Deck 3: Statements of Income and Comprehensive Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/168

Play

Full screen (f)

Deck 3: Statements of Income and Comprehensive Income

1

The primary sources of owners' equity must be separately identified in the accounts.

True

2

Retained Earnings restrictions are usually imposed on a company by a third party.

False

3

All unrealized gains and losses,regardless of origin,flow through Other Comprehensive Income.

False

4

Before a company can issue a property dividend in shares of another company,it must ensure that the shares are recorded at market value.The dividend is then paid out of the company's contributed capital accounts rather than its retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

5

When a corporation declares a small stock dividend,it should capitalize the par value of the shares.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

6

Shareholders in a corporation usually have limited liability.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

7

Retained earnings,if not designated otherwise,represents the unappropriated portion of retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

8

Preferred shares generally have fewer voting rights than common shareholders but receive preferential treatment (relative to the common shareholders)in the event of the company's liquidation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

9

A large stock split should be accounted for by capitalizing the current market value of the stock.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

10

Businesses engage in many transactions that are unaffected by the form of the business: proprietorship,partnership,or corporation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

11

Liquidating dividends are similar to stock dividends because neither one reduces total stockholders' equity.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

12

All Contributed Capital accounts may carry either a debit or a credit balance,depending on the transactions from which the account balance originated.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

13

A stock dividend and a stock split are identical in all respects for the corporation issuing the dividend or splitting the stock.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

14

When stock rights are issued to current shareholders,it may require more than one such right to later acquire one additional share of the stock covered by the rights.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

15

Total retained earnings include both appropriated and unappropriated retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

16

Dividends are paid when declared.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

17

Under IFRS,companies are required to disclose the components of their shareholders' equity along with an explanation of any shareholder equity transactions during the year.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

18

The contributed capital accounts should be classified by source.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

19

Property dividends are dividends that the corporation distributes in the form of non-cash assets.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

20

Preferred shareholders normally have the same voting rights as common shareholders.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

21

Treasury shares held by management are considered to be issued but not outstanding.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

22

If a corporation only has one class of shares,that class of shares will be referred to as Share Capital on the statement of financial position.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

23

Convertible preferred shares are convertible (usually to common shares)at the option of the shareholder and not at the option of the corporation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

24

Cumulative preferred shares usually carry the right; upon liquidation of the corporation to dividends in arrears to the extent the corporation has retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

25

When retained earnings are restricted,they must also be appropriated.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

26

Par value is typically set at a low amount so that the corporation can pay a minimum amount in dividends to the preferred shareholders.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

27

Legal capital is related directly to the total number of shares issued.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

28

Only certain unrealized gains flow through Other Comprehensive Income - any realized gains flow through retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

29

Treasury shares cannot be voted,nor paid dividends,pending resale.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

30

The conversion of preferred shares into common shares results in no change in total shareholders' equity.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

31

The purchase of treasury stock reduces the number of outstanding shares,and if the treasury stock is subsequently resold,it is again classified as outstanding.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

32

Both preferred and common shares may be cumulative.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

33

When a company is publicly traded,that means every class of share capital must be publicly traded.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

34

A Statement of Changes in Shareholder Equity is mandatory under both IFRS and ASPE.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

35

Common share subscriptions receivable should always be reported as a current asset.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

36

"Common shares subscribed" is credited in recording a common share subscription contract because the shares are usually issued at the time the contract is signed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

37

The Treasury Share account is debited and credited at the cost of the shares repurchased.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

38

IFRS requires that any public company repurchasing its own shares with the intent of reissuing these to the public treat these shares as treasury shares.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

39

A bad debt loss is recognized when a subscriber to common shares defaults.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

40

The shareholders of a corporation usually cannot be held legally liable for the debts of the corporation except to the extent that legal capital is impaired.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

41

LS issued 200 common shares to BH (last share transaction was a year prior when LS sold 10 shares at $4 per share),and received a patent in full payment.The patent had a current market value of $2,000 and was carried on the books of BH at $1,500.Under ASPE,common shares should be credited for:

A) $800

B) $1,500

C) $1,800

D) $2,000

E) This transaction has no commercial substance, therefore no entry is required.

A) $800

B) $1,500

C) $1,800

D) $2,000

E) This transaction has no commercial substance, therefore no entry is required.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

42

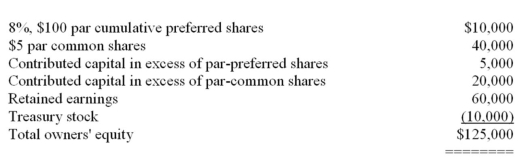

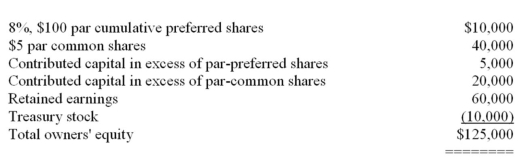

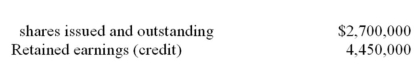

The following owners' equity section of a firm's balance sheet relates to the current year (end-of-year data):  How many common shares are issued?

How many common shares are issued?

A) 8,000

B) 6,000

C) 7,000

D) There is insufficient information provided to answer the question.

How many common shares are issued?

How many common shares are issued?A) 8,000

B) 6,000

C) 7,000

D) There is insufficient information provided to answer the question.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

43

The conversion from one type of share to another should be accounted for at:

A) Book Value.

B) Fair Market Value.

C) Book Value or Fair Market Value.

D) A discounted amount.

A) Book Value.

B) Fair Market Value.

C) Book Value or Fair Market Value.

D) A discounted amount.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

44

The date of record for a cash dividend follows the date of payment and precedes the date of declaration.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

45

DWWR purchased its own common shares for $20,000 and debited the treasury stock account for the purchase price.The shares were subsequently sold for $17,000.The $3,000 difference between the cost and sale price should be recorded as a reduction of:

A) Contributed capital from treasury stock transactions without regard as to whether or not there have been previous net "gains" from sales or retirements of the same class of shares.

B) Contributed capital from treasury stock transactions to the extent of previous net "gains" from sales or retirements of the same class of shares; otherwise retained earnings should be reduced.

C) The beginning balance of retained earnings.

D) Revenues on the income statement.

A) Contributed capital from treasury stock transactions without regard as to whether or not there have been previous net "gains" from sales or retirements of the same class of shares.

B) Contributed capital from treasury stock transactions to the extent of previous net "gains" from sales or retirements of the same class of shares; otherwise retained earnings should be reduced.

C) The beginning balance of retained earnings.

D) Revenues on the income statement.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

46

When a company issues to its shareholders some shares of another corporation's stock that currently are held as an investment,the company is issuing a stock dividend.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

47

In a stock split,only the content of contributed capital is changed,whereas in a stock dividend the amount of contributed capital is changed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

48

The entry to record share issue costs will never affect:

A) Earnings.

B) Share Capital.

C) Retained Earnings.

D) Liabilities.

A) Earnings.

B) Share Capital.

C) Retained Earnings.

D) Liabilities.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

49

Dividends in arrears on cumulative preferred shares constitute a liability to the corporation that should be recorded (accrued).

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following statements is correct?

A) Par value shares are prohibited under the CBCA.

B) Legal capital is that which would be distributed back to shareholders in the event of liquidation.

C) Contributed Capital is the amount on which dividend payments should be based.

D) Contributed Capital represents the proceeds from a share issue in jurisdictions where par values are allowed.

A) Par value shares are prohibited under the CBCA.

B) Legal capital is that which would be distributed back to shareholders in the event of liquidation.

C) Contributed Capital is the amount on which dividend payments should be based.

D) Contributed Capital represents the proceeds from a share issue in jurisdictions where par values are allowed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

51

Dividends in arrears on cumulative preferred shares must be paid at the end of the accounting period if cash and retained earnings are available.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

52

The accounting treatment for ordinary and liquidating dividends differs.Ordinary dividends cause a debit to retained earnings and liquidating dividends cause a debit to contributed capital.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

53

Preferred shares,which have the most restrictive features,are:

A) Noncumulative, non-participating, nonvoting.

