Deck 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

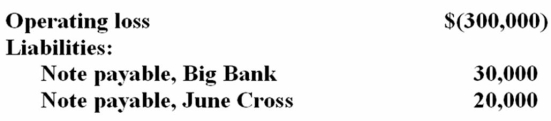

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

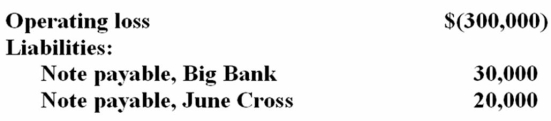

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/87

Play

Full screen (f)

Deck 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations

1

A corporate shareholder usually cannot be held personally liable for the debts arising from the corporate business.

True

2

Businesses must withhold payroll taxes from payments made to independent contractors and periodically remit such taxes to the state and federal governments.

False

3

Drake Partnership earned a net profit of $400,000. Four partners share profits and losses equally. No cash was distributed. The partners will report taxable income from the partnership on their personal income tax returns for the year.

True

4

Haddie's Hats is a regular corporation. The business must file an income tax return each year to report its taxable income or loss and pay any related taxes.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

5

Partners receiving guaranteed payments are not required to pay self-employment tax on such payments.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

6

On June 1, Jefferson had a basis in his partnership interest of $75,000. On June 2, he received a cash distribution from the partnership of $28,000. All of the cash distribution is taxable.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

7

Limited partners are prohibited by state law from becoming actively involved in the day-to-day operations of the partnership.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

8

A partner's distributive share of partnership profits will increase his or her tax basis in the partnership interest.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

9

All general partners have unlimited personal liability for the debts of the entity.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

10

Matthew earned $150,000 in wages during 2012. FICA taxes withheld by his employer would have been $11,475.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

11

A guaranteed payment may be designed to compensate a partner for personal services rendered to the partnership.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

12

Partners may deduct on their individual income tax returns an amount equal to 100% of self-employment tax paid.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

13

Mr. Dilly has expenses relating to a qualifying home office of $14,320. The taxable income generated by the business before any deduction of home office expenses was $13,700. His allowable home office deduction is $14,320.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

14

A partner's tax basis in his or her partnership interest is decreased by partnership distributions.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

15

Businesses are required by law to withhold federal income tax from the compensation paid to their employees.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

16

The allocations made to a partner are reported on Schedule K-1 and are referred to as his or her distributive share of partnership items.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

17

The FICA taxes authorized by the Federal Insurance Contribution Act is imposed upon all of the employee's wages for the year.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

18

A partner's distributive share of partnership nondeductible expenses does not decrease his or her tax basis in the partnership interest.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

19

A partnership is an unincorporated business activity owned by at least two taxpayers.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

20

Gabriel operates his business as a sole proprietorship. This year the business incurred an operating loss. The loss can be used to offset other income he earned during the year.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

21

Tax savings achieved by operating a business through a pass-through entity, rather than as a C corporation, is an example of entity variable tax planning.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

22

Randolph Scott operates a business as a sole proprietorship. This year his net profit was $10,570. For tax purposes this amount should be reported on:

A) Schedule C, Statement of Profit or Loss from Business

B) The first page of Form 1040 as other income

C) A separate tax return prepared for the business operation

D) Schedule E, Statement of Rent and Royalty Income

A) Schedule C, Statement of Profit or Loss from Business

B) The first page of Form 1040 as other income

C) A separate tax return prepared for the business operation

D) Schedule E, Statement of Rent and Royalty Income

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

23

A shareholder in an S corporation can include only his or her own loans to the corporation in tax basis.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

24

A major advantage of an S corporation is the ability to specially allocate losses to specific members of the company.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following statements regarding sole proprietorships is false?

A) A sole proprietorship has no legal identity separate from that of its owner.

B) Sole proprietorships are the most common form of business entity in the U.S.

C) The cash flow generated by a sole proprietorship belongs to the owner.

D) The assets and liabilities of a sole proprietorship are held in the name of the business, not the owner.

A) A sole proprietorship has no legal identity separate from that of its owner.

B) Sole proprietorships are the most common form of business entity in the U.S.

C) The cash flow generated by a sole proprietorship belongs to the owner.

D) The assets and liabilities of a sole proprietorship are held in the name of the business, not the owner.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

26

Carter's share of a partnership's operating loss is $17,200. His tax basis in his partnership interest before any adjustment for this loss is $26,000. Carter may deduct the full loss on his individual tax return.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding the home office deduction is true?

A) In order to qualify for the deduction, a portion of the taxpayer's home must be used regularly and exclusively to meet with clients or customers.

B) A home office deduction is not allowed for using the home office for administrative or management activities only.

C) The home office deduction is limited to the taxable income of the business before the deduction.

D) A depreciation deduction is not allowed for a home office.

A) In order to qualify for the deduction, a portion of the taxpayer's home must be used regularly and exclusively to meet with clients or customers.

B) A home office deduction is not allowed for using the home office for administrative or management activities only.

C) The home office deduction is limited to the taxable income of the business before the deduction.

D) A depreciation deduction is not allowed for a home office.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

28

A limited liability company that has only one member is generally treated as a disregarded entity for federal tax purposes.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

29

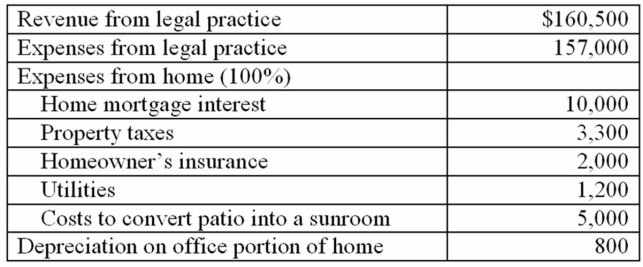

Rebecca has a qualifying home office. The room is 600 square feet and the entire house is 3,000 square feet. Use the following information to determine her allowable home office deduction:

A) $3,300 home office deduction

B) $16,500 home office deduction

C) $3,500 home office deduction

D) $4,100 home office deduction

A) $3,300 home office deduction

B) $16,500 home office deduction

C) $3,500 home office deduction

D) $4,100 home office deduction

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

30

During 2012, Scott Howell received a salary of $125,000. The social security base amount for 2012 was $110,100. How much payroll tax should have been withheld from Scott's salary for 2012?

A) $0

B) $7,063

C) $8,639

D) $6,437

A) $0

B) $7,063

C) $8,639

D) $6,437

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

31

The earnings of a C corporation are taxed only at the shareholder level.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

32

John's share of partnership loss was $60,000. He had only enough tax basis to deduct $34,000 of the loss. He may deduct the remaining loss against other income in the following year, regardless of what happens in the partnership.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

33

A limited liability company is always taxed as a partnership, regardless of the number of its members.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

34

A shareholder in an S corporation includes in tax basis his or her share of the corporation's liabilities.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

35

The shareholders of an S corporation must pay self-employment tax on their share of the corporation's ordinary income.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

36

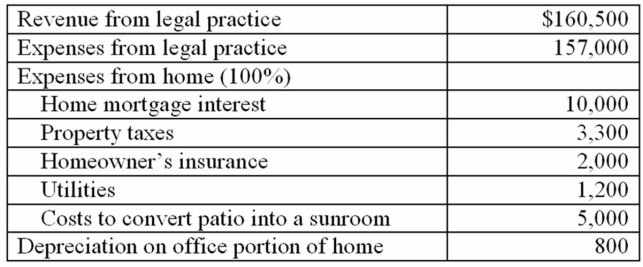

Aaron James has a qualifying home office. The office is 500 square feet and the entire house is 2,500 square feet. Use the following information to determine his allowable home office deduction:

A) $5,240

B) $4,140

C) $4,260

D) $21,800

A) $5,240

B) $4,140

C) $4,260

D) $21,800

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

37

A limited liability company with more than one member is generally considered a partnership for federal tax purposes.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

38

Kelly received a $60,000 salary during 2012. Her federal income tax withholding rate was 20%, and the Social Security base amount for 2012 was $110,100. What is the total amount that her employer should have withheld in 2012?

A) $15,390

B) $16,590

C) $15,979

D) $6,849

A) $15,390

B) $16,590

C) $15,979

D) $6,849

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

39

Corporations cannot be shareholders in an S corporation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

40

If a business is formed as an S corporation, its income may be subject to double taxation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

41

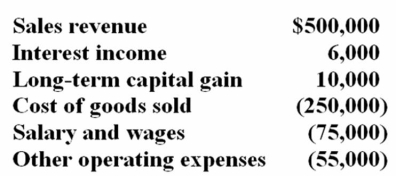

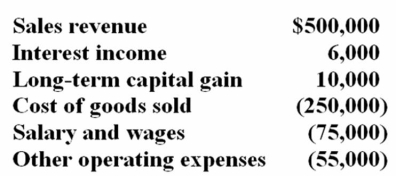

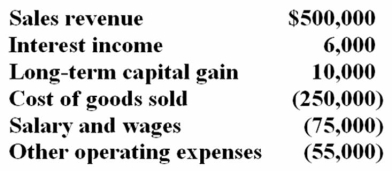

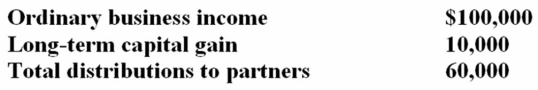

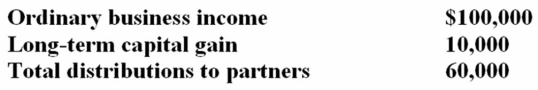

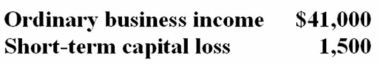

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

A) $63,000

B) $60,000

C) $68.000

D) $97,500

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?

Waters distributed $25,000 to each of its shareholders during the year. If Mia has no other sources of income, what is her gross income for the year?A) $63,000

B) $60,000

C) $68.000

D) $97,500

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

42

Jackie contributed $60,000 in cash to a partnership for a 50% interest. This year, the partnership earned $200,000 ordinary business income, made a $20,000 contribution to the United Way, and distributed $25,000 cash to Jackie. Her tax basis in the partnership at year end is:

A) $110,000

B) $85,000

C) $125,000

D) $215,000

A) $110,000

B) $85,000

C) $125,000

D) $215,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

43

Alan is a general partner in ADK Partnership. His partnership Schedule K-1 reports $50,000 ordinary business income, $22,000 guaranteed payment, $5,000 long-term capital gain, and $400 dividend income. Which of these items are subject to self-employment tax?

A) $50,000 ordinary income

B) $50,000 ordinary business income and $22,000 guaranteed payment

C) $50,000 ordinary business income, $22,000 guaranteed payment, and $5,000 long-term capital gain

D) All income reported on a general partner's Schedule K-1 are subject to self-employment tax

A) $50,000 ordinary income

B) $50,000 ordinary business income and $22,000 guaranteed payment

C) $50,000 ordinary business income, $22,000 guaranteed payment, and $5,000 long-term capital gain

D) All income reported on a general partner's Schedule K-1 are subject to self-employment tax

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

44

Alice is a partner in Axel Partnership. Her share of the partnership's 2012 ordinary business income was $100,000. She received a $60,000 cash distribution from the partnership on December 1, 2012. Assuming that Alice's marginal tax rate is 35%, calculate her after-tax cash flow from the partnership in 2012.

A) $65,000

B) $39,000

C) $60,000

D) $25,000

A) $65,000

B) $39,000

C) $60,000

D) $25,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

45

Cramer Corporation and Mr. Chips formed a partnership in which Cramer is the general partner and Mr. Chips is a limited partner. Cramer contributed $500,000 cash, and Mr. Chips contributed a building with a $500,000 FMV and $300,000 tax basis. The partnership immediately borrowed $700,000 of recourse debt. What is Cramer's tax basis in its partnership interest?

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

46

Bernard and Leon formed a partnership on January 1 with cash contributions of $600,000 and $200,000, respectively. The partners agree to share profits and losses in the ratio of their initial capital contributions. The partnership immediately borrowed $800,000. What is Bernard's tax basis in his partnership interest?

A) $1,200,000

B) $600,000

C) $800,000

D) $1,400,000

A) $1,200,000

B) $600,000

C) $800,000

D) $1,400,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

47

In 2012, Mike Elfred received a $165,000 salary from his employer and generated $39,000 net earnings from self-employment from his small business. Which of the following statements is true?

A) Mike does not owe any self-employment tax because his salary exceeded the 2012 base amount ($110,100) for federal employment tax.

B) Mike owes both the Medicare and Social Security tax portions of self-employment tax on his $39,000 earnings from his small business.

C) Mike owes Medicare tax but not Social Security tax on his $39,000 earnings from his small business.

D) Mike owes Social Security tax but not Medicare tax on his $39,000 earnings from his small business.

A) Mike does not owe any self-employment tax because his salary exceeded the 2012 base amount ($110,100) for federal employment tax.

B) Mike owes both the Medicare and Social Security tax portions of self-employment tax on his $39,000 earnings from his small business.

C) Mike owes Medicare tax but not Social Security tax on his $39,000 earnings from his small business.

D) Mike owes Social Security tax but not Medicare tax on his $39,000 earnings from his small business.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

48

Martha Pim is a general partner in PLF Partnership. This year, Martha received a $48,000 guaranteed payment from PLF, and her distributive share of PLF's ordinary business income was $93,200. Which of the following is accurate?

A) Martha must pay income tax on $141,200 and self-employment tax on $48,000.

B) Martha must pay income tax on $141,200 and self-employment tax on $93,200.

C) Martha must pay both income tax and self-employment tax on $141,200.

D) Martha must pay income tax on $48,000 and self-employment tax on $93,200.

A) Martha must pay income tax on $141,200 and self-employment tax on $48,000.

B) Martha must pay income tax on $141,200 and self-employment tax on $93,200.

C) Martha must pay both income tax and self-employment tax on $141,200.

D) Martha must pay income tax on $48,000 and self-employment tax on $93,200.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about partnerships is false?

A) A partnership is a legal entity that may enter into valid contracts.

B) Partnerships are unincorporated entities.

C) Only individuals may be partners in a partnership.

D) Partnerships are sometimes referred to as passthrough entities since they do not pay federal income tax.

A) A partnership is a legal entity that may enter into valid contracts.

B) Partnerships are unincorporated entities.

C) Only individuals may be partners in a partnership.

D) Partnerships are sometimes referred to as passthrough entities since they do not pay federal income tax.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

50

Cramer Corporation and Mr. Chips formed a general partnership. Cramer contributed $500,000 cash, and Mr. Chips contributed a building with a $500,000 FMV and $300,000 tax basis. The partnership immediately borrowed $700,000 of recourse debt. What is Mr. Chips' tax basis in its partnership interest?

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

51

Debbie is a limited partner in ADK Partnership. Her partnership Schedule K-1 reports $19,000 ordinary business income, $2,000 long-term capital gain, and $830 dividend income. Which of these items are subject to self-employment tax?

A) None of the items are subject to SE tax because Debbie is a limited partner.

B) $19,000 ordinary business income

C) $19,000 ordinary business income and $2,000 long-term capital gain

D) All income reported on a partner's Schedule K-1 are subject to self-employment tax.

A) None of the items are subject to SE tax because Debbie is a limited partner.

B) $19,000 ordinary business income

C) $19,000 ordinary business income and $2,000 long-term capital gain

D) All income reported on a partner's Schedule K-1 are subject to self-employment tax.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

52

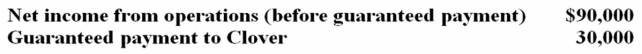

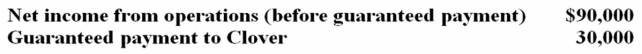

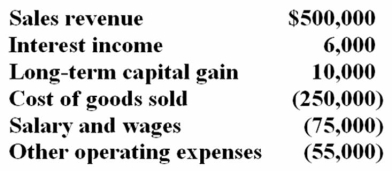

Hay, Straw and Clover formed the HSC Partnership, agreeing to share profits and losses equally. Clover will manage the business for which he will receive a guaranteed payment of $30,000 per year. Cash receipts and disbursements for the year were as follows:  What is Clover's share of the partnership's ordinary income and guaranteed payment?

What is Clover's share of the partnership's ordinary income and guaranteed payment?

A) Ordinary income, $30,000; Guaranteed payment, $10,000

B) Ordinary income, $20,000; Guaranteed payment, $10,000

C) Ordinary income, $30,000; Guaranteed payment, $30,000

D) Ordinary income, $20,000; Guaranteed payment, $30,000

What is Clover's share of the partnership's ordinary income and guaranteed payment?

What is Clover's share of the partnership's ordinary income and guaranteed payment?A) Ordinary income, $30,000; Guaranteed payment, $10,000

B) Ordinary income, $20,000; Guaranteed payment, $10,000

C) Ordinary income, $30,000; Guaranteed payment, $30,000

D) Ordinary income, $20,000; Guaranteed payment, $30,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

53

Cramer Corporation and Mr. Chips formed a general partnership. Cramer contributed $500,000 cash, and Mr. Chips contributed a building with a $500,000 FMV and $300,000 tax basis. The partnership immediately borrowed $700,000 of recourse debt. What is Cramer's tax basis in its partnership interest?

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

A) $500,000

B) $1,200,000

C) $850,000

D) $650,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

54

During 2012, Elena generated $24,500 of earnings on Schedule C. If Elena had no other earned income, how much self-employment tax will she owe on her Schedule C net profit?

A) $3,749

B) $3,259

C) $3,461

D) $3,008

A) $3,749

B) $3,259

C) $3,461

D) $3,008

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

55

Sue's 2012 net (take-home) pay was $23,805. Her only payroll deductions were for payroll taxes and federal income tax. Federal income tax withholdings totaled $4,500. What was the amount of her gross wages for the year?

A) $25,736

B) $30,000

C) $29,536

D) None of the above

A) $25,736

B) $30,000

C) $29,536

D) None of the above

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

56

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

A) Ordinary income, $126,000; long-term capital gain is separately stated

B) Ordinary income, $120,000; interest income and long-term capital gain are separately stated

C) Ordinary income, $136,000; nothing is separately stated

D) Ordinary income, $195,000; interest income, long-term capital gain, and salary costs are separately stated

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.A) Ordinary income, $126,000; long-term capital gain is separately stated

B) Ordinary income, $120,000; interest income and long-term capital gain are separately stated

C) Ordinary income, $136,000; nothing is separately stated

D) Ordinary income, $195,000; interest income, long-term capital gain, and salary costs are separately stated

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

57

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year, compute her adjusted tax basis in her partnership interest at the end of the year.

Waters distributed $25,000 to each of its shareholders during the year. If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year, compute her adjusted tax basis in her partnership interest at the end of the year.

A) $93,000

B) $118,000

C) $50,000

D) $85,000

Waters distributed $25,000 to each of its shareholders during the year. If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year, compute her adjusted tax basis in her partnership interest at the end of the year.

Waters distributed $25,000 to each of its shareholders during the year. If Mia's adjusted tax basis in her partnership interest was $50,000 at the beginning of the year, compute her adjusted tax basis in her partnership interest at the end of the year.A) $93,000

B) $118,000

C) $50,000

D) $85,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

58

Cramer Corporation and Mr. Chips formed a partnership in which Cramer is the general partner and Mr. Chips is a limited partner. Cramer contributed $500,000 cash, and Mr. Chips contributed a building with a $500,000 FMV and $300,000 tax basis. The partnership immediately borrowed $700,000 of recourse debt. What is Mr. Chips' tax basis in its partnership interest?

A) $500,000

B) $850,000

C) $650,000

D) $300,000

A) $500,000

B) $850,000

C) $650,000

D) $300,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

59

William is a member of an LLC. His Schedule K-1 reported a $1,200 share of capital loss and a $3,000 share of Section 1231 gain. William recognized a $4,500 capital gain on the sale of marketable securities and a $15,000 Section 1231 loss on the sale of business equipment. What is the net effect of these gains and losses on William's taxable income?

A) $3,300 net capital gain; $12,000 deductible net Section 1231 loss

B) $4,500 net capital gain; $12,000 deductible net Section 1231 loss

C) $4,500 net capital gain; $15,000 deductible net Section 1231 loss

D) $3,300 net capital gain; -0- deductible net Section 1231 loss

A) $3,300 net capital gain; $12,000 deductible net Section 1231 loss

B) $4,500 net capital gain; $12,000 deductible net Section 1231 loss

C) $4,500 net capital gain; $15,000 deductible net Section 1231 loss

D) $3,300 net capital gain; -0- deductible net Section 1231 loss

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements concerning partnerships is false?

A) A properly-drafted partnership agreement is crucial.

B) A general partner's basis in a partnership includes his share of partnership debt.

C) Limited partnerships must have at least one general partner.

D) A partner is taxed annually on only that portion of a partnership's taxable income that is actually distributed.

A) A properly-drafted partnership agreement is crucial.

B) A general partner's basis in a partnership includes his share of partnership debt.

C) Limited partnerships must have at least one general partner.

D) A partner is taxed annually on only that portion of a partnership's taxable income that is actually distributed.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

61

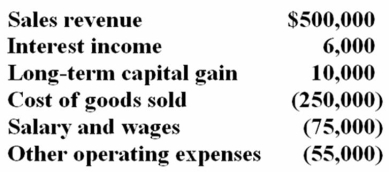

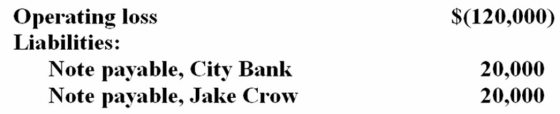

Funky Chicken is a calendar year S corporation with the following current year information:  On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

A) $57,000

B) $80,000

C) $65,000

D) $75,000

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?A) $57,000

B) $80,000

C) $65,000

D) $75,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

62

Grant and Amy have formed a new business to be operated through an S corporation. They each own 50% of the corporation's outstanding common stock. During the first year of operations, the business incurred an operating loss of $100,000. In allocating this loss to the shareholders:

A) Grant and Amy must each be allocated $50,000 of the operating loss.

B) If the corporate charter permits, the S corporation can make a special allocation of 100% of the operating loss to Grant.

C) Because the shareholders have limited liability for the S corporation's debts, they are not permitted any deduction for the operating loss.

D) The corporation should also consider ownership of any outstanding preferred stock in making the loss allocation.

A) Grant and Amy must each be allocated $50,000 of the operating loss.

B) If the corporate charter permits, the S corporation can make a special allocation of 100% of the operating loss to Grant.

C) Because the shareholders have limited liability for the S corporation's debts, they are not permitted any deduction for the operating loss.

D) The corporation should also consider ownership of any outstanding preferred stock in making the loss allocation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements regarding a partner's tax basis in a partnership interest is true?

A) Partnership tax basis is increased annually by cash distributions from the partnership.

B) Partnership tax basis is reduced by the partner's share of nondeductible partnership expenses.

C) Partnership tax basis is reduced by the partner's share of nontaxable partnership income.

D) Partnership tax basis becomes negative if allocable losses exceed basis.

A) Partnership tax basis is increased annually by cash distributions from the partnership.

B) Partnership tax basis is reduced by the partner's share of nondeductible partnership expenses.

C) Partnership tax basis is reduced by the partner's share of nontaxable partnership income.

D) Partnership tax basis becomes negative if allocable losses exceed basis.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

64

Loretta is the sole shareholder of Country Collectibles, a calendar year S corporation. Although Loretta spends at least 40 hours per week supervising Country Collectible's employees, she has never drawn a salary from the business. Country Collectibles has been in existence for five years and has earned a profit every year. Loretta withdraws $100,000 cash from the S corporation each year. Which of the following statements accurately describes the tax consequences of these withdrawals?

A) The withdrawals are nontaxable, with no risk that they could be recharacterized as taxable salary or dividend payments.

B) The withdrawals are considered taxable dividends to Loretta.

C) There is significant risk that the IRS could recharacterize the payments to Loretta as salary. Such treatment would increase taxable income for both Loretta and the S corporation.

D) There is significant risk that the IRS could recharacterize the payments to Loretta as salary. Such treatment would not change taxable income for Loretta and reduce taxable income of the S corporation.

A) The withdrawals are nontaxable, with no risk that they could be recharacterized as taxable salary or dividend payments.

B) The withdrawals are considered taxable dividends to Loretta.

C) There is significant risk that the IRS could recharacterize the payments to Loretta as salary. Such treatment would increase taxable income for both Loretta and the S corporation.

D) There is significant risk that the IRS could recharacterize the payments to Loretta as salary. Such treatment would not change taxable income for Loretta and reduce taxable income of the S corporation.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

65

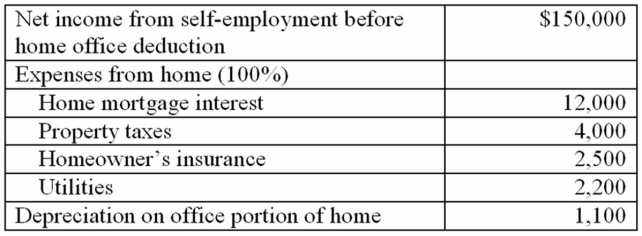

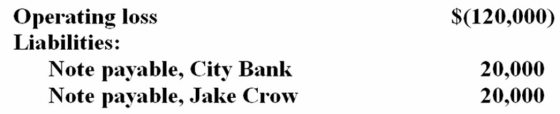

Cactus Company is a calendar year S corporation with the following current year information:  On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?

A) $60,000

B) $30,000

C) $40,000

D) $50,000

On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% of Cactus Company stock for $30,000. How much of the operating loss may John deduct on his Form 1040?A) $60,000

B) $30,000

C) $40,000

D) $50,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

66

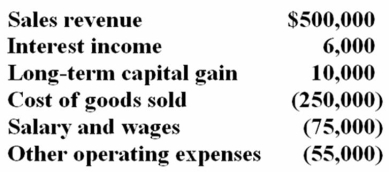

Mutt and Jeff are general partners in M&J Partnership and share profits and losses equally. Partnership operations for the current tax year were:  Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

A) $25,000

B) $37,000

C) $13,000

D) $27,000

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?

Mutt's tax basis in his partnership interest at the beginning of the current year was $12,000. What is his basis at the beginning of next year?A) $25,000

B) $37,000

C) $13,000

D) $27,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

67

XYZ, Inc. wishes to make an election to become an S corporation for federal tax purposes. Which of the following statements regarding the election is false?

A) All of the corporation's shareholders must consent to make an S election.

B) If a shareholder in an S corporation sells his shares of stock to a nonresident alien, the election will terminate.

C) If an S corporation loses its election, the shareholders cannot make a new election for five years without IRS consent.

D) All of the shareholders must consent to voluntarily terminating an S election.

A) All of the corporation's shareholders must consent to make an S election.

B) If a shareholder in an S corporation sells his shares of stock to a nonresident alien, the election will terminate.

C) If an S corporation loses its election, the shareholders cannot make a new election for five years without IRS consent.

D) All of the shareholders must consent to voluntarily terminating an S election.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements regarding limited liability companies is true?

A) Just like an S corporation, an LLC member's share of ordinary income is not subject to self-employment taxes.

B) Just like an S corporation, an LLC is restricted to 100 members.

C) Because LLCs are a relatively new organizational form, many tax questions concerning their operation have yet to be resolved.

D) Just like a limited partnership, only LLC members who are not actively involved in the entity's business activities have limited liability for the LLC's debts.

A) Just like an S corporation, an LLC member's share of ordinary income is not subject to self-employment taxes.

B) Just like an S corporation, an LLC is restricted to 100 members.

C) Because LLCs are a relatively new organizational form, many tax questions concerning their operation have yet to be resolved.

D) Just like a limited partnership, only LLC members who are not actively involved in the entity's business activities have limited liability for the LLC's debts.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

69

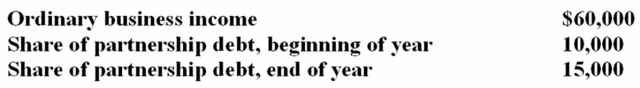

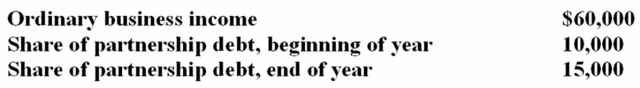

Gavin owns a 50% interest in London Partnership. His tax basis in his partnership interest at the beginning of the year was $20,000. His partnership Schedule K-1 showed the following:  Calculate Gavin's tax basis in his partnership interest at the end of the year?

Calculate Gavin's tax basis in his partnership interest at the end of the year?

A) $85,000

B) $95,000

C) $75,000

D) $65,000

Calculate Gavin's tax basis in his partnership interest at the end of the year?

Calculate Gavin's tax basis in his partnership interest at the end of the year?A) $85,000

B) $95,000

C) $75,000

D) $65,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements regarding S corporations is true?

A) An S corporation may have no more than 50 shareholders.

B) Any individual, estate, corporation, or trust may be an S corporation shareholder.

C) An S corporation may have only one class of stock.

D) An S corporation shareholder's allocable share of ordinary income is subject to self-employment tax.

A) An S corporation may have no more than 50 shareholders.

B) Any individual, estate, corporation, or trust may be an S corporation shareholder.

C) An S corporation may have only one class of stock.

D) An S corporation shareholder's allocable share of ordinary income is subject to self-employment tax.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements regarding the basis limitation on deduction of partnership losses is false?

A) If a partner's share of partnership losses exceeds the partner's tax basis in the partnership interest, the excess is not deductible in the current year.

B) Partnership losses that are not deductible due to the basis limitation can be carried forward indefinitely.

C) Partners can increase tax basis in their partnership interest only by making additional capital contributions.

D) If a partnership becomes profitable in the future, the partner's share of such future income will create basis against which loss carryforwards can be deducted.

A) If a partner's share of partnership losses exceeds the partner's tax basis in the partnership interest, the excess is not deductible in the current year.

B) Partnership losses that are not deductible due to the basis limitation can be carried forward indefinitely.

C) Partners can increase tax basis in their partnership interest only by making additional capital contributions.

D) If a partnership becomes profitable in the future, the partner's share of such future income will create basis against which loss carryforwards can be deducted.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

72

In applying the basis limitation on the deduction of S corporation losses, which of the following statements is true?

A) The basis of a shareholder's interest in an S corporation, for purposes of limiting deductibility of losses, is computed in the same manner as a partner's basis in a partnership interest.

B) A shareholder is permitted to deduct losses against basis in any debt obligation from the S corporation to the shareholder.

C) If a shareholder's tax basis in a debt obligation is reduced, any gain resulting from the repayment of that obligation is considered ordinary income.

D) All of the above statements are false.

A) The basis of a shareholder's interest in an S corporation, for purposes of limiting deductibility of losses, is computed in the same manner as a partner's basis in a partnership interest.

B) A shareholder is permitted to deduct losses against basis in any debt obligation from the S corporation to the shareholder.

C) If a shareholder's tax basis in a debt obligation is reduced, any gain resulting from the repayment of that obligation is considered ordinary income.

D) All of the above statements are false.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

73

Loretta is the sole shareholder of Country Collectibles, a calendar year S corporation. Although Loretta spends at least 40 hours per week supervising Country Collectible's employees, she has never drawn a salary from the business. Country Collectibles has been in existence for five years and has earned a profit every year. Loretta withdraws $100,000 cash from the S corporation each year. As a result of an audit, the IRS asserts that $75,000 of the cash withdrawal should be considered a salary payment to Loretta. What are the payroll tax consequences of this recharacterization?

A) No payroll taxes will be owed as a result of the audit.

B) Loretta and Country Collectibles will each be liable for unpaid payroll taxes as a result of the audit.

C) Only Loretta will be liable for unpaid payroll taxes as a result of the audit.

D) Only Country Collectibles will be liable for unpaid payroll taxes as a result of the audit.

A) No payroll taxes will be owed as a result of the audit.

B) Loretta and Country Collectibles will each be liable for unpaid payroll taxes as a result of the audit.

C) Only Loretta will be liable for unpaid payroll taxes as a result of the audit.

D) Only Country Collectibles will be liable for unpaid payroll taxes as a result of the audit.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

74

On January 1, Leon purchased a 10% stock interest in an S corporation for $30,000. He also loaned the S corporation $5,000 in exchange for a written promissory note. The S corporation generated a $330,000 operating loss for the year. Leon deducted his 10% share of the loss, reducing his tax basis in his stock to zero, and his tax basis in the note to $2,000. The following year, the S corporation repaid the note before Leon restored his basis in the note. What are the consequences of the loan repayment to Leon?

A) $3,000 capital gain

B) $3,000 ordinary income

C) $2,000 capital gain

D) $2,000 ordinary income

A) $3,000 capital gain

B) $3,000 ordinary income

C) $2,000 capital gain

D) $2,000 ordinary income

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

75

Perry is a partner in a calendar year partnership. His Schedule K-1 for the current tax year showed the following:  Perry's tax basis in his partnership interest at the beginning of the year was $15,400. How much of the ordinary loss may he deduct on his Form 1040?

Perry's tax basis in his partnership interest at the beginning of the year was $15,400. How much of the ordinary loss may he deduct on his Form 1040?

A) $11,700

B) $14,000

C) $10,200

D) $13,300

Perry's tax basis in his partnership interest at the beginning of the year was $15,400. How much of the ordinary loss may he deduct on his Form 1040?

Perry's tax basis in his partnership interest at the beginning of the year was $15,400. How much of the ordinary loss may he deduct on his Form 1040?A) $11,700

B) $14,000

C) $10,200

D) $13,300

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

76

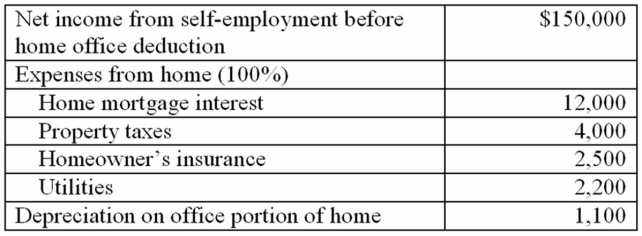

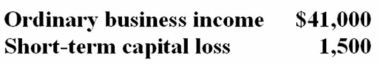

Orange, Inc. is a calendar year partnership with the following current year information:  On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?

A) $60,000

B) $30,000

C) $40,000

D) $50,000

On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?

On January 1, John James bought 50% general interest in Orange, Inc. for $30,000. How much of the operating loss may John deduct on his Form 1040?A) $60,000

B) $30,000

C) $40,000

D) $50,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements regarding limited liability companies is false?

A) Every member of an LLC has limited liability for the LLC's debts.

B) An LLC with only one member is generally treated as a corporation for income tax purposes.

C) An LLC with more than one member is generally treated as a partnership for income tax purposes.

D) State laws do not limit the number of members or the type of entity that can be a member in an LLC.

A) Every member of an LLC has limited liability for the LLC's debts.

B) An LLC with only one member is generally treated as a corporation for income tax purposes.

C) An LLC with more than one member is generally treated as a partnership for income tax purposes.

D) State laws do not limit the number of members or the type of entity that can be a member in an LLC.

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

78

At the beginning of year 1, Paulina purchased a 25% general partner interest in Gamma Partnership for $25,000. Paulina's partnership Schedule K-1 for year 1 reported that her share of Gamma's debt at year-end was $10,000 and her share of ordinary loss was $5,000. On January 1, year 2, Paulina sold her interest to another partner for $22,000 cash. Compute Paulina's gain or loss on the sale of her partnership interest.

A) $3,000 loss

B) $8,000 loss

C) $2,000 gain

D) $0 gain or loss

A) $3,000 loss

B) $8,000 loss

C) $2,000 gain

D) $0 gain or loss

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

79

Alex is a partner in a calendar year partnership. His partnership Schedule K-1 for the current tax year showed the following:  Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

A) $41,000

B) $32,500

C) $39,500

D) $34,000

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?

Alex has a $7,000 loss carryforward from the partnership last year, which he could not deduct because of the basis limitation. What is his tax basis in his partnership interest at the end of the current tax year?A) $41,000

B) $32,500

C) $39,500

D) $34,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck

80

Funky Chicken is a calendar year general partnership with the following current year information:  On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?

A) $57,000

B) $80,000

C) $65,000

D) $75,000

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the partnership $20,000. How much of the operating loss may Cross deduct currently?A) $57,000

B) $80,000

C) $65,000

D) $75,000

Unlock Deck

Unlock for access to all 87 flashcards in this deck.

Unlock Deck

k this deck