Deck 11: International Banking and Money Market

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 11: International Banking and Money Market

1

Which of the following is NOT true about WEBS

A)They are, in essence, mutual funds

B)They are traded on the exchange

C)They track indices of individual countries

D)Legally they are private investment partnerships

A)They are, in essence, mutual funds

B)They are traded on the exchange

C)They track indices of individual countries

D)Legally they are private investment partnerships

D

2

Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)0.20%

B)20.00%

C)0.28%

D)28.00%

A)0.20%

B)20.00%

C)0.28%

D)28.00%

A

3

Which of the following is not a potential explanation for the home bias in portfolio holdings?

A)Domestic portfolios allow for hedging inflation risk

B)Legal and institutional restrictions

C)Taxes and transaction/information costs

D)Higher rate of return on domestic stocks

A)Domestic portfolios allow for hedging inflation risk

B)Legal and institutional restrictions

C)Taxes and transaction/information costs

D)Higher rate of return on domestic stocks

D

4

In the context of investments in securities (stocks and bonds),portfolio risk diversification refers to:

A)the time-honored adage "Don't put all your eggs in one basket"

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly positively correlated

C)the fact that the less correlated the securities in a portfolio, the lower the portfolio risk

D)All of these

A)the time-honored adage "Don't put all your eggs in one basket"

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly positively correlated

C)the fact that the less correlated the securities in a portfolio, the lower the portfolio risk

D)All of these

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

If the investor had sold US$5,half of the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of US$0.64/$1.00,the dollar rate of return would be:

A) 13.14%

13.14%

B) 8.86%

8.86%

C) 5.00%

5.00%

D)8.86%

A)

13.14%

13.14%B)

8.86%

8.86%C)

5.00%

5.00%D)8.86%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Gains from portfolio diversification are largest when

A)The securities are perfectly positively correlated

B)The securities are not correlated

C)The securities are perfectly negatively correlated

D)Need more information

A)The securities are perfectly positively correlated

B)The securities are not correlated

C)The securities are perfectly negatively correlated

D)Need more information

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

If the investor had sold £5,the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of £0.60/$1.00,the dollar rate of return would be:

A)0.26%

B)26.00%

C)28.00%

D)30.00%

A)0.26%

B)26.00%

C)28.00%

D)30.00%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

The realized dollar returns for a U.S.resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms,if the variance of the foreign market's return (in terms of its own currency)is 1.14,the variance between the U.S.dollar and the foreign currency is 17.64,the covariance is 2.34,and the contribution of the cross-product term is 0.04.

A)21.16

B)23.50

C)26.89

D)28.65

A)21.16

B)23.50

C)26.89

D)28.65

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

Calculate the exchange rate return from a Canadian perspective.

A) 9.38

9.38

B) 8.57%

8.57%

C)8.57%

D)9.38

A)

9.38

9.38B)

8.57%

8.57%C)8.57%

D)9.38

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

Calculate the investor's annual percentage rate of return in Canadian dollars.

A) 13.14%

13.14%

B) 3.19%

3.19%

C)3.19%

D)13.14%

A)

13.14%

13.14%B)

3.19%

3.19%C)3.19%

D)13.14%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

Investors can use of the following to diversify their portfolios internationally except:

A)International mutual funds

B)ADRS

C)WEBS

D)STAS

A)International mutual funds

B)ADRS

C)WEBS

D)STAS

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

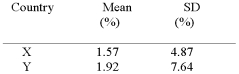

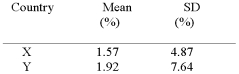

12

The mean and standard deviation (SD)of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are  Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:

A)SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B)SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C)SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D)SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:A)SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B)SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C)SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D)SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following characterizes international investor behaviour?

A)Investors are fully diversified

B)Investors hold optimal international portfolios

C)Investors show a home bias in their portfolio holdings

D)Investors don't invest in international stocks

A)Investors are fully diversified

B)Investors hold optimal international portfolios

C)Investors show a home bias in their portfolio holdings

D)Investors don't invest in international stocks

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

The "Sharpe performance measure" (SHP)is:

A)a "risk-adjusted" performance measure

B)the excess return (above and beyond the risk-free interest rate) per standard deviation risk

C)the sensitivity level of a national market to world market movements

D)a and b

A)a "risk-adjusted" performance measure

B)the excess return (above and beyond the risk-free interest rate) per standard deviation risk

C)the sensitivity level of a national market to world market movements

D)a and b

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

Exchange rate fluctuations contribute to the risk of foreign investment through three possible channels:

(i)- the volatility of the investment due to the volatility of the exchange rate

(ii)- the contribution of the cross-product term

(iii)- its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i) and (ii)

B)(ii) and (iii)

C)(i) and (iii)

D)only (ii)

(i)- the volatility of the investment due to the volatility of the exchange rate

(ii)- the contribution of the cross-product term

(iii)- its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i) and (ii)

B)(ii) and (iii)

C)(i) and (iii)

D)only (ii)

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

16

To evaluate the gains from holding international portfolios over purely domestic portfolios we can use

A)the increase in the Sharpe performance measure

B)the increase in the portfolio return

C)a and b

D)cannot be evaluated

A)the increase in the Sharpe performance measure

B)the increase in the portfolio return

C)a and b

D)cannot be evaluated

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A) 5.26%

5.26%

B) 5%

5%

C)5%

D)5.26%

A)

5.26%

5.26%B)

5%

5%C)5%

D)5.26%

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

A Canadian investor holds the British market portfolio.Calculate the variance of the monthly rate of return in Canadian dollar terms,if the variance of the British market return is 2,the variance between the U.S.dollar and the foreign currency is 20,the covariance is  2.34,and the contribution of the cross-product term is 0.06.

2.34,and the contribution of the cross-product term is 0.06.

A) 17.38

17.38

B) 14.48

14.48

C)14.48

D)17.38

2.34,and the contribution of the cross-product term is 0.06.

2.34,and the contribution of the cross-product term is 0.06.A)

17.38

17.38B)

14.48

14.48C)14.48

D)17.38

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is true?

A)Investors have a foreign bias in portfolio holdings.

B)Investors have a home bias in portfolio holdings.

C)We don't now the bias in portfolio holdings.

D)The foreign bias in portfolio holdings is consistent with portfolio theory.

A)Investors have a foreign bias in portfolio holdings.

B)Investors have a home bias in portfolio holdings.

C)We don't now the bias in portfolio holdings.

D)The foreign bias in portfolio holdings is consistent with portfolio theory.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

in pure-discount U.S.bonds.The investment was liquidated one year later when the exchange rate was 110 yen per dollar.If the rate of return earned on this investment was 46% in terms of yen,calculate the dollar amount that the bonds were sold at.

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)None of these

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)None of these

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

In May 2003 when the exchange rate was Yen 110/$,Nissan Motor Company invested ¥1,100,000,000 in pure-discount U.S.bonds and liquidated the investment one year later when the exchange rate was Yen 105/$.The Yen rate of return earned on this investment was 10%.

a)Calculate the dollar amount that the bonds were sold at.

b)Calculate the dollar rate of return of this investment.

a)Calculate the dollar amount that the bonds were sold at.

b)Calculate the dollar rate of return of this investment.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

A US investor bought shares in ABC Inc.on the Frankfurt Stock Exchange 2 years ago for EUR 10,000.The exchange rate at that time was EUR 1.20/USD.Currently,the shares are worth EUR 11,000 and the exchange rate is EUR 0.80/$.The investor had sold EUR 10,000 (the principal investment amount at the same time that the stock was purchased)forward at the forward exchange rate of EUR 1.15/$.What is the dollar rate of return?

Assume that the unhedged portion of the investment is exchanged at the current exchange rate.

Assume that the unhedged portion of the investment is exchanged at the current exchange rate.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

A US investor bought shares in ABC Inc.on the Frankfurt Stock Exchange 2 years ago for EUR 10,000.The exchange rate at that time was EUR 1.20/USD.Currently,the shares are worth EUR 11,000 and the exchange rate is EUR 0.80/$.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

A Canadian investor buys shares in DaimlerChrysler on the New York Stock Exchange when the stock's price and the exchange rate were US$ 40 and US$0.70/C$ respectively.One year later the investor sells the shares for US$ 41 and the exchange rate is US$0.80/$.

a)Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

b)Calculate the investor's annual percentage rate of return in Canadian dollars.

a)Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

b)Calculate the investor's annual percentage rate of return in Canadian dollars.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck