Deck 18: International Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

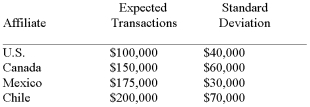

Question

Question

Question

Question

Question

Question

Question

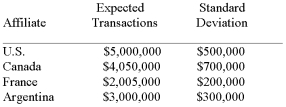

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 18: International Capital Budgeting

1

Calculate,in Singapore dollars,the amount that the interaffiliate foreign exchange transaction will be reduced by with multilateral netting.

A)S$152,000

B)S$170,000

C)S$322,000

D)S$405,000

A)S$152,000

B)S$170,000

C)S$322,000

D)S$405,000

B

2

Unexpected Funds blockage is a

A)Credit risk

B)Unavoidable risk

C)Unlikely risk

D)Political risk

A)Credit risk

B)Unavoidable risk

C)Unlikely risk

D)Political risk

D

3

If the transfer price is $8,000,what is the income tax paid in the United States?

A)300

B)400

C)700

D)1,000

A)300

B)400

C)700

D)1,000

A

4

Using the national airlines of the host country that has enforced exchange rate controls is an example of

A)Direct negotiation

B)Export creation

C)Blocked funds

D)Creative thinking

A)Direct negotiation

B)Export creation

C)Blocked funds

D)Creative thinking

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is not a basic method used by the internal revenue service (IRS)to establish an arm's-length price for tangible goods?

A)Comparable controlled price

B)Comparable uncontrolled price

C)Resale price

D)Cost-plus approach

A)Comparable controlled price

B)Comparable uncontrolled price

C)Resale price

D)Cost-plus approach

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

The United States decides to block funds leaving the country.What is the optimum transfer price?

A)6,000

B)7,000

C)9,000

D)10,000

A)6,000

B)7,000

C)9,000

D)10,000

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

If the transfer price is $8,000,what is the net income in Canada?

A)800

B)1,200

C)2,000

D)2,400

A)800

B)1,200

C)2,000

D)2,400

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

When a country enforces exchange controls the profits of a subsidiary in that country are referred to as:

A)Stuck funds

B)Locked profits

C)Blocked funds

D)Lost funds

A)Stuck funds

B)Locked profits

C)Blocked funds

D)Lost funds

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

If Canada changes its corporate income tax to 35%,does the optimum transfer price change?

A)Yes, it increases

B)Yes, it decreases

C)No, it doesn't change

D)Need more information

A)Yes, it increases

B)Yes, it decreases

C)No, it doesn't change

D)Need more information

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements about multilateral netting system are correct?

(i)- each affiliate nets all its interaffiliate receipts against all its disbursements

(ii)- it transfers or receives a balance,depending on whether it is a net payer or receiver

(iii)- the net funds to be received by the affiliates will equal the net disbursements to be made by the affiliates

(iv)- only two foreign exchange transactions are necessary since the affiliates' net receipts will always be equal to zero

(v)- only two foreign exchange transactions are necessary since the affiliates' net disbursements will always be equal to zero

A)(i) and (ii)

B)(i), (ii), and (iii)

C)(i), (ii), (iii), and (iv)

D)(i), (ii), (iii), and (v)

(i)- each affiliate nets all its interaffiliate receipts against all its disbursements

(ii)- it transfers or receives a balance,depending on whether it is a net payer or receiver

(iii)- the net funds to be received by the affiliates will equal the net disbursements to be made by the affiliates

(iv)- only two foreign exchange transactions are necessary since the affiliates' net receipts will always be equal to zero

(v)- only two foreign exchange transactions are necessary since the affiliates' net disbursements will always be equal to zero

A)(i) and (ii)

B)(i), (ii), and (iii)

C)(i), (ii), (iii), and (iv)

D)(i), (ii), (iii), and (v)

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

In reference to establishing "transfer prices" between the affiliates of an MNC,which of the following relates to the "resale" price approach?

A)comparable uncontrolled price between unrelated firms

B)the price at which the good is resold by the distribution affiliate is reduced by an amount to cover overhead costs and a reasonable profit

C)assumes that the manufacturing cost is readily available

D)is based on financial and economic models and econometric techniques

A)comparable uncontrolled price between unrelated firms

B)the price at which the good is resold by the distribution affiliate is reduced by an amount to cover overhead costs and a reasonable profit

C)assumes that the manufacturing cost is readily available

D)is based on financial and economic models and econometric techniques

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

Assume that Y pays a tax deductible tariff of 7 percent on imported merchandise.Calculate the increase in annual after-tax profits if the higher transfer price of $1,250 per unit is used.

A)$50,000

B)$100,000

C)$125,000

D)$250,000

A)$50,000

B)$100,000

C)$125,000

D)$250,000

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

If foreign exchange transactions cost ABC 0.45 percent,what savings results from netting?

A)S$ 684

B)S$ 765

C)S$1,449

D)S$1,823

A)S$ 684

B)S$ 765

C)S$1,449

D)S$1,823

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

Efficient cash management techniques can:

A)reduce the investment in cash balances and foreign exchange transaction expenses

B)provide for maximum return from the investment of excess cash

C)result in borrowing at lowest rate when a temporary cash shortage exists

D)all of these

A)reduce the investment in cash balances and foreign exchange transaction expenses

B)provide for maximum return from the investment of excess cash

C)result in borrowing at lowest rate when a temporary cash shortage exists

D)all of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Assuming that the interaffiliate cash flows are uncorrelated with one another,calculate the standard deviation of the portfolio of cash held by the centralized depository for the following affiliate members:

A)60,000

B)88,122

C)104,881

D)120,103

A)60,000

B)88,122

C)104,881

D)120,103

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

Assume that the US and Canadian governments impose no restrictions on transfer pricing.What transfer price should Company ABC charge?

A)5,000

B)6,000

C)7,000

D)10,000

A)5,000

B)6,000

C)7,000

D)10,000

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements about transfer pricing is true?

A)the higher the transfer price, the larger the gross profits of the transferring division relative to the receiving division

B)very high markup policy used in the transfer pricing to a subsidiary makes the adjusted present value (APV) of that subsidiary's capital expenditure appear less attractive

C)very low markup policy used in the transfer pricing to a subsidiary makes the adjusted present value (APV) of that subsidiary's capital expenditure appear less attractive

D)a and b

A)the higher the transfer price, the larger the gross profits of the transferring division relative to the receiving division

B)very high markup policy used in the transfer pricing to a subsidiary makes the adjusted present value (APV) of that subsidiary's capital expenditure appear less attractive

C)very low markup policy used in the transfer pricing to a subsidiary makes the adjusted present value (APV) of that subsidiary's capital expenditure appear less attractive

D)a and b

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Calculate the increase in annual after-tax profits if the higher transfer price of $1,250 per unit is used.

A)$250,000

B)$500,000

C)$1,000,000

D)$1,250,000

A)$250,000

B)$500,000

C)$1,000,000

D)$1,250,000

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements in not true about a centralized cash depository?

A)All cash is remitted to the central cash pool

B)Excess cash is remitted to the central cash pool

C)The central cash manager arranges to cover shortages of cash

D)It facilitates fund moblization

A)All cash is remitted to the central cash pool

B)Excess cash is remitted to the central cash pool

C)The central cash manager arranges to cover shortages of cash

D)It facilitates fund moblization

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

"Unbundling fund transfers" from an MNC and to its affiliates refers to the following activity:

A)instead of lumping all costs into a single transfer price, for the MNC (parent firm) to recognize the cost of the physical good and each service separately that it provides to its affiliates

B)in addition to charging for the cost of the physical good, for the parent firm to charge for technical training of the affiliates' staff, cost of worldwide advertising, royalty, licensing fee, and technology, whenever applicable

C)used for removing blocked funds from a host country that is enforcing foreign exchange restrictions

D)all of these

A)instead of lumping all costs into a single transfer price, for the MNC (parent firm) to recognize the cost of the physical good and each service separately that it provides to its affiliates

B)in addition to charging for the cost of the physical good, for the parent firm to charge for technical training of the affiliates' staff, cost of worldwide advertising, royalty, licensing fee, and technology, whenever applicable

C)used for removing blocked funds from a host country that is enforcing foreign exchange restrictions

D)all of these

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

Explain why governments regulate transfer prices for international transactions.What are the major rules that are applied?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

If interaffiliate cash flows are uncorrelated with one another,what is the standard deviation of the portfolio of cash held by the centralized depository for the following affiliate members:

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Soleil Inc.has an affiliate in Brazil and one in South Africa.The entire production of the South Africa affiliate is sold to the affiliate in Brazil which sells the final product to customers.The Brazilian affiliate has sales of 1000 and overhead costs of 100.The cost of goods sold in South Africa is 500 and overhead amounts to 300.The income tax rates are 40 percent in Brazil and 20 percent in South Africa.Assume that neither South Africa nor Brazil put any restrictions on the transfer price.What is the optimal transfer price?

What are the total taxes paid?

What are the total taxes paid?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

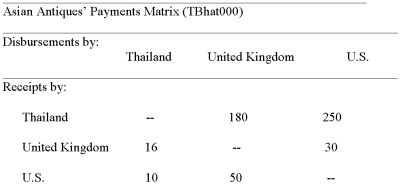

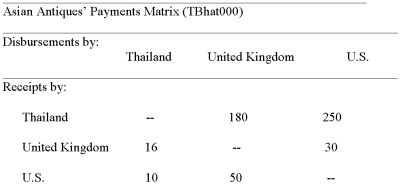

Asian Antiques of Bangkok,Thailand,buys antiques in Asia and sells them via sales affiliates in the United Kingdom and the Unites States.The following payments matrix of interaffiliate cash flows,stated in Thailand is forecasted for next month.  What is the total amount of interaffiliate foreign exchange transaction with bilateral netting?

What is the total amount of interaffiliate foreign exchange transaction with bilateral netting?

What is the total amount of interaffiliate foreign exchange transaction with bilateral netting?

What is the total amount of interaffiliate foreign exchange transaction with bilateral netting?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Soleil Inc.has an affiliate in France and one in Singapore.The entire production of the French affiliate is sold to the affiliate in Singapore which sells the final product to customers.The Singaporean affiliate has sales of 300 and overhead costs of 20.The cost of goods sold in France is 150.The income tax rates are 40 percent in France and 20 percent in Singapore.Assume that neither Singapore nor France put any restrictions on the transfer price.What is the optimal transfer price?

What are the total taxes paid?

What are the total taxes paid?

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck