Deck 1: Business Income,Deductions,and Accounting Methods

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/99

Play

Full screen (f)

Deck 1: Business Income,Deductions,and Accounting Methods

1

A fiscal tax year can end on the last day of any month other than December.

True

2

Employees cannot deduct the cost of uniforms if the uniforms are also appropriate for normal wear.

True

3

Business activities are distinguished from personal activities in that business activities are motivated by the pursuit of profits.

True

4

The phase "ordinary and necessary" has been defined to mean that an expense must be essential and indispensable to the conduct of a business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

5

The domestic production activities deduction is a deduction for the incremental cost of manufacturing tangible assets in the United States.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

6

Only half the cost of a business meal is deductible even if the meal is associated with the active conduct of business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

7

All taxpayers must account for taxable income using a calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

8

Qualified production activity income for calculating the domestic production activities deduction is limited to taxable income for a business or modified AGI for an individual.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

9

A loss deduction from a casualty of a business asset is only available if the asset is completely destroyed.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

10

Sole proprietorships must use the same tax year as the proprietor of the business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

11

The Internal Revenue Code authorizes deductions for trade or business activities if the expenditure is "ordinary and necessary".

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

12

A short tax year can end on any day of any month other than December.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

13

Reasonable in amount means that expenditures can be exorbitant as long as the activity is motivated by profit.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

14

A business generally adopts a fiscal or calendar year by using that year end on the first tax return for the business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

15

Taxpayers must maintain written contemporaneous records of business purpose when entertaining clients in order to claim a deduction for the expenditures.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

16

The domestic production activities deduction cannot exceed 50 percent of the wages paid to employees engaged in domestic manufacturing activities during the year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

17

Illegal bribes and kickbacks are not deductible as business expenses but fines imposed by a governmental unit are deductible as long as the fines are incurred in the ordinary course of business.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

18

When a taxpayer borrows money and invests the loan proceeds in municipal bonds,the interest paid by the taxpayer on the debt will not be deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

19

Although expenses associated with illegal activities are not deductible,political contributions can be deducted as long as the donation is not made to a candidate for public office.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

20

The test for whether an expenditure is reasonable in amount is whether the expenditure was for an "arm's length" amount.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

21

This year Clark leased a car to drive between his office and various work sites.Clark carefully recorded that he drove the car 23,000 miles this year and paid $7,200 of operating expenses ($2,700 for gas,oil,and repairs,and $4,500 for lease payments).What amount of these expenses may Clark deduct as business expenses?

A) $7,200

B) $4,500

C) $2,700

D) Clark cannot deduct these costs because taxpayers must use the mileage method to determine any transportation deduction.

E) Clark is not entitled to any deduction if he used the car for any personal trips.

A) $7,200

B) $4,500

C) $2,700

D) Clark cannot deduct these costs because taxpayers must use the mileage method to determine any transportation deduction.

E) Clark is not entitled to any deduction if he used the car for any personal trips.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

22

After a business meeting with a prospective client Holly took the client to dinner and the theatre.Holly paid $290 for the meal and $250 for the theatre tickets,amounts that were reasonable under the circumstances.What amount of these expenditures can Holly deduct as a business expense?

A) $540

B) $415

C) $270

D) None unless Holly discussed business with the client during the meal and the entertainment.

E) None-the meals and entertainment are not deductible except during travel.

A) $540

B) $415

C) $270

D) None unless Holly discussed business with the client during the meal and the entertainment.

E) None-the meals and entertainment are not deductible except during travel.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is a true statement?

A) Interest expense is not deductible if the loan is used to purchase municipal bonds.

B) Insurance premiums are not deductible if paid for "key man" life insurance.

C) One half of the cost of business meals is not deductible.

D) All of the choices are true.

E) None of the choices are true.

A) Interest expense is not deductible if the loan is used to purchase municipal bonds.

B) Insurance premiums are not deductible if paid for "key man" life insurance.

C) One half of the cost of business meals is not deductible.

D) All of the choices are true.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

24

The 12-month rule allows taxpayers to deduct the entire amount of certain prepaid business expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following expenditures is most likely to be deductible for a construction business?

A) A fine for a zoning violation.

B) A tax underpayment penalty.

C) An "under the table" payment to a government representative to obtain a better price for raw materials.

D) A payment to a foreign official to expedite an application for a business permit.

E) An arm's length payment to a related party for emergency repairs of a sewage line.

A) A fine for a zoning violation.

B) A tax underpayment penalty.

C) An "under the table" payment to a government representative to obtain a better price for raw materials.

D) A payment to a foreign official to expedite an application for a business permit.

E) An arm's length payment to a related party for emergency repairs of a sewage line.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

26

The all-events test for income determines the period in which income will be recognized for tax purposes.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is likely to be a fully deductible business expense?

A) Salaries in excess of the industry average paid to attract talented employees.

B) The cost of employee uniforms that can be adapted to ordinary personal wear.

C) A speeding fine paid by a trucker who was delivering a rush order.

D) The cost of a three-year subscription to a business publication.

E) None of the choices are likely to be deductible.

A) Salaries in excess of the industry average paid to attract talented employees.

B) The cost of employee uniforms that can be adapted to ordinary personal wear.

C) A speeding fine paid by a trucker who was delivering a rush order.

D) The cost of a three-year subscription to a business publication.

E) None of the choices are likely to be deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

28

Dick pays insurance premiums for his employees.What type of insurance premium is not deductible as compensation paid to the employee?

A) Health insurance with benefits payable to the employee.

B) Whole life insurance with benefits payable to the employee's dependents.

C) Group term life insurance with benefits payable to the employee's dependents.

D) Key man life insurance with benefits payable to Dick.

E) All of the choices are deductible by Dick.

A) Health insurance with benefits payable to the employee.

B) Whole life insurance with benefits payable to the employee's dependents.

C) Group term life insurance with benefits payable to the employee's dependents.

D) Key man life insurance with benefits payable to Dick.

E) All of the choices are deductible by Dick.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is a true statement?

A) Meals are never deductible as a business expense.

B) An employer can only deduct half of any meals provided to employees.

C) The cost of business meals must be reasonable.

D) A taxpayer can only deduct a meal for a client if business is discussed during the meal.

E) None of the choices are true.

A) Meals are never deductible as a business expense.

B) An employer can only deduct half of any meals provided to employees.

C) The cost of business meals must be reasonable.

D) A taxpayer can only deduct a meal for a client if business is discussed during the meal.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

30

According to the Internal Revenue Code §162,deductible trade or business expenses must be one of the following:

A) incurred for the production of investment income.

B) ordinary and necessary.

C) minimized.

D) appropriate and measurable.

E) personal and justifiable.

A) incurred for the production of investment income.

B) ordinary and necessary.

C) minimized.

D) appropriate and measurable.

E) personal and justifiable.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

31

The full-inclusion method requires cash basis taxpayers to include prepayments for goods or services into realized income.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is an explanation for why insurance premiums on a key employee are not deductible?

A) A deduction for the insurance premium would offset taxable income without the potential for the proceeds generating taxable income.

B) The federal government does not want to subsidize insurance companies.

C) It is impractical to trace insurance premiums to the receipt of proceeds.

D) Congress presumes that all expenses are not deductible unless specifically allowed in the Internal Revenue Code.

E) This rule was grandfathered from a time when the Internal Revenue Code disallowed all insurance premiums deductions.

A) A deduction for the insurance premium would offset taxable income without the potential for the proceeds generating taxable income.

B) The federal government does not want to subsidize insurance companies.

C) It is impractical to trace insurance premiums to the receipt of proceeds.

D) Congress presumes that all expenses are not deductible unless specifically allowed in the Internal Revenue Code.

E) This rule was grandfathered from a time when the Internal Revenue Code disallowed all insurance premiums deductions.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

33

Paris operates a talent agency as a sole proprietorship,and this year she incurred the following expenses in operating her talent agency.What is the total deductible amount of these expenditures? $1,000 dinner with a film producer where no business was discussed.

$500 lunch with sister Nicky where no business was discussed.

$700 business dinner with a client but Paris forgot to keep any records (oops!).

$900 tickets to the opera with a client following a business meeting.

A) $450.

B) $900.

C) $1,100.

D) $1,200.

E) $800.

$500 lunch with sister Nicky where no business was discussed.

$700 business dinner with a client but Paris forgot to keep any records (oops!).

$900 tickets to the opera with a client following a business meeting.

A) $450.

B) $900.

C) $1,100.

D) $1,200.

E) $800.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

34

Even a cash method taxpayer must consistently use accounting methods that "clearly reflect income" for tax purposes.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

35

The IRS would most likely apply the arm's length transaction test to determine which of the following?

A) whether an expenditure is related to a business activity.

B) whether an expenditure will be likely to produce income.

C) timeliness of an expenditure.

D) reasonableness of an expenditure.

E) All of the choices are correct.

A) whether an expenditure is related to a business activity.

B) whether an expenditure will be likely to produce income.

C) timeliness of an expenditure.

D) reasonableness of an expenditure.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

36

In order to deduct a portion of the cost of a business meal which of the following conditions must be met?

A) A client (not a supplier or vendor) must be present at the meal.

B) The taxpayer or an employee must be present at the meal.

C) The meal must occur on the taxpayer's business premises.

D) None of the choices is a condition for the deduction.

E) All of the choices are conditions for a deduction.

A) A client (not a supplier or vendor) must be present at the meal.

B) The taxpayer or an employee must be present at the meal.

C) The meal must occur on the taxpayer's business premises.

D) None of the choices is a condition for the deduction.

E) All of the choices are conditions for a deduction.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following expenditures is NOT likely to be allowed as a current deduction for a landscaping and nursery business?

A) cost of fertilizer.

B) accounting fees.

C) cost of a greenhouse.

D) cost of uniforms for employees.

E) a cash settlement for trade name infringement.

A) cost of fertilizer.

B) accounting fees.

C) cost of a greenhouse.

D) cost of uniforms for employees.

E) a cash settlement for trade name infringement.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

38

Individual proprietors report their business income and deductions on:

A) Form 1065.

B) Form 1120S.

C) Schedule C.

D) Schedule A.

E) Form 1041.

A) Form 1065.

B) Form 1120S.

C) Schedule C.

D) Schedule A.

E) Form 1041.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

39

Uniform capitalization of indirect inventory costs is required for most large taxpayers.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following business expense deductions is most likely to be unreasonable in amount?

A) Compensation paid to the taxpayer's spouse in excess of salary payments to other employees.

B) Amounts paid to a subsidiary corporation for services where the amount is in excess of the cost of comparable services by competing corporations.

C) Cost of entertaining a former client when there is no possibility of any future benefits from a relation with that client.

D) All of the choices are likely to be unreasonable in amount.

E) None of the choices are likely to be unreasonable in amount.

A) Compensation paid to the taxpayer's spouse in excess of salary payments to other employees.

B) Amounts paid to a subsidiary corporation for services where the amount is in excess of the cost of comparable services by competing corporations.

C) Cost of entertaining a former client when there is no possibility of any future benefits from a relation with that client.

D) All of the choices are likely to be unreasonable in amount.

E) None of the choices are likely to be unreasonable in amount.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

41

Jim operates his business on the accrual method and this year he received $4,000 for services that he intends to provide to his clients next year.Under what circumstances can Jim defer the recognition of the $4,000 of income until next year?

A) Jim can defer the recognition of the income if he absolutely promises not to provide the services until next year.

B) Jim must defer the recognition of the income until the income is earned.

C) Jim can defer the recognition of the income if he has requested that the client not pay for the services until the services are provided.

D) Jim can elect to defer the recognition of the income if the income is not recognized for financial accounting purposes.

E) Jim can never defer the recognition of the prepayments of income.

A) Jim can defer the recognition of the income if he absolutely promises not to provide the services until next year.

B) Jim must defer the recognition of the income until the income is earned.

C) Jim can defer the recognition of the income if he has requested that the client not pay for the services until the services are provided.

D) Jim can elect to defer the recognition of the income if the income is not recognized for financial accounting purposes.

E) Jim can never defer the recognition of the prepayments of income.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following cannot be selected as a valid tax year end?

A) December 31st.

B) January 31st.

C) The last Friday of the last week of June.

D) December 15th.

E) A tax year can end on any of these days.

A) December 31st.

B) January 31st.

C) The last Friday of the last week of June.

D) December 15th.

E) A tax year can end on any of these days.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

43

Ed is a self-employed heart surgeon who has incurred the following reasonable expenses.How much can Ed deduct? $1,000 in airfare to repair investment rental property in Colorado.

$500 in meals while attending a medical convention in New York.

$300 for tuition for an investment seminar "How to pick stocks."

$100 for tickets to a football game with hospital administrators to celebrate successful negotiation of a surgical contract earlier in the day.

The correct answer is _________.

A) $1,300 "for AGI"

B) $1,300 "for AGI" and $300 "from AGI"

C) $480 "for AGI"

D) $80 "for AGI" and $1,300 "from AGI"

E) None of the choices are correct.

$500 in meals while attending a medical convention in New York.

$300 for tuition for an investment seminar "How to pick stocks."

$100 for tickets to a football game with hospital administrators to celebrate successful negotiation of a surgical contract earlier in the day.

The correct answer is _________.

A) $1,300 "for AGI"

B) $1,300 "for AGI" and $300 "from AGI"

C) $480 "for AGI"

D) $80 "for AGI" and $1,300 "from AGI"

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is a true statement about travel that has both business and personal aspects?

A) Transportation costs are always fully deductible.

B) Meals are not deductible for this type of travel.

C) Only half of the cost of meals and transportation is deductible.

D) The cost of lodging, and incidental expenditures is limited to those incurred during the business portion of the travel.

E) None of the choices are correct.

A) Transportation costs are always fully deductible.

B) Meals are not deductible for this type of travel.

C) Only half of the cost of meals and transportation is deductible.

D) The cost of lodging, and incidental expenditures is limited to those incurred during the business portion of the travel.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following types of transactions may not typically be accounted for using the cash method?

A) sales of inventory.

B) services.

C) purchases of machinery.

D) payments of debt.

E) sales of securities by an investor.

A) sales of inventory.

B) services.

C) purchases of machinery.

D) payments of debt.

E) sales of securities by an investor.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

46

Don operates a taxi business,and this year one of his taxis was damaged in a traffic accident.The taxi was originally purchased for $32,000 and the adjusted basis was $2,000 at the time of the accident.The taxi was repaired at a cost of $2,500 and insurance reimbursed Don $700 of this cost.What is the amount of Don's casualty loss deduction?

A) $1,300.

B) $2,500.

C) $1,800.

D) $2,000.

E) Don is not eligible for a casualty loss deduction.

A) $1,300.

B) $2,500.

C) $1,800.

D) $2,000.

E) Don is not eligible for a casualty loss deduction.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

47

Beth operates a plumbing firm.In August of last year she signed a contract to provide plumbing services for a renovation.Beth began the work that August and finished the work in December of last year.However,Beth didn't bill the client until January of this year and she didn't receive the payment until March when she received payment in full.When should Beth recognize income under the accrual method of accounting?

A) In August of last year.

B) In December of last year.

C) In January of this year.

D) In March of this year.

E) In April of this year.

A) In August of last year.

B) In December of last year.

C) In January of this year.

D) In March of this year.

E) In April of this year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

48

When does the all-events test under the accrual method require the recognition of income from the sale of goods?

A) When the title of the goods passes to the buyer.

B) When the business receives payment.

C) When payment is due from the buyer.

D) The earliest of the above three dates.

E) None of the choices are correct.

A) When the title of the goods passes to the buyer.

B) When the business receives payment.

C) When payment is due from the buyer.

D) The earliest of the above three dates.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is a true statement about the domestic production activities deduction?

A) This deduction is determined by the amount of goods manufactured in the United States for export abroad.

B) The deduction is calculated as a percentage of the cost of goods manufactured in the United States.

C) This deduction represents a subsidy to taxpayers who manufacture or construct goods in the United States.

D) The domestic production activities deduction is not affected by the cost of labor.

E) All of the choices are true.

A) This deduction is determined by the amount of goods manufactured in the United States for export abroad.

B) The deduction is calculated as a percentage of the cost of goods manufactured in the United States.

C) This deduction represents a subsidy to taxpayers who manufacture or construct goods in the United States.

D) The domestic production activities deduction is not affected by the cost of labor.

E) All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

50

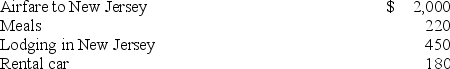

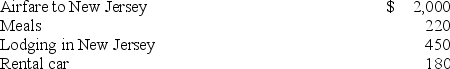

Shelley is employed in Texas and recently attended a two-day business conference in New Jersey.Shelley spent the entire time at the conference and documented her expenditures (described below).What amount can Shelley deduct as an employee business expense (before considering any miscellaneous itemized deduction limitations)?

A) $2,850

B) $2,740

C) $1,850 if Shelley's AGI is $50,000

D) All of the expenses are deductible if Shelley is reimbursed under an accountable plan.

E) None of the expenses are deductible - only employers can deduct travel expenses.

A) $2,850

B) $2,740

C) $1,850 if Shelley's AGI is $50,000

D) All of the expenses are deductible if Shelley is reimbursed under an accountable plan.

E) None of the expenses are deductible - only employers can deduct travel expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

51

Qualified production activities income is defined as follows for purposes of the domestic production activities deduction:

A) net income from selling or leasing property the taxpayer manufactured in the United States.

B) revenue from selling or leasing property the taxpayer manufactured in the United States.

C) revenue from selling or leasing property the taxpayer manufactured in the United States but the revenue was less than 50 percent of qualifying wages used in the production.

D) 6 percent of revenue from selling or leasing property the taxpayer manufactured in the United States.

E) None of the choices are correct.

A) net income from selling or leasing property the taxpayer manufactured in the United States.

B) revenue from selling or leasing property the taxpayer manufactured in the United States.

C) revenue from selling or leasing property the taxpayer manufactured in the United States but the revenue was less than 50 percent of qualifying wages used in the production.

D) 6 percent of revenue from selling or leasing property the taxpayer manufactured in the United States.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

52

Clyde operates a sole proprietorship using the cash method.This year Clyde made the following expenditures: $480 to U.S.Bank for 12 months of interest accruing on a business loan from September 1st of this year through August 31st of next year.

$600 for 12 months of property insurance beginning on July 1 of this year.

What is the maximum amount Clyde can deduct this year?

A) $760.

B) $600.

C) $480.

D) $160.

E) $360.

$600 for 12 months of property insurance beginning on July 1 of this year.

What is the maximum amount Clyde can deduct this year?

A) $760.

B) $600.

C) $480.

D) $160.

E) $360.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

53

Bill operates a proprietorship using the cash method of accounting,and this year he received the following payments: • $100 in cash from a customer for services rendered this year.

• a promise to pay $200 from a customer for services rendered this year.

• tickets to a football game worth $250 as payment for services performed last year.

• a check for $170 for services rendered this year that Bill forgot to cash.

How much income should Bill realize on Schedule C?

A) $100.

B) $300.

C) $350.

D) $270.

E) $520.

• a promise to pay $200 from a customer for services rendered this year.

• tickets to a football game worth $250 as payment for services performed last year.

• a check for $170 for services rendered this year that Bill forgot to cash.

How much income should Bill realize on Schedule C?

A) $100.

B) $300.

C) $350.

D) $270.

E) $520.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

54

George operates a business that generated adjusted gross income of $250,000 and taxable income of $170,000 this year (before the domestic production activities deduction).Included in income was $70,000 of qualified production activities income.George paid $60,000 of wages to employees engaged in domestic manufacturing.What domestic production activities deduction will George be eligible to claim this year?

A) $5,400.

B) $6,300.

C) $7,200.

D) $15,300.

E) $22,500.

A) $5,400.

B) $6,300.

C) $7,200.

D) $15,300.

E) $22,500.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

55

Colbert operates a catering service on the accrual method.In November of year 1 Colbert received a payment of $9,000 for 18 months of catering services to be rendered from December 1st of year 1 through May 31st year 3.When must Colbert recognize the income if his accounting methods are selected to minimize income recognition?

A) $500 is recognized in year 1, $6,000 in year 2, and $2,500 in year 3.

B) $500 is recognized in year 1 and $8,500 in year 2.

C) $9,000 is recognized in year 3.

D) $2,500 is recognized in year 1 and $6,500 in year 2.

E) $9,000 is recognized in year 1.

A) $500 is recognized in year 1, $6,000 in year 2, and $2,500 in year 3.

B) $500 is recognized in year 1 and $8,500 in year 2.

C) $9,000 is recognized in year 3.

D) $2,500 is recognized in year 1 and $6,500 in year 2.

E) $9,000 is recognized in year 1.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following expenses are completely deductible?

A) $1,000 spent on compensating your brother for a personal expense.

B) $50 spent on meals while traveling on business.

C) $2,000 spent by the employer on reimbursing an employee for entertainment.

D) All of the expenses are fully deductible.

E) None of the expenses can be deducted in full.

A) $1,000 spent on compensating your brother for a personal expense.

B) $50 spent on meals while traveling on business.

C) $2,000 spent by the employer on reimbursing an employee for entertainment.

D) All of the expenses are fully deductible.

E) None of the expenses can be deducted in full.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

57

Ronald is a cash method taxpayer who made the following expenditures this year.Which expenditure is completely deductible in this period as a business expense?

A) $4,000 for rent on his office that covers the next 24 months.

B) $3,000 for a new watch for the mayor to keep "good relations" with city hall.

C) $2,500 for professional hockey tickets distributed to a customer to generate "goodwill" for his business.

D) $55 to collect an account receivable from a customer who has failed to pay for services rendered.

E) None of the choices are completely deductible.

A) $4,000 for rent on his office that covers the next 24 months.

B) $3,000 for a new watch for the mayor to keep "good relations" with city hall.

C) $2,500 for professional hockey tickets distributed to a customer to generate "goodwill" for his business.

D) $55 to collect an account receivable from a customer who has failed to pay for services rendered.

E) None of the choices are completely deductible.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is a true statement?

A) Meals, lodging, and incidental expenditures are only deductible if the taxpayer is away from home overnight while traveling.

B) Meals are deductible for an employee who is forced to work during the lunch hour.

C) When a taxpayer travels solely for business purposes, only half of the costs of travel are deductible.

D) If travel has both business and personal aspects, the cost of transportation is always deductible but the deductibility of lodging depends upon whether business is conducted that day.

E) None of the choices are true.

A) Meals, lodging, and incidental expenditures are only deductible if the taxpayer is away from home overnight while traveling.

B) Meals are deductible for an employee who is forced to work during the lunch hour.

C) When a taxpayer travels solely for business purposes, only half of the costs of travel are deductible.

D) If travel has both business and personal aspects, the cost of transportation is always deductible but the deductibility of lodging depends upon whether business is conducted that day.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

59

John is a self-employed computer consultant who lives and works in Dallas.John paid for the following activities in conjunction with his business.Which is not deductible in any amount? 1.Dinner with a potential client where the client's business was discussed.

2)A trip to Houston to negotiate a contract.

3)A seminar in Houston on new developments in the software industry.

4)A trip to New York to visit a school chum who is also interested in computers.

A) 1 only.

B) 2 only.

C) 3 only.

D) 4 only.

E) None of the choices are correct.

2)A trip to Houston to negotiate a contract.

3)A seminar in Houston on new developments in the software industry.

4)A trip to New York to visit a school chum who is also interested in computers.

A) 1 only.

B) 2 only.

C) 3 only.

D) 4 only.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

60

Riley operates a plumbing business and this year the 3-year old van he used in the business was destroyed in a traffic accident.The van was originally purchased for $20,000 and the adjusted basis was $5,800 at the time of the accident.Although the van was worth $6,000 at the time of accident,insurance only paid Riley $1,200 for the loss.What is the amount of Riley's casualty loss deduction?

A) $6,000.

B) $14,000.

C) $5,800.

D) $4,600.

E) $5,300.

A) $6,000.

B) $14,000.

C) $5,800.

D) $4,600.

E) $5,300.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is a true statement about accounting for business activities?

A) An overall accounting method can only be adopted with the permission of the Commissioner.

B) An overall accounting method is initially adopted on the first return filed for the business.

C) The cash method can only be adopted by individual taxpayers.

D) The accrual method can only be adopted by corporate taxpayers.

E) None of the choices are true.

A) An overall accounting method can only be adopted with the permission of the Commissioner.

B) An overall accounting method is initially adopted on the first return filed for the business.

C) The cash method can only be adopted by individual taxpayers.

D) The accrual method can only be adopted by corporate taxpayers.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

62

Joe is a self-employed electrician who operates his business on the accrual method.This year Joe purchased a shop for his business,and for the first time at year end he received a bill for $4,500 of property taxes on his shop.Joe didn't pay the taxes until after year end but prior to filing his tax return.Which of the following is a true statement?

A) If he elects to treat the taxes as a recurring item, Joe can accrue and deduct $4,500 of taxes on the shop this year.

B) The taxes are a payment liability.

C) The taxes would not be deductible if Joe's business was on the cash method.

D) Unless Joe makes an election, the taxes are not deductible this year.

E) All of the choices are true.

A) If he elects to treat the taxes as a recurring item, Joe can accrue and deduct $4,500 of taxes on the shop this year.

B) The taxes are a payment liability.

C) The taxes would not be deductible if Joe's business was on the cash method.

D) Unless Joe makes an election, the taxes are not deductible this year.

E) All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

63

Big Homes Corporation is an accrual method calendar year taxpayer that manufactures and sells modular homes.This year for the first time Big Homes was forced to offer a rebate on the purchase of new homes.At year end,Big Homes had paid $12,000 in rebates and was liable for an additional $7,500 in rebates to buyers.What amount of the rebates,if any,can Big Homes deduct this year?

A) $12,000 because rebates are payment liabilities.

B) $19,500 because Big Homes is an accrual method taxpayer.

C) $19,500 if this amount is not material, Big Homes expects to continue the practice of offering rebates in future years, and Big Homes expects to pay the accrued rebates before filing their tax return for this year.

D) $12,000 because the $7,500 liability is not fixed and determinable.

E) Big Homes is not entitled to a deduction because rebates are against public policy.

A) $12,000 because rebates are payment liabilities.

B) $19,500 because Big Homes is an accrual method taxpayer.

C) $19,500 if this amount is not material, Big Homes expects to continue the practice of offering rebates in future years, and Big Homes expects to pay the accrued rebates before filing their tax return for this year.

D) $12,000 because the $7,500 liability is not fixed and determinable.

E) Big Homes is not entitled to a deduction because rebates are against public policy.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

64

Brad operates a storage business on the accrual method.On July 1 Brad paid $48,000 for rent on his storage warehouse and $18,000 for insurance on the contents of the warehouse.The rent and insurance covers the next 12 months.What is Brad's deduction for the rent and insurance?

A) $48,000 for the rent and $18,000 for the insurance.

B) $24,000 for the rent and $18,000 for the insurance.

C) $24,000 for the rent and $9,000 for the insurance.

D) $48,000 for the rent and $9,000 for the insurance.

E) None of the choices are true.

A) $48,000 for the rent and $18,000 for the insurance.

B) $24,000 for the rent and $18,000 for the insurance.

C) $24,000 for the rent and $9,000 for the insurance.

D) $48,000 for the rent and $9,000 for the insurance.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

65

Mike started a calendar year business on September 1st of this year by paying 12 months' rent on his shop at $1,000 per month.What is the maximum amount of rent that Mike can deduct this year under each type of accounting method?

A) $12,000 under the cash method and $12,000 under the accrual method.

B) $4,000 under the cash method and $12,000 under the accrual method.

C) $12,000 under the cash method and $4,000 under the accrual method.

D) $4,000 under the cash method and $4,000 under the accrual method.

E) $4,000 under the cash method and zero under the accrual method.

A) $12,000 under the cash method and $12,000 under the accrual method.

B) $4,000 under the cash method and $12,000 under the accrual method.

C) $12,000 under the cash method and $4,000 under the accrual method.

D) $4,000 under the cash method and $4,000 under the accrual method.

E) $4,000 under the cash method and zero under the accrual method.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

66

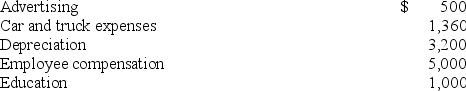

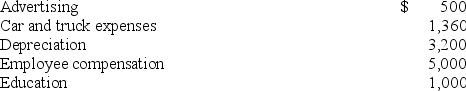

Smith operates a roof repair business.This year Smith's business generated cash receipts of $32,000 and Smith made the following expenditures associated with his business:

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week,nighttime course in business management.Smith believes the expenditure should qualify as an ordinary and necessary business expense.What net income should Smith report from his business? Smith is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

67

Todd operates a business using the cash basis of accounting.At the end of last year,Todd was granted permission to switch his sales on account to the accrual method.Last year Todd made $420,000 of sales on account and $64,000 was uncollected at the end of the year.What is Todd's §481 adjustment for this year?

A) increase income by $420,000.

B) increase income by $16,000.

C) increase expenses by $64,000.

D) increase expenses by $420,000.

E) Todd has no §481 adjustment this year.

A) increase income by $420,000.

B) increase income by $16,000.

C) increase expenses by $64,000.

D) increase expenses by $420,000.

E) Todd has no §481 adjustment this year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is a payment liability?

A) Tort claims.

B) Refunds.

C) Insurance premiums.

D) Real estate taxes.

E) All of the choices are correct.

A) Tort claims.

B) Refunds.

C) Insurance premiums.

D) Real estate taxes.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

69

Judy is a self-employed musician who performs for a variety of events.This year Judy was fined $250 by the city for violating the city's noise ordinance with a relatively loud performance.As a consequence,Judy contributed $1,000 to a campaign committee formed to recall the city's mayor.Judy normally hires three part-time employees to help her schedule events and transport equipment.Judy paid a total of $33,000 to her employees through June of this year.In June Judy fired her part-time employees and hired her husband to replace them.However,Judy paid him $55,000 rather than $33,000.Judy is on the cash method and calendar year,and she wants to know what amount of these expenditures is deductible as business expenses.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is a true statement about impermissible accounting methods?

A) An impermissible method is adopted by using the method to report results for two consecutive years.

B) An impermissible method may never be used by a taxpayer.

C) Cash method accounting is an impermissible method for partnerships and Subchapter S electing corporations.

D) There is no accounting method that is impermissible.

E) None of the choices are true.

A) An impermissible method is adopted by using the method to report results for two consecutive years.

B) An impermissible method may never be used by a taxpayer.

C) Cash method accounting is an impermissible method for partnerships and Subchapter S electing corporations.

D) There is no accounting method that is impermissible.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following types of expenditures is not subject to capitalization under the UNICAP rules?

A) Selling expenditures.

B) Cost of manufacturing labor.

C) Compensation of managers who supervise production.

D) Cost of raw materials.

E) All of the choices are subject to capitalization under the UNICAP rules.

A) Selling expenditures.

B) Cost of manufacturing labor.

C) Compensation of managers who supervise production.

D) Cost of raw materials.

E) All of the choices are subject to capitalization under the UNICAP rules.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

72

Kip started a wholesale store this year selling bulk peanut butter.In January of this year Kip purchased an initial five tubs of peanut butter for a total cost of $5,000.In July Kip purchased three tubs for a total cost of $6,000.Finally,in November Kip bought two tubs for a total cost of $1,000.Kip sold six tubs by year end.What is Kip's ending inventory under the FIFO cost-flow method?

A) $12,000.

B) $6,000.

C) $5,000.

D) $2,500.

E) $1,000.

A) $12,000.

B) $6,000.

C) $5,000.

D) $2,500.

E) $1,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a true statement about a request for a change in accounting method?

A) Some requests are automatically granted.

B) Most requests require the permission of the Commissioner.

C) Many requests require payment of a fee and a good business purpose for the change.

D) Form 3115 is required to be filed with a request for change in accounting method.

E) All of the choices are true.

A) Some requests are automatically granted.

B) Most requests require the permission of the Commissioner.

C) Many requests require payment of a fee and a good business purpose for the change.

D) Form 3115 is required to be filed with a request for change in accounting method.

E) All of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is NOT considered a related party for the purpose of limitation on accruals to related parties?

A) Spouse when the taxpayer is an individual.

B) A partner when the taxpayer is a partnership.

C) Brother when the taxpayer is an individual.

D) A minority shareholder when the taxpayer is a corporation.

E) All of the parties in all the choices are related parties.

A) Spouse when the taxpayer is an individual.

B) A partner when the taxpayer is a partnership.

C) Brother when the taxpayer is an individual.

D) A minority shareholder when the taxpayer is a corporation.

E) All of the parties in all the choices are related parties.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

75

Crystal operates a business that provides typing and delivery services.This year Crystal spent $2,500 to purchase special shirts that identify her employees and provide some notoriety for her business.The shirts are especially colorful and include logos on the front pocket and back.Besides salary payments,Crystal also compensates her employees by offering to pay whole life insurance premiums for any that want to provide insurance coverage for their beneficiaries.This year Crystal paid $5,000 in life insurance premiums.What amount of these payments can Crystal deduct? Crystal is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

76

Ajax Computer Company is an accrual method calendar year taxpayer.Ajax has never advertised in the national media prior to this year.In November of this year,however,Ajax paid $1 million for television advertising time during a "super" sporting event scheduled to take place in early February of next year.In addition,in November of this year the company paid $500,000 for advertising time during a professional golf tournament which will occur once in April of next year.What amount of these payments,if any,can Ajax deduct this year?

A) $1 million.

B) $500,000.

C) $1.5 million.

D) $1.5 million only if the professional golf tournament is played before April 15.

E) No deduction can be claimed this year.

A) $1 million.

B) $500,000.

C) $1.5 million.

D) $1.5 million only if the professional golf tournament is played before April 15.

E) No deduction can be claimed this year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

77

Bryon operates a consulting business and he usually works alone.However,during the summer Bryon will sometimes hire undergraduate students to collect data for his projects.This past summer Bryon hired Fred,the son of a prominent businessman,for a part-time summer job.The summer job usually pays about $17,000,but Bryon paid Fred $27,000 to gain favor with Fred's father.What amount of Fred's summer wages can Bryon deduct for tax purposes? Bryon is on the cash method and calendar year.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

78

Werner is the president and CEO of Acme,Inc.and this year he took a prospective client to dinner.During the dinner the President and the client discussed a proposed contract for over $6 million and personal matters.After dinner the CEO took the client to a football game and no business was discussed.The CEO paid $1,220 for an expensive dinner and spent $600 for tickets to the game.What is the deductible amount of these expenses?

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

79

Jones operates an upscale restaurant and he pays experienced cooks $35,000 per year.This year he hired his son as an apprentice cook.Jones agreed to pay his son $40,000 per year.Which of the following is a true statement about this transaction?

A) Jones will be allowed to deduct $40,000 only if his son eventually develops into an expert cook.

B) Jones will be allowed to accrue $40,000 only if he pays his son in cash.

C) Jones will be allowed to deduct $35,000 as compensation and another $5,000 can be deducted as an employee gift.

D) Jones can only deduct $20,000 because an apprentice cook is only worth half as much as an experienced cook.

E) None of the choices are true.

A) Jones will be allowed to deduct $40,000 only if his son eventually develops into an expert cook.

B) Jones will be allowed to accrue $40,000 only if he pays his son in cash.

C) Jones will be allowed to deduct $35,000 as compensation and another $5,000 can be deducted as an employee gift.

D) Jones can only deduct $20,000 because an apprentice cook is only worth half as much as an experienced cook.

E) None of the choices are true.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck

80

Manley operates a law practice on the accrual method and calendar year.At the beginning of the year Manley's firm had an allowance for doubtful accounts with a balance of $15,000.At the end of the year,Manley recorded bad debt expense of $23,000 and the balance of doubtful accounts had increased to $18,000.What is Manley's deduction for bad debt expense this year?

A) $23,000.

B) $3,000.

C) $26,000.

D) $5,000.

E) $20,000.

A) $23,000.

B) $3,000.

C) $26,000.

D) $5,000.

E) $20,000.

Unlock Deck

Unlock for access to all 99 flashcards in this deck.

Unlock Deck

k this deck