Deck 16: Capital Market Financing: Hybrid and Other Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/62

Play

Full screen (f)

Deck 16: Capital Market Financing: Hybrid and Other Securities

1

The design of stepped-up exercise prices is to control the timing of equity capital raised for the firm.

True

2

The conversion price of a convertible security is fixed and independent of stock market conditions.

True

3

A convertible debenture can never sell for more than its conversion value or less than its bond value.

False

4

Credit default swaps help protection sellers transfer all interest rate risk to the protection buyers.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

5

Most convertible securities are bonds or preferred stocks that,under specified terms and conditions,can be exchanged for common stock at the option of the holder.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

6

Asset securitizations allow investors to expand the scope of their investment choices.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

7

One warrant entitles the holder to purchase only one common share.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

8

The "misused" asset securitizations,credit derivatives,and CDOs took the blame for creating the credit crisis of 2007.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

9

Special purpose vehicles (SPVs) in asset securitization usually contain credit enhancements for their securities.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

10

A warrant is an option,and as such,it cannot be used as a "sweetener."

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

11

Liquid assets such as bankers' acceptance (BA) can never be used for securitization.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

12

Since warrants and convertibles give holders the right to exchange for their underlying stock,they should represent the same sources of financing.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

13

The ultimate credit risk of asset-backed securities lies with the special purpose vehicle that is the central payor.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

14

Convertible bonds typically have a call provision.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

15

Convertible bonds usually have higher credit ratings than the basic nonconvertible bonds.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

16

Warrants,convertible securities,and call and put options are similar in the sense that they have a value contingent upon the future value of the firm's shares.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

17

Asset-backed commercial papers do not appeal to investors because little is known about the assets backing the securities.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

18

A warrant holder is not entitled to vote,but he or she does receive any cash dividends paid on the underlying stock.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

19

The owner of a convertible bond owns,in effect,both a bond and a call option.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

20

The Bank of Canada is the primary guarantor of securitized assets in Canada.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements best describes convertibles?

A)One advantage of convertibles over warrants is that the issuer receives additional cash when convertibles are converted.

B)Investors are willing to accept a lower interest rate on a convertible than on otherwise similar straight debt because convertibles are less risky than straight debt.

C)At the time it is issued, a convertible's conversion (or exercise) price is generally set equal to or below the underlying stock's price.

D)For equilibrium to exist, the expected return on a convertible bond must normally be between the expected return on the firm's otherwise similar straight debt and the expected return on its common stock.

A)One advantage of convertibles over warrants is that the issuer receives additional cash when convertibles are converted.

B)Investors are willing to accept a lower interest rate on a convertible than on otherwise similar straight debt because convertibles are less risky than straight debt.

C)At the time it is issued, a convertible's conversion (or exercise) price is generally set equal to or below the underlying stock's price.

D)For equilibrium to exist, the expected return on a convertible bond must normally be between the expected return on the firm's otherwise similar straight debt and the expected return on its common stock.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements best describes warrants?

A)Warrants are long-term put options that have value because holders can sell the firm's common stock at the exercise price regardless of how low the market price drops.

B)Warrants are long-term call options that have value because holders can buy the firm's common stock at the exercise price regardless of how high the stock's price has risen.

C)A firm's investors would generally prefer to see it issue bonds with warrants than straight bonds because the warrants dilute the value of new shareholders, and that value is transferred to existing shareholders.

D)A drawback to using warrants is that if the firm is very successful, investors will be less likely to exercise the warrants, and this will deprive the firm of receiving any new capital.

A)Warrants are long-term put options that have value because holders can sell the firm's common stock at the exercise price regardless of how low the market price drops.

B)Warrants are long-term call options that have value because holders can buy the firm's common stock at the exercise price regardless of how high the stock's price has risen.

C)A firm's investors would generally prefer to see it issue bonds with warrants than straight bonds because the warrants dilute the value of new shareholders, and that value is transferred to existing shareholders.

D)A drawback to using warrants is that if the firm is very successful, investors will be less likely to exercise the warrants, and this will deprive the firm of receiving any new capital.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements best describes warrants?

A)One important difference between warrants and convertibles is that convertibles bring in additional funds when they are converted, but exercising warrants does not bring in any additional funds.

B)The coupon rate on convertible debt is normally set below the coupon rate that would be set on otherwise similar straight debt even though investing in convertibles is more risky than investing in straight debt.

C)The value of a warrant to buy a safe, stable stock should exceed the value of a warrant to buy a risky, volatile stock, other things held constant.

D)Warrants can sometimes be detached and traded separately from the debt with which they were issued, but this is unusual.

A)One important difference between warrants and convertibles is that convertibles bring in additional funds when they are converted, but exercising warrants does not bring in any additional funds.

B)The coupon rate on convertible debt is normally set below the coupon rate that would be set on otherwise similar straight debt even though investing in convertibles is more risky than investing in straight debt.

C)The value of a warrant to buy a safe, stable stock should exceed the value of a warrant to buy a risky, volatile stock, other things held constant.

D)Warrants can sometimes be detached and traded separately from the debt with which they were issued, but this is unusual.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

24

ABC Bank enters a credit default swap of $10 million for 5 years with XYZ Insurance.How much does ABC have to pay with a premium rate of 2.5% per year?

A)$100,000

B)$150,000

C)$250,000

D)$500,000

A)$100,000

B)$150,000

C)$250,000

D)$500,000

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

25

Warren Corporation's stock sells for $42 per share.The company wants to sell some 20-year,annual interest $1,000 par value bonds.Each bond would have 75 warrants attached to it,each exercisable into one share of stock at an exercise price of $47.The firm's straight bonds yield 10%.Each warrant is expected to have a market value of $2.00 given that the stock sells for $42.What coupon interest rate must the company set on the bonds in order to sell the bonds with warrants at par?

A)7.83%

B)8.24%

C)8.65%

D)9.08%

A)7.83%

B)8.24%

C)8.65%

D)9.08%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

26

Who or what is (are) the legal asset owner(s) behind home mortgage securitization?

A)special purpose vehicles (SPV)

B)individual investors

C)banks that originate the mortgages

D)Canada Mortgage and Housing Corporation (CMHC)

A)special purpose vehicles (SPV)

B)individual investors

C)banks that originate the mortgages

D)Canada Mortgage and Housing Corporation (CMHC)

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

27

When warrants are exercised,what happens as a result?

A)The security associated with the warrant drops in value depending on the exercise price of the warrant.

B)Funds are transferred from the retained earnings account to the common shares account for the market value of the shares.

C)The number of common shares outstanding changes.

D)There is no new capital for the firm because the warrants are exchanged for the common shares.

A)The security associated with the warrant drops in value depending on the exercise price of the warrant.

B)Funds are transferred from the retained earnings account to the common shares account for the market value of the shares.

C)The number of common shares outstanding changes.

D)There is no new capital for the firm because the warrants are exchanged for the common shares.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following assets CANNOT be used for securitization?

A)credit card receivables

B)student loans

C)accrued fees

D)home mortgages

A)credit card receivables

B)student loans

C)accrued fees

D)home mortgages

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

29

Which factor will NOT affect the price paid on warrants?

A)the coupon rates of the security to which the warrant is issued

B)the expiration time of the warrant

C)the difference between the current share price and the exercise price on warrants

D)the amount of cash dividends paid on the common shares of the firm

A)the coupon rates of the security to which the warrant is issued

B)the expiration time of the warrant

C)the difference between the current share price and the exercise price on warrants

D)the amount of cash dividends paid on the common shares of the firm

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

30

How does home mortgage securitization benefit mortgage originators?

A)They can improve the asset liquidity.

B)They have additional funds for other investment.

C)They are free from default and prepayment risks.

D)They can improve asset liquidity, have additional funds for other investments, and are free from default and prepayment risks.

A)They can improve the asset liquidity.

B)They have additional funds for other investment.

C)They are free from default and prepayment risks.

D)They can improve asset liquidity, have additional funds for other investments, and are free from default and prepayment risks.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

31

What is the theoretical value of a warrant when the current price of the stock is $50 and the exercise price is $45? The exchange ratio is four shares for each warrant.

A)$20

B)$15

C)$10

D)$5

A)$20

B)$15

C)$10

D)$5

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

32

Orient Airlines' common stock currently sells for $33,and its 8% convertible debentures (issued at par,or $1,000) sell for $850.Each debenture can be converted into 25 shares of common stock at any time before 2017.What is the conversion value of the bond?

A)$707.33

B)$744.56

C)$783.75

D)$825.00

A)$707.33

B)$744.56

C)$783.75

D)$825.00

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

33

Chocolate Factory's convertible debentures were issued at their $1,000 par value in 2007.At any time prior to maturity on February 1,2027,a debenture holder can exchange a bond for 25 shares of common stock.What is the conversion price,Pc?

A)$40.00

B)$42.00

C)$44.10

D)$46.31

A)$40.00

B)$42.00

C)$44.10

D)$46.31

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

34

You have paid $5 to buy a warrant with an exercise price of $40.The stock is currently trading at $50.How much profit or loss would you make by exercising the warrant if one warrant entitles the owner to buy one share of stock?

A)$5.00

B)$10.00

C)$40.00

D)$50.00

A)$5.00

B)$10.00

C)$40.00

D)$50.00

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

35

If a zero correlation of default exists between the different securities and the loan,the equity tranche may have no hope of being paid.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement regarding a collateralized debt obligation (CDO) is true?

A)A security has no default risk exposure.

B)A security is tax free.

C)A security involves a credit default swap.

D)A security represents a claim on the cash flows of a loan.

A)A security has no default risk exposure.

B)A security is tax free.

C)A security involves a credit default swap.

D)A security represents a claim on the cash flows of a loan.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

37

Why is asset securitization advantageous to investors?

A)It removes all risk of holding the assets.

B)It results in higher returns.

C)It increases investment choices.

D)It eliminates the need for financing.

A)It removes all risk of holding the assets.

B)It results in higher returns.

C)It increases investment choices.

D)It eliminates the need for financing.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

38

Which circumstance will decrease the protection payment for credit default swaps?

A)expected recovery values decrease

B)expected risk of default decreases

C)an unexpected increase of borrowing from the underlying company

D)an unexpected drop in share prices of the underlying company

A)expected recovery values decrease

B)expected risk of default decreases

C)an unexpected increase of borrowing from the underlying company

D)an unexpected drop in share prices of the underlying company

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

39

Curry Corporation is setting the terms on a new issue of bonds with warrants.The bonds will have a 30-year maturity and annual interest payments.Each bond will come with 20 warrants that give the holder the right to purchase one share of stock per warrant.The investment bankers estimate that each warrant will have a value of $10.00.A similar straight-debt issue would require a 10% coupon.What coupon rate should be set on the bonds with warrants so that the package would sell for $1,000?

A)6.75%

B)7.11%

C)7.48%

D)7.88%

A)6.75%

B)7.11%

C)7.48%

D)7.88%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

40

Upstate Water Company just sold a bond with 50 warrants attached.The bonds have a 20-year maturity and an annual coupon of 12%,and they were issued at their $1,000 par value.The current yield on similar straight bonds is 15%.What is the implied value of each warrant?

A)$3.76

B)$3.94

C)$4.14

D)$4.35

A)$3.76

B)$3.94

C)$4.14

D)$4.35

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is generally true of convertible issues?

A)Firms generally call their convertibles when the conversion value is greater than the call price.

B)Firms generally call their convertibles when the conversion value is less than the call price.

C)Firms generally do not call their convertibles unless the conversion value is equal to the call price.

D)Firms generally do not call their convertibles unless the conversion value is greater than the call price.

A)Firms generally call their convertibles when the conversion value is greater than the call price.

B)Firms generally call their convertibles when the conversion value is less than the call price.

C)Firms generally do not call their convertibles unless the conversion value is equal to the call price.

D)Firms generally do not call their convertibles unless the conversion value is greater than the call price.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is true regarding mortgage-backed security tranches?

A)Different tranches in a mortgage-backed security have different default risk exposure.

B)All tranches in a mortgage-backed security have the same default risk exposure.

C)All tranches in a mortgage-backed security have the same returns to investment.

D)Different tranches in a mortgage-backed security have different default risk exposure.

A)Different tranches in a mortgage-backed security have different default risk exposure.

B)All tranches in a mortgage-backed security have the same default risk exposure.

C)All tranches in a mortgage-backed security have the same returns to investment.

D)Different tranches in a mortgage-backed security have different default risk exposure.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

43

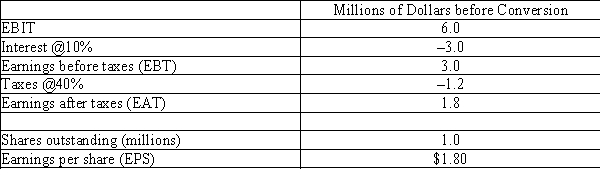

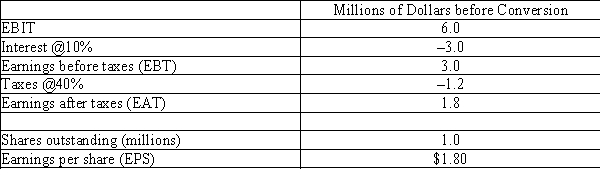

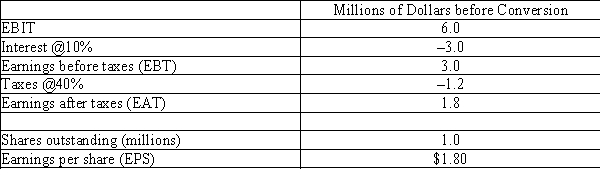

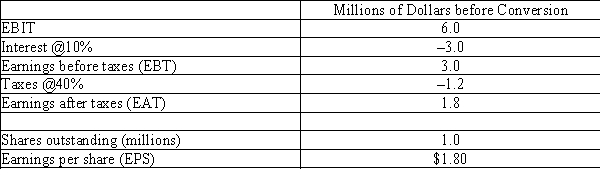

Canada Corp.A firm has $10 million of outstanding convertible bonds. The coupon on these convertibles is $100 per bond, and each bond is convertible into common stock at a conversion price of $25.The income statement of the firm before conversion is as follows and EBIT remains at $6 million after conversion. Assume the firm originally paid $2 million in interest on other outstanding debt before the convertible was issued.

Refer to Scenario: Canada Corp.How much is the firm's total earnings after conversion?

A)$1.71 million

B)$2.04 million

C)$2.40 million

D)$3.17 million

Refer to Scenario: Canada Corp.How much is the firm's total earnings after conversion?

A)$1.71 million

B)$2.04 million

C)$2.40 million

D)$3.17 million

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

44

A convertible bond has a call price of $1,100.Its underlying stock is selling at $70 per share,and the conversion price is $50.If owners of the convertible bond convert and sell the stock,what is the profit or loss on each bond if the convertible is called by the company?

A)-$100

B)-$200

C)-$300

D)+$300

A)-$100

B)-$200

C)-$300

D)+$300

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following best describes the sale of warrants and their effects on stockholder's earnings?

A)The sale of warrants do not dilute stockholder's earnings.

B)The sale of warrants dilute stockholder's earnings to the extent that dividends are paid out.

C)The sale of warrants do not dilute stockholder's earnings to the extent that dividends are paid out.

D)The sale of warrants dilute stockholder's earnings.

A)The sale of warrants do not dilute stockholder's earnings.

B)The sale of warrants dilute stockholder's earnings to the extent that dividends are paid out.

C)The sale of warrants do not dilute stockholder's earnings to the extent that dividends are paid out.

D)The sale of warrants dilute stockholder's earnings.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

46

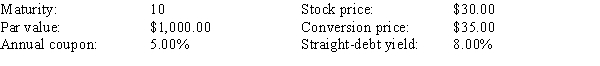

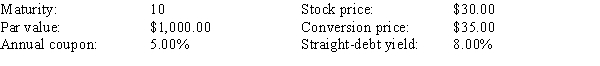

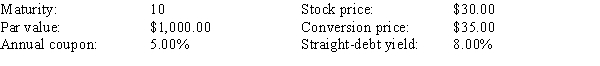

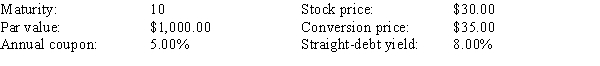

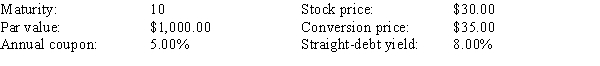

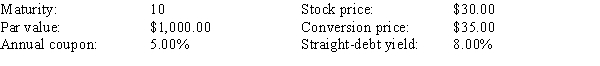

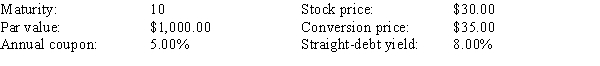

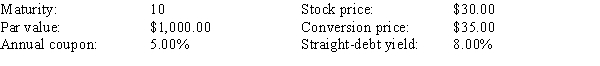

SaundersThe following data apply to Saunders Corporation's convertible bonds:

Refer to Scenario: Saunders.What is the bond's conversion ratio?

A)27.14

B)28.57

C)30.00

D)31.50

Refer to Scenario: Saunders.What is the bond's conversion ratio?

A)27.14

B)28.57

C)30.00

D)31.50

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following best describes the make up of a CDO?

A)A security made up of corporate loans and common equity swaps is called a collateralized debt obligation (CDO).

B)A security made up of corporate loans and preferred swaps is called a collateralized debt obligation (CDO).

C)A security made up of corporate loans and credit default swaps is called a collateralized debt obligation (CDO).

D)A security made up of corporate loans and accounts payable default swaps is called a collateralized debt obligation (CDO).

A)A security made up of corporate loans and common equity swaps is called a collateralized debt obligation (CDO).

B)A security made up of corporate loans and preferred swaps is called a collateralized debt obligation (CDO).

C)A security made up of corporate loans and credit default swaps is called a collateralized debt obligation (CDO).

D)A security made up of corporate loans and accounts payable default swaps is called a collateralized debt obligation (CDO).

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is correct regarding securitization?

A)Securitization can always improve liquidity with respect to fixed assets.

B)Securitization does not always improve the liquidity with respect to the securitized assets.

C)Securitization can always improve liquidity with respect to the securitized assets.

D)Securitization never improves liquidity with respect to the securitized assets.

A)Securitization can always improve liquidity with respect to fixed assets.

B)Securitization does not always improve the liquidity with respect to the securitized assets.

C)Securitization can always improve liquidity with respect to the securitized assets.

D)Securitization never improves liquidity with respect to the securitized assets.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

49

Canada Corp.A firm has $10 million of outstanding convertible bonds. The coupon on these convertibles is $100 per bond, and each bond is convertible into common stock at a conversion price of $25.The income statement of the firm before conversion is as follows and EBIT remains at $6 million after conversion. Assume the firm originally paid $2 million in interest on other outstanding debt before the convertible was issued.

Refer to Scenario: Canada Corp.What is the fully diluted EPS?

A)$1.57

B)$1.59

C)$1.62

D)$1.71

Refer to Scenario: Canada Corp.What is the fully diluted EPS?

A)$1.57

B)$1.59

C)$1.62

D)$1.71

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

50

The ABC Bank enters into a credit default swap with XYZ Financial.The swap runs for 5 years and is based upon a term loan to LMN Corp.The size of the protection payment is 5% per year.Unfortunately,LMN goes bankrupt a year after this swap agreement becomes effective.Even with a 75% recovery value on the underlying loan,XYZ has paid ABC $20 million for settlements.How much has ABC lent to LMN?

A)$100 million

B)$80 million

C)$50 million

D)$20 million

A)$100 million

B)$80 million

C)$50 million

D)$20 million

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

51

SaundersThe following data apply to Saunders Corporation's convertible bonds:

Refer to Scenario: Saunders.What is the bond's straight-debt value?

A)$684.78

B)$720.82

C)$758.76

D)$798.70

Refer to Scenario: Saunders.What is the bond's straight-debt value?

A)$684.78

B)$720.82

C)$758.76

D)$798.70

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is correct regarding credit derivatives?

A)If the expected recovery value increases, then the size of payment upon the occurrence of a credit event will increase. This will increase the protection payment.

B)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will decrease. This will increase the protection payment.

C)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will remain stable. This will increase the protection payment.

D)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will increase. This will increase the protection payment.

A)If the expected recovery value increases, then the size of payment upon the occurrence of a credit event will increase. This will increase the protection payment.

B)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will decrease. This will increase the protection payment.

C)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will remain stable. This will increase the protection payment.

D)If the expected recovery value decreases, then the size of payment upon the occurrence of a credit event will increase. This will increase the protection payment.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

53

Valdes Enterprises is considering issuing a 10-year convertible bond that would be priced at its $1,000 par value.The bonds would have an 8.00% annual coupon,and each bond could be converted into 20 shares of common stock.The required rate of return on an otherwise similar nonconvertible bond is 10.00%.The stock currently sells for $40.00 a share,has an expected dividend in the coming year of $2.00,and has an expected constant growth rate of 5.00%.What is the estimated floor price of the convertible at the end of Year 3?

A)$794.01

B)$835.81

C)$879.80

D)$926.10

A)$794.01

B)$835.81

C)$879.80

D)$926.10

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

54

The ABC Bank enters into a credit default swap with XYZ Financial.The notional amount of the swap is $50 million.The 5-year swap is based upon a 5-year loan to LMN Corp.The size of the protection payment is 3% per year.As LMN bankrupts during the time this swap is still valid,XYZ has paid ABC $22.5 million for settlements.What is the recovery ratio on the underlying loan?

A)60%

B)55%

C)45%

D)40%

A)60%

B)55%

C)45%

D)40%

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following best describes a detachable warrant?

A)A detachable warrant is a warrant that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to common shares.

B)A detachable warrant is a warrant that cannot be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

C)A detachable warrant is a warrant that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

D)A detachable warrant is a convertible bond that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

A)A detachable warrant is a warrant that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to common shares.

B)A detachable warrant is a warrant that cannot be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

C)A detachable warrant is a warrant that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

D)A detachable warrant is a convertible bond that can be detached and traded separately from the security with which it was issued. Most traded warrants are originally attached to bonds or preferred stocks.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

56

SaundersThe following data apply to Saunders Corporation's convertible bonds:

Refer to Scenario: Saunders.What is the bond's conversion value?

A)$734.89

B)$773.57

C)$814.29

D)$857.14

Refer to Scenario: Saunders.What is the bond's conversion value?

A)$734.89

B)$773.57

C)$814.29

D)$857.14

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

57

What is the theoretical value of a warrant when the current price of the stock is $75 and the exercise price is $50? The exchange ratio is five shares for each warrant.

A)$125

B)$115

C)$110

D)$105

A)$125

B)$115

C)$110

D)$105

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is correct regarding the interaction of a firm's share price and the value of issued warrants?

A)The value of the warrant increases as the market price of the underlying shares rises.

B)The value of the warrant decreases as the market price of the underlying shares eclines.

C)The value of the warrant increases as the market price of the underlying shares declines.

D)There is no relationship between the value of a warrant and its stock price.

A)The value of the warrant increases as the market price of the underlying shares rises.

B)The value of the warrant decreases as the market price of the underlying shares eclines.

C)The value of the warrant increases as the market price of the underlying shares declines.

D)There is no relationship between the value of a warrant and its stock price.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following best characterizes the position of borrowers in loan securitizations?

A)In many loan securitizations, most borrowers of the sold loans are unaware that the lender has sold the loans.

B)In many loan securitizations, most borrowers of the sold loans are notified that the lender has sold the loans.

C)In many loan securitizations, most borrowers of the sold loans have the right to decline the securitization.

D)In many loan securitizations, most borrowers of the unsold loans are aware that the lender has sold the loans.

A)In many loan securitizations, most borrowers of the sold loans are unaware that the lender has sold the loans.

B)In many loan securitizations, most borrowers of the sold loans are notified that the lender has sold the loans.

C)In many loan securitizations, most borrowers of the sold loans have the right to decline the securitization.

D)In many loan securitizations, most borrowers of the unsold loans are aware that the lender has sold the loans.

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

60

SaundersThe following data apply to Saunders Corporation's convertible bonds:

Refer to Scenario: Saunders.Based on your answers to the three preceding questions,what is the minimum price (or "floor" price) at which the Saunders bonds should sell?

A)$734.89

B)$773.57

C)$814.29

D)$857.14

Refer to Scenario: Saunders.Based on your answers to the three preceding questions,what is the minimum price (or "floor" price) at which the Saunders bonds should sell?

A)$734.89

B)$773.57

C)$814.29

D)$857.14

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

61

What is the theoretical value of a warrant when the current price of the stock is $10 and the exercise price is $8? The exchange ratio is three shares for each warrant.

A)$20

B)$15

C)$10

D)$6

A)$20

B)$15

C)$10

D)$6

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck

62

What is the theoretical value of a warrant when the current price of the stock is $25 and the exercise price is $20? The exchange ratio is two shares for each warrant.

A)$15

B)$10

C)$20

D)$5

A)$15

B)$10

C)$20

D)$5

Unlock Deck

Unlock for access to all 62 flashcards in this deck.

Unlock Deck

k this deck