Deck 15: International Portfolio Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/101

Play

Full screen (f)

Deck 15: International Portfolio Investment

1

The "Sharpe performance measure" (SHP)is

A)

B)

C)

D)none of the above

A)

B)

C)

D)none of the above

2

The mean and standard deviation (SD)of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are Assuming that the monthly risk-free interest rate is 0.25%,the Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:

A)SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B)SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C)SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D)SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

A)SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B)SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C)SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D)SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

3

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the OIP has more return and less risk for all investors, regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors, regardless of home country, if they hedge their risk with currency futures contracts.

D)none of the above

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the OIP has more return and less risk for all investors, regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors, regardless of home country, if they hedge their risk with currency futures contracts.

D)none of the above

none of the above

4

Systematic risk is

A)nondiversifiable risk.

B)the risk that remains even after investors fully diversify their portfolio holdings.

C)both a) and b)

D)none of the above

A)nondiversifiable risk.

B)the risk that remains even after investors fully diversify their portfolio holdings.

C)both a) and b)

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

5

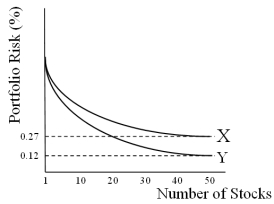

A fully diversified U.S.portfolio is about

A)75 percent as risky as a typical individual stock.

B)27 percent as risky as a typical individual stock.

C)12 percent as risky as a typical individual stock.

D)Half as risky as a fully diversified international portfolio.

A)75 percent as risky as a typical individual stock.

B)27 percent as risky as a typical individual stock.

C)12 percent as risky as a typical individual stock.

D)Half as risky as a fully diversified international portfolio.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

6

The "Sharpe performance measure" (SHP)is

A)a "risk-adjusted" performance measure.

B)the excess return (above and beyond the risk-free interest rate) per standard deviation risk.

C)the sensitivity level of a national market to world market movements.

D)both a) and b)

A)a "risk-adjusted" performance measure.

B)the excess return (above and beyond the risk-free interest rate) per standard deviation risk.

C)the sensitivity level of a national market to world market movements.

D)both a) and b)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

7

The less correlated the securities in a portfolio,

A)the lower the portfolio risk.

B)the higher the portfolio risk.

C)the lower the unsystematic risk.

D)the higher the diversifiable risk.

A)the lower the portfolio risk.

B)the higher the portfolio risk.

C)the lower the unsystematic risk.

D)the higher the diversifiable risk.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

8

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the composition of the optimal international portfolio varies depending upon the numeraire currency used to measure returns.

C)the composition of the optimal international portfolio is identical for all investors, regardless of home country, if they hedge their risk with currency futures contracts.

D)both b) and c)

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the composition of the optimal international portfolio varies depending upon the numeraire currency used to measure returns.

C)the composition of the optimal international portfolio is identical for all investors, regardless of home country, if they hedge their risk with currency futures contracts.

D)both b) and c)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

9

With regard to the OIP,

A)the optimal international portfolio contains investments from every country.

B)the OIP has more return and less risk for all investors.

C)the composition of the optimal international portfolio changes according to IRP.

D)none of the above

A)the optimal international portfolio contains investments from every country.

B)the OIP has more return and less risk for all investors.

C)the composition of the optimal international portfolio changes according to IRP.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

10

You will get more diversification

A)across industries than across countries.

B)across countries than across industries.

C)across stocks and bonds than across countries.

D)none of the above

A)across industries than across countries.

B)across countries than across industries.

C)across stocks and bonds than across countries.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

11

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the OIP has more return and less risk for all investors, regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors of a particular country, whether or not they hedge their risk with currency futures contracts.

D)none of the above

A)the composition of the optimal international portfolio is identical for all investors, regardless of home country.

B)the OIP has more return and less risk for all investors, regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors of a particular country, whether or not they hedge their risk with currency futures contracts.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

12

Regarding the mechanics of international portfolio diversification,which statement is true?

A)Security returns are much less correlated across countries than within a county.

B)Security returns are more correlated across countries than within a county.

C)Security returns are about as equally correlated across countries as they are within a county.

D)None of the above

A)Security returns are much less correlated across countries than within a county.

B)Security returns are more correlated across countries than within a county.

C)Security returns are about as equally correlated across countries as they are within a county.

D)None of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

13

In the context of investments in securities (stocks and bonds),portfolio risk diversification refers to

A)the time-honored adage "Don't put all your eggs in one basket".

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly positively correlated.

C)the fact that the less correlated the securities in a portfolio, the lower the portfolio risk.

D)all of the above

A)the time-honored adage "Don't put all your eggs in one basket".

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly positively correlated.

C)the fact that the less correlated the securities in a portfolio, the lower the portfolio risk.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

14

With regard to estimates of "world beta" measures of the sensitivity of a national market to world market movements,

A)the Japanese stock market is the most sensitive to world market movements.

B)the U.S.stock market is the least sensitive to world market movements.

C)both a) and b)

D)none of the above

A)the Japanese stock market is the most sensitive to world market movements.

B)the U.S.stock market is the least sensitive to world market movements.

C)both a) and b)

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

15

Systematic risk

A)is also known as non-diversifiable risk.

B)is market risk.

C)refers to the risk that remains even after investors fully diversify their portfolio holdings.

D)all of the above

A)is also known as non-diversifiable risk.

B)is market risk.

C)refers to the risk that remains even after investors fully diversify their portfolio holdings.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

16

The "world beta" measures the

A)unsystematic risk.

B)sensitivity of returns on a security to world market movements.

C)risk-adjusted performance.

D)risk of default and bankruptcy.

A)unsystematic risk.

B)sensitivity of returns on a security to world market movements.

C)risk-adjusted performance.

D)risk of default and bankruptcy.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

17

Under the investment dollar premium system,

A)U.K.residents received a premium over the prevailing commercial exchange rate when they sold foreign securities and repatriated the funds to the U.K.

B)U.K.residents had to pay a premium over the prevailing commercial exchange rate when they bought foreign currencies to invest in foreign securities.

C)none of the above

A)U.K.residents received a premium over the prevailing commercial exchange rate when they sold foreign securities and repatriated the funds to the U.K.

B)U.K.residents had to pay a premium over the prevailing commercial exchange rate when they bought foreign currencies to invest in foreign securities.

C)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

18

In the graph below,X and Y represent

A)U.S.stocks and international stocks.

B)international stocks and U.S.stocks.

C)systematic risk and unsystematic risk.

D)none of the above

A)U.S.stocks and international stocks.

B)international stocks and U.S.stocks.

C)systematic risk and unsystematic risk.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

19

Foreign equities as a proportion of U.S.investors' portfolio wealth rose from about 1 percent in the early 1980s to about ____________ by 2007.

A)10%

B)23%

C)33%

D)67%

A)10%

B)23%

C)33%

D)67%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

20

Studies show that international stock markets tend to move more closely together when the volatility is higher.This finding suggests that

A)investors should liquidate their portfolio holdings during turbulent periods.

B)since investors need risk diversification most precisely when markets are turbulent, there may be less benefit to international diversification for investors who liquidate their portfolio holdings during turbulent periods.

C)this kind of correlation is why international portfolio diversification is smart for today's investor.

D)none of the above

A)investors should liquidate their portfolio holdings during turbulent periods.

B)since investors need risk diversification most precisely when markets are turbulent, there may be less benefit to international diversification for investors who liquidate their portfolio holdings during turbulent periods.

C)this kind of correlation is why international portfolio diversification is smart for today's investor.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a true statement?

A)Generally, exchange rate volatility is greater than bond market volatility.

B)When investing in international bonds, it is essential to control exchange risk to enhance the efficiency of international bond portfolios.

C)The real-world evidence suggests that investing in Swiss bonds largely amounts to investing in Swiss currency.

D)All of the above

A)Generally, exchange rate volatility is greater than bond market volatility.

B)When investing in international bonds, it is essential to control exchange risk to enhance the efficiency of international bond portfolios.

C)The real-world evidence suggests that investing in Swiss bonds largely amounts to investing in Swiss currency.

D)All of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

22

Compared with bond markets

A)the risk of investing in foreign stock markets is, to a lesser degree, attributable to exchange rate uncertainty.

B)the risk of investing in foreign stock markets is, to a much greater degree, attributable to exchange rate uncertainty.

C)exchange risk is lower than default risk and interest rate risk.

D)all of the above

A)the risk of investing in foreign stock markets is, to a lesser degree, attributable to exchange rate uncertainty.

B)the risk of investing in foreign stock markets is, to a much greater degree, attributable to exchange rate uncertainty.

C)exchange risk is lower than default risk and interest rate risk.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

23

Emerald Energy is an oil exploration and production company that trades on the London stock market.Assume that when purchased by an international investor the stock's price and the exchange rate were £5 and £0.64/$1.00 respectively.At selling time,one year after purchase,they were £6 and £0.60/$1.00.If the investor had sold £5,the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of £0.60/$1.00,the dollar rate of return would be:

A)0.26%

B)26.00%

C)28.00%

D)30.00%

A)0.26%

B)26.00%

C)28.00%

D)30.00%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

24

A zero-coupon French bond promises to pay €100,000 in five years.The current exchange rate is $1.50 = €1.00 and inflation is forecast at 3% in the U.S.and 2% in the euro zone per year for the next five years.The appropriate discount rate for a bond of this risk would be 10% if it paid in dollars.What is the appropriate price of the bond?

A)£65,196.13 = $97,794.20

B)£62,092.13 = $93,138.20

C)none of the above

A)£65,196.13 = $97,794.20

B)£62,092.13 = $93,138.20

C)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

25

Emerald Energy is an oil exploration and production company that trades on the London stock market.Assume that when purchased by an international investor the stock's price and the exchange rate were £5 and £0.64/$1.00 respectively.At selling time,one year after the purchase date,they were £6 and £0.60/$1.00.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)0.20%

B)20.00%

C)1.28%

D)28.00%

A)0.20%

B)20.00%

C)1.28%

D)28.00%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

26

Bema Gold is an exploration and production company that trades on the Toronto stock exchange.Assume that when purchased by an international investor the stock's price and the exchange rate were CAD5 and CAD1.0/USD0.72 respectively.At selling time,one year after the purchase date,they were CAD6 and CAD1.0/USD1.0.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)-13.60%

B)66.67%

C)38.89%

D)28.00%

A)-13.60%

B)66.67%

C)38.89%

D)28.00%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

27

The realized dollar returns for a U.S.resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms,if the variance of the foreign market's return (in terms of its own currency)is 1.14,the variance between the U.S.dollar and the foreign currency is 17.64,the covariance is 2.34,and the contribution of the cross-product term is 0.04.

A)21.16

B)23.50

C)26.89

D)28.65

A)21.16

B)23.50

C)26.89

D)28.65

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

28

Bema Gold is an exploration and production company that trades on the Toronto stock exchange.Assume that when purchased by an international investor the stock's price and the exchange rate were CAD5 and CAD1.0/USD0.72 respectively.At selling time,one year after the purchase date,they were CAD6 and CAD1.0/USD1.0.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars if the investor had sold CAD5,the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of CAD1/USD.80.

A)-13.60%

B)66.67%

C)38.89%

D)28.00%

A)-13.60%

B)66.67%

C)38.89%

D)28.00%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago.You had invested €10,000 to buy Microsoft shares for $120 per share; the exchange rate was $1.55 per euro.You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.50 per euro.Compute the rate of return on your investment in euro terms.

A)12.50%

B)16.25%

C)28.00%

D)-9.09%

A)12.50%

B)16.25%

C)28.00%

D)-9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

30

Assume that you have invested $100,000 in British equities.When purchased,the stock's price and the exchange rate were £50 and £0.50/$1.00 respectively.At selling time,one year after purchase,they were £60 and £0.60/$1.00.If the investor had sold £50,000 forward at the forward exchange rate of £0.55/$1.00,the dollar rate of return would be:

A)10.90%

B)7.58%

C)28.00%

D)9.09%

A)10.90%

B)7.58%

C)28.00%

D)9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

31

A 5%-annual coupon British has a par value of £1,000,matures in five years,and has a yield to maturity of 4%.The current exchange rate is $2.00 = £1.00 and inflation is forecast at 3% in the U.S.and 2% in the U.K.per year for the next five years.If a dollar-based investor used forward contracts to redenominate this bond into dollars,what would be his rate of return?

A)5%

B)6%

C)7%

D)8%

A)5%

B)6%

C)7%

D)8%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that you have invested $100,000 in Japanese equities.When purchased the stock's price and the exchange rate were ¥100 and ¥100/$1.00 respectively.At selling time,one year after purchase,they were ¥110 and ¥110/$1.00.The dollar rate of return would be:

A)0%

B)4.32%

C)28.00%

D)-9.09%

A)0%

B)4.32%

C)28.00%

D)-9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago.You had invested €10,000 to buy Microsoft shares for $120 per share; the exchange rate was $1.55 per euro.You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.50 per euro.How much of the return is due to the exchange rate movement?

A)3.75%

B)3.33%

C)12.50%

D)16.25%

A)3.75%

B)3.33%

C)12.50%

D)16.25%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

34

Assume that you have invested $100,000 in Japanese equities.When purchased the stock's price and the exchange rate were ¥100 and ¥100/$1.00 respectively.At selling time,one year after purchase,they were ¥110 and ¥110/$1.00.If the investor had sold ¥10,000,000 forward at the forward exchange rate of ¥105/$1.00 the dollar rate of return would be:

A)-27.27%

B)4.32%

C)28.00%

D)-9.09%

A)-27.27%

B)4.32%

C)28.00%

D)-9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

35

Assume that you have invested $100,000 in British equities.When purchased the stock's price and the exchange rate were £50 and £0.50/$1.00 respectively.At selling time,one year after purchase,they were £45 and £0.60/$1.00.If the investor had sold £50,000 forward at the forward exchange rate of £0.55/$1.00,the dollar rate of return would be:

A)-27.27%

B)-17.42%

C)28.00%

D)-9.09%

A)-27.27%

B)-17.42%

C)28.00%

D)-9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

36

In May 1995 when the exchange rate was 80 yen per dollar,Japan Life Insurance Company invested ¥800,000,000 in pure-discount U.S.bonds.The investment was liquidated one year later when the exchange rate was 110 yen per dollar.If the rate of return earned on this investment was 46% in terms of yen,calculate the dollar amount that the bonds were sold at.

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)none of the above

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

37

Emerald Energy is an oil exploration and production company that trades on the London stock market.Over the past year,the stock has enjoyed a 20 percent return in pound terms,but over the same period,the exchange rate has fallen from $2.00 = £1 to $1.80 = £1.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5%

B)9.25%

C)8%

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5%

B)9.25%

C)8%

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

38

Emerald Energy is an oil exploration and production company that trades on the London stock market.Over the past year,the stock has gone from £50 per share to £55,but over the same period,the dollar has depreciated ten percent.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5%

B)-.01%

C)0%

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5%

B)-.01%

C)0%

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

39

Exchange rate fluctuations contribute to the risk of foreign investment through three possible channels: (i)- the volatility of the investment due to the volatility of the exchange rate

(ii)- the contribution of the cross-product term

(iii)- its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i) and (ii)

B)(ii) and (iii)

C)(i) and (iii)

D)only (ii)

(ii)- the contribution of the cross-product term

(iii)- its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i) and (ii)

B)(ii) and (iii)

C)(i) and (iii)

D)only (ii)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

40

A zero-coupon British bond promises to pay £100,000 in five years.The current exchange rate is $2.00 = £1.00 and inflation is forecast at 3% in the U.S.and 2% in the U.K.per year for the next five years.The appropriate discount rate for a bond of this risk would be 10% if it paid in dollars.What is the appropriate price of the bond?

A)£62,092.13 = $124,184.26

B)£65,196.13 = $130,392.26

C)none of the above

A)£62,092.13 = $124,184.26

B)£65,196.13 = $130,392.26

C)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

41

Hedge fund advisors typically receive a "2-plus-twenty" management fee

A)meaning 2 percent per year of the assets under management, plus performance fee 20 percent of any capital appreciation.

B)meaning 2 percent per year of the assets under management, plus performance fee 20 basis points.

C)meaning 2 percent per year of the assets under management, plus performance fee of 20 percent of the excess return.

D)meaning 2 percent per year of the assets under management, plus performance fee 20 percent of gross return net of the risk-free rate.

A)meaning 2 percent per year of the assets under management, plus performance fee 20 percent of any capital appreciation.

B)meaning 2 percent per year of the assets under management, plus performance fee 20 basis points.

C)meaning 2 percent per year of the assets under management, plus performance fee of 20 percent of the excess return.

D)meaning 2 percent per year of the assets under management, plus performance fee 20 percent of gross return net of the risk-free rate.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

42

Recent studies show that when investors control exchange risk by using currency forward contracts to hedge

A)international bond portfolios outperform domestic bond portfolios.

B)international bond portfolios dominate domestic stock portfolios in terms of risk-return efficiency.

C)both a) and b)

D)none of the above

A)international bond portfolios outperform domestic bond portfolios.

B)international bond portfolios dominate domestic stock portfolios in terms of risk-return efficiency.

C)both a) and b)

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

43

With regard to the past price performance of U.S.-based closed end country funds,

A)most CECFs behave more like U.S.securities than their corresponding NAVs.

B)most CECFs have track records nearly identical to their currency returns.

C)most CECFs have stock betas of around zero when measured against the S&P 500.

D)none of the above

A)most CECFs behave more like U.S.securities than their corresponding NAVs.

B)most CECFs have track records nearly identical to their currency returns.

C)most CECFs have stock betas of around zero when measured against the S&P 500.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

44

The record of investing in U.S.-based MNCs

A)shows that the share prices of U.S.-based MNCs behave much like those of domestic firms, without providing effective international diversification.

B)shows that the share prices of U.S.-based MNCs behave much differently than those of domestic firms, providing effective international diversification.

C)shows that the share prices of U.S.-based MNCs behave much like the currency returns of their foreign markets.

D)none of the above

A)shows that the share prices of U.S.-based MNCs behave much like those of domestic firms, without providing effective international diversification.

B)shows that the share prices of U.S.-based MNCs behave much differently than those of domestic firms, providing effective international diversification.

C)shows that the share prices of U.S.-based MNCs behave much like the currency returns of their foreign markets.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

45

U.S.-based mutual funds known as country funds.

A)Invest in the government securities of different sovereign governments, giving risk-free portfolios effective exchange rate diversification.

B)Invests exclusively in stocks of a single country.

C)Invests exclusively in government securities of a single country.

D)None of the above

A)Invest in the government securities of different sovereign governments, giving risk-free portfolios effective exchange rate diversification.

B)Invests exclusively in stocks of a single country.

C)Invests exclusively in government securities of a single country.

D)None of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

46

With regard to the past price performance of closed end mutual funds

A)most funds have traded at both a premium and a discount to NAV.

B)most funds trade on a stock exchange just like a publicly traded corporation.

C)suggests the risk-return characteristics can be quite different from those of the securities underlying the fund.

D)all of the above

A)most funds have traded at both a premium and a discount to NAV.

B)most funds trade on a stock exchange just like a publicly traded corporation.

C)suggests the risk-return characteristics can be quite different from those of the securities underlying the fund.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

47

Hedge fund advisors typically receive a management fee,often __________ of the fund asset value as compensation,plus performance fee that can be 20-25 percent of capital appreciation.

A)1 to 2 percent

B)10 to 20 basis points

C)10 percent

D)None of the above

A)1 to 2 percent

B)10 to 20 basis points

C)10 percent

D)None of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

48

A zero-coupon Japanese bond promises to pay ¥1,200,000 in five years.The current exchange rate is $1.00 = ¥100 and inflation is forecast at 3% in the U.S.and 2% in Japan per year for the next five years.The appropriate discount rate for a bond of this risk would be 10% if it paid in dollars.What is the appropriate price of the bond?

A)¥782,353.60 = $7,823.54

B)¥745,105.60 = $7,451.06

C)none of the above

A)¥782,353.60 = $7,823.54

B)¥745,105.60 = $7,451.06

C)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

49

The record of investing in U.S.-based international mutual funds

A)shows that most funds have a beta much less than one.

B)shows them to be a raging arbitrage opportunity.

C)shows that they offer less diversification benefits than just investing in U.S.-based MNCs.

D)none of the above

A)shows that most funds have a beta much less than one.

B)shows them to be a raging arbitrage opportunity.

C)shows that they offer less diversification benefits than just investing in U.S.-based MNCs.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

50

A closed end mutual fund

A)invests in bonds of a particular maturity, when they mature, the fund closes.

B)trades on a stock exchange just like a publicly traded corporation.

C)always trades at Net Asset Value.

D)all of the above

A)invests in bonds of a particular maturity, when they mature, the fund closes.

B)trades on a stock exchange just like a publicly traded corporation.

C)always trades at Net Asset Value.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

51

The record of investing in U.S.-based international mutual funds

A)suggests that it is a bad idea-the costs outweigh the benefits for U.S.investors.

B)without exception, they have higher returns than the U.S.market (as proxied by the S&P 500 index) and slightly lower risk.

C)suggests that for the most part, they have higher returns than the U.S.market (as proxied by the S&P 500 index) but with slightly higher risk.

D)none of the above

A)suggests that it is a bad idea-the costs outweigh the benefits for U.S.investors.

B)without exception, they have higher returns than the U.S.market (as proxied by the S&P 500 index) and slightly lower risk.

C)suggests that for the most part, they have higher returns than the U.S.market (as proxied by the S&P 500 index) but with slightly higher risk.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

52

American Depository Receipt (ADRs)represent foreign stocks

A)denominated in U.S.dollars that trade on European stock exchanges.

B)denominated in U.S.dollars that trade on a U.S.stock exchange.

C)denominated in a foreign currency that trade on a U.S.stock exchange.

D)non-registered (bearer) securities.

A)denominated in U.S.dollars that trade on European stock exchanges.

B)denominated in U.S.dollars that trade on a U.S.stock exchange.

C)denominated in a foreign currency that trade on a U.S.stock exchange.

D)non-registered (bearer) securities.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

53

Recent studies show that when investors control exchange risk by using currency forward contracts,

A)they can substantially enhance the efficiency of international bond portfolios.

B)they can substantially enhance the efficiency of international stock portfolios.

C)the risk of investing in foreign stock markets is can be completely hedged.

D)both a) and b)

A)they can substantially enhance the efficiency of international bond portfolios.

B)they can substantially enhance the efficiency of international stock portfolios.

C)the risk of investing in foreign stock markets is can be completely hedged.

D)both a) and b)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

54

Advantages of investing in mutual funds known as country funds include:

A)Speculation in a single foreign market at minimum cost.

B)Using them as building blocks of a personal international portfolio.

C)Diversification into emerging markets that are otherwise practically inaccessible.

D)All of the above

A)Speculation in a single foreign market at minimum cost.

B)Using them as building blocks of a personal international portfolio.

C)Diversification into emerging markets that are otherwise practically inaccessible.

D)All of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

55

The majority of ADRS

A)are from such developed countries as Australia and Japan.

B)are from developing nations.

C)are from emerging markets.

D)both b) and c)

A)are from such developed countries as Australia and Japan.

B)are from developing nations.

C)are from emerging markets.

D)both b) and c)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

56

With regard to the past performance of U.S.-based closed end country funds

A)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so.

B)NAVs offer superior diversification opportunities compared to the CECFs.

C)both a) and b)

D)none of the above

A)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so.

B)NAVs offer superior diversification opportunities compared to the CECFs.

C)both a) and b)

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

57

Advantages of investing in U.S.-based international mutual funds include

A)lower transactions costs relative to direct investing.

B)circumvention of many legal and institution barriers to direct portfolio investment in many foreign markets.

C)professional management, potentially expertise in security selection, definitely record-keeping.

D)all of the above

A)lower transactions costs relative to direct investing.

B)circumvention of many legal and institution barriers to direct portfolio investment in many foreign markets.

C)professional management, potentially expertise in security selection, definitely record-keeping.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

58

The record of investing in U.S.-based stock mutual funds

A)shows that the movements of the U.S.stock market account for about 20 percent of the fluctuations of the value of U.S.-based stock mutual funds.

B)shows that the talent of individual portfolio managers accounts for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds-luck the other ten percent.

C)shows that the movements of the U.S.stock market account for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds.

D)none of the above

A)shows that the movements of the U.S.stock market account for about 20 percent of the fluctuations of the value of U.S.-based stock mutual funds.

B)shows that the talent of individual portfolio managers accounts for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds-luck the other ten percent.

C)shows that the movements of the U.S.stock market account for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

59

WEBS are

A)World Equity Benchmark Shares.

B)exchange-traded open-end country funds designed to closely track foreign stock market indexes.

C)both a) and b)

D)none of the above

A)World Equity Benchmark Shares.

B)exchange-traded open-end country funds designed to closely track foreign stock market indexes.

C)both a) and b)

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

60

For those investors who desire international equity exposure,WEBS

A)may well serve as a major alternative to such traditional tools as international mutual funds, ADRs and closed-end country funds.

B)are probably overpriced relative to international mutual funds, ADRs and closed-end country funds.

C)would provide no international equity exposure since they are pools of bonds.

D)none of the above

A)may well serve as a major alternative to such traditional tools as international mutual funds, ADRs and closed-end country funds.

B)are probably overpriced relative to international mutual funds, ADRs and closed-end country funds.

C)would provide no international equity exposure since they are pools of bonds.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

61

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock using 50% margin.One year after investment,the stock pays a $1 dividend,and sells for $54 the exchange has changed from €.625 per dollar to €.6875 per dollar.The interest on the margin loan is 1% per year.The margin loan was denominated in dollars.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

62

If the investor hedges the exchange rate risk when investing internationally

A)the risk-return efficiency is likely to be superior.

B)the expected return to the U.S.dollar investor is approximately the same whether the investor hedges the exchange rate risk in the investment, or remains unhedged.

C)to the extent that the investor establishes an effective hedge to eliminate exchange rate uncertainty, the risk will be reduced.

D)all of the above

A)the risk-return efficiency is likely to be superior.

B)the expected return to the U.S.dollar investor is approximately the same whether the investor hedges the exchange rate risk in the investment, or remains unhedged.

C)to the extent that the investor establishes an effective hedge to eliminate exchange rate uncertainty, the risk will be reduced.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound,although he sold £8,800 forward at the forward rate of €1.28 per pound.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

64

You invested $100,000 in British equities.The stock's price was £50 and the exchange rate was £0.50/$1.00.At selling time,one year after purchase,they were £45 and £0.60/$1.00.Assume the investor sold £50,000 forward at the forward exchange rate of £0.55/$1.00.The dollar rate of return would be:

A)-27.27%

B)1.09%

C)28.00%

D)-9.09%

A)-27.27%

B)1.09%

C)28.00%

D)-9.09%

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

65

When a country is more remote,with an uncommon language

A)domestic investors tend to invest more in country's market and less abroad.

B)foreign investors tend to invest less in country's market.

C)domestic investors tend to invest more in country's market.

D)both a) and b)

A)domestic investors tend to invest more in country's market and less abroad.

B)foreign investors tend to invest less in country's market.

C)domestic investors tend to invest more in country's market.

D)both a) and b)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

66

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock.The stock pays a $0.30 quarterly dividend,and after one year the investment sells for $54 the exchange has changed from €.625 per dollar to €.6875 per dollar.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

67

The return and variance of return to a U.S.dollar investor from investing in individual foreign security i are given by:

A)Ri$ = (1 + Ri)(1 + ei) - 1 and Var(Ri$) = Var(Ri)

B)Ri$ = Ri + ei and Var(Ri$) = Var(Ri) + Var(ei)

C)Ri$ = (1 + Ri)(1 + ei) - 1 and Var(Ri$) = Var(Ri) + Var(ei) + 2Cov(Ri,ei)

D)None of the above

A)Ri$ = (1 + Ri)(1 + ei) - 1 and Var(Ri$) = Var(Ri)

B)Ri$ = Ri + ei and Var(Ri$) = Var(Ri) + Var(ei)

C)Ri$ = (1 + Ri)(1 + ei) - 1 and Var(Ri$) = Var(Ri) + Var(ei) + 2Cov(Ri,ei)

D)None of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

68

Current research suggests that

A)investors can get more diversification with shares of domestic, large-cap stocks.

B)investors can get more diversification with shares of domestic, small-cap stocks.

C)investors can get more diversification with shares of foreign, large-cap stocks.

D)investors can get more diversification with shares of foreign, small-cap stocks.

A)investors can get more diversification with shares of domestic, large-cap stocks.

B)investors can get more diversification with shares of domestic, small-cap stocks.

C)investors can get more diversification with shares of foreign, large-cap stocks.

D)investors can get more diversification with shares of foreign, small-cap stocks.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

69

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound,although he sold £10,000 forward at the forward rate of €1.28 per pound.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

70

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

71

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock on margin with only 40% down and 60% borrowed.The stock pays a £0.30 quarterly dividend,and after one year the investment sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.The interest on the margin loan is 1% per year.The margin loan is denominated in pounds.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

72

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.The stock pays a £0.30 quarterly dividend,and after one year the investment sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

73

Hedge funds

A)do not register as an investment company and are not subject to reporting or disclosure requirements.

B)have experienced phenomenal growth in recent years.

C)tend to have relatively low correlations with various stock market benchmarks.

D)all of the above

A)do not register as an investment company and are not subject to reporting or disclosure requirements.

B)have experienced phenomenal growth in recent years.

C)tend to have relatively low correlations with various stock market benchmarks.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

74

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock has no value since the firm is bankrupt.Meanwhile the exchange rate has changed from €1.25 per pound to €1.30 per pound,and he sold £8,000 forward at the forward rate of €1.28 per pound.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

75

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock using 50% margin.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.The interest on the margin loan is 1% per year.The margin loan was denominated in pounds.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

76

Consider a simple exchange risk hedging strategy in which the U.S.dollar based investor sells the expected foreign currency proceeds of a risky investment forward.Although the expected foreign investment proceeds will be converted into U.S.dollars at the known forward exchange rate under this strategy,the unexpected foreign investment proceeds

A)will have to be converted into U.S.dollars at the uncertain forward spot exchange rate.

B)will have to be converted into U.S.dollars at the uncertain future spot exchange rate.

C)will have to be converted into U.S.dollars at the uncertain swap exchange rate.

D)none of the above

A)will have to be converted into U.S.dollars at the uncertain forward spot exchange rate.

B)will have to be converted into U.S.dollars at the uncertain future spot exchange rate.

C)will have to be converted into U.S.dollars at the uncertain swap exchange rate.

D)none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

77

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock.One year after investment,the stock pays a $1 dividend,and sells for $54 the exchange rate has changed from €.625 per dollar to €.6875 per dollar.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

78

The degree of home bias varies across investors

A)wealthier, more experienced, and sophisticated investors are less likely to exhibit home bias.

B)wealthier, more experienced, and sophisticated investors are more likely to exhibit home bias.

C)wealthier, more experienced, and sophisticated investors are less likely to invest in foreign securities.

D)both b) and c)

A)wealthier, more experienced, and sophisticated investors are less likely to exhibit home bias.

B)wealthier, more experienced, and sophisticated investors are more likely to exhibit home bias.

C)wealthier, more experienced, and sophisticated investors are less likely to invest in foreign securities.

D)both b) and c)

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

79

Explanations for Home Bias include

A)domestic securities may provide investors with certain extra services, such as hedging against domestic inflation, that foreign securities do not.

B)there may be barriers, formal or informal, to investing in foreign securities.

C)investors may face country-specific inflation in violation of PPP.

D)all of the above

A)domestic securities may provide investors with certain extra services, such as hedging against domestic inflation, that foreign securities do not.

B)there may be barriers, formal or informal, to investing in foreign securities.

C)investors may face country-specific inflation in violation of PPP.

D)all of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock on margin with only 40% down and 60% borrowed.The stock pays a $0.30 quarterly dividend,and after one year the investment sells for $54 the exchange has changed from €.625 per dollar to €.6875 per dollar.The interest on the margin loan is 1% per year.The margin loan is denominated in dollars.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck