Deck 16: Option Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 16: Option Valuation

1

Which one of the following variables is NOT included in the Black-Scholes option pricing model?

A)strike price

B)time remaining until option expiration

C)stock volatility as measured by standard deviation

D)stock price

E)market rate of return

A)strike price

B)time remaining until option expiration

C)stock volatility as measured by standard deviation

D)stock price

E)market rate of return

E

2

Which option price(s)will increase when the interest rate increases?

A)both the call and put

B)call only

C)put only

D)neither the call nor the put

E)Answer cannot be determined from the information provided.

A)both the call and put

B)call only

C)put only

D)neither the call nor the put

E)Answer cannot be determined from the information provided.

B

3

Which one of the following statements concerning the relationship between time to option maturity and call and put prices is correct?

A)Put and call prices increase at the same rate as the time to option maturity increases.

B)Put prices and time to maturity are inversely related.

C)Call prices tend to increase faster than put prices as the time to option maturity increases.

D)Put prices increase while call prices remain constant as the time to option maturity increases.

E)Call prices are inversely related to time to maturity.

A)Put and call prices increase at the same rate as the time to option maturity increases.

B)Put prices and time to maturity are inversely related.

C)Call prices tend to increase faster than put prices as the time to option maturity increases.

D)Put prices increase while call prices remain constant as the time to option maturity increases.

E)Call prices are inversely related to time to maturity.

C

4

Which one of the following situations will produce the highest call price,all else constant?

A)$29 stock price; $30 strike price

B)$41 stock price; $40 strike price

C)$20 stock price; $20 strike price

D)$34 stock price; $35 strike price

E)$24 stock price; $25 strike price

A)$29 stock price; $30 strike price

B)$41 stock price; $40 strike price

C)$20 stock price; $20 strike price

D)$34 stock price; $35 strike price

E)$24 stock price; $25 strike price

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

An increase in which one of the following will have a negative effect on the price of a call option?

A)option strike price

B)time remaining to option expiration

C)underlying stock price

D)volatility of the underlying stock price

E)risk-free interest rate

A)option strike price

B)time remaining to option expiration

C)underlying stock price

D)volatility of the underlying stock price

E)risk-free interest rate

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

You know that a call will finish in-the-money.Based on that single piece of information,you also know which one of the following?

A)The stock price will equal the strike price at expiration.

B)The risk-free rate is zero percent.

C)A put on the same underlying asset with the same strike and expiration will finish out-of-the-money.

D)The strike price will exceed the stock price at expiration.

E)The price of the call is equal to the price of the put.

A)The stock price will equal the strike price at expiration.

B)The risk-free rate is zero percent.

C)A put on the same underlying asset with the same strike and expiration will finish out-of-the-money.

D)The strike price will exceed the stock price at expiration.

E)The price of the call is equal to the price of the put.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following terms is used as a shortcut means of saying "time to maturity"?

A)holder

B)expiry

C)timing

D)elapsing

E)dating

A)holder

B)expiry

C)timing

D)elapsing

E)dating

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

Which one of the following statements concerning the relationship between the volatility of the underlying stock price,as measured by sigma,and call and put prices is correct?

A)Call and put prices react fairly similarly in response to changes in sigma.

B)Call prices increase and put prices decrease as sigma increases.

C)Put price increase and call prices decrease as sigma increases.

D)Call prices increase and put prices remain relatively constant and sigma increases.

E)Neither put nor call prices are affected by changes in sigma.

A)Call and put prices react fairly similarly in response to changes in sigma.

B)Call prices increase and put prices decrease as sigma increases.

C)Put price increase and call prices decrease as sigma increases.

D)Call prices increase and put prices remain relatively constant and sigma increases.

E)Neither put nor call prices are affected by changes in sigma.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

An increase in which two of the following will have a negative effect on the value of a put option?

I)risk-free interest rate

II)time to option maturity

III)underlying stock price

IV)option strike price

A)I and II only

B)I and III only

C)II and III only

D)II and IV only

E)III and IV only

I)risk-free interest rate

II)time to option maturity

III)underlying stock price

IV)option strike price

A)I and II only

B)I and III only

C)II and III only

D)II and IV only

E)III and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following is defined as an estimate of stock price volatility obtained from an option price?

A)calculated alpha

B)estimated variance

C)implied theta

D)VIX

E)implied standard deviation

A)calculated alpha

B)estimated variance

C)implied theta

D)VIX

E)implied standard deviation

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

Which two of the following have the greatest effect on stock option prices?

I)volatility of underlying stock price

II)time to option maturity

III)underlying stock price

IV)option strike price

A)I and II only

B)I and IV only

C)II and III only

D)II and IV only

E)III and IV only

I)volatility of underlying stock price

II)time to option maturity

III)underlying stock price

IV)option strike price

A)I and II only

B)I and IV only

C)II and III only

D)II and IV only

E)III and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following statements concerning option prices is correct?

A)There is a relatively linear direct relationship between the volatility of the underlying stock price and option prices.

B)Call option prices decrease and put option prices increase as the time to expiration increases.

C)Put option prices are directly related to the price of the underlying stock.

D)The relationship between option prices and stock prices is a linear relationship.

E)Delta measures the effect that the underlying stock's dividend yield has on option prices.

A)There is a relatively linear direct relationship between the volatility of the underlying stock price and option prices.

B)Call option prices decrease and put option prices increase as the time to expiration increases.

C)Put option prices are directly related to the price of the underlying stock.

D)The relationship between option prices and stock prices is a linear relationship.

E)Delta measures the effect that the underlying stock's dividend yield has on option prices.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Employee stock options grant an employee which one of the following rights?

A)right to sell shares in an S&P 500 index fund

B)right to buy shares in an S&P 500 index fund

C)right to sell shares of the employer's stock

D)right to buy shares of the employer's stock

E)right to buy shares in the employer's retirement plan

A)right to sell shares in an S&P 500 index fund

B)right to buy shares in an S&P 500 index fund

C)right to sell shares of the employer's stock

D)right to buy shares of the employer's stock

E)right to buy shares in the employer's retirement plan

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following will result from a decrease in an option's strike price?

I)increase in call option price

II)decrease in call option price

III)increase in put option price

IV)decrease in put option price

A)I only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

I)increase in call option price

II)decrease in call option price

III)increase in put option price

IV)decrease in put option price

A)I only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

VIX represents the volatility index on which one of the following?

A)Wilshire 3000 index

B)DJIA

C)S&P 500 index

D)Dow Jones Transportation average

E)NASDAQ 100

A)Wilshire 3000 index

B)DJIA

C)S&P 500 index

D)Dow Jones Transportation average

E)NASDAQ 100

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

Which option price(s)will increase when the dividend yield increases?

A)both the call and put

B)call only

C)put only

D)neither the call nor the put

E)Answer cannot be determined from the information provided.

A)both the call and put

B)call only

C)put only

D)neither the call nor the put

E)Answer cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following best describes the graphical relationship between stock prices and option prices?

A)linearity

B)concavity

C)convexity

D)hyperbolic

E)exponential

A)linearity

B)concavity

C)convexity

D)hyperbolic

E)exponential

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following is another term for implied volatility?

A)implied delta

B)implied standard deviation

C)implied alpha

D)implied beta

E)implied gamma

A)implied delta

B)implied standard deviation

C)implied alpha

D)implied beta

E)implied gamma

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

Which one of the following statements is correct concerning the Black-Scholes option pricing model?

A)The model assumes a stock pays a constant annual dividend.

B)The model expresses time in terms of years.

C)The model is based on American-style options.

D)The model assumes that the current stock price is equal to the strike price.

E)The model assumes the put is in-the-money.

A)The model assumes a stock pays a constant annual dividend.

B)The model expresses time in terms of years.

C)The model is based on American-style options.

D)The model assumes that the current stock price is equal to the strike price.

E)The model assumes the put is in-the-money.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

Delta measures the dollar impact of a change in which one of the following on the value of a stock option?

A)volatility of the underlying stock price

B)risk-free interest rate

C)underlying stock price

D)option strike price

E)time to maturity

A)volatility of the underlying stock price

B)risk-free interest rate

C)underlying stock price

D)option strike price

E)time to maturity

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

Which two of the following are the key reasons why most major corporations issue employee stock options?

I)provide an employee benefit in place of a retirement plan

II)no immediate cost to the corporation

III)align management and shareholder interests

IV)replace employer-provided insurance benefits

A)I and II only

B)I and III only

C)II and III only

D)II and IV only

E)III and IV only

I)provide an employee benefit in place of a retirement plan

II)no immediate cost to the corporation

III)align management and shareholder interests

IV)replace employer-provided insurance benefits

A)I and II only

B)I and III only

C)II and III only

D)II and IV only

E)III and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

A 6-month call option on ABC stock is priced at $3.60.The call option delta is 0.76.How will the approximate call option price be computed if the underlying stock price increases by $1?

A)$3.60

B)$3.60 - $0.76

C)$3.60 + $0.76

D)$3.60 × .76

E)$3.60 × (1 + .76)

A)$3.60

B)$3.60 - $0.76

C)$3.60 + $0.76

D)$3.60 × .76

E)$3.60 × (1 + .76)

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

Which one of the following situations will produce the highest put price,all else constant? Assume the options are all in-the-money.

A)$15 strike price; 45 days to option expiration

B)$15 strike price; 60 days to option expiration

C)$20 strike price; 45 days to option expiration

D)$20 strike price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

A)$15 strike price; 45 days to option expiration

B)$15 strike price; 60 days to option expiration

C)$20 strike price; 45 days to option expiration

D)$20 strike price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

You own shares of AZT stock.Which of the following strategies can you use to hedge your risk associated with a price decrease in AZT stock?

I)buy call options

II)write call options

III)buy put options

IV)write put options

A)I only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

I)buy call options

II)write call options

III)buy put options

IV)write put options

A)I only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements related to employee stock options (ESO)are generally correct?

I)ESO vesting encourages long-term employment.

II)Most ESOs are issued at-the-money.

III)ESOs cannot be resold.

IV)ESOs that are in-the-money are frequently repriced.

A)I and II only

B)I and IV only

C)II and III only

D)I, II, and III only

E)I, II, III, and IV

I)ESO vesting encourages long-term employment.

II)Most ESOs are issued at-the-money.

III)ESOs cannot be resold.

IV)ESOs that are in-the-money are frequently repriced.

A)I and II only

B)I and IV only

C)II and III only

D)I, II, and III only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of the following inputs for the Black-Scholes model is NOT directly observable?

A)time to option maturity

B)risk-free interest rate

C)stock price

D)strike price

E)stock price volatility

A)time to option maturity

B)risk-free interest rate

C)stock price

D)strike price

E)stock price volatility

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

Which one of the following is an argument against repricing employee stock options?

A)ESO's are originally issued with positive intrinsic value so there's no reason to reprice.

B)Employees have more incentive when options are "under-water".

C)Repricing is a reward for failure.

D)It is unnecessary to reprice as ESOs expire quickly.

E)Repricing affects the market price of the firm's stock for all shareholders.

A)ESO's are originally issued with positive intrinsic value so there's no reason to reprice.

B)Employees have more incentive when options are "under-water".

C)Repricing is a reward for failure.

D)It is unnecessary to reprice as ESOs expire quickly.

E)Repricing affects the market price of the firm's stock for all shareholders.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

Which one of the following situations will produce the highest call price,all else constant? Assume the options are all in-the-money.

A)$20 strike price; 45 days to option expiration

B)$20 strike price; 60 days to option expiration

C)$25 strike price; 45 days to option expiration

D)$25 strike price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

A)$20 strike price; 45 days to option expiration

B)$20 strike price; 60 days to option expiration

C)$25 strike price; 45 days to option expiration

D)$25 strike price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

An employee stock option is which one of the following?

A)call option

B)covered call

C)put option

D)protective put

E)index option

A)call option

B)covered call

C)put option

D)protective put

E)index option

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

The VIX is a measure of which one of the following?

A)changes in the daily trading volume of the NASDAQ 100

B)investor expectations of future market volatility of the S&P 500

C)minute-by-minute changes in the value of the NASDAQ 100

D)number of option contracts outstanding on the S&P 500

E)the opening and closing historical values of the S&P 500

A)changes in the daily trading volume of the NASDAQ 100

B)investor expectations of future market volatility of the S&P 500

C)minute-by-minute changes in the value of the NASDAQ 100

D)number of option contracts outstanding on the S&P 500

E)the opening and closing historical values of the S&P 500

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

Which two of the following are key to making SPX options an easy choice as a hedge against an equity portfolio?

I)European style

II)American style

III)trade in whole or partial contracts

IV)cash settlement

A)III only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

I)European style

II)American style

III)trade in whole or partial contracts

IV)cash settlement

A)III only

B)I and III only

C)I and IV only

D)II and III only

E)II and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

All else constant,which one of the following situations will produce the highest call price given a strike price of $25?

A)$30 stock price; 40 days to option expiration

B)$30 stock price; 60 days to option expiration

C)$35 stock price; 40 days to option expiration

D)$35 stock price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

A)$30 stock price; 40 days to option expiration

B)$30 stock price; 60 days to option expiration

C)$35 stock price; 40 days to option expiration

D)$35 stock price; 60 days to option expiration

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

All else constant,which one of the following situations will produce the highest call price given a strike price of $27.50?

A)$25 stock price; 15 percent standard deviation

B)$25 stock price; 30 percent standard deviation

C)$30 stock price; 15 percent standard deviation

D)$30 stock price; 30 percent standard deviation

E)Insufficient information is provided to answer this question.

A)$25 stock price; 15 percent standard deviation

B)$25 stock price; 30 percent standard deviation

C)$30 stock price; 15 percent standard deviation

D)$30 stock price; 30 percent standard deviation

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following situations will produce the highest put price,all else constant? Assume the options are all in-the-money.

A)$50 stock price; 60 days to option expiration

B)$50 stock price; 90 days to option expiration

C)$55 stock price; 60 days to option expiration

D)$55 stock price; 90 days to option expiration

E)Insufficient information is provided to answer this question.

A)$50 stock price; 60 days to option expiration

B)$50 stock price; 90 days to option expiration

C)$55 stock price; 60 days to option expiration

D)$55 stock price; 90 days to option expiration

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following are typical characteristics of employee stock options?

I)originally issued with 10-year life

II)right to purchase stock at a designated price

III)exchange-traded

IV)vesting period

A)II only

B)I and II only

C)I and III only

D)I, II, and IV only

E)I, II, III, and IV

I)originally issued with 10-year life

II)right to purchase stock at a designated price

III)exchange-traded

IV)vesting period

A)II only

B)I and II only

C)I and III only

D)I, II, and IV only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

Which one of the following statements is correct?

A)Both call and put option deltas are always positive.

B)Put option deltas are always positive.

C)Call option deltas are always positive.

D)Both call and put option deltas are always negative.

E)All deltas can be positive, negative, or equal to zero.

A)Both call and put option deltas are always positive.

B)Put option deltas are always positive.

C)Call option deltas are always positive.

D)Both call and put option deltas are always negative.

E)All deltas can be positive, negative, or equal to zero.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

The S&P 500 volatility index is the _____ while the NASDAQ 100 volatility index is the _____.

A)VIX; VXO

B)VIX; VXN

C)VXO; VIX

D)VXO; VXN

E)VXN; VIX

A)VIX; VXO

B)VIX; VXN

C)VXO; VIX

D)VXO; VXN

E)VXN; VIX

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Stock prices and call option prices are:

A)unrelated.

B)negatively correlated.

C)directly related.

D)perfectly related.

E)inversely related.

A)unrelated.

B)negatively correlated.

C)directly related.

D)perfectly related.

E)inversely related.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

How frequently should you consider rebalancing the options hedge on a large equity portfolio if you wish to maintain an effective hedge?

A)weekly

B)annually

C)just prior to the fiscal year end

D)at option expiration

E)only when the options are in-the-money

A)weekly

B)annually

C)just prior to the fiscal year end

D)at option expiration

E)only when the options are in-the-money

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the following situations will produce the highest put price,all else constant? Assume the options are all in-the-money.

A)$30 stock price; 20 percent standard deviation

B)$30 stock price; 25 percent standard deviation

C)$35 stock price; 20 percent standard deviation

D)$35 stock price; 25 percent standard deviation

E)Insufficient information is provided to answer this question.

A)$30 stock price; 20 percent standard deviation

B)$30 stock price; 25 percent standard deviation

C)$35 stock price; 20 percent standard deviation

D)$35 stock price; 25 percent standard deviation

E)Insufficient information is provided to answer this question.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

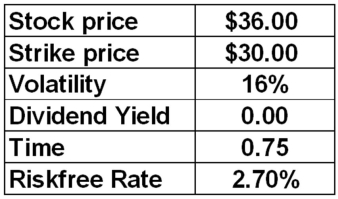

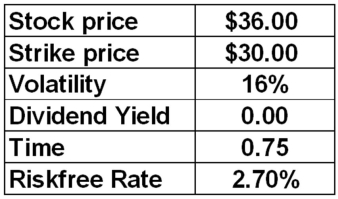

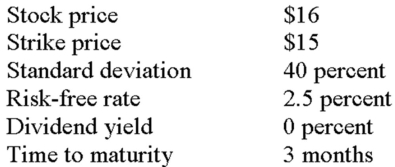

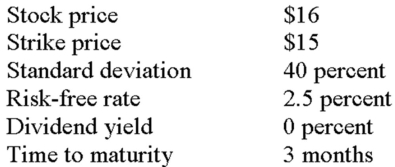

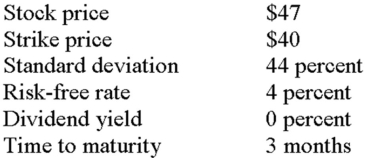

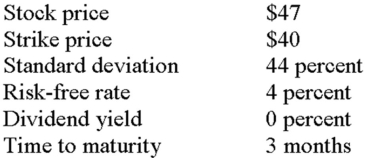

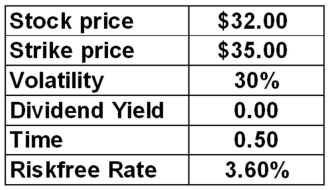

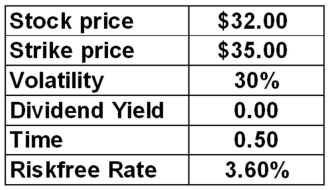

What is the call option premium given the following information?

A)$5.91

B)$6.28

C)$6.75

D)$6.90

E)$7.13

A)$5.91

B)$6.28

C)$6.75

D)$6.90

E)$7.13

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

Given a set of variables,the Black-Scholes option pricing formula has a put option delta of -.154.What is the call delta given these same variables?

A)-1.154

B)-.846

C).846

D)1.154

E)The answer cannot be determined based on the information provided.

A)-1.154

B)-.846

C).846

D)1.154

E)The answer cannot be determined based on the information provided.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

What is the put option premium given the following information?

A)$7.49

B)$7.98

C)$8.28

D)$8.76

E)$9.64

A)$7.49

B)$7.98

C)$8.28

D)$8.76

E)$9.64

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

A stock with a current price of $30 will either move up to $37 or down to $26 over the next period.The risk-free rate of interest is 2.5 percent.What is the value of a call option with a strike price of $35?

A)$0.49

B)$0.68

C)$0.86

D)$0.97

E)$1.21

A)$0.49

B)$0.68

C)$0.86

D)$0.97

E)$1.21

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

A stock is currently priced at $22 a share while the $30 put option is priced at $5.22.The put option delta is -.25.What is the approximate put price if the stock increases in value to $25?

A)$3.76

B)$4.97

C)$5.08

D)$5.27

E)$5.50

A)$3.76

B)$4.97

C)$5.08

D)$5.27

E)$5.50

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

You have determined that you need -1,589 call options to hedge your stock portfolio.What should you do based on this information?

A)buy 16 call option contracts

B)buy 1,589 call option contracts

C)write 16 call option contracts

D)write 160 call option contracts

E)write 1,589 call option contracts

A)buy 16 call option contracts

B)buy 1,589 call option contracts

C)write 16 call option contracts

D)write 160 call option contracts

E)write 1,589 call option contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

A stock with a current price of $18 will either move up by a factor of 1.2 or down by a factor of .9 each period over the next two periods.The risk-free rate of interest is 4.5 percent.What is the current value of a call option with a strike price of $20?

A)$1.02

B)$1.08

C)$1.17

D)$1.21

E)$1.27

A)$1.02

B)$1.08

C)$1.17

D)$1.21

E)$1.27

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

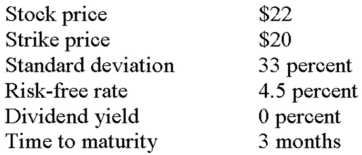

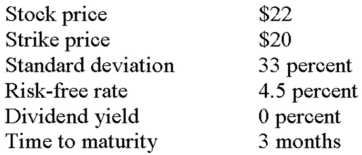

What is the call option premium given the following information?

A)$1.86

B)$2.20

C)$2.36

D)$2.98

E)$3.30

A)$1.86

B)$2.20

C)$2.36

D)$2.98

E)$3.30

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

Given a set of variables,the Black-Scholes option pricing formula has a call option delta of .496.What is the put delta given these same variables?

A)-1.496

B)-.504

C).504

D)1.496

E)The answer cannot be determined based on the information provided.

A)-1.496

B)-.504

C).504

D)1.496

E)The answer cannot be determined based on the information provided.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

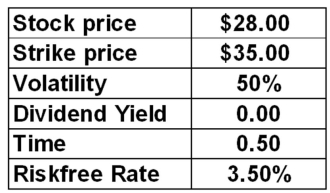

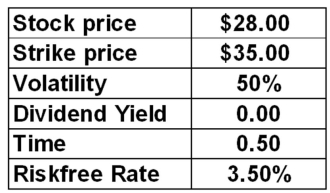

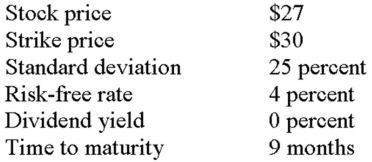

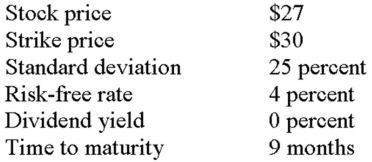

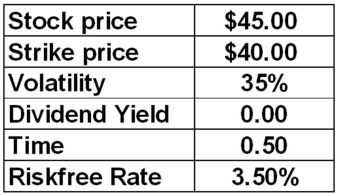

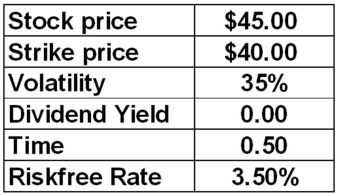

What is the put option premium given the following information?

A)$3.62

B)$4.23

C)$4.47

D)$4.89

E)$5.01

A)$3.62

B)$4.23

C)$4.47

D)$4.89

E)$5.01

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

A stock with a current price of $28 will either move up by a factor of 1.10 or down by a factor of .90 each period over the next two periods.The risk-free rate of interest is 4 percent.What is the current value of a call option with a strike price of $30?

A)$1.36

B)$1.49

C)$1.71

D)$2.09

E)$2.13

A)$1.36

B)$1.49

C)$1.71

D)$2.09

E)$2.13

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

A stock with a current price of $32 will either move up to $40.00 or down to $30 over the next period.The risk-free rate of interest is 3 percent.What is the value of a call option with a strike price of $35?

A)$1.30

B)$1.44

C)$1.87

D)$2.09

E)$2.41

A)$1.30

B)$1.44

C)$1.87

D)$2.09

E)$2.41

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

What is the call option premium given the following information?

A)$7.16

B)$7.78

C)$8.58

D)$9.03

E)$9.49

A)$7.16

B)$7.78

C)$8.58

D)$9.03

E)$9.49

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

What is the call option premium given the following information?

A)$4.63

B)$5.28

C)$6.39

D)$7.60

E)$8.66

A)$4.63

B)$5.28

C)$6.39

D)$7.60

E)$8.66

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

What is the put option premium given the following information?

A)$1.58

B)$2.01

C)$2.59

D)$3.63

E)$4.15

A)$1.58

B)$2.01

C)$2.59

D)$3.63

E)$4.15

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

What is the put option premium given the following information?

A)$0.20

B)$0.54

C)$0.82

D)$1.01

E)$1.12

A)$0.20

B)$0.54

C)$0.82

D)$1.01

E)$1.12

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

Which one of the following inputs is included in the Black-Scholes-Merton model but not in the Black-Scholes model?

A)stock price volatility

B)time to option maturity

C)risk-free interest rate

D)underlying stock price

E)dividend yield

A)stock price volatility

B)time to option maturity

C)risk-free interest rate

D)underlying stock price

E)dividend yield

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

A stock is currently priced at $44 a share while the $45 call option is priced at $1.22.The call option delta is .86.What is the approximate call price if the stock increases in value to $45?

A)$0.12

B)$0.26

C)$0.96

D)$1.98

E)$2.08

A)$0.12

B)$0.26

C)$0.96

D)$1.98

E)$2.08

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

Repricing an employee stock option involves which one of the following?

A)stock-split

B)stock dividend

C)change in option strike price

D)change in option expiration date

E)change in option premium

A)stock-split

B)stock dividend

C)change in option strike price

D)change in option expiration date

E)change in option premium

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

A stock with a current price of $25 will either move up to $32 or down to $20 over the next period.The risk-free rate of interest is 3.5 percent.What is the value of a call option with a strike price of $30?

A)$0.61

B)$0.72

C)$0.93

D)$1.11

E)$1.36

A)$0.61

B)$0.72

C)$0.93

D)$1.11

E)$1.36

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

You own 1,200 shares of Banner Co.stock that is currently priced at $42 a share.Given this price,the option delta for a $40 call option on this stock is .664.How many $40 call options do you need to hedge against a -$1 change in the price of the stock?

A)buy 1,613 options

B)buy 1,713 options

C)buy 1,8.7 options

D)write 1,713 options

E)write 1,807 options

A)buy 1,613 options

B)buy 1,713 options

C)buy 1,8.7 options

D)write 1,713 options

E)write 1,807 options

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

Create a stock price tree for three periods for a stock that is currently valued at $10 a share.The up amount per period is 1.15 and the down amount per period is .90.Show all dollar amounts to 3 decimal places.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

You own 1,800 shares of Textile stock which is currently valued at $62 a share.The $65 put has a premium of $4.26 and a put delta of -.60.What position should you take in $65 put contracts to hedge your stock against a $1 decrease in price?

A)buy 3 contracts

B)buy 30 contracts

C)buy 300 contracts

D)write 3 contracts

E)write 30 contracts

A)buy 3 contracts

B)buy 30 contracts

C)buy 300 contracts

D)write 3 contracts

E)write 30 contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

You own 1,500 shares of ABC stock that is currently priced at $27 a share.Given this price,the option delta for a $25 call option on this stock is .724.How many $25 call options do you need to hedge against a -$1 change in the price of the stock?

A)buy 1,500 options

B)buy 2,482 options

C)write 1,500 options

D)write 2,072 options

E)write 3,295 options

A)buy 1,500 options

B)buy 2,482 options

C)write 1,500 options

D)write 2,072 options

E)write 3,295 options

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

Draw a graph with the option price on the vertical axis and the time to expiration on the horizontal axis.Illustrate how put and call option prices vary as the time to expiration increases.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

Identify the five factors of the Black-Scholes option pricing model and identify whether each factor must increase or decrease to cause the price of a put option to increase.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

You have an equity portfolio valued at $1.55 million that has a beta of 1.21.You have decided to hedge this portfolio using SPX call option contracts.The S&P 500 index is currently 1457.The option delta is .6435.How many option contracts must you write to effectively hedge your portfolio?

A)14 contracts

B)18 contracts

C)20 contracts

D)25 contracts

E)28 contracts

A)14 contracts

B)18 contracts

C)20 contracts

D)25 contracts

E)28 contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

Laura has an equity portfolio valued at $11.2 million that has a beta of 1.32.She has decided to hedge this portfolio using SPX call option contracts.The S&P 500 index is currently 1402.The option delta is .582.How many option contracts must Laura write to effectively hedge her portfolio?

A)37 contracts

B)42 contracts

C)175 contracts

D)181 contracts

E)191 contracts

A)37 contracts

B)42 contracts

C)175 contracts

D)181 contracts

E)191 contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

You have been granted stock options on 300 shares of your employer's stock.The stock is currently selling for $37.80 and has a standard deviation of 30 percent.The option's strike price is $35 and the time to maturity is 10 years.What is the value of each option given a risk-free rate of 3.0 percent? Assume that no dividends are paid.

A)$12.95

B)$14.47

C)$16.68

D)$18.39

E)$20.01

A)$12.95

B)$14.47

C)$16.68

D)$18.39

E)$20.01

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

You own 4,800 shares of a stock that is currently priced at $34 a share.Given this price,the option delta for a $30 call option on this stock is .955.How many $30 call option contracts do you need to hedge against a -$1 change in the price of the stock?

A)buy 50 option contracts

B)buy 503 option contracts

C)write 50 option contracts

D)write 503 option contracts

E)write 5,026 option contracts

A)buy 50 option contracts

B)buy 503 option contracts

C)write 50 option contracts

D)write 503 option contracts

E)write 5,026 option contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

Mike was granted stock options on 1,000 shares of his employer's stock.The stock is currently selling for $27.70 a share and has a standard deviation of 36 percent.The option's strike price is $27.50 and the time to maturity is 10 years.What is the value of each option given a risk-free rate of 3 percent? Assume that no dividends are paid.

A)$14.35

B)$15.67

C)$17.80

D)$20.15

E)$22.70

A)$14.35

B)$15.67

C)$17.80

D)$20.15

E)$22.70

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

You own 7,500 shares of GO stock which is currently valued at $47 a share.The $50 put has a premium of $2.50 and a put delta of -.60.What position should you take in $50 put contracts to hedge your stock against a $1 decrease in price?

A)buy 125 contracts

B)buy 1,250 contracts

C)buy 12,500 contracts

D)write 125 contracts

E)write 1,250 contracts

A)buy 125 contracts

B)buy 1,250 contracts

C)buy 12,500 contracts

D)write 125 contracts

E)write 1,250 contracts

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck