Deck 13: Equities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/91

Play

Full screen (f)

Deck 13: Equities

1

Explain the meaning of "contributed capital" and "common share." What distinguishes a common share from a preferred share?

common share: An equity interest that has the lowest priority and represents the residual ownership interest in the company.

contributed capital: The component of equity that reflects amounts received by the reporting entity from transactions with its owners,net of any repayments from capital.

Any share that does not represent the residual interest in the company is a preferred share.Preferred shares have priority over the common shares.

contributed capital: The component of equity that reflects amounts received by the reporting entity from transactions with its owners,net of any repayments from capital.

Any share that does not represent the residual interest in the company is a preferred share.Preferred shares have priority over the common shares.

2

Where is accumulated other comprehensive income reported and what does it represent?

AOCI is reported as a component of equity in the balance sheet.AOCI represents the accumulation of OCI from all prior periods.

3

What does "priority" mean?

A)Higher priority confers preferential payout before lower priority claimants.

B)Refers to the amount of payment that will be made upon bankruptcy.

C)Lower priority confers preferential payout before higher priority claimants.

D)Debtors will be paid after the equity holders if there is a bankruptcy.

A)Higher priority confers preferential payout before lower priority claimants.

B)Refers to the amount of payment that will be made upon bankruptcy.

C)Lower priority confers preferential payout before higher priority claimants.

D)Debtors will be paid after the equity holders if there is a bankruptcy.

A

4

If 700 preferred shares with a par value of $35/share,a dividend rate of 5% and redeemable for $50/share,are sold for $45/share how much dividend may the preferred equity holders expect to receive?

A)$525

B)$1,225

C)$1,575

D)$1,750

A)$525

B)$1,225

C)$1,575

D)$1,750

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

5

When is a corporation legally obligated (liable)to pay dividends?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

6

If 1,000 preferred shares with a par value of $50/share,a dividend rate of 10% and redeemable for $80/share,are sold for $75/share,how much dividend may the preferred equity holders expect to receive?

A)$3,000

B)$5,000

C)$7,500

D)$8,000

A)$3,000

B)$5,000

C)$7,500

D)$8,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

7

What is the primary difference between common and preferred shares?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

8

Which statement is correct?

A)Dividends are never discretionary payments.

B)A corporation need only pay dividends when it declares them to be payable.

C)A company can avoid a cumulative dividend on preferred shares if it declares dividends on common shares.

D)Companies must pay the shareholders interest to compensate for the time value of money lost on the deferral of dividend payments.

A)Dividends are never discretionary payments.

B)A corporation need only pay dividends when it declares them to be payable.

C)A company can avoid a cumulative dividend on preferred shares if it declares dividends on common shares.

D)Companies must pay the shareholders interest to compensate for the time value of money lost on the deferral of dividend payments.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

9

Which statement is correct about "par value"?

A)Par value refers to the price at which a common share is sold to the equity holders.

B)The dividend rate can be specified as a percentage of the par value for common shares.

C)The dividend rate can be specified as a percentage of the par value for preferred shares.

D)Par value refers to the price at which a preferred share is sold to the equity holders.

A)Par value refers to the price at which a common share is sold to the equity holders.

B)The dividend rate can be specified as a percentage of the par value for common shares.

C)The dividend rate can be specified as a percentage of the par value for preferred shares.

D)Par value refers to the price at which a preferred share is sold to the equity holders.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

10

Who uses information about "equity" and what information about equity is useful to financial statement users?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

11

Outline the difference between cumulative and non-cumulative dividends.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

12

Golf Is for Nerds Inc.sells 20,000 no-par value common shares for $8.00 each on a subscription basis.Terms of the sale require the purchaser to pay $3.00 per share when the contract is signed and the balance in three months' time.

Required: Prepare the journal entries at (a)the date of signing the contract; (b)the date that the remaining payment is made; (c)the date the shares are transferred.

Required: Prepare the journal entries at (a)the date of signing the contract; (b)the date that the remaining payment is made; (c)the date the shares are transferred.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement is correct?

A)Equity holders are concerned more about the debt accounts in the financial statements.

B)Equity holders are concerned about the debt and equity accounts in the financial statements.

C)Debt holders are concerned about the debt and equity accounts in the financial statements.

D)Debt holders are concerned more about the equity accounts in the financial statements.

A)Equity holders are concerned more about the debt accounts in the financial statements.

B)Equity holders are concerned about the debt and equity accounts in the financial statements.

C)Debt holders are concerned about the debt and equity accounts in the financial statements.

D)Debt holders are concerned more about the equity accounts in the financial statements.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

14

If a company issues 2,000 shares for $55 and then repurchases 50 shares at $55,how much is the contributed capital?

A)$ 0

B)$ 2,750

C)$107,250

D)$110,000

A)$ 0

B)$ 2,750

C)$107,250

D)$110,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

15

Briefly describe recycling as it pertains to other comprehensive income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

16

Explain the meaning of "par value," "contributed surplus," and "preferred shares."

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

17

What is the meaning of "contributed capital"?

A)This is the amount received from the debt holders of the company.

B)This is the repayment of capital to owners of the company.

C)This is the dividends received from the owners of the company.

D)This is the amount received from the equity holders of the company.

A)This is the amount received from the debt holders of the company.

B)This is the repayment of capital to owners of the company.

C)This is the dividends received from the owners of the company.

D)This is the amount received from the equity holders of the company.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

18

Briefly describe the difference between issued and outstanding shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement about "common shares" is correct?

A)Common shares have the lowest claim to residual ownership interest of all shares.

B)Common shares have the lowest priority of all shares issued by a company.

C)Common shares have the highest priority of all shares issued by a company.

D)Common shares have no claim to residual ownership interest of all shares.

A)Common shares have the lowest claim to residual ownership interest of all shares.

B)Common shares have the lowest priority of all shares issued by a company.

C)Common shares have the highest priority of all shares issued by a company.

D)Common shares have no claim to residual ownership interest of all shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

20

Supply Company Ltd.issues a $60 million bond due in 10 years,and the bond indenture specifies that the company must set aside $6 million per year in a sinking fund so that the company will have funds to repay the bondholders at the end of 10 years.Assuming that the company complies with the contractual requirements,what would the journal entry be for each of the next 10 years?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

21

If a company issues 2,000 shares for $55 and then repurchases 50 shares at $50,how much is in the account "contributed surplus on retirement of shares'?

A)$ 250

B)$ 2,750

C)$107,250

D)$110,000

A)$ 250

B)$ 2,750

C)$107,250

D)$110,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

22

What kind of transaction is "appropriated reserves"?

A)An example of "par value" preferred shares.

B)An example of a transaction with owners.

C)An example of a "retained earnings."

D)An example of a "other comprehensive income."

A)An example of "par value" preferred shares.

B)An example of a transaction with owners.

C)An example of a "retained earnings."

D)An example of a "other comprehensive income."

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

23

Which is an example of "contributed capital"?

A)Retained earnings.

B)Preferred shares.

C)Other comprehensive income.

D)Accumulated other comprehensive income.

A)Retained earnings.

B)Preferred shares.

C)Other comprehensive income.

D)Accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

24

Which statement about a "stock split" is correct?

A)The economic position of the investors is diluted after a stock split.

B)The economic position of the investors is increased after a stock split.

C)The economic position of the investors is decreased after a stock split.

D)The economic position of the investors is unaffected after a stock split.

A)The economic position of the investors is diluted after a stock split.

B)The economic position of the investors is increased after a stock split.

C)The economic position of the investors is decreased after a stock split.

D)The economic position of the investors is unaffected after a stock split.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

25

What are three potential outcomes for defaults on share subscriptions?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

26

List and explain four reasons why a company might repurchase its own shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

27

Briefly describe the primary reason why companies declare a stock split.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

28

In which account would "transactions with non-owners" be reported?

A)Appropriated reserves.

B)Common shares.

C)Contributed surplus.

D)Par value of preferred shares.

A)Appropriated reserves.

B)Common shares.

C)Contributed surplus.

D)Par value of preferred shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

29

If 10,000 shares with par value of $15/share are issued for $20/share,how much will be presented as "contributed capital" for financial statement purposes?

A)$10,000

B)$50,000

C)$150,000

D)$200,000

A)$10,000

B)$50,000

C)$150,000

D)$200,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

30

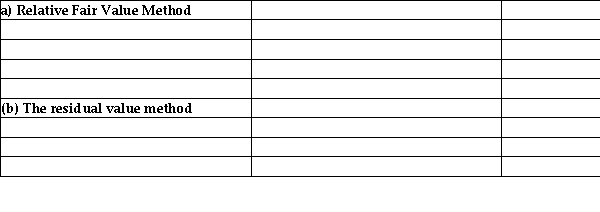

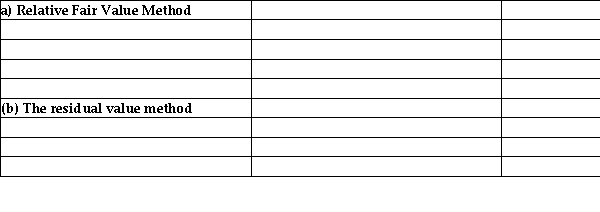

Ellwoods Bar and Grill Ltd.sells 1,000 packages of equity security consisting of one common share and one preferred share.Each package was sold for $100;total proceeds were $100,000.At time of sale,the market price of the common shares was $91.00 and the estimated fair value of the preferred shares was $10.00.Contrast the two alternative methods of accounting for this bundled purchase (a)The company uses the relative fair value method and (b)the company uses the residual value method.Use the following table:

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

31

What is the economic significance of "par value" for accounting purposes?

A)The par value determines the amount of contributed surplus.

B)Par value has no economic significance for accounting purposes.

C)Par values determines the amount of cash received from investors.

D)Par value shares are not permitted under IFRS or ASPE.

A)The par value determines the amount of contributed surplus.

B)Par value has no economic significance for accounting purposes.

C)Par values determines the amount of cash received from investors.

D)Par value shares are not permitted under IFRS or ASPE.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

32

What is the meaning of "shares authorized," "shares issued," and "shares outstanding"?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

33

What kind of transaction is "appropriated reserves"?

A)An example of "contributed surplus."

B)An example of a transaction with owners.

C)An example of a "contributed capital."

D)An example of a transaction with non-owners.

A)An example of "contributed surplus."

B)An example of a transaction with owners.

C)An example of a "contributed capital."

D)An example of a transaction with non-owners.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

34

In which account would "transactions with owners" be reported?

A)Appropriated reserves.

B)Unappropriated retained earnings.

C)Contributed surplus.

D)Accumulated other comprehensive income.

A)Appropriated reserves.

B)Unappropriated retained earnings.

C)Contributed surplus.

D)Accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

35

When shares are repurchased at an amount different from their original issue price,then held in treasury or cancelled,will the journal entry affect the following components?

Share capital

Contributed surplus

Treasury stock

Loss/gain on share retirement

Accumulated other comprehensive income

Appropriated reserves

Unappropriated retained earnings

Share capital

Contributed surplus

Treasury stock

Loss/gain on share retirement

Accumulated other comprehensive income

Appropriated reserves

Unappropriated retained earnings

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

36

What is a "stock split"?

A)It is an increase in the number of shares issued for which book value consideration is received from investors.

B)It is an increase in the number of shares issued for which no consideration is received from investors.

C)It is an increase in the number of shares issued for which par value consideration is received from investors.

D)It is an increase in the number of shares issued for which market value consideration is received from investors.

A)It is an increase in the number of shares issued for which book value consideration is received from investors.

B)It is an increase in the number of shares issued for which no consideration is received from investors.

C)It is an increase in the number of shares issued for which par value consideration is received from investors.

D)It is an increase in the number of shares issued for which market value consideration is received from investors.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

37

How should subscriptions receivable be reported on the balance sheet and why?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

38

Which statement about dividends is correct?

A)Dividends on cumulative preferred shares are not discretionary payments.

B)Dividends are mandatory payments required for both common and preferred shares.

C)Dividends are discretionary payments that can be made for common and preferred shares.

D)Dividends must be paid on common shares before dividends can be paid on preferred shares.

A)Dividends on cumulative preferred shares are not discretionary payments.

B)Dividends are mandatory payments required for both common and preferred shares.

C)Dividends are discretionary payments that can be made for common and preferred shares.

D)Dividends must be paid on common shares before dividends can be paid on preferred shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

39

If a company issues 2,000 shares for $55 and then repurchases 50 shares at $50 and subsequently purchase another 50 shares at $60 each,how much is in the account "contributed surplus on retirement of shares"?

A)$250

B)$0

C)$107,250

D)$110,000

A)$250

B)$0

C)$107,250

D)$110,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

40

Which is an example of "contributed capital"?

A)Appropriated reserves.

B)Unappropriated retained earnings.

C)Common shares.

D)Accumulated other comprehensive income.

A)Appropriated reserves.

B)Unappropriated retained earnings.

C)Common shares.

D)Accumulated other comprehensive income.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

41

Which statement about a "treasury shares" is correct?

A)The company does not pay dividends on these shares.

B)These shares must be cancelled upon re-purchase.

C)These shares are disclosed as issued and outstanding.

D)These shares continue to have voting rights.

A)The company does not pay dividends on these shares.

B)These shares must be cancelled upon re-purchase.

C)These shares are disclosed as issued and outstanding.

D)These shares continue to have voting rights.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

42

Burlington Corp.has a single class of shares.As at its year ended December 31,2017,the company had 5,000,000 shares issued and outstanding.On the stock exchange,these shares were trading at around $7.In the company's accounts,these shares had a value of $50,000,000.The equity accounts also show $650,000 of contributed surplus from previous repurchases of shares.

On January 15,2018,Burlington repurchased and cancelled 250,000 shares at a cost of $7 per share.Later in the year,on August 20,the company repurchased and cancelled a further 475,000 shares at a cost of $14 per share.

Required:

Record the journal entries for the two share transactions in 2018.

On January 15,2018,Burlington repurchased and cancelled 250,000 shares at a cost of $7 per share.Later in the year,on August 20,the company repurchased and cancelled a further 475,000 shares at a cost of $14 per share.

Required:

Record the journal entries for the two share transactions in 2018.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

43

Elville Inc.was incorporated under provincial legislation with a December 31 year-end.The company has a single class of shares.As at December 31,2016,it had 900,000 shares issued and outstanding.These shares had a book value of $18,000,000 on the balance sheet.

During 2017,Elville repurchased 10% of the issued shares from one of the minority shareholders at a cost of $25 per share.The company held these in treasury and later found a buyer for half of these shares at $30.The other half were sold at $21 to another investor.

Required:

Record the share transactions using the single-transaction method for treasury stock,which is the preferred accounting method.

During 2017,Elville repurchased 10% of the issued shares from one of the minority shareholders at a cost of $25 per share.The company held these in treasury and later found a buyer for half of these shares at $30.The other half were sold at $21 to another investor.

Required:

Record the share transactions using the single-transaction method for treasury stock,which is the preferred accounting method.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

44

Which statement about contributed surplus is correct?

A)Contributed surplus can only arise from the issuance of shares.

B)Contributed surplus can arise from the issuance of stock options.

C)Contributed surplus arising from share repurchase gives rise to a debit journal entry.

D)Contributed surplus arising from share issuance gives rise to a debit journal entry.

A)Contributed surplus can only arise from the issuance of shares.

B)Contributed surplus can arise from the issuance of stock options.

C)Contributed surplus arising from share repurchase gives rise to a debit journal entry.

D)Contributed surplus arising from share issuance gives rise to a debit journal entry.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

45

Assume that a company issued 10,000 shares for $30/share.What entry would be required to record the repurchase and cancellation of 1,000 shares at $28/share?

A)Debit to common shares for $28,000

B)Debit to common shares for $30,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $1,000

A)Debit to common shares for $28,000

B)Debit to common shares for $30,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $1,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

46

Which statement about "share buyback" is correct?

A)If the repurchase price is below the issue price,an accounting "gain" results.

B)If the repurchase price is below the issue price,the difference goes to "common shares."

C)If the repurchase price is below the issue price,the difference goes to "contributed surplus."

D)If the repurchase price is below the issue price,an accounting "loss" results.

A)If the repurchase price is below the issue price,an accounting "gain" results.

B)If the repurchase price is below the issue price,the difference goes to "common shares."

C)If the repurchase price is below the issue price,the difference goes to "contributed surplus."

D)If the repurchase price is below the issue price,an accounting "loss" results.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

47

Which statement best describes the accounting when a company cancels its own shares at an amount greater than their par value?

A)Retained earnings will be debited at an amount equal to the par value of the shares.

B)Retained earnings will be credited at an amount equal to the par value of the shares.

C)Contributed surplus will be debited at an amount equal to the par value of the shares.

D)Share capital will be debited at an amount equal to the par value of the shares.

A)Retained earnings will be debited at an amount equal to the par value of the shares.

B)Retained earnings will be credited at an amount equal to the par value of the shares.

C)Contributed surplus will be debited at an amount equal to the par value of the shares.

D)Share capital will be debited at an amount equal to the par value of the shares.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

48

Mountip Inc.was incorporated under provincial legislation with a December 31 year-end.The company has a single class of shares.As at December 31,2016,it had 150,000 shares issued and outstanding.These shares had a book value of $5,700,000 on the balance sheet.During 2017,Mountip repurchased 5% of the issued shares from one of the minority shareholders at a cost of $48 per share.The company held these in treasury and later found a buyer for half of these shares at $52.The other half were sold at $46 to another investor.

Required:

Record the share transactions using the alternative two-transaction method for treasury stock.

Required:

Record the share transactions using the alternative two-transaction method for treasury stock.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

49

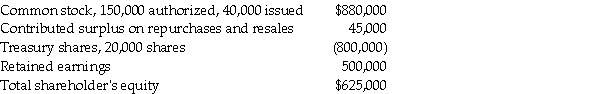

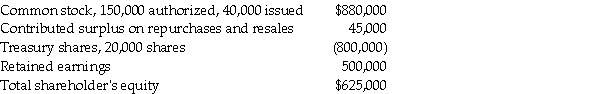

Dunst Company had the following shareholders' equity account balances on December 31,2017:

During 2018,the following transactions occurred:

i.May 1: Dunst resold 1,600 of the treasury shares at $52 per share.

ii.Dec.30: The board of directors declared cash dividends of $2 per share.

iii.Dec.31: Net income for the year ended December 31,2018 was $150,000.

Dunst uses the single transaction method for treasury shares.

Required:

a.Record the journal entries for the transactions in 2018 and make all the necessary year-end entries relating to shareholders' equity accounts.

b.Prepare the presentation of the shareholders' equity section of Dunst's balance sheet as at December 31,2018.

During 2018,the following transactions occurred:

i.May 1: Dunst resold 1,600 of the treasury shares at $52 per share.

ii.Dec.30: The board of directors declared cash dividends of $2 per share.

iii.Dec.31: Net income for the year ended December 31,2018 was $150,000.

Dunst uses the single transaction method for treasury shares.

Required:

a.Record the journal entries for the transactions in 2018 and make all the necessary year-end entries relating to shareholders' equity accounts.

b.Prepare the presentation of the shareholders' equity section of Dunst's balance sheet as at December 31,2018.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

50

Assume that a company issued 10,000 shares for $30/share.What entry would be required to record the repurchase and cancellation of 1,000 shares at $28/share?

A)Credit to common shares for $28,000

B)Credit to common shares for $30,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $2,000

A)Credit to common shares for $28,000

B)Credit to common shares for $30,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $2,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

51

If 10,000 shares with par value of $15/share are issued for $20/share,how much will be presented as "contributed surplus" for financial statement purposes?

A)$10,000

B)$50,000

C)$150,000

D)$200,000

A)$10,000

B)$50,000

C)$150,000

D)$200,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

52

Assume that a company issued 10,000 shares for $30/share and a par value of $5/share.1,000 shares were repurchased back at $22/share.Which statement about share repurchases and cancellation is correct?

A)Contributed surplus from the share repurchase can be netted against the contributed surplus from share issuance.

B)Contributed surplus from the share repurchase must be separated from the contributed surplus on share issuance.

C)Contributed surplus arising from share repurchase must be debited in this transaction.

D)Contributed surplus from the initial share issuance must now be credited in this transaction.

A)Contributed surplus from the share repurchase can be netted against the contributed surplus from share issuance.

B)Contributed surplus from the share repurchase must be separated from the contributed surplus on share issuance.

C)Contributed surplus arising from share repurchase must be debited in this transaction.

D)Contributed surplus from the initial share issuance must now be credited in this transaction.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

53

If 10,000 shares with par value of $15/share are issued for $20/share,how much will be presented as "common shares" for financial statement purposes?

A)$10,000

B)$50,000

C)$150,000

D)$200,000

A)$10,000

B)$50,000

C)$150,000

D)$200,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is correct respecting a company's repurchase of its own shares?

A)It provides a tax disadvantage to the shareholder.

B)It enables the company to acquire stock for distribution as compensation to employees.

C)It provides a negative signal to the market.

D)It causes earnings per share to decrease.

A)It provides a tax disadvantage to the shareholder.

B)It enables the company to acquire stock for distribution as compensation to employees.

C)It provides a negative signal to the market.

D)It causes earnings per share to decrease.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

55

Great-West Lifeco Inc.announced the following share issuances:

March 1,2013

10,000,000 2% non-cumulative five-year rate reset first preferred shares (series J)for par value of $12 each.After five years the dividend rate will be reset to the five-year Canada bond rate plus 3.35%.Dividends are payable as declared by the board of directors.

April 9,2013

28,350,000 common shares for $19.25 per share.This represents approximately 4.6% of Lifeco's total outstanding common shares.

The CEO of the company stated the following regarding these share issuances:

For many years,Great-West Life and its subsidiaries have pursued a risk-averse strategy with respect to both liabilities and assets.Consequently,today the company's balance sheet is one of the strongest in its industry.With this issue,the company will move forward with an enhanced capability to take advantage of market opportunities.

Required:

a.Prepare the journal entries to record the share issuances.

b.Explain how the share issuances result in a "risk-averse strategy with respect to both liabilities and assets," and how this results in a strong balance sheet that allows the company to take advantage of market opportunities,such as profitable investments.

c.Assume the board of directors declares dividends on December 31,2013 in the amount of $15,000,000.Calculate the amount of dividends to be paid to preferred shareholders and common shareholders (assume the company only has the above stated series of preferred shares outstanding).

March 1,2013

10,000,000 2% non-cumulative five-year rate reset first preferred shares (series J)for par value of $12 each.After five years the dividend rate will be reset to the five-year Canada bond rate plus 3.35%.Dividends are payable as declared by the board of directors.

April 9,2013

28,350,000 common shares for $19.25 per share.This represents approximately 4.6% of Lifeco's total outstanding common shares.

The CEO of the company stated the following regarding these share issuances:

For many years,Great-West Life and its subsidiaries have pursued a risk-averse strategy with respect to both liabilities and assets.Consequently,today the company's balance sheet is one of the strongest in its industry.With this issue,the company will move forward with an enhanced capability to take advantage of market opportunities.

Required:

a.Prepare the journal entries to record the share issuances.

b.Explain how the share issuances result in a "risk-averse strategy with respect to both liabilities and assets," and how this results in a strong balance sheet that allows the company to take advantage of market opportunities,such as profitable investments.

c.Assume the board of directors declares dividends on December 31,2013 in the amount of $15,000,000.Calculate the amount of dividends to be paid to preferred shareholders and common shareholders (assume the company only has the above stated series of preferred shares outstanding).

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

56

Which statement about a "reverse stock split" is correct?

A)The economic position of the investors is diluted after a stock split.

B)The economic position of the investors is increased after a stock split.

C)The economic position of the investors is decreased after a stock split.

D)The economic position of the investors is unaffected after a stock split.

A)The economic position of the investors is diluted after a stock split.

B)The economic position of the investors is increased after a stock split.

C)The economic position of the investors is decreased after a stock split.

D)The economic position of the investors is unaffected after a stock split.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

57

Which statement about a "share buybacks" is correct?

A)The EPS of the company will decrease after a share buyback.

B)Share buy-back decreases the information asymmetry for investors.

C)It is an administratively cumbersome way to award stock compensation.

D)Accounting is the same whether repurchased shares are cancelled or not.

A)The EPS of the company will decrease after a share buyback.

B)Share buy-back decreases the information asymmetry for investors.

C)It is an administratively cumbersome way to award stock compensation.

D)Accounting is the same whether repurchased shares are cancelled or not.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

58

When a corporation engages in a capital transaction (those relating to its contributed capital),the journal entry may involve either a debit or a credit to contributed surplus.While not permitted by accounting standards,if these debits or credits were to be recognized through income,a debit would be called a "loss" and a credit would be called a "gain."

Consider the following sequence of transactions:

∙ Jan.1,2012: Company issues 1,500,000 no par common shares at $14 each.

∙ Jan.1,2018: Company reacquires 150,000 common shares in the open market at $9 each,and cancels them immediately.

There were no other capital transactions and the company had not paid any dividends.

Required:

a.Prepare the journal entries for the two transactions.

b.Review the journal entry for January 1,2018.How much was credited other than cash? Does this credit reflect good or bad management? As a shareholder,would you be happy or unhappy about this credit entry?

c.What would have been the journal entry for January 1,2018 had the repurchase price been $24?

d.In the journal entry for part (c),explain why the debit goes to reduce retained earnings.How would a shareholder interpret the reduction in retained earnings?

Consider the following sequence of transactions:

∙ Jan.1,2012: Company issues 1,500,000 no par common shares at $14 each.

∙ Jan.1,2018: Company reacquires 150,000 common shares in the open market at $9 each,and cancels them immediately.

There were no other capital transactions and the company had not paid any dividends.

Required:

a.Prepare the journal entries for the two transactions.

b.Review the journal entry for January 1,2018.How much was credited other than cash? Does this credit reflect good or bad management? As a shareholder,would you be happy or unhappy about this credit entry?

c.What would have been the journal entry for January 1,2018 had the repurchase price been $24?

d.In the journal entry for part (c),explain why the debit goes to reduce retained earnings.How would a shareholder interpret the reduction in retained earnings?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

59

Assume that a company issued 10,000 shares for $30 and a par value of $1/share.What entry would be required to record the repurchase and cancellation of 1,000 shares at $28/share?

A)Debit to common shares for $28,000

B)Debit to common shares for $1,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $1,000

A)Debit to common shares for $28,000

B)Debit to common shares for $1,000

C)Credit to contributed surplus for $29,000

D)Credit to contributed surplus for $1,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

60

Assume that a company issued 10,000 shares for $30 and a par value of $2/share.What entry would be required to record the repurchase and cancellation of 1,000 shares at $28/share?

A)Debit to common shares for $2,000

B)Debit to common shares for $28,000

C)Debit to contributed surplus for $1,000

D)Credit to contributed surplus for $1,000

A)Debit to common shares for $2,000

B)Debit to common shares for $28,000

C)Debit to contributed surplus for $1,000

D)Credit to contributed surplus for $1,000

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

61

Use the facts from #13,above,to determine how much each of the three classes of shares receives of the $1,000,000 cash dividend if dividends were last declared in 2017.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

62

Contrast the different treatment between IFRS and ASPE with respect to property dividends.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

63

Which statement best describes the accounting when a company cancels its own shares at an amount higher than the average share value?

A)Contributed surplus and retained earnings will be credited.

B)Contributed surplus and retained earnings will be debited.

C)Contributed surplus will be credited,thereby increasing equity.

D)Contributed surplus will be debited,thereby decreasing equity.

A)Contributed surplus and retained earnings will be credited.

B)Contributed surplus and retained earnings will be debited.

C)Contributed surplus will be credited,thereby increasing equity.

D)Contributed surplus will be debited,thereby decreasing equity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement is correct about the "single transaction method" for treasury shares?

A)This method has the same effect on contributed surplus to that of the two transaction method.

B)This method uses a separate "treasury shares" account upon repurchase.

C)This method treats the reacquisition and subsequent sale separately for accounting.

D)This method decreases contributed surplus at the time of repurchase.

A)This method has the same effect on contributed surplus to that of the two transaction method.

B)This method uses a separate "treasury shares" account upon repurchase.

C)This method treats the reacquisition and subsequent sale separately for accounting.

D)This method decreases contributed surplus at the time of repurchase.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

65

Which statement best explains the "single transaction method" for treasury shares?

A)This method treats the reacquisition as the end of the initial share issuance transaction.

B)This method treats the subsequent sale as the start of another transaction.

C)This method treats the reacquisition and subsequent sale separately for accounting.

D)This method treats the reacquisition and subsequent sale as two parts of the same transaction.

A)This method treats the reacquisition as the end of the initial share issuance transaction.

B)This method treats the subsequent sale as the start of another transaction.

C)This method treats the reacquisition and subsequent sale separately for accounting.

D)This method treats the reacquisition and subsequent sale as two parts of the same transaction.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

66

Which statement is correct about the "two transaction method" for treasury shares resold for greater than their repurchase cost?

A)This method decreases the contributed surplus when the repurchased shares are later resold.

B)This method has the same effect on contributed surplus to that of the two transaction method.

C)This method treats the reacquisition and subsequent sale as once cycle for accounting.

D)This method increases contributed surplus at the time of repurchase.

A)This method decreases the contributed surplus when the repurchased shares are later resold.

B)This method has the same effect on contributed surplus to that of the two transaction method.

C)This method treats the reacquisition and subsequent sale as once cycle for accounting.

D)This method increases contributed surplus at the time of repurchase.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

67

When does a company record dividends payable?

A)On date of record.

B)On ex-dividend date.

C)On payment date.

D)On declaration date.

A)On date of record.

B)On ex-dividend date.

C)On payment date.

D)On declaration date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

68

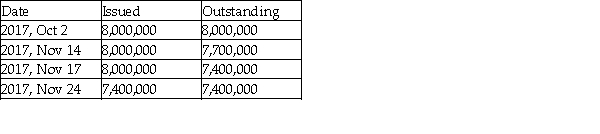

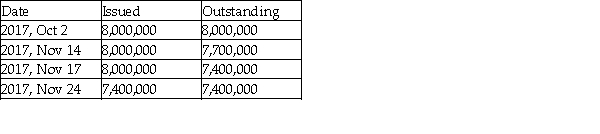

Key Corp has a October 31 year end.On October 2,2017,the board of directors declared a cash dividend of $1.50 per common share,payable on November 24,2017.The date of record for this dividend is November 17,and the ex-dividend date is November 15,2017.Additional information relating to the shares follows:

Required:

a.Determine the dollar amount of dividends to be paid as a result of the dividend declaration on October 2,2017.

b.Record all the journal entries related to this dividend in 2017.

Required:

a.Determine the dollar amount of dividends to be paid as a result of the dividend declaration on October 2,2017.

b.Record all the journal entries related to this dividend in 2017.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement is correct concerning property dividends?

A)Issuing property dividends is a common method of distributing value to the shareholders.

B)A property dividend could be used to transfer assets from a subsidiary to a parent company.

C)Property dividends cannot be used by a parent company to distribute shares of an associate or subsidiary to its shareholders.

D)The historical value of the property is used for purposes of recording the value of the dividend.

A)Issuing property dividends is a common method of distributing value to the shareholders.

B)A property dividend could be used to transfer assets from a subsidiary to a parent company.

C)Property dividends cannot be used by a parent company to distribute shares of an associate or subsidiary to its shareholders.

D)The historical value of the property is used for purposes of recording the value of the dividend.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

70

Which statement about "stock dividends" is correct?

A)Only a memo entry is needed for this transaction.

B)No entry is needed in the accounting records.

C)A journal entry is needed for this transaction.

D)This is the same as a stock split for accounting purposes.

A)Only a memo entry is needed for this transaction.

B)No entry is needed in the accounting records.

C)A journal entry is needed for this transaction.

D)This is the same as a stock split for accounting purposes.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

71

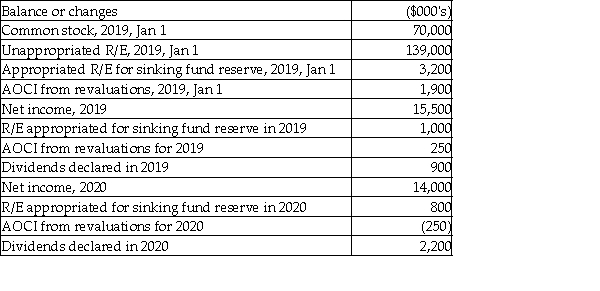

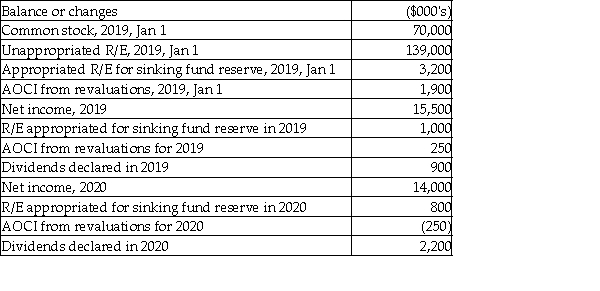

Below are details relating to balances for the equity accounts of Cauvet Company,and changes to those balances.Note that AOCI is accumulated other comprehensive income.

Required: Prepare a statement of changes in equity for the years ended December 31,2019 and 2020.

Required: Prepare a statement of changes in equity for the years ended December 31,2019 and 2020.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

72

Which statement best describes the accounting when a company cancels its own shares at an amount lower than the average share value?

A)Contributed surplus and retained earnings will be credited.

B)Contributed surplus and retained earnings will be debited.

C)Contributed surplus will be credited,thereby increasing equity.

D)Contributed surplus will be debited,thereby decreasing equity.

A)Contributed surplus and retained earnings will be credited.

B)Contributed surplus and retained earnings will be debited.

C)Contributed surplus will be credited,thereby increasing equity.

D)Contributed surplus will be debited,thereby decreasing equity.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

73

Milton Corporation declared and distributed a 8% stock dividend.Milton had 440,000 common shares outstanding and 940,000 common shares authorized before the stock dividend.The board of directors determined the appropriate market value per share as $10.

Required:

How much should be recorded for the stock dividend? Record the journal entry (if any)for the shares distributed.

Required:

How much should be recorded for the stock dividend? Record the journal entry (if any)for the shares distributed.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

74

Cardiff Corporation is a public company traded on a major exchange.Cardiff's common shares are currently trading at $21 per share.The board of directors is debating whether to issue a 200% stock dividend or accomplish a similar result by doing a stock split.The board is wondering how shareholders' equity would be affected,and whether the value of the typical shareholder's investment will change.

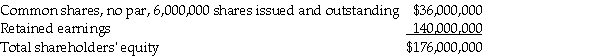

Details of Cardiff's equity section of the balance sheet is as follows:

Required:

a.At what price would you expect the shares to trade after either transaction? Explain with calculations.

b.Show what the equity section of the balance sheet for Cardiff would look like after the stock dividend or stock split.

c.Assume that an investor has 6,000 common shares before the stock dividend or stock split.What would be the value of the investor's holdings before and after the stock dividend or stock split?

d.What is your recommendation to the board of directors?

Details of Cardiff's equity section of the balance sheet is as follows:

Required:

a.At what price would you expect the shares to trade after either transaction? Explain with calculations.

b.Show what the equity section of the balance sheet for Cardiff would look like after the stock dividend or stock split.

c.Assume that an investor has 6,000 common shares before the stock dividend or stock split.What would be the value of the investor's holdings before and after the stock dividend or stock split?

d.What is your recommendation to the board of directors?

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

75

Which statement about the "ex-dividend date" is correct?

A)The ex-dividend date relates only to shares that are publicly traded.

B)An investor who buys shares before the ex-dividend date does not have the right to receive a dividend that has been declared.

C)The ex-dividend date will occur after the record date.

D)An investor who buys shares on or after the ex-dividend date has the right to receive a dividend that has been declared.

A)The ex-dividend date relates only to shares that are publicly traded.

B)An investor who buys shares before the ex-dividend date does not have the right to receive a dividend that has been declared.

C)The ex-dividend date will occur after the record date.

D)An investor who buys shares on or after the ex-dividend date has the right to receive a dividend that has been declared.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

76

What is the "ex-dividend" date for the Toronto Stock Exchange?

A)2 business days after the declaration date.

B)2 business days after the date of record.

C)2 business days before the date of record.

D)2 business days before the declaration date.

A)2 business days after the declaration date.

B)2 business days after the date of record.

C)2 business days before the date of record.

D)2 business days before the declaration date.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

77

Use the following facts to determine how much each of the three classes of shares receives of the $1,000,000 cash dividend.

Facts: In 2019 Blueberry Juice Inc.declared $1,000,000 in cash dividends.Its capital structure includes 300,000 common shares;200,000 cumulative preferred shares "A" each entitled to an annual dividend of $1.00;and 50,000 non-cumulative preferred shares "B" each entitled to an annual dividend of $3.00.The prescribed dividends on both series of preferred shares were paid in 2018;there are no dividends in arrears.

Facts: In 2019 Blueberry Juice Inc.declared $1,000,000 in cash dividends.Its capital structure includes 300,000 common shares;200,000 cumulative preferred shares "A" each entitled to an annual dividend of $1.00;and 50,000 non-cumulative preferred shares "B" each entitled to an annual dividend of $3.00.The prescribed dividends on both series of preferred shares were paid in 2018;there are no dividends in arrears.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

78

Which statement about cash dividends is correct?

A)The date of declaration is the date that determines which shareholders will receive the dividends.

B)The date of declaration is the date on which the Board of Directors declares a dividend and the company has an obligation to pay the dividend.

C)The date of record is the date when the funds for the dividend are transferred to shareholders.

D)The company must record a journal entry on the date of declaration,the date of record and the date of payment.

A)The date of declaration is the date that determines which shareholders will receive the dividends.

B)The date of declaration is the date on which the Board of Directors declares a dividend and the company has an obligation to pay the dividend.

C)The date of record is the date when the funds for the dividend are transferred to shareholders.

D)The company must record a journal entry on the date of declaration,the date of record and the date of payment.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

79

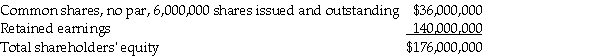

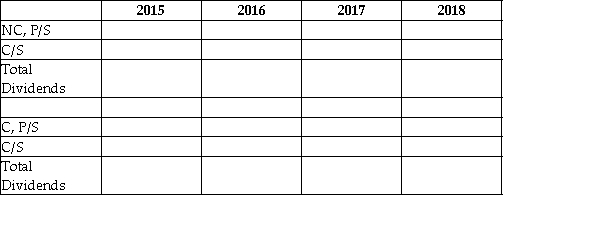

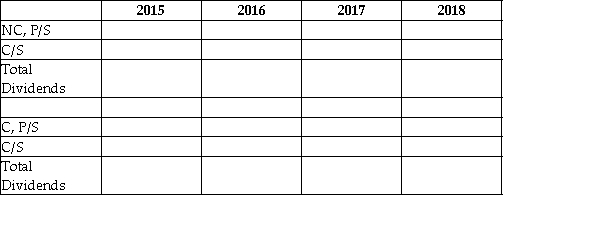

Nala Company has two classes of shares that were both issued on January 1,2015:

Class A,$10 par value,8% preferred shares,2,750,000 shares issued and outstanding;

Class B,no par value common shares issued at $30/share,1,300,000 shares issued and outstanding.

Due to challenging start-up problems in 2015 and 2016 there were no dividends paid;in 2017 dividends of $8,000,000 were paid;and,for 2018,dividends paid totaled $16,000,000.

Required:

How much was the amount of dividends paid to preferred and common shares in 2015 to 2018? First assume that the preferred shares are non-cumulative,then assume that they are cumulative.

NC = Non-cumulative

C = Cumulative

P/S = Preferred shares

C/S = Common shares

Class A,$10 par value,8% preferred shares,2,750,000 shares issued and outstanding;

Class B,no par value common shares issued at $30/share,1,300,000 shares issued and outstanding.

Due to challenging start-up problems in 2015 and 2016 there were no dividends paid;in 2017 dividends of $8,000,000 were paid;and,for 2018,dividends paid totaled $16,000,000.

Required:

How much was the amount of dividends paid to preferred and common shares in 2015 to 2018? First assume that the preferred shares are non-cumulative,then assume that they are cumulative.

NC = Non-cumulative

C = Cumulative

P/S = Preferred shares

C/S = Common shares

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck

80

Which statement about a "treasury shares " is correct?

A)No company is permitted to hold treasury shares.

B)Treasury shares have voting rights.

C)Treasury shares receive dividends.

D)There are two methods that can be used to account for treasury shares: the single-transaction method and the two-transaction method.

A)No company is permitted to hold treasury shares.

B)Treasury shares have voting rights.

C)Treasury shares receive dividends.

D)There are two methods that can be used to account for treasury shares: the single-transaction method and the two-transaction method.

Unlock Deck

Unlock for access to all 91 flashcards in this deck.

Unlock Deck

k this deck