its weighted average cost of capital (WACC):

A)40% debt and 60% equity.

B)50% debt and 50% equity.

C)45.5% debt and 54.5% equity.

D)66.7% debt and 33.3% equity.

Market price/share = $12; Book value/share = $10; Number of shares outstanding = 100 million; Market price/bond = $800; Face value/bond = $1,000; Number of bonds outstanding = 1 million.Calculate the proportions of debt (D/V)and equity (E/V)for Golf Corporation that you should use for estimating its weighted average cost of capital (WACC):

A)40% debt and 60% equity.

B)50% debt and 50% equity.

C)45.5% debt and 54.5% equity.

D)66.7% debt and 33.3% equity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

20

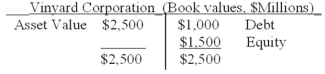

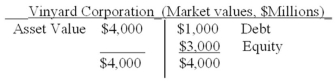

Given are the following data for Vinyard Corporation:

Calculate the proportions of debt (D/V)and equity (E/V)that you would use for estimating Vinyard's weighted average cost of capital (WACC):

A)40% debt and 60% equity.

B)50% debt and 50% equity.

C)25% debt and 75% equity.

D)75% debt and 25% equity.

Calculate the proportions of debt (D/V)and equity (E/V)that you would use for estimating Vinyard's weighted average cost of capital (WACC):

A)40% debt and 60% equity.

B)50% debt and 50% equity.

C)25% debt and 75% equity.

D)75% debt and 25% equity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

21

Calculate the present value of the horizon value.(Assume that the horizon value includes the 6.24M FCF in year 4.)

A)$90.4 million

B)$104 million

C)$78.1 million

D)$75.1 million

A)$90.4 million

B)$104 million

C)$78.1 million

D)$75.1 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

22

The flow-to-equity method uses:

I.cash flows to equity,after interest and after taxes;

II.the cost of equity capital as the discount rate;

III.the weighted average cost of capital for discount rate;

IV.after-tax cash flows without considering interest and dividend payments

A)I and II only

B)II and III only

C)I and III only

D)II and IV only

I.cash flows to equity,after interest and after taxes;

II.the cost of equity capital as the discount rate;

III.the weighted average cost of capital for discount rate;

IV.after-tax cash flows without considering interest and dividend payments

A)I and II only

B)II and III only

C)I and III only

D)II and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

23

Mirion Tech,Inc.,has rE of 12%,an rD of 6%,at a debt-equity ratio of 0.50.Mirion plans to raise enough preferred stock to retire half of their outstanding common stock,which currently has a market value of $7 million.If the preferred stock has an expected rate of return of 10%,what is the new WACC? (Assume a 35% marginal corporate tax rate and that rD remains at 6%.)

A)14.23%

B)11.02%

C)9.30%

D)6.60%

A)14.23%

B)11.02%

C)9.30%

D)6.60%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

24

The opportunity cost of capital,used to calculate the base-case for adjusted present value analyses,can be thought of as:

A)the promised yield rather than the expected yield of an investment.

B)the rate corresponding to an average debt level among firms in the industry.

C)the WACC of an all-equity financed version of the firm.

D)the return on the opportunities exploited by a firm's competitors.

A)the promised yield rather than the expected yield of an investment.

B)the rate corresponding to an average debt level among firms in the industry.

C)the WACC of an all-equity financed version of the firm.

D)the return on the opportunities exploited by a firm's competitors.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

25

Calculate the value of the firm:

A)$100 million

B)$65 million

C)$30 million

D)$170 million

A)$100 million

B)$65 million

C)$30 million

D)$170 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

26

The flow to equity method provides an accurate estimate of the value of a firm if:

A)the debt-equity ratio remains constant for the life of the firm.

B)amount of debt remains constant for the life of the firm.

C)free cash flows remain constant for the life of the firm.

D)the firm's financial leverage changes significantly over the life of the firm.

A)the debt-equity ratio remains constant for the life of the firm.

B)amount of debt remains constant for the life of the firm.

C)free cash flows remain constant for the life of the firm.

D)the firm's financial leverage changes significantly over the life of the firm.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

27

A firm has debt beta of 0.2 and an asset beta of 1.9.If the debt-equity ratio is 75%,what is the levered equity beta?

A)1.90

B)3.18

C)2.42

D)2.63

A)1.90

B)3.18

C)2.42

D)2.63

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

28

Johnston Company has a 7% cost of debt,a 50% debt ratio,and a 15% cost of equity.The marginal tax rate is 25%.What is Johnston's WACC if it were 100% equity financed?

A)11.00%

B)10.13%

C)7.50%

D)15.00%

A)11.00%

B)10.13%

C)7.50%

D)15.00%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

29

A firm finances itself with 30% debt,60% common equity,and 10% preferred stock.The before-tax cost of debt is 5%,the firm's cost of common equity is 15%,and that of preferred stock is 10%.The marginal tax rate is 30%.What is the firm's weighted average cost of capital?

A)10.05%

B)11.05%

C)12.50%

D)10.75%

A)10.05%

B)11.05%

C)12.50%

D)10.75%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

30

The Miles-Ezzell formula for the adjusted cost of capital assumes that:

A)the firm rebalances its debt ratio only once per year.

B)the project cash flow is a perpetuity.

C)the project's risk is a carbon copy of the firm's risk.

D)MM's Proposition I corrected for taxes holds .

A)the firm rebalances its debt ratio only once per year.

B)the project cash flow is a perpetuity.

C)the project's risk is a carbon copy of the firm's risk.

D)MM's Proposition I corrected for taxes holds .

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

31

The Granite Paving Company is all-equity financed and has the following free cash flows in years 1-4: $3 million ($3M); $3.7M; $4M; $4.2M.After year 4,the firm is expected to grow at a sustainable rate of 3% per annum.With a WACC of 12%,what is the horizon value in year 4 of Granite Paving Co?

A)$4.3M

B)$4.2M

C)$46.7M

D)$48.1M

A)$4.3M

B)$4.2M

C)$46.7M

D)$48.1M

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

32

A firm uses $30 million of debt,$10 million of preferred stock,and $60 million of common equity to finance its assets.If the before-tax cost of debt is 8%,cost of preferred stock is 10%,and the cost of common equity is 15%,calculate the weighted average cost of capital for the firm assuming a tax rate of 35%.

A)12.4%

B)11.56%

C)10.84%

D)19.27%

A)12.4%

B)11.56%

C)10.84%

D)19.27%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

33

Financial practitioners usually include short-term debt in WACC calculations if:

I.short-term debt is at least 10% of total liabilities;

II.short-term debt is at least 10% of the total assets;

III.net working capital is negative;

IV.net working capital is positive

A)I and IV only

B)I and III only

C)II and IV only

D)II and III only

I.short-term debt is at least 10% of total liabilities;

II.short-term debt is at least 10% of the total assets;

III.net working capital is negative;

IV.net working capital is positive

A)I and IV only

B)I and III only

C)II and IV only

D)II and III only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

34

If a firm has preferred stock,the after-tax weighted average cost of capital (WACC)equals:

A)rD (D/V)+ rP (P/V)+ rE (E/V); (where V = D + P + E).

B)rD (1 - TC)(D/V)+ rP (P/V)+ rE (E/V); (where V = D + P + E).

C)rD (D/V)+ (1 - TC)[rP (P/V)+ rE (E/V)]; (where V = D + P + E).

D)(1 - TC)[rD (D/V)+ rP (P/V)+ rE (E/V)]; (where V = D + P + E).

A)rD (D/V)+ rP (P/V)+ rE (E/V); (where V = D + P + E).

B)rD (1 - TC)(D/V)+ rP (P/V)+ rE (E/V); (where V = D + P + E).

C)rD (D/V)+ (1 - TC)[rP (P/V)+ rE (E/V)]; (where V = D + P + E).

D)(1 - TC)[rD (D/V)+ rP (P/V)+ rE (E/V)]; (where V = D + P + E).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

35

Lowering the debt-equity ratio of the firm can change the firm's:

i.financial leverage; II)cost of equity; III)cost of debt; IV)effective tax rate

A)II and III only

B)I only

C)I,II,and III only

D)I,II,III,and IV

i.financial leverage; II)cost of equity; III)cost of debt; IV)effective tax rate

A)II and III only

B)I only

C)I,II,and III only

D)I,II,III,and IV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose that the market value of the debt = $30 million.Calculate the total market value of equity of the firm.

A)$100 million

B)$70 million

C)$30 million

D)$35 million

A)$100 million

B)$70 million

C)$30 million

D)$35 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is an important assumption required if using the WACC formula?

A)Companies rebalance their capital structure to maintain a constant debt ratio.

B)WACC must be used on public companies with actively traded securities.

C)Management bonuses must be added back to free cash flows.

D)The firm cannot issue any further debt without adjusting its WACC.

A)Companies rebalance their capital structure to maintain a constant debt ratio.

B)WACC must be used on public companies with actively traded securities.

C)Management bonuses must be added back to free cash flows.

D)The firm cannot issue any further debt without adjusting its WACC.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

38

The bonds of Casino,Inc.,trade in the market at a yield of 10.8%,have a 12% coupon rate,and a promised yield of 14.0%.However,investors only expect Casino to pay in full with 65% probability.What cost of debt should be used in Casino's WACC?

A)14.0%

B)10.8%

C)12.0%

D)9.1%

A)14.0%

B)10.8%

C)12.0%

D)9.1%

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

39

Mirion,Inc.,has a debt-equity ratio of 50%,with no preferred stock.However,Mirion now plans to raise enough preferred stock to retire half of its outstanding common stock.Its common equity is currently valued at $7 million.Which of the following choices displays Mirion's market value capital structure,in market values (i.e.,V = D + P + E),after the preferred stock issue?

A)10.5[V] = 3.5[E] + 3.5[P] + 3.5[D]

B)10.5[V] = 7 [E] + 3.5[P] + 0[D]

C)14[V] = 3.5[E] + 3.5[P] + 7[D]

D)D)14[V] = 7[E] + 3.5[P] + 3.5[D]

A)10.5[V] = 3.5[E] + 3.5[P] + 3.5[D]

B)10.5[V] = 7 [E] + 3.5[P] + 0[D]

C)14[V] = 3.5[E] + 3.5[P] + 7[D]

D)D)14[V] = 7[E] + 3.5[P] + 3.5[D]

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose that the market value of the debt = $30 million and the number of shares outstanding = 5 million.Calculate the share price.

A)$20

B)$14

C)$13

D)$6

A)$20

B)$14

C)$13

D)$6

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

41

In the case of large international investments,the project might include:

I.custom-tailored project financing;

II.special contracts with suppliers;

III.special contracts with customers;

IV.special arrangements with governments

A)I and II only

B)I,II,and III only

C)I,II,III,and IV

D)IV only

I.custom-tailored project financing;

II.special contracts with suppliers;

III.special contracts with customers;

IV.special arrangements with governments

A)I and II only

B)I,II,and III only

C)I,II,III,and IV

D)IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

42

The APV method should be used:

A)when the project's level of debt is known over the life of the project.

B)when the project's target debt to value ratio is constant over the life of the project.

C)when the project's debt financing is unknown over the life of the project.

D)when the level of debt doesn't change over the life of the firm.

A)when the project's level of debt is known over the life of the project.

B)when the project's target debt to value ratio is constant over the life of the project.

C)when the project's debt financing is unknown over the life of the project.

D)when the level of debt doesn't change over the life of the firm.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

43

A firm has a project with an NPV of -$52 million.If it has access to risk-free government financing that can create a permanent annual tax shield of $5 million,what is the APV of the project assuming the risk-free interest rate is 6%?

A)-52 million

B)$5 million

C)$31 million

D)$83 million

A)-52 million

B)$5 million

C)$31 million

D)$83 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

44

The MFC Corporation has decided to build a new facility.It estimates the cost of the facility at $9.7 million.MFC wishes to finance this project using its traditional debt-to-equity ratio of 1.5.The issue cost of equity is 6%,and the issue cost of debt is 1%.What is the total flotation cost of raising funds?

A)$300,000

B)$100,000

C)$600,000

D)$970,000

A)$300,000

B)$100,000

C)$600,000

D)$970,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

45

The APV method is most useful in analyzing:

A)large international projects.

B)domestic projects.

C)small projects.

D)projects having the same risk as the firm.

A)large international projects.

B)domestic projects.

C)small projects.

D)projects having the same risk as the firm.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

46

A project costs $14 million and is expected to produce cash flows of $4 million per year for 15 years.The opportunity cost of capital is 20%.If the firm has to issue stock to undertake the project and issue costs are $1 million,what is the project's APV?

A)$3.7 million

B)$4.5 million

C)$4.7 million

D)$3.0 million

A)$3.7 million

B)$4.5 million

C)$4.7 million

D)$3.0 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

47

The MM formula for the adjusted cost of capital takes into consideration only the effect of the interest tax shield on permanent debt.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

48

When calculating the WACC for a firm,one should use the book values of debt and equity.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

49

Subsidized loans will impact the NPV of a project by:

A)increasing the NPV of the project,thereby reducing the APV.

B)decreasing the NPV of the project,thereby reducing the APV.

C)decreasing the NPV of the project,thereby increasing the APV.

D)increasing the NPV of the project,thereby increasing the APV.

A)increasing the NPV of the project,thereby reducing the APV.

B)decreasing the NPV of the project,thereby reducing the APV.

C)decreasing the NPV of the project,thereby increasing the APV.

D)increasing the NPV of the project,thereby increasing the APV.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

50

A project costs $7 million and is expected to produce cash flows of $2 million per year for 10 years.The opportunity cost of capital is 16%.If the firm has to issue stock to undertake the project and issue costs are $0.5 million,what is the project's APV?

A)$9.67 million

B)$2.17 million

C)$1.67 million

D)$0.67 million

A)$9.67 million

B)$2.17 million

C)$1.67 million

D)$0.67 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

51

A project costs $15 million and is expected to produce cash flows of $3 million a year for 10 years.The opportunity cost of capital is 14%.If the firm has to issue stock to undertake the project and issue costs are $500,000,what is the project's APV?

A)-$352,000

B)$148,350

C)$648,350

D)$952,000

A)-$352,000

B)$148,350

C)$648,350

D)$952,000

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

52

The MFC Corporation needs to raise $200 million for its mega project.The NPV of the project using all-equity financing is $40 million.If the cost of raising funds for the project is $20 million,what is the APV of the project?

A)$40 million

B)$240 million

C)$20 million

D)$160 million

A)$40 million

B)$240 million

C)$20 million

D)$160 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

53

A firm has issued $5 par value preferred stock that pays a $0.80 annual dividend.The stock currently sells for $9.50.In calculating WACC,what should one use for the value of the firm's preferred stock?

A)$0.80

B)$4.20

C)$5.00

D)$9.50

A)$0.80

B)$4.20

C)$5.00

D)$9.50

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

54

The APV method includes the NPV of a project assuming all-equity financing and then adds in the NPV of financing effects.The financing effects are:

A)tax subsidy of dividends,cost of issuing new securities,subsidies of financial distress,and cost of debt financing.

B)cost of issuing new securities,cost of financial distress,tax subsidy of debt,and other subsidies.

C)cost of issuing new securities,cost of financial distress,tax subsidy of dividends,and cost of debt financing.

D)subsidies of financial distress,tax subsidy of debt,cost of other debt financing,and cost of issuing new securities.

A)tax subsidy of dividends,cost of issuing new securities,subsidies of financial distress,and cost of debt financing.

B)cost of issuing new securities,cost of financial distress,tax subsidy of debt,and other subsidies.

C)cost of issuing new securities,cost of financial distress,tax subsidy of dividends,and cost of debt financing.

D)subsidies of financial distress,tax subsidy of debt,cost of other debt financing,and cost of issuing new securities.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

55

The WACC formula calculates the cost of capital for the "average risk" project.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

56

The Modigliani-Miller (MM)formula for the after-tax discount rate,for the case of fixed perpetual debt,is given by:

A)rMM = r(1 - TCD/V).

B)rMM = r(1 + TCD/V).

C)rMM = r/(1 - TCD/V).

D)rMM = r/(1 + TCD/V).

A)rMM = r(1 - TCD/V).

B)rMM = r(1 + TCD/V).

C)rMM = r/(1 - TCD/V).

D)rMM = r/(1 + TCD/V).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements regarding guarantees and government restrictions on international projects is (are)true?

I.The value of the guarantees is added to the APV.

II.The value of the guarantees is subtracted from the APV.

III.The value of the government restrictions is added to the APV.

IV.The value of the government restrictions is subtracted from the APV.

A)I and III only

B)II and III only

C)II and IV only

D)I and IV only

I.The value of the guarantees is added to the APV.

II.The value of the guarantees is subtracted from the APV.

III.The value of the government restrictions is added to the APV.

IV.The value of the government restrictions is subtracted from the APV.

A)I and III only

B)II and III only

C)II and IV only

D)I and IV only

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

58

Flotation costs are incorporated into the APV framework by:

A)adding them to the all-equity value of the project

B)subtracting them from the all-equity value of the project

C)incorporating them into the WACC

D)Flotation costs should not be included into APV

A)adding them to the all-equity value of the project

B)subtracting them from the all-equity value of the project

C)incorporating them into the WACC

D)Flotation costs should not be included into APV

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

59

APV = NPV(base-case assuming all equity financing)- NPV(financing decisions caused by project financing).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

60

The BSC Co.was planning to raise $2.5 million in perpetual debt at 11%.However,they just received an offer from the governor of a nearby state to raise the financing for them at 8% if they locate a new facility in that state.What is the total value added from debt financing if the tax rate is 34% and the state subsidizes the loan for the company?

A)$2.5 million

B)$1.2 million

C)$1.3 million

D)$0.9 million

A)$2.5 million

B)$1.2 million

C)$1.3 million

D)$0.9 million

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

61

The total value of a firm is the present value of its free cash flows minus the present value of its horizon value.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

62

Adjusted present value is equal to base-case NPV plus the sum of the present values of any financing side effects.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

63

Briefly explain how WACC can be used for valuing a business.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

64

The firm's horizon value at period H is given by: PVH = (FCFH + 1)/(WACC - g).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

65

Generally,subsidized loans decrease the APV of a project.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

66

The computation of a firm's WACC does not change after it issues preferred stock.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

67

Discounting free cash flows at the WACC assumes that debt is rebalanced every period to maintain a constant ratio of debt to market value of the firm.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

68

The market value of debt is very close to the book value of debt for healthy firms.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

69

Discuss the advantages and limitations of using the weighted average cost of capital as a discount rate to evaluate capital budgeting projects.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

70

In the second step of the 3-step process to adjust WACC when debt ratios change,one should use the following formula: rE = r + (r - rD)× (D/V).

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

71

Government loan guarantees for firms may increase APV by reducing bankruptcy risk.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

72

Discuss why WACC is used most often by managers to make capital budgeting decisions.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

73

Generally,the imposition of government restrictions increases the APV of a project.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

74

Enterprise zone subsidies,a government program that provides financial incentives to make investments in a specific location,increase APV.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

75

Briefly explain how the firm's equity beta changes with changes in its debt-equity ratio when taxes are considered.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

76

Briefly explain how APV can be used for valuing a business.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

77

Generally,APV is not suitable for international projects.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

78

The APV method can be used for valuing entire businesses.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

79

One can estimate the value of a firm by calculating the present value of free cash flows using the WACC (weighted average cost of capital)for the discount rate.

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck

80

Under which circumstances would it be better to use the adjusted present value approach versus the WACC approach?

Unlock Deck

Unlock for access to all 84 flashcards in this deck.

Unlock Deck

k this deck