Deck 10: Depreciation, Amortization, and Impairment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/154

Play

Full screen (f)

Deck 10: Depreciation, Amortization, and Impairment

1

The failure to expense a prepaid asset is an example of a counterbalancing error.

False

2

A voluntary change in accounting policy is only justifiable when it results information that is both more reliable and more relevant.

True

3

A change from inventory costing using FIFO to inventory costing using Weighted Average is an example of a change in accounting principle.

True

4

A change in accounting principle occurs when a company adopts a principle different from an approved principle previously used.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

5

Accounting policy changes must always be handled retrospectively.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

6

Changes in accounting policy are always voluntary in nature.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

7

Revised estimates of the useful life or residual value of a depreciable asset are examples of a change in accounting principle.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

8

A change in policy mandated by a change of standard under IFRS is an example of a mandatory policy change.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

9

A change,for depreciation purposes,of either estimated useful life or from one GAAP to another GAAP accounting method,usually is referred to as a change in accounting principle.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

10

Some changes in accounting principle must be reported by using the retrospective approach.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

11

When an asset's residual value estimate is changed,the entire depreciation schedule for the asset is recomputed all the way back to the date of acquisition.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

12

A change from a non-GAAP procedure to a GAAP procedure usually is referred to as a change in accounting principle.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

13

Accounting policy changes are only justifiable when there is a change to a primary source of GAAP.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

14

A change,for depreciation purposes,of either estimated useful life or estimated residual value usually is referred to as a change in accounting estimate.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

15

A change in the useful life of an asset requires an accounting estimate change,which affects only periods after the change,is made.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

16

Accounting changes reported by using the current approach,require that the "catch-up adjustment" include the effect on earnings in the year of the change.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

17

Most changes in accounting principle are recognized by using the current approach.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

18

If a change in estimate and a change in principal occur on the same item and at the same time,the one that is dominant is reported.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

19

A change in accounting principle occurs when a company adopts a principle that is different from a previously used principle that is also generally accepted.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

20

If a corporation changes from reporting investments on the cost basis to reporting on the equity basis,the prospective approach of reporting must be used.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

21

An understatement of ending inventory will result in a credit to Future Income Taxes.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

22

Accounting errors require the restatement of previous years' financial statements.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

23

If it is impracticable to determine the cumulative effect at the beginning of the current period or,if it is allowed by the creation of a new accounting standard,an accounting change may be applied prospectively.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

24

The fact that most accounting changes are not disclosed may lead to ethical concerns among stakeholders.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

25

A misstatement of opening inventory is an example of a counterbalancing error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

26

Change in accounting estimate requires that a "catch-up adjustment" be recorded and reported in the year of the change.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

27

If a $1,000 purchase on credit last year was not recorded until this year and these goods purchased were not included in any year's ending inventory,the purchase error is counterbalancing.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

28

Both IFRS and ASPE require note disclosures pertaining to accounting standards not yet in effect.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

29

The correction of an accounting error affecting prior years' income is reported and recorded by using the retrospective approach.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

30

If a change in an accounting estimate affects the current period and future periods,the retrospective reporting approach must be used.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

31

Early adoption of involuntary changes in accounting policy is prohibited under IFRS.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

32

Changing from an insupportable (bad faith)estimate to a supportable estimate is classified as a change in estimate.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

33

Changes in estimates and prospectively-applied accounting policy changes occur more often in practice than do retrospectively-applied accounting policy changes.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

34

A change in an accounting estimate should be reported on the financial statements on a retrospective basis.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

35

An overstatement of opening inventory will result in an understatement of Cost of Goods Sold and therefore an overstatement of the current period's earnings.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

36

An overstatement of opening inventory will result in an understatement of operating cash flows in the current period.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

37

All changes in accounting estimates should be accounted for only in the period of the change; there is no effect on future periods.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

38

A change in an estimate,which was not determined reasonable (i.e.,not in good faith)to a good faith estimate,is accounted for as an accounting error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

39

With respect to the application of retrospective accounting changes,both IFRS and ASPE require that an opening balance sheet be provided for the start of the earliest period affected by the changes.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

40

A change in accounting principle occurs when a company adopts a principle different from an inappropriate procedure that was used previously.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

41

When an error is discovered,it should be corrected as of the end of the year in which the error was made.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

42

With respect to a retrospectively applied change in accounting policy,the effects on prior years' income is treated as an adjustment to opening retained earnings.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

43

A change from the sum-of-the-years'-digits depreciation method to the straight-line depreciation method should be accounted for as a(n):

A) Change in accounting policy.

B) Prospective change.

C) Change in accounting estimate.

D) Accounting error.

A) Change in accounting policy.

B) Prospective change.

C) Change in accounting estimate.

D) Accounting error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is not a change in accounting policy?

A) Change in the depreciation method from straight-line to declining balance.

B) Change from completed contract to percentage of completion.

C) Change from Weighted Average to FIFO.

D) Change in depreciation from eight years to five years.

E) They are all changes in accounting policy.

A) Change in the depreciation method from straight-line to declining balance.

B) Change from completed contract to percentage of completion.

C) Change from Weighted Average to FIFO.

D) Change in depreciation from eight years to five years.

E) They are all changes in accounting policy.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

45

Failure to record accrued wages at year-end (an adjusting entry)results in what usually is called a counterbalancing error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

46

Failure to record depreciation expense in one-year results in what is usually called a counterbalancing error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

47

A retrospectively applied change in accounting policy relating to fixed assets where a company changes from the straight-line amortization method to the double-declining balance method would result in a decrease to opening retained earnings.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

48

When an accounting change is recorded and reported using the retrospective approach,the cumulative effect on Retained Earnings is recorded in that account.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

49

On January 1,2015,JTC changed to the weighted-average cost method from the first-in,first-out (FIFO)cost method for inventory cost flow purposes.JTC can justify this as a change in policy.The change will result in a $120,000 decrease in the beginning inventory at January 1,2015.Ignoring income taxes,the cumulative effect of changing to the weighted-average method from the FIFO method must be reported by JTC in the 2015:

A) Income statement as a $120,000 debit.

B) Statement of retained earnings as a $120,000 debit adjustment to the beginning balance.

C) Income statement as a $120,000 credit.

D) Statement of retained earnings as a $120,000 credit adjustment to the beginning balance.

A) Income statement as a $120,000 debit.

B) Statement of retained earnings as a $120,000 debit adjustment to the beginning balance.

C) Income statement as a $120,000 credit.

D) Statement of retained earnings as a $120,000 credit adjustment to the beginning balance.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

50

An understatement of accrued wages will,if not corrected,cause income for the current and following reporting period,separately,to be overstated.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

51

Which one of the following statements is not correct?

A) A change from an inappropriate accounting principle to a proper one should be accounted for as an accounting error.

B) Assets purchased on the 14th of the month may be depreciated from the first of the month for practical reasons.

C) Depreciation accounting is a process of allocation of periodic expense, rather than one of asset valuation.

D) Use of straight-line depreciation gives a higher total expense than accelerated methods over the total useful life of the asset.

A) A change from an inappropriate accounting principle to a proper one should be accounted for as an accounting error.

B) Assets purchased on the 14th of the month may be depreciated from the first of the month for practical reasons.

C) Depreciation accounting is a process of allocation of periodic expense, rather than one of asset valuation.

D) Use of straight-line depreciation gives a higher total expense than accelerated methods over the total useful life of the asset.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

52

An error in the inventory amount recorded involves a self-correcting error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

53

A change from an accelerated depreciation method to the straight-line depreciation method should be accounted for as a:

A) Change in accounting entity.

B) Change in accounting principle.

C) Change in accounting estimate.

D) Correction of accounting error.

E) Change in accounting principle or estimate, depending on the degree of practicality.

A) Change in accounting entity.

B) Change in accounting principle.

C) Change in accounting estimate.

D) Correction of accounting error.

E) Change in accounting principle or estimate, depending on the degree of practicality.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

54

The failure to accrue revenues for services rendered but not billable until future periods would be considered a self-correcting error.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

55

When a firm changes only the estimated residual value of equipment:

A) Depreciation must be recomputed for each previous year based on the new residual value.

B) The remaining book value, reduced by the new residual value, is the basis for subsequent depreciation.

C) The original cost, reduced by the new residual value, is the basis for subsequent depreciation.

D) No adjustment is needed.

A) Depreciation must be recomputed for each previous year based on the new residual value.

B) The remaining book value, reduced by the new residual value, is the basis for subsequent depreciation.

C) The original cost, reduced by the new residual value, is the basis for subsequent depreciation.

D) No adjustment is needed.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

56

On comparative financial statements,all errors must be corrected for each year presented,rather than only for the current year.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following events would require disclosure in the current financial statements?

A) Change in the method used to calculate bad debt expense.

B) Change from Weighted Average to FIFO for merchandise inventory.

C) Change in the estimated amortization period for an intangible asset.

D) Change in recording the income for long-term construction contracts

E) All of these choices are correct.

A) Change in the method used to calculate bad debt expense.

B) Change from Weighted Average to FIFO for merchandise inventory.

C) Change in the estimated amortization period for an intangible asset.

D) Change in recording the income for long-term construction contracts

E) All of these choices are correct.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

58

An increase in assets relating to a retrospective change in accounting policy will result in a credit to the related future tax accounts.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

59

A change in the unit depletion rate would be accounted for as a:

A) Correction of an accounting error.

B) Change in accounting estimate.

C) Change in accounting principle.

D) Change in accounting entity.

A) Correction of an accounting error.

B) Change in accounting estimate.

C) Change in accounting principle.

D) Change in accounting entity.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

60

An overstatement of opening inventory entails an overstatement of Cost of Goods Sold in the current period.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following is not an example of a change in accounting estimate?

A) Change in the estimated loss rate on receivables

B) Change in the residual value of natural resources subject to depletion

C) Change in the expected warranty costs on goods sold under a warranty

D) Change in the expected recovery of a deferred charge

E) Change in the composition of inventory cost

A) Change in the estimated loss rate on receivables

B) Change in the residual value of natural resources subject to depletion

C) Change in the expected warranty costs on goods sold under a warranty

D) Change in the expected recovery of a deferred charge

E) Change in the composition of inventory cost

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

62

Choose the correct statement regarding accounting changes.

A) All changes in accounting principle require a cumulative effect to be recognized in the income statement.

B) Changing from FIFO to Weighted Average is a retrospective accounting principle change.

C) Income statements numbers are required to be disclosed for most accounting principle changes.

D) The amount of the correction for an error affecting previous earnings will be disclosed in current earnings.

A) All changes in accounting principle require a cumulative effect to be recognized in the income statement.

B) Changing from FIFO to Weighted Average is a retrospective accounting principle change.

C) Income statements numbers are required to be disclosed for most accounting principle changes.

D) The amount of the correction for an error affecting previous earnings will be disclosed in current earnings.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

63

The primary principle addressed by recent changes to ASPE and IFRS on accounting changes and error corrections is the:

A) Going-concern principle.

B) Matching principle.

C) Comparability principle.

D) Full-disclosure principle.

A) Going-concern principle.

B) Matching principle.

C) Comparability principle.

D) Full-disclosure principle.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is characteristic of a change in accounting estimate?

A) Requires the reporting of income statements amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported through restatement of the financial statements

A) Requires the reporting of income statements amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported through restatement of the financial statements

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

65

WZ acquired some machinery on January 2,20x1.WZ used straight-line depreciation with an estimated life of 15 years with no residual value.On January 1,20x6,WZ estimated that the remaining life of this machinery was 6 years with no residual value.How should this change be accounted for by WZ?

A) Revising future depreciation per year, computed by dividing the book value on January 1, 20x6 by six.

B) Revising future depreciation per year, computed by dividing the original cost by six.

C) Estimating the effect of the change on each year's net earnings, but maintaining the method of depreciation as originally determined.

D) None of these choices are correct.

A) Revising future depreciation per year, computed by dividing the book value on January 1, 20x6 by six.

B) Revising future depreciation per year, computed by dividing the original cost by six.

C) Estimating the effect of the change on each year's net earnings, but maintaining the method of depreciation as originally determined.

D) None of these choices are correct.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is an example of a change in accounting estimate?

A) Change from the percentage-of-completion method to the completed-contract method of income recognition for long-term construction contracts

B) Change from capitalizing research and development costs to expensing such costs

C) Change from the gross margin method to the retail method of estimating the ending inventory

D) Change from the Weighted Average method to the FIFO inventory method

E) Change in the estimate of future warranty costs

A) Change from the percentage-of-completion method to the completed-contract method of income recognition for long-term construction contracts

B) Change from capitalizing research and development costs to expensing such costs

C) Change from the gross margin method to the retail method of estimating the ending inventory

D) Change from the Weighted Average method to the FIFO inventory method

E) Change in the estimate of future warranty costs

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

67

The concept of consistency is sacrificed in the accounting for which of the following items?

A) Change is the estimated salvage value of an asset

B) Cumulative effect of change in accounting principle

C) Discontinued operations

D) Loss on disposal of a segment of a business

A) Change is the estimated salvage value of an asset

B) Cumulative effect of change in accounting principle

C) Discontinued operations

D) Loss on disposal of a segment of a business

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

68

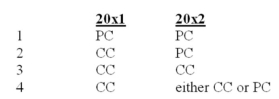

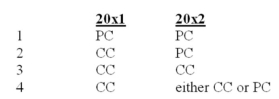

In 20x2,a firm changed from the completed contract (CC)method of accounting for revenue on long-term contracts to the percentage of completion (PC)method.The firm's 20x1 and 20x2 comparative financial statements will reflect which method or methods.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following changes would be accounted for prospectively?

A) Changing from declining-balance depreciation to straight-line depreciation

B) Change in the expected life of a depreciable asset

C) First time presentation of assumption financial statements with the FIFO cost flow

D) Error corrections

A) Changing from declining-balance depreciation to straight-line depreciation

B) Change in the expected life of a depreciable asset

C) First time presentation of assumption financial statements with the FIFO cost flow

D) Error corrections

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

70

Which type of accounting change should always be accounted for in current and future periods?

A) Change in accounting estimate

B) Correction of an error

C) Change in accounting principle

D) Change in inventory costing methods

A) Change in accounting estimate

B) Correction of an error

C) Change in accounting principle

D) Change in inventory costing methods

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

71

Reported income during the early years of the estimated life of a depreciable asset usually would be understated by the most as a result of:

A) High estimates of residual value and useful life.

B) Using actual residual value and actual useful life.

C) Low estimate of residual value and useful life.

D) Low estimate of residual value and high estimate of useful life.

A) High estimates of residual value and useful life.

B) Using actual residual value and actual useful life.

C) Low estimate of residual value and useful life.

D) Low estimate of residual value and high estimate of useful life.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following statements is correct?

A) A change in estimated useful life for a building should cause a correction to prior years' retained earnings.

B) A change in method of accounting for depreciation should cause an adjustment to current year's depreciation expense and a cumulative effect for the effect of the change on prior year's earnings.

C) An error affecting prior year's depreciation is treated as a change in estimate.

D) A cumulative effect will never be accompanied by a related tax effect

A) A change in estimated useful life for a building should cause a correction to prior years' retained earnings.

B) A change in method of accounting for depreciation should cause an adjustment to current year's depreciation expense and a cumulative effect for the effect of the change on prior year's earnings.

C) An error affecting prior year's depreciation is treated as a change in estimate.

D) A cumulative effect will never be accompanied by a related tax effect

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

73

The effects for a change in accounting principle would usually be reported on the face of the income statement for a change:

A) From the straight-line method of depreciation to the declining-balance method.

B) From presenting statements for errors which effect only one of the financial statements.

C) In the service lives of depreciable assets.

D) In the residual value of a depreciable asset.

E) None of these choices are correct.

A) From the straight-line method of depreciation to the declining-balance method.

B) From presenting statements for errors which effect only one of the financial statements.

C) In the service lives of depreciable assets.

D) In the residual value of a depreciable asset.

E) None of these choices are correct.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following changes would be accounted for using the approach of a retrospective approach without restatement?

A) Change in the estimated life of a depreciable asset

B) Change from a non-GAAP accounting method to a GAAP method of accounting for bad debts

C) Overstatement of unearned revenue of the prior period

D) Change in the method of accounting for long-term construction contracts

E) Change to FIFO with previous year's information unavailable

A) Change in the estimated life of a depreciable asset

B) Change from a non-GAAP accounting method to a GAAP method of accounting for bad debts

C) Overstatement of unearned revenue of the prior period

D) Change in the method of accounting for long-term construction contracts

E) Change to FIFO with previous year's information unavailable

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

75

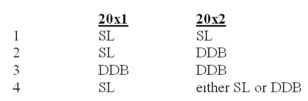

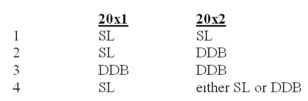

In 20x2,a firm changed from the straight-line (SL)method of depreciation to double declining balance (DDB)to conform to long-standing industry practice.The firm's 20x1 and 20x2 comparative financial statements will reflect which method or methods.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

76

A change in the salvage value of a depreciable asset should be accounted for as a:

A) Change in accounting entity.

B) Correction of an accounting error.

C) Change in accounting estimate.

D) Change in accounting principle.

A) Change in accounting entity.

B) Correction of an accounting error.

C) Change in accounting estimate.

D) Change in accounting principle.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

77

A change in the estimated useful life of a building:

A) is not allowed under ASPE or IFRS.

B) affects depreciation on the building beginning with the year of the change.

C) must be handled as a retrospective adjustment to all accounts affected, back to the year of building acquisition.

D) creates a new account to be recognized on the income statement, and reflects the depreciation difference up to the beginning of the year of change.

A) is not allowed under ASPE or IFRS.

B) affects depreciation on the building beginning with the year of the change.

C) must be handled as a retrospective adjustment to all accounts affected, back to the year of building acquisition.

D) creates a new account to be recognized on the income statement, and reflects the depreciation difference up to the beginning of the year of change.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

78

A change in an amortization rate,such as on a copyright,should be accounted for:

A) Retrospectively.

B) By recording an amount in retained earnings only.

C) Prospectively.

D) Currently.

A) Retrospectively.

B) By recording an amount in retained earnings only.

C) Prospectively.

D) Currently.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

79

If the estimated useful life of an asset was originally 10 years and then later changed to 12 years,the effects of this change should be:

A) Reported as a special item on the income statement in the year it occurs.

B) Spread over the current and future periods.

C) Reported and recorded retrospectively, including pro forma financial statements in the year of change.

D) Recorded in an adjustment to the Accumulated Depreciation account and the Retained Earnings account in the year of change.

A) Reported as a special item on the income statement in the year it occurs.

B) Spread over the current and future periods.

C) Reported and recorded retrospectively, including pro forma financial statements in the year of change.

D) Recorded in an adjustment to the Accumulated Depreciation account and the Retained Earnings account in the year of change.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck

80

When an accounting change is to be recorded and reported under the Retrospective approach,the:

A) Retained earnings is adjusted for the cumulative effect of the change.

B) Cumulative effect of the change is reported as a special item in the income statement in the year of the change.

C) Effect of the change is spread over the past, current, and future accounting periods.

D) Pro forma financial statements for future years must be disclosed.

A) Retained earnings is adjusted for the cumulative effect of the change.

B) Cumulative effect of the change is reported as a special item in the income statement in the year of the change.

C) Effect of the change is spread over the past, current, and future accounting periods.

D) Pro forma financial statements for future years must be disclosed.

Unlock Deck

Unlock for access to all 154 flashcards in this deck.

Unlock Deck

k this deck