Deck 4: Corporate Governance Around the World

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/27

Play

Full screen (f)

Deck 4: Corporate Governance Around the World

1

The 3 month forward rate between British pound and the Swiss franc is £0.5.A speculator predicts the spot rate in three months to be £0.51 and has £1,000,000 for speculation.The speculator should not

A)get a long position on British pounds

B)get a short position on Swiss francs

C)speculate

D)get a long position on Swiss francs

A)get a long position on British pounds

B)get a short position on Swiss francs

C)speculate

D)get a long position on Swiss francs

D

2

The US dollar is quoted directly against the Canadian dollar (US$/C$)and indirectly against the yen (¥/US$).In order to get the Canadian dollar - yen cross rate you need to:

A)divide the first exchange rate by the second exchange rate

B)divide the second exchange rate by the first exchange rate

C)multiply the first exchange rate by the second exchange rate

D)multiply the first exchange rate by the inverse of the second exchange rate

A)divide the first exchange rate by the second exchange rate

B)divide the second exchange rate by the first exchange rate

C)multiply the first exchange rate by the second exchange rate

D)multiply the first exchange rate by the inverse of the second exchange rate

C

3

The $/CD spot bid-ask rates are $0.7560-$0.7625.The 3-month forward points are 12-16.Determine the $/CD 3-month forward bid-ask rates.

A)$0.7548-$0.7609

B)$0.7572-$0.7641

C)$0.7512-$0.7616

D)cannot be determined with the information given

A)$0.7548-$0.7609

B)$0.7572-$0.7641

C)$0.7512-$0.7616

D)cannot be determined with the information given

B

4

The foreign exchange market closes:

A)Never

B)4:00 p.m.EST (New York time)

C)4:00 p.m.GMT (London time)

D)4:00 p.m.(Tokyo time)

A)Never

B)4:00 p.m.EST (New York time)

C)4:00 p.m.GMT (London time)

D)4:00 p.m.(Tokyo time)

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

5

The 3 month forward rate between British pound and the Swiss franc is £0.5/SF.The current spot rate is £0.51/SF.

A)The Swiss franc is trading at a 1.96% premium to the British pound for delivery in 90 days.

B)The Swiss franc is trading at a 7.84% premium to the British pound for delivery in 90 days.

C)The Swiss franc is trading at a 1.96% discount to the British pound for delivery in 90 days.

D)The Swiss franc is trading at a 7.84% discount to the British pound for delivery in 90 days.

A)The Swiss franc is trading at a 1.96% premium to the British pound for delivery in 90 days.

B)The Swiss franc is trading at a 7.84% premium to the British pound for delivery in 90 days.

C)The Swiss franc is trading at a 1.96% discount to the British pound for delivery in 90 days.

D)The Swiss franc is trading at a 7.84% discount to the British pound for delivery in 90 days.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

6

On average,worldwide daily trading of foreign exchange is:

A)$15.95 billion

B)impossible to estimate

C)$504 billion

D)$3.21 trillion

A)$15.95 billion

B)impossible to estimate

C)$504 billion

D)$3.21 trillion

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

7

Most foreign exchange transactions are for:

A)intervention

B)speculation or arbitrage

C)retail trade

D)purchase of currencies

A)intervention

B)speculation or arbitrage

C)retail trade

D)purchase of currencies

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

8

If the speculator's predictions prove wrong and the actual spot rate in 3 months is £0.52 speculator will make a loss of

A)£20,000

B)£38,461

C)SF 20,000

D)SF 38,461

A)£20,000

B)£38,461

C)SF 20,000

D)SF 38,461

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

9

The foreign exchange market is:

A)an organized exchange with trading floors around the world

B)an over-the-counter market

C)a market with a central market place

D)non existent

A)an organized exchange with trading floors around the world

B)an over-the-counter market

C)a market with a central market place

D)non existent

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

10

If the speculator's predictions prove correct,the speculator will make a profit of

A)£10,000

B)£20,048

C)SF 10,000

D)SF 20,048

A)£10,000

B)£20,048

C)SF 10,000

D)SF 20,048

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

11

The world's largest foreign exchange trading center is:

A)New York

B)Tokyo

C)London

D)Hong Kong

A)New York

B)Tokyo

C)London

D)Hong Kong

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

12

All of the following are key elements of a forward contract except:

A)forward rate

B)maturity

C)settlement date

D)settlement function

A)forward rate

B)maturity

C)settlement date

D)settlement function

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

13

The SF/$ spot exchange rate is 1.25 and the 180 forward exchange rate is 1.30.The forward premium (discount)is:

A)The dollar is trading at an 8% premium to the Swiss franc for delivery in 180 days.

B)The dollar is trading at a 4% premium to the Swiss franc for delivery in 180 days.

C)The dollar is trading at an 8% discount to the Swiss franc for delivery in 180 days.

D)The dollar is trading at a 4% discount to the Swiss franc for delivery in 180 days.

A)The dollar is trading at an 8% premium to the Swiss franc for delivery in 180 days.

B)The dollar is trading at a 4% premium to the Swiss franc for delivery in 180 days.

C)The dollar is trading at an 8% discount to the Swiss franc for delivery in 180 days.

D)The dollar is trading at a 4% discount to the Swiss franc for delivery in 180 days.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

14

The speculator

A)Should sell the British pound forward

B)Should sell the Swiss franc forward

C)Cannot make any speculative profit

D)Can make a guaranteed profit

A)Should sell the British pound forward

B)Should sell the Swiss franc forward

C)Cannot make any speculative profit

D)Can make a guaranteed profit

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

15

Intervention in the foreign exchange market is the process of:

A)A central bank requiring the commercial banks of that country to trade at a set price level.

B)Commercial banks in different countries coordinating efforts in order to stabilize one or more currencies.

C)A central bank buying or selling its currency in order to influence its value.

D)The government of a country prohibiting transactions in one or more currencies.

A)A central bank requiring the commercial banks of that country to trade at a set price level.

B)Commercial banks in different countries coordinating efforts in order to stabilize one or more currencies.

C)A central bank buying or selling its currency in order to influence its value.

D)The government of a country prohibiting transactions in one or more currencies.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

16

Participants in the interbank foreign exchange markets include the following except:

A)international banks

B)foreign exchange brokers

C)nonbank dealers

D)credit unions

A)international banks

B)foreign exchange brokers

C)nonbank dealers

D)credit unions

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

17

The S$/$ spot exchange rate is 1.60,the C$/$ spot rate is 1.33 and the S$/C$ 1.15.Determine the triangular arbitrage profit that is possible if you have $1,000,000.

A)$44,063 profit

B)$46,093 loss

C)No profit is possible

D)$46,093 profit

A)$44,063 profit

B)$46,093 loss

C)No profit is possible

D)$46,093 profit

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

18

If the $/£ bid and ask prices are $1.50 and 1.51,respectively,the corresponding £/$ bid and ask prices are:

A)£0.6667 and £0.6623

B)$1.51 and $1.50

C)£0.6623 and £0.6667

D)cannot be determined with the information given

A)£0.6667 and £0.6623

B)$1.51 and $1.50

C)£0.6623 and £0.6667

D)cannot be determined with the information given

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

19

Exchange rates are quoted on American terms if:

A)The US dollar is quoted directly

B)The US dollar is quoted indirectly

C)The US dollar is not quoted

D)The US dollar is quoted in the denominator

A)The US dollar is quoted directly

B)The US dollar is quoted indirectly

C)The US dollar is not quoted

D)The US dollar is quoted in the denominator

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

20

The AUD/$ spot exchange rate is 1.60 and the SF/$ is 1.25.The AUD/SF cross exchange rate is:

A)0.7813

B)2.0000

C)1.2800

D)0.3500

A)0.7813

B)2.0000

C)1.2800

D)0.3500

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

21

The current spot exchange rate is $1.6/euro and the 6-months forward rate is $1.63/euro.You think that the spot rate will be $1.62/euro in six months.Assume that you can buy or sell euro100,000.

a)What would be your expected profit from speculating in the forward market?

b)What would be you profit if the actual spot rate in 6 months is $1.60/euro?

a)What would be your expected profit from speculating in the forward market?

b)What would be you profit if the actual spot rate in 6 months is $1.60/euro?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

22

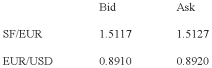

The following rates are given:  Determine the bid and ask rate and the spread on the SF against the dollar.

Determine the bid and ask rate and the spread on the SF against the dollar.

Determine the bid and ask rate and the spread on the SF against the dollar.

Determine the bid and ask rate and the spread on the SF against the dollar.

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

23

The following quotes are given for the Euro against the US dollar:

0.9075 - 85,15-10,22-11,30-15 for the spot,one month,three months and six months forward contracts.

a)Calculate the outright quotations and the spread for each maturity.

b)Is the dollar at a forward premium or discount?

c)Where are the interest rates higher?

0.9075 - 85,15-10,22-11,30-15 for the spot,one month,three months and six months forward contracts.

a)Calculate the outright quotations and the spread for each maturity.

b)Is the dollar at a forward premium or discount?

c)Where are the interest rates higher?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

24

If CIBC posts 1.10CAD/USD - 1.14 CAD/USD bid-ask exchange rates,Scotiabank posts 1.12CAD/USD - 1.15 CAD/USD,and Bank of America posts 0.88USD/CAD - 0.9 USD/CAD exchange rates,what is the maximum amount of CAD can you get for 1 USD?

A)1.100

B)1.111

C)1.120

D)1.136

A)1.100

B)1.111

C)1.120

D)1.136

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

25

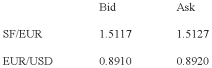

Given the following information:  a)What kind of arbitrage is possible?

a)What kind of arbitrage is possible?

b)If you have SF100,000 for the arbitrage,what arbitrage profit can be made?

c)At what exchange rate at the Credit Suisse would there be no arbitrage (assume that the other two exchange rates don't change)?

a)What kind of arbitrage is possible?

a)What kind of arbitrage is possible?b)If you have SF100,000 for the arbitrage,what arbitrage profit can be made?

c)At what exchange rate at the Credit Suisse would there be no arbitrage (assume that the other two exchange rates don't change)?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

26

Assume the following quotes:

1)Bank A:

$1.5400/pound

2)Bank B:

EURO 1.6000/pound

3)Bank C: $0.9700/EURO

a)Can a trader make a profit on these quotes?

b)Assume that the trader has $1,000,000 or the equivalent in another currency available for the transaction.What profit can the trader make?

1)Bank A:

$1.5400/pound

2)Bank B:

EURO 1.6000/pound

3)Bank C: $0.9700/EURO

a)Can a trader make a profit on these quotes?

b)Assume that the trader has $1,000,000 or the equivalent in another currency available for the transaction.What profit can the trader make?

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck

27

If CIBC posts 1.10CAD/USD - 1.14 CAD/USD bid-ask exchange rates,Scotiabank posts 1.12CAD/USD - 1.15 CAD/USD bid-ask exchange rates,and RBC posts 1.13-1.16 bid-ask exchange rates,which of the following statements is correct:

A)You can make an arbitrage by exchanging CAD for USD at CIBC and then exchanging USD for CAD at RBC

B)You can make an arbitrage by exchanging USD for CAD at CIBC and then exchanging CAD for USD at RBC

C)You can make an arbitrage but none of these strategies allows you to make the arbitrage

D)Arbitrage is not possible

A)You can make an arbitrage by exchanging CAD for USD at CIBC and then exchanging USD for CAD at RBC

B)You can make an arbitrage by exchanging USD for CAD at CIBC and then exchanging CAD for USD at RBC

C)You can make an arbitrage but none of these strategies allows you to make the arbitrage

D)Arbitrage is not possible

Unlock Deck

Unlock for access to all 27 flashcards in this deck.

Unlock Deck

k this deck