Deck 20: International Trade Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 20: International Trade Finance

1

The foreign tax credit method followed by the United States is:

A)to grant the parent firm credit against its U.S.tax liability for taxes paid to foreign tax authorities on foreign-source income

B)for the purpose of avoiding double taxation

C)a and b

D)none of these

A)to grant the parent firm credit against its U.S.tax liability for taxes paid to foreign tax authorities on foreign-source income

B)for the purpose of avoiding double taxation

C)a and b

D)none of these

C

2

A tax levied on passive income earned by an individual or a corporation of one country within the tax jurisdiction of another is called

A)foreign income tax

B)value-added tax

C)investment tax

D)withholding tax

A)foreign income tax

B)value-added tax

C)investment tax

D)withholding tax

D

3

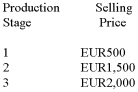

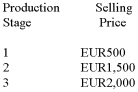

A product has the following stages of production:  If the value-added tax (VAT)rate is 20%,what would be the incremental VAT at the final stage of production?

If the value-added tax (VAT)rate is 20%,what would be the incremental VAT at the final stage of production?

A)EUR50

B)EUR100

C)EUR200

D)EUR400

If the value-added tax (VAT)rate is 20%,what would be the incremental VAT at the final stage of production?

If the value-added tax (VAT)rate is 20%,what would be the incremental VAT at the final stage of production?A)EUR50

B)EUR100

C)EUR200

D)EUR400

B

4

The three basic types of taxation are:

A)income tax, withholding tax, and value-added tax

B)income tax, withholding tax, business tax

C)withholding tax, value-added tax, corporate tax

D)personal tax, corporate tax, and operating tax

A)income tax, withholding tax, and value-added tax

B)income tax, withholding tax, business tax

C)withholding tax, value-added tax, corporate tax

D)personal tax, corporate tax, and operating tax

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Value-added tax is

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

To tax national residents of a country on their worldwide income is called

A)worldwide or residential taxation

B)worldwide or source taxation

C)territorial or residential taxation

D)territorial or source taxation

A)worldwide or residential taxation

B)worldwide or source taxation

C)territorial or residential taxation

D)territorial or source taxation

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

To tax all income earned with the country by any taxpaper is called

A)worldwide or residential taxation

B)worldwide or source taxation

C)territorial or residential taxation

D)territorial or source taxation

A)worldwide or residential taxation

B)worldwide or source taxation

C)territorial or residential taxation

D)territorial or source taxation

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

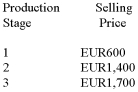

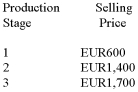

A product sells in the first stage of production for EUR600,the second stage of production for EUR 1,400 and the third stage of production for EUR 1,700.If the value-added tax (VAT)rate is 15%,what would be the total VAT?

A)EUR 90

B)EUR120

C)EUR210

D)EUR255

A)EUR 90

B)EUR120

C)EUR210

D)EUR255

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

When excess tax credits go unused,the foreign tax liability for a branch is greater than the corresponding U.S.tax liability when the foreign income tax rate is greater than the U.S.rate.Calculate the total tax liability for a wholly-owned subsidiary when excess tax credits cannot be used in a country given:

U)S.tax rate = 35%

Foreign tax rate = 39%

Withholding tax rate = 5%

A)30.00%

B)35.00%

C)39.00%

D)42.05%

U)S.tax rate = 35%

Foreign tax rate = 39%

Withholding tax rate = 5%

A)30.00%

B)35.00%

C)39.00%

D)42.05%

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

A foreign subsidiary is:

A)an extension of the parent and is not an independently incorporated firm separate from the parent

B)an affiliate organization of the MNC that is independently incorporated in the foreign country, and one in which the U.S.MNC owns at least 10 percent of the voting equity stock

C)either a minority foreign subsidiary (an uncontrolled foreign corporation) or a controlled foreign corporation

D)b and c

A)an extension of the parent and is not an independently incorporated firm separate from the parent

B)an affiliate organization of the MNC that is independently incorporated in the foreign country, and one in which the U.S.MNC owns at least 10 percent of the voting equity stock

C)either a minority foreign subsidiary (an uncontrolled foreign corporation) or a controlled foreign corporation

D)b and c

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

Assume that a product as the following three stages of production:  If the value-added tax (VAT)rate is 15%,what would be the incremental VAT at Stage 2 of production?

If the value-added tax (VAT)rate is 15%,what would be the incremental VAT at Stage 2 of production?

A)EUR90

B)EUR120

C)EUR210

D)EUR255

If the value-added tax (VAT)rate is 15%,what would be the incremental VAT at Stage 2 of production?

If the value-added tax (VAT)rate is 15%,what would be the incremental VAT at Stage 2 of production?A)EUR90

B)EUR120

C)EUR210

D)EUR255

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Income tax is

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is true about the taxes paid by Canadian-based MNC to Canadian government on the foreign-source income:

A)They are equal to the firm's ordinal income tax rate times the amount of foreign-source income

B)They are equal to half of the firm's ordinal income tax rate times the amount of foreign-source income

C)They are equal to the firm's ordinal income tax rate times the amount of foreign-source income minus tax credits on taxes paid abroad

D)They are equal to zero

A)They are equal to the firm's ordinal income tax rate times the amount of foreign-source income

B)They are equal to half of the firm's ordinal income tax rate times the amount of foreign-source income

C)They are equal to the firm's ordinal income tax rate times the amount of foreign-source income minus tax credits on taxes paid abroad

D)They are equal to zero

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

A controlled foreign corporation (CFC)is:

A)a foreign corporation established as an affiliate of a U.S.corporation for the purpose of "buying" from the U.S.corporation property for resale and use abroad

B)a foreign subsidiary that has more than 50 percent of its voting equity owned by U.S.shareholders

C)is a separate domestic U.S.corporation actively engaged in business in a U.S.possession (Puerto Rico and the U.S.Virgin Islands)

D)one that has no "overall limitation" as regards to its foreign tax credits

A)a foreign corporation established as an affiliate of a U.S.corporation for the purpose of "buying" from the U.S.corporation property for resale and use abroad

B)a foreign subsidiary that has more than 50 percent of its voting equity owned by U.S.shareholders

C)is a separate domestic U.S.corporation actively engaged in business in a U.S.possession (Puerto Rico and the U.S.Virgin Islands)

D)one that has no "overall limitation" as regards to its foreign tax credits

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Two fundamental policy objectives in international taxation are

A)tax neutrality and international treatment

B)tax revenues and national treatment

C)tax neutrality and national treatment

D)tax revenues and international treatment

A)tax neutrality and international treatment

B)tax revenues and national treatment

C)tax neutrality and national treatment

D)tax revenues and international treatment

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

A foreign branch is:

A)an extension of the parent and is not an independently incorporated firm separate from the parent

B)an affiliate organization of the MNC that is independently incorporated in the foreign country, and one in which the U.S.MNC owns at least 10 percent of the voting equity stock

C)either a minority foreign subsidiary (an uncontrolled foreign corporation) or a controlled foreign corporation

D)b and c

A)an extension of the parent and is not an independently incorporated firm separate from the parent

B)an affiliate organization of the MNC that is independently incorporated in the foreign country, and one in which the U.S.MNC owns at least 10 percent of the voting equity stock

C)either a minority foreign subsidiary (an uncontrolled foreign corporation) or a controlled foreign corporation

D)b and c

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Value-added tax (VAT)is:

A)a direct national tax levied on the value added in the production of a good (or service) as it moves through various stages of production

B)an indirect national tax levied on the value added in the production of a good (or service) as it moves through various stages of production

C)the equivalent of imposing a national sales tax

D)b and c

A)a direct national tax levied on the value added in the production of a good (or service) as it moves through various stages of production

B)an indirect national tax levied on the value added in the production of a good (or service) as it moves through various stages of production

C)the equivalent of imposing a national sales tax

D)b and c

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Withholding tax is

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

A)a tax levied on passive income earned by an individual or corporation of one country within the jurisdiction of another country

B)a direct tax on personal and corporate income

C)an indirect national tax levied on the value added in the production of a good or service

D)an indirect national tax levied on personal and corporate income

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

The term "capital export neutrality" refers to:

A)the criterion that an ideal tax should be effective in raising revenue for the government and not have any negative effects on the economic decision-making process of the taxpayer

B)the fact that taxable income is taxed in the same manner by the taxpayer's national tax authority regardless of where in the world it is earned

C)the criterion that the tax burden a host country imposes on the foreign subsidiary of a MNC should be the same regardless in which country the MNC is incorporated and the same as that placed on domestic firms

D)underlying principle that all similarly situated taxpayers should participate in the cost of operating the government according to the same rules

A)the criterion that an ideal tax should be effective in raising revenue for the government and not have any negative effects on the economic decision-making process of the taxpayer

B)the fact that taxable income is taxed in the same manner by the taxpayer's national tax authority regardless of where in the world it is earned

C)the criterion that the tax burden a host country imposes on the foreign subsidiary of a MNC should be the same regardless in which country the MNC is incorporated and the same as that placed on domestic firms

D)underlying principle that all similarly situated taxpayers should participate in the cost of operating the government according to the same rules

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

A "tax haven" country is one that has a low,or zero percent,national tax rates.Some of the countries that fall into this category are:

A)Bahamas, Bahrain, Bermuda, and the Cayman Islands

B)Denmark, Norway, Switzerland, and Sweden

C)Bulgaria, Canada, Saudi Arabia, and South Africa

D)Congo, Egypt, Kuwait, and Zaire

A)Bahamas, Bahrain, Bermuda, and the Cayman Islands

B)Denmark, Norway, Switzerland, and Sweden

C)Bulgaria, Canada, Saudi Arabia, and South Africa

D)Congo, Egypt, Kuwait, and Zaire

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

What are the major ways in which countries levy taxes?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

ABC Inc.,an exporting firm,expects to earn $20 million if the dollar depreciates,but only $10 million if the dollar appreciates.Assume that the dollar has an equal chance of appreciating or depreciating.Calculate the expected tax of ABC if it is operating in a foreign country that has progressive corporate taxes as shown below:

Corporate income tax rate = 15% for the first $7,500,000.

Corporate income tax rate = 30% for earnings exceeding $7,500,000.

Corporate income tax rate = 15% for the first $7,500,000.

Corporate income tax rate = 30% for earnings exceeding $7,500,000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Calculate the American foreign tax credit for a subsidiary in Germany.Assume that the German income tax rate is 50%,the American income tax rate is 35%,and the withholding tax rate is 10%.The taxable income in Germany is 500.Assume that all income is remitted to the parent immediately.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

How can double taxation result out of the two major ways to determine who has to pay taxes?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

A product sells for EUYR 1,6000 in the first production stage,EUR2,000 the second and EUR2,700 in the third and last production stage.If the value-added tax (VAT)rate is 20%,what would be the incremental VAT at each state of production?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck