Deck 4: Adjustments for Adjusted Gross Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/109

Play

Full screen (f)

Deck 4: Adjustments for Adjusted Gross Income

1

Tuition,fees,books,supplies,room,board,and other necessary expenses of attendance are qualified education expenses for purposes of the student loan interest deduction.

True

2

For the moving expense distance test,the new job location must be at least 100 miles farther from the taxpayer's old residence than was the old job location.

False

3

For 2014,the amount of the student loan interest deduction is limited to $3,500.

False

4

Under a divorce agreement executed in 2014,periodic payments of either cash or property must be made at regular intervals to be deductible as alimony.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

5

Deductible moving expenses may include moving household goods and personal effects from the old residence to the new residence.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

6

There is an employment test,a distance test,and a time test that must be met in order to deduct qualifying moving expenses.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

7

In lieu of making cash payments of alimony directly to a former spouse,payments to a third party on behalf of the former spouse can qualify as alimony.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

8

Roberto files his tax return as married filing separately.He has not lived with his wife for over three years.In the current year,by order of the court,he paid her $500 per month for 12 months as separate maintenance.He will be able to deduct $6,000 as alimony for the year.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

9

To be eligible to fund a Health Savings Account (HSA),a taxpayer must be self-employed,or an employee (or spouse)of an employer who maintains a high deductible health plan,or an employee of a company that offers no health coverage and the employee has purchased a high deductible health plan on his or her own .

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

10

For the interest on a student loan to qualify for the student loan interest deduction,the student must be enrolled full-time.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

11

The self-employed health insurance deduction is also available to a partner in a partnership and to a shareholder in a Subchapter S corporation who owns more than 2% of the stock in the corporation.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

12

The student loan interest deduction may be limited based on the modified AGI of the taxpayer.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

13

The payment of alimony has tax ramifications.These tax ramifications only affect the payor of the alimony.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

14

Distributions from Health Savings Accounts (HSAs)are subject to tax,if they are used to pay for qualified medical expenses.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

15

If a taxpayer incurs an early withdrawal of savings penalty,the taxpayer is entitled to report the penalty as a for AGI deduction on Form 1040.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

16

For 2014,unreimbursed qualifying moving expenses are an itemized deduction.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

17

Qualified self-employed taxpayers can deduct,as a for AGI deduction,80% of health insurance payments for 2014.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

18

Self-employment tax is calculated on the gross earnings of the business.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

19

Paola is a freshman in the UC-Davis degree program in veterinary medicine.In 2014,Paola paid $3,000 in tuition,$500 for books,and $250 for supplies for class.Paola also paid room and board of $3,500.What is the total qualifying education expense for the student loan interest deduction for Paola in 2014?

A)$7,250.

B)$3,750.

C)$3,500.

D)$3,000.

A)$7,250.

B)$3,750.

C)$3,500.

D)$3,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

20

Self-employed persons are allowed a for AGI deduction equal to one-half of the self-employment tax imposed.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

21

Peter,having moved from Oregon to Florida in the current year,met all the requirements to deduct moving expenses.Which of the following expenses that he incurred is not deductible as qualified moving expenses?

A)Home improvements to sell his home in Oregon.

B)Shipping costs for his classic Corvette.

C)Temporary storage costs incurred while his furniture was in transit from Oregon to Florida.

D)The cost of an oil change incurred in driving his other car from Oregon to Florida.

A)Home improvements to sell his home in Oregon.

B)Shipping costs for his classic Corvette.

C)Temporary storage costs incurred while his furniture was in transit from Oregon to Florida.

D)The cost of an oil change incurred in driving his other car from Oregon to Florida.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

22

Taxpayers who contribute to or withdraw from an HSA during the year must:

A)attach a written note to their tax return.

B)file a Form 8889 and attach it to their Form 1040.

C)do nothing.

D)report it on Schedule A.

A)attach a written note to their tax return.

B)file a Form 8889 and attach it to their Form 1040.

C)do nothing.

D)report it on Schedule A.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

23

Under a 2014 divorce decree,Antoine is required pay $800 of alimony and $400 of child support each month for the next 10 years.In addition,Antoine makes a voluntary payment of $200 per month.How much of the total monthly payments are deductible by Antoine?

A)$ 200.

B)$ 400.

C)$ 800.

D)$1,000.

A)$ 200.

B)$ 400.

C)$ 800.

D)$1,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

24

The determination for the deduction of the self-employment tax is based upon the:

A)net earnings of the business.

B)gross earnings of the business.

C)total of 7.65% of FICA taxes.

D)total of itemized deductions.

A)net earnings of the business.

B)gross earnings of the business.

C)total of 7.65% of FICA taxes.

D)total of itemized deductions.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

25

In 2013,Robert,who is single,received his Bachelor's degree and started working.In 2014,he began paying interest on qualified education loans and had modified AGI of $70,000.He paid interest of $1,200 in 2014.Which of the following statements is correct?

A)The full $1,200 is deductible in arriving at adjusted gross income.

B)Taxpayers are not allowed a deduction for education loan interest in 2014.

C)If his modified AGI had been $75,000,the phase-out rules would have reduced his deductible interest to zero.

D)Due to the phase-out rules,only a portion of the $1,200 will be deductible.

A)The full $1,200 is deductible in arriving at adjusted gross income.

B)Taxpayers are not allowed a deduction for education loan interest in 2014.

C)If his modified AGI had been $75,000,the phase-out rules would have reduced his deductible interest to zero.

D)Due to the phase-out rules,only a portion of the $1,200 will be deductible.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

26

At the beginning of 2014,Melissa was permanently transferred from her office in New York City to New Jersey.Her office in NYC was 15 miles from her old NY home.For Melissa to meet the distance test for qualifying moving expense deductions,how many miles must the office in New Jersey be from her old home?

A)65.

B)50.

C)40.

D)35.

A)65.

B)50.

C)40.

D)35.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

27

For a taxpayer to be eligible to deduct moving expenses,in addition to the employment test,he or she:

A)Must meet both the time and distance test.

B)Must meet either the time or distance test.

C)Must meet the distance test.

D)Must meet the time test.

A)Must meet both the time and distance test.

B)Must meet either the time or distance test.

C)Must meet the distance test.

D)Must meet the time test.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

28

Henry graduated from the University of Maryland in 2012.In 2014,to take advantage of lower interest rates,he refinanced his qualified education loans with another qualified student loan.He is not a dependent on another person's tax return.Before AGI limits,what is the maximum deduction available to him for the $3,200 he paid for educational student loan interest in 2014?

A)$0.

B)$2,000.

C)$2,500.

D)$3,000.

A)$0.

B)$2,000.

C)$2,500.

D)$3,000.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

29

Under a court-ordered decree of separate maintenance executed in 2014,Rebecca is required to pay her ex-husband,Carl,$4,750 a month until their youngest son turns age 18.At that time,the required payments are reduced to $2,100 per month.How much of each payment is deductible by Rebecca as alimony for 2014?

A)$6,850.

B)$4,750.

C)$2,100.

D)$ 0.

A)$6,850.

B)$4,750.

C)$2,100.

D)$ 0.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not deductible as a moving expense?

A)The cost of moving household goods.

B)Travel expenses during the move.

C)The cost of a pre-move house hunting trip.

D)Lodging for household members during the move.

A)The cost of moving household goods.

B)Travel expenses during the move.

C)The cost of a pre-move house hunting trip.

D)Lodging for household members during the move.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

31

An early withdrawal penalty is reported on Form:

A)W-2.

B)1098.

C)1099-DIV.

D)1099-INT.

A)W-2.

B)1098.

C)1099-DIV.

D)1099-INT.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

32

For the deduction of self-employment taxes,which of the following statements is correct?

A)They are taken as an itemized deduction on Schedule A.

B)They are not deductible.

C)They are 80% deductible as a for AGI deduction.

D)They are 50% deductible as a for AGI deduction.

A)They are taken as an itemized deduction on Schedule A.

B)They are not deductible.

C)They are 80% deductible as a for AGI deduction.

D)They are 50% deductible as a for AGI deduction.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

33

Sharon is a self-employed hair stylist and had net earnings from self-employment of $4,100.She paid $375 per month for health insurance over the last year.Sharon is entitled to a for AGI deduction for health insurance premiums of:

A)$ 0.

B)$ 375.

C)$4,100.

D)$4,500.

A)$ 0.

B)$ 375.

C)$4,100.

D)$4,500.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

34

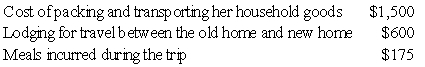

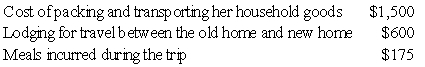

Rena had the following moving expenses during 2014:  Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?

Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?

A)$2,275.

B)$2,100.

C)$1,675.

D)$ 600.

Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?

Rena moved to start a new job and met all the required tests for moving expense deductibility.What is the total amount of moving expenses that can be deducted on her 2014 return?A)$2,275.

B)$2,100.

C)$1,675.

D)$ 600.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

35

For a taxpayer to be eligible to fund a Health Savings Account (HSA),he or she must be:

A)An employee (or spouse)who works for an employer with a high deductible health plan.

B)An employee of a company that offers no health coverage and the employee has purchased a high deductible health plan on their own.

C)A self-employed individual.

D)All of the above.

A)An employee (or spouse)who works for an employer with a high deductible health plan.

B)An employee of a company that offers no health coverage and the employee has purchased a high deductible health plan on their own.

C)A self-employed individual.

D)All of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

36

The percentage of self-employed health insurance premiums that is deductible as a for AGI deduction is:

A)100%.

B)80%.

C)70%.

D)50%.

A)100%.

B)80%.

C)70%.

D)50%.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

37

All of the following are requirements for a payment to be considered alimony except,

A)Payments cannot be a transfer of services.

B)Payments are not required after the death of the recipient spouse.

C)Payments are required by a divorce or separation agreement.

D)Payments can either be in cash or property.

A)Payments cannot be a transfer of services.

B)Payments are not required after the death of the recipient spouse.

C)Payments are required by a divorce or separation agreement.

D)Payments can either be in cash or property.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

38

In 2010 through 2013,Rory borrowed a total of $30,000 for higher education expenses on qualified education loans.In 2014,while still living at home and being claimed by his parents as a dependent,he began making payments on the loan.The first year interest on the loan was reported as $1,750.The amount that Rory can claim on his tax return is:

A)$ 0.

B)$1,500.

C)$1,750.

D).$2,500.

A)$ 0.

B)$1,500.

C)$1,750.

D).$2,500.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

39

Charde,who is single,had a student loan for qualified education expenses on which interest was due.For 2014,the total interest payments were $2,000.Assuming she has AGI under $65,000,how much may she deduct in arriving at adjusted gross income for 2014?

A)$2,500.

B)$2,000.

C)$1,700.

D)$ 0.

A)$2,500.

B)$2,000.

C)$1,700.

D)$ 0.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

40

The early withdrawal penalty is deductible as an:

A)itemized deduction on Schedule A.

B)above-the-line deduction for AGI.

C)adjustment on Schedule B.

D)none of the above.

A)itemized deduction on Schedule A.

B)above-the-line deduction for AGI.

C)adjustment on Schedule B.

D)none of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

41

What is meant by a penalty on early withdrawal of savings and under what circumstances is it deductible?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

42

What is a Health Savings Account (HSA)?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

43

Renee and Thomas obtained a divorce effective May 1,2014.In accordance with the divorce decree,Thomas was required to pay Renee alimony of $2,500 per month (payments were to stop only in the event of her death or remarriage).Furthermore,he was to transfer title of their house which had a cost of $150,000 and a fair value of $200,000 on the date of transfer,and was to continue making the monthly mortgage payments of $1,500.

(a)Determine the amount of Thomas's alimony deduction in 2014.

(b)Determine the amount of Renee's alimony income in 2014.

(c)Assume that Thomas was required to pay off the remaining mortgage balance in the event Renee died.Does Thomas's alimony deduction in 2014 change? Why or why not?

(a)Thomas would report alimony payments of $32,000 in 2014.This represents the monthly payments of $2,500 to Renee plus the $1,500 mortgage payments,both for a period of eight months.

(b)Renee would have alimony income of $32,000 determined in the same manner as part (a).

(c)Thomas would be entitled to an alimony deduction of $20,000 in 2014.This amount represents eight months of $2,500 payments,but no deduction for the $1,500 mortgage payments.For a payment to be classified as alimony,the payment must cease at the payee spouse's death.If any payments are required to be made after the death of the spouse,then,under IRC § 71(b)(1)(D),the payments do not qualify as alimony,even payments made during the life of the spouse.In the problem,Thomas is required to pay off the mortgage balance if Renee dies.Since payoff is not required UNTIL she dies,Thomas will not make the payoff until AFTER she dies.Thus,the mortgage payments are not deemed to be alimony.

(a)Determine the amount of Thomas's alimony deduction in 2014.

(b)Determine the amount of Renee's alimony income in 2014.

(c)Assume that Thomas was required to pay off the remaining mortgage balance in the event Renee died.Does Thomas's alimony deduction in 2014 change? Why or why not?

(a)Thomas would report alimony payments of $32,000 in 2014.This represents the monthly payments of $2,500 to Renee plus the $1,500 mortgage payments,both for a period of eight months.

(b)Renee would have alimony income of $32,000 determined in the same manner as part (a).

(c)Thomas would be entitled to an alimony deduction of $20,000 in 2014.This amount represents eight months of $2,500 payments,but no deduction for the $1,500 mortgage payments.For a payment to be classified as alimony,the payment must cease at the payee spouse's death.If any payments are required to be made after the death of the spouse,then,under IRC § 71(b)(1)(D),the payments do not qualify as alimony,even payments made during the life of the spouse.In the problem,Thomas is required to pay off the mortgage balance if Renee dies.Since payoff is not required UNTIL she dies,Thomas will not make the payoff until AFTER she dies.Thus,the mortgage payments are not deemed to be alimony.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

44

The goal of the alimony recapture rules is to properly define the substance of payments made to a former spouse in order to ensure proper tax treatment.These rules "lookback" to the following years for the calculation:

A)Years 1 and 2.

B)Years 3 and 4.

C)Years 1 through 3.

D)Years 4 through 6.

A)Years 1 and 2.

B)Years 3 and 4.

C)Years 1 through 3.

D)Years 4 through 6.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

45

Define each of the following: alimony,child support,and a property settlement.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

46

For 2014,the maximum amount of deductible student loan interest is $2,500.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

47

What is the key limitation related to income associated with deductibility of student loan interest?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

48

In 2014,Miguel accepted a new job and moved from San Diego to Boston to begin work.He incurred moving expenses for his household goods and furniture of $3,500.Prior to moving,Miguel flew to Boston to look for a new residence.The transportation and lodging for this trip to Boston was $900 and his meals were $150.The cost of his travel during the actual move to Boston was $500 which included $75 for meals.Calculate the amount of Miguel's moving expense deduction for 2014.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

49

David,who is single,received his degree in 2013,and took a job earning $62,500 per year.In 2013,he was required to begin making payments on his qualified education loans.In 2014 he paid $1,350 in interest on those loans.How much can he claim as an educational loan interest deduction for the year?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

50

What is the amount of self-employment tax that self-employed individuals must pay and what is the proper treatment on their tax return?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

51

What are the two limitations associated with the deduction for health insurance for self-employed individuals?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

52

In order to qualify for a moving expense deduction,taxpayers must meet three tests.What are they?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

53

What are the contribution amounts for a Health Savings Account for 2014?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

54

What is an "eligible educational institution" as it relates to the deductibility of student loan interest?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

55

Are any moving expenses deductible other than those incurred directly for the taxpayer? If so,what are the requirements for deductibility?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

56

Why is it important to distinguish between a property settlement and alimony?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

57

Qualifying moving expenses are treated as an itemized deduction for 2014.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following items are considered alimony?

A)Payments made to a third party on behalf of the former spouse for the former spouse's dental expenses.

B)Payments made for a six month period after the death of the recipient spouse.

C)Noncash property settlement.

D)Payments made on a piece of property transferred to the ex-spouse under the settlement agreement.

A)Payments made to a third party on behalf of the former spouse for the former spouse's dental expenses.

B)Payments made for a six month period after the death of the recipient spouse.

C)Noncash property settlement.

D)Payments made on a piece of property transferred to the ex-spouse under the settlement agreement.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

59

Maria files her tax return married filing separately.She has not lived with her husband for over two years.Beginning in January 2014,by court ordered decree,she is to pay her husband $600 per month as separate maintenance.For 2014 how much will she be able to deduct as alimony?

A)$7,200.

B)$3,600.

C)$ 600.

D)$ 0.

A)$7,200.

B)$3,600.

C)$ 600.

D)$ 0.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

60

Is the self-employed health insurance deduction available to individuals other than self-employed taxpayers? If so,to whom is it available?

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

61

The self-employment tax is calculated on:

A)Form 1040.

B)Schedule C.

C)Form SE.

D)Schedule D.

A)Form 1040.

B)Schedule C.

C)Form SE.

D)Schedule D.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

62

In order to qualify for a Health Savings Plan (HSA),a taxpayer must be:

A)An employee (or spouse)who works for an employer with a high deductible health plan.

B)A self-employed individual.

C)An uninsured employee of a company that does not offer health coverage,who purchases high-deductible health coverage on his or her own.

D)All of the above.

A)An employee (or spouse)who works for an employer with a high deductible health plan.

B)A self-employed individual.

C)An uninsured employee of a company that does not offer health coverage,who purchases high-deductible health coverage on his or her own.

D)All of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following types of income is subject to the self-employment tax?

A)Income from a sole proprietor's coffee shop.

B)Gain on the sale of a home.

C)W-2 income.

D)Interest earned on a bank account.

A)Income from a sole proprietor's coffee shop.

B)Gain on the sale of a home.

C)W-2 income.

D)Interest earned on a bank account.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

64

For family coverage in 2014,the maximum deductible and out of pocket expense to a Health Savings Account is:

A)$ 1,250.

B)$ 6,350.

C)$12,700.

D)None of the above.

A)$ 1,250.

B)$ 6,350.

C)$12,700.

D)None of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

65

The maximum amount of the deduction for student loan interest for an eligible taxpayer is limited in the 2014 tax year to:

A)$1,500.

B)$2,000.

C)$2,350.

D)$2,500.

A)$1,500.

B)$2,000.

C)$2,350.

D)$2,500.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

66

The cost of self-employed health insurance premiums are deductible above-the line at a rate of 80% of the cost.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

67

The amount of self-employed health insurance premiums that are deductible as a for AGI deduction is:

A)100%.

B)80%.

C)70%.

D)50%.

A)100%.

B)80%.

C)70%.

D)50%.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

68

In order to meet the distance test criteria for qualifying moving expenses,the new job location must be:

A)100 miles from the old residence.

B)100 miles from the old job location.

C)at least 50 miles farther than the old residence was from the old job location.

D)at least 50 miles farther than the new residence from the old job location.

A)100 miles from the old residence.

B)100 miles from the old job location.

C)at least 50 miles farther than the old residence was from the old job location.

D)at least 50 miles farther than the new residence from the old job location.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not a deductible alimony payment?

A)Payments for child support required by the divorce decree.

B)Payments for life insurance premiums required by the divorce decree.

C)Half of the mortgage payment on a home jointly owned with the ex-spouse when required by the decree of divorce.

D)Payments for dental expenses of the ex-spouse under terms of the divorce agreement.

A)Payments for child support required by the divorce decree.

B)Payments for life insurance premiums required by the divorce decree.

C)Half of the mortgage payment on a home jointly owned with the ex-spouse when required by the decree of divorce.

D)Payments for dental expenses of the ex-spouse under terms of the divorce agreement.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

70

Rebecca is required under a divorce agreement effective January 1,2014 to pay $800 of alimony and $250 of child support per month for 10 years.Rebecca also makes a voluntary payment of $150 per month.How much of each monthly payment can Rebecca deduct as alimony in 2014?

A)$ 0.

B)$800.

C)$950.

D)$1050.

A)$ 0.

B)$800.

C)$950.

D)$1050.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

71

Student loan interest is deductible only by the person who actually attended the educational institution.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

72

A Health Savings Account (HSA)is a tax-exempt savings account to pay for qualified medical expenses.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

73

The deduction for self-employment taxes in 2014 is deductible as an above-the-line deduction at a rate of 7.65% based on the employer's portion of the taxes.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

74

A qualified education loan is one incurred by the taxpayer solely to pay qualified education expenses incurred on behalf of the:

A)taxpayer.

B)taxpayer's spouse.

C)a dependent of the taxpayer.

D)all of the above.

A)taxpayer.

B)taxpayer's spouse.

C)a dependent of the taxpayer.

D)all of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

75

Sade,who is single and self-employed as a graphic artist,had net earnings from self-employment of $7,250 for the year.She paid $285 a month for health insurance premiums over the last year.Sade is entitled to a for AGI deduction for health insurance of:

A)$ 0.

B)$ 285.

C)$3,420.

D)$3,830.

A)$ 0.

B)$ 285.

C)$3,420.

D)$3,830.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

76

If a divorce agreement executed in 2014 specifies that a portion of the amount of an alimony payment is contingent upon the status of a child,that portion is considered to be a child support payment.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

77

If a taxpayer withdraws his or her deposit on a CD before the instrument matures,the penalty for the early withdrawal on interest will be reported by the financial institution:

A)On Form EWIP.

B)In Box 2 of Form 1099-INT.

C)In a letter of notification.

D)None of the above.

A)On Form EWIP.

B)In Box 2 of Form 1099-INT.

C)In a letter of notification.

D)None of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

78

The Oroscos were granted a decree of divorce effective January 1,2014.In accordance with the decree,César Orosco is to pay his wife $24,000 a year until their only child,Ricardo now 11,turns 18,and then the payments will decrease by $11,000 per year.For 2014,how much can César deduct as alimony?

A)$11,000.

B)$13,000.

C)$35,000.

D)None of the above.

A)$11,000.

B)$13,000.

C)$35,000.

D)None of the above.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is deductible as a moving expense?

A)The cost of moving household goods.

B)Meal costs incurred during the move.

C)The cost of a pre-move house hunting trip.

D)All of the above are deductible as moving expenses.

A)The cost of moving household goods.

B)Meal costs incurred during the move.

C)The cost of a pre-move house hunting trip.

D)All of the above are deductible as moving expenses.

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck

80

In order to meet the time test for qualifying moving expenses,a taxpayer must:

A)Be a full-time employee for a period of 39 weeks during the 12 months following arrival in the new area.

B)Be a self-employed individual for at least 78 weeks during the 24 months immediately following arrival in the new area.At least 39 of the 78 weeks must be during the first 12-month period.

C)Remain employed only in the initial new job for the entire 39 or 78 week period.

D)a and

A)Be a full-time employee for a period of 39 weeks during the 12 months following arrival in the new area.

B)Be a self-employed individual for at least 78 weeks during the 24 months immediately following arrival in the new area.At least 39 of the 78 weeks must be during the first 12-month period.

C)Remain employed only in the initial new job for the entire 39 or 78 week period.

D)a and

Unlock Deck

Unlock for access to all 109 flashcards in this deck.

Unlock Deck

k this deck