Deck 20: Mergers and Acquisitions and Financial Distress

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/82

Play

Full screen (f)

Deck 20: Mergers and Acquisitions and Financial Distress

1

Which of the following is defined as a merged firm's ability to generate synergistic cost savings through the joint use of inputs in producing multiple products?

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

Economies of scope

2

Which of these terms is defined as the value of the combined firms being greater than the sum of the value of the two firms individually?

A)Composition

B)Synergy

C)Consolidation

D)Conglomerate

A)Composition

B)Synergy

C)Consolidation

D)Conglomerate

Synergy

3

Which of the following is a voluntary liquidation proceeding that passes the liquidation of the firm's assets to a third party that is designated as the assignee or trustee?

A)Liquidation

B)Assignment

C)Composition

D)Consolidation

A)Liquidation

B)Assignment

C)Composition

D)Consolidation

Assignment

4

Which of the following is a type of merger in which two firms that sell the same products in different market areas are combined?

A)Vertical

B)Conglomerate

C)Product extension

D)Market extension

A)Vertical

B)Conglomerate

C)Product extension

D)Market extension

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT one of the sources of value enhancing synergy in a merger?

A)Revenue enhancement

B)Cost reduction

C)Tax considerations

D)Higher cost of capital

A)Revenue enhancement

B)Cost reduction

C)Tax considerations

D)Higher cost of capital

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is a type of merger in which an entirely new firm is created?

A)Composition

B)Synergy

C)Consolidation

D)Assignment

A)Composition

B)Synergy

C)Consolidation

D)Assignment

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is defined as a merged firm's advantage over smaller firms if cuts associated with the merger lower the firm's operating costs of production?

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is a combination of firms that sell different, but somewhat related, products?

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the most extreme type of financial distress for a business?

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

10

Which of these is the person who liquidates the firm's assets through a private sale or public auction and then distributes any proceeds from the sale to the firms' creditors and stockholders?

A)Assignor

B)Grantor

C)Trustor

D)Trustee

A)Assignor

B)Grantor

C)Trustor

D)Trustee

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is the termination of the firm as a going concern in which assets are sold and any proceeds go to pay off the firm's creditors?

A)Liquidation

B)Assignment

C)Composition

D)Consolidation

A)Liquidation

B)Assignment

C)Composition

D)Consolidation

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is the type of financial distress in which a firm's operating cash flows are not sufficient to pay its liabilities as they come due?

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is cost savings usually attributed to superior management skills and other difficult-to-measure managerial factors?

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

A)Economies of scale

B)Economies of scope

C)Economies of synergy

D)X-efficiencies

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is defined as a transaction in which two firms combine to form a single firm?

A)Merger

B)Synergy

C)Acquisition

D)Assignment

A)Merger

B)Synergy

C)Acquisition

D)Assignment

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is NOT a tax consideration motive for a merger?

A)Tax gains from net operating losses

B)Tax gains from used debt capacity

C)Tax gains from used equity capacity

D)Tax gains from surplus firms

A)Tax gains from net operating losses

B)Tax gains from used debt capacity

C)Tax gains from used equity capacity

D)Tax gains from surplus firms

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following combines two companies that have no related products or markets?

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is the type of financial distress in which the return on a firm's assets is less than the firm's cost of capital?

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

A)Business failure

B)Economic failure

C)Technical insolvency

D)Business extension

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is defined as the purchase of one firm by another firm?

A)Merger

B)Synergy

C)Acquisition

D)Assignment

A)Merger

B)Synergy

C)Acquisition

D)Assignment

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is a combination of a firm with a supplier or distributor?

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

A)Vertical merger

B)Conglomerate merger

C)Product extension merger

D)Market extension merger

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

20

Which of these makes the following a true statement? Diversification resulting from a merger can:

A)make the debt of the merged firm more risky, thus lowering the cost of capital.

B)make the debt of the merged firm less risky, thus lowering the cost of capital.

C)make the debt of the merged firm less risky, thus raising the cost of capital.

D)None of the options make the statement true.

A)make the debt of the merged firm more risky, thus lowering the cost of capital.

B)make the debt of the merged firm less risky, thus lowering the cost of capital.

C)make the debt of the merged firm less risky, thus raising the cost of capital.

D)None of the options make the statement true.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.15, X2 = Retained earnings/Total assets = 0.10, X3 = Earnings before interest and taxes/Total assets = 0.15, X4 = Market value of equity/Book value of long-term debt = 0.40, X5 = Sales/Total assets ratio = 0.8. Calculate the Altman's Z-score for this firm.

A)9.10

B)1.60

C)0.371

D)1.855

A)9.10

B)1.60

C)0.371

D)1.855

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is a formal bankruptcy proceeding involving the reorganization of the corporation with some provision for repayment to the firm's creditors?

A)Chapter 7

B)Chapter 11

C)Chapter 13

D)Chapter 17

A)Chapter 7

B)Chapter 11

C)Chapter 13

D)Chapter 17

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

23

Baby Supplies is considering a merger with Tot Toy Stores. Baby's total operating costs of producing services are $450,000 for sales volume of $2.15 million. Tot's total operating costs of producing services are $250,000 for a sales volume (JP) of $975,000. Calculate the average cost of production for the Baby and Tot Toy firms, respectively.

A)11.63 percent, 20.93 percent

B)20.93 percent, 25.64 percent

C)46.15 percent, 11.63 percent

D)22.4 percent, 22.4 percent

A)11.63 percent, 20.93 percent

B)20.93 percent, 25.64 percent

C)46.15 percent, 11.63 percent

D)22.4 percent, 22.4 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a formal bankruptcy proceeding which outlines the process to be followed for liquidating a failed firm?

A)Chapter 7

B)Chapter 11

C)Chapter 13

D)Chapter 17

A)Chapter 7

B)Chapter 11

C)Chapter 13

D)Chapter 17

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

25

Crib World is considering a merger with Tots Supply Stores. Crib's total operating costs of producing services are $250,000 for sales volume of $1.25 million. Tots' total operating costs of producing services are $210,000 for a sales volume (JP) of $900,000. For a sales volume of $2.15 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 17.5 percent.

A)Decrease of $376,250

B)Decrease of $83,750

C)Decrease of $127,500

D)Decrease of $87,500

A)Decrease of $376,250

B)Decrease of $83,750

C)Decrease of $127,500

D)Decrease of $87,500

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

26

Blinds N Such is considering a merger with Window Supply Stores. Blinds' total operating costs of producing services are $750,000 for sales volume of $6 million. Window's total operating costs of producing services are $100,000 for a sales volume (JP) of $1 million. For a sales volume of $7 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 12 percent.

A)Decrease of $840,000

B)Decrease of $10,000

C)Decrease of $40,000

D)Decrease of $90,000

A)Decrease of $840,000

B)Decrease of $10,000

C)Decrease of $40,000

D)Decrease of $90,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

27

Jan's Bakery is considering a merger with Tina's Cookies. Jan's total operating costs of producing services are $300,000 for a sales volume of $2 million. Tina's total operating costs of producing services are $75,000 for a sales volume of $600,000. If the two firms merge, calculate the total average cost for the merged firm assuming no synergies.

A)12.5 percent

B)11.54 percent

C)14.42 percent

D)13.75 percent

A)12.5 percent

B)11.54 percent

C)14.42 percent

D)13.75 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

28

Jewelry Designs is considering a merger with Beads Supply Stores. Jewelry's total operating costs of producing services are $300,000 for sales volume of $2 million. Beads' total operating costs of producing services are $125,000 for a sales volume (JP) of $2.25 million. Calculate the average cost of production for the Jewelry and Beads firms, respectively.

A)15 percent, 5.56 percent

B)5.56 percent, 15 percent

C)15 percent, 55.56 percent

D)13.33 percent, 6.25 percent

A)15 percent, 5.56 percent

B)5.56 percent, 15 percent

C)15 percent, 55.56 percent

D)13.33 percent, 6.25 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

29

Building Supplies is considering a merger with Tools and More. Building's total operating costs of producing services are $4 million for a sales volume of $20 million. Tools' total operating costs of producing services are $1 million for a sales volume of $5 million. Suppose that synergies in the production process result in a cost of production for the merged firms totalling $4.8 million with total sales remaining unchanged. Calculate the total average cost for the merged firm.

A)9.6 percent

B)40.0 percent

C)19.2 percent

D)20.0 percent

A)9.6 percent

B)40.0 percent

C)19.2 percent

D)20.0 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

30

Baby Supplies is considering a merger with Tot Toy Stores. Baby's total operating costs of producing services are $450,000 for sales volume of $2.15 million. Tot's total operating costs of producing services are $250,000 for a sales volume (JP) of $975,000. For a sales volume of $3.125 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 19.5 percent.

A)Decrease of $609,375

B)Decrease of $90,625

C)Decrease of $9,375

D)Decrease of $159,375

A)Decrease of $609,375

B)Decrease of $90,625

C)Decrease of $9,375

D)Decrease of $159,375

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

31

Blinds N Such is considering a merger with Window Supply Stores. Blinds' total operating costs of producing services are $750,000 for sales volume of $6 million. Window's total operating costs of producing services are $100,000 for a sales volume (JP) of $1 million. Calculate the average cost of production for the Blinds and Window firms, respectively.

A)10 percent, 12.5 percent

B)12.5 percent, 10 percent

C)75 percent, 1.67 percent

D)13.93 percent, 13.93 percent

A)10 percent, 12.5 percent

B)12.5 percent, 10 percent

C)75 percent, 1.67 percent

D)13.93 percent, 13.93 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.30, X2 = Retained earnings/Total assets = 0.40, X3 = Earnings before interest and taxes/Total assets = 0.43, X4 = Market value of equity/Book value of long-term debt = 0.65, X5 = Sales/Total assets ratio = 0.95. Calculate the Altman's Z-score for this firm.

A)3.679

B)2.73

C)10.23

D)2.046

A)3.679

B)2.73

C)10.23

D)2.046

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.25, X2 = Retained earnings/Total assets = 0.30, X3 = Earnings before interest and taxes/Total assets = 0.35, X4 = Market value of equity/Book value of long-term debt = 0.50, X5 = Sales/Total assets ratio = 0.9. Calculate the Altman's Z-score for this firm.

A)2.30

B)3.075

C)9.8

D)1.96

A)2.30

B)3.075

C)9.8

D)1.96

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following involves a firm and its creditors agreeing to a private reorganization outside the formal bankruptcy process?

A)Consolidation bankruptcy

B)Prepackaged bankruptcy

C)Chapter 13

D)Chapter 7

A)Consolidation bankruptcy

B)Prepackaged bankruptcy

C)Chapter 13

D)Chapter 7

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

35

Crib World is considering a merger with Tots Supply Stores. Crib's total operating costs of producing services are $250,000 for sales volume of $1.25 million. Tots' total operating costs of producing services are $210,000 for a sales volume (JP) of $900,000. Calculate the average cost of production for the Crib and Tots firms, respectively.

A)20 percent, 23.33 percent

B)23.33 percent, 20 percent

C)27.78 percent, 16.8 percent

D)21.4 percent, 21.4 percent

A)20 percent, 23.33 percent

B)23.33 percent, 20 percent

C)27.78 percent, 16.8 percent

D)21.4 percent, 21.4 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

36

Dee's Dry Cleaning is considering a merger with Larry's Laundry Supply Stores. Dee's total operating costs of producing services are $600,000 for sales volume of $4 million. Larry's total operating costs of producing services are $200,000 for a sales volume (JP) of $1 million. For a sales volume of $5 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 10 percent.

A)Decrease of $500,000

B)Decrease of $300,000

C)Decrease of $100,000

D)Decrease of $200,000

A)Decrease of $500,000

B)Decrease of $300,000

C)Decrease of $100,000

D)Decrease of $200,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.35, X2 = Retained earnings/Total assets = 0.50, X3 = Earnings before interest and taxes/Total assets = 0.60, X4 = Market value of equity/Book value of long-term debt = 1.50, X5 = Sales/Total assets ratio = 3.65. Calculate the Altman's Z-score for this firm.

A)7.65

B)1.54

C)6.60

D)1.32

A)7.65

B)1.54

C)6.60

D)1.32

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

38

Jewelry Designs is considering a merger with Beads Supply Stores. Jewelry's total operating costs of producing services are $300,000 for sales volume of $2 million. Beads' total operating costs of producing services are $125,000 for a sales volume (JP) of $2.25 million. For a sales volume of $4.25 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 8 percent.

A)Decrease of $340,000

B)Decrease of $85,000

C)Decrease of $40,000

D)Decrease of $25,000

A)Decrease of $340,000

B)Decrease of $85,000

C)Decrease of $40,000

D)Decrease of $25,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

39

Dee's Dry Cleaning is considering a merger with Larry's Laundry Supply Stores. Dee's total operating costs of producing services are $600,000 for sales volume of $4 million. Larry's total operating costs of producing services are $200,000 for a sales volume (JP) of $1 million. Calculate the average cost of production for Dee's and Larry's firms, respectively.

A)15 percent, 20 percent

B)20 percent, 15 percent

C)16 percent, 16 percent

D)60 percent, 5 percent

A)15 percent, 20 percent

B)20 percent, 15 percent

C)16 percent, 16 percent

D)60 percent, 5 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

40

Flowers Galore is considering a merger with Balloons N More. Flowers Galore's total operating costs of producing services are $400,000 for a sales volume of $4 million. Balloons' total operating costs of producing services are $30,000 for a sales volume of $700,000. If the two firms merge, calculate the total average cost for the merged firm assuming no synergies.

A)4.29 percent

B)9.15 percent

C)10.00 percent

D)7.14 percent

A)4.29 percent

B)9.15 percent

C)10.00 percent

D)7.14 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

41

The managers of BSW Inc. have been approached by EAG Corp. for a possible merger. EAG Corp. is asking a price of $20.5 million to be purchased by BSW Inc. The two firms currently have cumulative total cash flows of $1 million that are growing at 3 percent annually. Managers of EAG estimate that because of synergies the merged firm's cash flows will increase by an additional 4 percent for the first three years following the merger. After the first three years, managers of EAG have estimated that cash flows will grow at a rate of 2 percent. The WACC for the merged firms is 8 percent. Managers of BSW Inc. agree that cash flows should grow at an additional 4 percent for the first three years, but are unsure of the long-term growth rate in cash flows estimated by EAG. Calculate the minimum growth rate needed after the first three years such that BSW Inc. would see this merger as a positive NPV project.

A)3.00 percent

B)2.82 percent

C)4.05 percent

D)8.00 percent

A)3.00 percent

B)2.82 percent

C)4.05 percent

D)8.00 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

42

George's Dry Cleaning is considering a merger with Weezzie's Laundry Supply Stores. George's total operating costs of producing services are $590,000 for sales volume (SG) of $4.7 million. Weezzie's total operating costs of producing services are $152,000 for a sales volume (SW) of $2.3 million. For a sales volume of $7 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 9 percent.

A)$97,000

B)$101,000

C)$112,000

D)$128,000

A)$97,000

B)$101,000

C)$112,000

D)$128,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

43

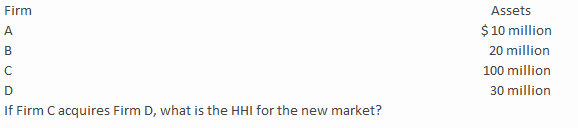

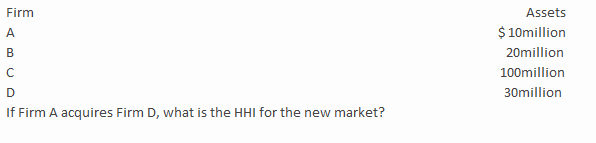

The Justice Department has been asked to review a merger request for a market with the following four firms.

A)100

B)160

C)6,796.875

D)17,400.00

A)100

B)160

C)6,796.875

D)17,400.00

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

44

George's Dry Cleaning is considering a merger with Weezzie's Laundry Supply Stores. George's total operating costs of producing services are $790,000 for sales volume (SG) of $4.7 million. Weezzie's total operating costs of producing services are $202,000 for a sales volume (SW) of $2.3 million. For a sales volume of $7 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 12 percent.

A)$840,000

B)$710,000

C)$175,000

D)$152,000

A)$840,000

B)$710,000

C)$175,000

D)$152,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

45

A survey of a national market provided the following average cost data: Jackson County Construction (JCC) has assets of $2 million and an average cost of 30 percent; Arkansas Architects (AA) has assets of $1.5 million and an average cost of 20 percent; Colorado Home Builders (CHB) has assets of $500,000 and an average cost of 10 percent. For each firm, average costs are measured as a proportion of assets. JCC is planning to acquire AA and CHB with the expectation of reducing overall average costs by eliminating the duplication of services. If JCC plans to reduce operating costs by $200,000 after the merger, what will the average cost be for the new firm?

A)18.75 percent

B)19.74 percent

C)20.00 percent

D)16.67 percent

A)18.75 percent

B)19.74 percent

C)20.00 percent

D)16.67 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

46

Jenny's Day Care is considering a merger with Lionel's Diaper Manufacturers. Jenny's total operating costs of producing services are $350,000 for sales volume of $1.4 million. Lionel's total operating costs of producing services are $300,000 for a sales volume of $1.3 million. For a sales volume of $2.7 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 20 percent.

A)$129,000

B)$110,000

C)$540,000

D)$103,000

A)$129,000

B)$110,000

C)$540,000

D)$103,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

47

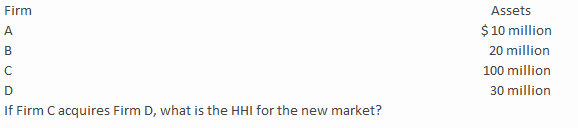

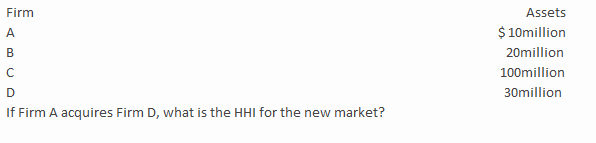

The Justice Department has been asked to review a merger request for a market with the following four firms.

A)100

B)625

C)3,906.25

D)4,687.50

A)100

B)625

C)3,906.25

D)4,687.50

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

48

A merger between BankOne and Amcore is an example of a:

A)vertical merger.

B)horizontal merger.

C)conglomerate merger.

D)none of the options.

A)vertical merger.

B)horizontal merger.

C)conglomerate merger.

D)none of the options.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

49

Cindy's Computer Corp. is considering a merger with Bobby's Computer, Inc. Cindy's total operating costs of producing services are $2.1 million for a sales volume (SC) of $13 million. Bobby's total operating costs of producing services are $2.5 million for a sales volume (SB) of $7 million. If the two firms merge, calculate the total average cost (TAC) for the merged firm assuming no synergies.

A)23 percent

B)17 percent

C)19 percent

D)21 percent

A)23 percent

B)17 percent

C)19 percent

D)21 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

50

A survey of a local market provided the following average cost data: Johnson Construction Corp. (JCC) has assets of $5 million and an average cost of 15 percent; Anderson Architects (AA) has assets of $8 million and an average cost of 20 percent; Cole Home Builders (CHB) has assets of $8 million and an average cost of 17 percent. For each firm, average costs are measured as a proportion of assets. JCC is planning to acquire AA and CHB with the expectation of reducing overall average costs by eliminating the duplication of services. What should be the average cost after the acquisition for JCC to justify this merger?

A)17.667 percent or lower

B)17.667 percent or higher

C)17.333 percent or lower

D)15.00 percent or lower

A)17.667 percent or lower

B)17.667 percent or higher

C)17.333 percent or lower

D)15.00 percent or lower

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is NOT a source of value-enhancing synergy in a merger?

A)Cost reduction

B)Revenue enhancement

C)Increased marketing presence

D)Tax considerations

A)Cost reduction

B)Revenue enhancement

C)Increased marketing presence

D)Tax considerations

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

52

Peter's TV Supplies is considering a merger with Jan's Radio Supply Stores. Peter's total operating costs of producing services are $330,000 for a sales volume (SP) of $4.5 million. Jan's total operating costs of producing services are $30,000 for a sales volume (SJ) of $550,000. Suppose that synergies in the production process result in a cost of production for the merged firms totalling $360,000 for a sales volume of $5,050,000. Calculate the total average cost (TAC) for the merged firm.

A)7.61 percent

B)7.43 percent

C)7.13 percent

D)7.52 percent

A)7.61 percent

B)7.43 percent

C)7.13 percent

D)7.52 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.15, X2 = Retained earnings/Total assets = 0.27, X3 = Earnings before interest and taxes/Total assets = 0.28, X4 = Market value of equity/Book value of long-term debt = 0.68, X5 = Sales/Total assets ratio = 0.9. Calculate and interpret the Altman's Z-score for this firm.

A)1.92; Low risk

B)2.01; Indeterminate

C)2.79; Low risk

D)2.79; Indeterminate

A)1.92; Low risk

B)2.01; Indeterminate

C)2.79; Low risk

D)2.79; Indeterminate

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

54

Stubborn Motors, Inc., is asking a price of $10.5 million to be purchased by Rubber Tire Motor Corp. Rubber Tire currently has total cash flows of $6 million which are growing at 1 percent annually. Managers estimate that because of synergies the merged firm's cash flows will increase by an additional 4 percent for the first four years following the merger. After the first four years, incremental cash flows will grow at a rate of 3 percent annually. The WACC for the merged firms is 9.75 percent. Calculate the NPV of the merger. Should Rubber Tire Motor Corporation agree to acquire Stubborn Motors for the asking price of $10.5 million?

A)Agree to the merger because the NPV = -$2.32 million.

B)Agree to the merger because the NPV = $1.03 million.

C)Disagree to the merger because the NPV = -$0.96 million.

D)Agree to the merger because the NPV = $2.48 million.Year after merger

A)Agree to the merger because the NPV = -$2.32 million.

B)Agree to the merger because the NPV = $1.03 million.

C)Disagree to the merger because the NPV = -$0.96 million.

D)Agree to the merger because the NPV = $2.48 million.Year after merger

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

55

A survey of a local market provided the following average cost data: Johnson Construction Corp. (JCC) has assets of $4 million and an average cost of 10 percent; Anderson Architects (AA) has assets of $5 million and an average cost of 20 percent; Cole Home Builders (CHB) has assets of $5 million and an average cost of 15 percent. For each firm, average costs are measured as a proportion of assets. JCC is planning to acquire AA and CHB with the expectation of reducing overall average costs by eliminating the duplication of services. What should be the average cost after the acquisition for JCC to justify this merger?

A)15.357 percent or lower

B)15.357 percent or higher

C)15.000 percent or lower

D)10.000 percent or lower

A)15.357 percent or lower

B)15.357 percent or higher

C)15.000 percent or lower

D)10.000 percent or lower

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

56

The main motive for a merger is:

A)product extension.

B)manager's personal incentives.

C)synergies.

D)none of the options.

A)product extension.

B)manager's personal incentives.

C)synergies.

D)none of the options.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

57

A survey of a local market has provided the following average cost data: Johnson Construction Corp. (JCC) has assets of $3 million and an average cost of 22 percent. Anderson Architects (AA) has assets of $4 million and an average cost of 31 percent. Cole Home Builders (CHB) has assets of $5 million and an average cost of 28 percent. For each firm, average costs are measured as a proportion of assets. JCC is planning to acquire AA and CHB with the expectation of reducing overall average costs by eliminating the duplication of services. If JCC plans to reduce operating costs by $500,000 after the merger, what will the average cost be for the new firm?

A)23.33 percent

B)23.87 percent

C)24.12 percent

D)22.50 percent

A)23.33 percent

B)23.87 percent

C)24.12 percent

D)22.50 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

58

The managers of BSW Inc. have been approached by EAG Corp. for a possible merger. EAG Corp. is asking a price of $50 million to be purchased by BSW Inc. The two firms currently have cumulative total cash flows of $2.5 million that are growing at 2 percent annually. Managers of EAG estimate that because of synergies the merged firm's cash flows will increase by an additional 5 percent for the first three years following the merger. After the first three years, managers of EAG have estimated that cash flows will grow at a rate of 2 percent. The WACC for the merged firms is 12 percent. Managers of BSW Inc. agree that cash flows should grow at an additional 5 percent for the first three years, but are unsure of the long-term growth rate in cash flows estimated by EAG. Calculate the minimum growth rate needed after the first three years such that BSW Inc. would see this merger as a positive NPV project.

A)5.00 percent

B)6.925 percent

C)1.728 percent

D)12.00 percent

A)5.00 percent

B)6.925 percent

C)1.728 percent

D)12.00 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

59

A survey of a local market provided the following average cost data: Johnson Construction Corp. (JCC) has assets of $5 million and an average cost of 15 percent; Anderson Architects (AA) has assets of $8 million and an average cost of 20 percent; Cole Home Builders (CHB) has assets of $8 million and an average cost of 17 percent. For each firm, average costs are measured as a proportion of assets. JCC is planning to acquire AA and CHB with the expectation of reducing overall average costs by eliminating the duplication of services. If JCC plans to reduce operating costs by $300,000 after the merger, what will the average cost be for the new firm?

A)16.238 percent

B)15.00 percent

C)17.33 percent

D)17.667 percent

A)16.238 percent

B)15.00 percent

C)17.33 percent

D)17.667 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.05, X2 = Retained earnings/Total assets = 0.12, X3 = Earnings before interest and taxes/Total assets = 0.17, X4 = Market value of equity/Book value of long-term debt = 0.42, X5 = Sales/Total assets ratio = 0.6. Calculate and interpret the Altman's Z-score for this firm.

A)1.64; High risk

B)1.64; Indeterminate

C)1.99; Low risk

D)2.79; Indeterminate

A)1.64; High risk

B)1.64; Indeterminate

C)1.99; Low risk

D)2.79; Indeterminate

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is incorrect?

A)While linear probability models divide firms into high or low bankruptcy risk classes, logit models and linear discriminant models produce a value for the expected probability of bankruptcy.

B)The logit model overcomes a weakness of the linear probability model by restricting the estimated range of bankruptcy probabilities to lie between 0 and 1.

C)All three credit scoring models use past data, such as financial ratios, as inputs to explain repayment experiences on old debt.

D)All of the statements are correct.

A)While linear probability models divide firms into high or low bankruptcy risk classes, logit models and linear discriminant models produce a value for the expected probability of bankruptcy.

B)The logit model overcomes a weakness of the linear probability model by restricting the estimated range of bankruptcy probabilities to lie between 0 and 1.

C)All three credit scoring models use past data, such as financial ratios, as inputs to explain repayment experiences on old debt.

D)All of the statements are correct.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

62

All of the following are problems associated with using the Z-score model to make credit risk evaluations EXCEPT:

A)the model does not benchmark firms to the average in the industry.

B)the model does not use important data that is difficult to quantify such as the phase of the business cycle.

C)the model categorizes firms as either high risk or low risk.

D)All of the options are problems associated with using the Z-score model.

A)the model does not benchmark firms to the average in the industry.

B)the model does not use important data that is difficult to quantify such as the phase of the business cycle.

C)the model categorizes firms as either high risk or low risk.

D)All of the options are problems associated with using the Z-score model.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

63

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.65, X2 = Retained earnings/Total assets = 1.10, X3 = Earnings before interest and taxes/Total assets = 0.10, X4 = Market value of equity/Book value of long-term debt = 2.05, X5 = Sales/Total assets ratio = 0.45. Calculate the Altman's Z-score for this firm.

A)8.70

B)4.35

C)4.33

D)2.33

A)8.70

B)4.35

C)4.33

D)2.33

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

64

All of the following are an advantage of prepackaged bankruptcy EXCEPT:

A)there is less disruption to the firm's business and less damage to its goodwill.

B)reduced legal expenses and other fees, which leave more funds available for the creditors.

C)it is a shorter and simpler bankruptcy process.

D)All of the options are advantages.

A)there is less disruption to the firm's business and less damage to its goodwill.

B)reduced legal expenses and other fees, which leave more funds available for the creditors.

C)it is a shorter and simpler bankruptcy process.

D)All of the options are advantages.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

65

If Walmart acquires Target, this would be an example of a:

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is NOT an example of a revenue enhancement that is a result of a merger?

A)The revenue stream of the acquired firm becomes more stable because the target firm has different risk characteristics.

B)The merger may expand the target firm's operations into areas that are not fully competitive.

C)The merger may create cost synergies.

D)All of the options are examples of a revenue enhancement that is a result of a merger.

A)The revenue stream of the acquired firm becomes more stable because the target firm has different risk characteristics.

B)The merger may expand the target firm's operations into areas that are not fully competitive.

C)The merger may create cost synergies.

D)All of the options are examples of a revenue enhancement that is a result of a merger.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

67

If Walt Disney and American Airlines merged, it would be an example of a:

A)consolidation merger.

B)conglomerate merger.

C)vertical merger.

D)horizontal merger.

A)consolidation merger.

B)conglomerate merger.

C)vertical merger.

D)horizontal merger.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

68

One Day Dry Cleaning is considering a merger with Speedy's Laundry Supply Stores. One Day's total operating costs of producing services are $450,000 for sales volume (SG) of $3.75 million. Speedy's total operating costs of producing services are $200,000 for a sales volume (SW) of $1.70 million. For a sales volume of $5 million, calculate the reduction in production costs the merged firms need to experience such that the total average cost (TAC) for the merged firms is equal to 11 percent.

A)$100,000

B)$200,000

C)$450,000

D)$550,000

A)$100,000

B)$200,000

C)$450,000

D)$550,000

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is a poor justification for a merger?

A)Tax considerations

B)Lowering cost of capital

C)Reducing costs

D)Increasing the size of the firm

A)Tax considerations

B)Lowering cost of capital

C)Reducing costs

D)Increasing the size of the firm

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following refers to a firm that is still allowed to continue to operate while the creditors' claims are settled using a collective procedure?

A)Chapter 7 bankruptcy

B)Chapter 11 bankruptcy

C)Technical insolvency

D)Prepackaged bankruptcy

A)Chapter 7 bankruptcy

B)Chapter 11 bankruptcy

C)Technical insolvency

D)Prepackaged bankruptcy

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

71

Cost savings not directly due to economies of scope or economies of scale are referred to as:

A)economies of scale.

B)economies of scope.

C)x-efficiencies.

D)none of the options.

A)economies of scale.

B)economies of scope.

C)x-efficiencies.

D)none of the options.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose that the financial ratios of a potential borrowing firm took the following values: X1 = Net working capital/Total assets = 0.36, X2 = Retained earnings/Total assets = 0.08, X3 = Earnings before interest and taxes/Total assets = 0.25, X4 = Market value of equity/Book value of long-term debt = 0.80, X5 = Sales/Total assets ratio = 0.75. Calculate and interpret the Altman's Z-score for this firm.

A)2.24; High risk

B)2.24; Indeterminate

C)2.60; Low risk

D)2.60; Indeterminate

A)2.24; High risk

B)2.24; Indeterminate

C)2.60; Low risk

D)2.60; Indeterminate

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

73

The main reason for a vertical merger is:

A)avoidance of fixed costs.

B)elimination of costs of searching for input prices.

C)control over input prices.

D)All of the options.

A)avoidance of fixed costs.

B)elimination of costs of searching for input prices.

C)control over input prices.

D)All of the options.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

74

If Verizon buys the Green Bay Packers, this would be an example of a:

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

75

If Whole Foods grocery store buys Whole Wheat Bread, this would be an example of a:

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

A)horizontal merger.

B)vertical merger.

C)market extension merger.

D)conglomerate merger.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

76

Market-specific reasons for financial distress include all of the following EXCEPT:

A)high interest rates.

B)high unemployment.

C)economic recession.

D)volatility in earnings.

A)high interest rates.

B)high unemployment.

C)economic recession.

D)volatility in earnings.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is an incorrect priority of claims in the event of liquidation? (Note: The first item would be paid first.)

A)Secured creditors, wages due employees, unsecured creditor claims, common shareholders

B)Secured creditors, unsecured creditor claims, preferred shareholders, common shareholders

C)Secured creditors, administration expenses, common shareholders, preferred shareholders

D)Secured creditors, wages due employees, taxes due federal government, preferred shareholders

A)Secured creditors, wages due employees, unsecured creditor claims, common shareholders

B)Secured creditors, unsecured creditor claims, preferred shareholders, common shareholders

C)Secured creditors, administration expenses, common shareholders, preferred shareholders

D)Secured creditors, wages due employees, taxes due federal government, preferred shareholders

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

78

Firm-specific reasons for financial distress include all of the following EXCEPT:

A)large amounts of financial leverage.

B)poor management.

C)economic recession.

D)volatility in earnings.

A)large amounts of financial leverage.

B)poor management.

C)economic recession.

D)volatility in earnings.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

79

Cathy Corp. is considering a merger with Russell, Inc. Cathy's total operating costs of producing services are $200,000 for a sales volume (SC) of $700,000. Russell's total operating costs of producing services are $400,000 for a sales volume (SB) of $1 million. If the two firms merge, calculate the total average cost (TAC) for the merged firm assuming no synergies.

A)28.57 percent

B)35.29 percent

C)40.00 percent

D)68.57 percent

A)28.57 percent

B)35.29 percent

C)40.00 percent

D)68.57 percent

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck

80

The merged firm's ability to generate synergistic cost savings through the joint use of inputs in producing multiple products is referred to as:

A)economies of scale.

B)economies of scope.

C)x-efficiencies.

D)none of the options.

A)economies of scale.

B)economies of scope.

C)x-efficiencies.

D)none of the options.

Unlock Deck

Unlock for access to all 82 flashcards in this deck.

Unlock Deck

k this deck