Deck 13: Capital, interest, entrepreneurship, and Corporate Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/199

Play

Full screen (f)

Deck 13: Capital, interest, entrepreneurship, and Corporate Finance

1

The opportunity cost of producing capital goods is a(n)_____

A)decrease in the current production of consumption goods.

B)increase in the future production of consumption goods.

C)increase in the rate of interest.

D)increase in the stock of capital available for future use.

E)decrease in the amount of capital available for future use.

A)decrease in the current production of consumption goods.

B)increase in the future production of consumption goods.

C)increase in the rate of interest.

D)increase in the stock of capital available for future use.

E)decrease in the amount of capital available for future use.

A

2

For a typical consumer,present consumption is _____

A)preferred to future consumption.

B)less rewarding than future consumption.

C)equally preferred as future consumption.

D)not preferred to future saving.

E)financed out of present saving.

A)preferred to future consumption.

B)less rewarding than future consumption.

C)equally preferred as future consumption.

D)not preferred to future saving.

E)financed out of present saving.

A

3

If you would rather risk burning your mouth rather than wait until your pizza cools,then you _____

A)value future consumption more than present consumption.

B)value current consumption more than future consumption.

C)value current and future consumption equally.

D)value neither current nor future consumption.

E)are more likely to delay consuming pizza.

A)value future consumption more than present consumption.

B)value current consumption more than future consumption.

C)value current and future consumption equally.

D)value neither current nor future consumption.

E)are more likely to delay consuming pizza.

B

4

A positive rate of time preference means that _____

A)as time progresses, people value consumption more than saving.

B)consumption in the future is more important than current consumption.

C)current consumption is valued equally as consumption in the future.

D)consumption in the future is valued less than current consumption.

E)consumption in the future and consumption today are positively related.

A)as time progresses, people value consumption more than saving.

B)consumption in the future is more important than current consumption.

C)current consumption is valued equally as consumption in the future.

D)consumption in the future is valued less than current consumption.

E)consumption in the future and consumption today are positively related.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

5

Sally loves to see a movie as soon as it is released in theaters.This is an example of _____

A)a positive rate of time preference.

B)utility maximization.

C)diminishing marginal utility.

D)relative preference.

E)Pareto optimality.

A)a positive rate of time preference.

B)utility maximization.

C)diminishing marginal utility.

D)relative preference.

E)Pareto optimality.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

6

Identify the correct statement.

A)Savings reduces the current production of only capital goods.

B)Savings reduces the current production of only consumer goods.

C)Savings is necessary for production because production takes time.

D)Savings is necessary for production because production is expensive.

E)Savings is not necessary for production because the opportunity cost of production is zero.

A)Savings reduces the current production of only capital goods.

B)Savings reduces the current production of only consumer goods.

C)Savings is necessary for production because production takes time.

D)Savings is necessary for production because production is expensive.

E)Savings is not necessary for production because the opportunity cost of production is zero.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

7

Production cannot occur without _____

A)saving.

B)government intervention.

C)a market system.

D)low interest rates.

E)high interest rates.

A)saving.

B)government intervention.

C)a market system.

D)low interest rates.

E)high interest rates.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

8

The benefit of the production of capital goods is a(n)_____

A)increase in the current production of consumption goods.

B)increase in the future production of all goods.

C)increase in the market interest rate.

D)decrease in the market interest rate.

E)increase in the expected rate of return on capital.

A)increase in the current production of consumption goods.

B)increase in the future production of all goods.

C)increase in the market interest rate.

D)decrease in the market interest rate.

E)increase in the expected rate of return on capital.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

9

If Arnold has a positive rate of time preference,he prefers to _____

A)save now to protect himself from inflation.

B)consume now rather than save.

C)invest in stocks and bonds.

D)invest in education.

E)plan for retirement.

A)save now to protect himself from inflation.

B)consume now rather than save.

C)invest in stocks and bonds.

D)invest in education.

E)plan for retirement.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

10

Banks and other financial institutions _____

A)channel savings directly to producers.

B)are intermediaries between savers and borrowers.

C)move money from borrowers to savers.

D)move money from those who need money to those that have money.

E)serve no purpose in the economy.

A)channel savings directly to producers.

B)are intermediaries between savers and borrowers.

C)move money from borrowers to savers.

D)move money from those who need money to those that have money.

E)serve no purpose in the economy.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

11

The rate of time preference is positive _____

A)only when interest rates are positive.

B)only when interest rates are negative.

C)only when people save.

D)when people prefer to save now rather than consume.

E)when people prefer to consume now rather than later.

A)only when interest rates are positive.

B)only when interest rates are negative.

C)only when people save.

D)when people prefer to save now rather than consume.

E)when people prefer to consume now rather than later.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following does not reflect a positive rate of time preference?

A)people being willing to pay high prices to see new movies at theaters

B)a bank paying interest on savings accounts

C)Ed saving money for a rainy day

D)dry cleaners that provide faster service charging more for their service

E)Dan buying the Harry Potter books as soon as they are published

A)people being willing to pay high prices to see new movies at theaters

B)a bank paying interest on savings accounts

C)Ed saving money for a rainy day

D)dry cleaners that provide faster service charging more for their service

E)Dan buying the Harry Potter books as soon as they are published

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

13

Most companies that sell CDs by mail deliver in 1 to 2 weeks.Mosey Music Inc.takes 4 weeks to deliver CDs.Which of the following is likely to be true in this case?

A)Mosey Music will lose all its customers.

B)Mosey Music will not lose customers because the good in question is CDs, which has substitutes.

C)Mosey Music will have to charge more for its CDs to make up for the business it loses through slow delivery.

D)Mosey Music will have to charge less for its CDs to compete with firms that deliver CDs faster.

E)Mosey Music will be able to charge the same amount for its CDs as other firms do as long as the quality of the CDs is the same.

A)Mosey Music will lose all its customers.

B)Mosey Music will not lose customers because the good in question is CDs, which has substitutes.

C)Mosey Music will have to charge more for its CDs to make up for the business it loses through slow delivery.

D)Mosey Music will have to charge less for its CDs to compete with firms that deliver CDs faster.

E)Mosey Music will be able to charge the same amount for its CDs as other firms do as long as the quality of the CDs is the same.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

14

What increases with saving?

A)production

B)consumption

C)interest rates

D)time

E)uncertainty

A)production

B)consumption

C)interest rates

D)time

E)uncertainty

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

15

Explanations for a positive rate of time preference include _____

A)patience.

B)certainty.

C)impatience.

D)planning.

E)investments.

A)patience.

B)certainty.

C)impatience.

D)planning.

E)investments.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

16

Increased saving today means _____

A)more consumption today and in the future.

B)less consumption today and in the future.

C)more consumption today and less in the future.

D)less consumption today and more in the future.

E)more income today and more consumption in the future.

A)more consumption today and in the future.

B)less consumption today and in the future.

C)more consumption today and less in the future.

D)less consumption today and more in the future.

E)more income today and more consumption in the future.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

17

Saving is _____

A)helpful for production but not necessary.

B)not useful for production because it decreases consumption.

C)required for production.

D)not useful for production because it is not a resource.

E)not useful for production because savers must be paid interest.

A)helpful for production but not necessary.

B)not useful for production because it decreases consumption.

C)required for production.

D)not useful for production because it is not a resource.

E)not useful for production because savers must be paid interest.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

18

Explanations for a positive rate of time preference include _____

A)patience.

B)uncertainty.

C)saving.

D)planning.

E)investments.

A)patience.

B)uncertainty.

C)saving.

D)planning.

E)investments.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

19

Financial markets for stocks and bonds _____

A)channel savings directly to producers.

B)are intermediaries between savers and borrowers.

C)move money from borrowers to savers.

D)move money from those who need money to those that have money.

E)serve no purpose in the economy.

A)channel savings directly to producers.

B)are intermediaries between savers and borrowers.

C)move money from borrowers to savers.

D)move money from those who need money to those that have money.

E)serve no purpose in the economy.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

20

The difference between income and consumption is known as _____

A)rent.

B)profit.

C)saving.

D)opportunity cost.

E)investment.

A)rent.

B)profit.

C)saving.

D)opportunity cost.

E)investment.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

21

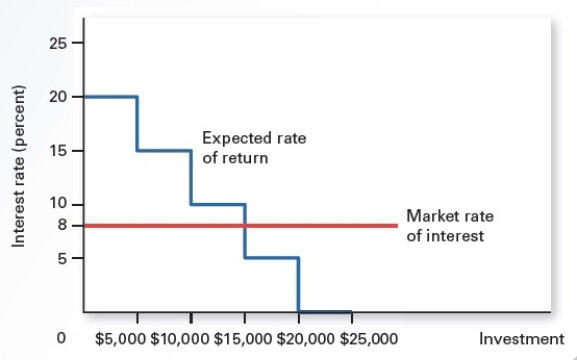

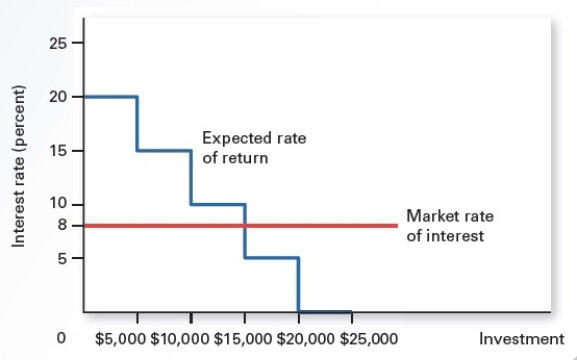

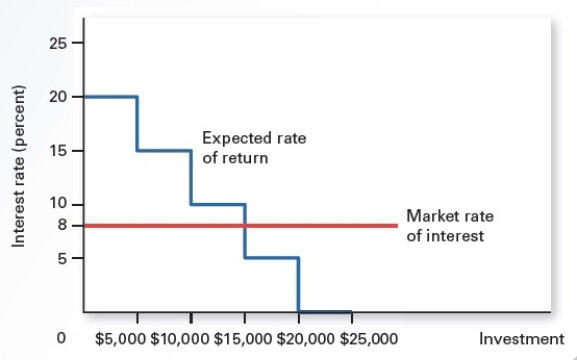

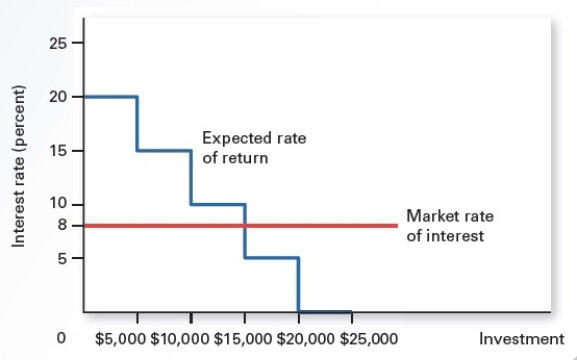

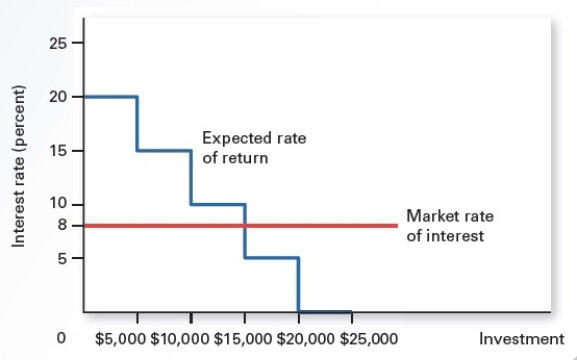

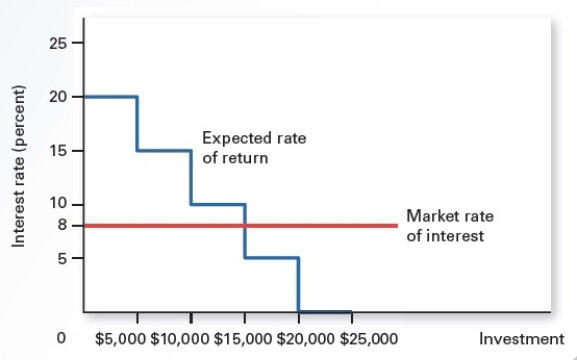

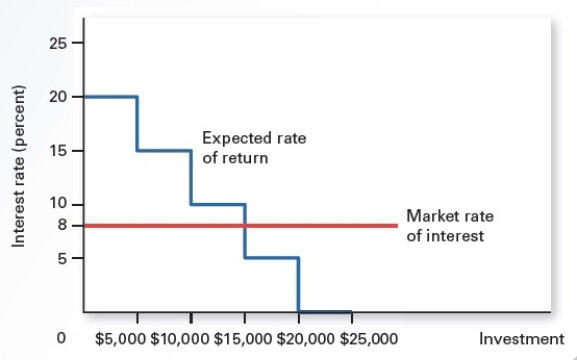

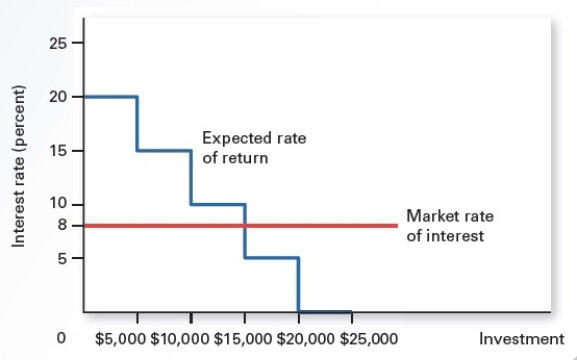

Exhibit 13.2

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest rises to 16 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest rises to 16 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

22

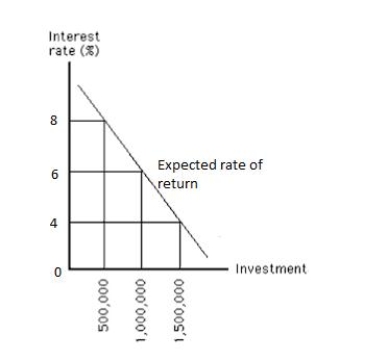

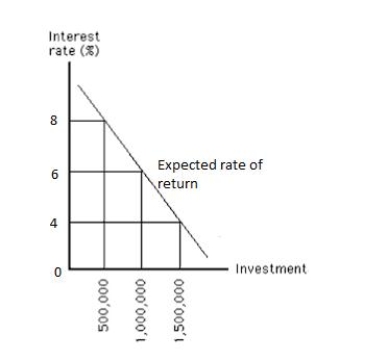

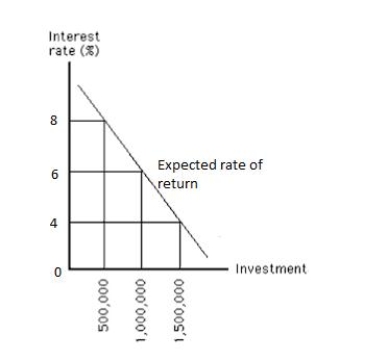

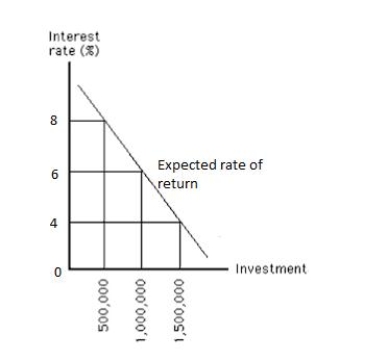

Exhibit 13.1

Refer to Exhibit 13.1,which shows the expected rate of return on investment undertaken by a firm.At an interest rate of 8 percent,investment will equal approximately _____

A)$1,500,000.

B)$500,000.

C)$1,000,000.

D)$950,000.

E)$1,250,000.

Refer to Exhibit 13.1,which shows the expected rate of return on investment undertaken by a firm.At an interest rate of 8 percent,investment will equal approximately _____

A)$1,500,000.

B)$500,000.

C)$1,000,000.

D)$950,000.

E)$1,250,000.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

23

Exhibit 13.2

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest is 8 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest is 8 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

24

If a firm can borrow or lend at a 10 percent annual interest rate,it will _____.

A)buy all the units of capital with an expected rate of return above 10 percent.

B)buy all the units of capital with an average rate of return above 0.1 percent.

C)buy all the units of capital with an expected rate of return below 10 percent.

D)buy all the units of capital with an average rate of return below 10 percent.

E)select only the unit of capital with the highest expected rate of return, assuming it is above 10 percent.

A)buy all the units of capital with an expected rate of return above 10 percent.

B)buy all the units of capital with an average rate of return above 0.1 percent.

C)buy all the units of capital with an expected rate of return below 10 percent.

D)buy all the units of capital with an average rate of return below 10 percent.

E)select only the unit of capital with the highest expected rate of return, assuming it is above 10 percent.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

25

If the expected rate of return from a purchase of equipment is greater than the market interest rate,the firm should _____

A)not purchase the equipment.

B)purchase the equipment.

C)seek government assistance in decreasing the market interest rate.

D)inform stockholders that the firm expects a decrease in earnings from the purchase.

E)seek government assistance in increasing the market interest rate.

A)not purchase the equipment.

B)purchase the equipment.

C)seek government assistance in decreasing the market interest rate.

D)inform stockholders that the firm expects a decrease in earnings from the purchase.

E)seek government assistance in increasing the market interest rate.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

26

Intellectual property is _____

A)a special form of capital.

B)a type of labor.

C)a special type of service.

D)cheap to produce, but expensive to transmit.

E)a kind of entrepreneurial ability.

A)a special form of capital.

B)a type of labor.

C)a special type of service.

D)cheap to produce, but expensive to transmit.

E)a kind of entrepreneurial ability.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

27

Interest is a payment for deferred _____

A)taxation.

B)saving.

C)consumption.

D)investment.

E)annuity.

A)taxation.

B)saving.

C)consumption.

D)investment.

E)annuity.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would be true if the market interest rate increases?

A)The cost of borrowing would increase, and this would decrease saving.

B)The opportunity cost of consuming a good in the future would increase, and this would increase saving.

C)The opportunity cost of consuming a good in the future would increase, and saving would decrease.

D)The reward for saving would decrease, and present consumption would increase.

E)The reward for saving would increase, and this would increase saving.

A)The cost of borrowing would increase, and this would decrease saving.

B)The opportunity cost of consuming a good in the future would increase, and this would increase saving.

C)The opportunity cost of consuming a good in the future would increase, and saving would decrease.

D)The reward for saving would decrease, and present consumption would increase.

E)The reward for saving would increase, and this would increase saving.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

29

Exhibit 13.1

Refer to Exhibit 13.1,which shows the expected rate of return on investment undertaken by a firm.If the interest rate is 5 percent,investment will equal approximately _____

A)$1,500,000.

B)$700,000.

C)$1,000,000.

D)$950,000.

E)$1,250,000.

Refer to Exhibit 13.1,which shows the expected rate of return on investment undertaken by a firm.If the interest rate is 5 percent,investment will equal approximately _____

A)$1,500,000.

B)$700,000.

C)$1,000,000.

D)$950,000.

E)$1,250,000.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

30

If the annual interest rate is 4 percent,a consumer who spends $100 today _____

A)will have to return $104 to a bank.

B)will have to pay $104 next year to get the same set of goods.

C)will receive $96 from a bank next year.

D)will have to pay $96 next year to get the same set of goods.

E)is giving up the ability to spend $104 on goods next year.

A)will have to return $104 to a bank.

B)will have to pay $104 next year to get the same set of goods.

C)will receive $96 from a bank next year.

D)will have to pay $96 next year to get the same set of goods.

E)is giving up the ability to spend $104 on goods next year.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

31

A firm's demand curve for investment is its _____

A)expected annual earnings curve.

B)marginal product curve.

C)marginal revenue curve.

D)expected rate of return on investment curve.

E)supply of loanable funds curve.

A)expected annual earnings curve.

B)marginal product curve.

C)marginal revenue curve.

D)expected rate of return on investment curve.

E)supply of loanable funds curve.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following is true of the market interest rate?

A)It typically increases from one year to the next.

B)It represents the demand for investment.

C)It represents the opportunity cost of investing in capital.

D)It represents the supply of loanable funds.

E)It is not affected by the demand for investment.

A)It typically increases from one year to the next.

B)It represents the demand for investment.

C)It represents the opportunity cost of investing in capital.

D)It represents the supply of loanable funds.

E)It is not affected by the demand for investment.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

33

Exhibit 13.2

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.Given the market rate of interest shown,the firm should reject any investment with an expected rate of return that is _____

A)above 8 percent.

B)above 10 percent.

C)above 15 percent.

D)above 20 percent.

E)below 8 percent.

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.Given the market rate of interest shown,the firm should reject any investment with an expected rate of return that is _____

A)above 8 percent.

B)above 10 percent.

C)above 15 percent.

D)above 20 percent.

E)below 8 percent.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

34

The interest rate compensates _____

A)bankers for their time spent on paperwork.

B)borrowers for their increased consumption today.

C)savers for forgoing consumption in the current period.

D)consumers for increasing current consumption.

E)savers for deferring investment in the current period.

A)bankers for their time spent on paperwork.

B)borrowers for their increased consumption today.

C)savers for forgoing consumption in the current period.

D)consumers for increasing current consumption.

E)savers for deferring investment in the current period.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

35

The Whitmans decided to offer their beach house in Miami for rent.If they expect a monthly rent of $5,000 and the cost of building the house is $1 million,their expected rate of return should be _____

A)0.005 percent annually.

B)0.5 percent annually.

C)6 percent annually.

D)15 percent annually.

E)10 percent annually.

A)0.005 percent annually.

B)0.5 percent annually.

C)6 percent annually.

D)15 percent annually.

E)10 percent annually.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

36

If the interest rate increases from 6 percent to 10 percent per year,every $100 saved will earn _____

A)$4 more per year than before.

B)$6 more per year than before.

C)$10 more per year than before.

D)$16 more per year than before.

E)$60 more per year than before.

A)$4 more per year than before.

B)$6 more per year than before.

C)$10 more per year than before.

D)$16 more per year than before.

E)$60 more per year than before.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

37

Exhibit 13.2

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest falls to 4 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Refer to Exhibit 13.2,which shows the expected rate of return on investment undertaken by a firm.What is the firm's investment in a project if the market rate of interest falls to 4 percent?

A)$5,000

B)$10,000

C)$15,000

D)$20,000

E)$25,000

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

38

When the expected rate of return from a purchase of equipment is lower than the market interest rate,a firm should _____

A)seek government assistance in decreasing the market interest rate.

B)inform stockholders that the firm can expect increased earnings from the purchase.

C)use the equipment less intensively in production to reduce its depreciation cost.

D)purchase the equipment.

E)not purchase the equipment.

A)seek government assistance in decreasing the market interest rate.

B)inform stockholders that the firm can expect increased earnings from the purchase.

C)use the equipment less intensively in production to reduce its depreciation cost.

D)purchase the equipment.

E)not purchase the equipment.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

39

If the annual interest rate is 5 percent,_____

A)$100 saved today will be worth $105 after one year.

B)$90 saved today will be worth $100 after one year.

C)$100 saved today will be worth $150 after one year.

D)$99 saved today will be worth $100 after one year.

E)$100 saved today will be worth $1,000 after one year.

A)$100 saved today will be worth $105 after one year.

B)$90 saved today will be worth $100 after one year.

C)$100 saved today will be worth $150 after one year.

D)$99 saved today will be worth $100 after one year.

E)$100 saved today will be worth $1,000 after one year.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

40

A firm's expected rate of return on investment curve shows the amount _____

A)saved by the firm at each interest rate.

B)invested by the firm at each interest rate.

C)saved by the firm at each alternative rate of time preference.

D)invested by the firm at each alternative marginal resource cost.

E)saved by the firm at each alternative marginal revenue product of investment.

A)saved by the firm at each interest rate.

B)invested by the firm at each interest rate.

C)saved by the firm at each alternative rate of time preference.

D)invested by the firm at each alternative marginal resource cost.

E)saved by the firm at each alternative marginal revenue product of investment.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

41

Intellectual property _____

A)requires copyright protection that is expensive to obtain but cheap to enforce.

B)usually ends up being owned by the government.

C)is costly to create but can be reproduced at low cost.

D)cannot be owned by anyone.

E)is a tangible asset owned by digital companies.

A)requires copyright protection that is expensive to obtain but cheap to enforce.

B)usually ends up being owned by the government.

C)is costly to create but can be reproduced at low cost.

D)cannot be owned by anyone.

E)is a tangible asset owned by digital companies.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

42

The slope of the demand curve for loanable funds can be explained by the slope of the _____

A)marginal resource cost curve.

B)marginal revenue product curve.

C)expected rate of return on investment curve.

D)expected annual earnings curve.

E)marginal product curve.

A)marginal resource cost curve.

B)marginal revenue product curve.

C)expected rate of return on investment curve.

D)expected annual earnings curve.

E)marginal product curve.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

43

As the interest rate increases,the opportunity cost of _____

A)saving decreases.

B)past consumption decreases.

C)saving increases.

D)current consumption increases.

E)borrowing decreases.

A)saving decreases.

B)past consumption decreases.

C)saving increases.

D)current consumption increases.

E)borrowing decreases.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is true in the context of the loanable funds market?

A)Savers are the suppliers of loanable funds, and borrowers are the demanders of loanable funds.

B)The supply of loanable funds curve slopes downward, and the demand for loanable funds curve slopes upward.

C)The supply of loanable funds curve reflects the negative relation between the market rate of interest and the quantity of savings.

D)Households play the role of financial intermediaries.

E)Banks pay a higher interest rate on consumer savings than what they could earn by lending these funds out.

A)Savers are the suppliers of loanable funds, and borrowers are the demanders of loanable funds.

B)The supply of loanable funds curve slopes downward, and the demand for loanable funds curve slopes upward.

C)The supply of loanable funds curve reflects the negative relation between the market rate of interest and the quantity of savings.

D)Households play the role of financial intermediaries.

E)Banks pay a higher interest rate on consumer savings than what they could earn by lending these funds out.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

45

Market interest rates are determined _____

A)by banks.

B)by the New York Stock Exchange (NYSE).

C)only by the demand for loanable funds.

D)only by the supply of loanable funds.

E)by both the demand for and supply of loanable funds.

A)by banks.

B)by the New York Stock Exchange (NYSE).

C)only by the demand for loanable funds.

D)only by the supply of loanable funds.

E)by both the demand for and supply of loanable funds.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

46

The supply of loanable funds curve reflects _____

A)the inverse relationship between the market interest rate and investment, other things constant.

B)the inverse relationship between the market interest rate and the quantity of saving, other things constant.

C)the direct relationship between the market interest rate and the investment, other things constant.

D)the direct relationship between the market interest rate and the quantity of saving, other things constant.

E)the direct relationship between the market interest rate and the quantity of present consumption, other things constant.

A)the inverse relationship between the market interest rate and investment, other things constant.

B)the inverse relationship between the market interest rate and the quantity of saving, other things constant.

C)the direct relationship between the market interest rate and the investment, other things constant.

D)the direct relationship between the market interest rate and the quantity of saving, other things constant.

E)the direct relationship between the market interest rate and the quantity of present consumption, other things constant.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

47

If the interest rate increases from 3 to 4 percent,other things constant,individuals will want to _____

A)both save and borrow more.

B)both save and borrow less.

C)save more and borrow less.

D)save less and borrow more.

E)borrow more but save the same amount.

A)both save and borrow more.

B)both save and borrow less.

C)save more and borrow less.

D)save less and borrow more.

E)borrow more but save the same amount.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

48

The supply of loanable funds comes,in part,from _____

A)consumer saving.

B)business investment.

C)the federal government.

D)current consumption.

E)future consumption.

A)consumer saving.

B)business investment.

C)the federal government.

D)current consumption.

E)future consumption.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

49

One problem associated with intellectual property is that _____

A)only one person can use it at a time.

B)the patent system reduces incentives to create new intellectual property.

C)the cost of producing it usually exceeds the benefit from it.

D)encryption software creates monopoly power.

E)the original owner has difficulty preventing non-paying beneficiaries from using the property.

A)only one person can use it at a time.

B)the patent system reduces incentives to create new intellectual property.

C)the cost of producing it usually exceeds the benefit from it.

D)encryption software creates monopoly power.

E)the original owner has difficulty preventing non-paying beneficiaries from using the property.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

50

The Internet has created some special problems for intellectual property.One problem is that _____

A)the price of intellectual property exceeds marginal cost.

B)the cyber market has not yet reached equilibrium.

C)intellectual property can be downloaded, modified, and then resold.

D)the marginal cost of enforcing property rights exceeds marginal benefit.

E)the price of intellectual property usually exceeds marginal benefit.

A)the price of intellectual property exceeds marginal cost.

B)the cyber market has not yet reached equilibrium.

C)intellectual property can be downloaded, modified, and then resold.

D)the marginal cost of enforcing property rights exceeds marginal benefit.

E)the price of intellectual property usually exceeds marginal benefit.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

51

The patent and copyright systems _____

A)reduce the cost of duplicating intellectual property.

B)help make the market for intellectual property more competitive.

C)are forms of intellectual property.

D)help increase the incentives to create new intellectual property.

E)help easily transfer intellectual property rights from the creator to the user.

A)reduce the cost of duplicating intellectual property.

B)help make the market for intellectual property more competitive.

C)are forms of intellectual property.

D)help increase the incentives to create new intellectual property.

E)help easily transfer intellectual property rights from the creator to the user.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

52

A decrease in the expected rate of return is likely to _____

A)increase the quantity of loanable funds demanded and cause a downward movement along the demand for loanable funds curve.

B)decrease the quantity of loanable funds demanded and cause a downward movement along the demand for loanable funds curve.

C)increase the quantity of loanable funds demanded and cause an upward movement along the demand for loanable funds curve.

D)increase the quantity of loanable funds supplied and cause a downward movement along the supply of loanable funds curve.

E)increase the quantity of loanable funds supplied and cause an upward movement along the supply of loanable funds curve.

A)increase the quantity of loanable funds demanded and cause a downward movement along the demand for loanable funds curve.

B)decrease the quantity of loanable funds demanded and cause a downward movement along the demand for loanable funds curve.

C)increase the quantity of loanable funds demanded and cause an upward movement along the demand for loanable funds curve.

D)increase the quantity of loanable funds supplied and cause a downward movement along the supply of loanable funds curve.

E)increase the quantity of loanable funds supplied and cause an upward movement along the supply of loanable funds curve.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

53

The loanable funds market brings together savers and borrowers to determine the _____

A)marginal rate of return on investment.

B)rate of time preference.

C)market rate of interest.

D)marginal resource cost of investment.

E)marginal revenue product of investment.

A)marginal rate of return on investment.

B)rate of time preference.

C)market rate of interest.

D)marginal resource cost of investment.

E)marginal revenue product of investment.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

54

Other things constant,the supply of loanable funds curve is _____

A)upward sloping because fewer people have to be persuaded to forgo current consumption as the interest rate rises.

B)downward sloping, showing that more investment will be undertaken as inflation decreases.

C)upward sloping because the reward for saving increases as the interest rate increases.

D)downward sloping, showing that as more funds are available, the risk of loaning funds decreases.

E)usually horizontal, showing that the supply of loans is independent of the rate of inflation in an economy.

A)upward sloping because fewer people have to be persuaded to forgo current consumption as the interest rate rises.

B)downward sloping, showing that more investment will be undertaken as inflation decreases.

C)upward sloping because the reward for saving increases as the interest rate increases.

D)downward sloping, showing that as more funds are available, the risk of loaning funds decreases.

E)usually horizontal, showing that the supply of loans is independent of the rate of inflation in an economy.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following will cause a rightward shift of the demand for loanable funds curve?

A)a decrease in the expected rate of return on investment

B)an increase in the expected rate of return on investment

C)an increase in the prices of other resources

D)a decrease in the expected rate of inflation

E)a decrease in the price of the product that is produced

A)a decrease in the expected rate of return on investment

B)an increase in the expected rate of return on investment

C)an increase in the prices of other resources

D)a decrease in the expected rate of inflation

E)a decrease in the price of the product that is produced

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

56

The demand curve for loanable funds is _____

A)a straight line through the origin.

B)horizontal.

C)vertical.

D)downward sloping.

E)S-shaped.

A)a straight line through the origin.

B)horizontal.

C)vertical.

D)downward sloping.

E)S-shaped.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

57

Everything else remaining unchanged,if consumers decide to increase their rate of saving,the _____

A)supply of loanable funds will decrease.

B)supply of loanable funds will increase.

C)demand for loanable funds will decrease.

D)quantity of loanable funds demanded will increase.

E)quantity of loanable funds supplied will increase.

A)supply of loanable funds will decrease.

B)supply of loanable funds will increase.

C)demand for loanable funds will decrease.

D)quantity of loanable funds demanded will increase.

E)quantity of loanable funds supplied will increase.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

58

As the interest rate increases,consumers will tend to _____

A)increase their savings because of the higher opportunity cost of future consumption.

B)decrease savings because of their greater reliance on borrowing.

C)increase their savings because of the lower opportunity cost of current consumption.

D)decrease savings because of diminishing marginal utility.

E)increase savings because of the higher opportunity cost of current consumption.

A)increase their savings because of the higher opportunity cost of future consumption.

B)decrease savings because of their greater reliance on borrowing.

C)increase their savings because of the lower opportunity cost of current consumption.

D)decrease savings because of diminishing marginal utility.

E)increase savings because of the higher opportunity cost of current consumption.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

59

Financial intermediaries bring suppliers and demanders together in the market for _____

A)labor.

B)loanable funds.

C)saving.

D)physical capital.

E)human capital.

A)labor.

B)loanable funds.

C)saving.

D)physical capital.

E)human capital.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

60

Everything else remaining constant,a technological breakthrough that increases the marginal productivity of capital will increase the _____

A)demand for loanable funds, leading to a lower equilibrium market interest rate.

B)supply of loanable funds, leading to a lower equilibrium market interest rate.

C)demand for loanable funds, leading to a higher equilibrium market interest rate.

D)supply of loanable funds, leading to a higher equilibrium market interest rate.

E)supply of loanable funds, but have no impact on the equilibrium market interest rate.

A)demand for loanable funds, leading to a lower equilibrium market interest rate.

B)supply of loanable funds, leading to a lower equilibrium market interest rate.

C)demand for loanable funds, leading to a higher equilibrium market interest rate.

D)supply of loanable funds, leading to a higher equilibrium market interest rate.

E)supply of loanable funds, but have no impact on the equilibrium market interest rate.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

61

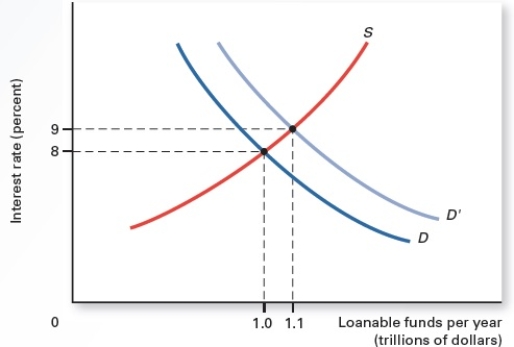

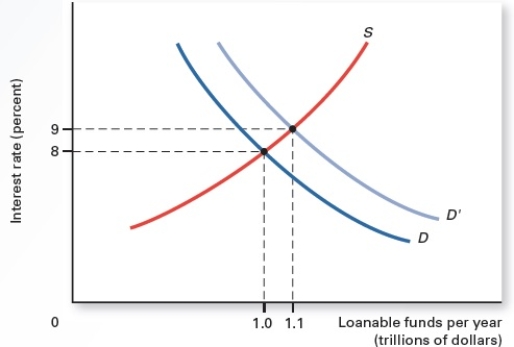

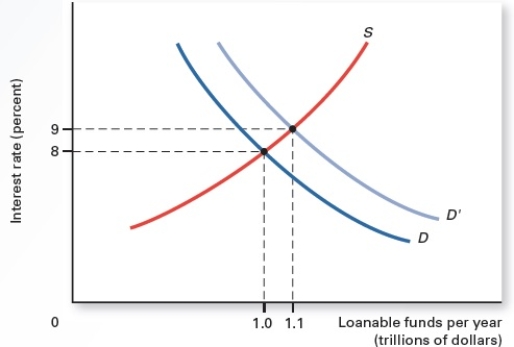

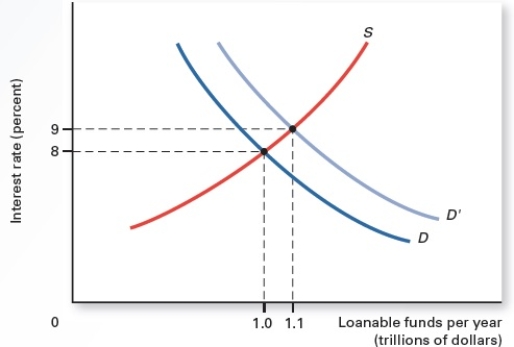

Exhibit 13.4

Refer to Exhibit 13.4,which shows a loanable funds market.An increase in the demand for loanable funds from D to D' raises the market interest rate from:

A)1.0 to 1.1 trillion dollars.

B)0 to 1.0 trillion dollars.

C)0 percent to 8 percent.

D)0 percent to 9 percent.

E)8 percent to 9 percent.

Refer to Exhibit 13.4,which shows a loanable funds market.An increase in the demand for loanable funds from D to D' raises the market interest rate from:

A)1.0 to 1.1 trillion dollars.

B)0 to 1.0 trillion dollars.

C)0 percent to 8 percent.

D)0 percent to 9 percent.

E)8 percent to 9 percent.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is true of lending by banks?

A)Banks always charge a lower rate of interest on a car loan than on a home loan.

B)Banks increase their prime rate of lending to protect their loans.

C)Banks require borrowers to put up collateral to reduce the risk of lending.

D)Banks discount the present value of loans to reduce the risk of lending.

E)Banks charge lower rates of interest to people with poor credit ratings.

A)Banks always charge a lower rate of interest on a car loan than on a home loan.

B)Banks increase their prime rate of lending to protect their loans.

C)Banks require borrowers to put up collateral to reduce the risk of lending.

D)Banks discount the present value of loans to reduce the risk of lending.

E)Banks charge lower rates of interest to people with poor credit ratings.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

63

_____ is an asset pledged by a borrower to a bank when he or she takes a loan.

A)A bond

B)Owner's equity

C)Collateral

D)A mutual fund

E)A hedge fund

A)A bond

B)Owner's equity

C)Collateral

D)A mutual fund

E)A hedge fund

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

64

If the interest rate increases,_____

A)the cost of saving will increase.

B)the cost of borrowing will increase.

C)a firm should decrease the amount of capital it owns.

D)a firm should acquire more capital.

E)the supply of loanable funds will increase.

A)the cost of saving will increase.

B)the cost of borrowing will increase.

C)a firm should decrease the amount of capital it owns.

D)a firm should acquire more capital.

E)the supply of loanable funds will increase.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

65

The costs of executing a loan agreement,monitoring the loan,and collecting payments are called _____

A)administration costs.

B)sunk costs.

C)variable costs.

D)opportunity costs.

E)transaction costs.

A)administration costs.

B)sunk costs.

C)variable costs.

D)opportunity costs.

E)transaction costs.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

66

The term structure of interest rates describes the relationship between the interest rate charged and the _____

A)duration of a loan.

B)amount of a loan.

C)riskiness of a borrower.

D)credit history of a borrower.

E)age of a borrower.

A)duration of a loan.

B)amount of a loan.

C)riskiness of a borrower.

D)credit history of a borrower.

E)age of a borrower.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

67

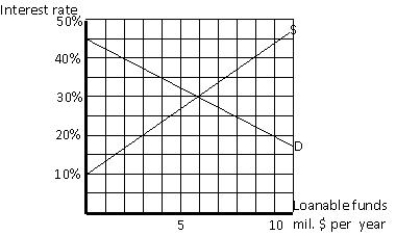

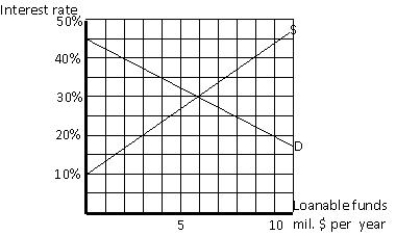

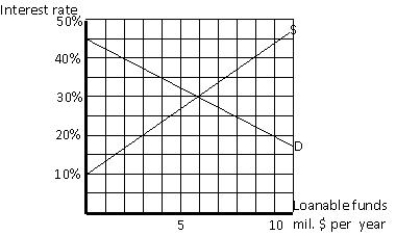

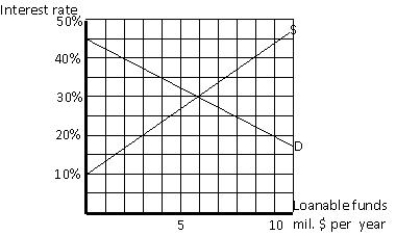

Exhibit 13.3

Refer to Exhibit 13.3,which shows a loanable funds market.The equilibrium amount of loanable funds exchanged is _____

A)$4 million.

B)$5 million.

C)$6 million.

D)$7 million.

E)$8 million.

Refer to Exhibit 13.3,which shows a loanable funds market.The equilibrium amount of loanable funds exchanged is _____

A)$4 million.

B)$5 million.

C)$6 million.

D)$7 million.

E)$8 million.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

68

The interest rate lenders charge their most trustworthy business borrowers is called the_____

A)discount rate.

B)repo rate.

C)mortgage rate.

D)reverse repo rate.

E)prime rate.

A)discount rate.

B)repo rate.

C)mortgage rate.

D)reverse repo rate.

E)prime rate.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

69

Exhibit 13.4

Refer to Exhibit 13.4,which shows the loanable funds market.An increase in the demand for loanable funds _____

A)will cause a rightward shift of the demand for loanable funds curve from D to D'.

B)will cause a leftward shift of the demand for loanable funds curve from D' to D.

C)is represented by a movement along the curve, D.

D)is represented by a movement along the curve, D'.

E)is represented by a movement along the curve, S.

Refer to Exhibit 13.4,which shows the loanable funds market.An increase in the demand for loanable funds _____

A)will cause a rightward shift of the demand for loanable funds curve from D to D'.

B)will cause a leftward shift of the demand for loanable funds curve from D' to D.

C)is represented by a movement along the curve, D.

D)is represented by a movement along the curve, D'.

E)is represented by a movement along the curve, S.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

70

What is the relationship between the duration of a loan and the interest rate charged called?

A)the risk structure of interest rates

B)the term structure of interest rates

C)the duration structure of interest rates

D)the yield structure of interest rates

E)the collateral structure of interest rates

A)the risk structure of interest rates

B)the term structure of interest rates

C)the duration structure of interest rates

D)the yield structure of interest rates

E)the collateral structure of interest rates

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

71

Other things constant,the interest rate usually _____

A)increases with the duration of the loan.

B)decreases with the duration of the loan.

C)decreases as risk increases.

D)increases as risk decreases.

E)is constant and does not float.

A)increases with the duration of the loan.

B)decreases with the duration of the loan.

C)decreases as risk increases.

D)increases as risk decreases.

E)is constant and does not float.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

72

Administration costs,as a proportion of the loan,_____

A)increase as the size of the loan increases.

B)decrease as the size of the loan increases.

C)decrease as the size of the loan decreases.

D)do not change with the size of the loan.

E)increase the interest rate for larger loams.

A)increase as the size of the loan increases.

B)decrease as the size of the loan increases.

C)decrease as the size of the loan decreases.

D)do not change with the size of the loan.

E)increase the interest rate for larger loams.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

73

The costs of executing the loan agreement,monitoring the loan,and collecting payments are called the _____ of the loan.

A)after-tax rate of interest

B)before-tax rate of interest

C)administration costs

D)term costs

E)collateral costs

A)after-tax rate of interest

B)before-tax rate of interest

C)administration costs

D)term costs

E)collateral costs

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

74

If risk,administrative costs,and tax treatments are the same,a borrower will expect to pay _____ interest rate for a 10-year loan,and _____ interest rate for a 5-year loan.

A)a lower; a higher

B)a higher; a lower

C)a lower; the same low

D)a higher; the same high

E)the same; the same

A)a lower; a higher

B)a higher; a lower

C)a lower; the same low

D)a higher; the same high

E)the same; the same

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

75

The interest rate charged on a car loan is usually higher than the interest rate charged on a home loan because _____

A)the market price of a car is less than the market price of a home.

B)a car is a worse collateral than a home.

C)the rate of default on car loans is lower than the rate of default on home loans.

D)people with poor credit ratings take car loans.

E)people with poor credit ratings are willing to pay higher rates of interest.

A)the market price of a car is less than the market price of a home.

B)a car is a worse collateral than a home.

C)the rate of default on car loans is lower than the rate of default on home loans.

D)people with poor credit ratings take car loans.

E)people with poor credit ratings are willing to pay higher rates of interest.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 13.3

Refer to Exhibit 13.3,which shows the loanable funds market.The equilibrium interest rate is _____

A)50 percent.

B)40 percent.

C)30 percent.

D)20 percent.

E)10 percent.

Refer to Exhibit 13.3,which shows the loanable funds market.The equilibrium interest rate is _____

A)50 percent.

B)40 percent.

C)30 percent.

D)20 percent.

E)10 percent.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

77

As the duration of a loan increases,_____

A)lenders require a lower interest rate because of lower risk.

B)lenders require a higher interest rate to compensate for the greater risk.

C)the administration costs, as a proportion of the loan size, increase.

D)the administration costs, as a proportion of the loan size, decrease.

E)the federal income tax rate decreases.

A)lenders require a lower interest rate because of lower risk.

B)lenders require a higher interest rate to compensate for the greater risk.

C)the administration costs, as a proportion of the loan size, increase.

D)the administration costs, as a proportion of the loan size, decrease.

E)the federal income tax rate decreases.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

78

Identify the correct statement about the market interest rate.

A)It is directly related to the demand for loanable funds.

B)It has no impact on a firm's investment decision if the firm uses borrowed funds.

C)It is indirectly related to the supply of loanable funds.

D)It has no impact on a firm's investment decision if the firm uses savings.

E)It represents the opportunity cost of investing with either borrowed funds or savings.

A)It is directly related to the demand for loanable funds.

B)It has no impact on a firm's investment decision if the firm uses borrowed funds.

C)It is indirectly related to the supply of loanable funds.

D)It has no impact on a firm's investment decision if the firm uses savings.

E)It represents the opportunity cost of investing with either borrowed funds or savings.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

79

As defined by economists,interest is _____

A)only the amount earned by productive capital as a resource.

B)only the amount earned by land as a resource.

C)only the amount earned by lending money.

D)both the amount earned by productive capital and the amount earned by lending money.

E)both the amount earned by land as a resource and the amount earned by lending money.

A)only the amount earned by productive capital as a resource.

B)only the amount earned by land as a resource.

C)only the amount earned by lending money.

D)both the amount earned by productive capital and the amount earned by lending money.

E)both the amount earned by land as a resource and the amount earned by lending money.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements is true?

A)Interest rates charged to well-known corporations are higher than rates charged to individuals because corporations can afford it.

B)If people expect higher rates of inflation, the market interest rate will decrease because fewer people will borrow.

C)Interest rates in politically and economically unstable countries are lower than rates in stable countries.

D)The risk of doing business in a high-crime area is greater than that in a safe area, and the cost of borrowing is also greater.

E)The lower the tax rate, the greater the cost of borrowing.

A)Interest rates charged to well-known corporations are higher than rates charged to individuals because corporations can afford it.

B)If people expect higher rates of inflation, the market interest rate will decrease because fewer people will borrow.

C)Interest rates in politically and economically unstable countries are lower than rates in stable countries.

D)The risk of doing business in a high-crime area is greater than that in a safe area, and the cost of borrowing is also greater.

E)The lower the tax rate, the greater the cost of borrowing.

Unlock Deck

Unlock for access to all 199 flashcards in this deck.

Unlock Deck

k this deck