Deck 11: Financial Instruments: Investments in Bonds and Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/162

Play

Full screen (f)

Deck 11: Financial Instruments: Investments in Bonds and Equity Securities

1

A high working capital ratio is always a favourable situation from the shareholders' viewpoint.

False

2

A statement of accounting policies is required to be clearly enunciated in the notes to the financial statements.

True

3

All companies are required to have audits.

False

4

Ratios that measure current position are useful for assessing the ability of a company to pay its short-term obligations.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

5

Published financial statements are always the best source of timely information on practically all financial items relevant to investors and creditors.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

6

A prospective investor in common shares is primary interested in the long-run profitability of the company.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

7

Information about the significant accounting policies of an entity is not necessary because GAAP prescribes uniform accounting treatment of all items,and it is widely understood.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

8

Financial statement analysis is only used to determine whether a company is worth investing in.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

9

The current ratio is one measure of the adequacy of a company's working capital.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

10

A qualified auditors' opinion is given when the financial statements present information in conformity with GAAP.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

11

A clean opinion is another term to describe a company that has received an unqualified audit report.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

12

One of the most important aspects of analysis of financial statements is the wording of the auditors' report.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

13

Vertical analysis of financial statements refers to the development of percentages indicating the proportionate changes in selected financial statements for two or more reporting periods.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

14

In horizontal analysis of financial statements,the base amounts used for purposes of comparison are the financial results of a previous time period.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

15

A statement of accounting policies must be included in the annual financial statements.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

16

GAAP requires the presentation of financial statements for the current year and the two immediately preceding reporting periods.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

17

The statement of significant accounting policies,which is included in the notes to the financial statements,must include reasons for the selection of one generally accepted accounting method over another generally accepted accounting method.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

18

A trade creditor will be primarily interested in the long-run profitability of the company.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

19

Examination of comparative financial statements does not enable financial statement users to better identify long-term trends.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

20

A primary reason for the analysis of financial statements is identification of major changes and to provide relative relationships among dollar amounts.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

21

The use of an accelerated depreciation method rather than the straight-line method may have an unfavourable effect on some ratios.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

22

A price-earnings ratio of 10 to 1 implies an earnings rate on market value per share of 10%.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

23

The quick (or acid-test)ratio always will be less than,or equal to,the current ratio.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

24

For both the accounts receivable turnover and the inventory turnover ratios,the numerator of the fraction is credit sales.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

25

Profit margin on sales is very relevant for purposes of comparison,both between periods and between similar companies.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

26

When data used in ratio analysis are based on historical book values,the resulting ratios reflect price-level effects and real economic values.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

27

Return on total assets is generally considered to be a better measure of the overall profit performance of a business than is profit margin on sales.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

28

Book value per share is based upon all voting common and preferred shares.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

29

If a company's ratio of net income to net sales (generally referred to as profit margin on sales)is low,then its return on investment will be low.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

30

Return on investment (of a corporation)is affected by the market price of its shares.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

31

Generally,an acid-test ratio of 2 to 1 is preferable to a working capital ratio of 2 to 1.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

32

A review engagement provides more reliance for the users of the financial statements than an audit engagement.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

33

Longitudinal comparisons compare a company's performance over time to that of its competitors while cross-sectional comparisons compare a company's own performance from one period to another.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

34

A company may decide not to follow GAAP if it does not present them in a favourable position.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

35

A company which offers "n/30" credit terms would be expected to have a receivable turnover of about 12 times a year.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

36

To calculate the book value per common share,total shareholders' equity (including retained earnings)must be allocated to the respective common and preferred equities.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

37

The section on significant accounting policies describes where deviations from GAAP have occurred.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

38

Return on total assets and return on owners' equity are used to compute financial leverage.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

39

A debt-equity ratio in excess of 1 indicates that a majority of the entity's resources was provided by the shareholders' or is reflected in shareholders' equity.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

40

Book value per common share is particularly useful for predicting the expected market value per share.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

41

In calculating the book value per common share,total owners equity must be allocated to the respective common and preferred.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

42

If treasury stock is purchased and retired at a cost in excess of its book value,book value per share (for the remaining shares)will decrease.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

43

The allocation to the respective common and preferred equities in calculation of the book value per common share will depend upon the preferential rights of preferred shares.Liquidation,cumulative and participating preferences of the preferred shares must be satisfied; the balance of owners' equity then becomes the common share equity.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

44

Earnings per share is computed by dividing the number of shares issued into the net income for the period.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

45

It is possible for companies with revenues totalling in excess of $10 million dollars to be exempt from an audit.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

46

Where there is a deficit in total owners' equity,the ratio of total liabilities to total assets will be greater than 1 to 1; e.g.,1.2 to 1.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

47

To apply a vertical analysis to the balance sheet,the base amount usually selected is:

A) total assets.

B) total liabilities.

C) total shareholders' equity.

D) total revenues.

E) either total liabilities or total shareholders' equity.

A) total assets.

B) total liabilities.

C) total shareholders' equity.

D) total revenues.

E) either total liabilities or total shareholders' equity.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

48

IFRS standards require the presentation of comparative financial statements by most companies for the current year as well as:

A) one preceding year.

B) three succeeding years.

C) two preceding years.

D) three preceding years.

E) four preceding years.

A) one preceding year.

B) three succeeding years.

C) two preceding years.

D) three preceding years.

E) four preceding years.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

49

A company's return on investment is affected by the market price of its shares.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

50

The current ratio is a measure of the adequacy of a company's working capital.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

51

If a company's ratio of net income to net sales (generally referred to as profit margin)is low,then return on investment will be low.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

52

An unqualified opinion is given if an audit has not been completed.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

53

The negotiating of a collective agreement is a contractual decision that may necessitate the use of financial analysis.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

54

Liquidity ratios essentially provide information about a company's ability to meet its short term obligations,while solvency ratios evaluate a company's long-term going-concern potential.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

55

A price-earnings ratio of 10 to 1 implies an earnings rate on market value per share of 10%.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

56

Ratio analysis is aided by the presentation of comparative statements.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

57

Disclosure of significant accounting policies results from application of the:

A) full disclosure principle.

B) consistency principle.

C) reliability principle.

D) matching principle.

A) full disclosure principle.

B) consistency principle.

C) reliability principle.

D) matching principle.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

58

A company which offers "n/15" credit terms assuming 360 days in year would be expected to have a receivable turnover of about 24 times a year.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

59

An adverse opinion is given if the auditor disagrees with the company on decisions made.This is generally not a serious condition as it relates only to a difference of opinion.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

60

The quick ratio will always be less than or equal to the current ratio.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

61

If a company converted a short-term note payable into a long-term note payable,this transaction would:

A) decrease only working capital.

B) decrease both working capital and the current ratio.

C) increase only working capital.

D) increase both working capital and the current ratio.

E) have no effect on either the current ratio or net working capital.

A) decrease only working capital.

B) decrease both working capital and the current ratio.

C) increase only working capital.

D) increase both working capital and the current ratio.

E) have no effect on either the current ratio or net working capital.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

62

All of the following are examples of regulatory decisions except:

A) negotiating collective agreements.

B) need for rate or price increases.

C) impact of past regulatory decisions.

D) ability to withstand competition.

A) negotiating collective agreements.

B) need for rate or price increases.

C) impact of past regulatory decisions.

D) ability to withstand competition.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

63

The effect of recording a 100 percent stock dividend would be to:

A) leave working capital unaffected, decrease earnings per share, and decrease book value per share.

B) leave working capital unaffected, decrease earnings per share, and decrease the debt to equity ratio.

C) decrease the current ratio, decrease working capital, and decrease book value per share.

D) leave inventory turnover unaffected, decrease working capital, and decrease book value per share.

E) None of these choices are correct.

A) leave working capital unaffected, decrease earnings per share, and decrease book value per share.

B) leave working capital unaffected, decrease earnings per share, and decrease the debt to equity ratio.

C) decrease the current ratio, decrease working capital, and decrease book value per share.

D) leave inventory turnover unaffected, decrease working capital, and decrease book value per share.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

64

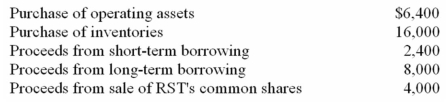

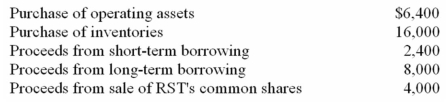

RST has provided the following information in 000's on selected cash transactions for 2014:  What is the increase in working capital for the year ended December 31,2014,as a result of the above information?

What is the increase in working capital for the year ended December 31,2014,as a result of the above information?

A) $400

B) $4,000

C) $5,600

D) None of these choices are correct.

What is the increase in working capital for the year ended December 31,2014,as a result of the above information?

What is the increase in working capital for the year ended December 31,2014,as a result of the above information?A) $400

B) $4,000

C) $5,600

D) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following transactions would increase a company's positive current ratio?

A) Borrow money on a short-term note

B) Repay the principal on a short-term note

C) Sell a temporary investment at a loss

D) Use the equity method to reflect earnings of an investee

E) None of these choices would increase a company's positive current ratio

A) Borrow money on a short-term note

B) Repay the principal on a short-term note

C) Sell a temporary investment at a loss

D) Use the equity method to reflect earnings of an investee

E) None of these choices would increase a company's positive current ratio

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

66

Horizontal analysis:

A) refers to the development of percentages indicating the proportionate change in the same item over time.

B) is exactly the same as "vertical analysis".

C) is useful for balance sheet but not for income statement.

D) involves the expression of each item on a particular period's financial statements as a percent of one specific item which is referred to as a base.

E) None of these choices are correct.

A) refers to the development of percentages indicating the proportionate change in the same item over time.

B) is exactly the same as "vertical analysis".

C) is useful for balance sheet but not for income statement.

D) involves the expression of each item on a particular period's financial statements as a percent of one specific item which is referred to as a base.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

67

Disclosure of significant accounting policies should include all of the following items except:

A) the amortization methods.

B) the valuation method used for operational assets.

C) the depreciation methods.

D) the inventory costing methods.

A) the amortization methods.

B) the valuation method used for operational assets.

C) the depreciation methods.

D) the inventory costing methods.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

68

Vertical analysis of financial statements refers to a comparison of amounts which are expressed in terms of a base amount that is from a:

A) financial summary.

B) previous time period.

C) common size statement.

D) specific amount that is on the same financial statement.

E) either previous time period or common size statement.

A) financial summary.

B) previous time period.

C) common size statement.

D) specific amount that is on the same financial statement.

E) either previous time period or common size statement.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

69

A qualified auditor's opinion means that in the judgment of the auditor:

A) the audit was not completed.

B) all items on the financial statements are in conformity with GAAP.

C) a number of substantive items on the financial statements are doubtful as to their ultimate outcome.

D) one, or only a few minor, items on the financial statements are doubtful as to their ultimate outcome.

E) None of these choices are correct.

A) the audit was not completed.

B) all items on the financial statements are in conformity with GAAP.

C) a number of substantive items on the financial statements are doubtful as to their ultimate outcome.

D) one, or only a few minor, items on the financial statements are doubtful as to their ultimate outcome.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

70

A company issuing financial statements would most prefer to receive an auditor's opinion that is:

A) adverse.

B) qualified.

C) a disclaimer.

D) unqualified.

E) either qualified or unqualified.

A) adverse.

B) qualified.

C) a disclaimer.

D) unqualified.

E) either qualified or unqualified.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

71

A company has a current ratio of 2 to 1.This ratio will decrease if the company:

A) borrows cash on a six-month note.

B) sells merchandise for more than cost and records the sale using the perpetual inventory method.

C) receives a 5 percent stock dividend on one of its marketable securities.

D) pays a large account payable which had been a current liability.

E) None of these choices are correct.

A) borrows cash on a six-month note.

B) sells merchandise for more than cost and records the sale using the perpetual inventory method.

C) receives a 5 percent stock dividend on one of its marketable securities.

D) pays a large account payable which had been a current liability.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

72

All of the following are examples of lending decisions except:

A) finance the takeover of another corporation.

B) extend normal credit terms.

C) buy corporate bonds on the open market.

D) accepting employment.

A) finance the takeover of another corporation.

B) extend normal credit terms.

C) buy corporate bonds on the open market.

D) accepting employment.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

73

All of the following are decisions that may be made with financial statement analysis except:

A) share investment decisions.

B) regulatory decisions.

C) share offering decisions.

D) lending decisions.

E) contractual decisions.

A) share investment decisions.

B) regulatory decisions.

C) share offering decisions.

D) lending decisions.

E) contractual decisions.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is a list of the types of auditors' opinions going from worst to best?

A) Unqualified, qualified, adverse, disclaimer

B) Qualified, disclaimer, adverse, unqualified

C) Disclaimer, unqualified, adverse, qualified

D) Disclaimer, unqualified, qualified, adverse

E) None of these choices are correct.

A) Unqualified, qualified, adverse, disclaimer

B) Qualified, disclaimer, adverse, unqualified

C) Disclaimer, unqualified, adverse, qualified

D) Disclaimer, unqualified, qualified, adverse

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following ratios is an indicator of liquidity?

A) The Current Ratio.

B) The Inventory Turnover Ratio

C) The Age of Receivables Ratio.

D) The Debt-to-Total Assets Ratio.

A) The Current Ratio.

B) The Inventory Turnover Ratio

C) The Age of Receivables Ratio.

D) The Debt-to-Total Assets Ratio.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

76

If current assets exceed current liabilities,payments to creditors made on the last day of the month will:

A) decrease net working capital.

B) increase net working capital.

C) decrease current ratio.

D) increase current ratio.

E) have no effect on either the current ratio or net working capital.

A) decrease net working capital.

B) increase net working capital.

C) decrease current ratio.

D) increase current ratio.

E) have no effect on either the current ratio or net working capital.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

77

The "best" opinion that an auditor can give is a(n):

A) adverse opinion.

B) unqualified opinion.

C) qualified opinion.

D) disclaimer of opinion.

E) unqualified opinion and disclaimer of opinion are equally good.

A) adverse opinion.

B) unqualified opinion.

C) qualified opinion.

D) disclaimer of opinion.

E) unqualified opinion and disclaimer of opinion are equally good.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

78

All of the following are examples of contractual decisions except:

A) negotiating collective agreements.

B) accepting employment.

C) ability to withstand competition.

D) entering into a joint venture.

A) negotiating collective agreements.

B) accepting employment.

C) ability to withstand competition.

D) entering into a joint venture.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

79

Quick assets,as usually defined,include:

A) cash, accounts receivable, short-term investments in marketable securities, only.

B) cash, accounts receivable, short-term investments in marketable securities, and inventories.

C) cash only.

D) cash and accounts receivable only.

E) None of these choices are correct.

A) cash, accounts receivable, short-term investments in marketable securities, only.

B) cash, accounts receivable, short-term investments in marketable securities, and inventories.

C) cash only.

D) cash and accounts receivable only.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck

80

The amount of working capital would not be affected by which of the following transactions?

A) Sale of long-term investments for cash at a loss

B) Transfer of a long-term investment for cash

C) Issuance of a long-term note in exchange for cash

D) Issuance of common shares of the corporation in exchange for noncurrent assets

E) All of these choices would affect working capital

A) Sale of long-term investments for cash at a loss

B) Transfer of a long-term investment for cash

C) Issuance of a long-term note in exchange for cash

D) Issuance of common shares of the corporation in exchange for noncurrent assets

E) All of these choices would affect working capital

Unlock Deck

Unlock for access to all 162 flashcards in this deck.

Unlock Deck

k this deck