Deck 17: Tax Consequences of Personal Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 17: Tax Consequences of Personal Activities

1

For federal income tax purposes, a taxpayer may deduct state and federal employment taxes as an itemized deduction.

False

2

Congress provides an indirect subsidy to charities by allowing a deduction for charitable contributions.

True

3

Chad won a car valued at $25,000 from a game show. Because he immediately donated the car to the Red Cross, Chad can exclude $25,000 from gross income.

False

4

For federal income tax purposes, property transfers pursuant to a divorce are nontaxable events.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

Mia inherited $1 million from her deceased grandfather. Mia must include the inheritance in gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

Alimony payments are included in the recipient's gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

This year, David paid his physician $6,200 for routine examinations and received a $3,000 reimbursement from his medical insurance company. David is allowed a $3,200 medical expense as an above-the-line deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

For federal income tax purposes, a taxpayer may elect to deduct state and local sales taxes as an itemized deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

Mrs. Kronin received $16,200 child support payments from her former husband. These payments are excluded from Mrs. Kronin's gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

A drunk driver seriously injured Leah. The court awarded her $200,000 for her physical injuries and $300,000 as punitive damages. Leah must include $300,000 in gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

The cost of commuting to and from a place of employment is a nondeductible personal expense.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

Under the terms of a divorce decree, Harold transferred his one-half interest in the marital residence to his former wife Francine. Francine must include the value of the interest in gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

Unemployment benefits are excluded from gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

Recipients of the Nobel Peace Prize must include the prize in gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

Losses realized on the sale of personal use assets are deductible.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

Gifts are not included in the recipient's gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

Ben received a $5,000 tuition scholarship from his local community college. He can exclude the $5,000 from gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

Taxpayers include a maximum of 85% of Social Security benefits in gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

A child of divorced parents is considered a dependent of the parent with custody unless that parent agrees to allow the noncustodial parent to claim the dependency exemption.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

Gains realized on the sale of personal use assets are taxable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

Helen makes quilts and sells them at the regional county fairs. This year, she earned $950 from quilt sales and spent $3,300 on supplies and travel relating to her quilting activity. If the IRS determines that this activity is a hobby instead of a business, Helen can't deduct her $2,350 net loss.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

Personal exemptions are allowed in computing alternative minimum taxable income (AMTI).

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

A taxpayer must have owned and lived in a personal residence at least two of the last five years in order to qualify for the maximum exclusion of gain on sale of that residence.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

Real estate taxes deducted for regular tax purposes must be added back in computing alternative minimum taxable income (AMTI).

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

Tax return preparation fees are miscellaneous itemized deductions subject to the 2% AGI floor.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

Mary Stone, a single individual, sold a personal residence on June 3, 2014, and excluded her $93,600 gain from gross income. If she sells another personal residence before June 4, 2016, she can exclude a maximum of $156,400 of any gain.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

Lori owns a vacation home that she rents out for about three months each year. Her deduction for expenses allocable to the rental periods is limited to her gross rental income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

A taxpayer must purchase a new personal residence in order to exclude any gain from the sale of the old residence.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

An activity will be classified as a hobby if the taxpayer fails to make a profit from the activity.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

30

Violet took out a $900,000 mortgage to purchase her personal residence. She can deduct the mortgage interest payments as an itemized deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

Any gain recognized on the sale of a personal residence is excluded from the seller's gross income.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

William took out a $740,000 mortgage to purchase his personal residence. The residence is worth over $1.4 million, and William wants to take out a $200,000 second mortgage and use the proceeds to consolidate his credit card debt. William can deduct 50% of the interest he will pay on the second mortgage.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

Carl had $2,000 gambling winnings and $8,400 gambling losses this. Carl must include $2,000 in gross income and can deduct $8,400 as an itemized deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

Interest paid on home equity debt is not deductible in computing alternative minimum taxable income (AMTI).

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

Mr. Lightfoot owns three mortgaged residences that he occupies at different times of the year. He can treat the interest paid on only one mortgage as qualified residence interest.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

A thief broke into Kate's condominium and stole her laptop computer. Kate purchased the computer for $1,400, but its current value is only $300. Kate's casualty loss is $1,400.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

The federal income tax system provides incentives for individual taxpayers to meet their housing needs by purchasing instead of renting a home.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

A nondeductible charitable contribution may be carried forward five years.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

Damage to a personal residence by a tornado is an example of a casualty loss.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

Interest paid on debt incurred to acquire, build, or improve a personal residence is a preference item for computing the alternative minimum tax.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

Six years ago, Milo Lenz, an amateur artist, sculpted a garden gnome as a gift for his mother. This year, his mother sold the gnome on eBay for $1,200. What is the amount and character of the mother's gain?

A) No gain recognized on the sale of a personal asset.

B) $1,200 ordinary gain.

C) $1,200 long-term capital gain.

D) None of the above.

A) No gain recognized on the sale of a personal asset.

B) $1,200 ordinary gain.

C) $1,200 long-term capital gain.

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

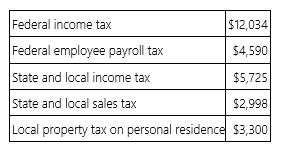

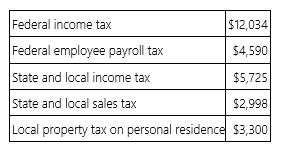

Spencer paid the following taxes this year.  Compute Spencer's itemized deduction for taxes.

Compute Spencer's itemized deduction for taxes.

A) $5,725

B) $13,615

C) $9,025

D) $12,023

Compute Spencer's itemized deduction for taxes.

Compute Spencer's itemized deduction for taxes.A) $5,725

B) $13,615

C) $9,025

D) $12,023

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

Mr. and Mrs. Shohler received $25,200 Social Security benefits this year. Their only other source of income was Mrs. Shohler's $10,479 taxable pension from her former employer. How much of their Social Security is included in gross income?

A) $0

B) $12,600

C) $21420

D) $25,200

A) $0

B) $12,600

C) $21420

D) $25,200

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following items is included in the recipient's gross income?

A) Life insurance death benefit

B) Legal award for personal injury

C) Legal award for punitive damages

D) Scholarship for tuition, fees, and books

A) Life insurance death benefit

B) Legal award for personal injury

C) Legal award for punitive damages

D) Scholarship for tuition, fees, and books

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

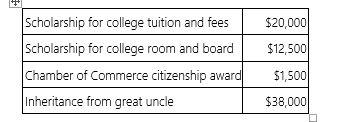

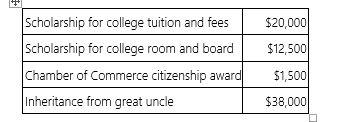

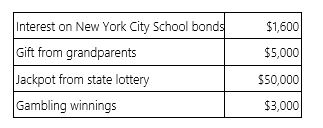

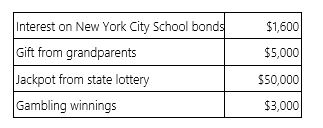

James Dean received the following this year.  Compute James' gross income.

Compute James' gross income.

A) $12,500

B) $14,000

C) $34,000

D) None of the above.

Compute James' gross income.

Compute James' gross income.A) $12,500

B) $14,000

C) $34,000

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

Mr. and Mrs. Trent divorced last year. Pursuant to the divorce, Mr. Trent transferred marketable securities (FMV $100,000; basis $67,000) to Mrs. Trent. This year, Mrs. Trent sold the securities for $112,000. Which of the following statements is true?

A) Mrs. Trent recognized a $45,000 gain on sale this year.

B) Mrs. Trent recognized $100,000 income last year.

C) Mrs. Trent recognized a $12,000 gain on sale this year.

D) Mrs. Trent recognized no income last year and no gain on sale this year.

A) Mrs. Trent recognized a $45,000 gain on sale this year.

B) Mrs. Trent recognized $100,000 income last year.

C) Mrs. Trent recognized a $12,000 gain on sale this year.

D) Mrs. Trent recognized no income last year and no gain on sale this year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

Polly received the following items this year.  Compute Polly's gross income.

Compute Polly's gross income.

A) $59,600

B) $58,000

C) $53,000

D) $50,000

Compute Polly's gross income.

Compute Polly's gross income.A) $59,600

B) $58,000

C) $53,000

D) $50,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements about divorce settlements is true?

A) Property transfers pursuant to divorce have no income tax consequences.

B) Child support is excluded from the recipient's gross income.

C) Child support is an above-the-line deduction for the payer.

D) Statements A. and B. are true.

A) Property transfers pursuant to divorce have no income tax consequences.

B) Child support is excluded from the recipient's gross income.

C) Child support is an above-the-line deduction for the payer.

D) Statements A. and B. are true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is excluded from gross income?

A) $50,000 slot machine winnings

B) $13,900 value of Hawaiian vacation won on a game show

C) $85,000 Pulitzer prize for journalism

D) None of the above is excluded.

A) $50,000 slot machine winnings

B) $13,900 value of Hawaiian vacation won on a game show

C) $85,000 Pulitzer prize for journalism

D) None of the above is excluded.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

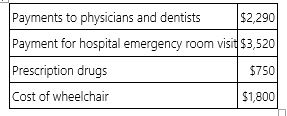

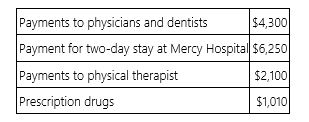

Mr. and Mrs. Oliva, ages 70 and 67, incurred the following unreimbursed medical expenses this year.  If the Olivas' AGI is $23,200, compute their medical expense deduction.

If the Olivas' AGI is $23,200, compute their medical expense deduction.

A) $0

B) $6,040

C) $8,360

D) None of the above.

If the Olivas' AGI is $23,200, compute their medical expense deduction.

If the Olivas' AGI is $23,200, compute their medical expense deduction.A) $0

B) $6,040

C) $8,360

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

Mr. and Mrs. McGraw received $50,160 Social Security benefits this year. They also received $108,000 taxable pension payments and earned $47,300 interest and dividends from their investment portfolio. How much of the McGraw's Social Security is included in gross income?

A) $0

B) $25,080

C) $42,636

D) $50,160

A) $0

B) $25,080

C) $42,636

D) $50,160

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

Josh donated a painting to the local art museum. He purchased the painting twenty years ago for $34,000, and its appraised FMV at date of gift was $115,000. Which of the following statements about this donation is true?

A) Josh must recognize an $81,000 long-term capital gain and is allowed a $115,000 charitable contribution deduction.

B) Josh recognizes no gain and is allowed a $115,000 charitable contribution deduction.

C) Josh recognizes no gain and is allowed a $34,000 charitable contribution deduction.

D) None of the above is true.

A) Josh must recognize an $81,000 long-term capital gain and is allowed a $115,000 charitable contribution deduction.

B) Josh recognizes no gain and is allowed a $115,000 charitable contribution deduction.

C) Josh recognizes no gain and is allowed a $34,000 charitable contribution deduction.

D) None of the above is true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements about divorce settlements is false?

A) Alimony is excluded from the recipient's gross income.

B) Child support is excluded from the recipient's gross income.

C) Alimony is an above-the-line deduction for the payer.

D) None of the above is false.

A) Alimony is excluded from the recipient's gross income.

B) Child support is excluded from the recipient's gross income.

C) Alimony is an above-the-line deduction for the payer.

D) None of the above is false.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following items is not included in the recipient's gross income?

A) Alimony

B) Unemployment compensation from a state government

C) Gain on sale of an antique car

D) Welfare payments from a state government

A) Alimony

B) Unemployment compensation from a state government

C) Gain on sale of an antique car

D) Welfare payments from a state government

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following government transfer payments is included in the recipient's gross income?

A) Food stamps

B) Need-based welfare payments

C) Unemployment compensation

D) None of the above is included.

A) Food stamps

B) Need-based welfare payments

C) Unemployment compensation

D) None of the above is included.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

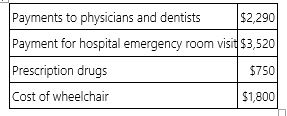

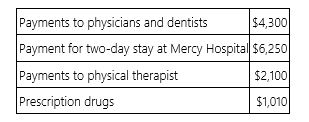

Dotty, age 45, incurred the following medical expenses this year.  Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

A) $0

B) $1,320

C) $10,120

D) $13,660

Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.

Dotty's insurance company reimbursed her for $8,800 of these expenses. If Dotty's AGI is $35,400, compute her medical expense deduction.A) $0

B) $1,320

C) $10,120

D) $13,660

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

Three years ago, Suzanne bought a new personal automobile for $26,900. This year, she sold it for $19,000. What is the amount and character of Suzanne's recognized loss?

A) No loss recognized on the sale of a personal asset.

B) $26,900 long-term capital loss.

C) $7,900 ordinary loss.

D) $7,900 long-term capital loss.

A) No loss recognized on the sale of a personal asset.

B) $26,900 long-term capital loss.

C) $7,900 ordinary loss.

D) $7,900 long-term capital loss.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following tax payments is allowed as an itemized income tax deduction?

A) Federal gift tax

B) Payroll tax on wages paid to a housekeeper

C) Social Security tax withheld from salary

D) Local property tax on personal automobile

A) Federal gift tax

B) Payroll tax on wages paid to a housekeeper

C) Social Security tax withheld from salary

D) Local property tax on personal automobile

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following expenditures is not a medical expense for federal tax purposes?

A) Payment for eyeglasses

B) Health insurance premiums

C) Payment for prescription antibiotics

D) All of the above are deductible medical expenses

A) Payment for eyeglasses

B) Health insurance premiums

C) Payment for prescription antibiotics

D) All of the above are deductible medical expenses

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

Ted and Alice divorced this year. Pursuant to the divorce agreement, Ted pays $5,000 alimony and $7,500 child support to Alice every month. Which of the following statements is true?

A) Alice includes the monthly alimony and child support payments in gross income.

B) Ted is allowed to deduct the monthly alimony and child support payments.

C) Ted is entitled to the exemptions for the couples' two minor children because he is paying child support.

D) None of the above is true.

A) Alice includes the monthly alimony and child support payments in gross income.

B) Ted is allowed to deduct the monthly alimony and child support payments.

C) Ted is entitled to the exemptions for the couples' two minor children because he is paying child support.

D) None of the above is true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

A flood destroyed an antique Persian rug owned by Mr. and Mrs. McConnell. The couple purchased the rug for $13,000 fifteen years ago, but its appraised FMV before the flood was $42,500. Unfortunately, their homeowners' insurance policy does not cover flood damage. Compute the McConnells' casualty loss resulting from the flood.

A) $41,900

B) $42,000

C) $13,000

D) $12,900

A) $41,900

B) $42,000

C) $13,000

D) $12,900

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

Sue, a single taxpayer, purchased a principal residence in 2001 for $415,000. In 2005, she paid $18,000 to add a sunroom. This year, Sue sold the residence for $686,000. Her selling expenses were $5,000. How much gain must Sue recognize on the sale?

A) $0

B) $3,000

C) $16,000

D) $25,000

A) $0

B) $3,000

C) $16,000

D) $25,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

Twelve years ago, Mr. Drake incurred a $790,000 mortgage to purchase his principal residence. Last year, he took out a $32,000 loan secured by his considerable equity in the residence and used the proceeds to send his daughter to Stanford University. Which of the following statements is true?

A) Mr. Drake can report the interest paid on both his first and second mortgages as an itemized deduction.

B) Mr. Drake can deduct the interest paid on both his first and second mortgages as an above-the-line deduction.

C) Mr. Drake can report the interest paid on only his first mortgage as an itemized deduction.

D) Mr. Drake can report the interest paid on his first mortgage as an above-the-line deduction and the interest paid on his second mortgage as an itemized deduction.

A) Mr. Drake can report the interest paid on both his first and second mortgages as an itemized deduction.

B) Mr. Drake can deduct the interest paid on both his first and second mortgages as an above-the-line deduction.

C) Mr. Drake can report the interest paid on only his first mortgage as an itemized deduction.

D) Mr. Drake can report the interest paid on his first mortgage as an above-the-line deduction and the interest paid on his second mortgage as an itemized deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

Mr. Haugh owns a sporting goods store as a sole proprietorship. This year, he donated baseball equipment (bats, gloves, balls) to the local YMCA to use in their community sports programs. His cost basis in the inventory items was $45,700, and their retail value was $68,200. Which of the following statements about this donation is true?

A) Mr. Haugh must recognize $22,500 ordinary business income and is allowed a $68,200 business deduction.

B) Mr. Haugh must recognize $22,500 ordinary business income and is allowed a $68,200 charitable contribution deduction.

C) Mr. Haugh is allowed a $45,700 charitable contribution deduction.

D) Mr. Haugh is allowed a $68,200 charitable contribution deduction.

A) Mr. Haugh must recognize $22,500 ordinary business income and is allowed a $68,200 business deduction.

B) Mr. Haugh must recognize $22,500 ordinary business income and is allowed a $68,200 charitable contribution deduction.

C) Mr. Haugh is allowed a $45,700 charitable contribution deduction.

D) Mr. Haugh is allowed a $68,200 charitable contribution deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

Mr. and Mrs. Perry own three personal residences, all of which are subject to an acquisition mortgage. The mortgage on the first residence is $290,000, the mortgage on the second residence is $400,000, and the mortgage on the third residence is $357,000. Which of the following statements is true?

A) Mr. and Mrs. Perry can report an itemized deduction for the interest paid on all three mortgages.

B) The Perrys' itemized deduction is limited to the interest on $1 million of their acquisition debt.

C) The Perrys' itemized deduction is limited to the interest on the $400,000 mortgage.

D) None of these statements is true.

A) Mr. and Mrs. Perry can report an itemized deduction for the interest paid on all three mortgages.

B) The Perrys' itemized deduction is limited to the interest on $1 million of their acquisition debt.

C) The Perrys' itemized deduction is limited to the interest on the $400,000 mortgage.

D) None of these statements is true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is not a tax incentive for individuals to purchase a home instead of renting?

A) Real property taxes on the home are deductible.

B) Premiums paid on homeowner's insurance are deductible.

C) Interest paid on a home mortgage is deductible.

D) All of the above are tax incentives.

A) Real property taxes on the home are deductible.

B) Premiums paid on homeowner's insurance are deductible.

C) Interest paid on a home mortgage is deductible.

D) All of the above are tax incentives.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

Ms. Bjorn's only contribution this year was a donation of marketable securities (FMV $600,000; tax basis $273,000) to a public charity. Her AGI was $814,000. Which of the following statements is true?

A) Ms. Bjorn's charitable contribution deduction is limited to $407,000, and she has a $193,000 contribution carryover to future years.

B) Ms. Bjorn's charitable contribution deduction is $273,000.

C) Ms. Bjorn's charitable contribution deduction is limited to $407,000. The $193,000 nondeductible amount will never result in a tax benefit.

D) Ms. Bjorn's charitable contribution deduction is $600,000.

A) Ms. Bjorn's charitable contribution deduction is limited to $407,000, and she has a $193,000 contribution carryover to future years.

B) Ms. Bjorn's charitable contribution deduction is $273,000.

C) Ms. Bjorn's charitable contribution deduction is limited to $407,000. The $193,000 nondeductible amount will never result in a tax benefit.

D) Ms. Bjorn's charitable contribution deduction is $600,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

This year, Mr. and Mrs. Franklin paid $93,000 interest on a mortgage they incurred to build their home in Santa Fe. The average principal balance of the mortgage was $1.43 million. The home has an appraised FMV of only $900,000. Compute the Franklin's itemized deduction for their home mortgage interest.

A) $65,035

B) $58,531

C) $93,000

D) None of the above.

A) $65,035

B) $58,531

C) $93,000

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

Gary is a successful architect who also sings at weddings. This year, he received $5,400 fees from his singing and spent $6,250 on singing lessons, sheet music, and travel to the weddings. If Gary reports this activity as a hobby for federal tax purposes, which of the following statements is true?

A) Gary is not required to include the $5,400 in gross income.

B) Gary is not allowed to deduct any of his hobby expenses.

C) Gary is allowed to deduct $5,400 as an above-the-line deduction.

D) None of the above is true.

A) Gary is not required to include the $5,400 in gross income.

B) Gary is not allowed to deduct any of his hobby expenses.

C) Gary is allowed to deduct $5,400 as an above-the-line deduction.

D) None of the above is true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

Ms. Ruang owns a principal residence subject to an $817,000 acquisition mortgage. The home has an $875,000 appraised FMV. What is the maximum home equity debt that Ms. Ruang could incur for federal tax purposes?

A) $183,000

B) $100,000

C) $58,000

D) $0

A) $183,000

B) $100,000

C) $58,000

D) $0

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements about the tax consequences of gambling is true?

A) Gambling winnings are not taxable, and gambling losses are not deductible.

B) Gambling losses are deductible as miscellaneous itemized deductions only to the extent of gambling winnings.

C) Gambling losses are deductible as itemized deductions only to the extent of gambling winnings.

D) Gambling winnings are taxable, but gambling losses are not deductible.

A) Gambling winnings are not taxable, and gambling losses are not deductible.

B) Gambling losses are deductible as miscellaneous itemized deductions only to the extent of gambling winnings.

C) Gambling losses are deductible as itemized deductions only to the extent of gambling winnings.

D) Gambling winnings are taxable, but gambling losses are not deductible.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

Mr. and Mrs. Frazier recognized a $723,000 gain on sale of a home that had been their principal residence for 29 years. They moved into a rented condominium in Naples, Florida. What are the tax consequences of the sale to the Fraziers?

A) $723,000 long-term capital gain

B) $223,000 long-term capital gain

C) $473,000 ordinary gain

D) $473,000 long-term capital gain

A) $723,000 long-term capital gain

B) $223,000 long-term capital gain

C) $473,000 ordinary gain

D) $473,000 long-term capital gain

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

Mr. and Mrs. Blake suffered two casualty losses this year. Mr. Blake's wallet containing $1,300 cash was stolen, and their uninsured sailboat (basis $67,000; FMV $50,000) sank after colliding with a reef. Compute the Blakes' itemized deduction for casualty losses if their AGI was $112,200.

A) $40,080

B) $56,080

C) $39,980

D) None of the above.

A) $40,080

B) $56,080

C) $39,980

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following donations does not qualify as a charitable contribution for federal tax purposes?

A) $50 cash given to a homeless panhandler

B) Used furniture valued at $300 given to the Salvation Army

C) $3,000 cash given to the University of Georgia

D) $600 cash given to the Boy Scouts of America

A) $50 cash given to a homeless panhandler

B) Used furniture valued at $300 given to the Salvation Army

C) $3,000 cash given to the University of Georgia

D) $600 cash given to the Boy Scouts of America

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

Over the course of the year, Mr. Soo won $8,200 and lost $5,900 gambling in the local casino. Mr. Soo does not itemize deductions on his federal tax return. What is the net effect of his gambling on Mr. Soo's taxable income?

A) No effect on taxable income.

B) $8,200 increase in taxable income.

C) $2,300 increase in taxable income.

D) None of the above.

A) No effect on taxable income.

B) $8,200 increase in taxable income.

C) $2,300 increase in taxable income.

D) None of the above.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements about tax subsidies for higher education is false?

A) Individuals can deduct a limited amount of qualified tuition expenses as an above-the-line deduction.

B) Individuals can deduct a limited amount of interest paid on qualified education loans as an above-the-line deduction.

C) Individuals can claim an American Opportunity Credit for a limited amount of college tuition, fees, and course materials.

D) None of the above is false.

A) Individuals can deduct a limited amount of qualified tuition expenses as an above-the-line deduction.

B) Individuals can deduct a limited amount of interest paid on qualified education loans as an above-the-line deduction.

C) Individuals can claim an American Opportunity Credit for a limited amount of college tuition, fees, and course materials.

D) None of the above is false.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

Mr. Rex had his car stolen this year. The car had $35,600 basis and a $22,000 FMV. Rex received a $16,500 reimbursement from his insurance company. Compute Rex's casualty loss resulting from the theft.

A) $5,400

B) $5,500

C) $19,000

D) $22,000

A) $5,400

B) $5,500

C) $19,000

D) $22,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

Mr. and Mrs. King had only one casualty loss this year. A tornado severely damaged their home, decreasing its value by $70,000. The couple received a $48,000 reimbursement from their insurance company. Compute the Kings' itemized deduction for casualty losses if their AGI was $98,200.

A) $22,000

B) $21,900

C) $12,080

D) $60,080

A) $22,000

B) $21,900

C) $12,080

D) $60,080

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

Gary is a successful architect who also sings at weddings. This year, he received $5,400 of fees for his singing and spent $6,250 on voice lessons, sheet music, and travel to the weddings. Which of the following statements is true?

A) Because the singing activity resulted in a loss, Gary can't treat it as a business.

B) If facts and circumstances support Gary's claim that his singing activity is a business, he can deduct an $850 above-the-line loss.

C) Because Gary's primary source of income is his architecture practice, he can't treat the singing activity as a business.

D) None of the above is true.

A) Because the singing activity resulted in a loss, Gary can't treat it as a business.

B) If facts and circumstances support Gary's claim that his singing activity is a business, he can deduct an $850 above-the-line loss.

C) Because Gary's primary source of income is his architecture practice, he can't treat the singing activity as a business.

D) None of the above is true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

Jenna Leigh is employed as a receptionist for a CPA firm, but on evenings and weekends, she bakes wedding cakes. In each of the past four years, Jenna's baking activity resulted in a net profit. This year, the activity generated a $720 net loss. Which of the following statements is true?

A) The legal presumption is that Jenna's $720 loss is a business loss.

B) The legal presumption is that Jenna's $720 loss is a nondeductible hobby loss.

C) Jenna must include the revenues from her baking activity in gross income but can't deduct any of her related expenses.

D) Jenna is allowed to report her $720 loss as a miscellaneous itemized deduction.

A) The legal presumption is that Jenna's $720 loss is a business loss.

B) The legal presumption is that Jenna's $720 loss is a nondeductible hobby loss.

C) Jenna must include the revenues from her baking activity in gross income but can't deduct any of her related expenses.

D) Jenna is allowed to report her $720 loss as a miscellaneous itemized deduction.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck