Deck 2: How to Calculate Present Values

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 2: How to Calculate Present Values

1

The one-year discount factor,at a discount rate of 25% per year,is:

A)1.25.

B)1.0.

C)0.8.

D)0.75.

A)1.25.

B)1.0.

C)0.8.

D)0.75.

0.8.

2

If the present value of $250 expected one year from today is $200,what is the one-year discount rate?

A)10%

B)20%

C)25%

D)30%

A)10%

B)20%

C)25%

D)30%

25%

3

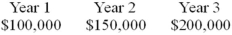

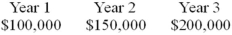

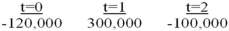

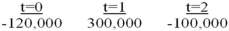

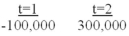

What is the present value of the following cash flows at a discount rate of 9%?

A)$372,431.81

B)$450,000.00

C)$405,950.68

D)$412,844.04

A)$372,431.81

B)$450,000.00

C)$405,950.68

D)$412,844.04

$372,431.81

4

If the present value of $480 to be paid at the end of one year is $400,what is the one-year discount factor?

A)0.8333

B)1.20

C)0.20

D)1.00

A)0.8333

B)1.20

C)0.20

D)1.00

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

An initial investment of $400,000 is expected to produce an end-of-year cash flow of $480,000.What is the NPV of the project at a discount rate of 20%?

A)$176,000

B)$80,000

C)$0 (zero)

D)$64,000

A)$176,000

B)$80,000

C)$0 (zero)

D)$64,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

The present value of $100,000 expected at the end of one year,at a discount rate of 25% per year,is:

A)$80,000.

B)$125,000.

C)$100,000.

D)$75,000.

A)$80,000.

B)$125,000.

C)$100,000.

D)$75,000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Present value is defined as:

A)future cash flows discounted to the present by an appropriate discount rate.

B)inverse of future cash flows.

C)present cash flows compounded into the future.

D)future cash flows multiplied by the factor (1 + r)t.

A)future cash flows discounted to the present by an appropriate discount rate.

B)inverse of future cash flows.

C)present cash flows compounded into the future.

D)future cash flows multiplied by the factor (1 + r)t.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

If the one-year discount factor is 0.8333,what is the discount rate (interest rate)per year?

A)10%

B)20%

C)30%

D)40%

A)10%

B)20%

C)30%

D)40%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

If the present value of a cash flow generated by an initial investment of $200,000 is $250,000,what is the NPV of the project?

A)$250,000

B)$50,000

C)$200,000

D)-$50,000

A)$250,000

B)$50,000

C)$200,000

D)-$50,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

The present value formula for a cash flow expected one period from now is:

A)PV = C1 × (1 + r).

B)PV = C1/(1 + r).

C)PV = C1/r.

D)PV = (1 + r)/C1.

A)PV = C1 × (1 + r).

B)PV = C1/(1 + r).

C)PV = C1/r.

D)PV = (1 + r)/C1.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

The net present value formula for one period is:

A)NPV = C0 + [C1/(1 + r)].

B)NPV = PV required investment.

C)NPV = C0/C1.

D)NPV = C1/C0.

A)NPV = C0 + [C1/(1 + r)].

B)NPV = PV required investment.

C)NPV = C0/C1.

D)NPV = C1/C0.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

The rate of return is also called the: I)

Discount rate; II)hurdle rate; III)opportunity cost of capital

A)I only.

B)I and II only.

C)I,II,and III.

D)I and III only.

Discount rate; II)hurdle rate; III)opportunity cost of capital

A)I only.

B)I and II only.

C)I,II,and III.

D)I and III only.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

The present value of $121,000 expected one year from today at an interest rate (discount rate)of 10% per year is:

A)$121,000.

B)$100,000.

C)$110,000.

D)$108,900.

A)$121,000.

B)$100,000.

C)$110,000.

D)$108,900.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

The present value of $100.00 expected two years from today at a discount rate of 6% is:

A)$112.36.

B)$106.00.

C)$100.00.

D)$89.00.

A)$112.36.

B)$106.00.

C)$100.00.

D)$89.00.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

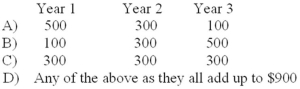

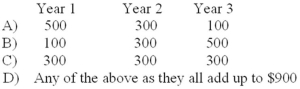

At an interest rate of 10%,which of the following sequences of cash flows should you prefer?

A)option A

B)option B

C)option C

D)option D

A)option A

B)option B

C)option C

D)option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

If the present value of cash flow X is $240,and the present value of cash flow Y is $160,then the present value of the combined cash flows is:

A)$240.

B)$160.

C)$80.

D)$400.

A)$240.

B)$160.

C)$80.

D)$400.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

If the annual interest rate is 12.00%,what is the two-year discount factor?

A)0.7972

B)0.8929

C)1.2544

D)0.8065

A)0.7972

B)0.8929

C)1.2544

D)0.8065

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

The one-year discount factor,at an interest rate of 100% per year,is:

A)1.50.

B)0.50.

C)0.25.

D)1.00.

A)1.50.

B)0.50.

C)0.25.

D)1.00.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

If the present value of $600,expected one year from today,is $400,what is the one-year discount rate?

A)15%

B)20%

C)25%

D)50%

A)15%

B)20%

C)25%

D)50%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

If the one-year discount factor is 0.90,what is the present value of $120 expected one year from today?

A)$100

B)$96

C)$108

D)$133

A)$100

B)$96

C)$108

D)$133

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements regarding the net present value rule and the rate of return rule is false?

A)Accept a project if NPV > cost of investment.

B)Accept a project if NPV is positive.

C)Accept a project if return on investment exceeds the rate of return on an equivalent-risk investment in the financial market.

D)Reject a project if NPV is negative.

A)Accept a project if NPV > cost of investment.

B)Accept a project if NPV is positive.

C)Accept a project if return on investment exceeds the rate of return on an equivalent-risk investment in the financial market.

D)Reject a project if NPV is negative.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

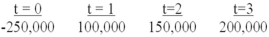

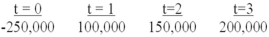

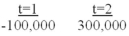

What is the net present value of the following cash flow sequence at a discount rate of 11%?

A)$69,108.03

B)$231,432.51

C)$80,000.00

D)$88,000.00

A)$69,108.03

B)$231,432.51

C)$80,000.00

D)$88,000.00

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

You would like to have enough money saved to receive a $50,000 per year perpetuity after retirement.How much would you need to have saved in your retirement fund to achieve this goal? (Assume that the perpetuity payments start on the day of your retirement.The annual interest rate is 8%.)

A)$1,000,000

B)$675,000

C)$625,000

D)$500,000

A)$1,000,000

B)$675,000

C)$625,000

D)$500,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is generally considered an example of a perpetuity?

A)Interest payments on a 10-year bond

B)Interest payments on a 30-year bond

C)Interest payments on a consol

D)Interest payments on government bonds

A)Interest payments on a 10-year bond

B)Interest payments on a 30-year bond

C)Interest payments on a consol

D)Interest payments on government bonds

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

You would like to have enough money saved to receive an $80,000 per year perpetuity after retirement.How much would you need to have saved in your retirement fund to achieve this goal? (Assume that the perpetuity payments start on the day of your retirement.The annual interest rate is 10%.)

A)$1,500,000

B)$880,000

C)$800,000

D)$80,000

A)$1,500,000

B)$880,000

C)$800,000

D)$80,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

According to the net present value rule,an investment in a project should be made if the:

A)net present value is greater than the cost of investment.

B)net present value is greater than the present value of cash flows.

C)net present value is positive.

D)net present value is negative.

A)net present value is greater than the cost of investment.

B)net present value is greater than the present value of cash flows.

C)net present value is positive.

D)net present value is negative.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

An annuity is defined as a set of:

A)equal cash flows occurring at equal intervals of time for a specified period.

B)equal cash flows occurring at equal intervals of time forever.

C)unequal cash flows occurring at equal intervals of time forever.

D)unequal cash flows occurring at equal intervals of time for a specified period.

A)equal cash flows occurring at equal intervals of time for a specified period.

B)equal cash flows occurring at equal intervals of time forever.

C)unequal cash flows occurring at equal intervals of time forever.

D)unequal cash flows occurring at equal intervals of time for a specified period.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

You would like to have enough money saved to receive $80,000 per year in perpetuity after retirement for you and your heirs.How much would you need to have saved in your retirement fund to achieve this goal? (Assume that the perpetuity payments start one year from the date of your retirement.The annual interest rate is 8%.)

A)$7,500,000

B)$750,000

C)$1,000,000

D)$800,000

A)$7,500,000

B)$750,000

C)$1,000,000

D)$800,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

If you are paid $1,000 at the end of each year for the next five years,what type of cash flow did you receive?

A)uneven cash flow stream

B)an annuity

C)an annuity due

D)a perpetuity

A)uneven cash flow stream

B)an annuity

C)an annuity due

D)a perpetuity

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

A perpetuity is defined as a sequence of:

A)equal cash flows occurring at equal intervals of time for a specific number of periods.

B)equal cash flows occurring at equal intervals of time forever.

C)unequal cash flows occurring at equal intervals of time forever.

D)unequal cash flows occurring at equal intervals of time for a specific number of periods.

A)equal cash flows occurring at equal intervals of time for a specific number of periods.

B)equal cash flows occurring at equal intervals of time forever.

C)unequal cash flows occurring at equal intervals of time forever.

D)unequal cash flows occurring at equal intervals of time for a specific number of periods.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

What is the eight-year present value annuity factor at a discount rate of 11%?

A)5.7122

B)11.8594

C)5.1461

D)6.9158

A)5.7122

B)11.8594

C)5.1461

D)6.9158

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

You would like to have enough money saved after your retirement such that you and your heirs can receive $100,000 per year in perpetuity.How much would you need to have saved at the time of your retirement in order to achieve this goal? (Assume that the perpetuity payments start one year after the date of your retirement.The annual interest rate is 12.5%.)

A)$1,000,000

B)$10,000,000

C)$800,000

D)$1,125,000

A)$1,000,000

B)$10,000,000

C)$800,000

D)$1,125,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

An initial investment of $500 produces a cash flow of $550 one year from today.Calculate the rate of return on the project.

A)10%

B)15%

C)20%

D)25%

A)10%

B)15%

C)20%

D)25%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

What is the present value of $10,000 per year in perpetuity at an interest rate of 10%?

A)$10,000

B)$100,000

C)$200,000

D)$1,000

A)$10,000

B)$100,000

C)$200,000

D)$1,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

What is the net present value (NPV)of the following sequence of cash flows at a discount rate of 9%?

A)$122,431.81

B)$200,000.00

C)$155,950.68

D)$177,483.77

A)$122,431.81

B)$200,000.00

C)$155,950.68

D)$177,483.77

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

If the five-year present value annuity factor is 3.60478 and the four-year present value annuity factor is 3.03735,what is the present value at the $1 received at the end of five years?

A)$0.63552

B)$1.76233

C)$0.56743

D)$1.2132

A)$0.63552

B)$1.76233

C)$0.56743

D)$1.2132

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements regarding the NPV rule and the rate of return rule is false?

A)Accept a project if its NPV > 0.

B)Reject a project if the NPV < 0.

C)Accept a project if its rate of return > 0.

D)Accept a project if its rate of return > opportunity cost of capital.

A)Accept a project if its NPV > 0.

B)Reject a project if the NPV < 0.

C)Accept a project if its rate of return > 0.

D)Accept a project if its rate of return > opportunity cost of capital.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

The opportunity cost of capital for a risky project is:

A)the expected rate of return on a government security having the same maturity as the project.

B)the expected rate of return on a well-diversified portfolio of common stocks.

C)the expected rate of return on a security of similar risk as the project.

D)The expected rate of return on a typical bond portfolio.

A)the expected rate of return on a government security having the same maturity as the project.

B)the expected rate of return on a well-diversified portfolio of common stocks.

C)the expected rate of return on a security of similar risk as the project.

D)The expected rate of return on a typical bond portfolio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

If the three-year present value annuity factor is 2.673 and the two-year present value annuity factor is 1.833,what is the present value of $1 received at the end of the three years?

A)$1.19

B)$0.84

C)$0.89

D)$0.92

A)$1.19

B)$0.84

C)$0.89

D)$0.92

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

What is the net present value of the following sequence of annual cash flows at a discount rate of 16% APR?

A)$136,741.97

B)$122,948.87

C)$158,620.69

D)$139,418.23

A)$136,741.97

B)$122,948.87

C)$158,620.69

D)$139,418.23

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

If the present value annuity factor at 12% for five years is 3.6048,what is the equivalent future value annuity factor?

A)2.0455

B)6.3529

C)1.7623

D)5.1237

A)2.0455

B)6.3529

C)1.7623

D)5.1237

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

If the present value annuity factor for 10 years at 10% interest rate is 6.1446,what is the present value annuity factor for an equivalent annuity due?

A)6.1446

B)7.3800

C)6.7590

D)5.7321

A)6.1446

B)7.3800

C)6.7590

D)5.7321

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

John House has taken a 20-year,$250,000 mortgage on his house at an interest rate of 6% per year.What is the value of the mortgage after the payment of the fifth annual installment?

A)$128,958.41

B)$211,689.53

C)$141,019.50

A)$128,958.41

B)$211,689.53

C)$141,019.50

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

After retirement,you expect to live for 25 years.You would like to have $75,000 income each year.How much should you have saved in your retirement account to receive this income,if the interest rate is 9% per year? (Assume that the payments start on the day of your retirement.)

A)$736,693.47

B)$802,995.88

C)$2,043,750.21

D)$1,427,831.93

A)$736,693.47

B)$802,995.88

C)$2,043,750.21

D)$1,427,831.93

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

What is the present value of a six-year,$5,000 per year annuity at a discount rate of 10%?

A)$21,776.30

B)$3,371.91

C)$16,760.78

D)$18,327.82

A)$21,776.30

B)$3,371.91

C)$16,760.78

D)$18,327.82

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

John House has taken a $250,000 mortgage on his house at an interest rate of 6% per year.If the mortgage calls for 20 equal,annual payments,what is the amount of each payment?

A)$21,796.14

B)$10,500.00

C)$16,882.43

D)$24,327.18

A)$21,796.14

B)$10,500.00

C)$16,882.43

D)$24,327.18

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

After retirement,you expect to live for 25 years.You would like to have $75,000 income each year.How much should you have saved in your retirement account to receive this income if the interest rate is 9% per year? (Assume that the payments start one year after your retirement.)

A)$736,693.47

B)$83,431.17

C)$1,875,000

D)$1,213,487.12

A)$736,693.47

B)$83,431.17

C)$1,875,000

D)$1,213,487.12

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

Mr.Hopper expects to retire in 25 years,and he wishes to accumulate $750,000 in his retirement fund by that time.If the interest rate is 10% per year,how much should Mr.Hopper put into his retirement fund each year in order to achieve this goal? (Assume that he makes payments at the end of each year.)

A)$4,559.44

B)$2,500

C)$7,626.05

A)$4,559.44

B)$2,500

C)$7,626.05

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

What is the present value of a $1,000 per year annuity for five years at an interest rate of 12%?

A)$6,352.85

B)$3,604.78

C)$567.43

D)$2,743.28

A)$6,352.85

B)$3,604.78

C)$567.43

D)$2,743.28

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

For $10,000,you can purchase a five-year annuity that will pay $2,504.57 per year for five years.The payments occur at the end of each year.Calculate the effective annual interest rate implied by this arrangement.

A)8%

B)9%

C)10%

A)8%

B)9%

C)10%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

If the present value of $1.00 received n years from today at an interest rate of r is 0.3855,then what is the future value of $1.00 invested today at an interest rate of r% for n years?

A)$1.3855

B)$2.594

C)$1.701

D)not enough information is given to solve the problem

A)$1.3855

B)$2.594

C)$1.701

D)not enough information is given to solve the problem

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

For $10,000,you can purchase a five-year annuity that will pay $2,358.65 per year for five years.The payments occur at the beginning of each year.Calculate the effective annual interest rate implied by this arrangement.

A)8%

B)9%

C)10%

A)8%

B)9%

C)10%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

What is the six-year present value annuity factor at an interest rate of 9%?

A)7.5233

B)4.4859

C)1.6771

D)3.1432

A)7.5233

B)4.4859

C)1.6771

D)3.1432

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

If the present value annuity factor at 8% for 10 years is 6.71,what is the equivalent future value annuity factor?

A)3.108

B)14.486

C)2.159

D)5.384

A)3.108

B)14.486

C)2.159

D)5.384

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

If the present value of $1.00 received n years from today at an interest rate of r is 0.621,then what is the future value of $1.00 invested today at an interest rate of r% for n years?

A)$1.000

B)$1.610

C)$1.621

D)not enough information is given to solve the problem

A)$1.000

B)$1.610

C)$1.621

D)not enough information is given to solve the problem

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

If the future value of $1 invested today at an interest rate of r% for n years is 9.6463,what is the present value of $1 to be received in n years at r% interest rate?

A)$9.6463

B)$1.0000

C)$0.1037

D)$0.4132

A)$9.6463

B)$1.0000

C)$0.1037

D)$0.4132

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

If the future value annuity factor at 10% and five years is 6.1051,calculate the equivalent present value annuity factor:

A)6.1051

B)3.7908

C)6.7156

D)4.8127

A)6.1051

B)3.7908

C)6.7156

D)4.8127

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

If the present value annuity factor at 10% for 10 years is 6.1446,what is the equivalent future value annuity factor?

A)3.1080

B)15.9375

C)2.5937

D)8.4132

A)3.1080

B)15.9375

C)2.5937

D)8.4132

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

If the present value annuity factor is 3.8896,what is the present value annuity factor for an equivalent annuity due if the interest rate is 9%?

A)3.5684

B)4.2397

C)3.8896

D)5.3127

A)3.5684

B)4.2397

C)3.8896

D)5.3127

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

You are considering investing in a retirement fund that requires you to deposit $5,000 per year,and you want to know how much the fund will be worth when you retire.What financial technique should you use to calculate this value?

A)Future value of a single payment

B)Future value of an annuity

C)Present value of an annuity

D)Present value of a perpetuity

A)Future value of a single payment

B)Future value of an annuity

C)Present value of an annuity

D)Present value of a perpetuity

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is true?

A)The process of discounting is the inverse of the process of compounding.

B)Ending balances using simple interest are always greater than ending balances using compound interest at positive interest rates.

C)The present value of an annuity due is always less than the present value of an equivalent ordinary annuity at positive interest rates.

D)The future value of an annuity due is always less than the present value of an equivalent ordinary annuity at positive interest rates.

A)The process of discounting is the inverse of the process of compounding.

B)Ending balances using simple interest are always greater than ending balances using compound interest at positive interest rates.

C)The present value of an annuity due is always less than the present value of an equivalent ordinary annuity at positive interest rates.

D)The future value of an annuity due is always less than the present value of an equivalent ordinary annuity at positive interest rates.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

A dollar today is worth more than a dollar tomorrow if the interest rate is positive.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

Ms.Colonial has just taken out a $150,000 mortgage at an interest rate of 6% per year.If the mortgage calls for equal monthly payments for 20 years,what is the amount of each payment? (Assume monthly compounding or discounting.)

A)$1,254.70

B)$1,625.00

C)$1,263.06

D)$1,074.65

A)$1,254.70

B)$1,625.00

C)$1,263.06

D)$1,074.65

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

The rate of return,discount rate,hurdle rate,and opportunity cost of capital all have the same meaning.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

You would like to have enough money saved to receive a growing annuity for 20 years,growing at a rate of 5% per year,with the first payment of $50,000 occurring exactly one year after retirement.How much would you need to save in your retirement fund to achieve this goal? (The interest rate is 10%.)

A)$1,000,000.00

B)$425,678.19

C)$605,604.20

D)$827,431.28

A)$1,000,000.00

B)$425,678.19

C)$605,604.20

D)$827,431.28

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

If you invest $100 at 12% APR for three years,how much would you have at the end of three years using compound interest?

A)$136

B)$140.49

C)$240.18

D)$173.18

A)$136

B)$140.49

C)$240.18

D)$173.18

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

The managers of a firm can maximize stockholder wealth by:

A)taking all projects with positive NPVs.

B)taking all projects with NPVs greater than the cost of investment.

C)taking all projects with NPVs greater than the present value of cash flows.

D)taking only the highest NPV project each year.

A)taking all projects with positive NPVs.

B)taking all projects with NPVs greater than the cost of investment.

C)taking all projects with NPVs greater than the present value of cash flows.

D)taking only the highest NPV project each year.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

Mr.Williams expects to retire in 30 years and would like to accumulate $1 million in his pension fund.If the annual interest rate is 12% APR,how much should Mr.Williams put into his pension fund each month in order to achieve his goal? (Assume that Mr.Williams will deposit the same amount each month into his pension fund,using monthly compounding.)

A)$286.13

B)$771.60

C)$345.30

D)$437.13

A)$286.13

B)$771.60

C)$345.30

D)$437.13

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

You just inherited a trust that will pay you $100,000 per year in perpetuity.However,the first payment will not occur for exactly four more years.Assuming an 8% annual interest rate,what is the value of this trust?

A)$918,787

B)$992,290

C)$1,000,000

D)$1,250,000

A)$918,787

B)$992,290

C)$1,000,000

D)$1,250,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

You just inherited a trust that will pay you $100,000 per year in perpetuity.However,the first payment will not occur for exactly five more years.Assuming an 8% annual interest rate,what is the value of this trust?

A)$850,729

B)$918,787

C)$1,000,000

D)$1,250,000

A)$850,729

B)$918,787

C)$1,000,000

D)$1,250,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

You would like to have enough money saved to receive a growing annuity for 25 years,growing at a rate of 4% per year,with the first payment of $60,000 occurring exactly one year after retirement.How much would you need to save in your retirement fund to achieve this goal? (The interest rate is 12%.)

A)$1,500,000.00

B)$632,390

C)$452,165

D)$1,043,287

A)$1,500,000.00

B)$632,390

C)$452,165

D)$1,043,287

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

An investment at 10% compounded continuously has an equivalent annual rate of:

A)10.250%.

B)10.517%.

C)10.381%.

D)none of the options.

A)10.250%.

B)10.517%.

C)10.381%.

D)none of the options.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

An investment at 12% APR compounded monthly is equal to an effective annual rate of:

A)12.68%

B)12.36%

C)12.00%

D)11.87%

A)12.68%

B)12.36%

C)12.00%

D)11.87%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

Mr.Hopper expects to retire in 30 years,and he wishes to accumulate $1,000,000 in his retirement fund by that time.If the interest rate is 12% per year,how much should Mr.Hopper put into his retirement fund at the end of each year in order to achieve this goal?

A)$4,143.66

B)$8,287.32

C)$4,000.00

A)$4,143.66

B)$8,287.32

C)$4,000.00

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

You just inherited a trust that will pay you $100,000 per year in perpetuity.However,the first payment will not occur for exactly five more years.Assuming a 10% annual interest rate,what is the value of this trust?

A)$620,921

B)$683,013

C)$1,000,000

D)$1,100,000

A)$620,921

B)$683,013

C)$1,000,000

D)$1,100,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

If you invest $100 at 12% APR for three years,how much would you have at the end of three years using simple interest?

A)$136.00

B)$140.49

C)$240.18

D)$187.13

A)$136.00

B)$140.49

C)$240.18

D)$187.13

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

The present value of a $100 per year perpetuity at 10% per year interest rate is $1000.What would be the present value of this perpetuity if the payments were compounded continuously?

A)$1000.00

B)$1049.21

C)$1024.40

D)$986.14

A)$1000.00

B)$1049.21

C)$1024.40

D)$986.14

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

You just inherited a trust that will pay you $100,000 per year in perpetuity.However,the first payment will not occur for exactly four more years.Assuming a 10% annual interest rate,what is the value of this trust?

A)$683,013

B)$751,315

C)$1,000,000

D)$1,100,000

A)$683,013

B)$751,315

C)$1,000,000

D)$1,100,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

The concept of compound interest is best described as:

A)interest earned on an investment.

B)the total amount of interest earned over the life of an investment.

C)interest earned on interest.

D)the inverse of simple interest.

A)interest earned on an investment.

B)the total amount of interest earned over the life of an investment.

C)interest earned on interest.

D)the inverse of simple interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

An investment having a 10.47% effective annual rate (EAR)has what APR? (Assume monthly compounding.)

A)10.99%

B)9.57%

C)10.00%

D)8.87%

A)10.99%

B)9.57%

C)10.00%

D)8.87%

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck