Deck 7: Financial Assets: Cash and Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/227

Play

Full screen (f)

Deck 7: Financial Assets: Cash and Receivables

1

The principal attribute of finance leases is that the risks and rewards of asset ownership are deemed to remain with the lessor.

True

2

The use of contingent lease payments is one method companies use to avoid lease capitalization.

True

3

If the straight-line method is used by the lessee to amortize the non-refundable down payment in an operating lease,a constant dollar amount of the prepayment is allocated as expense to each period covered by the lease.

True

4

The term of a finance lease includes the initial lease term and any bargain renewal terms.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

5

A lessee's insurance expense throughout the term of a finance lease is usually an estimate as opposed to an actual expense amount.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

6

The same quantitative thresholds for determining the existence of finance leases apply under both IFRS and ASPE.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

7

Geisler Company leased a building from Ryan Company for 5 years.The first year of the lease was forgiven with payments beginning in the second year.No journal entry is required until the second year.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

8

To qualify as a lessor for tax purposes,a company must derive at least 90% of its revenues from leasing.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

9

The lessor's internal rate of return is normally the rate implicit in the lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

10

All long-term leases should be capitalized in the accounts by the lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

11

The effective interest method is normally used to compute the lessor's finance expense related to a finance lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

12

Any operating or executory costs should be excluded from the calculation of the minimum lease payments.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

13

If a lease transfers the residual value of the leased asset to the lessee at the end of the lease term,the lessee has permanent ownership of the leased asset.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

14

Both guaranteed and unguaranteed residual values should be included in the calculation of the lessee's minimum lease payments of the lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

15

The lessee should use the lessor's borrowing rate (if known)to account for a finance lease,even if this provides a present value of lease payments that is higher than the fair value of the asset at the inception of the lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

16

Operating leases are usually of shorter duration than finance leases and under this type of lease,the risks and rewards of asset ownership remain with the lessor.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

17

The lessee's incremental borrowing rate is the rate that,at the inception of the lease,the lessee would have incurred to borrow over a similar term the funds necessary to purchase the leased asset.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

18

A lessee is usually motivated to report a lease liability as a finance lease because the lessee can capitalize the "cost" of the leased asset.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

19

For an operating lease,the amount initially capitalized by the lessee is the present value of the lease rents to be paid over the lease term.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

20

Companies that opt for finance leases usually do so because of the tax advantages finance leases provide.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

21

A sale and leaseback occurs when one party sells an asset to a second party who then leases it back to the first party.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

22

Both the lessee's interest and depreciation expense should be added back to net income to calculate cash flows from operating activities under the indirect method.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

23

Off-balance sheet financing occurs when a company makes use of assets but does not record the asset or corresponding liability on the financial statements.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

24

Sales-type leases are essentially a selling tool used by manufacturers to sell their merchandise.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

25

Contingent rent is one of three common methods used to avoid capitalization.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

26

Leased assets treated as a finance lease for accounting purposes and an operating lease for tax purposes will create a temporary difference.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

27

Contingent rent is a bargaining tool used by the lessee in order to negotiate a more favourable lease agreement.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

28

For a finance lease,the amount initially capitalized by the lessee is the sum of the future value of the periodic lease payments,plus the future value of any bargain purchase option.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

29

To be classified as a finance lease by the lessee,no important uncertainties surrounding the amount of unreimbursable costs yet to be incurred by the lessor may exist.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

30

The definition of an operating lease is essentially a lease wherein the criteria for finance lease classification have not been met.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

31

Current IFRS standards do not distinguish between sales-type leases direct financing lease,as both are finance leases.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

32

The lessor recognizes two different kinds of earnings for a sales-type lease,that is,dealer's profit and interest revenue.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

33

A finance lease is based upon the view that there was a sale/purchase (between the parties)of the leased asset at the inception date of the lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

34

Under ASPE,if a lessor's estimated future cash flow collections under finance leases are in doubt,an impairment loss may have occurred.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

35

Under both operating and finance leases,periodic rent expense for a lessee is likely to be the same over successive periods.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

36

Under ASPE,if a leased asset's fair value is less than its carrying value at the date of sale under a sale-and-lease-back transaction,the lessor has experienced an impairment loss.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

37

One of the most common methods of avoiding the capitalization of a lease is to enter into lease agreements that provide year-by-year renewal.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

38

A finance lease is accounted for "as if" it transfers a material interest in the leased asset from the lessor to the lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

39

A lessee's debt to equity ratio is not increased if the lease is a finance lease,whereas,it would be if the asset were purchased outright.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

40

A lease which contains a bargain purchase option,but which has a term equal to only 70% of the estimated economic life of the leased property cannot properly be classified as a finance lease by a lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

41

A journal entry is not required for either the lessor or lessee when an operating lease is initiated unless there is an advance payment,such as a lease bonus or prepayment of rent in addition to the periodic rents.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

42

The same lease may be classified differently by the lessor as compared to the classification used by the lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

43

While only certain leases are currently accounted for as a sale or purchase,there is theoretical justification for considering all leases to be sales or purchases.The principle reason that supports this idea is that:

A) a lease reflects the purchase or sale of a quantifiable right to the use of the property.

B) during the life of the lease, the lessee can effectively treat the property as if it were owned by the lessee.

C) all leases are generally for the economic life of the property and the residual value of the property at the end of the lease is minimal.

D) at the end of the lease, the property usually can be purchased by the lessee.

A) a lease reflects the purchase or sale of a quantifiable right to the use of the property.

B) during the life of the lease, the lessee can effectively treat the property as if it were owned by the lessee.

C) all leases are generally for the economic life of the property and the residual value of the property at the end of the lease is minimal.

D) at the end of the lease, the property usually can be purchased by the lessee.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

44

All four finance lease criteria must be met in order for a lease to be deemed a finance lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

45

Assume the following facts relating to a lease: Leased asset,new at inception of lease term.

Estimated useful life,14 years.

Lease term,8 years; asset returns to lessor.

Interest rate implicit in the lease,10 percent (known by lessee).

Lessee's marginal borrowing rate,12 percent.

Amount of each lease payment,$2,000.

Lessor's cost of the leased asset,$15,164.

Market value of leased asset at inception of the lease term,$15,164

Lease payments are due at the end of each period.

From the perspective of the lessee,this lease should be classified as a(n):

A) sales-type lease.

B) direct financing lease.

C) operating lease.

D) finance lease.

Estimated useful life,14 years.

Lease term,8 years; asset returns to lessor.

Interest rate implicit in the lease,10 percent (known by lessee).

Lessee's marginal borrowing rate,12 percent.

Amount of each lease payment,$2,000.

Lessor's cost of the leased asset,$15,164.

Market value of leased asset at inception of the lease term,$15,164

Lease payments are due at the end of each period.

From the perspective of the lessee,this lease should be classified as a(n):

A) sales-type lease.

B) direct financing lease.

C) operating lease.

D) finance lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

46

Under proposed changes to IFRS leasing standards,a lease that is less than 12 months in duration may be classified as long-term if there are substantial penalties for non-renewal.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

47

The recorded values of the asset(s)and corresponding liability at the inception of a finance lease (from the point of view of the lessee)will always be the same under ASPE and IFRS.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

48

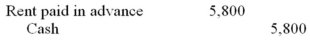

On January 1,2014,WXY signed an operating lease agreement,which required $5,800 annual rentals to be paid at the end of each year.The accounting period ends December 31.At the end of 2014,WXY (lessee)should make the following entry:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

49

The term usually used to describe the situation where a lessee has an option to purchase the leased property at a price that is sufficiently lower than its fair market value so that the exercise of the option appears reasonably assured is:

A) assured purchase option.

B) bargain buy-out option.

C) bargain purchase option.

D) bargain renewal option.

A) assured purchase option.

B) bargain buy-out option.

C) bargain purchase option.

D) bargain renewal option.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

50

Sale and Leaseback arrangements may be finance or operating leases.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

51

In an operating lease,if a non-refundable down payment is made in advance,the lessor should initially debit Cash and credit Unearned Rent (liability).

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

52

Non-refundable payments made in advance on operating leases may be amortized either over the term of the lease,or any other period consistent with the GAAP guidelines for amortizing intangible assets.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

53

Under proposed changes to IFRS leasing standards,leases will generally be classified as short-term or long-term.The finance and operating lease classifications will disappear.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

54

What is the cost basis of an asset acquired by a lease,which is in substance an instalment purchase?

A) The present value of the market price of the asset discounted at an appropriate rate as an amount to be received at the end of the lease

B) The present value of the future minimum lease payments under the lease (exclusive of executory costs and any profit thereon) discounted at an appropriate rate

C) The net realizable value of the asset determined at the date of the lease agreement plus the sum of the future minimum lease payments under the lease

D) The sum of the future minimum lease payments under the lease

A) The present value of the market price of the asset discounted at an appropriate rate as an amount to be received at the end of the lease

B) The present value of the future minimum lease payments under the lease (exclusive of executory costs and any profit thereon) discounted at an appropriate rate

C) The net realizable value of the asset determined at the date of the lease agreement plus the sum of the future minimum lease payments under the lease

D) The sum of the future minimum lease payments under the lease

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

55

The straight-line method is frequently used to amortize non-refundable rental payments made in advance on leased assets because:

A) It is less complex, therefore, less costly.

B) The interest method may result in unreliable amounts being recognized as expense.

C) It is more theoretically sound.

D) IFRS requires that it be used in all situations.

A) It is less complex, therefore, less costly.

B) The interest method may result in unreliable amounts being recognized as expense.

C) It is more theoretically sound.

D) IFRS requires that it be used in all situations.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

56

Under a sales-type lease,the lessor recognizes a dealer's or manufacturer's profit on the date of inception of the lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

57

Each periodic rent collected on a finance lease by the lessor is usually part principal and part interest revenue.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

58

The treatment of gains and losses under Sale and Leaseback arrangements are identical under ASPE and IFRS.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

59

Finance revenue is recognized on a finance lease because the leased asset is considered sold at the inception of the lease,and the lease is a way of financing the lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

60

The appropriate valuation of an operating lease on the balance sheet of a lessee is:

A) the present value of the sum of the lease payments discounted at an appropriate rate.

B) the market value of the asset at the date of the inception of the lease.

C) the absolute sum of the lease payments.

D) zero unless the lessee made a prepayment of rent.

A) the present value of the sum of the lease payments discounted at an appropriate rate.

B) the market value of the asset at the date of the inception of the lease.

C) the absolute sum of the lease payments.

D) zero unless the lessee made a prepayment of rent.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

61

The lessee measures the cost of a leased asset,and the corresponding lease liability of a finance lease,as the:

A) fair market value of the leased asset.

B) future value of the periodic rental payments.

C) sum of the annual cash payments to be made during term of the lease.

D) present value of the periodic rental payments.

A) fair market value of the leased asset.

B) future value of the periodic rental payments.

C) sum of the annual cash payments to be made during term of the lease.

D) present value of the periodic rental payments.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

62

A 5-year lease contract is signed on 1/1/x1 calling for $4,000 to be paid by the lessee on 12/31/x1,and $6,000 on 12/31/x2,x3,and x4.Total lease payments over the lease term are therefore $22,000.The lessee expects to use the leased asset evenly throughout the lease term,which ends 12/31/x4.No payment is due in 20x2.The entry recorded by the lessee for this operating lease,on 12/31/x1 includes which of the following?

A) cr. rent payable $200

B) dr. rent expense $4,400

C) dr. prepaid rent $400

D) dr. rent expense $4,000

A) cr. rent payable $200

B) dr. rent expense $4,400

C) dr. prepaid rent $400

D) dr. rent expense $4,000

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

63

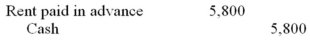

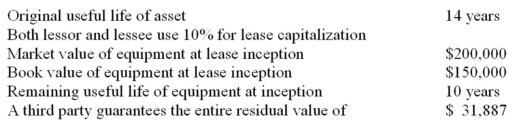

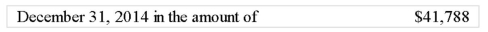

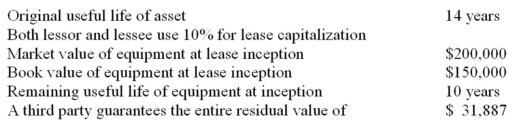

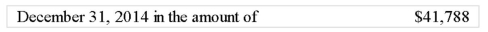

A company became a lessee by leasing equipment on January 1,2014 from a lessor.The lease has the following characteristics:  Six end-of-year lease payments are due beginning

Six end-of-year lease payments are due beginning  The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?

The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?

A) $200,000

B) $181,998

C) $180,000

D) $194,566

E) $178,233

Six end-of-year lease payments are due beginning

Six end-of-year lease payments are due beginning  The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?

The lease term ends December 31,2019 Assume this is a finance lease for both parties.What is the present value of minimum lease payments for the lessee?A) $200,000

B) $181,998

C) $180,000

D) $194,566

E) $178,233

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

64

Lessee ABC INC.leased from Lessor QRS a machine that cost $35,000,which was properly classified as a finance lease by both parties.Assume the lessor used a 12 percent implicit interest rate and that the lessee was informed of that rate.The lease did not include a bargain purchase option and the estimated residual value at termination of the lease was zero.Equal semi-annual lease payments are to be made at the start of each such period,including one on the date the lease was signed.The amount of each semi-annual payment,assuming a five-year lease term,would be:

A) $2,074

B) $2,916

C) $4,486

D) $4,755

E) $9,709

A) $2,074

B) $2,916

C) $4,486

D) $4,755

E) $9,709

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

65

What are the three types of period costs that a lessee experiences with finance leases?

A) Depreciation expense, executory costs, and lease expense.

B) Executory costs, finance expense, and lease expense.

C) Lease expense, finance expense, and depreciation expense.

D) Finance expense, depreciation expense, and executory costs.

A) Depreciation expense, executory costs, and lease expense.

B) Executory costs, finance expense, and lease expense.

C) Lease expense, finance expense, and depreciation expense.

D) Finance expense, depreciation expense, and executory costs.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

66

On January 1,2014,MU Corporation leased an asset,under an operating lease,to obtain the use of a special machine for three years.The lease payments were $9,000 per year payable at each year-end; the lessee must pay all operating expenses.At the inception date,MU Corporation should:

A) record the asset at $27,000.

B) record the rent expense of $27,000.

C) record the asset at its fair market value.

D) record the asset at the present value of the annual lease payments.

E) make no entry.

A) record the asset at $27,000.

B) record the rent expense of $27,000.

C) record the asset at its fair market value.

D) record the asset at the present value of the annual lease payments.

E) make no entry.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following would be excluded from both the minimum lease payments and net lease liability at inception for the lessee?

A) Lessee guarantee of residual.

B) Bargain purchase option.

C) Third party guarantee of residual.

D) Annual lease payments

A) Lessee guarantee of residual.

B) Bargain purchase option.

C) Third party guarantee of residual.

D) Annual lease payments

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

68

At the inception of a finance lease which calls for payments on an annuity due basis,the lessee typically debits:

A) leased asset.

B) lease expense.

C) rent expense.

D) lease receivable.

A) leased asset.

B) lease expense.

C) rent expense.

D) lease receivable.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

69

For a finance lease,an amount equal to the present value at the beginning of the lease term of minimum lease payments during the lease term,excluding that portion of the payments representing executory costs such as insurance,maintenance,and property taxes to be paid by the lessor,together with any profit thereon,should be recorded by the lessee as a(n):

A) expense.

B) asset but not a liability.

C) liability but not an asset.

D) asset and a liability.

A) expense.

B) asset but not a liability.

C) liability but not an asset.

D) asset and a liability.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

70

The estimated residual value of a depreciable leased asset at the end of the lease term is:

A) added to the bargain purchase option at the expiration of the lease.

B) always guaranteed by either the lessor or the lessee.

C) an important factor in how the lessor and lessee must account for the lease.

D) used by the lessor to compute the annual amount of depreciation expense.

A) added to the bargain purchase option at the expiration of the lease.

B) always guaranteed by either the lessor or the lessee.

C) an important factor in how the lessor and lessee must account for the lease.

D) used by the lessor to compute the annual amount of depreciation expense.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

71

When the lessee guarantees the residual value at the end of the lease term,the:

A) lessor will use this amount in computing periodic depreciation expense.

B) lessor will receive an additional cash flow at the end of the lease term.

C) lessee may have to pay the lessor additional cash if the actual residual value is not equal to the estimated residual value.

D) lessee will have to pay the lessor additional cash because the guaranteed residual value was included in computing the annual rental amounts.

A) lessor will use this amount in computing periodic depreciation expense.

B) lessor will receive an additional cash flow at the end of the lease term.

C) lessee may have to pay the lessor additional cash if the actual residual value is not equal to the estimated residual value.

D) lessee will have to pay the lessor additional cash because the guaranteed residual value was included in computing the annual rental amounts.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

72

An asset with a market value of $100,000 is leased on 1/1/x0.Five annual lease payments are due each January 1 beginning 1/1/x0.The unguaranteed residual value on 12/31/x4,the last day of the lease term,is estimated at $40,000.The lessor's implicit interest rate is 8%.What is the annual lease payment?

A) $18,227

B) $16,877

C) $23,191

D) $25,046

A) $18,227

B) $16,877

C) $23,191

D) $25,046

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

73

XYZ leased a tract of land for a 20-year term.The lease agreement did not contain a bargain purchase option,and consequently,the land will revert back to the lessor at the end of the lease term.At the inception of the lease,XYZ initiated construction on a small building on the land.The building was completed at the end of the third year of the lease,at a cost of $60,000.The building was a permanent structure on the land.Its estimated life was 20 years and was expected to have no residual value.XYZ should record annual depreciation (straight-line)on the building of:

A) $2,400

B) $3,000

C) $3,529

D) $6,000

A) $2,400

B) $3,000

C) $3,529

D) $6,000

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

74

A lessee is attempting to circumvent the accounting rules,which require lease capitalization.Which of the following is most likely to lead to classification of a lease as an operating lease for the lessee?

A) contract provides that lessee pays executory costs

B) contract provides for a third-party guarantee of residual value

C) attempt to reduce the lessee's borrowing rate

D) increase the term of the lease. decrease annual executory costs

A) contract provides that lessee pays executory costs

B) contract provides for a third-party guarantee of residual value

C) attempt to reduce the lessee's borrowing rate

D) increase the term of the lease. decrease annual executory costs

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

75

CDE leases land and secures the landowner's permission to erect a warehouse on the leased site.The lease has 25 years to run from the time CDE completes the warehouse at a cost of $300,000.The warehouse is expected to last 50 years.In connection with the warehouse,CDE's annual depreciation should be:

A) $6,000

B) $7,500

C) $12,000

D) The entire $300,000 should be expensed the first year.

A) $6,000

B) $7,500

C) $12,000

D) The entire $300,000 should be expensed the first year.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

76

The following information relates to a lease contract: Inception: 1/1/x1

Annual lease payments of $3,000 due each 12/31 beginning 12/31/x1

End of lease term: 1/1/x5

There are 4 lease payments in all

Useful life of asset at inception: 10 yrs

Expected residual value at 1/1/x5: $6,000

Lessee is given option to purchase asset at 1/1/x5 for $1,000

Using an interest rate of 10%,what is the present value of minimum lease payments for the lessee at inception?

A) $10,193

B) $9,510

C) $10,419

D) $13,608

E) $13,000

Annual lease payments of $3,000 due each 12/31 beginning 12/31/x1

End of lease term: 1/1/x5

There are 4 lease payments in all

Useful life of asset at inception: 10 yrs

Expected residual value at 1/1/x5: $6,000

Lessee is given option to purchase asset at 1/1/x5 for $1,000

Using an interest rate of 10%,what is the present value of minimum lease payments for the lessee at inception?

A) $10,193

B) $9,510

C) $10,419

D) $13,608

E) $13,000

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

77

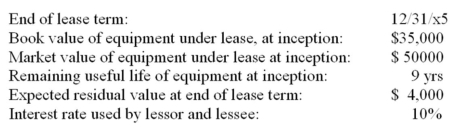

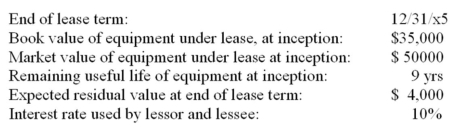

A lessor and lessee enter into a lease agreement with the following characteristics: Inception: 1/1/x0

6 annual lease payments of $10,000 are due each Jan.1 beginning

1/1/x0 Assuming the lessee will capitalize this lease,what is the amount of the net lease liability at inception,before the first payment is made?

Assuming the lessee will capitalize this lease,what is the amount of the net lease liability at inception,before the first payment is made?

A) $47,908

B) $60,000

C) $50,166

D) $64,000

6 annual lease payments of $10,000 are due each Jan.1 beginning

1/1/x0

Assuming the lessee will capitalize this lease,what is the amount of the net lease liability at inception,before the first payment is made?

Assuming the lessee will capitalize this lease,what is the amount of the net lease liability at inception,before the first payment is made?A) $47,908

B) $60,000

C) $50,166

D) $64,000

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

78

An asset with a market value of $100,000 is leased on 1/1/x0.Five annual lease payments are due each January 1 beginning 1/1/x0.The lessee guarantees the $40,000 residual value as of 12/31/x4,the last day of the lease term.The lessor's implicit interest rate is 8%.What is the annual lease payment?

A) $18,227

B) $16,877

C) $23,191

D) $25,046

A) $18,227

B) $16,877

C) $23,191

D) $25,046

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

79

If the residual value of a leased asset turns out to be more than the amount guaranteed by the lessee,the:

A) lessee may reduce depreciation expense for the prior year, through a prior period adjustment, to take into account the excess.

B) lessor is under no obligation to compensate the lessee for the excess.

C) lessor must pay the lessee the amount of the excess.

D) lessee may reduce the annual rentals for the excess.

A) lessee may reduce depreciation expense for the prior year, through a prior period adjustment, to take into account the excess.

B) lessor is under no obligation to compensate the lessee for the excess.

C) lessor must pay the lessee the amount of the excess.

D) lessee may reduce the annual rentals for the excess.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck

80

The depreciation period used by the lessee for a depreciable leased asset must be:

A) the same period that was used by the lessor.

B) the remaining life of the asset from the lease inception.

C) the term of the lease.

D) at most the term of the lease but possibly longer if title is transferred at end of lease.

A) the same period that was used by the lessor.

B) the remaining life of the asset from the lease inception.

C) the term of the lease.

D) at most the term of the lease but possibly longer if title is transferred at end of lease.

Unlock Deck

Unlock for access to all 227 flashcards in this deck.

Unlock Deck

k this deck