B) Fully participating, nonvoting.

C) Noncumulative, fully participating, nonvoting.

D) Non-participating, cumulative, nonvoting.

A) Noncumulative, non-participating, nonvoting.

B) Fully participating, nonvoting.

C) Noncumulative, fully participating, nonvoting.

D) Non-participating, cumulative, nonvoting.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

54

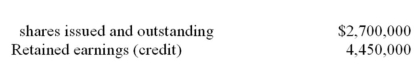

SXC reported the following data on its 2014 statement of financial position:  If the average price paid for all of the common shares sold and subscribed were $5.00,the total number of sold and subscribed shares was:

If the average price paid for all of the common shares sold and subscribed were $5.00,the total number of sold and subscribed shares was:

A) 44,400

B) 40,400

C) 44,000

D) 40,000

E) None of these answers are correct.

If the average price paid for all of the common shares sold and subscribed were $5.00,the total number of sold and subscribed shares was:

If the average price paid for all of the common shares sold and subscribed were $5.00,the total number of sold and subscribed shares was:A) 44,400

B) 40,400

C) 44,000

D) 40,000

E) None of these answers are correct.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

55

Gains on sale of treasury stock should be credited to:

A) Additional contributed capital.

B) Other income.

C) Share capital.

D) Retained earnings.

A) Additional contributed capital.

B) Other income.

C) Share capital.

D) Retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

56

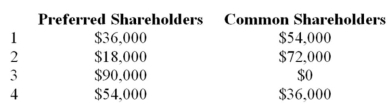

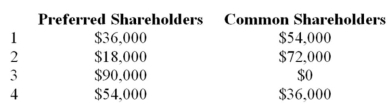

Ryan Corp.has the following share capital outstanding: Common,10,000 shares

Preferred $1.80 noncumulative,non-participating,10,000 shares

Dividends are two years in arrears,excluding the current year.Total dividends of $90,000 will be paid for the current year.The total amounts that will be received by the preferred shareholders and common shareholders are:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Preferred $1.80 noncumulative,non-participating,10,000 shares

Dividends are two years in arrears,excluding the current year.Total dividends of $90,000 will be paid for the current year.The total amounts that will be received by the preferred shareholders and common shareholders are:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

57

In accounting for dividends,the declaration date is the most important date because dividends are paid to whomever owns the shares on that date.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

58

A stock split results in the reduction of the par or stated value per share and a proportional increase in the number of shares outstanding.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

59

Dividends in arrears on noncumulative preferred shares must be paid before dividends can be paid to the common shareholders.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

60

ABC Inc.issued 1,000 common shares and 3,000 preferred shares for a lump sum of $25,000.The fair market value of each share on the date of issue was $6 per common share and $8 per preferred share.How much of the proceeds received should be allocated to the preferred shares on the date of issue?

A) $5,000

B) $20,000

C) $6,250

D) $19,750

A) $5,000

B) $20,000

C) $6,250

D) $19,750

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

61

For dividends,the date of record is the date:

A) The market price of the shares drops due to the dividend.

B) On which the list of shareholders is prepared.

C) The dividend is actually paid.

D) The dividend is announced.

A) The market price of the shares drops due to the dividend.

B) On which the list of shareholders is prepared.

C) The dividend is actually paid.

D) The dividend is announced.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

62

On December 31,2014,when JR Corporation's shares were selling at $44 per share,its shareholders' equity accounts were as follows: Common shares (no par value)100,000  A 100 percent stock dividend was declared and issued.The effect of this dividend was:

A 100 percent stock dividend was declared and issued.The effect of this dividend was:

A) Total shareholders' equity did not change.

B) Common shares increased to $5,600,000.

C) Common shares increased to $6,460,000.

D) Total shareholders' equity decreased.

A 100 percent stock dividend was declared and issued.The effect of this dividend was:

A 100 percent stock dividend was declared and issued.The effect of this dividend was:A) Total shareholders' equity did not change.

B) Common shares increased to $5,600,000.

C) Common shares increased to $6,460,000.

D) Total shareholders' equity decreased.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

63

Identify the missing component (X)in the following equation: Retained earnings,ending balance = Net income to date + prior period adjustments to date - cash and property dividends to date - X

A) Stock dividends and splits to date.

B) Stock dividends to date.

C) Stock splits to date.

D) Net unrealized gain or loss on securities available for sale.

A) Stock dividends and splits to date.

B) Stock dividends to date.

C) Stock splits to date.

D) Net unrealized gain or loss on securities available for sale.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following dividends does not reduce retained earnings?

A) Scrip dividend.

B) Stock dividend.

C) Cash dividend.

D) Property dividend.

E) Liquidating dividend.

A) Scrip dividend.

B) Stock dividend.

C) Cash dividend.

D) Property dividend.

E) Liquidating dividend.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

65

Share capital may be classified primarily as:

A) Par Value, Common; or No- par, Preferred.

B) No-par, Common; or Par Value, Preferred.

C) Par Value, Common; No-par, Common; Par Value, Preferred; or No-par, Preferred.

D) Par Value, Common; Stated Value Common; or No-par, Preferred.

A) Par Value, Common; or No- par, Preferred.

B) No-par, Common; or Par Value, Preferred.

C) Par Value, Common; No-par, Common; Par Value, Preferred; or No-par, Preferred.

D) Par Value, Common; Stated Value Common; or No-par, Preferred.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

66

A property dividend causes a debit to retained earnings equal to the ___________ of the property distributed.

A) Book value

B) Fair market value

C) Original cost

D) Income tax basis

A) Book value

B) Fair market value

C) Original cost

D) Income tax basis

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

67

At the date of the financial statements,common shares issued would exceed common shares outstanding as a result of the:

A) Payment in full of subscribed shares.

B) Declaration of a stock split.

C) Declaration of a stock dividend.

D) Purchase of treasury stock.

A) Payment in full of subscribed shares.

B) Declaration of a stock split.

C) Declaration of a stock dividend.

D) Purchase of treasury stock.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

68

Under IFRS,the treatment of any of a company's foreign subsidiary is dependent upon:

A) The functional currency of the subsidiary.

B) The nature and extent of the parent company's relationship with the subsidiary.

C) Whether the subsidiary is integrated or self-sustaining.

D) Managerial judgement.

A) The functional currency of the subsidiary.

B) The nature and extent of the parent company's relationship with the subsidiary.

C) Whether the subsidiary is integrated or self-sustaining.

D) Managerial judgement.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

69

Owners' equity must equal the:

A) Total contributed capital plus retained earnings less liabilities.

B) Sum of the share capital account balances plus the total contributed capital in excess of par (or stated value).

C) Total assets minus total liabilities.

D) Total contributed capital less total retained earnings.

A) Total contributed capital plus retained earnings less liabilities.

B) Sum of the share capital account balances plus the total contributed capital in excess of par (or stated value).

C) Total assets minus total liabilities.

D) Total contributed capital less total retained earnings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

70

Zygo sold 1,000 common shares (par $3)at $5 per share on a subscription basis.The entry to record this transaction included a credit to:

A) Accounts receivable.

B) Contributed capital in excess of par.

C) Cash.

D) Subscriptions receivable.

A) Accounts receivable.

B) Contributed capital in excess of par.

C) Cash.

D) Subscriptions receivable.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

71

Authorized share capital refers to the total number of shares:

A) Outstanding.

B) Issued.

C) That can be issued in conformity with the corporation's charter.

D) Issued, less all treasury shares owned.

A) Outstanding.

B) Issued.

C) That can be issued in conformity with the corporation's charter.

D) Issued, less all treasury shares owned.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

72

Ownership of shares usually entitles the holders to all of the following rights except:

A) To elect the board of directors of the corporation.

B) To control the day-to-day operations of the corporation.

C) To purchase new shares when they are offered for sale.

D) To share in the profits of the corporation.

A) To elect the board of directors of the corporation.

B) To control the day-to-day operations of the corporation.

C) To purchase new shares when they are offered for sale.

D) To share in the profits of the corporation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

73

Issued share capital refers to the number of shares:

A) Outstanding.

B) Outstanding less all shares held as treasury shares.

C) Outstanding plus all shares held as treasury shares.

D) That may be issued according to the corporate charter.

A) Outstanding.

B) Outstanding less all shares held as treasury shares.

C) Outstanding plus all shares held as treasury shares.

D) That may be issued according to the corporate charter.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is not a basic right of shareholders?

A) To inspect the books of account and to insist upon an audit in the event of dissatisfaction with results revealed by such inspection.

B) To participate in the management of the corporation through taking part in and voting in shareholders' meetings.

C) To participate in the profits of the corporation through dividends declared by the board of directors.

D) To share in the distribution of assets of the corporation at liquidation or through liquidating dividends.

E) To sell shares in the corporation at a price exceeding its cost.

A) To inspect the books of account and to insist upon an audit in the event of dissatisfaction with results revealed by such inspection.

B) To participate in the management of the corporation through taking part in and voting in shareholders' meetings.

C) To participate in the profits of the corporation through dividends declared by the board of directors.

D) To share in the distribution of assets of the corporation at liquidation or through liquidating dividends.

E) To sell shares in the corporation at a price exceeding its cost.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

75

ABC Inc.engages in a non-cash exchange with a third party whereby ABC Inc.issues common shares to the third party in exchange for some highly specialized Machinery & Equipment.The value of the shares issued was $15,000 while the appraised value of the Machinery & Equipment was $12,000.At what amount would this transaction be valued on ABC's books?

A) $12,000 under IFRS and $15,000 under ASPE.

B) $15,000 under IFRS and $12,000 under ASPE.

C) $12,000 under either ASPE or IFRS.

D) $15,000 under either ASPE or IFRS.

A) $12,000 under IFRS and $15,000 under ASPE.

B) $15,000 under IFRS and $12,000 under ASPE.

C) $12,000 under either ASPE or IFRS.

D) $15,000 under either ASPE or IFRS.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

76

Major factors contributing to the growth of the corporate form of business includes all of the following except:

A) The facility to accumulate large amounts of resources.

B) Limited liability of the shareholders.

C) Easy transferability of ownership.

D) The lack of government regulation.

A) The facility to accumulate large amounts of resources.

B) Limited liability of the shareholders.

C) Easy transferability of ownership.

D) The lack of government regulation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

77

Total equities of a corporation usually include:

A) Assets plus contributed capital, and plus retained earnings.

B) Contributed capital plus retained earnings.

C) Contributed capital plus retained earnings, and plus creditors' interest.

D) Total owners' equity less treasury stock at cost.

A) Assets plus contributed capital, and plus retained earnings.

B) Contributed capital plus retained earnings.

C) Contributed capital plus retained earnings, and plus creditors' interest.

D) Total owners' equity less treasury stock at cost.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

78

XHC had only two share transactions.Initially,XHC issued 1,000 common shares,at $15 per share.XHC later bought back 200 shares at $16 per share.Under the single-transaction method,what is the amount that should be recorded in the treasury stock account?

A) $2,000

B) $3,000

C) $3,200

D) $3,600

A) $2,000

B) $3,000

C) $3,200

D) $3,600

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

79

CB Corporation issued a 2 for 1 stock split.Which of the following is NOT a true statement concerning the effect of the split?

A) The number of shares outstanding is increased.

B) There is a transfer of retained earnings to contributed capital.

C) A proportionate reduction in the par value per share occurs.

D) There is a continuation of retained earnings with no reduction in its balance.

A) The number of shares outstanding is increased.

B) There is a transfer of retained earnings to contributed capital.

C) A proportionate reduction in the par value per share occurs.

D) There is a continuation of retained earnings with no reduction in its balance.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

80

Cash dividends sometimes are declared in one reporting period and are payable in the next reporting period.The dividend should be recorded on the:

A) Payment date.

B) Declaration date.

C) Record date.

D) Either the declaration, record, or payment date, as preferred by the company.

A) Payment date.

B) Declaration date.

C) Record date.

D) Either the declaration, record, or payment date, as preferred by the company.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck