Deck 2: Reviewing Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/115

Play

Full screen (f)

Deck 2: Reviewing Financial Statements

1

An equity-financed firm will:

A)pay more in income taxes than a debt-financed firm.

B)pay less in income taxes than a debt-financed firm.

C)pay the same in income taxes as a debt-finance firm.

D)not pay any income taxes.

A)pay more in income taxes than a debt-financed firm.

B)pay less in income taxes than a debt-financed firm.

C)pay the same in income taxes as a debt-finance firm.

D)not pay any income taxes.

pay more in income taxes than a debt-financed firm.

2

Free cash flow is defined as:

A)cash flows available for payments to stockholders of a firm after the firm has made payments to all others with claims against it.

B)cash flows available for payments to stockholders and debt holders of a firm after the firm has made payments necessary to vendors.

C)cash flows available for payments to stockholders and debt holders of a firm after the firm has made investments in assets necessary to sustain the ongoing operations of the firm.

D)cash flows available for payments to stockholders and debt holders of a firm that would be tax-free to the recipients.

A)cash flows available for payments to stockholders of a firm after the firm has made payments to all others with claims against it.

B)cash flows available for payments to stockholders and debt holders of a firm after the firm has made payments necessary to vendors.

C)cash flows available for payments to stockholders and debt holders of a firm after the firm has made investments in assets necessary to sustain the ongoing operations of the firm.

D)cash flows available for payments to stockholders and debt holders of a firm that would be tax-free to the recipients.

cash flows available for payments to stockholders and debt holders of a firm after the firm has made investments in assets necessary to sustain the ongoing operations of the firm.

3

Which financial statement reports a firm's assets, liabilities, and equity at a particular point in time?

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

Balance sheet

4

On which of the four major financial statements would you find the increase in inventory?

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following activities result in an increase in a firm's cash?

A)Decrease fixed assets

B)Decrease accounts payable

C)Pay dividends

D)Repurchase of common stock

A)Decrease fixed assets

B)Decrease accounts payable

C)Pay dividends

D)Repurchase of common stock

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

6

This is the amount of additional taxes a firm must pay out for every additional dollar of taxable income it earns.

A)Average tax rate

B)Marginal tax rate

C)Progressive tax system

D)Earnings before tax

A)Average tax rate

B)Marginal tax rate

C)Progressive tax system

D)Earnings before tax

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

7

Common stockholders' equity divided by number of shares of common stock outstanding is the formula for calculating:

A)Earnings per share (EPS).

B)Dividends per share (DPS).

C)Book value per share (BVPS).

D)Market value per share (MVPS).

A)Earnings per share (EPS).

B)Dividends per share (DPS).

C)Book value per share (BVPS).

D)Market value per share (MVPS).

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

8

Financial statements of publicly traded firms can be found in a number of places. Which of the following is NOT an option for finding publicly traded firms' financial statements?

A)Facebook

B)A firm's website

C)Securities and Exchange Commission's (SEC) website

D)Websites such as finance.yahoo.com

A)Facebook

B)A firm's website

C)Securities and Exchange Commission's (SEC) website

D)Websites such as finance.yahoo.com

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

9

When a firm alters its capital structure to include more or less debt (and, in turn, less or more equity), it impacts which of the following?

A)The residual cash flows available for stock holders

B)The number of shares of stock outstanding

C)The earnings per share (EPS)

D)All of the choices

A)The residual cash flows available for stock holders

B)The number of shares of stock outstanding

C)The earnings per share (EPS)

D)All of the choices

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

10

Which financial statement reconciles net income earned during a given period and any cash dividends paid within that period using the change in retained earnings between the beginning and end of the period?

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

11

If a company reports a large amount of net income on its income statement during a year, the firm will have:

A)positive cash flow.

B)negative cash flow.

C)zero cash flow.

D)Any of these scenarios are possible.

A)positive cash flow.

B)negative cash flow.

C)zero cash flow.

D)Any of these scenarios are possible.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

12

On which of the four major financial statements would you find net plant and equipment?

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

13

On which of the four major financial statements would you find the common stock and paid-in surplus?

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

A)Balance sheet

B)Income statement

C)Statement of cash flows

D)Statement of retained earnings

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

14

For which of the following would one expect the book value of the asset to differ widely from its market value?

A)Cash

B)Accounts receivable

C)Inventory

D)Fixed assets

A)Cash

B)Accounts receivable

C)Inventory

D)Fixed assets

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

15

Which financial statement shows the total revenues that a firm earns and the total expenses the firm incurs to generate those revenues over a specific period of time-generally one year?

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

A)Balance sheet

B)Income statement

C)Statement of retained earnings

D)Statement of cash flows

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

16

These are cash inflows and outflows associated with buying and selling of fixed or other long-term assets.

A)Cash flows from operations

B)Cash flows from investing activities

C)Cash flows from financing activities

D)Net change in cash and cash equivalents

A)Cash flows from operations

B)Cash flows from investing activities

C)Cash flows from financing activities

D)Net change in cash and cash equivalents

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

17

Net operating profit after taxes (NOPAT) is defined as which of the following?

A)Net profit a firm earns before taxes, but after any financing costs

B)Net profit a firm earns after taxes, and after any financing cots

C)Net profit a firm earns after taxes, but before any financing costs

D)Net profit a firm earns before taxes, and before any financing cost

A)Net profit a firm earns before taxes, but after any financing costs

B)Net profit a firm earns after taxes, and after any financing cots

C)Net profit a firm earns after taxes, but before any financing costs

D)Net profit a firm earns before taxes, and before any financing cost

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

18

Which financial statement reports the amounts of cash that the firm generated and distributed during a particular time period?

A)Balance sheet

B)Income statement

C)Statement of retained Earnings

D)Statement of cash Flows

A)Balance sheet

B)Income statement

C)Statement of retained Earnings

D)Statement of cash Flows

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

19

This is cash flow available for payments to stockholders and debt holders of a firm after the firm has made investments in assets necessary to sustain the ongoing operations of the firm.

A)Net income available to common stockholders

B)Cash flow from operations

C)Net cash flow

D)Free cash flow

A)Net income available to common stockholders

B)Cash flow from operations

C)Net cash flow

D)Free cash flow

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

20

Deferred taxes occur when a company postpones taxes on profits pertaining to:

A)tax years they are under an audit by the Internal Revenue Service.

B)funds they have not collected because they use the accrual method of accounting.

C)a loss they intend to carry back or carry forward on their income tax returns.

D)a particular period as they end up postponing part of their tax liability on this year's profits to future years.

A)tax years they are under an audit by the Internal Revenue Service.

B)funds they have not collected because they use the accrual method of accounting.

C)a loss they intend to carry back or carry forward on their income tax returns.

D)a particular period as they end up postponing part of their tax liability on this year's profits to future years.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

21

Night Scapes, Corp. began the year 2013 with $10 million in retained earnings. The firm suffered a net loss of $2 million in 2013 and yet paid $2 million to its preferred stockholders and $1 million to its common stockholders. What is the year-end 2013 balance in retained earnings for Night Scapes?

A)$5 million

B)$8 million

C)$9 million

D)$15 million

A)$5 million

B)$8 million

C)$9 million

D)$15 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

22

Eccentricity, Inc. had $300,000 in 2013 taxable income. Using the tax schedule from Table 2-3, what are the company's 2013 income taxes, average tax rate, and marginal tax rate, respectively?

A)$22,250, 7.42%, 39%

B)$78,000, 26.00%, 39%

C)$100,250, 33.42%, 39%

D)$139,250, 46.42%, 39%

A)$22,250, 7.42%, 39%

B)$78,000, 26.00%, 39%

C)$100,250, 33.42%, 39%

D)$139,250, 46.42%, 39%

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

23

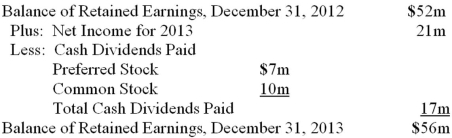

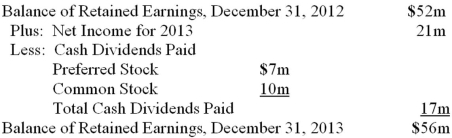

Use the following information to find dividends paid to common stockholders during 2013.

A)$3 million

B)$4 million

C)$10 million

D)$17 million

A)$3 million

B)$4 million

C)$10 million

D)$17 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

24

Consider a firm with an EBIT of $5,000,000. The firm finances its assets with $20,000,000 debt (costing 5 percent) and 70,000 shares of stock selling at $50.00 per share. To reduce the firm's risk associated with this financial leverage, the firm is considering reducing its debt by $5,000,000 by selling an additional 100,000 shares of stock. The firm is in the 40 percent tax bracket. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain $5,000,000. What is the change in the firm's EPS from this change in capital structure?

A)Decrease EPS by $9.29

B)Decrease EPS by $18.70

C)Decrease EPS by $19.29

D)Increase EPS by $2.14

A)Decrease EPS by $9.29

B)Decrease EPS by $18.70

C)Decrease EPS by $19.29

D)Increase EPS by $2.14

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

25

You are considering an investment in Cruise, Inc. and want to evaluate the firm's free cash flow. From the income statement, you see that Cruise earned an EBIT of $202 million, paid taxes of $51 million, and its depreciation expense was $75 million. Cruise's gross fixed assets increased by $70 million from 2012 to 2013. The firm's current assets decreased by $10 million and spontaneous current liabilities increased by $6 million. What is Cruise's operating cash flow, investment in operating capital, and free cash flow for 2013, respectively, in millions?

A)$202, $70, $130

B)$226, $70, $156

C)$226, $54, $172

D)$226, $74, $152

A)$202, $70, $130

B)$226, $70, $156

C)$226, $54, $172

D)$226, $74, $152

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

26

In 2013, Lower Case Productions had cash flows from investing activities of +$50,000 and cash flows from financing activities of +$100,000. The balance in the firm's cash account was $80,000 at the beginning of 2013 and $65,000 at the end of the year. What was Lower Case's cash flow from operations for 2013?

A)-$15,000

B)-$150,000

C)-$165,000

D)-$65,000

A)-$15,000

B)-$150,000

C)-$165,000

D)-$65,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

27

You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: cash and marketable securities = $400,000, accounts receivable = $200,000, inventory = $100,000, accrued wages and taxes = $10,000, accounts payable = $300,000, and notes payable = $600,000. What is Campus's net working capital?

A)-$210,000

B)$700,000

C)$910,000

D)$1,610,000

A)-$210,000

B)$700,000

C)$910,000

D)$1,610,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

28

TriCycle, Corp. began the year 2013 with $25 million in retained earnings. The firm earned net income of $7 million in 2008 and paid $1 million to its preferred stockholders and $3 million to its common stockholders. What is the year-end 2013 balance in retained earnings for TriCycle?

A)$25 million

B)$28 million

C)$32 million

D)$36 million

A)$25 million

B)$28 million

C)$32 million

D)$36 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

29

Harvey's Hamburger Stand has total assets of $3 million of which $1 million are current assets. Cash makes up 20 percent of the current assets and accounts receivable makes up another 5 percent of current assets. Harvey's gross plant and equipment has a book value of $1.5 million and other long-term assets have a book value of $1 million. Using this information, what is the balance of inventory and the balance of depreciation on Harvey's Hamburger Stand's balance sheet?

A)$250,000, $500,000

B)$250,000, $1 million

C)$750,000, $500,000

D)$750,000, $1 million

A)$250,000, $500,000

B)$250,000, $1 million

C)$750,000, $500,000

D)$750,000, $1 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

30

Jack and Jill Corporation's year-end 2013 balance sheet lists current assets of $250,000, fixed assets of $800,000, current liabilities of $195,000, and long-term debt of $300,000. What is Jack and Jill's total stockholders' equity?

A)$495,000

B)$555,000

C)$1,050,000

D)There is not enough information to calculate total stockholder's equity.

A)$495,000

B)$555,000

C)$1,050,000

D)There is not enough information to calculate total stockholder's equity.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

31

Swimmy, Inc. had $400,000 in 2013 taxable income. Using the tax schedule from Table 2-3, what are the company's 2013 income taxes, average tax rate, and marginal tax rate, respectively?

A)$22,100, 5.53%, 34%

B)$113,900, 28.48%, 34%

C)$136,000, 34.00%, 34%

D)$136,000, 39.00%, 34%

A)$22,100, 5.53%, 34%

B)$113,900, 28.48%, 34%

C)$136,000, 34.00%, 34%

D)$136,000, 39.00%, 34%

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

32

You are considering an investment in Crew Cut, Inc. and want to evaluate the firm's free cash flow. From the income statement, you see that Crew Cut earned an EBIT of $23 million, paid taxes of $4 million, and its depreciation expense was $8 million. Crew Cut's gross fixed assets increased by $10 million from 2007 to 2008. The firm's current assets increased by $6 million and spontaneous current liabilities increased by $4 million. What is Crew Cut's operating cash flow, investment in operating capital and free cash flow for 2013, respectively in millions?

A)$23, $10, $13

B)$23, $12, $11

C)$27, $10, $17

D)$27, $12, $15

A)$23, $10, $13

B)$23, $12, $11

C)$27, $10, $17

D)$27, $12, $15

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

33

The Sarbanes-Oxley Act requires public companies to ensure which of the following individuals have considerable experience applying generally accepted accounting principles (GAAP) for financial statements.

A)External auditors

B)Internal auditors

C)Chief financial officers

D)Corporate boards' audit committees

A)External auditors

B)Internal auditors

C)Chief financial officers

D)Corporate boards' audit committees

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

34

In 2013, Upper Crust had cash flows from investing activities of ($250,000) and cash flows from financing activities of ($150,000). The balance in the firm's cash account was $90,000 at the beginning of 2013 and $105,000 at the end of the year. What was Upper Crust's cash flow from operations for 2013?

A)$15,000

B)$105,000

C)$400,000

D)$415,000

A)$15,000

B)$105,000

C)$400,000

D)$415,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

35

Consider a firm with an EBIT of $500,000. The firm finances its assets with $2,000,000 debt (costing 6 percent) and 50,000 shares of stock selling at $20.00 per share. To reduce the firm's risk associated with this financial leverage, the firm is considering reducing its debt by $1,000,000 by selling an additional 50,000 shares of stock. The firm is in the 40 percent tax bracket. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain $500,000. What is the change in the firm's EPS from this change in capital structure?

A)Decrease EPS by $1.68

B)Decrease EPS by $1.92

C)Decrease EPS by $3.20

D)Increase EPS by $0.72

A)Decrease EPS by $1.68

B)Decrease EPS by $1.92

C)Decrease EPS by $3.20

D)Increase EPS by $0.72

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

36

Scuba, Inc. is concerned about the taxes paid by the company in 2013. In addition to $5 million of taxable income, the firm received $80,000 of interest on state-issued bonds and $500,000 of dividends on common stock it owns in Boating Adventures, Inc. What are Scuba's tax liability, average tax rate, and marginal tax rate, respectively?

A)$1,637,100, 31.79%, 34%

B)$1,751,000, 34.00%, 34%

C)$1,870,000, 34.00%, 34%

D)$1,983,900, 36.07%, 34%

A)$1,637,100, 31.79%, 34%

B)$1,751,000, 34.00%, 34%

C)$1,870,000, 34.00%, 34%

D)$1,983,900, 36.07%, 34%

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

37

Bullseye, Inc.'s 2013 income statement lists the following income and expenses: EBIT = $900,000, interest expense = $85,000, and net income = $570,000. What are the 2013 taxes reported on the income statement?

A)$245,000

B)$330,000

C)$815,000

D)There is not enough information to calculate 2013 taxes.

A)$245,000

B)$330,000

C)$815,000

D)There is not enough information to calculate 2013 taxes.

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

38

Barnyard, Inc.'s 2013 income statement lists the following income and expenses: EBIT = $500,000, interest expense = $45,000, and taxes = $152,000. Barnyard's has no preferred stock outstanding and 200,000 shares of common stock outstanding. What are its 2013 earnings per share?

A)$2.50

B)$2.275

C)$1.74

D)$1.515

A)$2.50

B)$2.275

C)$1.74

D)$1.515

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

39

Catering Corp. reported free cash flows for 2013 of $8 million and investment in operating capital of $2 million. Catering listed $1 million in depreciation expense and $2 million in taxes on its 2008 income statement. What was Catering's 2013 EBIT?

A)$7 million

B)$10 million

C)$11 million

D)$13 million

A)$7 million

B)$10 million

C)$11 million

D)$13 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

40

Paige's Properties Inc. reported 2013 net income of $5 million and depreciation of $1,500,000. The top part Paige's Properties, Inc.'s 2012 and 2013 balance sheets is listed as follows (in millions of dollars). What is the 2013 net cash flow from operating activities for Paige's Properties, Inc.?

A)-$13,500,000

B)$1,500,000

C)$5,000,000

D)$6,500,000

A)-$13,500,000

B)$1,500,000

C)$5,000,000

D)$6,500,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

41

Glo's Glasses balance sheet lists net fixed assets as $20 million. The fixed assets could currently be sold for $25 million. Glo's current balance sheet shows current liabilities of $7 million and net working capital of $3 million. If all the current accounts were liquidated today, the company would receive $9 million cash after paying $7 million in liabilities. What is the book value of Glo's assets today? What is the market value of these assets?

A)$10 million, $16 million

B)$10 million, $35 million

C)$30 million, $35 million

D)$30 million, $41 million

A)$10 million, $16 million

B)$10 million, $35 million

C)$30 million, $35 million

D)$30 million, $41 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

42

School Books, Inc. has total assets of $18 million of which $6 million are current assets. Cash makes up 10 percent of the current assets and accounts receivable makes up another 40 percent of current assets. School Books' gross plant and equipment has an original cost of $13 million and other long-term assets have a cost value of $2 million. Using this information, what are the balance of inventory and the balance of depreciation on School Books' balance sheet?

A)$3 million, $2 million

B)$3 million, $3 million

C)$2.4 million, $2 million

D)$2.4 million, $3 million

A)$3 million, $2 million

B)$3 million, $3 million

C)$2.4 million, $2 million

D)$2.4 million, $3 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

43

Ted's Taco Shop has total assets of $5 million. Forty percent of these assets are financed with debt of which $400,000 is current liabilities. The firm has no preferred stock but the balance in common stock and paid-in surplus is $1 million. Using this information what is the balance for long-term debt and retained earnings on Ted's Taco Shop's balance sheet?

A)$400,000, $1 million

B)$1.6 million, $2 million

C)$1.6 million, $3 million

D)$2 million, $3 million

A)$400,000, $1 million

B)$1.6 million, $2 million

C)$1.6 million, $3 million

D)$2 million, $3 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

44

The Carolina Corporation had a 2013 taxable income of $3,000,000 from operations after all operating costs but before: (1) interest charges of $500,000,

(2) dividends received of $75,000,

(3) dividends paid of $1,000,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Carolina's income tax liability?

What are Carolina's average and marginal tax rates on taxable income from operations?

A)$857,650, 28.59%, 34%, respectively

B)$875,500, 29.18%, 34%, respectively

C)$875,500, 34.00%, 34%, respectively

D)$1,020,000, 34.00%, 34%, respectively

(2) dividends received of $75,000,

(3) dividends paid of $1,000,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Carolina's income tax liability?

What are Carolina's average and marginal tax rates on taxable income from operations?

A)$857,650, 28.59%, 34%, respectively

B)$875,500, 29.18%, 34%, respectively

C)$875,500, 34.00%, 34%, respectively

D)$1,020,000, 34.00%, 34%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

45

You have been given the following information for Romeo's Rockers Corp.: Net sales = $5,200,000;

Cost of goods sold = $2,100,000;

Addition to retained earnings = $1,000,000;

Dividends paid to preferred and common stockholders = $400,000;

Interest expense = $200,000.The firm's tax rate is 30 percent. What is the depreciation expense for Romeo's Rockers Corp.?

A)$900,000

B)$1,100,000

C)$1,500,000

D)$1,600,000

Cost of goods sold = $2,100,000;

Addition to retained earnings = $1,000,000;

Dividends paid to preferred and common stockholders = $400,000;

Interest expense = $200,000.The firm's tax rate is 30 percent. What is the depreciation expense for Romeo's Rockers Corp.?

A)$900,000

B)$1,100,000

C)$1,500,000

D)$1,600,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

46

Rupert's Rims balance sheet lists net fixed assets as $15 million. The fixed assets could currently be sold for $17 million. Rupert's current balance sheet shows current liabilities of $5 million and net working capital of $3 million. If all the current accounts were liquidated today, the company would receive $6 million cash after paying $5 million in liabilities. What is the book value of Rupert's assets today? What is the market value of these assets?

A)$8 million, $23 million

B)$23 million, $25 million

C)$23 million, $28 million

D)$31 million, $28 million

A)$8 million, $23 million

B)$23 million, $25 million

C)$23 million, $28 million

D)$31 million, $28 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

47

You have been given the following information for Kaye's Krumpet Corp.: Net sales = $150,000;

Gross profit = $100,000;

Addition to retained earnings = $20,000;

Dividends paid to preferred and common stockholders = $8,000;

Depreciation expense = $50,000.The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Kaye's Krumpet Corp.?

A)$10,000, and $50,000, respectively

B)$50,000, and $10,000, respectively

C)$50,000, and $22,000, respectively

D)$62,000, and $10,000, respectively

Gross profit = $100,000;

Addition to retained earnings = $20,000;

Dividends paid to preferred and common stockholders = $8,000;

Depreciation expense = $50,000.The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Kaye's Krumpet Corp.?

A)$10,000, and $50,000, respectively

B)$50,000, and $10,000, respectively

C)$50,000, and $22,000, respectively

D)$62,000, and $10,000, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

48

The AOK Corporation had a 2013 taxable income of $2,200,000 from operations after all operating costs but before: (1) interest charges of $90,000,

(2) dividends received of $750,000,

(3) dividends paid of $80,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is AOK's income tax liability?

What are AOK's average and marginal tax rates on taxable income from operations?

A)$793,900, 34%, 34%, respectively

B)$793,900, 36.0864%, 34%, respectively

C)$972,400, 34%, 34%, respectively

D)$972,400, 44.2%, 34%, respectively

(2) dividends received of $750,000,

(3) dividends paid of $80,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is AOK's income tax liability?

What are AOK's average and marginal tax rates on taxable income from operations?

A)$793,900, 34%, 34%, respectively

B)$793,900, 36.0864%, 34%, respectively

C)$972,400, 34%, 34%, respectively

D)$972,400, 44.2%, 34%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

49

You have been given the following information for Ross's Rocket Corp.: Net sales = $1,000,000;

Gross profit = $400,000;

Addition to retained earnings = $60,000;

Dividends paid to preferred and common stockholders = $90,000;

Depreciation expense = $50,000.The firm's tax rate is 40 percent. What are the cost of goods sold and the interest expense for Ross's Rocket Corp.?

A)$100,000, and $600,000, respectively

B)$600,000, and $100,000, respectively

C)$600,000, and $200,000, respectively

D)$700,000, and $100,000, respectively

Gross profit = $400,000;

Addition to retained earnings = $60,000;

Dividends paid to preferred and common stockholders = $90,000;

Depreciation expense = $50,000.The firm's tax rate is 40 percent. What are the cost of goods sold and the interest expense for Ross's Rocket Corp.?

A)$100,000, and $600,000, respectively

B)$600,000, and $100,000, respectively

C)$600,000, and $200,000, respectively

D)$700,000, and $100,000, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

50

You are considering a stock investment in one of two firms (AllDebt, Inc. and AllEquity, Inc.), both of which operate in the same industry and have identical operating income of $400,000. AllDebt, Inc. finances its $800,000 in assets with $600,000 in debt (on which it pays 5 percent interest annually) and $200,000 in equity. AllEquity, Inc. finances its $800,000 in assets with no debt and $800,000 in equity. Both firms pay a tax rate of 30 percent on their taxable income. What are the asset funders' (the debt holders and stockholders) resulting return on assets for the two firms?

A)32.375%, and 35.00%, respectively

B)36.125%, and 35.00%, respectively

C)46.25%, and 50%, respectively

D)50%, and 50%, respectively

A)32.375%, and 35.00%, respectively

B)36.125%, and 35.00%, respectively

C)46.25%, and 50%, respectively

D)50%, and 50%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

51

You are considering a stock investment in one of two firms (AllDebt, Inc. and AllEquity, Inc.), both of which operate in the same industry and have identical operating income of $3 million. AllDebt, Inc. finances its $6 million in assets with $5 million in debt (on which it pays 5 percent interest annually) and $1 million in equity. AllEquity, Inc. finances its $6 million in assets with no debt and $6 million in equity. Both firms pay a tax rate of 40 percent on their taxable income. What are the asset funders' (the debt holders and stockholders) resulting return on assets for the two firms?

A)27.5%, and 30%, respectively

B)31.67%, and 30%, respectively

C)33%, and 30%, respectively

D)50%, and 50%, respectively

A)27.5%, and 30%, respectively

B)31.67%, and 30%, respectively

C)33%, and 30%, respectively

D)50%, and 50%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

52

You are considering a stock investment in one of two firms (AllDebt, Inc. and AllEquity, Inc.), both of which operate in the same industry and have identical operating income of $600,000. AllDebt, Inc. finances its $1.2 million in assets with $1 million in debt (on which it pays 10 percent interest annually) and $0.2 million in equity. AllEquity, Inc. finances its $1.2 million in assets with no debt and $1.2 million in equity. Both firms pay a tax rate of 30 percent on their taxable income. What are the asset funders' (the debt holders and stockholders) resulting return on assets for the two firms?

A)29.17%, and 35%, respectively

B)37.5%, and 35%, respectively

C)37.5%, and 37.5%, respectively

D)50%, and 50%, respectively

A)29.17%, and 35%, respectively

B)37.5%, and 35%, respectively

C)37.5%, and 37.5%, respectively

D)50%, and 50%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

53

Suppose that in addition to the $5.5 million of taxable income from operations, Emily's Flowers, Inc. received $500,000 of interest on state-issued bonds and $300,000 of dividends on common stock it owns in Amy's Iris Bulbs, Inc.Using the tax schedule in Table 2.3 what is Emily's Flowers' income tax liability? What are Emily's Flowers' average and marginal tax rates on total taxable income?

A)$1,900,600, 34%, 34%, respectively

B)$1,972,000, 34%, 34%, respectively

C)$2,070,600, 34%, 34%, respectively

D)$2,142,000, 34%, 34%, respectively

A)$1,900,600, 34%, 34%, respectively

B)$1,972,000, 34%, 34%, respectively

C)$2,070,600, 34%, 34%, respectively

D)$2,142,000, 34%, 34%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

54

The Ohio Corporation had a 2013 taxable income of $50,000,000 from operations after all operating costs but before: (1) interest charges of $500,000,

(2) dividends received of $45,000,

(3) dividends paid of $10,000,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Ohio's income tax liability?

What are Ohio's average and marginal tax rates on taxable income from operations?

A)$6,416,667, 12.83%, 35%, respectively

B)$13,829,725, 27.66%, 35%, respectively

C)$17,329,725, 34.66%, 35%, respectively

D)$17,340,750, 34.68%, 35%, respectively

(2) dividends received of $45,000,

(3) dividends paid of $10,000,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Ohio's income tax liability?

What are Ohio's average and marginal tax rates on taxable income from operations?

A)$6,416,667, 12.83%, 35%, respectively

B)$13,829,725, 27.66%, 35%, respectively

C)$17,329,725, 34.66%, 35%, respectively

D)$17,340,750, 34.68%, 35%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

55

Hair Etc. has total assets of $15 million. Twenty percent of these assets are financed with debt of which $1 million is current liabilities. The firm has no preferred stock but the balance in common stock and paid-in surplus is $8 million. Using this information what is the balance for long-term debt and retained earnings on Hair Etc.'s balance sheet?

A)$1 million, $8 million

B)$2 million, $4 million

C)$2 million, $8 million

D)$3 million, $4 million

A)$1 million, $8 million

B)$2 million, $4 million

C)$2 million, $8 million

D)$3 million, $4 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

56

The Sasnak Corporation had a 2013 taxable income of $4,450,000 from operations after all operating costs but before: (1) interest charges of $750,000,

(2) dividends received of $900,000,

(3) dividends paid of $500,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Sasnak's income tax liability?

What are Sasnak's average and marginal tax rates on taxable income from operations?

A)$1,349,800, 30.33%, 34%, respectively

B)$1,349,800, 34.00%, 34%, respectively

C)$1,564,000, 34.00%, 34%, respectively

D)$1,564,000, 35.15%, 34%, respectively

(2) dividends received of $900,000,

(3) dividends paid of $500,000, and

(4) income taxes.Using the tax schedule in Table 2.3, what is Sasnak's income tax liability?

What are Sasnak's average and marginal tax rates on taxable income from operations?

A)$1,349,800, 30.33%, 34%, respectively

B)$1,349,800, 34.00%, 34%, respectively

C)$1,564,000, 34.00%, 34%, respectively

D)$1,564,000, 35.15%, 34%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

57

You have been given the following information for Nicole's Neckties Corp.: Net sales = $2,500,000;

Cost of goods sold = $1,300,000;

Addition to retained earnings = $30,000;

Dividends paid to preferred and common stockholders = $300,000;

Interest expense = $50,000.The firm's tax rate is 40 percent. What is the depreciation expense for Nicole's Neckties Corp.?

A)$550,000

B)$600,000

C)$650,000

D)$820,000

Cost of goods sold = $1,300,000;

Addition to retained earnings = $30,000;

Dividends paid to preferred and common stockholders = $300,000;

Interest expense = $50,000.The firm's tax rate is 40 percent. What is the depreciation expense for Nicole's Neckties Corp.?

A)$550,000

B)$600,000

C)$650,000

D)$820,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

58

You have been given the following information for Fina's Furniture Corp.: Net sales = $25,500,000;

Cost of goods sold = $10,250,000;

Addition to retained earnings = $305,000;

Dividends paid to preferred and common stockholders = $500,000;

Interest expense = $2,000,000.The firm's tax rate is 30 percent. What is the depreciation expense for Fina's Furniture Corp.?

A)$12,100,000

B)$12,400,000

C)$14,100,000

D)$14,400,000

Cost of goods sold = $10,250,000;

Addition to retained earnings = $305,000;

Dividends paid to preferred and common stockholders = $500,000;

Interest expense = $2,000,000.The firm's tax rate is 30 percent. What is the depreciation expense for Fina's Furniture Corp.?

A)$12,100,000

B)$12,400,000

C)$14,100,000

D)$14,400,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

59

Acme Bricks balance sheet lists net fixed assets as $40 million. The fixed assets could currently be sold for $50 million. Acme's current balance sheet shows current liabilities of $15 million and net working capital of $12 million. If all the current accounts were liquidated today, the company would receive $77 million cash after paying $15 million in liabilities. What is the book value of Acme's assets today? What is the market value of these assets?

A)$12 million, $77 million

B)$27 million, $92 million

C)$40 million, $50 million

D)$67 million, $142 million

A)$12 million, $77 million

B)$27 million, $92 million

C)$40 million, $50 million

D)$67 million, $142 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

60

You have been given the following information for Sherry's Sandwich Corp.: Net sales = $300,000;

Gross profit = $100,000;

Addition to retained earnings = $30,000;

Dividends paid to preferred and common stockholders = $8,500;

Depreciation expense = $25,000.The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Sherry's Sandwich Corp.?

A)$20,000, and $200,000, respectively

B)$100,000, and $20,000, respectively

C)$200,000, and $20,000, respectively

D)$200,000, and $36,500, respectively

Gross profit = $100,000;

Addition to retained earnings = $30,000;

Dividends paid to preferred and common stockholders = $8,500;

Depreciation expense = $25,000.The firm's tax rate is 30 percent. What are the cost of goods sold and the interest expense for Sherry's Sandwich Corp.?

A)$20,000, and $200,000, respectively

B)$100,000, and $20,000, respectively

C)$200,000, and $20,000, respectively

D)$200,000, and $36,500, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

61

The 2013 income statement for Betty's Barstools shows that depreciation expense is $100 million, EBIT is $400 million, and taxes are $120 million. At the end of the year, the balance of gross fixed assets was $510 million. The increase in net operating working capital during the year was $94 million. Betty's free cash flow for the year was $625 million. What was the beginning of year balance for gross fixed assets?

A)$359 million

B)$380 million

C)$849 million

D)$1,094 million

A)$359 million

B)$380 million

C)$849 million

D)$1,094 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

62

The 2013 income statement for Paige's Purses shows that depreciation expense is $10 million, EBIT is $25 million, EBT is $15 million, and the tax rate is 30 percent. At the beginning of the year, the balance of gross fixed assets was $80 million and net operating working capital was $30 million. At the end of the year gross fixed assets was $100 million. Paige's free cash flow for the year was $20 million. What is their end of year balance for net operating working capital?

A)$10.5 million

B)$14 million

C)$20.5 million

D)$30.5 million

A)$10.5 million

B)$14 million

C)$20.5 million

D)$30.5 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

63

Soccer Starz, Inc. started the year with a balance of retained earnings of $25 million and ended the year with retained earnings of $32 million. The company paid dividends of $2 million to the preferred stock holders and $6 million to common stock holders. What was Soccer Starz's net income for the year?

A)$7 million

B)$15 million

C)$40 million

D)$49 million

A)$7 million

B)$15 million

C)$40 million

D)$49 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

64

You have been given the following information for Halle's Holiday Store Corp. for the year 2013: Net sales = $50,000,000;

Cost of goods sold = $35,000,000;

Addition to retained earnings = $2,000,000;

Dividends paid to preferred and common stockholders = $3,000,000;

Interest expense = $3,000,000.The firm's tax rate is 30 percent.In 2014, net sales are expected to increase by $5 million,

Cost of goods sold is expected to be 65 percent of net sales,

Expensed depreciation is expected to be the same as in 2013,

Interest expense is expected to be $2,500,000,

The tax rate is expected to be 30 percent of EBT, and

Dividends paid to preferred and common stockholders will not change.What is the addition to retained earnings expected in 2014?

A)$2,000,000

B)$5,325,000

C)$8,447,500

D)$10,304,643

Cost of goods sold = $35,000,000;

Addition to retained earnings = $2,000,000;

Dividends paid to preferred and common stockholders = $3,000,000;

Interest expense = $3,000,000.The firm's tax rate is 30 percent.In 2014, net sales are expected to increase by $5 million,

Cost of goods sold is expected to be 65 percent of net sales,

Expensed depreciation is expected to be the same as in 2013,

Interest expense is expected to be $2,500,000,

The tax rate is expected to be 30 percent of EBT, and

Dividends paid to preferred and common stockholders will not change.What is the addition to retained earnings expected in 2014?

A)$2,000,000

B)$5,325,000

C)$8,447,500

D)$10,304,643

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

65

The following is the 2013 income statement for Lamps, Inc. Lamps, Inc

Income Statement for Year Ending December 31, 2013

(in millions of dollars)

The CEO of Lamps wants the company to earn a net income of $12 million in 2014. Cost of goods sold is expected to be 75 percent of net sales, depreciation expense is not expected to change, interest expense is expected to increase to $4 million, and the firm's tax rate will be 40 percent. What is the net sales needed to produce net income of $12 million?

A)$29 million

B)$112 million

C)$116 million

D)$124 million

Income Statement for Year Ending December 31, 2013

(in millions of dollars)

The CEO of Lamps wants the company to earn a net income of $12 million in 2014. Cost of goods sold is expected to be 75 percent of net sales, depreciation expense is not expected to change, interest expense is expected to increase to $4 million, and the firm's tax rate will be 40 percent. What is the net sales needed to produce net income of $12 million?

A)$29 million

B)$112 million

C)$116 million

D)$124 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

66

Martha's Moving Van 4U, Inc. had free cash flow during 2013 of $1 million, EBIT of $30 million, tax expense of $8 million, and depreciation of $4 million. Using this information, what was Martha's Accounts Payable ending balance in 2013?

A)$5 million

B)$15 million

C)$35 million

D)$45 million

A)$5 million

B)$15 million

C)$35 million

D)$45 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

67

The 2010 income statement for Pete's Pumpkins shows that depreciation expense is $250 million, EBIT is $500 million, EBT is $320 million, and the tax rate is 30 percent. At the beginning of the year, the balance of gross fixed assets was $1,600 million and net operating working capital was $640 million. At the end of the year gross fixed assets was $2,000 million. Pete's free cash flow for the year was $630 million. What is their end of year balance for net operating working capital?

A)$24 million

B)$264 million

C)$654 million

D)$1,064 million

A)$24 million

B)$264 million

C)$654 million

D)$1,064 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

68

Bike and Hike, Inc. started the year with a balance of retained earnings of $100 million and ended the year with retained earnings of $128 million. The company paid dividends of $9 million to the preferred stock holders and $22 million to common stock holders. What was Bike and Hike's net income for the year?

A)$28 million

B)$31 million

C)$59 million

D)$128 million

A)$28 million

B)$31 million

C)$59 million

D)$128 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

69

You are evaluating the balance sheet for Goodman's Bees Corporation. From the balance sheet you find the following balances: cash and marketable securities = $200,000, accounts receivable = $1,100,000, inventory = $2,000,000, accrued wages and taxes = $500,000, accounts payable = $600,000, and notes payable = $100,000. Calculate Goodman's Bees' net working capital.

A)$2,000,000

B)$2,100,000

C)$1,400,000

D)$1,900,000

A)$2,000,000

B)$2,100,000

C)$1,400,000

D)$1,900,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

70

Crispy Corporation has net cash flow from financing activities for the last year of $20 million. The company paid $5 million in dividends last year. During the year, the change in notes payable on the balance sheet was an increase of $2 million, and change in common and preferred stock was an increase of $3 million. The end of year balance for long-term debt was $45 million. What was their beginning of year balance for long-term debt?

A)$15 million

B)$20 million

C)$25 million

D)$35 million

A)$15 million

B)$20 million

C)$25 million

D)$35 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

71

Nickolas's Nut Farms, Inc. has net cash flows from operating activities for the last year of $25 million. The income statement shows that net income is $15 million and depreciation expense is $6 million. During the year, the change in inventory on the balance sheet was a decrease of $4 million, change in accrued wages and taxes was a decrease of $1 million and change in accounts payable was a decrease of $1 million. At the beginning of the year the balance of accounts receivable was $5 million. What was the end of year balance for accounts receivable?

A)$2 million

B)$3 million

C)$7 million

D)$9 million

A)$2 million

B)$3 million

C)$7 million

D)$9 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

72

Fina's Faucets, Inc. has net cash flows from operating activities for the last year of $17 million. The income statement shows that net income is $15 million and depreciation expense is $6 million. During the year, the change in inventory on the balance sheet was an increase of $4 million, change in accrued wages and taxes was an increase of $1 million and change in accounts payable was an increase of $1 million. At the beginning of the year the balance of accounts receivable was $5 million. What was the end of year balance for accounts receivable?

A)$2 million

B)$3 million

C)$7 million

D)$9 million

A)$2 million

B)$3 million

C)$7 million

D)$9 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

73

Full Moon Productions Inc. has net cash flow from financing activities for the last year of $105 million. The company paid $15 million in dividends last year. During the year, the change in notes payable on the balance sheet was an increase of $40 million, and change in common and preferred stock was an increase of $50 million. The end of year balance for long-term debt was $50 million. What was their beginning of year balance for long-term debt?

A)$5 million

B)$20 million

C)$30 million

D)$35 million

A)$5 million

B)$20 million

C)$30 million

D)$35 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

74

Jamaican Ice Cream Corp. started the year with a balance of retained earnings of $100 million. The company reported net income for the year of $45 million, paid dividends of $2 million to the preferred stock holders and $15 million to common stock holders. What is Jamaican Ice Cream's end of year balance in retained earnings?

A)$38 million

B)$55 million

C)$128 million

D)$162 million

A)$38 million

B)$55 million

C)$128 million

D)$162 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

75

The 2013 income statement for Lou's Shoes shows that depreciation expense is $2 million, EBIT is $5 million, EBT is $3 million, and the tax rate is 40 percent. At the beginning of the year, the balance of gross fixed assets was $16 million and net operating working capital was $6 million. At the end of the year gross fixed assets was $20 million. Lou's free cash flow for the year was $4 million. What is their end of year balance for net operating working capital?

A)$1.8 million

B)$3.8 million

C)$5.8 million

D)$12.2 million

A)$1.8 million

B)$3.8 million

C)$5.8 million

D)$12.2 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

76

The 2013 income statement for John's Gym shows that depreciation expense is $20 million, EBIT is $80 million, and taxes are $24 million. At the end of the year, the balance of gross fixed assets was $102 million. The increase in net operating working capital during the year was $18 million. John's free cash flow for the year was $41 million. What was the beginning of year balance for gross fixed assets?

A)$43 million

B)$85 million

C)$84 million

D)$163 million

A)$43 million

B)$85 million

C)$84 million

D)$163 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

77

Zoeckler Mowing & Landscaping's year-end 2011 balance sheet lists current assets of $350,000, fixed assets of $325,000, current liabilities of $145,000, and long-term debt of $185,000. Calculate Zoeckler's total stockholders' equity.

A)$115,000

B)$490,000

C)$345,000

D)$500,000

A)$115,000

B)$490,000

C)$345,000

D)$500,000

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

78

Café Creations Inc. has net cash flow from financing activities for the last year of $25 million. The company paid $15 million in dividends last year. During the year, the change in notes payable on the balance sheet was a decrease of $40 million, and change in common and preferred stock was an increase of $50 million. The end of year balance for long-term debt was $40 million. What was their beginning of year balance for long-term debt?

A)$10 million

B)$20 million

C)$30 million

D)$40 million

A)$10 million

B)$20 million

C)$30 million

D)$40 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

79

Suppose that in addition to the $300,000 of taxable income from operations, Liam's Burgers, Inc. received $25,000 of interest on state-issued bonds and $50,000 of dividends on common stock it owns in Sodas, Inc.Using the tax schedule in Table 2.3 what is Liam's income tax liability? What are Liam's average and marginal tax rates on total taxable income?

A)$106,100, 33.68%, 39%, respectively

B)$122,850, 39.00%, 39%, respectively

C)$129,500, 34.53%, 39%, respectively

D)$139,250, 37.13%, 39%, respectively

A)$106,100, 33.68%, 39%, respectively

B)$122,850, 39.00%, 39%, respectively

C)$129,500, 34.53%, 39%, respectively

D)$139,250, 37.13%, 39%, respectively

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck

80

Zoe's Dog Biscuits, Inc. has net cash flows from operating activities for the last year of $226 million. The income statement shows that net income is $150 million and depreciation expense is $85 million. During the year, the change in inventory on the balance sheet was an increase of $14 million, change in accrued wages and taxes was an increase of $15 million and change in accounts payable was an increase of $10 million. At the beginning of the year the balance of accounts receivable was $45 million. What was the end of year balance for accounts receivable?

A)$20 million

B)$25 million

C)$45 million

D)$65 million

A)$20 million

B)$25 million

C)$45 million

D)$65 million

Unlock Deck

Unlock for access to all 115 flashcards in this deck.

Unlock Deck

k this deck